Beruflich Dokumente

Kultur Dokumente

Technical Format With Stock 25.10

Hochgeladen von

Angel BrokingOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Technical Format With Stock 25.10

Hochgeladen von

Angel BrokingCopyright:

Verfügbare Formate

Daily Technical Report

October 25, 2012

Sensex (18710) / NIFTY (5691)

On Tuesday, we witnessed yet another choppy trading session where our indices once again traded in a narrow range and closed below 5700 mark. On sectoral front, along with other sectors, Consumer Durables, IT and Metal counters were the major losers whereas; Consumer Goods was the only sector in green. The advance to decline ratio was in favor of declining counters (A=1308 D=1490) (Source www.bseindia.com).

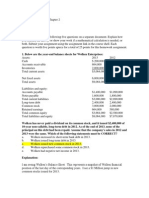

Exhibit 1: Nifty Daily Chart

Formation

The 20-day EMA and the 20-week EMA are placed at 18617/ 5654 and 17919/ 5434 levels, respectively. The monthly RSI oscillator is moving higher from the 50 mark and the positive in ADX (9) indicator is intact. The negative crossover in weekly Stochastic oscillator is still intact. At present, the value of Daily RSI oscillator is 56.38. The RSI trading above the 50 mark shows strength of the current up trend. The 38.2% and 50% Fibonacci Retracement levels of the rise from 17250 to 19138 / 5216 to 5815 are placed at 18416 / 5586 and 18194 / 5515, respectively.

Source: Falcon:

Actionable points:

View for the day Resistance Levels Support Levels Neutral 5729 - 5757 5633

Trading strategy:

On Tuesdays session, markets ended in the negative territory and extremely narrow and range bound movement was witnessed. The markets are still stuck in trading band and we continue to await the breakout from the trading range of 18886 to 18535 / 5729 to 5633. Only a sustainable breakout / breakdown on either side would give clarity of the near term trend. A move beyond 5729 would push indices towards their next resistance and we may then expect our indices to move towards 18973 19138 / 5757 5816. A breach of 18535 / 5633 level would reinforce the selling momentum and in this case we may witness a correction towards 18416 - 18194 / 5586 - 5515 levels.

www.angelbroking.com

Daily Technical Report

October 25, 2012

Bank Nifty Outlook - (11578)

On Tuesday, Bank Nifty opened on a flat note and traded in a narrow range throughout the day to close with a minute loss of 0.25%. The index continued its consolidation phase in the mentioned range of 11745 11245. In line with our benchmark indices there is no major change in the chart structure of Bank Nifty. Thus, we reiterate our view that any fresh positions in the index should be created only if the index sustains outside the said range. In the mentioned range 11657 11722 levels are likely to act as resistance and 11534 11470 levels are likely to act as support in coming trading session. Actionable points:

View for the day Resistance Levels Support Levels Neutral 11657 11722 11534 - 11470

Exhibit 2: Bank Nifty Daily Chart

Source: Falcon:

www.angelbroking.com

Daily Technical Report

October 25, 2012

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS SENSEX NIFTY BANKNIFTY ACC AMBUJACEM ASIANPAINT AXISBANK BAJAJ-AUTO BANKBARODA BHARTIARTL BHEL BPCL CAIRN CIPLA COALINDIA DLF DRREDDY GAIL GRASIM HCLTECH HDFC HDFCBANK HEROMOTOCO HINDALCO HINDUNILVR ICICIBANK IDFC INFY ITC JINDALSTEL JPASSOCIAT KOTAKBANK LT LUPIN M&M MARUTI NTPC ONGC PNB POWERGRID RANBAXY RELIANCE RELINFRA SBIN SESAGOA SIEMENS SUNPHARMA TATAMOTORS TATAPOWER TATASTEEL TCS ULTRACEMCO WIPRO S2 18,614 5,659 11,468 1,383 199 3,867 1,206 1,754 765 267 236 340 333 360 351 202 1,711 349 3,358 598 743 628 1,766 111 564 1,064 151 2,328 285 380 93 608 1,665 547 816 1,352 168 273 809 116 533 800 500 2,207 165 676 688 261 104 400 1,305 1,984 339 S1 18,662 5,675 11,523 1,394 201 3,889 1,214 1,762 774 269 238 344 336 363 355 203 1,721 352 3,379 603 747 631 1,781 112 567 1,072 152 2,341 287 385 94 614 1,683 555 822 1,359 168 275 814 117 537 805 504 2,221 166 685 693 263 105 402 1,310 2,003 341 PIVOT 18,737 5,698 11,590 1,409 204 3,916 1,222 1,773 782 272 241 347 339 366 358 206 1,736 356 3,404 608 751 635 1,797 114 570 1,080 154 2,362 291 395 95 625 1,694 567 831 1,369 169 277 821 118 541 810 509 2,244 167 694 698 265 105 406 1,317 2,021 343 R1 18,786 5,714 11,645 1,419 206 3,938 1,230 1,781 792 274 243 352 342 368 362 208 1,746 360 3,426 614 755 638 1,812 115 573 1,088 155 2,375 294 400 96 631 1,712 575 837 1,376 170 278 826 118 545 815 513 2,258 168 703 703 267 106 408 1,322 2,041 345 R2 18,861 5,737 11,712 1,434 208 3,965 1,237 1,793 800 277 246 354 345 371 366 211 1,761 364 3,451 618 759 642 1,829 117 576 1,096 156 2,396 297 410 97 641 1,723 588 845 1,386 171 280 832 119 549 820 518 2,282 170 712 708 269 107 412 1,329 2,059 347

www.angelbroking.com

Daily Technical Report

October 25, 2012

Research Team Tel: 022 - 39357800 E-mail: research@angelbroking.com Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni Sameet Chavan Sacchitanand Uttekar Mehul Kothari Ankur Lakhotia Head Technicals Technical Analyst Technical Analyst Technical Analyst Technical Analyst

For any Queries, Suggestions and Feedback kindly mail to sameet.chavan@angelbroking.com

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 3952 6600

Sebi Registration No: INB 010996539

www.angelbroking.com 4

Das könnte Ihnen auch gefallen

- A Comprehensive Guide To The American Silver EagleDokument12 SeitenA Comprehensive Guide To The American Silver EagleJonas Vets100% (1)

- Alcoa PDFDokument184 SeitenAlcoa PDFNADIA SABINA SUASTI GUDIÑONoch keine Bewertungen

- 726 Various Hedge Fund LettersDokument13 Seiten726 Various Hedge Fund Lettersapi-3733080100% (3)

- Freeport-McMoRan Annual Report 2018Dokument136 SeitenFreeport-McMoRan Annual Report 2018kennygNoch keine Bewertungen

- Ezzahti, Ali - The Accuracy of The Black Scholes Model in Pricing AEX Index Call Options, Literature and Emperical StudyDokument35 SeitenEzzahti, Ali - The Accuracy of The Black Scholes Model in Pricing AEX Index Call Options, Literature and Emperical StudyEdwin HauwertNoch keine Bewertungen

- Athleta Memo V1 DraftDokument5 SeitenAthleta Memo V1 Draftuygh gNoch keine Bewertungen

- 101 Case Studies In Wall Street (Practical)Von Everand101 Case Studies In Wall Street (Practical)Noch keine Bewertungen

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Dokument4 SeitenDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Technical Format With Stock 26.10Dokument4 SeitenTechnical Format With Stock 26.10Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 23.10Dokument4 SeitenTechnical Format With Stock 23.10Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 09.10Dokument4 SeitenTechnical Format With Stock 09.10Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 29.11.2012Dokument4 SeitenTechnical Format With Stock 29.11.2012Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 27.09Dokument4 SeitenTechnical Format With Stock 27.09Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17105) / NIFTY (5193)Dokument4 SeitenDaily Technical Report: Sensex (17105) / NIFTY (5193)angelbrokingNoch keine Bewertungen

- Technical Format With Stock 23.11.2012Dokument4 SeitenTechnical Format With Stock 23.11.2012Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 25.06.2013Dokument4 SeitenDaily Technical Report, 25.06.2013Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 25.09Dokument4 SeitenTechnical Format With Stock 25.09Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17399) / NIFTY (5279)Dokument4 SeitenDaily Technical Report: Sensex (17399) / NIFTY (5279)Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 10.10Dokument4 SeitenTechnical Format With Stock 10.10Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 17.10Dokument4 SeitenTechnical Format With Stock 17.10Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 02.11.2012Dokument4 SeitenTechnical Format With Stock 02.11.2012Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 15.11.2012Dokument4 SeitenTechnical Format With Stock 15.11.2012Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 01.11.2012Dokument4 SeitenTechnical Format With Stock 01.11.2012Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17602) / NIFTY (5337)Dokument4 SeitenDaily Technical Report: Sensex (17602) / NIFTY (5337)Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 26.09Dokument4 SeitenTechnical Format With Stock 26.09Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 02.08.2013Dokument4 SeitenDaily Technical Report, 02.08.2013Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 29.10.2012Dokument4 SeitenTechnical Format With Stock 29.10.2012Angel BrokingNoch keine Bewertungen

- Technical Report, 24 January 2013Dokument4 SeitenTechnical Report, 24 January 2013Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 19.10Dokument4 SeitenTechnical Format With Stock 19.10Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 26.11.2012Dokument4 SeitenTechnical Format With Stock 26.11.2012Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 16.11.2012Dokument4 SeitenTechnical Format With Stock 16.11.2012Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 11.10Dokument4 SeitenTechnical Format With Stock 11.10Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 24.09Dokument4 SeitenTechnical Format With Stock 24.09Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17885) / NIFTY (5421)Dokument4 SeitenDaily Technical Report: Sensex (17885) / NIFTY (5421)Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 04.10Dokument4 SeitenTechnical Format With Stock 04.10Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 12.09Dokument4 SeitenTechnical Format With Stock 12.09Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 22.10Dokument4 SeitenTechnical Format With Stock 22.10Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 07.11.2012Dokument4 SeitenTechnical Format With Stock 07.11.2012Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 06.11.2012Dokument4 SeitenTechnical Format With Stock 06.11.2012Angel BrokingNoch keine Bewertungen

- DailyTech Report 07.08.12 Angel BrokingDokument4 SeitenDailyTech Report 07.08.12 Angel BrokingAngel BrokingNoch keine Bewertungen

- Daily Technical Report, 15.04.2013Dokument4 SeitenDaily Technical Report, 15.04.2013Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 30.10.2012Dokument4 SeitenTechnical Format With Stock 30.10.2012Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 27.11.2012Dokument4 SeitenTechnical Format With Stock 27.11.2012Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17679) / NIFTY (5350)Dokument4 SeitenDaily Technical Report: Sensex (17679) / NIFTY (5350)Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 30.11.2012Dokument4 SeitenTechnical Format With Stock 30.11.2012Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17489) / NIFTY (5306)Dokument4 SeitenDaily Technical Report: Sensex (17489) / NIFTY (5306)angelbrokingNoch keine Bewertungen

- Technical Format With Stock 19.11.2012Dokument4 SeitenTechnical Format With Stock 19.11.2012Angel BrokingNoch keine Bewertungen

- Technical Report 2nd May 2012Dokument4 SeitenTechnical Report 2nd May 2012Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 29.05.2013Dokument4 SeitenDaily Technical Report, 29.05.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 10.04.2013Dokument4 SeitenDaily Technical Report, 10.04.2013Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 18.09Dokument4 SeitenTechnical Format With Stock 18.09Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 21.11.2012Dokument4 SeitenTechnical Format With Stock 21.11.2012Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 07.05.2013Dokument4 SeitenDaily Technical Report, 07.05.2013Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 05.10Dokument4 SeitenTechnical Format With Stock 05.10Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 03.10Dokument4 SeitenTechnical Format With Stock 03.10Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 21.09Dokument4 SeitenTechnical Format With Stock 21.09Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (18980) / NIFTY (5593)Dokument4 SeitenDaily Technical Report: Sensex (18980) / NIFTY (5593)Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 28.06.2013Dokument4 SeitenDaily Technical Report, 28.06.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17542) / NIFTY (5315)Dokument4 SeitenDaily Technical Report: Sensex (17542) / NIFTY (5315)Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (16918) / NIFTY (5128)Dokument4 SeitenDaily Technical Report: Sensex (16918) / NIFTY (5128)angelbrokingNoch keine Bewertungen

- Technical Format With Stock 22.11.2012Dokument4 SeitenTechnical Format With Stock 22.11.2012Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17618) / NIFTY (5345)Dokument4 SeitenDaily Technical Report: Sensex (17618) / NIFTY (5345)Angel BrokingNoch keine Bewertungen

- Technical Report 3rd May 2012Dokument4 SeitenTechnical Report 3rd May 2012Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 09.04.2013Dokument4 SeitenDaily Technical Report, 09.04.2013Angel BrokingNoch keine Bewertungen

- Technical Format With Stock 13.09Dokument4 SeitenTechnical Format With Stock 13.09Angel BrokingNoch keine Bewertungen

- Daily Technical Report, 30.05.2013Dokument4 SeitenDaily Technical Report, 30.05.2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (17728) / NIFTY (5380)Dokument4 SeitenDaily Technical Report: Sensex (17728) / NIFTY (5380)Angel BrokingNoch keine Bewertungen

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDokument4 SeitenRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNoch keine Bewertungen

- Daily Metals and Energy Report September 16 2013Dokument6 SeitenDaily Metals and Energy Report September 16 2013Angel BrokingNoch keine Bewertungen

- Oilseeds and Edible Oil UpdateDokument9 SeitenOilseeds and Edible Oil UpdateAngel BrokingNoch keine Bewertungen

- WPIInflation August2013Dokument5 SeitenWPIInflation August2013Angel BrokingNoch keine Bewertungen

- International Commodities Evening Update September 16 2013Dokument3 SeitenInternational Commodities Evening Update September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 16 2013Dokument9 SeitenDaily Agri Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 16 2013Dokument2 SeitenDaily Agri Tech Report September 16 2013Angel BrokingNoch keine Bewertungen

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDokument6 SeitenTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 14 2013Dokument2 SeitenDaily Agri Tech Report September 14 2013Angel BrokingNoch keine Bewertungen

- Currency Daily Report September 16 2013Dokument4 SeitenCurrency Daily Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Dokument4 SeitenDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Derivatives Report 8th JanDokument3 SeitenDerivatives Report 8th JanAngel BrokingNoch keine Bewertungen

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDokument1 SeitePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report Sept 13Dokument2 SeitenMetal and Energy Tech Report Sept 13Angel BrokingNoch keine Bewertungen

- Currency Daily Report September 13 2013Dokument4 SeitenCurrency Daily Report September 13 2013Angel BrokingNoch keine Bewertungen

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDokument4 SeitenJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument12 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 12 2013Dokument2 SeitenDaily Agri Tech Report September 12 2013Angel BrokingNoch keine Bewertungen

- Currency Daily Report September 12 2013Dokument4 SeitenCurrency Daily Report September 12 2013Angel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Daily Metals and Energy Report September 12 2013Dokument6 SeitenDaily Metals and Energy Report September 12 2013Angel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report Sept 12Dokument2 SeitenMetal and Energy Tech Report Sept 12Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 12 2013Dokument9 SeitenDaily Agri Report September 12 2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Dokument4 SeitenDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNoch keine Bewertungen

- Finman2 Material1 MidtermsDokument8 SeitenFinman2 Material1 MidtermsKimberly Laggui PonayoNoch keine Bewertungen

- Rane DocumentDokument90 SeitenRane DocumentVasanth KumarNoch keine Bewertungen

- MBA Case Study Finance AssignmentDokument15 SeitenMBA Case Study Finance AssignmentsimmonelleNoch keine Bewertungen

- Caso 1Dokument7 SeitenCaso 1Carlos Rafael Angeles GuzmanNoch keine Bewertungen

- Eng 111 Sample Formula SheetDokument1 SeiteEng 111 Sample Formula Sheetjohn wickonsonNoch keine Bewertungen

- FSM MAPS ModAggressive Growth 3Dokument3 SeitenFSM MAPS ModAggressive Growth 3Meng AunNoch keine Bewertungen

- The Owner Operator CompanyDokument7 SeitenThe Owner Operator CompanyaugustaboundNoch keine Bewertungen

- Jensen VBA Code Step by StepDokument14 SeitenJensen VBA Code Step by StepVuNoch keine Bewertungen

- Auto Trender PPT SMCDokument14 SeitenAuto Trender PPT SMCMithil Doshi100% (1)

- Difference Between Large Mid Small Cap FundsDokument14 SeitenDifference Between Large Mid Small Cap FundsNaresh KotrikeNoch keine Bewertungen

- Euromoney 2010 Handbook Environmental FinanceDokument8 SeitenEuromoney 2010 Handbook Environmental FinanceAnaNoch keine Bewertungen

- Ashok Leyland Profit & Loss Account, Ashok Leyland Financial Statement & AccountsDokument3 SeitenAshok Leyland Profit & Loss Account, Ashok Leyland Financial Statement & AccountsRaghaw MundhraNoch keine Bewertungen

- Diploma in International Financial Reporting: Thursday 6 December 2007Dokument9 SeitenDiploma in International Financial Reporting: Thursday 6 December 2007Ajit TiwariNoch keine Bewertungen

- Coal India IPO Final ProspectusDokument684 SeitenCoal India IPO Final Prospectusmsanshulguptapacemak100% (1)

- Anastasia Guha Director, Northern Europe and MEA Principles For Responsible InvestmentDokument9 SeitenAnastasia Guha Director, Northern Europe and MEA Principles For Responsible InvestmentSid KaulNoch keine Bewertungen

- Exhibit 1 Polaroid Recent Financial Results ($ Millions)Dokument5 SeitenExhibit 1 Polaroid Recent Financial Results ($ Millions)Arijit MajiNoch keine Bewertungen

- FIN 534 Homework Chap.2Dokument3 SeitenFIN 534 Homework Chap.2Jenna KiragisNoch keine Bewertungen

- Course OtamDokument4 SeitenCourse Otamkam456Noch keine Bewertungen

- Ifsa Chapter2Dokument31 SeitenIfsa Chapter2bingoNoch keine Bewertungen

- RA 9136, Sec 28 Amended RulesDokument4 SeitenRA 9136, Sec 28 Amended RulesHjktdmhmNoch keine Bewertungen

- PRTC Corporation Equity SecuritiesDokument2 SeitenPRTC Corporation Equity SecuritieshersheyNoch keine Bewertungen

- Revision Pack 4 May 2011Dokument27 SeitenRevision Pack 4 May 2011Lim Hui SinNoch keine Bewertungen

- Esquire VERTU - Blink - Take It To The Limit - 7 June 2010Dokument1 SeiteEsquire VERTU - Blink - Take It To The Limit - 7 June 2010BlinkNoch keine Bewertungen