Beruflich Dokumente

Kultur Dokumente

Ultratech: Performance Highlights

Hochgeladen von

Angel BrokingOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ultratech: Performance Highlights

Hochgeladen von

Angel BrokingCopyright:

Verfügbare Formate

2QFY2013 Result Update | Cement

October 23, 2012

UltraTech

Performance Highlights

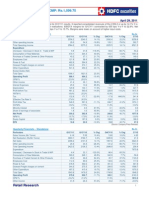

Quarterly results (Standalone)

Y/E March (` cr) Net sales Operating profit OPM (%) Net profit 2QFY2013 4,700 1,035 21.9 550 1QFY2013 5,075 1,308 25.7 778 % Chg qoq (7.4) (20.8) (379) (29.3) 1QFY2012 3,910 652 16.4 279 % Chg yoy 20.2 58.7 551 97.2

NEUTRAL

CMP Target Price

Investment Period

Stock Info Sector Market Cap (` cr) Net Debt Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code Cement 55,382 494 0.6 2075/1057 11,233 10 18,710 5,691 ULTC.BO UTCEM@IN

`2,021 -

Source: Company, Angel Research

During 2QFY2013, UltraTech Cement (ULTC) posted a strong 97.2% yoy growth in its bottom-line, which was in-line with our estimate. The robust performance was on account of a substantial 20.2% yoy growth (up 1.9% sequentially) in blended realization. However, the company faced margin pressures due to the increase in raw material and freight costs. We remain Neutral on the stock. OPM up by 551bp yoy: During 2QFY2013, ULTCs net sales grew by 20.2% yoy to `4,700cr, largely on account of better realization. The companys realization rose 20.2% yoy and 1.9% qoq to `5,005/tonne. The improvement in realization led the OPM to rise by 551bp yoy to 21.9%. The companys operating cost per tonne too rose by 10.9% yoy and 7.4% qoq to `3,932/tonne. The raw material cost per tonne rose by 22.1% yoy and 9.1% qoq to `763. The freight cost per tonne rose by 24.2% yoy due to increase in diesel costs and hike in railway fare. The power and fuel (P&F) cost per tonne too rose by 12.5% on a yoy basis. The steep decline in INR vs USD partly negated the fall in global coal prices, resulting in higher power and fuel costs. Outlook and valuation: We expect ULTC to post a 14.6% and 16.6% CAGR in its top-line and bottom-line over FY2012-14, respectively. At the current levels, the stock is trading at an EV/tonne of US$178 on FY2014 capacity, which we believe is fair. We continue to remain Neutral on the stock.

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 62.8 4.3 20.4 12.5

Abs. (%) Sensex UTCEM

3m 10.9 26.6

1yr 11.5

3yr 11.3

80.9 161.4

Key financials (Standalone)

Y/E March (` cr) Net sales % chg Net profit % chg FDEPS (`) OPM (%) P/E (x) P/BV (x) RoE (%) RoCE (%) EV/Sales (x) EV/Tonne (US $) EV/EBITDA (x)

Source: Company, Angel research

FY2011 13,210 87.4 1,404 28.4 51.2 20.5 39.4 5.2 18.4 16.4 4.3 245 20.9

FY2012 18,166 37.5 2,446 74.2 89.3 22.8 22.6 4.3 20.8 18.3 3.0 223 13.3

FY2013E 21,197 16.7 2,838 16.0 103.5 22.5 19.5 3.6 20.2 18.8 2.6 201 11.3

FY2014E 23,850 12.5 3,327 17.2 121.4 23.5 16.6 3.1 20.1 19.4 2.4 178 10.1

V Srinivasan

022-39357800 Ext 6831 v.srinivasan@angelbroking.com

Please refer to important disclosures at the end of this report

UltraTech Cement | 2QFY2013 Result Update

Exhibit 1: 2QFY2013 performance (Standalone)

Y/E March (` cr) Net Sales Other operating Income Total Operating Income Net raw-material costs (% of sales) Power & fuel (% of sales) Staff costs (% of sales) Freight & forwarding (% of sales) Other expenses (% of sales) Total Expenditure Operating Profit OPM (%) Interest Depreciation Other Income PBT (excl. Extr. Items) PBT Provision for Taxation (% of PBT) Reported PAT PATM (%) EPS (`)

Source: Company, Angel Research

2QFY2013 4,700 28 4,727 652 13.9 1,074 22.9 239 5.1 929 19.8 798 17.0 3,692 1,035 21.9 60 232 41 783 783 233 29.8 550 11.7 20.1

1QFY2013 5,075 16 5,091 744 14.7 1,086 21.4 224 4.8 1,036 22.1 693 14.7 3,783 1,308 25.7 50 228 69 1,099 1,099 320 29.2 778 15.3 28.4

% Chg qoq (7.4) 73.0 (7.1) (12.4) (1.1) 7.1 (10.3) 15.2 (2.4) (20.8) (379) 20.5 1.9 (40.9) (28.7) (28.7) (27.2) (29.3) (29.3)

2QFY2012 3,910 71 3,981 667 17.1 955 24.4 206 4.4 748 15.9 753 16.0 3,328 652 16.4 67 223 33 395 395 116 29.4 279 7.1 10.2

% Chg yoy 20.2 (60.7) 18.8 (2.3) 12.5 16.3 24.2 6.0 10.9 58.7 551 (10.7) 4.4 24.9 98.3 100.8 97.2 97.2

1HFY2013 9,771 44 9,815 1,396 14.3 2,160 22.1 463 9.9 1,966 41.8 1,487 31.6 7,472 2,343 23.9 110 461 109 1,882 1,882 554 29.4 1,328 13.6 48.5

1HFY2012 8,259 81 8,340 1,176 14.2 1,996 24.2 389 8.3 1,706 36.3 1,220 26.0 6,487 1,853 22.2 137 446 83 1,353 1,353 391 28.9 962 11.6 35.1

% Chg 18.3 (45.9) 17.7 18.7 8.2 18.9 15.2 21.9 15.2 26.4 (20.0) 3.3 31.5 39.1 39.1 41.5 38.1

Exhibit 2: Financial performance

(` cr) 6,400 5,600 4,800 4,000 3,200 2,400 1,600 800 0 4QFY11 1QFY12 2QFY12 3QFY12 4QFY12 Net operating income Net Profit 1QFY13 2QFY13 OPM (RHS) 727 683 16 279 617 867 778 550 4,556 24 4,404 28 4,651 3,981 22 24 5,392 5,075 26 4,700 (%) 30 27 24 22 21 18 15 12

Source: Company, Angel Research

October 23, 2012

UltraTech Cement | 2QFY2013 Result Update

Exhibit 3: 2QFY2013 Actual vs Angel Estimates

(` cr) Net sales Operating profit Net profit

Source: Company, Angel Research

Actual 4,700 1,035 550

Estimates 4,650 1,022 558

Variation (%) 1.1 1.3 (1.4)

Performance highlights

Net sales up 20.2% yoy, aided by higher realization

During 2QFY2013, ULTCs net sales rose by 20.2% yoy on account of higher realization. During the quarter, the realization improved by 20.2% yoy to `5,005/tonne. The companys domestic volumes (including clinker and white cement) stood at 9.3mn tonne, up 1.6% yoy, in 2QFY2013. Even on a qoq basis the realization was higher by 1.9% as delayed monsoon resulted in prices remaining healthy in this seasonally weak quarter. Cement prices rose in the month of July before witnessing a decline in the month of August and September.

OPM increases despite steep increase in costs

Despite the increase in costs, the OPM rose by 551bp yoy to 21.9%. The companys operating cost per tonne too rose by 10.9% yoy and 7.4% qoq to `3,932/tonne. The raw material cost per tonne rose by 22.1% yoy and 9.1% qoq to `763. The freight costs per tonne rose by 24.2% yoy due to increase in diesel costs and hike in railway fare. The power and fuel costs per tonne too rose by 12.5% on a yoy basis. The steep decline in INR vs USD partly negated the fall in global coal prices, resulting in higher power and fuel costs.

Per tonne analysis

During 2QFY2013, ULTCs realization per tonne rose by 20.2% yoy to `5,005. The raw-material cost per tonne increased by 22.1% yoy. The power and fuel cost per tonne increased by 12.5% on a yoy basis. The freight cost/per tonne rose by 24.2% yoy. The companys operating profit/tonne increased by 73.2% yoy to `1,073 during the quarter.

Exhibit 4: Operational performance

Particulars (`) Realization/tonne Raw-material cost/tonne P&F cost /tonne Freight cost/tonne Other costs Operating costs Operating profit/tonne

Source: Company, Angel Research

2QFY2013 1QFY2013 2QFY2012 chg (%) yoy chg (%) qoq

5,005 763 1,144 990 849 3,932 4,913 700 1,051 1,003 670 3,662 4,164 625 1,017 797 801 3,544 20.2 22.1 12.5 24.2 6.0 10.9 1.9 9.1 8.8 (1.4) 26.7 7.4

1,073

1,250

619

73.2

(14.2)

October 23, 2012

UltraTech Cement | 2QFY2013 Result Update

Investment arguments

Indias largest cement manufacturer: Post the merger of Samruddhi (erstwhile cement division of Grasim) with itself, ULTC is now Indias largest cement player with a pan-India presence. The company has also acquired a controlling stake in Dubai-based ETA Star. ETA Stars manufacturing facilities include a 2.3mtpa clinkerization plant and a 2.1mtpa grinding capacity in UAE, and 0.4mtpa and 0.5mtpa grinding facilities in Bahrain and Bangladesh, respectively. ULTC has a capital outlay of `10,400cr to be spent over setting up additional clinkerization plants at Chattisgarh and Karnataka along with grinding units and bulk packaging terminals across various states. Post these expansions, the companys total capacity is expected to increase by 10.2mtpa, which is expected to be operational by FY2014. Pan-India presence to insulate ULTC from price volatility: ULTC has been enjoying good brand equity, which has only strengthened post Samruddhis merger along with being insulated from the wide variations in regional demand and price volatility. Post the merger, ULTC has been enjoying synergic benefits by way of superior operating efficiencies due to its large size. Increased use of captive power to protect margins: Currently, ULTC has 504MW of power capacity. The company is planning to expand its capacity by 70MW. Increased use of captive power for its overall power requirements would help the company to maintain healthy operating margins. Outlook and valuation: We expect ULTC to post a 14.6% and 16.6% CAGR in its top-line and bottom-line over FY2012-14, respectively. At current levels, the stock is trading at EV/tonne of US$178 on FY2014 capacity, which we believe is fair. We continue to remain Neutral on the stock.

Exhibit 5: One-year forward EV/Tonne

500,000 450,000 400,000 350,000 EV (` mn) 300,000 250,000 200,000 150,000 100,000 50,000 0 May-06 May-07 May-08 May-09 May-10 May-11 May-12 Sep-05 Jan-06 Sep-06 Jan-07 Sep-07 Jan-08 Sep-08 Jan-09 Sep-09 Jan-10 Sep-10 Jan-11 Sep-11 Jan-12 Sep-12 EV/tonne $70 $100 $130 $160

Source: BSE, Company, Angel Research

October 23, 2012

UltraTech Cement | 2QFY2013 Result Update

Exhibit 6: Recommendation summary

Company ACC* Ambuja Cements* India Cements JK Lakshmi Madras Cement Shree Cements UltraTech Cements Reco CMP (`) Tgt. Price (`) Upside (%) FY2014E P/BV (x) FY2014E P/E (x) FY2012-14E EPS CAGR FY2014E EV/tonne^ RoE (%) US $

Neutral Neutral Neutral Neutral Neutral

Neutral

1,404 203 98 126 187

4,124

3.1 3.5 0.8 1.0 1.6

3.4

16.9 15.7 8.0 7.1 10.2

15.8

8.5 25.7 12.8 41.7 6.2

20.0

19.2 21.1 10.2 14.6 17.0

23.6

136 184 63 50 65

138

Neutral

2,021

3.1

16.6

16.6

20.1

204

Source: Company, Angel Research; Note: *Y/E December; ^ Computed on TTM basis

Company Background

UltraTech (ULTC) became India's largest cement player on a standalone basis, with total capacity of 48.8mtpa, post the merger of Samruddhi (erstwhile cement division of Grasim) with itself in 2010. ULTC also acquired a controlling stake in Dubai-based ETA Star (cement capacities of 3mtpa in the Middle East and Bangladesh) in 2010, which took its consolidated total capacity to 51.8mtpa. ULTC is a pan-India player, with 22 cement plants spread across the country. Of its total capacity, the southern, western and northern regions constitute the maximum share (26%, 26% and 23%, respectively), as against 14% by the eastern and northeastern region and 11% by the central region.

October 23, 2012

UltraTech Cement | 2QFY2013 Result Update

Profit and loss statement (Standalone)

Y/E March (` cr) Net Sales Other operating income Total operating income % chg Total Expenditure Net Raw Materials Other Mfg costs Personnel Other EBITDA % chg (% of net Sales) Depreciation& Amortization EBIT % chg (% of net Sales) Interest & other Charges Other Income (% of PBT) Recurring PBT % chg Extraordinary expense/(Inc.) PBT (reported) Tax (% of PBT) PAT (reported) Adjusted PAT % chg (% of Net Sales) Basic EPS (`) Fully Diluted EPS (`) % chg

previous year numbers

FY2009 FY2010 FY2011 6,383 61 6,444 15.7 4,679 607 1,727 218 2,127 1,765 (1.0) 28 323 1,442 (6.7) 22.6 126 45 3 1,362 (9.6) 1,362 384.4 28 977 977 (3.0) 15.3 78 78 (3.0) 7,050 67 7,116 10.4 5,079 1,023 1,431 251 2,375 2,038 15.5 29 388 1,650 14.4 23.4 118 56 4 1,588 16.7 1,588 494.9 31 1,093 1,093 11.9 15.5 88 88 11.9 13,210 164 13,374 87.9 10,668 1,855 3,123 667 5,023 2,707 32.8 20.5 766 1,941 17.7 14.7 277 122 7 1,786 12.5 1,786 382.0 21 1,404 1,404 28.4 10.6 51 51 (41.7)

FY2012 FY2013E FY2014E 18,166 147 18,313 36.9 14,166 2,576 4,304 831 6,454 4,147 53.2 22.8 903 3,245 67.2 17.9 224 372 11 3,393 90.0 3,393 946.7 28 2,446 2,446 74.2 13.5 89 89 74.2 21,197 171 21,368 16.7 16,592 2,914 4,584 997 8,097 4,776 15.2 22.5 957 3,820 17.7 18.0 219 335 9 3,936 16.0 3,936 1,098.2 28 2,838 2,838 16.0 13.4 104 104 16.0 23,850 193 24,043 12.5 18,436 3,272 4,960 1,087 9,117 5,607 17.4 23.5 1,086 4,521 18.4 19.0 232 325 7 4,614 17.2 4,614 1,287.4 28 3,327 3,327 17.2 13.9 121 121 17.2

Note: Some of the figures from FY2011 onwards are reclassified; hence not comparable with

October 23, 2012

UltraTech Cement | 2QFY2013 Result Update

Balance sheet (Standalone)

Y/E March (` cr) SOURCES OF FUNDS Equity share capital Reserves & surplus Shareholders funds Total loans Deferred tax liability Other Long term liabilities Long term provisions Total Liabilities APPLICATION OF FUNDS Gross block Less: acc. depreciation Net Block Capital work-in-progress Goodwill Investments Long term loans and adv. Current Assets Cash Loans & advances Other Current liabilities Net Current Assets Misc. exp. not written off Total Assets 7,401 2,765 4,636 677 1,035 1,372 104 382 886 1,253 119 6,467 8,078 3,136 4,942 259 1,670 1,472 84 351 1,038 1,299 173 7,044 17,942 6,542 11,401 682 3,730 562 3,619 145 904 2,570 3,339 280 16,655 19,014 7,380 11,634 1,897 3,789 1,462 4,161 188 1,164 2,809 4,071 90 18,873 21,514 8,336 13,177 4,897 2,489 1,462 4,472 194 909 3,369 4,821 (349) 21,676 27,514 9,422 18,092 1,897 3,589 1,462 5,275 254 1,262 3,758 5,432 (157) 24,882 124 3,478 3,602 2,142 723 6,467 124 4,484 4,609 1,605 831 7,044 274 10,392 10,666 4,125 1,730 22 112 16,655 274 12,586 12,860 4,119 1,738 35 121 18,873 274 14,929 15,203 4,579 1,738 35 121 21,676 274 17,676 17,950 5,039 1,738 35 121 24,882 FY2009 FY2010 FY2011 FY2012 FY2013E FY2014E

October 23, 2012

UltraTech Cement | 2QFY2013 Result Update

Cash flow statement (Standalone)

Y/E March (` cr) Profit before tax Depreciation Change in Working Capital Add: Interest expenses Less: Other income Direct taxes paid Cash Flow from Operations (Inc.)/ Dec. in Fixed Assets (Inc.)/ Dec. in Investments Other income Cash Flow from Investing Issue of Equity Inc./(Dec.) in loans Dividend Paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) in Cash Opening Cash balances Closing Cash balances FY2009 FY2010 FY2011 1,362 323 (113) 126 45 210 1,442 (823) (864) 45 (1,641) 401 73 126 203 4 101 104 1,588 388 (90) 118 56 389 1,559 (259) (635) 56 (838) (537) 87 118 (742) (21) 104 84 1,786 766 (93) 277 122 519 2,095 (1,223) (542) 122 (1,642) 1 (1) 141 252 (392) 61 84 145 FY2012 FY2013E FY2014E 3,393 903 (541) 224 372 947 2,659 (2,286) (58) 372 (1,973) 0 8 426 224 (643) 44 145 188 3,936 957 445 219 335 1,098 4,124 (5,500) 1,300 335 (3,865) 460 495 219 (254) 5 188 194 4,614 1,086 (132) 232 325 1,287 4,187 (3,000) (1,100) 325 (3,775) 460 580 232 (352) 61 194 254

October 23, 2012

UltraTech Cement | 2QFY2013 Result Update

Key ratios

Y/E March Valuation Ratio (x) P/E (on FDEPS) P/CEPS P/BV Dividend yield (%) EV/Sales EV/EBITDA EV / Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value Dupont Analysis EBIT margin Tax retention ratio Asset turnover (x) ROIC (Post-tax) Cost of Debt (Post Tax) Leverage (x) Operating ROE Returns (%) ROCE (Pre-tax) Angel ROIC (Pre-tax) ROE Turnover ratios (x) Asset Turnover (Gross Block) Inventory / Sales (days) Receivables (days) Payables (days) WC cycle (ex-cash) (days) Solvency ratios (x) Net debt to equity Net debt to EBITDA Interest Coverage (EBIT / Int.) FY2009 FY2010 FY2011 FY2012 FY2013E FY2014E

25.7 19.3 7.0 0.3 4.1 14.8 4.1 78.5 78.5 104.4 5.8 289.3 22.4 71.8 1.1 18.4 4.6 0.6 26.9 25.2 34.8 31.0 1.0 37 12 99 (2) 0.3 0.6 11.5

23.0 17.0 5.5 0.3 3.6 12.6 3.6 87.8 87.8 119.0 7.0 370.2 23.2 68.8 1.1 17.0 4.3 0.5 22.9 24.4 26.6 26.6 0.9 39 11 92 3 (0.0) (0.1) 14.0

39.4 25.5 5.2 0.3 4.3 20.9 3.4 51.2 51.2 79.2 5.1 389.2 14.5 78.6 1.1 13.0 7.6 0.4 15.0 16.4 17.2 18.4 1.0 38 11 79 3 0.0 0.1 7.0

22.6 16.5 4.3 0.8 3.0 13.3 2.9 89.3 89.3 122.2 15.6 469.2 17.7 72.1 1.0 13.3 3.9 0.4 16.6 18.3 19.9 20.8 1.0 40 14 95 0 0.0 0.0 14.5

19.5 14.6 3.6 0.9 2.6 11.3 2.5 103.5 103.5 138.4 18.1 554.7 17.9 72.1 1.1 13.7 3.6 0.3 16.8 18.8 22.9 20.2 1.1 38 14 98 (5) 0.1 0.4 17.4

16.6 12.5 3.1 1.0 2.4 10.1 2.3 121.4 121.4 161.0 21.2 654.9 18.8 72.1 1.0 14.1 3.5 0.3 17.2 19.4 23.0 20.1 1.0 40 14 101 (7) 0.1 0.2 19.5

October 23, 2012

UltraTech Cement | 2QFY2013 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

UltraTech Cement No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

October 23, 2012

10

Das könnte Ihnen auch gefallen

- Ultratech 4Q FY 2013Dokument10 SeitenUltratech 4Q FY 2013Angel BrokingNoch keine Bewertungen

- ACC Result UpdatedDokument10 SeitenACC Result UpdatedAngel BrokingNoch keine Bewertungen

- Shree Cement: Performance HighlightsDokument10 SeitenShree Cement: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Ambuja Cements Result UpdatedDokument11 SeitenAmbuja Cements Result UpdatedAngel BrokingNoch keine Bewertungen

- Madras Cements: Performance HighlightsDokument10 SeitenMadras Cements: Performance HighlightsAngel BrokingNoch keine Bewertungen

- JK Lakshmi Cement, 12th February, 2013Dokument10 SeitenJK Lakshmi Cement, 12th February, 2013Angel BrokingNoch keine Bewertungen

- Ambuja Cements Result UpdatedDokument11 SeitenAmbuja Cements Result UpdatedAngel BrokingNoch keine Bewertungen

- India Cements Result UpdatedDokument12 SeitenIndia Cements Result UpdatedAngel BrokingNoch keine Bewertungen

- India Cements: Performance HighlightsDokument12 SeitenIndia Cements: Performance HighlightsAngel BrokingNoch keine Bewertungen

- JKLakshmi Cement, 1Q FY 2014Dokument10 SeitenJKLakshmi Cement, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Ambuja, 15th February 2013Dokument10 SeitenAmbuja, 15th February 2013Angel BrokingNoch keine Bewertungen

- India Cements: Performance HighlightsDokument10 SeitenIndia Cements: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Madras Cements Result UpdatedDokument11 SeitenMadras Cements Result UpdatedAngel BrokingNoch keine Bewertungen

- JK Lakshmi Cement: Performance HighlightsDokument10 SeitenJK Lakshmi Cement: Performance HighlightsAngel BrokingNoch keine Bewertungen

- UltraTech Result UpdatedDokument10 SeitenUltraTech Result UpdatedAngel BrokingNoch keine Bewertungen

- ACC Result UpdatedDokument11 SeitenACC Result UpdatedAngel BrokingNoch keine Bewertungen

- Acc 3qcy2012ruDokument10 SeitenAcc 3qcy2012ruAngel BrokingNoch keine Bewertungen

- India Cements Result UpdatedDokument10 SeitenIndia Cements Result UpdatedAngel BrokingNoch keine Bewertungen

- Ambuja Cements: Performance HighlightsDokument11 SeitenAmbuja Cements: Performance HighlightsAngel BrokingNoch keine Bewertungen

- JKLakshmi Cement 4Q FY 2013Dokument10 SeitenJKLakshmi Cement 4Q FY 2013Angel BrokingNoch keine Bewertungen

- Ambuja Cements Result UpdatedDokument11 SeitenAmbuja Cements Result UpdatedAngel BrokingNoch keine Bewertungen

- Madras Cements Result UpdatedDokument11 SeitenMadras Cements Result UpdatedAngel BrokingNoch keine Bewertungen

- Acc 1Q CY 2013Dokument10 SeitenAcc 1Q CY 2013Angel BrokingNoch keine Bewertungen

- Petronet LNG: Performance HighlightsDokument10 SeitenPetronet LNG: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Madras Cements 4Q FY 2013Dokument10 SeitenMadras Cements 4Q FY 2013Angel BrokingNoch keine Bewertungen

- GIPCL, 12th February, 2013Dokument10 SeitenGIPCL, 12th February, 2013Angel BrokingNoch keine Bewertungen

- Sarda Energy 4Q FY 2013Dokument12 SeitenSarda Energy 4Q FY 2013Angel BrokingNoch keine Bewertungen

- Finolex Cables, 1Q FY 2014Dokument14 SeitenFinolex Cables, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Acc 2Q Cy 2013Dokument10 SeitenAcc 2Q Cy 2013Angel BrokingNoch keine Bewertungen

- TTMT, 15th February 2013Dokument16 SeitenTTMT, 15th February 2013Angel BrokingNoch keine Bewertungen

- KEC International, 4th February, 2013Dokument11 SeitenKEC International, 4th February, 2013Angel BrokingNoch keine Bewertungen

- Neutral: Performance HighlightsDokument10 SeitenNeutral: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Madras Cements: Performance HighlightsDokument12 SeitenMadras Cements: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Exide Industries: Performance HighlightsDokument12 SeitenExide Industries: Performance HighlightsAngel BrokingNoch keine Bewertungen

- India Cements, 20th February, 2013Dokument9 SeitenIndia Cements, 20th February, 2013Angel BrokingNoch keine Bewertungen

- Thermax: Performance HighlightsDokument10 SeitenThermax: Performance HighlightsAngel BrokingNoch keine Bewertungen

- KEC International, 1Q FY 14Dokument11 SeitenKEC International, 1Q FY 14Angel BrokingNoch keine Bewertungen

- IRB Infrastructure: Performance HighlightsDokument14 SeitenIRB Infrastructure: Performance HighlightsAngel BrokingNoch keine Bewertungen

- JK Lakshmi Cement: Performance HighlightsDokument10 SeitenJK Lakshmi Cement: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Sterlite, 1Q FY 2014Dokument13 SeitenSterlite, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Amara Raja Batteries: Performance HighlightsDokument11 SeitenAmara Raja Batteries: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Itnl 4Q Fy 2013Dokument13 SeitenItnl 4Q Fy 2013Angel BrokingNoch keine Bewertungen

- Sarda Energy and MineralsDokument12 SeitenSarda Energy and MineralsAngel BrokingNoch keine Bewertungen

- GIPCL Result UpdatedDokument11 SeitenGIPCL Result UpdatedAngel BrokingNoch keine Bewertungen

- NTPC 4Q Fy 2013Dokument10 SeitenNTPC 4Q Fy 2013Angel BrokingNoch keine Bewertungen

- National Aluminium Result UpdatedDokument12 SeitenNational Aluminium Result UpdatedAngel BrokingNoch keine Bewertungen

- Acc LTD (Acc) CMP: Rs.1,099.75: Q1CY11 Result Update April 29, 2011Dokument4 SeitenAcc LTD (Acc) CMP: Rs.1,099.75: Q1CY11 Result Update April 29, 2011Mohammed Asif ValsangkarNoch keine Bewertungen

- GIPCL Result UpdatedDokument11 SeitenGIPCL Result UpdatedAngel BrokingNoch keine Bewertungen

- GSPL, 11th February, 2013Dokument10 SeitenGSPL, 11th February, 2013Angel BrokingNoch keine Bewertungen

- Coal India: Performance HighlightsDokument10 SeitenCoal India: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Gujarat Gas, 2Q CY 2013Dokument10 SeitenGujarat Gas, 2Q CY 2013Angel BrokingNoch keine Bewertungen

- Reliance Industries: Performance HighlightsDokument14 SeitenReliance Industries: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Madras Cements, 1Q FY 2014Dokument10 SeitenMadras Cements, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Gujarat State Petronet: Performance HighlightsDokument10 SeitenGujarat State Petronet: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Gipcl, 1Q Fy 2014Dokument10 SeitenGipcl, 1Q Fy 2014Angel BrokingNoch keine Bewertungen

- Performance Highlights: AccumulateDokument11 SeitenPerformance Highlights: AccumulateAngel BrokingNoch keine Bewertungen

- NTPC Result UpdatedDokument11 SeitenNTPC Result UpdatedAngel BrokingNoch keine Bewertungen

- Indraprasth Gas Result UpdatedDokument10 SeitenIndraprasth Gas Result UpdatedAngel BrokingNoch keine Bewertungen

- IL&FS Transportation Networks: Performance HighlightsDokument14 SeitenIL&FS Transportation Networks: Performance HighlightsAngel BrokingNoch keine Bewertungen

- WPIInflation August2013Dokument5 SeitenWPIInflation August2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 16 2013Dokument9 SeitenDaily Agri Report September 16 2013Angel BrokingNoch keine Bewertungen

- Oilseeds and Edible Oil UpdateDokument9 SeitenOilseeds and Edible Oil UpdateAngel BrokingNoch keine Bewertungen

- International Commodities Evening Update September 16 2013Dokument3 SeitenInternational Commodities Evening Update September 16 2013Angel BrokingNoch keine Bewertungen

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDokument4 SeitenRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Dokument4 SeitenDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 16 2013Dokument2 SeitenDaily Agri Tech Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Metals and Energy Report September 16 2013Dokument6 SeitenDaily Metals and Energy Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 14 2013Dokument2 SeitenDaily Agri Tech Report September 14 2013Angel BrokingNoch keine Bewertungen

- Currency Daily Report September 16 2013Dokument4 SeitenCurrency Daily Report September 16 2013Angel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument12 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDokument4 SeitenJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Derivatives Report 8th JanDokument3 SeitenDerivatives Report 8th JanAngel BrokingNoch keine Bewertungen

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDokument6 SeitenTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report Sept 13Dokument2 SeitenMetal and Energy Tech Report Sept 13Angel BrokingNoch keine Bewertungen

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDokument1 SeitePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNoch keine Bewertungen

- Currency Daily Report September 13 2013Dokument4 SeitenCurrency Daily Report September 13 2013Angel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report Sept 12Dokument2 SeitenMetal and Energy Tech Report Sept 12Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19997) / NIFTY (5913)Dokument4 SeitenDaily Technical Report: Sensex (19997) / NIFTY (5913)Angel Broking100% (1)

- Daily Metals and Energy Report September 12 2013Dokument6 SeitenDaily Metals and Energy Report September 12 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 12 2013Dokument2 SeitenDaily Agri Tech Report September 12 2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19997) / NIFTY (5897)Dokument4 SeitenDaily Technical Report: Sensex (19997) / NIFTY (5897)Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 12 2013Dokument9 SeitenDaily Agri Report September 12 2013Angel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Currency Daily Report September 12 2013Dokument4 SeitenCurrency Daily Report September 12 2013Angel BrokingNoch keine Bewertungen

- 1st Annual Charity Golf Tournament For ChloeDokument2 Seiten1st Annual Charity Golf Tournament For ChloeM.G. PerezNoch keine Bewertungen

- ADDIE - Model - For - E-Learning - Sinteza2017 - Corr-With-Cover-Page-V2 (New)Dokument6 SeitenADDIE - Model - For - E-Learning - Sinteza2017 - Corr-With-Cover-Page-V2 (New)arief m.fNoch keine Bewertungen

- Level - 1: Expansion of DeterminantsDokument13 SeitenLevel - 1: Expansion of DeterminantsAtomitronNoch keine Bewertungen

- Javier Guzman v. City of Cranston, 812 F.2d 24, 1st Cir. (1987)Dokument4 SeitenJavier Guzman v. City of Cranston, 812 F.2d 24, 1st Cir. (1987)Scribd Government DocsNoch keine Bewertungen

- Precision Nutrition. Nutrient TimingDokument21 SeitenPrecision Nutrition. Nutrient TimingPaolo AltoéNoch keine Bewertungen

- Sanjay Seth - Once Was Blind But Now Can See Modernity and The Social SciencesDokument16 SeitenSanjay Seth - Once Was Blind But Now Can See Modernity and The Social SciencesQuelen GuedesNoch keine Bewertungen

- NyirabahireS Chapter5 PDFDokument7 SeitenNyirabahireS Chapter5 PDFAndrew AsimNoch keine Bewertungen

- Lab Exercise: 8Dokument5 SeitenLab Exercise: 8Test UserNoch keine Bewertungen

- Redemption and The Relief Work RevisedDokument234 SeitenRedemption and The Relief Work RevisedYewo Humphrey MhangoNoch keine Bewertungen

- Prof Chase B. Wrenn - The True and The Good - A Strong Virtue Theory of The Value of Truth-Oxford University Press (2024)Dokument196 SeitenProf Chase B. Wrenn - The True and The Good - A Strong Virtue Theory of The Value of Truth-Oxford University Press (2024)Mihaela DodiNoch keine Bewertungen

- Background Essay LSA Skills (Speaking)Dokument12 SeitenBackground Essay LSA Skills (Speaking)Zeynep BeydeşNoch keine Bewertungen

- Lesson Plan Tower of LondonDokument5 SeitenLesson Plan Tower of Londonmacrinabratu4458Noch keine Bewertungen

- Grade 3 MathematicsDokument3 SeitenGrade 3 Mathematicsailaine grace alapNoch keine Bewertungen

- LAAG4 Elementary Row Operations-3Dokument14 SeitenLAAG4 Elementary Row Operations-3Kamran AliNoch keine Bewertungen

- NotesDokument2 SeitenNotesNoella Marie BaronNoch keine Bewertungen

- Tapan Pathak Case StudiesDokument33 SeitenTapan Pathak Case StudiesNeelee SoniNoch keine Bewertungen

- Internship ProposalDokument6 SeitenInternship ProposalatisaniaNoch keine Bewertungen

- Vocabulary ListDokument2 SeitenVocabulary List謝明浩Noch keine Bewertungen

- Maria Da Piedade Ferreira - Embodied Emotions - Observations and Experiments in Architecture and Corporeality - Chapter 11Dokument21 SeitenMaria Da Piedade Ferreira - Embodied Emotions - Observations and Experiments in Architecture and Corporeality - Chapter 11Maria Da Piedade FerreiraNoch keine Bewertungen

- Labor Law Review Questions and AnswersDokument151 SeitenLabor Law Review Questions and AnswersCarty MarianoNoch keine Bewertungen

- DSP Setting Fundamentals PDFDokument14 SeitenDSP Setting Fundamentals PDFsamuel mezaNoch keine Bewertungen

- A Phonological Reconstruction of Proto-ChinDokument191 SeitenA Phonological Reconstruction of Proto-ChinHming Lem100% (1)

- Comparative Analysis of Severe Pediatric and Adult Leptospirosis in Sa o Paulo, BrazilDokument3 SeitenComparative Analysis of Severe Pediatric and Adult Leptospirosis in Sa o Paulo, BrazilShofura AzizahNoch keine Bewertungen

- Simonkucher Case Interview Prep 2015Dokument23 SeitenSimonkucher Case Interview Prep 2015Jorge Torrente100% (1)

- Muzakarah Jawatankuasa Fatwa Majlis Kebangsaan Bagi Hal Ehwal Ugama Islam Malaysia Kali KeDokument7 SeitenMuzakarah Jawatankuasa Fatwa Majlis Kebangsaan Bagi Hal Ehwal Ugama Islam Malaysia Kali KeSiti Zubaidah ZulkhairieNoch keine Bewertungen

- Cri 192Dokument5 SeitenCri 192Reyn CagmatNoch keine Bewertungen

- Psychology ProjectDokument7 SeitenPsychology Projectsai indiraNoch keine Bewertungen

- Muslimah's Handbook of PurityDokument60 SeitenMuslimah's Handbook of PurityMuadh KhanNoch keine Bewertungen

- Quiz Simple Present Simple For Elementary To Pre-IntermediateDokument2 SeitenQuiz Simple Present Simple For Elementary To Pre-IntermediateLoreinNoch keine Bewertungen

- Academic 8 2.week Exercise Solutions PDFDokument8 SeitenAcademic 8 2.week Exercise Solutions PDFAhmet KasabalıNoch keine Bewertungen