Beruflich Dokumente

Kultur Dokumente

Faq M034

Hochgeladen von

chitru_chichruOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Faq M034

Hochgeladen von

chitru_chichruCopyright:

Verfügbare Formate

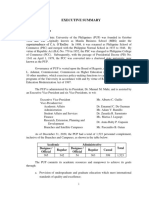

FREQUENTLY ASKED QUESTIONS ON MEMORANDUM NO.

M-2012-034

To facilitate implementation of Memorandum No. M-2012-034 dated 13 July 2012 on the prohibition against non-residents from investing in the Special Deposit Account (SDA) facility of the Bangko Sentral ng Pilipinas (BSP), the following clarifications are hereby issued: 1. As a branch of a foreign bank, capital is comprised of assigned capital plus net due to head office where net due to head office is capped at 3 or 4 times of assigned capital. Is the net due to head office component of capital considered funds obtained directly or indirectly from non-residents for purposes of compliance with the Memorandum? Net Due to Head Office (NDTHO), even if within the allowable limits that may be considered regulatory capital, is considered non-compliant with the Memorandum if they are at such a level more than the expected to support the ordinary business of the bank given its risk profile. However, the unremitted profits component of NDTHO is not considered as funds obtained from nonresidents, hence, can be invested in SDA. 2. Are overseas Filipino workers (OFWs) considered non-residents? Land-based OFWs with work contracts of 1 year or more are considered nonresidents, while those with work contracts of less than 1 year are considered residents. Sea-based OFWs are considered residents. 3. For joint accounts where one of the accountholders is a non-resident, will the account be considered non-resident? Generally, for joint accounts where 1 of the accountholders is a non-resident, the account will be considered as non-resident. However, joint accounts involving a non-resident OFW and a resident beneficiary may invest in SDA. 4. Will a Filipino individual temporarily residing abroad (e.g. a student studying overseas for 1-2 years) be considered a non-resident? A Filipino individual who goes abroad for full-time study generally continues to be resident in the Philippines. This treatment is adopted even if his/her degree/course may exceed one year. However, a Filipino student may change to being a resident of the territory in which he/she is studying when he/she develops an intention to continue his/her presence abroad.

5. If the non-resident invests in a Peso unit investment trust fund (UITF), and the Peso UITF has SDA investments, are we supposed to terminate the UITF placement of the non-resident? Non-residents may invest in UITF products with SDA placements so long as such SDA placements are for prudential liquidity requirements of the fund or are in the nature of interim/temporary investments.

6. Will Dual Citizenship be considered for this purpose? The issue is residency, not citizenship. Hence, please be guided by the definition of non-residents under Section 1 of the MORFXT. 7. Does an Alien Certificate of Registration give permanent residence to foreigner? The requirement is for a non-Filipino citizen to reside for a year or more in the Philippines. If he/she is residing in the Philippines for a year or more, he is considered a resident. 8. Does period of residence have to be uninterrupted? Under Section 1 of the Manual of Regulations on Foreign Exchange Transactions, the individual should be permanently residing in the Philippines for a year or more to be considered a resident. 9. Shall we consider the retirees and ambassadors as "non-residents", if the source of funds is the retirement pay and salaries, respectively, which are paid by either GSIS, SSS or Filipino employers? National diplomats, peacekeeping and other military personnel, and other civil servants employed abroad in government enclaves, as well as members of their households are considered to be residents of the economic territory of the employing government. Ambassadors and retirees who are employed or were formerly employed by the Philippine government, are thus considered residents. In the case of retirees of private entities, they may be considered non-residents if they stayed abroad for a year or more. However, if it is clearly established by the Bank that the funds are sourced domestically (e.g. retirement pay), then, these funds may be invested in SDA. 10. What does indirect sourcing mean? It refers to funds ultimately obtained from non-residents which through layering or other schemes are represented to be from a resident source.

Page 2 of 3

11. The memorandum says that we shall report to the SES all existing placements prohibited by said memorandum. When we report the outstanding SDA by nonresidents which will be terminated as they mature, what format do we use? Banks and their trust departments are required to report all existing SDA transactions prohibited by the Memorandum as of cut-off date of 18 July 2012. The Banks Compliance Officers have been provided by the BSP with the reporting template. The inventory of such prohibited transactions shall be submitted to the Central Point of Contact Department I or II not later than 31 July 2012. The notarized Letter of Undertaking (LOU) shall be submitted to the BSPs Treasury Department not later than 24 July 2012 as a basic requirement for continued access to the SDA facility. 12. Are deposit placements of non-residents prohibited to be invested in SDA considering that funds are fungible? In general, deposits generated by a bank from any source may be invested in SDA as part of normal banking activity. However, management activities of a bank are not covered by the prohibition, provided, the bank does not enter into arrangements or schemes that effectively allow a bank to act as conduit of nonresidents to the SDA facility (e.g. offering preferential yields to non-residents higher than the Banks regular deposit rates). 13. Aside from the submission of notarized Letter of Undertaking and inventory of all existing SDA transactions not consistent with the Memorandum, what are other expectations from a bank or trust department/entity? Banks and trust departments/entities are expected to develop internal policies consistent with the Memorandum which shall be effectively communicated across the organization. The Banks compliance system should be able to monitor compliance with said policies and internal audit shall conduct independent review to ensure effective implementation of said policy. The action/operational plan including policy institutionalization, compliance mechanism and audit controls of the bank and its trust department to comply with the terms and conditions for the access to the SDA facility shall be implemented not later than 31 August 2012. The implementation thereof shall be subject to verification by the BSP.

Page 3 of 3

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- D@VLD $ed@ri$ - Dre$$ Y0ur F@mily in C0rdur0y @ND Denim PDFDokument418 SeitenD@VLD $ed@ri$ - Dre$$ Y0ur F@mily in C0rdur0y @ND Denim PDFchitru_chichruNoch keine Bewertungen

- D@VLD $ed@ri$ - Dre$$ Y0ur F@mily in C0rdur0y @ND Denim PDFDokument418 SeitenD@VLD $ed@ri$ - Dre$$ Y0ur F@mily in C0rdur0y @ND Denim PDFchitru_chichruNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Criminal Law Reviewer 2008 UPDokument62 SeitenCriminal Law Reviewer 2008 UPKatrina Montes100% (15)

- CRIMINAL PROCEDURE JURISDICTIONDokument99 SeitenCRIMINAL PROCEDURE JURISDICTIONRamon Muñez100% (4)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Constitutional Law II ReviewerDokument45 SeitenConstitutional Law II Reviewerchitru_chichru100% (2)

- RA 3591 (As Amended) PDIC CharterDokument39 SeitenRA 3591 (As Amended) PDIC Charterchitru_chichruNoch keine Bewertungen

- Criminal Law (Arts. 1-237)Dokument124 SeitenCriminal Law (Arts. 1-237)MiGay Tan-Pelaez94% (18)

- UST GN 2011 - Political Law ProperDokument284 SeitenUST GN 2011 - Political Law ProperGhost67% (3)

- Stoic Quotes PDFDokument18 SeitenStoic Quotes PDFAlejandro Rocha Pérez100% (1)

- Petty Cash SampleDokument11 SeitenPetty Cash SampleMohammed Ataullah KhanNoch keine Bewertungen

- Rednotes - Civil LawDokument116 SeitenRednotes - Civil Lawjojitus100% (2)

- Fundamentals of Accountancy, Business and Management 1 Accounting Cycle of A Merchandising BusinessDokument13 SeitenFundamentals of Accountancy, Business and Management 1 Accounting Cycle of A Merchandising BusinessVenice100% (1)

- OBLICON ReviewerDokument110 SeitenOBLICON ReviewerNikkiAgeroNoch keine Bewertungen

- RA 8791 General Banking ActDokument22 SeitenRA 8791 General Banking ActStephanie Mei100% (1)

- Criminal-Law Reviewer San Beda Red Notes PDFDokument74 SeitenCriminal-Law Reviewer San Beda Red Notes PDF8LYN LAW100% (2)

- Criminal Procedure ReviewerDokument51 SeitenCriminal Procedure ReviewerJingJing Romero94% (156)

- J.cornejo - Criminal LawDokument56 SeitenJ.cornejo - Criminal Lawcmv mendozaNoch keine Bewertungen

- How To Be An ExistentialistDokument16 SeitenHow To Be An ExistentialistContinuum47% (19)

- The Anti-Money Laundering Act of 2001Dokument25 SeitenThe Anti-Money Laundering Act of 2001chitru_chichru100% (1)

- Excel Keyboard ShortcutsDokument2 SeitenExcel Keyboard Shortcutschitru_chichruNoch keine Bewertungen

- Negotibale Instruments Law Star ProvisionsDokument1 SeiteNegotibale Instruments Law Star Provisionschitru_chichruNoch keine Bewertungen

- Anti Money Laundering Act of The PhilippinesDokument9 SeitenAnti Money Laundering Act of The PhilippinesJito Ricardo SantiagoNoch keine Bewertungen

- Republic Act 10168Dokument13 SeitenRepublic Act 10168chitru_chichruNoch keine Bewertungen

- PD1034Dokument5 SeitenPD1034chitru_chichruNoch keine Bewertungen

- PDIC LawDokument6 SeitenPDIC LawAnna Fatima ChavezNoch keine Bewertungen

- RA 9194 - Implementing Rules and RegulationsDokument35 SeitenRA 9194 - Implementing Rules and Regulationschitru_chichru100% (1)

- Pawnshops Regulation Act Presidential Decree 114Dokument5 SeitenPawnshops Regulation Act Presidential Decree 114Johney DoeNoch keine Bewertungen

- RA9194Dokument5 SeitenRA9194Vernie BacalsoNoch keine Bewertungen

- BSP CharterDokument62 SeitenBSP CharterJane Dela CruzNoch keine Bewertungen

- RA 7721 - Liberalizing Entry and Scope of Foreign BanksDokument4 SeitenRA 7721 - Liberalizing Entry and Scope of Foreign BanksRem RamirezNoch keine Bewertungen

- PRESIDENTIAL DECREE No. 129 February 15, 1973Dokument6 SeitenPRESIDENTIAL DECREE No. 129 February 15, 1973chitru_chichruNoch keine Bewertungen

- Announcement On IAI-SOA IFRI Certificate ProgramDokument3 SeitenAnnouncement On IAI-SOA IFRI Certificate ProgramDeepakIMTNoch keine Bewertungen

- Job Description for Pharmacy In-chargeDokument5 SeitenJob Description for Pharmacy In-chargeUsman JamilNoch keine Bewertungen

- GST Multiple Choice QuestionsDokument3 SeitenGST Multiple Choice QuestionsCOMEDY WATCHNoch keine Bewertungen

- Book Keeping AccountancyDokument8 SeitenBook Keeping AccountancyNarra JanardhanNoch keine Bewertungen

- Donde R. Salazar, Cpa: Independent Auditors' Report The Board of Directors Seabutterfly IncDokument2 SeitenDonde R. Salazar, Cpa: Independent Auditors' Report The Board of Directors Seabutterfly IncJheza Mae PitogoNoch keine Bewertungen

- F2 Past Paper - Question06-2002Dokument8 SeitenF2 Past Paper - Question06-2002ArsalanACCANoch keine Bewertungen

- Ankit Gautam ResumeDokument3 SeitenAnkit Gautam ResumeK.d. GargNoch keine Bewertungen

- Effectiveness of Minority Language ProjectsDokument22 SeitenEffectiveness of Minority Language ProjectslaloshNoch keine Bewertungen

- MCSR (General Rules)Dokument78 SeitenMCSR (General Rules)akshayryukNoch keine Bewertungen

- A Project Report On Budgetary ControlDokument28 SeitenA Project Report On Budgetary ControlPranit Anil Chavan100% (2)

- Audit Commands For FinacleDokument3 SeitenAudit Commands For FinacleDavinder Kaur Oberoi100% (1)

- Bhavani Sankar VankadariDokument4 SeitenBhavani Sankar Vankadaridr_shaikhfaisalNoch keine Bewertungen

- Gadang Holdings Berhad (278114-K) Scholarship Application FormDokument4 SeitenGadang Holdings Berhad (278114-K) Scholarship Application FormKasturi LetchumananNoch keine Bewertungen

- Auditing-Unit 3-VouchingDokument12 SeitenAuditing-Unit 3-VouchingAnitha RNoch keine Bewertungen

- CH 01 Intro To Financial StatementsDokument26 SeitenCH 01 Intro To Financial StatementsRyan GublerNoch keine Bewertungen

- BASIC ACCOUNTING FOR NON-ABM STUDENTS (BAB 101ADokument25 SeitenBASIC ACCOUNTING FOR NON-ABM STUDENTS (BAB 101APamela PerezNoch keine Bewertungen

- Worksheet 1 Check Policy ComplianceDokument9 SeitenWorksheet 1 Check Policy ComplianceMichael Aborot Dela TorreNoch keine Bewertungen

- Ledger Accounting and Double Entry Bookkeeping: Chapter Learning ObjectivesDokument46 SeitenLedger Accounting and Double Entry Bookkeeping: Chapter Learning Objectiveskoti kebele100% (1)

- 03-PUP2020 Executive SummaryDokument16 Seiten03-PUP2020 Executive SummaryMiss_AccountantNoch keine Bewertungen

- Becg LongDokument16 SeitenBecg LongBhaskaran BalamuraliNoch keine Bewertungen

- AA02 Post October Dormant Company Accounts Dca 2 PDFDokument3 SeitenAA02 Post October Dormant Company Accounts Dca 2 PDFMaharshi ShrimaliNoch keine Bewertungen

- Bye-Laws of Sanskruti Township Flat Owners Welfare AssociationDokument18 SeitenBye-Laws of Sanskruti Township Flat Owners Welfare AssociationSaddi Mahender Reddy100% (1)

- DocxDokument7 SeitenDocxHeni OktaviantiNoch keine Bewertungen

- AnnualReport2016 17Dokument244 SeitenAnnualReport2016 17RiteshRajputNoch keine Bewertungen

- NSDL IAR New FormatDokument20 SeitenNSDL IAR New FormatMansoor Ahmed Siddiqui0% (1)

- Paper T5 Managing People and Systems: Sample Multiple Choice Questions - June 2009Dokument6 SeitenPaper T5 Managing People and Systems: Sample Multiple Choice Questions - June 2009asad27192Noch keine Bewertungen

- Internal Audit Function Quality Linked to Financial Reporting QualityDokument40 SeitenInternal Audit Function Quality Linked to Financial Reporting QualityEL GHARBAOUINoch keine Bewertungen

- This Part Describes Preliminary and Basic Services Which An Architect Will Normally ProvideDokument9 SeitenThis Part Describes Preliminary and Basic Services Which An Architect Will Normally ProvidedodsmNoch keine Bewertungen