Beruflich Dokumente

Kultur Dokumente

Assignment 2

Hochgeladen von

dowwaymingOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Assignment 2

Hochgeladen von

dowwaymingCopyright:

Verfügbare Formate

MGTB09 2011 Fall Assignment 2 Due Date: December 1, 2011 Show your steps.

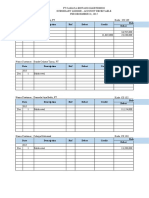

Question 1 (25 marks) Considering two mutual exclusive projects: A and B. Project A requires initial investment of $2,000 and pays cash flow of $500 per year for seven years. Project B requires initial investment of $1,800 and pays $3,400 at the end of month 54. The annual discount rate is 12%. (a) Calculate the payback period, discounted payback period, IRR, PI, and NPV for both projects. (b) If we have to repeat the project forever, which project you will choose?

Question 2 (25 marks) KIT Inc. is planning to launch a new product, priced at $10 per unit. The unit cost is $4. The sale volume is 1,000 units in the first year and increases by 100 units per year for the next five years. To begin, KIT has to pay $2,000 (tax deductible) to clean up the site. The production requires an initial investment in equipment of $15,000. The equipment is in an asset class with a CCA rate of 20% and it is the only asset in the class. At the end of year six, the equipment will be sold for $4,000 and KIT has to pay $1,000 (tax deductible) to restore the site. The net working capital is expected to be 20% of the following years sales. Half of the total net working capital will be recovered when the production halts at the end of year 6 and the remaining half at the end of year 7. The tax rate is 30% and KITs cost of capital is 15%. Calculate the net present value.

Question 3 (25%) The following table shows the probabilities and the possible returns on Assets A and B: States Good Bad Probability 0.3 0.7 Asset A 0.16 0.05 Asset B 0.05 0.16

a. Calculate the expected returns and standard deviations of Assets A and B. b. Calculate the correlation between Asset A and Asset B. c. What must be the risk-free rate? d. If the Market portfolio has an expected return of 12.5% and both Assets A and B are fairly priced, what are the betas of Assets A and B?

Question 4 (25 marks) Consider the following returns of Asset A and the Market under different GDP growth: GDP growth = 5% 30% 9% 12% GDP growth = 10% 40% 16% 18% GDP growth = 15% 30% 18% 24%

Probability Asset A return Market return (a) (b) (c) (d)

Calculate the expected return and standard deviation of asset A and the Market. Calculate the beta of asset A. Find the risk-free rate if asset A is fairly priced. If asset B has -1 correlation with asset A and standard deviation of 0.985%, find the expected return of asset B. (e) Construct a portfolio that consists of assets A and B, and has standard deviation of 2%. Calculate the expected return of this portfolio.

END

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Business Economics - Question BankDokument4 SeitenBusiness Economics - Question BankKinnari SinghNoch keine Bewertungen

- Globalization #1 PDFDokument2 SeitenGlobalization #1 PDFSuzette Hermoso100% (4)

- Sponsorship Prospectus - FINALDokument20 SeitenSponsorship Prospectus - FINALAndrea SchermerhornNoch keine Bewertungen

- MBBcurrent 564548147990 2022-12-31 PDFDokument10 SeitenMBBcurrent 564548147990 2022-12-31 PDFAdeela fazlinNoch keine Bewertungen

- 386 - 33 - Powerpoint - Slides - Lipsey - PPT - ch07 (Autosaved)Dokument46 Seiten386 - 33 - Powerpoint - Slides - Lipsey - PPT - ch07 (Autosaved)Ayush KumarNoch keine Bewertungen

- Request BADACODokument1 SeiteRequest BADACOJoseph HernandezNoch keine Bewertungen

- Readymade Plant Nursery in Maharashtra - Goa - KarnatakaDokument12 SeitenReadymade Plant Nursery in Maharashtra - Goa - KarnatakaShailesh NurseryNoch keine Bewertungen

- Aus Tin 20105575Dokument120 SeitenAus Tin 20105575beawinkNoch keine Bewertungen

- Billing Summary Customer Details: Total Amount Due (PKR) : 2,831Dokument1 SeiteBilling Summary Customer Details: Total Amount Due (PKR) : 2,831Shazil ShahNoch keine Bewertungen

- Financial Literacy PDFDokument44 SeitenFinancial Literacy PDFGilbert MendozaNoch keine Bewertungen

- Arithmetic of EquitiesDokument5 SeitenArithmetic of Equitiesrwmortell3580Noch keine Bewertungen

- Guide To Accounting For Income Taxes NewDokument620 SeitenGuide To Accounting For Income Taxes NewRahul Modi100% (1)

- DuPont Analysis On JNJDokument7 SeitenDuPont Analysis On JNJviettuan91Noch keine Bewertungen

- Project ReportDokument110 SeitenProject ReportAlaji Bah CireNoch keine Bewertungen

- Aml Az Compliance TemplateDokument35 SeitenAml Az Compliance TemplateAnonymous CZV5W00Noch keine Bewertungen

- Change Control Procedure: Yogendra GhanwatkarDokument19 SeitenChange Control Procedure: Yogendra GhanwatkaryogendraNoch keine Bewertungen

- GST Rate-: Type of Vehicle GST Rate Compensation Cess Total Tax PayableDokument3 SeitenGST Rate-: Type of Vehicle GST Rate Compensation Cess Total Tax PayableAryanNoch keine Bewertungen

- Regional Policy in EU - 2007Dokument65 SeitenRegional Policy in EU - 2007sebascianNoch keine Bewertungen

- Rental AgreementDokument1 SeiteRental AgreementrampartnersbusinessllcNoch keine Bewertungen

- Bye, Bye Nyakatsi Concept PaperDokument6 SeitenBye, Bye Nyakatsi Concept PaperRwandaEmbassyBerlinNoch keine Bewertungen

- Fatigue Crack Growth Behavior of JIS SCM440 Steel N 2017 International JournDokument13 SeitenFatigue Crack Growth Behavior of JIS SCM440 Steel N 2017 International JournSunny SinghNoch keine Bewertungen

- RBS Internship ReportDokument61 SeitenRBS Internship ReportWaqas javed100% (3)

- © 2015 Mcgraw-Hill Education Garrison, Noreen, Brewer, Cheng & YuenDokument62 Seiten© 2015 Mcgraw-Hill Education Garrison, Noreen, Brewer, Cheng & YuenHIỀN LÊ THỊNoch keine Bewertungen

- The System of Government Budgeting Bangladesh: Motahar HussainDokument9 SeitenThe System of Government Budgeting Bangladesh: Motahar HussainManjare Hassin RaadNoch keine Bewertungen

- Latihan Soal PT CahayaDokument20 SeitenLatihan Soal PT CahayaAisyah Sakinah PutriNoch keine Bewertungen

- Boquet 2017, Philippines, Springer GeographyDokument856 SeitenBoquet 2017, Philippines, Springer Geographyfusonegro100% (3)

- Community Development Fund in ThailandDokument41 SeitenCommunity Development Fund in ThailandUnited Nations Human Settlements Programme (UN-HABITAT)100% (1)

- Indian Contract ActDokument8 SeitenIndian Contract ActManish SinghNoch keine Bewertungen

- Manufactures Near byDokument28 SeitenManufactures Near bykomal LPS0% (1)

- EOQ HomeworkDokument4 SeitenEOQ HomeworkCésar Vázquez ArzateNoch keine Bewertungen