Beruflich Dokumente

Kultur Dokumente

Male Female Married Single Own House Rented House Yes No

Hochgeladen von

Abhishek JainOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Male Female Married Single Own House Rented House Yes No

Hochgeladen von

Abhishek JainCopyright:

Verfügbare Formate

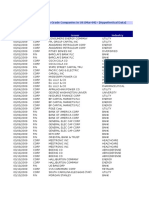

Age Gender Marital Status You live in Sole Bread Winner

Number of Dependents

Male Female Married Single Own house Rented house Yes No

Occupation: Annual Personal Income Household Income

Could you tell us all the different types of insurance you currently have? Life insurance Mortgage protection insurance Term Insurance Retirement plans Endowment Insurance Medical/Health insurance Critical illness Personal accident insurance Whole-life insurance Auto/Car insurance Money back insurance Travel insurance Unit-linked insurance All of them

Now, thinking of all the personal insurance policies you currently have, how much in total are you covered for only? Less than Rs 50,000 Rs 750,001-10,00,000 Rs 50,001-100,000 Rs 10,00,001-15,00,000 Rs 100,001-300,000 Rs Above Rs 15 lakh Rs 300,001-500,000 Do not know/cant recall Rs 500,001-750,000 What are the reasons why you do not own any insurance (besides those bought by your employer)? It's too expensive Insurance is not important, no reason to get it It is not necessary or worth doing It is too hard to understand/confusing I do not trust insurance companies It is too much hassle to get It is not worth of good value Employer sponsored cover is sufficient for me Insurance is not worth investing I am well-covered by my Employer do not know All of them Other Please tell us how well do you think you are covered? Definitely well-covered Probably well-covered

May or may not be well-covered Probably not well-covered Definitely not well-covered

How long do you think the death cover amount will cover your family/ beneficiaries? Less than one year 11-15 years 1-3 years More than 15 years 4-7 years do not know/can't recall 8-10 years Please tell us if you have any plans to get insurance? Definitely have plans to buy Probably have plans to buy May/May not have plans to buy Probably have no plans to buy Definitely have no plans to buy What are the reasons why you have no plans of buying insurance? It is too expensive Insurance is not important, no reason to get it It is not necessary or worth doing It is too hard to understand/confusing I do not trust insurance companies It is too much hassle to get It is not worth of good value Employer sponsored cover is sufficient for me Insurance is not worth investing I am well-covered by my Employer do not know All of them Other

Q5: What financial constraints guided you to opt for this plan? a) Returns and dividends b) Higher return at the end of maturity c) Lesser risk

d) Any others, please mention _________________________________________________ Q6: What do you do with the amount that you receive from the insurance policy?

a) Reinvest b) Spend on financial expenditures c) Others please mention _______________________________________ Q7: What are your financial goals? a) Income generation b) Capital appreciation and income generation c) Capital preservation d) Other _____________________________ Q8: What are your financial constraints in the short term (1-5 years)? ___________________________________________________________ Q9. What are your financial considerations in the long term (>5 years)? ___________________________________________________________ Q10. Mention your satisfaction level with this insurance policy a) Very Dissatisfied b) Dissatisfied c) Moderately satisfied d) Satisfied e) Highly satisfied

QUESTIONNAIRE

A STUDY CONDUCTED TO UNDERSTAND THE CONSUMERS PERCEPTION ABOUT LIFE INSURANCE POLICIES 1. Name: - _______________________________________________________________

2. Age:

_______________________________________________________________

3. Address: ______________________________________________________________ ______________________________________________________________ 4. Phone number: _________________________________________________________ 5. Occupation: ___________________________________________________________ 6. Monthly income: o <5000 o 5001-10,000 o 10,000-15,000 o 15,001-20000 o 20,001-25,000 o >25,000

7. Do You Own o House o Two Wheeler o Car

8. Do you have a Life Insurance Policy with any Life Insurance Company? o Yes o No a) If yes, name the Company________________________________________________ b) Name the policy which you own___________________________________________

9. What factors do you consider while selecting a life insurance company? o Premium Outflow o Company Reputation o Service Quality o Product Quality o Return on Investment

10. What factors influenced to select a Life Insurance company? o Personal interest o Friends o Family o Agents o Advertisements

o Others

11. What is the value of your life insurance? o >10,000 o 10,000-25,000 o 25,000-50,000 o 50,000-1,00,000 o >1,00,000 12. Do you prefer to invest your money in a Insurance company or in a Bank? o Insurance Company o Bank

13. Are you satisfied with your current Life Insurance Company? o Yes o No If Yes Why? ____________________________________________________________ If No Why? _____________________________________________________________

14. How do you rate the service offered by your Life Insurance Company? o Excellent o Very Good o Good

o Average o Poor

15. Would you like to communicate the service offered by your Life Insurance Company to others? o Yes o No

16. How many Life insurance Companies do you know? o <5 o 5-7 o 8-10 o >10

17. How do you rate the following Life Insurance Companies? o LIC o HDFC o ING Vysya o Met life India insurance o Birla sun life o ICICI Prudential o TATA AIG

18. Would you like to continue with the same Life Insurance Company? o Yes

o No

19. Any suggestions for improving the service offered by life insurance companies ___________________________________________________________________ ___________________________________________________________________ ___________________________________________________________________ _______________________________________________________________

Das könnte Ihnen auch gefallen

- Questionnaire For Consumer Perception in Investment in ULIP and Mutual FundDokument4 SeitenQuestionnaire For Consumer Perception in Investment in ULIP and Mutual Fundrahul_jayaswal80% (10)

- Comparative Analysis of RECRUITMENT of Public and Private Bank SectorDokument91 SeitenComparative Analysis of RECRUITMENT of Public and Private Bank Sectorlokesh_045100% (4)

- Systematic Investment Plan - SIP Project ReportDokument109 SeitenSystematic Investment Plan - SIP Project ReportCarmen Alvarado64% (11)

- Questionnaire: Understanding The Consumer'S Preference For Life Insurance ProductDokument3 SeitenQuestionnaire: Understanding The Consumer'S Preference For Life Insurance Productsoumya dubeyNoch keine Bewertungen

- Updated Health Insurance QuestionnnaireDokument5 SeitenUpdated Health Insurance QuestionnnaireMohitBhardwajNoch keine Bewertungen

- Study On Factors Influence in Investment Decision Making To InvestorsDokument3 SeitenStudy On Factors Influence in Investment Decision Making To InvestorsprajapatirimaNoch keine Bewertungen

- Questionnaire - For Agents: Personal DataDokument8 SeitenQuestionnaire - For Agents: Personal DataRachi JainNoch keine Bewertungen

- Promotion Mix of LicDokument5 SeitenPromotion Mix of LicRohitBhatiaNoch keine Bewertungen

- Lovely Professional University Model Home Work: #2: Mgt-516: Research MethodologyDokument7 SeitenLovely Professional University Model Home Work: #2: Mgt-516: Research MethodologyPrerna TandonNoch keine Bewertungen

- Questionnaire On Health InsuranceDokument3 SeitenQuestionnaire On Health InsuranceSoumyaPrasadNoch keine Bewertungen

- Ankit Iifl InternshipDokument22 SeitenAnkit Iifl InternshipAnkit TiwariNoch keine Bewertungen

- Indian Financial System PDFDokument16 SeitenIndian Financial System PDFANCHAL SINGHNoch keine Bewertungen

- "Marketing Strategies of Few Insurance Policies" of Kotak Life InsuranceDokument56 Seiten"Marketing Strategies of Few Insurance Policies" of Kotak Life Insurancesachin1065Noch keine Bewertungen

- Price Attention and MemoryDokument14 SeitenPrice Attention and MemoryMohamed LisaamNoch keine Bewertungen

- Final SIP Report 4Dokument62 SeitenFinal SIP Report 4Aveena GhoshNoch keine Bewertungen

- OUEST1Dokument2 SeitenOUEST1Karthik MbaNoch keine Bewertungen

- Strategic Analysis of Indian Life Insurance IndustryDokument40 SeitenStrategic Analysis of Indian Life Insurance IndustryPunit RaithathaNoch keine Bewertungen

- Questionnaire: Services of Private Sector Banks and Public Sector Bank" I AmDokument4 SeitenQuestionnaire: Services of Private Sector Banks and Public Sector Bank" I Amaxay12_kimcos10Noch keine Bewertungen

- Marketing Strategies of Insurance Companies in Us, Uk, India EtcDokument15 SeitenMarketing Strategies of Insurance Companies in Us, Uk, India EtclegendarystuffNoch keine Bewertungen

- QuestionsDokument5 SeitenQuestionsBushra KhanNoch keine Bewertungen

- Child Insurance PlanDokument72 SeitenChild Insurance Plan6338250% (4)

- Pmsby PDFDokument3 SeitenPmsby PDFmd mubarakNoch keine Bewertungen

- Interview QuestionDokument3 SeitenInterview QuestionPayal PatelNoch keine Bewertungen

- Preethi QuestionnaireDokument5 SeitenPreethi Questionnairetamil selviNoch keine Bewertungen

- Dear RespondentDokument5 SeitenDear RespondentPankaj SinghNoch keine Bewertungen

- Questionnaires of Micro InsuranceDokument1 SeiteQuestionnaires of Micro InsuranceUnknwn Nouwn33% (3)

- Questionnaire - On - Investor's Perception Regarding Various Investment Avenues Available at Financial MarketDokument4 SeitenQuestionnaire - On - Investor's Perception Regarding Various Investment Avenues Available at Financial Marketrajesh bathulaNoch keine Bewertungen

- Mcom BookDokument30 SeitenMcom BookHarshNoch keine Bewertungen

- Health Insurance in India-An Overview: K.Swathi, R.AnuradhaDokument4 SeitenHealth Insurance in India-An Overview: K.Swathi, R.AnuradhaAnkit YadavNoch keine Bewertungen

- Awareness and Preference For Mutual FundsDokument3 SeitenAwareness and Preference For Mutual Fundsamitnpatel1Noch keine Bewertungen

- Recent Trends in Marketing Strategy of Lic of IndiaDokument6 SeitenRecent Trends in Marketing Strategy of Lic of IndiaAkhil DasNoch keine Bewertungen

- Marketing of Financial Services Part 2Dokument66 SeitenMarketing of Financial Services Part 2Mohmmad Sameem100% (1)

- Diary of An Insurance Seller AllDokument9 SeitenDiary of An Insurance Seller AllPriyanka Patel100% (1)

- Questionare 123Dokument6 SeitenQuestionare 123Thanuja BhaskarNoch keine Bewertungen

- Car QuestionnaireDokument4 SeitenCar QuestionnaireArunKumarNoch keine Bewertungen

- 9) ConclusionDokument4 Seiten9) ConclusionSameer KapoorNoch keine Bewertungen

- Customer Satisfaction Towards Life Insurance Policies of SBIDokument78 SeitenCustomer Satisfaction Towards Life Insurance Policies of SBIRiya YadavNoch keine Bewertungen

- Comparative Study of Services Provided by LIC ICICI Prudential Life InsuranceDokument94 SeitenComparative Study of Services Provided by LIC ICICI Prudential Life InsuranceSimran SomaiyaNoch keine Bewertungen

- Research On Life InsuranceDokument90 SeitenResearch On Life InsuranceDhananjay SharmaNoch keine Bewertungen

- Y QuestionniareDokument3 SeitenY QuestionniareYadwinder SinghNoch keine Bewertungen

- Questionnaire On Customer Perception in Ulips PlanDokument3 SeitenQuestionnaire On Customer Perception in Ulips PlanKavi ArasanNoch keine Bewertungen

- CRM Initiatives by Lic of IndiaDokument5 SeitenCRM Initiatives by Lic of Indiashivacrazze0% (1)

- MBA Finance Interview Material For Broadridge Financial Solutions Inc - 2 PDFDokument3 SeitenMBA Finance Interview Material For Broadridge Financial Solutions Inc - 2 PDFAvinash GowdaNoch keine Bewertungen

- A Study On InvestorDokument6 SeitenA Study On InvestorshariffNoch keine Bewertungen

- SBI Life SWOT AnalysisDokument12 SeitenSBI Life SWOT AnalysisSantosh ReddyNoch keine Bewertungen

- Personal Accident Insurance ProjectDokument9 SeitenPersonal Accident Insurance Projectbhavika_08_1680844570% (1)

- QUESTION BANK For Banking and Insurance MBA Sem IV-FinanceDokument2 SeitenQUESTION BANK For Banking and Insurance MBA Sem IV-FinanceAgnya PatelNoch keine Bewertungen

- 7 P's of ICICI BANKDokument13 Seiten7 P's of ICICI BANKSumit VishwakarmaNoch keine Bewertungen

- LIC Plans PresentationDokument30 SeitenLIC Plans PresentationdineshghatkarNoch keine Bewertungen

- A Comperative Study of Customer Perception in Icici Bank and HDFC BankDokument11 SeitenA Comperative Study of Customer Perception in Icici Bank and HDFC BankSourabh Mishra100% (1)

- QuestionnaireDokument5 SeitenQuestionnaireridimakhijaNoch keine Bewertungen

- Questionnaire On Consumer Awareness Class 11thDokument1 SeiteQuestionnaire On Consumer Awareness Class 11thHarsh AgrawalNoch keine Bewertungen

- Project of Life InsuranceDokument64 SeitenProject of Life Insurancesingh_satbir50% (6)

- RamanDokument50 SeitenRamanAlisha SharmaNoch keine Bewertungen

- Wealth Management in Delhi and NCR Research Report On Scope of Wealth Management in Delhi and NCR 95pDokument98 SeitenWealth Management in Delhi and NCR Research Report On Scope of Wealth Management in Delhi and NCR 95pSajal AroraNoch keine Bewertungen

- Green Products A Complete Guide - 2020 EditionVon EverandGreen Products A Complete Guide - 2020 EditionBewertung: 5 von 5 Sternen5/5 (1)

- Questionnaire 2Dokument3 SeitenQuestionnaire 2sudhanshu28041989Noch keine Bewertungen

- SurveyDokument4 SeitenSurveyLeena LalwaniNoch keine Bewertungen

- Questionnaire: A Study Conducted To Understand The Consumer'S Perception About Life Insurance PoliciesDokument3 SeitenQuestionnaire: A Study Conducted To Understand The Consumer'S Perception About Life Insurance PoliciesNiyati SandisNoch keine Bewertungen

- Since When Are You Investing in Financial Instruments?Dokument4 SeitenSince When Are You Investing in Financial Instruments?amol0134Noch keine Bewertungen

- QuestionerDokument9 SeitenQuestionerUmi MariamNoch keine Bewertungen

- New Microsoft Office Word DocumentDokument88 SeitenNew Microsoft Office Word DocumentNaveen KandukuriNoch keine Bewertungen

- Gdpi Videos: Group Discussion Part 1Dokument1 SeiteGdpi Videos: Group Discussion Part 1Abhishek JainNoch keine Bewertungen

- Personal Interview Question AnswerDokument2 SeitenPersonal Interview Question AnswerAbhishek JainNoch keine Bewertungen

- Mat Dec 2013 Sample PaperDokument5 SeitenMat Dec 2013 Sample PaperEshan MaheshwariNoch keine Bewertungen

- OUTPUT2Dokument32 SeitenOUTPUT2Abhishek JainNoch keine Bewertungen

- Project Report ABHISHEK JAINDokument71 SeitenProject Report ABHISHEK JAINAbhishek JainNoch keine Bewertungen

- Regular Result of Bba G 2nd Semester e T Exam May 2011Dokument332 SeitenRegular Result of Bba G 2nd Semester e T Exam May 2011Abhishek JainNoch keine Bewertungen

- Keeping Ahead of The CurveDokument36 SeitenKeeping Ahead of The Curvegagandhillon10Noch keine Bewertungen

- Issue Date Issue Type Issuer Industry: US$ Bond Issues From High Grade Companies in US (Mar-09) - (Hypothetical Data)Dokument10 SeitenIssue Date Issue Type Issuer Industry: US$ Bond Issues From High Grade Companies in US (Mar-09) - (Hypothetical Data)ayush jainNoch keine Bewertungen

- RMC 35-06Dokument18 SeitenRMC 35-06Aris Basco DuroyNoch keine Bewertungen

- Welcome To Park Controls UpdatedDokument6 SeitenWelcome To Park Controls UpdatedRitu DasNoch keine Bewertungen

- Data CaptureDokument14 SeitenData CaptureJaime BasabeNoch keine Bewertungen

- CSP Vendor Maintenance FormDokument4 SeitenCSP Vendor Maintenance FormKurt FinkNoch keine Bewertungen

- Appendices To Substantive Defenses To Consumer Debt Collection Suits TDokument59 SeitenAppendices To Substantive Defenses To Consumer Debt Collection Suits Tdbush2778Noch keine Bewertungen

- CB Team Product Presentation LatestDokument31 SeitenCB Team Product Presentation LatestFlaviu HotnogNoch keine Bewertungen

- 7110 w10 QP 01Dokument12 Seiten7110 w10 QP 01iisjafferNoch keine Bewertungen

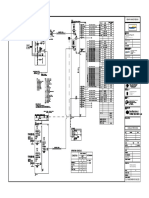

- EL-1104 Wiring Diagram PTM, PUTR PKG.R2Dokument1 SeiteEL-1104 Wiring Diagram PTM, PUTR PKG.R2Muh FarhanNoch keine Bewertungen

- A Day in The Life of A Shipbroker - Shipping and Freight ResourceDokument5 SeitenA Day in The Life of A Shipbroker - Shipping and Freight ResourcetaufiqNoch keine Bewertungen

- Notice Inviting Tender (Nit) : (Bidding Document No. TP/068107C001/T/BS-IV/16)Dokument9 SeitenNotice Inviting Tender (Nit) : (Bidding Document No. TP/068107C001/T/BS-IV/16)amitjustamitNoch keine Bewertungen

- Heuristic Analysis of "Growth of PayTM"Dokument10 SeitenHeuristic Analysis of "Growth of PayTM"Sumit BasantrayNoch keine Bewertungen

- Triple V v. Filipino MerchantsDokument2 SeitenTriple V v. Filipino MerchantsRem Serrano100% (2)

- Bankers' Books Evidence Act 1879Dokument7 SeitenBankers' Books Evidence Act 1879Jo JoNoch keine Bewertungen

- Submitted By:: Mohi Ud Din Islamic University Neraian Sharif (Ajk)Dokument4 SeitenSubmitted By:: Mohi Ud Din Islamic University Neraian Sharif (Ajk)banthNoch keine Bewertungen

- Practice Sums-Journal Entries 1Dokument2 SeitenPractice Sums-Journal Entries 1Sanket SinghaiNoch keine Bewertungen

- Child Fortune Plus Write UpDokument7 SeitenChild Fortune Plus Write Upap87Noch keine Bewertungen

- Marine GlossaryDokument10 SeitenMarine GlossaryJoe BurgessNoch keine Bewertungen

- Enter Amount To Be Added in Wallet: Search For A Product, Brand or CategoryDokument1 SeiteEnter Amount To Be Added in Wallet: Search For A Product, Brand or CategoryHowaxNoch keine Bewertungen

- The Following Parties Are Involved in Payment Card TransactionDokument5 SeitenThe Following Parties Are Involved in Payment Card TransactionMahesh MalveNoch keine Bewertungen

- MritunjayDokument6 SeitenMritunjaykaydev1Noch keine Bewertungen

- Kel 6 - Creve Couer Pizza IncDokument3 SeitenKel 6 - Creve Couer Pizza IncTiara PradaniNoch keine Bewertungen

- Cma NivasDokument4 SeitenCma NivaskasyapNoch keine Bewertungen

- UNICREDIT AG List of Correspondents For Commercial PaymentsDokument5 SeitenUNICREDIT AG List of Correspondents For Commercial PaymentsAnonymous XgX8kTNoch keine Bewertungen

- Final FormatingDokument69 SeitenFinal FormatingSyed Munawar Abbas NaqviNoch keine Bewertungen

- DEL VAL vs. Del ValDokument3 SeitenDEL VAL vs. Del ValJane Paez-De MesaNoch keine Bewertungen

- 0452 m15 Ms 12Dokument9 Seiten0452 m15 Ms 12IslamAltawanayNoch keine Bewertungen