Beruflich Dokumente

Kultur Dokumente

Bills of Exchange

Hochgeladen von

Sachin TiwariOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bills of Exchange

Hochgeladen von

Sachin TiwariCopyright:

Verfügbare Formate

Bills of Exchange

The function of the Bill of Exchange in International Trade:

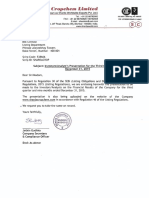

The Bill of Exchange performs many functions in international trade including: Facilitates the granting of trade credit in a legal format by permitting payments on agreed future dates. Provides formal evidence of the demand for payment from a seller to a buyer. Provides the seller with access to finance by permitting them to transfer their debts to a bank or other financier by merely endorsing the Bill of Exchange to that bank or financier. Permits the banker or financier to retain a valid legal claim on both the buyer and the seller. In certain circumstances a bank or financier may have a stronger legal claim under a Bill than the party that sold them the debt. Permits a seller to obtain greater security over the payment by enabling a bank to guarantee a drawee's acceptance (guarantee to pay on the due date) by signing or endorsing the Bill. (See Guaranteed Bills of Exchange below) Allows a seller protect their access to the legal system in the event of problems, while providing easier access to that legal system.

How the Bill of Exchange is used in international trade: A Bill of Exchange can either be payable immediately or at some future date. If a Bill is payable immediately, it is usually issued payable at sight. The term "at sight" means that a buyer should pay once they have sighted the Bill, that is once the demand for payment has been made. If a Bill is payable at some future date, it must facilitate the calculation of the actual due date. For example Bills of Exchange may be drawn payable at 60 days sight, at 60 days from Bill of Lading Date etc.

Banks should be used as agents for the collection of the Bill. Visit our section on Documentary Collections in the Products and Services or Product Diagrams area of this website for further details. Guaranteed Bills of Exchange: To provide greater payment security a seller may look to have a Bill of Exchange guaranteed by a buyer's bank. A guaranteed Bill of Exchange is one drawn on and accepted by the buyer and to which, the buyer's bank has added its guarantee that the Bill will be paid at maturity. The security to a seller comes from a bank giving an undertaking to effect payment on a certain date regardless of the financial standing of a buyer on that date.

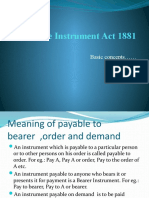

What is a Bill of Exchange?

A Bill of Exchange is one of the key financial instruments in International Trade. The laws regulating Bills of Exchange in different countries come under two An unconditional order issued by

a person or business which directs the recipient to pay a fixed sum of money to a third party at a future date. The future date may be either fixed or negotiable. A bill of exchange must be in writing and signed and dated. also calleddraft.

Definition of 'Bill Of Exchange'

A non-interest-bearing written order used primarily in international trade that binds one party to pay a fixed sum of money to another party at a predetermined future date.

There are two kinds of bills: Inland Bill: An inland bill is one which is (i) drawn and payable in India or (ii) drawn in India upon some person resident in India even though it is made payable in a foreign country. Thus in an inland bill of exchange both drawer and drawee belong to the same country. Foreign Bill: A foreign bill is one which is drawn in one country and payable in another country. Foreign bills are drawn in a set of three and each part of the set called a via contains a reference to the other parts. This is done to avoid delay or loss or miscarriage during the transit.

Das könnte Ihnen auch gefallen

- Bill of Lading (B/L) : What Is Bill of Exchange and State Its Essentials ?Dokument4 SeitenBill of Lading (B/L) : What Is Bill of Exchange and State Its Essentials ?Dhananjay KumarNoch keine Bewertungen

- Dishonour of Negotiable InstrumentsDokument6 SeitenDishonour of Negotiable InstrumentsMukul BajajNoch keine Bewertungen

- HypothecationDokument3 SeitenHypothecationanu0% (1)

- Naked Guide to Bonds: What You Need to Know -- Stripped Down to the Bare EssentialsVon EverandNaked Guide to Bonds: What You Need to Know -- Stripped Down to the Bare EssentialsNoch keine Bewertungen

- Q Remedies For Breach of Contract/9Dokument10 SeitenQ Remedies For Breach of Contract/9Mahir UddinNoch keine Bewertungen

- Negotiable Instrument Act, 1881Dokument18 SeitenNegotiable Instrument Act, 1881Pappu YadavNoch keine Bewertungen

- Tutorial 9 - Bills of ExchangeDokument5 SeitenTutorial 9 - Bills of Exchangemajmmallikarachchi.mallikarachchiNoch keine Bewertungen

- CA Notes Bill of Exchange and Promissory Notes PDFDokument28 SeitenCA Notes Bill of Exchange and Promissory Notes PDFBijay Aryan DhakalNoch keine Bewertungen

- The Declaration of Independence: A Play for Many ReadersVon EverandThe Declaration of Independence: A Play for Many ReadersNoch keine Bewertungen

- The Sales of Goods Act (1930)Dokument44 SeitenThe Sales of Goods Act (1930)swatishetNoch keine Bewertungen

- The Negotiable Instruments Act 1881Dokument16 SeitenThe Negotiable Instruments Act 1881vivekNoch keine Bewertungen

- ADL 12 Business Laws V4Dokument26 SeitenADL 12 Business Laws V4Aditya BhatNoch keine Bewertungen

- Negotiable Instruments: Chapter - 3Dokument11 SeitenNegotiable Instruments: Chapter - 3Mae CaraigNoch keine Bewertungen

- EndorsementDokument13 SeitenEndorsementsagarg94gmailcom100% (2)

- Legal Chapter-2 Contract PDFDokument19 SeitenLegal Chapter-2 Contract PDFNusrat Jahan RimuNoch keine Bewertungen

- Notes ConsiderationDokument5 SeitenNotes Consideration3D StormNoch keine Bewertungen

- Negotiable Instruments NotesDokument39 SeitenNegotiable Instruments NotesMehru KhanNoch keine Bewertungen

- 5112 Law 6 NegotiableInstrumentsDokument199 Seiten5112 Law 6 NegotiableInstrumentsRaghavendra Pundaleek ChittaNoch keine Bewertungen

- This Study Resource Was: Q1: Define A Contract and Describe The Essentials of A Valid ContractDokument8 SeitenThis Study Resource Was: Q1: Define A Contract and Describe The Essentials of A Valid ContractchangumanguNoch keine Bewertungen

- Banking Law and OperationsDokument35 SeitenBanking Law and OperationsViraja GuruNoch keine Bewertungen

- Negotiable InstrumentsDokument11 SeitenNegotiable InstrumentsMahesh ChavanNoch keine Bewertungen

- CLearing HouseDokument23 SeitenCLearing HouseNitin KapoorNoch keine Bewertungen

- Negotiable Instruments ActDokument38 SeitenNegotiable Instruments ActSonali Namdeo DaineNoch keine Bewertungen

- Revocation of GuaranteeDokument34 SeitenRevocation of GuaranteeHardik SharmaNoch keine Bewertungen

- Negotiable InstrumentsDokument18 SeitenNegotiable InstrumentsBrahmanand ShetNoch keine Bewertungen

- Business and Environment Laws: Negotiable Instrument Act 1881 MBA Sem:3Dokument41 SeitenBusiness and Environment Laws: Negotiable Instrument Act 1881 MBA Sem:3UtsavNoch keine Bewertungen

- Negotiable Instrument ActDokument18 SeitenNegotiable Instrument ActmahendrabpatelNoch keine Bewertungen

- Study Material - 6.5 Law of Banking and Negotiable InstrumentsDokument305 SeitenStudy Material - 6.5 Law of Banking and Negotiable InstrumentsAKHIL H KRISHNANNoch keine Bewertungen

- L31 Negotiable Instrument ActDokument43 SeitenL31 Negotiable Instrument ActNidhi WadaskarNoch keine Bewertungen

- Negotiable Instrument ActDokument28 SeitenNegotiable Instrument ActShrikant RathodNoch keine Bewertungen

- Assignment ON NEGOTIABLE INSTRUMENTS ACTDokument12 SeitenAssignment ON NEGOTIABLE INSTRUMENTS ACTFarha RahmanNoch keine Bewertungen

- Insurance As ContractDokument3 SeitenInsurance As ContractAparajita SharmaNoch keine Bewertungen

- Was Frankenstein Really Uncle Sam? Vol Ix: Notes on the State of the Declaration of IndependenceVon EverandWas Frankenstein Really Uncle Sam? Vol Ix: Notes on the State of the Declaration of IndependenceNoch keine Bewertungen

- Letters of Credit Q and ADokument5 SeitenLetters of Credit Q and ARose Ann VeloriaNoch keine Bewertungen

- DDFDokument66 SeitenDDFPankaj Kumar100% (2)

- Limitation ActDokument28 SeitenLimitation ActHuzefa Mannan DohadwalaNoch keine Bewertungen

- My Banking Law NotesDokument14 SeitenMy Banking Law NotesarmsarivuNoch keine Bewertungen

- Negotiable Instrument Act 1881Dokument22 SeitenNegotiable Instrument Act 1881Akash saxenaNoch keine Bewertungen

- Mode of Charging of SecurityDokument13 SeitenMode of Charging of SecurityAbhijit SahaNoch keine Bewertungen

- Bankruptcy ActDokument15 SeitenBankruptcy Actaparajita promaNoch keine Bewertungen

- Term Paper of Basic Financial Management: Submitted To: Ms. Shikha DhawanDokument21 SeitenTerm Paper of Basic Financial Management: Submitted To: Ms. Shikha DhawanLeena100% (1)

- Admin RemedyDokument9 SeitenAdmin Remedy1 2Noch keine Bewertungen

- D-Negotiable Instrument ActDokument37 SeitenD-Negotiable Instrument Actharsh100% (1)

- Discharge of Contract, Breach and RemediesDokument21 SeitenDischarge of Contract, Breach and RemediesWajid AliNoch keine Bewertungen

- Module 2 (B) Promissory Note: Negotiable Instruments Act (Module 2B) The LAW LearnersDokument5 SeitenModule 2 (B) Promissory Note: Negotiable Instruments Act (Module 2B) The LAW LearnersAbhishek100% (1)

- Meaning of Banker and Customer Meaning of Banker and CustomerDokument14 SeitenMeaning of Banker and Customer Meaning of Banker and CustomerSaiful IslamNoch keine Bewertungen

- Banking Law and PracticeDokument59 SeitenBanking Law and PracticeThanga Durai100% (2)

- Constitution of the State of Minnesota — 1876 VersionVon EverandConstitution of the State of Minnesota — 1876 VersionNoch keine Bewertungen

- Contract Act, ModifiedDokument20 SeitenContract Act, ModifiedhamidfarahiNoch keine Bewertungen

- The Negotiable Instruments ActDokument63 SeitenThe Negotiable Instruments ActRavi KumarNoch keine Bewertungen

- Chapter 7-Law of InsuranceDokument9 SeitenChapter 7-Law of Insuranceworkineh meleseNoch keine Bewertungen

- Bank Regulation and Deposit InsuranceDokument7 SeitenBank Regulation and Deposit InsuranceZainur NadiaNoch keine Bewertungen

- PAPER 2 Paper On Credit TransactionsDokument11 SeitenPAPER 2 Paper On Credit TransactionsPouǝllǝ ɐlʎssɐNoch keine Bewertungen

- Signature Card: Account Name: Account Type: Account No. DateDokument2 SeitenSignature Card: Account Name: Account Type: Account No. DateApril Joyce Evangelista Patricio100% (2)

- Negotiable Instrument ActDokument9 SeitenNegotiable Instrument ActHimanshu DarganNoch keine Bewertungen

- LC1Dokument40 SeitenLC1Tran Thi Thu HuongNoch keine Bewertungen

- The Rights of The Banker IncludeDokument5 SeitenThe Rights of The Banker Includem_dattaias67% (3)

- Negotiable Instrument Act-1Dokument56 SeitenNegotiable Instrument Act-1Law LawyersNoch keine Bewertungen

- A Note On RhotrixDokument10 SeitenA Note On RhotrixJade Bong NatuilNoch keine Bewertungen

- Aluminium, Metal and The SeaDokument186 SeitenAluminium, Metal and The SeaMehdi GhasemiNoch keine Bewertungen

- The Identification of Prisoners Act, 1920Dokument5 SeitenThe Identification of Prisoners Act, 1920Shahid HussainNoch keine Bewertungen

- Class 11 Biology Notes Chapter 2 Studyguide360Dokument10 SeitenClass 11 Biology Notes Chapter 2 Studyguide360ANoch keine Bewertungen

- Investor Presentation (Company Update)Dokument17 SeitenInvestor Presentation (Company Update)Shyam SunderNoch keine Bewertungen

- JSRG - Mom - DRM - 04 (13.12.2018) PDFDokument3 SeitenJSRG - Mom - DRM - 04 (13.12.2018) PDFNithyanandhan TranzionNoch keine Bewertungen

- Principle of ManagementsDokument77 SeitenPrinciple of ManagementsJayson LucenaNoch keine Bewertungen

- 1ST Periodical Test in English 10Dokument3 Seiten1ST Periodical Test in English 10kira buenoNoch keine Bewertungen

- SerpılDokument82 SeitenSerpılNurhayat KaripNoch keine Bewertungen

- Balochistan Civil Servants (Appointment, Promotion and Transfer) Rules 2009 (22222)Dokument42 SeitenBalochistan Civil Servants (Appointment, Promotion and Transfer) Rules 2009 (22222)Zarak KhanNoch keine Bewertungen

- Revalida ResearchDokument3 SeitenRevalida ResearchJakie UbinaNoch keine Bewertungen

- The Daily Jinx 0 - ENG-3 (1) - 1Dokument3 SeitenThe Daily Jinx 0 - ENG-3 (1) - 1NoxNoch keine Bewertungen

- A Summer Training Project Report OnDokument79 SeitenA Summer Training Project Report OnAnkshit Singhal100% (2)

- Class 10 Science Super 20 Sample PapersDokument85 SeitenClass 10 Science Super 20 Sample PapersParas Tyagi100% (1)

- Six Sigma PDFDokument62 SeitenSix Sigma PDFssno1Noch keine Bewertungen

- Indus River Valley Civilization ObjectivesDokument4 SeitenIndus River Valley Civilization ObjectivesArslan AsifNoch keine Bewertungen

- 4 Economics Books You Must Read To Understand How The World Works - by Michelle Middleton - Ascent PublicationDokument10 Seiten4 Economics Books You Must Read To Understand How The World Works - by Michelle Middleton - Ascent Publicationjayeshshah75Noch keine Bewertungen

- HG G2 Q1 W57 Module 3 RTPDokument11 SeitenHG G2 Q1 W57 Module 3 RTPJennilyn Amable Democrito100% (1)

- Tiktok, Identity Struggles and Mental Health Issues: How Are The Youth of Today Coping?Dokument6 SeitenTiktok, Identity Struggles and Mental Health Issues: How Are The Youth of Today Coping?Trúc NgânNoch keine Bewertungen

- 001 The Crib SheetDokument13 Seiten001 The Crib Sheetmoi moiNoch keine Bewertungen

- Theology NotesDokument3 SeitenTheology NotesNia De GuzmanNoch keine Bewertungen

- RAW TM & HM Users Manual V 11Dokument8 SeitenRAW TM & HM Users Manual V 11arcangelus22Noch keine Bewertungen

- Vishnu Dental College: Secured Loans Gross BlockDokument1 SeiteVishnu Dental College: Secured Loans Gross BlockSai Malavika TuluguNoch keine Bewertungen

- Syntax 1Dokument35 SeitenSyntax 1galcarolina722202100% (1)

- The Impact of Eschatology and ProtologyDokument48 SeitenThe Impact of Eschatology and ProtologyJuan SteinNoch keine Bewertungen

- Em Swedenborg THE WORD EXPLAINED Volume IX INDICES Academy of The New Church Bryn Athyn PA 1951Dokument236 SeitenEm Swedenborg THE WORD EXPLAINED Volume IX INDICES Academy of The New Church Bryn Athyn PA 1951francis batt100% (2)

- Death and Dying: Presented by Dr. Judith SugayDokument21 SeitenDeath and Dying: Presented by Dr. Judith SugayMichelle HutamaresNoch keine Bewertungen

- Frugal Innovation in Developed Markets - Adaption o - 2020 - Journal of InnovatiDokument9 SeitenFrugal Innovation in Developed Markets - Adaption o - 2020 - Journal of InnovatiGisselle RomeroNoch keine Bewertungen

- Syllabus Tourism Laws CKSCDokument6 SeitenSyllabus Tourism Laws CKSCDennis Go50% (2)

- Polymer ConcreteDokument15 SeitenPolymer ConcreteHew LockNoch keine Bewertungen