Beruflich Dokumente

Kultur Dokumente

BHFC 2qfy2013ru

Hochgeladen von

Angel BrokingOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

BHFC 2qfy2013ru

Hochgeladen von

Angel BrokingCopyright:

Verfügbare Formate

2QFY2013 Result Update | Auto Ancillary

November 2, 2012

Bharat Forge

Performance Highlights

Y/E March - Standalone (` cr) 2QFY13 2QFY12 Net Sales EBITDA EBITDA margin (%) Adjusted PAT

Source: Company, Angel Research

BUY

CMP Target Price

% chg (yoy) 1QFY13 (4.7) (11.1) (162)bp (13.3) 936 235 25.1 105 % chg (qoq) (7.3) (17.3) (271)bp (12.4)

`270 `324

12 Months

Investment Period

Stock Info Sector Market Cap (` cr) Net Debt (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code

868 194 22.4 92

910 219 24.0 106

Auto Ancillary 6,290 1,381 1.0 347/231 54,181 2.0 18,755 5,698 BFRG.BO BHFC@IN

Weak standalone performance: Bharat Forge (BHFC) posted lower-than-expected results for 2QFY2013 led by weakness in the domestic as well as export markets which resulted in a volume decline of 13.8% yoy (9.3% qoq). As a result, the standalone revenue posted a decline of 4.7% yoy (7.3% qoq) to `868cr. The net average realization however, registered a strong growth of 12.1% yoy (2.9% qoq) benefiting from higher share of machining component and better realization on exports on account of weak INR. The weak demand sentiment in the export markets primarily, Europe, led to a sluggish growth in exports revenue (up 8.1% yoy) during the quarter. The non-auto segment too posted a marginal growth of 2.6% yoy led by weakness in the domestic markets. On the operating front, margins declined 162bp yoy (271bp qoq) to 22.4% which was lower than estimated owing to a sharp increase in manufacturing and other expenses. Hence the operating profit and net profit registered a decline of 11.1% (17.3% qoq) and 13.3% yoy (12.4% qoq) respectively. China and Europe operations continue to drag down consolidated results: BHFC registered poor results at the consolidated level, with top-line and operating profit registering a decline of 8.3% and 22.6% yoy respectively. The poor performance was on account of continued severe downturn in the heavy truck market in China and lower demand in Europe. While the wholly owned subsidiaries (ex. China) registered a net loss of `9.2cr; China operations registered a loss of `12.4cr. Outlook and valuation: Guiding for the future, the management has indicated that the coming two quarters will be challenging for the company due to weakness in the domestic markets and subdued market conditions in China and Europe. Consequently, we lower our earnings estimates by 7.8%/7.6% for FY2013E/14E. At `270, BHFC is attractively valued at 11.7x FY2014E earnings. We maintain our Buy rating on the stock with a revised target price of `324, valuing it at 14x FY2014E earnings.

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 42.1 31.8 9.8 16.3

Abs. (%) Sensex Bharat Forge

3m 8.9 (10.1)

1yr 7.4 (7.5)

3yr 18.0 8.0

Key financials (Consolidated)

Y/E March (` cr) Net sales % chg Net profit % chg EBITDA (%) EPS (`) P/E (x) P/BV (x) RoE (%) RoCE (%) EV/Sales (x) EV/EBITDA (x)

Source: Company, Angel Research

FY2011 5,087 54.8 292 15.3 12.5 21.6 3.2 17.1 12.9 1.4 9.7

FY2012 6,279 23.4 410 40.7 15.9 17.6 15.4 2.9 19.8 15.1 1.2 7.7

FY2013E 6,754 7.6 436 6.4 15.5 18.7 14.4 2.5 18.5 14.1 1.1 7.0

FY2014E 7,565 12.0 539 23.5 15.7 23.1 11.7 2.1 19.7 16.0 0.9 5.9

Yaresh Kothari

022-3935 7800 Ext: 6844 yareshb.kothari@angelbroking.com

Please refer to important disclosures at the end of this report

Bharat Forge | 2QFY2013 Result Update

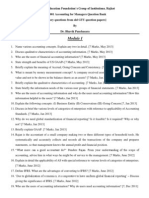

Exhibit 1: Financial performance (Standalone)

Y/E March (` cr) Net Sales Consumption of RM (% of Sales) Staff Costs (% of Sales) Manufacturing expenses (% of Sales) Other Expenses (% of Sales) Total Expenditure Operating Profit OPM (%) Interest Depreciation Other Income PBT (excl. Extr. Items) Extr. Income/(Expense) PBT (incl. Extr. Items) (% of Sales) Provision for Taxation (% of PBT) Reported PAT Adjusted PAT Adj. PATM Equity capital (cr) Reported EPS (`) Adjusted EPS (`)

Source: Company, Angel Research

2QFY13 868 378 43.6 64 7.4 162 18.7 69 7.9 673 194 22.4 29 55 26 136 (11) 146 16.8 43 29.7 103 92 10.6 46.6 4.4 4.0

2QFY12 910 412 45.2 66 7.3 158 17.4 55 6.1 691 219 24.0 38 54 24 151 151 16.6 45 29.6 106 106 11.7 46.6 4.6 4.6

% chg (yoy) (4.7) (8.1) (3.0) 2.3 24.4 (2.6) (11.1) (23.1) 2.9 6.3 (10.3) (3.3) (3.2) (3.4) (13.3)

1QFY13 936 405 43.2 69 7.3 172 18.4 56 6.0 701 235 25.1 55 57 28 152 152 16.2 47 30.7 105 105 11.2 46.6

% chg (qoq) (7.3) (6.5) (6.2) (5.8) 22.5 (4.0) (17.3) (10.8) (47.1) (1.8) (8.1) (10.7) (3.7) (6.8) (2.3) (12.4)

1HFY13 1,804 783 43.4 133 7.4 334 18.5 125 6.9 1,374 430 23.8 84 112 54 287 (11) 298 16.5 90 30.2 208 197 10.9 46.6

1HFY12 1,768 797 45.1 128 7.3 306 17.3 110 6.2 1,341 427 24.1 69 106 40 293 293 16.6 89 30.4 204 204 11.5 46.6 8.8 8.8

% chg (yoy) 2.1 (1.7) 3.5 9.3 13.0 2.5 0.7 21.6 6.1 32.9 (1.8) 1.8 1.3 2.0 (3.1)

(3.4) (13.3)

4.5 4.5

(2.3) (12.4)

8.9 8.5

2.0 (3.1)

Exhibit 2: 2QFY2013 Actual vs Angel estimates

Y/E March (` cr) Net Sales EBITDA EBITDA margin (%) Adj. PAT

Source: Company, Angel Research

Actual 868 194 22.4 92

Estimates 927 230 24.8 103

Variation (%) (6.4) (15.6) (244)bp (10.6)

November 2, 2012

Bharat Forge | 2QFY2013 Result Update

Exhibit 3: Segmental performance Standalone

Y/E Mar (` cr) Revenue Steel Forging Gen. Engg. etc. Total Less: Inter Seg. Rev. Inc. from Operations PBIT Steel Forging Gen. Engg. etc. Total PBIT Less: Interest Other exp. (net) PBT (ex. extraordinary items) PBIT (%) Steel Forging Gen. Engg. etc. Total

Source: Company, Angel Research

2QFY13 861 6 868 2 866 205 1 206 29 42 136 23.8 17.4 23.8

2QFY12 % chg (yoy) 905 7 912 2 910 223 3 226 38 37 151 24.6 38.2 24.7 (4.8) (12.3) (4.9) (4.3) (4.9) (8.0) (60.1) (8.7) (23.1) 12.9 (10.3)

1QFY13 % chg (qoq) 930 6 936 1 935 224 2 225 55 19 152 24.0 29.8 24.1 (7.4) 7.4 (7.3) 43.5 (7.4) (8.3) (37.4) (8.5) (47.1) 121.5 (10.7)

1HFY13 1,791 12 1,803 3 1,800 429 3 431 84 60 287 23.9 23.4 23.9

1HFY12 % chg (yoy) 1,758 13 1,771 3 1,768 417 5 421 69 60 293 23.7 37.5 23.8 1.9 (4.3) 1.8 (12.5) 1.8 2.8 (40.2) 2.4 21.6 0.5 (1.8)

Top-line down 4.7% yoy on weak demand in domestic as well as export markets: For 2QFY2013, standalone revenues posted a decline of 4.7% yoy (7.3% qoq) to `868cr led by 13% yoy (7.4% qoq) decline in domestic revenues due to slowdown in domestic automotive volumes. Further, weak demand sentiment in the export markets primarily, Europe, led to a sluggish growth in exports revenue (up 8.1% yoy) during the quarter. Exports revenue was boosted by a strong 61.8% yoy growth in US revenues on the back of a strong demand in the commercial

vehicle (CV) market and continued traction in the non-auto segment in the US. The non-auto segment too posted a marginal growth of 2.6% yoy led by weakness

in the domestic markets. As a result, total volumes registered a decline of 13.8% yoy (9.3% qoq) to 46,350MT. The net average realization however, registered a strong growth of 12.1% yoy (2.5% qoq) benefiting from higher share of machining component and better realization on exports on account of weak INR.

Exhibit 4: Domestic revenue down 13% yoy

(` cr) 600 500 400 300 200 100 0 466 431 478 489

35.0 34.3 17.4 5.2 (5.6) (13.0) 15.3 13.8

Exhibit 5: Slowdown in export revenue growth

(%) 70 60 50 40 30 20 10 0 (10) (20) 427 (`cr) 600 500 400 300 200 100 0 274 359 358 381 432 464

84.2

Domestic revenue

59.5

yoy change (RHS)

Export revenue

80.7 63.5 67.1 57.6

yoy change (RHS)

(%) 90 80 70 60 50

29.2

27.7

30.7

40 30

8.1

20 10 0

491

497

544

461

458

498

467

2QFY11

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

4QFY12

1QFY13

2QFY11

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

4QFY12

1QFY13

Source: Company, Angel Research

2QFY13

Source: Company, Angel Research

November 2, 2012

2QFY13

Bharat Forge | 2QFY2013 Result Update

Exhibit 6: Volume trend

(MT) 70,000 60,000 50,000 40,000 30,000 20,000 10,000 0 51.8 36.4 31.4 24.2 16.5 15.2 11.7 (3.6) (13.8) Volume (tonnage) yoy change (%) (%) 60.0 50.0 40.0 30.0 20.0 10.0 0.0 (10.0) (20.0)

Exhibit 7: Geographical break-up of revenue

(%) 70.0 60.0 50.0 40.0 30.0 20.0 10.0 0.0 19 16 3 23 20 5 21 19 4 24 18 3 2123 4 25 21 4 24 17 5 3 27 23 15 3 India 62 52 56 US 56 53 Europe 53 47 46 36 Others

50

2QFY11

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

4QFY12

1QFY13

2QFY11

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

4QFY12

1QFY13

Source: Company, Angel Research

2QFY13

Source: Company, Angel Research

EBITDA margin contracts to 22.4%: BHFCs EBITDA margin contracted 162bp yoy (down 271bp qoq) to 22.4% which was lower-than-estimated owing to a sharp increase in manufacturing (up 130bp yoy) and other expenses (up 180bp yoy) as a percentage of sales on account of lower operating leverage benefits. However, a 160bp yoy decline in raw-material cost as a percentage of sales provided some respite to the operating performance.

Exhibit 8: EBITDA margin trend

(%) 50.0 45.0 40.0 35.0 30.0 25.0 20.0 15.0 10.0 5.0 0.0 EBITDA margin RM cost/net sales

Exhibit 9: Adj net profit down 13.3% yoy

(` cr) 140 120 44.4 44.2 44.4 100 80 10.6 Net profit (LHS) 12.3 9.5 11.4 11.7 Net profit margin (RHS) 12.8 11.0 11.2 10.6 (%) 14.0 12.0 10.0 8.0 6.0 4.0 68 83 101 97 106 103 126 105 92 2.0 0.0

47.2

46.9

45.9

46.4

46.7

44.8

24.2

24.3

24.0

24.3

24.0

25.4

25.7

25.1

60 22.4 40 20 0

2QFY11

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

4QFY12

1QFY13

2QFY11

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

4QFY12

1QFY13

Source: Company, Angel Research

2QFY13

Source: Company, Angel Research

Adjusted net profit down 13.3% yoy: Led by weak operating performance, the adjusted net profit registered a decline of 13.3% yoy (12.4% qoq) to `92cr, which was lower than our expectations of `103cr.

November 2, 2012

2QFY13

2QFY13

Bharat Forge | 2QFY2013 Result Update

Exhibit 10: Financial performance (Consolidated)

Y/E March (` cr) Net Sales EBITDA EBITDA margin (%) Reported PBT

Source: Company, Angel Research

2QFY13 1,430 198 13.9 101

2QFY12 1,559 257 16.5 155

% chg (yoy) (8.3) (22.6) (258)bp (35.1)

1QFY13 1,643 275 16.7 152

% chg qoq (12.9) (27.9) (287)bp (33.7)

China and Europe operations continue to drag down consolidated results: BHFCs consolidated top-line declined by 8.3% yoy (12.9% qoq) to `1,430cr primarily due to continued severe downturn in the heavy truck market in China and lower demand in Europe. The China JV witnessed deterioration in performance due to weak demand which has led to lower utilization (~30-35%) levels. As a result, the EBITDA margin declined 258bp yoy (287bp qoq) to 13.9%. While the wholly owned subsidiaries (ex. China) registered a bottom-line loss of `9.2cr (vs net profit of `7.9cr); China operations registered a loss of `12.4cr (as against loss of `6.1cr) during the quarter.

Exhibit 11: Top-line down 8.3% yoy

(` cr) 1,800 1,600 1,400 1,200 1,000 800 600 400 200 0

37.0 25.3 14.2 10.3 4.7 (8.3) 75.2

Exhibit 12: EBITDA margin declines sharply

(%) 80 70 60 50 40 30 20 10 0 (10) (20) (` cr) 350 300 250 200 150 100 50 0 15.8 15.8 EBITDA 15.5 15.8 16.5 EBITDA margin (RHS) 17.2 17.4 16.7 13.9 (%) 20 18 16 14 12 10 8 6 4 2 0

Total revenue

70.2 65.7

yoy growth (RHS)

2QFY11

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

4QFY12

1QFY13

2QFY13

2QFY11

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

4QFY12

1QFY13

Source: Company, Angel Research

Source: Company, Angel Research

November 2, 2012

2QFY13

Bharat Forge | 2QFY2013 Result Update

Investment arguments

Domestic operations dependent on CV demand: BHFC, being a market leader in the CV space for products such as crankshaft, axle beams and connecting rods, with a ~90% market share, has been able to register robust growth over the last two years. However, with slowdown in the domestic commercial vehicle segment we expect the companys domestic operations to post slightly subdued growth in FY2013. Improvement in overseas subsidiaries and JVs to boost consolidated performance: BHFCs international operations posted losses (pre-tax) in FY2010 due to a decline in demand and high operational costs. However, a strong turnaround in the Chinese JV (FAW-BF) and other subsidiaries due to restructuring and operational efficiencies led to improved performance and the international operations returned to profitability in FY2011. Though absolute levels of profits have fallen in FY2012 due to demand slowdown, particularly in China, we expect international subsidiaries to turnaround on account of buoyant truck demand in the US and increasing contribution from industrial forgings and improving utilization levels. Thrust on non-auto business to diversify product portfolio: BHFC intends to increase its non-automotive revenue to 40% (~35% of consolidated revenue in FY2012) by FY2013E. To achieve this goal, BHFC has set up an 80MT hammer (40,000 TPA capacity) and a ring rolling (25,000 TPA capacity) facility in Baramati in addition to the existing 60,000 TPA non-auto facility in Mundhwa. We expect BHFC to benefit from new investments by various players in the power, oil and gas and capital goods sectors, leading to a strong demand for non-automotive forgings.

Outlook and valuation

Guiding for the future, the management has indicated that the coming two quarters will be challenging for the company due to weakness in the domestic markets and subdued market conditions in China and Europe. We revise our revenue estimates downwards to factor in the weak demand for forging components led by weakness in the domestic medium and heavy commercial vehicle (MHCV) segment. Further, we have also revised our margin estimates marginally downwards to account for weak performance of overseas subsidiaries. Consequently, our earnings estimates are lowered by 7.8%/7.6% for FY2013E/14E.

November 2, 2012

Bharat Forge | 2QFY2013 Result Update

Exhibit 13: Change in estimates

Y/E March (` cr) Net sales OPM (%) EPS (`) Earlier Estimates FY2013E 7,004 16.2 20.3 FY2014E 7,985 16.4 25.1 Revised Estimates FY2013E 6,754 15.5 18.7 FY2014E 7,565 15.7 23.1 % chg FY2013E (3.6) (65)bp (7.8) FY2014E (5.3) (65)bp (7.6)

Source: Company, Angel Research

At `270, BHFC is attractively valued at 11.7x FY2014E earnings. We maintain our Buy rating on the stock with a revised target price of `324, valuing it at 14x FY2014E earnings.

Exhibit 14: Angel vs consensus forecast

Angel estimates FY13E Total op. income (` cr) EPS (`) 6,754 18.7 FY14E 7,565 23.1 Consensus FY13E 6,629 18.7 FY14E 7,442 23.3 Variation (%) FY13E 1.9 0.2 FY14E 1.6 (0.6)

Source: Company, Angel Research

Exhibit 15: One-year forward EV/EBITDA band

(`cr) 25,000 20,000 15,000 10,000 5,000 0 EV (`cr) 5x 10x 15x 20x

Exhibit 16: One-year forward EV/EBITDA chart

(x) 35.0 30.0 25.0 20.0 15.0 10.0 5.0 One-yr forward EV/EBITDA Three-yr average EV/EBITDA

Dec-04

Dec-09

Mar-09

Aug-10

Apr-04

Oct-07

Jan-12

Sep-05

May-06

Feb-07

May-11

Oct-12

0.0

Jul-08

Mar-06

Mar-08

Mar-10

Jun-11

Feb-12

Nov-06

Nov-08

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 17: Auto Ancillary Recommendation summary

Company Amara Raja Batteries Automotive Axle Bharat Forge* Bosch India# Exide Industries FAG Bearings# Motherson Sumi* Subros

^

Reco. Neutral Accumulate Buy Neutral Accumulate Neutral Neutral Accumulate

CMP (`) 226 377 270 8,885 143 1,714 159 31

Tgt. price (`) 430 324 155 34

Upside (%) 14.1 19.9 8.9 10.2

P/E (x) FY13E 14.2 10.2 14.4 25.5 19.9 16.6 19.8 6.9 FY14E 12.0 8.8 11.7 20.4 15.9 13.5 15.1 5.4

EV/EBITDA (x) FY13E 8.3 5.3 7.0 16.3 11.0 10.2 8.0 4.5 FY14E 6.9 4.2 5.9 12.7 8.6 7.8 6.6 4.0

RoE (%) FY13E 28.9 21.2 18.5 19.4 18.5 21.3 22.9 9.8 FY14E 26.9 21.2 19.7 20.1 19.9 21.6 24.7 11.8

Oct-10

FY12-14E EPS CAGR (%) 22.2 6.2 14.6 13.3 28.4 9.5 56.2 6.4

Source: Company, Angel Research; Note: *Consolidated

November 2, 2012

Oct-12

Jul-05

Jul-07

Jul-09

Bharat Forge | 2QFY2013 Result Update

Company background

Bharat Forge, a global forging conglomerate, is the largest exporter of automotive components from India and a leading chassis component manufacturer in the world. The company manufactures a wide range of safety and critical components for passenger cars, SUVs, light commercial vehicles (LCVs), MHCVs and tractors through its facilities spread across 11 locations globally - India (4), Germany (3), China (2), U.S. (1) and Sweden (1). BHFC also produces forged and machined components for non-automotive industries, such as power generation, marine, oil and gas, railways and construction. The automotive industry currently contributes ~75% to the company's consolidated revenue; although through diversification BHFC expects the share of the automotive industry's revenue to fall to 55% by FY2013.

November 2, 2012

Bharat Forge | 2QFY2013 Result Update

Profit and loss statement (Consolidated)

Y/E March (` cr) Total operating income % chg Total expenditure Net raw material costs Other mfg costs Employee expenses Other EBITDA % chg (% of total op. income) Depreciation & amortization EBIT % chg (% of total op. income) Interest and other charges Other income Recurring PBT % chg Extraordinary items PBT (reported) Tax (% of PBT) Minority interest (MI) PAT (reported) ADJ. PAT % chg (% of total op. income) Basic EPS (`) Adj. EPS (`) % chg FY2009 FY2010 FY2011 FY2012 4,711 2.5 4,351 2,307 872 709 463 360 (44.6) 7.6 252 108 (74.5) 2.3 129 124 103 (77.1) (8) 110 69 62.8 (18) 58 66 (78.2) 1.4 2.6 3.0 (78.2) 3,286 (30.3) 3,081 1,578 645 524 334 204 (43.2) 6.2 245 (41) (1.2) 130 89 (82) (17) (65) 12 (18.0) (13) (63) (46) (1.4) (2.8) (2.1) 5,087 54.8 4,309 2,427 911 646 325 777 280.4 15.3 255 522 10.3 153 66 435 (1) 437 140 32.0 7 290 292 5.7 12.5 12.5 6,279 23.4 5,283 2,913 1,193 791 387 996 28.1 15.9 302 694 32.9 11.1 184 93 603 38.6 3 600 180 29.9 7 413 410 40.7 6.5 17.8 17.6 40.7 FY2013E 6,754 7.6 5,707 3,127 1,290 858 432 1,047 5.1 15.5 330 717 3.3 10.6 172 94 639 5.9 639 195 30.5 7 436 436 6.4 6.5 18.7 18.7 6.4 FY2014E 7,565 12.0 6,377 3,480 1,449 965 484 1,188 13.4 15.7 344 844 17.6 11.2 157 102 789 23.5 789 241 30.5 9 539 539 23.5 7.1 23.1 23.1 23.5

November 2, 2012

Bharat Forge | 2QFY2013 Result Update

Balance sheet statement (Consolidated)

Y/E March (` cr) SOURCES OF FUNDS Equity share capital Reserves & surplus Shareholders funds Minority interest Total loans Deferred tax liability Other long term liabilities Long term provisions Total Liabilities APPLICATION OF FUNDS Gross block Less: Acc. depreciation Net Block Capital work-in-progress Investments Long term loans and advances Other noncurrent assets Current assets Cash Loans & advances Other Current liabilities Net current assets Total Assets 4,028 1,560 2,468 322 0 2,532 488 720 1,323 1,208 1,324 4,114 4,135 1,727 2,408 199 274 2,417 598 658 1,162 1,419 998 3,878 4,501 2,038 2,463 201 261 325 37 2,388 396 426 1,565 1,468 920 4,206 4,999 2,358 2,642 524 387 511 71 3,200 672 492 2,036 2,355 845 4,979 5,498 2,688 2,810 275 413 511 71 3,361 800 517 2,043 2,283 1,078 5,158 5,736 3,032 2,704 287 431 511 71 3,804 974 543 2,287 2,418 1,386 5,389 45 1,599 1,643 95 2,191 184 4,114 45 1,418 1,463 78 2,253 84 3,878 47 1,906 1,953 154 1,886 132 1 80 4,206 47 2,144 2,190 196 2,419 89 1 85 4,979 47 2,472 2,519 196 2,269 89 1 85 5,158 47 2,903 2,951 196 2,069 89 1 85 5,389 FY2009 FY2010 FY2011 FY2012 FY2013E FY2014E

November 2, 2012

10

Bharat Forge | 2QFY2013 Result Update

Cash flow statement (Consolidated)

Y/E March (` cr) Profit before tax Depreciation Change in working capital Others Other income Direct taxes paid Cash Flow from Operations (Inc.)/Dec. in fixed assets (Inc.)/Dec. in investments Other income Cash Flow from Investing Issue of equity Inc./(Dec.) in loans Dividend paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) in cash Opening Cash balances Closing Cash balances FY2009 FY2010 FY2011 110 252 (298) 390 (124) (69) 261 (666) 299 124 (243) 2 536 92 (479) 152 170 318 488 (65) 245 435 28 (89) (12) 542 16 (273) 89 (168) 100 62 26 (453) (265) 109 488 598 437 255 (123) (22) (66) (140) 341 (368) 12 66 (290) (267) (366) 27 354 (252) (201) 598 396 FY2012 FY2013E FY2014E 600 302 350 (277) (93) (180) 703 (821) (126) 93 (854) 67 859 95 (189) 832 275 396 672 639 330 (111) (94) (195) 568 (250) (26) 94 (181) (150) 108 (258) 129 672 800 789 344 (142) (102) (241) 648 (250) (18) 102 (166) (200) 108 (308) 174 800 974

November 2, 2012

11

Bharat Forge | 2QFY2013 Result Update

Key ratios

Y/E March Valuation Ratio (x) P/E (on FDEPS) P/CEPS P/BV Dividend yield (%) EV/Sales EV/EBITDA EV / Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value Dupont Analysis EBIT margin Tax retention ratio Asset turnover (x) ROIC (Post-tax) Cost of Debt (Post Tax) Leverage (x) Operating ROE Returns (%) ROCE (Pre-tax) Angel ROIC (Pre-tax) ROE Turnover ratios (x) Asset Turnover (Gross Block) Inventory / Sales (days) Receivables (days) Payables (days) WC cycle (ex-cash) (days) Solvency ratios (x) Net debt to equity Net debt to EBITDA Interest Coverage (EBIT / Int.) 1.0 4.7 0.8 0.9 6.8 (0.3) 0.6 1.6 3.4 0.6 1.4 3.8 0.4 1.0 4.2 0.2 0.6 5.4 1.3 59 47 66 53 0.8 80 58 124 69 1.2 53 45 95 33 1.3 59 46 127 20 1.3 65 46 109 12 1.3 61 46 103 17 2.8 3.0 4.0 (1.0) (1.2) (3.0) 12.9 13.7 17.1 15.1 16.1 19.8 14.1 16.5 18.5 16.0 19.1 19.7 2.3 0.4 1.4 1.2 2.5 0.8 0.1 (1.2) 1.2 1.0 (1.4) 6.9 1.0 (9.6) 10.3 0.7 1.4 10.0 5.0 0.8 13.8 11.1 0.7 1.5 12.0 6.0 0.6 15.7 10.6 0.7 1.6 11.5 5.1 0.5 14.8 11.2 0.7 1.7 13.4 5.0 0.3 16.0 2.6 3.0 14.3 1.0 73.8 (2.8) (2.1) 8.9 1.0 65.7 12.5 12.5 23.5 3.5 83.9 17.6 17.6 30.6 4.0 94.1 18.7 18.7 32.9 4.0 108.2 23.1 23.1 37.9 4.0 126.7 102.5 18.9 3.7 0.4 1.7 22.2 1.9 30.3 4.1 0.4 2.3 37.5 2.0 21.6 11.5 3.2 1.3 1.4 9.7 1.8 15.4 8.8 2.9 1.5 1.2 7.7 1.5 14.4 8.2 2.5 1.5 1.1 7.0 1.4 11.7 7.1 2.1 1.5 0.9 5.9 1.3 FY2009 FY2010 FY2011 FY2012 FY2013E FY2014E

November 2, 2012

12

Bharat Forge | 2QFY2013 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Bharat Forge No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

November 2, 2012

13

Das könnte Ihnen auch gefallen

- Metal and Energy Tech Report November 12Dokument2 SeitenMetal and Energy Tech Report November 12Angel BrokingNoch keine Bewertungen

- WPIInflation August2013Dokument5 SeitenWPIInflation August2013Angel BrokingNoch keine Bewertungen

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDokument4 SeitenRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNoch keine Bewertungen

- Special Technical Report On NCDEX Oct SoyabeanDokument2 SeitenSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNoch keine Bewertungen

- Oilseeds and Edible Oil UpdateDokument9 SeitenOilseeds and Edible Oil UpdateAngel BrokingNoch keine Bewertungen

- Technical & Derivative Analysis Weekly-14092013Dokument6 SeitenTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Commodities Weekly Outlook 16-09-13 To 20-09-13Dokument6 SeitenCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 14 2013Dokument2 SeitenDaily Agri Tech Report September 14 2013Angel BrokingNoch keine Bewertungen

- International Commodities Evening Update September 16 2013Dokument3 SeitenInternational Commodities Evening Update September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 16 2013Dokument9 SeitenDaily Agri Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 16 2013Dokument2 SeitenDaily Agri Tech Report September 16 2013Angel BrokingNoch keine Bewertungen

- MetalSectorUpdate September2013Dokument10 SeitenMetalSectorUpdate September2013Angel BrokingNoch keine Bewertungen

- Daily Metals and Energy Report September 16 2013Dokument6 SeitenDaily Metals and Energy Report September 16 2013Angel BrokingNoch keine Bewertungen

- Currency Daily Report September 16 2013Dokument4 SeitenCurrency Daily Report September 16 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 8th JanDokument3 SeitenDerivatives Report 8th JanAngel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Dokument4 SeitenDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNoch keine Bewertungen

- Commodities Weekly Tracker 16th Sept 2013Dokument23 SeitenCommodities Weekly Tracker 16th Sept 2013Angel BrokingNoch keine Bewertungen

- Technical Report 13.09.2013Dokument4 SeitenTechnical Report 13.09.2013Angel BrokingNoch keine Bewertungen

- Sugar Update Sepetmber 2013Dokument7 SeitenSugar Update Sepetmber 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 16 Sept 2013Dokument3 SeitenDerivatives Report 16 Sept 2013Angel BrokingNoch keine Bewertungen

- IIP CPIDataReleaseDokument5 SeitenIIP CPIDataReleaseAngel BrokingNoch keine Bewertungen

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDokument1 SeitePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNoch keine Bewertungen

- TechMahindra CompanyUpdateDokument4 SeitenTechMahindra CompanyUpdateAngel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Market Outlook 13-09-2013Dokument12 SeitenMarket Outlook 13-09-2013Angel BrokingNoch keine Bewertungen

- MarketStrategy September2013Dokument4 SeitenMarketStrategy September2013Angel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report Sept 13Dokument2 SeitenMetal and Energy Tech Report Sept 13Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 06 2013Dokument2 SeitenDaily Agri Tech Report September 06 2013Angel BrokingNoch keine Bewertungen

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDokument6 SeitenTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNoch keine Bewertungen

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDokument4 SeitenJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- P5-2 Dan 3Dokument5 SeitenP5-2 Dan 3ramaNoch keine Bewertungen

- Lesson Plan in Business Finance I. ObjectiveDokument3 SeitenLesson Plan in Business Finance I. ObjectiveZandra QuillaNoch keine Bewertungen

- FAR - Learning Assessment 2 - For PostingDokument6 SeitenFAR - Learning Assessment 2 - For PostingDarlene JacaNoch keine Bewertungen

- Tata & Corus: Presented By:-Ankur Keshari Ashish Lal Priyanka Jain Ritu Gautam Presented To: - Ms. Parul NagarDokument25 SeitenTata & Corus: Presented By:-Ankur Keshari Ashish Lal Priyanka Jain Ritu Gautam Presented To: - Ms. Parul Nagarnikzz_jainNoch keine Bewertungen

- Materials For Soap MakingDokument31 SeitenMaterials For Soap Making123satNoch keine Bewertungen

- PAS 7 Statement of Cash FlowsDokument4 SeitenPAS 7 Statement of Cash Flowsnash lastNoch keine Bewertungen

- Cir Vs Campos RuedaDokument4 SeitenCir Vs Campos RuedaAljay LabugaNoch keine Bewertungen

- Jet Airways Case StudyDokument7 SeitenJet Airways Case StudySachin KinareNoch keine Bewertungen

- Darlington Business Venture Balance Sheet BasicsDokument10 SeitenDarlington Business Venture Balance Sheet BasicsVipul DesaiNoch keine Bewertungen

- Earnings Management: A Review of Selected Cases: July 2018Dokument15 SeitenEarnings Management: A Review of Selected Cases: July 2018Andre SetiawanNoch keine Bewertungen

- Tax RTP 2019 PDFDokument40 SeitenTax RTP 2019 PDFvenkateshNoch keine Bewertungen

- PresentationDokument27 SeitenPresentationMenuka WatankachhiNoch keine Bewertungen

- J Crew LBODokument15 SeitenJ Crew LBOTom HoughNoch keine Bewertungen

- Questions Asked in Previous Examination From Module 1Dokument3 SeitenQuestions Asked in Previous Examination From Module 1ruckhiNoch keine Bewertungen

- Building Strategy and Performance Through Time: The Critical PathDokument19 SeitenBuilding Strategy and Performance Through Time: The Critical PathBusiness Expert PressNoch keine Bewertungen

- CA Intermediate Accounting Marathon Handwritten Summary NotesDokument133 SeitenCA Intermediate Accounting Marathon Handwritten Summary Notesadsa100% (1)

- RMO No. 64-2016 PDFDokument1 SeiteRMO No. 64-2016 PDFGabriel EdizaNoch keine Bewertungen

- SAP Finance TablesDokument9 SeitenSAP Finance TablesGary Powers100% (1)

- Solutions Chapter 8Dokument29 SeitenSolutions Chapter 8Brenda WijayaNoch keine Bewertungen

- MCS Additional InputsDokument6 SeitenMCS Additional InputsHarshit AnandNoch keine Bewertungen

- FAR LiabilitiesDokument31 SeitenFAR LiabilitiesKenneth Bryan Tegerero Tegio100% (2)

- Third QuizDokument6 SeitenThird Quizibrahim haniNoch keine Bewertungen

- DTC ProvisionsDokument3 SeitenDTC ProvisionsrajdeeppawarNoch keine Bewertungen

- Accounting For Managers Question BankDokument5 SeitenAccounting For Managers Question BankbhfunNoch keine Bewertungen

- 2.1 Elasticity of DemandDokument32 Seiten2.1 Elasticity of DemandMasterMM12Noch keine Bewertungen

- Full Download Short Term Financial Management 3rd Edition Maness Test BankDokument35 SeitenFull Download Short Term Financial Management 3rd Edition Maness Test Bankcimanfavoriw100% (31)

- House Leader Welcomes Court Ruling Rejecting Petition Against New Sin Tax LawDokument1 SeiteHouse Leader Welcomes Court Ruling Rejecting Petition Against New Sin Tax Lawpribhor2Noch keine Bewertungen

- Aecon - Project IDokument39 SeitenAecon - Project IRaji MohanNoch keine Bewertungen

- Aligning Corporate and Financial StrategyDokument46 SeitenAligning Corporate and Financial StrategyDr-Mohammed FaridNoch keine Bewertungen

- Homework 4Dokument3 SeitenHomework 4amisha25625850% (1)