Beruflich Dokumente

Kultur Dokumente

Canadian Consumer Price Index Commentary

Hochgeladen von

International Business TimesOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Canadian Consumer Price Index Commentary

Hochgeladen von

International Business TimesCopyright:

Verfügbare Formate

www.td.

com/economics

TD Economics

Commentary

January 23, 2009

INFLATION FALLS TO 1.2% IN DECEMBER

• All items inflation plummets to 1.2% from 2.0% CONSUMER PRICE INDEX - CANADA

in November on falling gasoline prices Dec-08 Nov-08 Dec-08 Nov-08

• Core price steady at 2.4% % Chg. % Chg. % Chg. % Chg.

M/M M/M Y/Y Y/Y

Canadian consumer price inflation continued to mellow in All-items* -0.4 -0.3 1.2 2.0

Core ex. indirect taxes* 0.0 0.6 2.4 2.4

December on the back of falling gasoline prices, dropping to

Goods -1.5 -0.7 -0.8 0.5

1.2% from 2.0% in November. Core consumer price infla- Services 0.1 0.0 3.1 3.3

tion remained steady at 2.4%. The perseverance in the core Energy -5.9 -11.4 -11.0 -4.2

rate is more reflective of the strong downward pressure on Food* 0.3 1.0 7.3 7.4

core prices one year ago, rather than any signal of renewed Shelter* 0.0 0.2 3.5 3.9

Transportation* -2.6 -3.2 -6.1 -3.0

price pressures today. Still, it is stunning just how quickly things Clothing & Footwear* -0.3 0.4 -2.6 -2.4

can change on the inflation front and a far cry from the situ- *M/M uses seasonally adjusted data; Source: Statistics Canada

ation in mid-2008 when rising food and energy prices were

pushing headline inflation away from core in a major way. As yesterday’s Monetary Policy Report Update from the

It is always a good idea to look at the sources of the price Bank of Canada (BoC) noted, the hefty build up of slack as

pressure in forming expectations of future price growth. Ear- the Canadian economy enters recession will continue to put

lier in the year, our belief that energy prices had gotten ahead downward pressure on inflation in Canada over the next year.

of underlying fundamentals formed our belief that the rise in In fact, it is only with a very strong and relatively quick re-

headline inflation would likely be relatively short lived. Simi- bound in economic growth in 2010 that inflation returns to the

larly, in the current environment core inflation has been pushed banks target rate of 2.0% in 2011 (the BoC expects eco-

up by the elimination of price incentives on motor-vehicles in nomic growth of 3.8% compared to TD’s forecast of 2.4%).

late 2008 (which, once again, calls to mind the impact of the What is equally important in determining the actual path of

Canadian dollar at parity with the U.S. in late 2007). But this inflation, is inflation expectations and recent signs, such as the

is a short lived phenomenon. Motor vehicle sales plummeted spread on inflation adjusted bonds, show that if anything get-

in Canada at the end of 2008 as demand waned and if any- ting back to target may take longer than the central bank

thing a return to incentive pricing can be expected. anticipates. Given the stresses on the Canadian economy from

Regionally, consumer prices trended down across the falling household wealth and more moderate personal income

country, no more so than in the Atlantic region. Year-over- growth, and the external pressure on exporters during the

year inflation actually turned negative in New Brunswick (- global economic recession, inflation is likely to come in below

0.6%) and Nova Scotia (-0.2%), while in PEI the rate stood the Bank of Canada’s expectations, prompting one more half

at an even 0.0%. But even Alberta, at 1.9%, has seen the percentage point rate cut in March.

core rate come below 2.0%. Only Saskatchewan, at 2.6%

remains above the 2.0% level and even here prices are clearly James Marple, Economist

on a downward trend. 416-982-2557

TD Economics Commentary January 23, 2009

www.td.com/economics

This report is provided by TD Economics for customers of TD Bank Financial Group. It is for information purposes only and may not

be appropriate for other purposes. The report does not provide material information about the business and affairs of TD Bank

Financial Group and the members of TD Economics are not spokespersons for TD Bank Financial Group with respect to its

business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not

guaranteed to be accurate or complete. The report contains economic analysis and views, including about future economic and

financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and

uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that

comprise TD Bank Financial Group are not liable for any errors or omissions in the information, analysis or views contained in this

report, or for any loss or damage suffered.

TD Economics Commentary January 23, 2009

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Gang of Eight Immigration ProposalDokument844 SeitenGang of Eight Immigration ProposalThe Washington PostNoch keine Bewertungen

- Interior Letter-February Sequester HearingDokument4 SeitenInterior Letter-February Sequester HearingInternational Business TimesNoch keine Bewertungen

- HHS Letter-February Sequester HearingDokument3 SeitenHHS Letter-February Sequester HearingInternational Business TimesNoch keine Bewertungen

- Immigration Standards 3 0Dokument1 SeiteImmigration Standards 3 0International Business TimesNoch keine Bewertungen

- Homeland Letter-February Sequester HearingDokument3 SeitenHomeland Letter-February Sequester HearingInternational Business TimesNoch keine Bewertungen

- CPAC ScheduleDokument18 SeitenCPAC ScheduleFoxNewsInsiderNoch keine Bewertungen

- University of Notre Dame v. HHS Et AlDokument57 SeitenUniversity of Notre Dame v. HHS Et AlDoug MataconisNoch keine Bewertungen

- Supreme Court of The United States: Wal-Mart Stores, Inc. V. DukesDokument53 SeitenSupreme Court of The United States: Wal-Mart Stores, Inc. V. DukesInternational Business TimesNoch keine Bewertungen

- Department of Commerce Sequestration Letter To CongressDokument4 SeitenDepartment of Commerce Sequestration Letter To CongressFedScoopNoch keine Bewertungen

- Έρευνα Αμερικανών ακαδημαϊκών για καταδίκες αθώων στις ΗΠΑ (1989-2012)Dokument108 SeitenΈρευνα Αμερικανών ακαδημαϊκών για καταδίκες αθώων στις ΗΠΑ (1989-2012)LawNetNoch keine Bewertungen

- Whitney Houston Coroner ReportDokument42 SeitenWhitney Houston Coroner ReportSharonWaxman100% (4)

- Greater Mekong Species Report Web Ready Version Nov 14 2011-1-1Dokument24 SeitenGreater Mekong Species Report Web Ready Version Nov 14 2011-1-1International Business TimesNoch keine Bewertungen

- EtfilesDokument33 SeitenEtfilesInternational Business TimesNoch keine Bewertungen

- EtfilesDokument33 SeitenEtfilesInternational Business TimesNoch keine Bewertungen

- Supreme Court of The United States: Wal-Mart Stores, Inc. V. DukesDokument53 SeitenSupreme Court of The United States: Wal-Mart Stores, Inc. V. DukesInternational Business TimesNoch keine Bewertungen

- Harold Camping: We Are Almost There!Dokument80 SeitenHarold Camping: We Are Almost There!International Business Times100% (3)

- Walmart Stores v. Dukes Et AlDokument42 SeitenWalmart Stores v. Dukes Et AlDoug MataconisNoch keine Bewertungen

- Intelligent Investor UK Edition. March 2 2011Dokument5 SeitenIntelligent Investor UK Edition. March 2 2011International Business TimesNoch keine Bewertungen

- Fao Global Information and Early Warning System On Food and Agriculture (Giews)Dokument4 SeitenFao Global Information and Early Warning System On Food and Agriculture (Giews)International Business TimesNoch keine Bewertungen

- Us 2012 Budget - Gov Isbn 978 0 16 087366 9Dokument216 SeitenUs 2012 Budget - Gov Isbn 978 0 16 087366 9UCSDresearchNoch keine Bewertungen

- Sept 5 2002 US Iraq WMD ReportDokument9 SeitenSept 5 2002 US Iraq WMD ReportInternational Business TimesNoch keine Bewertungen

- US Inflation '10, Y-O-Y % ChangeDokument2 SeitenUS Inflation '10, Y-O-Y % ChangeInternational Business TimesNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- CertificatesDokument21 SeitenCertificatesJed AbadNoch keine Bewertungen

- Research ProposalDokument2 SeitenResearch Proposal1aqualeo100% (1)

- Chapter 6 Demand ForecastingDokument27 SeitenChapter 6 Demand ForecastingRajveer Singh90% (10)

- Urban Informal Sector: A Case Study of Street Vendors in KashmirDokument4 SeitenUrban Informal Sector: A Case Study of Street Vendors in KashmirMikoNoch keine Bewertungen

- 1 ECONTWO IntroductionDokument20 Seiten1 ECONTWO IntroductionNang Kit SzeNoch keine Bewertungen

- The Goods Market and The: IS RelationDokument20 SeitenThe Goods Market and The: IS RelationIbrohim JunaediNoch keine Bewertungen

- CAFC M21 CHP Wise Test Paper+hintsDokument2 SeitenCAFC M21 CHP Wise Test Paper+hintsAkshay r GowdaNoch keine Bewertungen

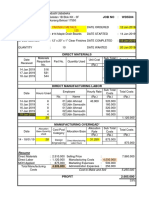

- COST SHEET Atau JOB COSTDokument1 SeiteCOST SHEET Atau JOB COSTWiraswasta MandiriNoch keine Bewertungen

- Innovation TheoryDokument9 SeitenInnovation TheoryRoselle Laqui100% (1)

- BBMP1103 OUM Mathematics For Management September 2023Dokument9 SeitenBBMP1103 OUM Mathematics For Management September 2023KogiNoch keine Bewertungen

- PPC ActivityDokument2 SeitenPPC ActivityJohn JohnsonNoch keine Bewertungen

- Sosc 1340Dokument23 SeitenSosc 1340dawNoch keine Bewertungen

- Costbenefit Analysis 2015Dokument459 SeitenCostbenefit Analysis 2015TRÂM NGUYỄN THỊ BÍCHNoch keine Bewertungen

- Lesson 1-2 DISSDokument9 SeitenLesson 1-2 DISSangie vibarNoch keine Bewertungen

- Measuring Exchange Rate MovementsDokument10 SeitenMeasuring Exchange Rate Movementsmuhammad ahmadNoch keine Bewertungen

- Finman ShitDokument19 SeitenFinman ShitAlyssa marie100% (1)

- Lecture 1Dokument6 SeitenLecture 1Siti Nadirah Shuhaimi100% (1)

- Alan Ware (Auth.) - The Logic of Party Democracy-Palgrave Macmillan UK (1979)Dokument219 SeitenAlan Ware (Auth.) - The Logic of Party Democracy-Palgrave Macmillan UK (1979)NicolasEvaristoNoch keine Bewertungen

- EconomicsDokument113 SeitenEconomicsdevanshsoni4116Noch keine Bewertungen

- Difference Between Hedging and ArbitrageDokument2 SeitenDifference Between Hedging and Arbitrageshreya_rachh1469Noch keine Bewertungen

- Engineering Economics OutlineDokument6 SeitenEngineering Economics Outlineali ghalibNoch keine Bewertungen

- Chapter 31 - Open-Economy Macroeconomics - Basic Concepts - StudentsDokument25 SeitenChapter 31 - Open-Economy Macroeconomics - Basic Concepts - StudentsPham Thi Phuong Anh (K16 HCM)Noch keine Bewertungen

- Prof. SARPV Chaturvedi - Business Management ProfileDokument8 SeitenProf. SARPV Chaturvedi - Business Management Profileलक्षमी नृसिहंन् वेन्कटपतिNoch keine Bewertungen

- Market Failure and The Case of Government InterventionDokument16 SeitenMarket Failure and The Case of Government InterventionCristine ParedesNoch keine Bewertungen

- 1.8 - An Introductory Note On The Environmental Economics of The Circular EconomyDokument9 Seiten1.8 - An Introductory Note On The Environmental Economics of The Circular EconomyKaroline Brito Coutinho FerreiraNoch keine Bewertungen

- SYJCECOLMRDokument61 SeitenSYJCECOLMRAvni S. PatilNoch keine Bewertungen

- MAMCOMDokument22 SeitenMAMCOMRoshniNoch keine Bewertungen

- Ideal Money - John NashDokument9 SeitenIdeal Money - John NashjustingoldbergNoch keine Bewertungen

- Macroeconomics LectureDokument128 SeitenMacroeconomics LectureImran KhanNoch keine Bewertungen