Beruflich Dokumente

Kultur Dokumente

Neutral: Performance Highlights

Hochgeladen von

Angel BrokingOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Neutral: Performance Highlights

Hochgeladen von

Angel BrokingCopyright:

Verfügbare Formate

2QFY2013 Result Update | Oil & Gas

November 7, 2012

IGL

Performance Highlights

Quarterly Performance (Standalone)

Particulars (` cr) Net sales EBITDA EBITDA margin (%) PAT

2QFY2013 2QFY2012 % chg (yoy) 1QFY2013 % chg (qoq)

NEUTRAL

CMP Target Price

Investment Period

597 158 26.4 77 43.1 30.8 (228)bp 28.5 760 179 23.6 85 12.5 15.2 58bp 17.2

`265 -

855 207 24.2 99

Stock Info Sector Market Cap (` cr) Net Debt (`cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code Oil & Gas 3,707 357 0.6 436/170 398,200 10 18,902 5,760 IGAS.BO IGL@IN

Source: Company, Angel Research

Indraprastha Gass (IGL) 2QFY2013 top-line grew by 43.1% yoy. However, EBITDA and PAT grew by only 30.8% yoy and 28.5% yoy on account of higher RLNG and interest costs. Maintain Neutral. Top-line driven by volume and realization growth: The companys net sales grew by 43.1% yoy to `855cr mainly driven by increases in both, sales as well as realization. CNG and PNG volumes increased by 9.2% and 19.4% yoy to 194mn kg and 81mmscm, respectively. Average CNG realisation increased 28.1% yoy to `37.9/kg. OPM contracts on cost pressures: The cost of goods sold increased by 52.5% yoy to `547cr mainly on account of higher RLNG costs. Hence, despite higher growth in net sales, EBITDA grew by only 30.8% yoy to `207cr in 2QFY2013. The EBITDA margin slipped 228bp yoy to 24.2% in 2QFY2013. Further, interest expense stood at `14cr in 2QFY2013, compared to `12cr in 2QFY2012. Hence, net profit grew by only 28.5 % yoy to `99cr. Outlook and valuation: IGL has frequently raised prices of CNG and PNG. However, as the proportion of costly gas is expected to increase, we expect the companys margin to soften in the years ahead. Further, the recent proposal to cap gas marketing margin by Petroleum and Natural Gas Regulatory Board (PNGRB) remains an overhang on the stock. On the valuation front, at the current level, the stock is trading at 10.9x and 10.3x FY2013E and FY2014E earnings, respectively. We recommend Neutral rating on the stock. Key financials (Standalone)

Y/E March (` cr) Net sales % chg Net profit % chg OPM (%) EPS (`) P/E (x) P/BV (x) RoE (%) RoCE (%) EV/Sales (x) EV/EBITDA (x)

Source: Company, Angel Research

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 45.0 12.5 16.8 25.7

Abs. (%) Sensex IGL

3m 7.4 8.7

1yr 7.6 (37.0)

3yr 17.0 62.0

FY2011 1,746 62.0 260 20.5 28.3 18.6 14.3 3.7 28.4 33.6 2.3 8.0

FY2012 2,519 44.2 306 18.0 25.2 21.9 12.1 3.0 27.5 29.5 1.6 6.3

FY2013E 3,213 27.6 340 11.0 23.3 24.3 10.9 2.5 25.0 27.8 1.2 5.4

FY2014E 3,643 13.4 360 5.9 23.5 25.7 10.3 2.1 22.1 26.7 1.0 4.6

Bhavesh Chauhan

Tel: 022 3935 7800 Ext: 6821 bhaveshu.chauhan@angelbroking.comeepak.par

Vinay Rachh

Tel: 022- 39357600 Ext: 6841 Vinay.rachh@angelbroking.com

Please refer to important disclosures at the end of this report

IGL | 2QFY2013 Result Update

Exhibit 1: 2QFY2013 performance (Standalone)

Particulars (` cr) Total Operating Income COGS Total operating expenditure EBITDA EBITDA Margin (%) Other Income Depreciation Interest PBT PBT Margin (%) Total Tax % of PBT PAT PAT Margin (%)

Source: Company, Angel Research

2QFY2013 855 547 649 207 24.2 3 48 14 148 17.3 49 33.0 99 11.6

2QFY2012 597 358 440 158 26.4 1 34 12 113 19.0 36 31.8 77 12.9

% chg (yoy) 43.1 52.5 47.6 30.8 120.6 38.5 19.4 30.8 35.8 28.5

1QFY2013 760 490 581 179 23.6 3 43 16 124 16.3 40 31.9 85 11.1

% chg (qoq) 1HFY2013 1HFY2012 12.5 11.6 11.6 15.2 5.3 11.8 (9.5) 19.2 23.6 17.2 1,616 1,037 1,230 386 23.9 6 90 30 272 16.9 89 32.5 184 11.4 1,135 659 819 316 27.9 3 67 21 232 20.4 74 32.1 157 13.9

% chg (yoy) 42.4 57.3 50.2 22.0 126.4 35.6 42.3 17.6 19.0 16.9

Net sales up 43.1% yoy: The companys net sales grew by 43.1% yoy to `855cr mainly driven by increases in both, sales as well as realization. CNG and PNG volumes increased by 9.2% and 19.4% yoy to 194mn kg and 81mmscm, respectively. Average CNG realisation increased 28.1% yoy to `37.9/kg, mainly due to hike in price of CNG from `35.5/kg to `38.4/kg.

Exhibit 2: CNG volumes stood at 194mn kg

250 200 158

(mn kg)

Exhibit 3: PNG volume stood at 81mmscm

45 90 80 70 60

(` per kg)

(mmscm)

161

177

180

180

183

194

40 35 30 25 20 15 10 5 -

78.0 59.1 64.8 68.2 71.1

80.0

81.0

30 25

(` per scm)

150 100 50 4QFY11 1QFY12 2QFY12 3QFY12 4QFY12 1QFY13 2QFY13 CNG volumes Gross realization-RHS

20 15 10 5 0

50 40 30 20 10 0 4QFY11 1QFY12 2QFY12 3QFY12 4QFY12 1QFY13 2QFY13 PNG volumes Gross realization-RHS

Source: Company, Angel Research

Source: Company, Angel Research

November 7, 2012

IGL | 2QFY2013 Result Update

Exhibit 4: Net sales grew by 43.1% yoy

900 800 700 600 59.8 537 511 45.1 34.0 500 400 300 200 100 4QFY11 1QFY12 2QFY12 3QFY12 4QFY12 1QFY13 2QFY13 Net sales

Source: Company, Angel Research

855 76.3 597 663 720 760

90.0 80.0 70.0 60.0 40.0 30.0 20.0 10.0 50.0

(` cr)

43.1

Net sales growth (RHS)

OPM contracts to 24.2%: Cost of goods sold increased by 52.5% yoy to `547cr mainly on account of higher RLNG costs. Hence, despite higher growth in net sales, EBITDA grew by only 30.8% yoy to `207cr in 2QFY2013. The EBITDA margin slipped 228bp yoy to 24.2% in 2QFY2013. Further, interest expense stood at `14cr in 2QFY2013, compared to `12cr in 2QFY2012. Hence, net profit grew by only 28.5 % yoy to `99cr.

Exhibit 5: Operating performance trend

250 200 150 100 50 4QFY11 1QFY12 2QFY12 3QFY12 4QFY12 1QFY13 2QFY13 Operating Profit Operating Margins (RHS) 26.9 29.5 26.5 22.7 23.6 23.7 24.2 35.0 30.0 25.0

(%)

Exhibit 6: PAT growth trend

120 100 80 34.2 39.6 28.5 45.0 40.0 35.0 30.0 20.0 15.0 10.0 2.9 5.7 5.0 4QFY11 1QFY12 2QFY12 3QFY12 4QFY12 1QFY13 2QFY13 PAT PAT growth (RHS) 25.0

(` cr)

(` cr)

60 40 20 17.8

20.0 15.0 10.0

Source: Company, Angel Research

Source: Company, Angel Research

November 7, 2012

(%)

18.9

(%)

41.0

41.5

IGL | 2QFY2013 Result Update

Investment arguments

Volume growth to continue: IGL has exhibited strong volume growth over the past few years. We expect the trend to continue going ahead, given that penetration of CNG vehicles in Delhi is still at lower levels and the launch of newer CNG-variant cars by automotive companies could keep conversions in the high growth orbit. The PNG segment is also expected to continue its robust performance on account of lower penetration in NCR and higher demand. The company continues to focus on the fast-growing PNG segment. Regulatory overhang to persist: After the verdict of Delhi HC, the companys marketing margin remains outside the purview of PNGRB. However, PNGRB has indicated that it aims to regulate the marketing margins charged by the utilities. This could potentially impact IGLs margins adversely in case there is a cap on network tariff and/or marketing margin.

Outlook and valuation

The company has frequently raised prices of CNG and PNG. However, as the proportion of costly gas is expected to increase, we expect the companys margin to soften in the years ahead. Further, the recent proposal to cap gas marketing margin by PNGRB remains an overhang on the stock. On the valuation front, at the current level, the stock is trading at 10.9x and 10.3x FY2013E and FY2014E earnings, respectively. We maintain our Neutral rating on the stock.

Exhibit 7: Key assumptions

Particulars CNG volumes (mmscm) PNG volumes (mmscm)

Source: Company, Angel Research

FY2013E 1,126 321

FY2014E 1,166 434

Exhibit 8: Angel EPS forecast vs Consensus

Year FY2013E FY2014E

Source: Company, Angel Research

Angel 24.3 25.7

Bloomberg consensus

Variation 9.5 10.9

22.2 23.2

Exhibit 9: Recommendation summary

Company GAIL IGL CMP (`) 366 265 75 300 TP (`) - Neutral - Neutral - Neutral - Neutral Reco. Mcap (` cr) 45,880 3,707 4,203 3,850 Upside (%) P/E (x) FY13E 10.8 10.9 8.5 13.2 FY14E 10.4 10.3 8.9 12.7 P/BV (x) FY13E 1.9 2.5 1.4 4.0 FY14E 1.6 2.1 1.3 3.5 EV/EBITDA (x) FY13E 5.9 5.4 3.9 7.8 FY14E 4.7 4.6 4.0 7.2 RoE (%) FY13E 18.5 25.0 17.9 33.2 FY14E 16.8 22.1 15.0 29.2 RoCE (%) FY13E 19.8 27.8 19.4 29.3 FY14E 18.1 26.7 17.0 27.1

GSPL Guj. Gas

Source: Angel Research

November 7, 2012

IGL | 2QFY2013 Result Update

Exhibit 10: One-year forward P/E

600 500

Share price (`)

400 300 200 100 0

Apr-07

Apr-08

Apr-09

Apr-10

Apr-11

Jul-07

Apr-12

Jul-08

Jul-09

Jul-10

Jul-11

Oct-07

Oct-08

Oct-09

Oct-10

Oct-11

Jul-12

7x

10x

13x

16x

19x

Company background

Incorporated in 1998, IGL is in the retail gas distribution business of supplying CNG to the transport sector, and PNG to domestic, industrial and commercial sectors in Delhi and NCR. IGL started its operations in NCT of Delhi in 1999 with only 9 CNG stations and 1000 PNG consumers. Currently, IGL has 280 CNG stations, 310,000 residential consumers and 730 industrial customers.

November 7, 2012

Oct-12

Jan-07

Jan-08

Jan-09

Jan-10

Jan-11

Jan-12

IGL | 2QFY2013 Result Update

Profit & Loss Statement (Standalone)

Y/E March (` cr) Gross sales Less: Excise duty Net Sales Other operating income Total operating income % chg Total Expenditure Purchase of gas Staff expenditure Other operating expenditure EBITDA % chg (% of Net Sales) Depreciation and amortization EBIT % chg (% of Net Sales) Interest & other Charges Other Income (% of PBT) Share in profit of Associates Recurring PBT % chg Extraordinary Expense/(Inc.) PBT (reported) Tax (% of PBT) PAT (reported) Add: Share of earnings of asso. Less: Minority interest (MI) Prior period items PAT after MI (reported) ADJ. PAT % chg (% of Net Sales) Basic EPS (`) Fully Diluted EPS (`) % chg FY2009 FY2010 FY2011 FY2012 FY2013E FY2014E 962 109 853 853 20.8 553 411 24 118 300 0.0 35.2 67 233 (2.0) 27.3 26 10.1 259 (0.8) 259 86 33.4 172 172 172 (1.1) 20.2 12.3 12.3 (1.1) 1,213 135 1,078 1,078 26.4 697 495 31 172 381 26.9 35.3 77 303 30.4 28.1 21 6.5 324 25.3 324 109 33.6 215 215 215 24.9 20.0 15.4 15.4 24.9 1,954 207 1,746 1,746 62.0 1,252 984 38 230 494 29.8 28.3 103 391 29.0 22.4 13 7 1.9 (1.0) 386 18.9 (1) 387 126 32.6 260 260 260 20.5 14.9 18.6 18.6 20.5 2,794 275 2,519 2,519 44.2 1,884 1,539 44 301 635 28.4 25.2 143 491 25.5 19.5 48 7 1.5 450 16.7 450 144 31.9 306 306 306 18.0 12.2 21.9 21.9 18.0 3,564 351 3,213 3,213 27.6 2,465 2,083 62 320 748 17.9 23.3 196 552 12.4 17.2 58 13 2.5 507 12.6 507 167 32.9 340 340 340 11.0 10.6 24.3 24.3 11.0 4,041 398 3,643 3,643 13.4 2,787 2,386 65 336 856 14.4 23.5 264 592 7.2 16.2 60 14 2.5 546 7.6 546 186 34.0 360 360 360 5.9 9.9 25.7 25.7 5.9

Note: Some of the figures from FY2011 onwards are reclassified; hence not comparable with previous year numbers

November 7, 2012

IGL | 2QFY2013 Result Update

Balance Sheet (Standalone)

Y/E March (` cr) SOURCES OF FUNDS Equity Share Capital Preference Capital Reserves& Surplus Shareholders Funds Minority Interest Total Loans Other Long term liabilities Long term Provisions Net Deferred Tax Liability Total Liabilities APPLICATION OF FUNDS Gross Block Less: Acc. Depreciation Net Block Capital Work-in-Progress Goodwill Investments Long term loans and adv. Current Assets Cash Loans & Advances Other Current liabilities Net Current Assets Mis. Exp. not written off Total Assets 817 378 439 82 104 259 146 55 58 154 106 731 1,105 454 651 183 17 257 121 69 67 204 53 904 1,716 557 1,159 327 42 39 199 17 57 124 319 (120) 1,447 2,266 688 1,579 375 98 5 264 32 56 177 444 (180) 1,878 2,800 884 1,916 320 42 5 304 0 58 245 487 (183) 2,101 3,300 1,148 2,152 300 42 5 367 31 59 277 540 (173) 2,327 140 543 683 27 21 731 140 685 825 55 24 904 140 863 1,003 282 117 4 41 1,447 140 1,088 1,228 389 193 5 63 1,878 140 1,350 1,490 350 193 5 63 2,101 140 1,626 1,766 300 193 5 63 2,327 FY2009 FY2010 FY2011 FY2012 FY2013E FY2014E

Note: Some of the figures from FY2011 onwards are reclassified; hence not comparable with previous year numbers

November 7, 2012

IGL | 2QFY2013 Result Update

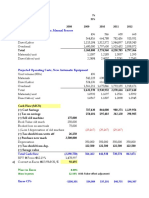

Cash Flow Statement (Standalone)

Y/E March (` cr) Profit before tax Depreciation Dep. accepted during the year Change in Working Capital Less: Other income Direct taxes paid Cash Flow from Operations (Inc.)/ Dec. in Fixed Assets (Inc.)/ Dec. in Investments Other income Cash Flow from Investing Issue of Equity Inc./(Dec.) in loans Dividend Paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) in Cash Opening Cash balances Closing Cash balances FY2009 FY2010 FY2011 FY2012 FY2013E FY2014E 259 67 20 (18) (26) (89) 212 (172) 5 26 (141) (66) (65) 6 140 146 324 77 29 25 (21) (106) 328 (389) 87 21 (281) (73) 1 (72) (25) 146 138 386 103 62 (9) (6) (114) 421 (771) (6) (748) 345 (73) 262 (79) 138 59 450 143 107 69 (7) (150) 612 (599) 7 (606) 107 (84) (131) 65 71 59 130 513 196 (39) 65 (13) (163) 559 (479) 13 (466) (39) (84) 7 (181) (88) 130 42 546 264 (50) 108 (14) (162) 691 (480) 14 (466) (50) (84) 5 (194) 31 42 73

Note: Some of the figures from FY2011 onwards are reclassified; hence not comparable with previous year numbers

November 7, 2012

IGL | 2QFY2013 Result Update

Key Ratios

Y/E March Valuation Ratio (x) P/E (on FDEPS) P/CEPS P/BV Dividend yield (%) EV/Sales EV/EBITDA EV/Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value Dupont Analysis (%) EBIT margin Tax retention ratio Asset turnover (x) ROIC (Post-tax) Cost of Debt (Post Tax) Leverage (x) Operating ROE Returns (%) ROCE (Pre-tax) Angel ROIC (Pre-tax) ROE Turnover ratios (x) Asset Turnover (Gross Block) Inventory / Sales (days) Receivables (days) Payables (days) WC cycle (ex-cash) (days) Solvency ratios (x) Net debt to equity Net debt to EBITDA Interest Coverage (EBIT/Int.) (0.3) (0.7) (0.1) (0.2) 0.2 0.5 29.7 0.2 0.4 10.3 0.2 0.4 9.6 0.1 0.3 9.9 1.1 10 12 54 (21) 1.1 9 11 56 (18) 1.2 7 11 53 (21) 1.3 5 15 58 (25) 1.3 9 14 57 (22) 1.2 13 12 57 (19) 36.0 71.2 27.4 38.1 64.7 28.6 33.6 48.3 28.4 29.5 40.4 27.5 27.8 35.5 25.0 26.7 32.1 22.1 27.3 66.6 2.1 39.0 39.0 28.1 66.4 1.8 33.5 33.5 22.4 67.3 1.6 24.7 24.7 19.5 67.0 1.6 21.0 21.0 17.2 67.0 1.7 19.4 19.4 16.2 66.0 1.7 18.1 18.1 12.3 12.3 17.1 4.0 48.8 15.4 15.4 20.9 5.0 59.0 18.6 18.6 25.9 5.0 71.7 21.9 21.9 32.1 6.0 87.7 24.3 24.3 38.3 6.0 106.4 25.7 25.7 44.6 6.0 126.2 21.5 15.5 5.4 1.5 4.1 11.6 4.8 17.2 12.7 4.5 1.9 3.4 9.5 4.0 14.3 10.2 3.7 1.9 2.3 8.0 2.7 12.1 8.2 3.0 2.3 1.6 6.3 2.1 10.9 6.9 2.5 2.3 1.2 5.4 1.9 10.3 5.9 2.1 2.3 1.0 4.6 1.7 FY2009 FY2010 FY2011 FY2012 FY2013E FY2014E

Note: Some of the figures from FY2011 onwards are reclassified; hence some ratios may not be comparable with previous year ratios

November 7, 2012

IGL | 2QFY2013 Result Update

Research Team Tel: 022 - 3935 7800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

IGL No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors.

Ratings (Returns) :

Buy (> 15%) Reduce (-5% to -15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

November 7, 2012

10

Das könnte Ihnen auch gefallen

- Building Inspection Service Revenues World Summary: Market Values & Financials by CountryVon EverandBuilding Inspection Service Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosVon EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNoch keine Bewertungen

- Igl 4Q Fy 2013Dokument10 SeitenIgl 4Q Fy 2013Angel BrokingNoch keine Bewertungen

- Petronet LNG: Performance HighlightsDokument10 SeitenPetronet LNG: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Performance Highlights: 2QFY2012 Result Update - Oil & GasDokument10 SeitenPerformance Highlights: 2QFY2012 Result Update - Oil & GasAngel BrokingNoch keine Bewertungen

- Indraprasth Gas Result UpdatedDokument10 SeitenIndraprasth Gas Result UpdatedAngel BrokingNoch keine Bewertungen

- Indraprastha GasDokument11 SeitenIndraprastha GasAngel BrokingNoch keine Bewertungen

- Gujarat Gas: Performance HighlightsDokument10 SeitenGujarat Gas: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Gujarat Gas, 2Q CY 2013Dokument10 SeitenGujarat Gas, 2Q CY 2013Angel BrokingNoch keine Bewertungen

- Gujarat Gas: Performance HighlightsDokument10 SeitenGujarat Gas: Performance HighlightsAngel BrokingNoch keine Bewertungen

- GAIL India, 1Q FY 2014Dokument12 SeitenGAIL India, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Crompton Greaves: Performance HighlightsDokument12 SeitenCrompton Greaves: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Petronet LNG: Performance HighlightsDokument10 SeitenPetronet LNG: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Gujarat Gas Result UpdatedDokument10 SeitenGujarat Gas Result UpdatedAngel BrokingNoch keine Bewertungen

- Reliance Industries Result UpdatedDokument13 SeitenReliance Industries Result UpdatedAngel BrokingNoch keine Bewertungen

- NTPC 4Q Fy 2013Dokument10 SeitenNTPC 4Q Fy 2013Angel BrokingNoch keine Bewertungen

- Gujarat State Petronet: Performance HighlightsDokument10 SeitenGujarat State Petronet: Performance HighlightsAngel BrokingNoch keine Bewertungen

- GSPL, 11th February, 2013Dokument10 SeitenGSPL, 11th February, 2013Angel BrokingNoch keine Bewertungen

- Acc 1Q CY 2013Dokument10 SeitenAcc 1Q CY 2013Angel BrokingNoch keine Bewertungen

- GAIL India: Performance HighlightsDokument12 SeitenGAIL India: Performance HighlightsAngel BrokingNoch keine Bewertungen

- National Aluminium Result UpdatedDokument12 SeitenNational Aluminium Result UpdatedAngel BrokingNoch keine Bewertungen

- GSPL 4Q Fy 2013Dokument10 SeitenGSPL 4Q Fy 2013Angel BrokingNoch keine Bewertungen

- Reliance Industries: Performance HighlightsDokument14 SeitenReliance Industries: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Colgate 2QFY2013RUDokument10 SeitenColgate 2QFY2013RUAngel BrokingNoch keine Bewertungen

- Gujarat GAS, 22nd February, 2013Dokument10 SeitenGujarat GAS, 22nd February, 2013Angel BrokingNoch keine Bewertungen

- Gail, 15th February 2013Dokument12 SeitenGail, 15th February 2013Angel BrokingNoch keine Bewertungen

- Coal India: Performance HighlightsDokument10 SeitenCoal India: Performance HighlightsAngel BrokingNoch keine Bewertungen

- GAIL India: Performance HighlightsDokument12 SeitenGAIL India: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Acc 2Q Cy 2013Dokument10 SeitenAcc 2Q Cy 2013Angel BrokingNoch keine Bewertungen

- Ongc 4Q Fy 2013Dokument12 SeitenOngc 4Q Fy 2013Angel BrokingNoch keine Bewertungen

- BGR, 12th February 2013Dokument10 SeitenBGR, 12th February 2013Angel BrokingNoch keine Bewertungen

- ACC Result UpdatedDokument10 SeitenACC Result UpdatedAngel BrokingNoch keine Bewertungen

- GIPCL Result UpdatedDokument11 SeitenGIPCL Result UpdatedAngel BrokingNoch keine Bewertungen

- Performance Highlights: 2QFY2013 Result Update - Auto AncillaryDokument11 SeitenPerformance Highlights: 2QFY2013 Result Update - Auto AncillaryAngel BrokingNoch keine Bewertungen

- BGR Energy Systems: Performance HighlightsDokument11 SeitenBGR Energy Systems: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Hero Motocorp: Performance HighlightsDokument14 SeitenHero Motocorp: Performance HighlightsAngel BrokingNoch keine Bewertungen

- GIPCL Result UpdatedDokument11 SeitenGIPCL Result UpdatedAngel BrokingNoch keine Bewertungen

- Itnl 4Q Fy 2013Dokument13 SeitenItnl 4Q Fy 2013Angel BrokingNoch keine Bewertungen

- Hero MotocorpDokument11 SeitenHero MotocorpAngel BrokingNoch keine Bewertungen

- Colgate Result UpdatedDokument10 SeitenColgate Result UpdatedAngel BrokingNoch keine Bewertungen

- Bajaj Auto: Performance HighlightsDokument12 SeitenBajaj Auto: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Graphite India: Performance HighlightsDokument11 SeitenGraphite India: Performance HighlightsAngel BrokingNoch keine Bewertungen

- TVS Motor Result UpdatedDokument12 SeitenTVS Motor Result UpdatedAngel BrokingNoch keine Bewertungen

- Moil 2qfy2013Dokument10 SeitenMoil 2qfy2013Angel BrokingNoch keine Bewertungen

- United Spirits: Performance HighlightsDokument11 SeitenUnited Spirits: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Hindalco: Performance HighlightsDokument15 SeitenHindalco: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Madras Cements: Performance HighlightsDokument10 SeitenMadras Cements: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Amara Raja Batteries: Performance HighlightsDokument11 SeitenAmara Raja Batteries: Performance HighlightsAngel BrokingNoch keine Bewertungen

- GSK Consumer, 2Q CY 2013Dokument10 SeitenGSK Consumer, 2Q CY 2013Angel BrokingNoch keine Bewertungen

- Gujarat State Petronet, 1Q FY 2014Dokument9 SeitenGujarat State Petronet, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Ashok Leyland Result UpdatedDokument13 SeitenAshok Leyland Result UpdatedAngel BrokingNoch keine Bewertungen

- United Spirits, 1Q FY 2014Dokument10 SeitenUnited Spirits, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Ashok Leyland Result UpdatedDokument13 SeitenAshok Leyland Result UpdatedAngel BrokingNoch keine Bewertungen

- Ambuja, 15th February 2013Dokument10 SeitenAmbuja, 15th February 2013Angel BrokingNoch keine Bewertungen

- Crompton GreavesDokument12 SeitenCrompton GreavesAngel BrokingNoch keine Bewertungen

- Ceat, 11th January, 2013Dokument12 SeitenCeat, 11th January, 2013Angel Broking100% (2)

- Bajaj Electricals, 1Q FY 2014Dokument14 SeitenBajaj Electricals, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Finolex Cables, 1Q FY 2014Dokument14 SeitenFinolex Cables, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- S. Kumars Nationwide: Performance HighlightsDokument19 SeitenS. Kumars Nationwide: Performance HighlightsmarathiNoch keine Bewertungen

- JK Lakshmi Cement: Performance HighlightsDokument10 SeitenJK Lakshmi Cement: Performance HighlightsAngel BrokingNoch keine Bewertungen

- WPIInflation August2013Dokument5 SeitenWPIInflation August2013Angel BrokingNoch keine Bewertungen

- Technical & Derivative Analysis Weekly-14092013Dokument6 SeitenTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Daily Metals and Energy Report September 16 2013Dokument6 SeitenDaily Metals and Energy Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 16 2013Dokument9 SeitenDaily Agri Report September 16 2013Angel BrokingNoch keine Bewertungen

- Oilseeds and Edible Oil UpdateDokument9 SeitenOilseeds and Edible Oil UpdateAngel BrokingNoch keine Bewertungen

- Commodities Weekly Outlook 16-09-13 To 20-09-13Dokument6 SeitenCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report November 12Dokument2 SeitenMetal and Energy Tech Report November 12Angel BrokingNoch keine Bewertungen

- Special Technical Report On NCDEX Oct SoyabeanDokument2 SeitenSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNoch keine Bewertungen

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDokument4 SeitenRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNoch keine Bewertungen

- International Commodities Evening Update September 16 2013Dokument3 SeitenInternational Commodities Evening Update September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 16 2013Dokument2 SeitenDaily Agri Tech Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 14 2013Dokument2 SeitenDaily Agri Tech Report September 14 2013Angel BrokingNoch keine Bewertungen

- Commodities Weekly Tracker 16th Sept 2013Dokument23 SeitenCommodities Weekly Tracker 16th Sept 2013Angel BrokingNoch keine Bewertungen

- Currency Daily Report September 16 2013Dokument4 SeitenCurrency Daily Report September 16 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 16 Sept 2013Dokument3 SeitenDerivatives Report 16 Sept 2013Angel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Sugar Update Sepetmber 2013Dokument7 SeitenSugar Update Sepetmber 2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Dokument4 SeitenDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNoch keine Bewertungen

- Technical Report 13.09.2013Dokument4 SeitenTechnical Report 13.09.2013Angel BrokingNoch keine Bewertungen

- Market Outlook 13-09-2013Dokument12 SeitenMarket Outlook 13-09-2013Angel BrokingNoch keine Bewertungen

- TechMahindra CompanyUpdateDokument4 SeitenTechMahindra CompanyUpdateAngel BrokingNoch keine Bewertungen

- Derivatives Report 8th JanDokument3 SeitenDerivatives Report 8th JanAngel BrokingNoch keine Bewertungen

- MarketStrategy September2013Dokument4 SeitenMarketStrategy September2013Angel BrokingNoch keine Bewertungen

- IIP CPIDataReleaseDokument5 SeitenIIP CPIDataReleaseAngel BrokingNoch keine Bewertungen

- MetalSectorUpdate September2013Dokument10 SeitenMetalSectorUpdate September2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 06 2013Dokument2 SeitenDaily Agri Tech Report September 06 2013Angel BrokingNoch keine Bewertungen

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDokument1 SeitePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report Sept 13Dokument2 SeitenMetal and Energy Tech Report Sept 13Angel BrokingNoch keine Bewertungen

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDokument6 SeitenTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNoch keine Bewertungen

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDokument4 SeitenJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNoch keine Bewertungen

- Projected Operating Costs, Manual Process: Inflatio Mexico 7% Tax Rate 35%Dokument4 SeitenProjected Operating Costs, Manual Process: Inflatio Mexico 7% Tax Rate 35%Cesar CameyNoch keine Bewertungen

- Final accounts of sole traderDokument32 SeitenFinal accounts of sole tradervickramravi16Noch keine Bewertungen

- Practice Exam 1 - ACC 3365Dokument21 SeitenPractice Exam 1 - ACC 3365Jessica Colin100% (2)

- Wac Service Metro SailsDokument17 SeitenWac Service Metro SailsJasmine Acta100% (2)

- Factsheet - 0305709591 - CONG TY CO PHAN PHONG PHU SAC VIET - Company ReportDokument10 SeitenFactsheet - 0305709591 - CONG TY CO PHAN PHONG PHU SAC VIET - Company ReportHung NguyenNoch keine Bewertungen

- Class 11 Accounts SP 2 Answer KeyDokument18 SeitenClass 11 Accounts SP 2 Answer KeyUdyamGNoch keine Bewertungen

- Manufacturing 1cqhd8sj1 - 416110Dokument88 SeitenManufacturing 1cqhd8sj1 - 416110DGLNoch keine Bewertungen

- Exercise SolutionsDokument114 SeitenExercise SolutionsCarolyn ImaniNoch keine Bewertungen

- FM Lesson PlanDokument3 SeitenFM Lesson PlanashwiniNoch keine Bewertungen

- PTFC Redevelopment Corporation SEC Form 17-ADokument261 SeitenPTFC Redevelopment Corporation SEC Form 17-AqrqrqrqrqrqrqrqrqrNoch keine Bewertungen

- Introduction and Overview of IBCDokument3 SeitenIntroduction and Overview of IBCArushi JindalNoch keine Bewertungen

- Chapter 2: Corporations: Introduction and Operating RulesDokument22 SeitenChapter 2: Corporations: Introduction and Operating RulesAvneet KaurNoch keine Bewertungen

- Shareholders EquityDokument92 SeitenShareholders EquityJoshua MolinaNoch keine Bewertungen

- Econ F212 1120Dokument6 SeitenEcon F212 1120rohit BindNoch keine Bewertungen

- Qualifying Round QuestionsDokument9 SeitenQualifying Round QuestionsShenne MinglanaNoch keine Bewertungen

- Accounting and The Business Environment: Short Exercises S 1-1Dokument52 SeitenAccounting and The Business Environment: Short Exercises S 1-1iLessNoch keine Bewertungen

- Business Combi - SubsequentDokument5 SeitenBusiness Combi - Subsequentnaser100% (2)

- Topic 3 - Impairment - SVDokument4 SeitenTopic 3 - Impairment - SVHuỳnh Minh Gia Hào100% (2)

- Entrep 12 GASDokument2 SeitenEntrep 12 GASCamille ManlongatNoch keine Bewertungen

- Investor Protection and Corporate Governance-Dissertation For Seminar Paper IDokument54 SeitenInvestor Protection and Corporate Governance-Dissertation For Seminar Paper Ijjgnlu100% (4)

- Accounting For A Service CompanyDokument9 SeitenAccounting For A Service CompanyAnnie RapanutNoch keine Bewertungen

- FINANCIAL ANALYSISDokument8 SeitenFINANCIAL ANALYSISErica GaytosNoch keine Bewertungen

- Assessing Control Environment and Risk of Financial Statement FraudDokument6 SeitenAssessing Control Environment and Risk of Financial Statement FraudPrince GueseNoch keine Bewertungen

- Capital Budgeting Exercise1Dokument14 SeitenCapital Budgeting Exercise1rohini jha0% (1)

- Insider TradingDokument2 SeitenInsider TradingSanju VargheseNoch keine Bewertungen

- Market IndicatorsDokument7 SeitenMarket Indicatorssantosh kumar mauryaNoch keine Bewertungen

- Total (CF) 17,500,000.0 550,000 5,000,000 550,000 5,000,000 600,000 5,000,000 650,000 5,000,000 700,000 5,000,000 IRR Jumlah 4,450,000Dokument5 SeitenTotal (CF) 17,500,000.0 550,000 5,000,000 550,000 5,000,000 600,000 5,000,000 650,000 5,000,000 700,000 5,000,000 IRR Jumlah 4,450,000Devania PratiwiNoch keine Bewertungen

- PPE Multiple Choice TestDokument4 SeitenPPE Multiple Choice TestRonna Mae ColminasNoch keine Bewertungen

- Code of Corporate Governance For Issuers of Securities To The Public 2015Dokument16 SeitenCode of Corporate Governance For Issuers of Securities To The Public 2015owinohNoch keine Bewertungen

- Cio DataDokument6 SeitenCio DataVikramNoch keine Bewertungen