Beruflich Dokumente

Kultur Dokumente

Alt Hedge Strategies June 2012

Hochgeladen von

Bill HallmanOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Alt Hedge Strategies June 2012

Hochgeladen von

Bill HallmanCopyright:

Verfügbare Formate

G.I.

ALTERNATIVE HEDGE STRATEGY JUNE 2012

GI CAPITAL

G.I. Alternative Hedge Strategy Pool

The Alternative Hedge Strategy is an alternative to traditional bond funds, which although carry very low credit risk, currently have minimal return; and to equity funds that exhibit high volatility. The Alternative Hedge Strategy seeks to invest in alternative strategies like hedge funds, private equity, and real estate, which offer higher returns, at a reasonable risk, while minimizing exposure to global stock and bond markets. The fund provides access to sophisticated private investment vehicles traditionally reserved for large pension plans and the ultra high net worth investors. The strategys objectives are to preserve capital, minimize volatility, have a low or zero correlation with stock and bond markets, and achieve an annual return of 7-9% net of fees. The pool is a core holding across all of GIs managed accounts.

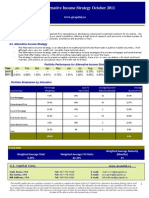

PORTFOLIO PERFORMANCE FOR ALTERNATIVE HEDGE STRATEGY

Ye a r 2011 2012 0.31% - 0.16% 0.61% 0.19% 3.28% - 1.19% Jan Fe b Mar A pr May J un J ul A ug Sep Oc t N ov Dec - 0.07% Tot a l - 0.07% 3.02%

STRATEGY

COUNTRY US US US CAN US

Securitized Fixed Income High Yield Bond Strategies Private Distressed Debt Hedged Fixed Income Distressed Real Estate

DESCRIPTION Long senior or mezzanine tranches of securitized bonds (RMBS, CMBS, CDOs, CLOs) through granular analysis of underlying assets in the pool. Hedged through tactically shorting the ABX (RMBS Index), etc. Publically traded bonds that have fallen below 75% of their par value. High current yields and yield to maturity. Some hedging through shorts on equities and non-distressed bonds. Private placements into charged off consumer debt at a severe discount to face value (ie 1-2% of par value). Purchased from distressed banks trying to clean up their balance sheets. High quality fixed income fund which has been hedged against a rise in interest rates. Private placements into real property with positive cash flows, purchased at significant discounts to replacement cost. MONTH PERFORMANCE BY STRATEGY

-0.71% -2.03% 0.37% 1.00% 0.00% -0.88% Cash

Hedged Fixed Income High Yield Bond Strategies Securitized Fixed Income Private Distressed Debt Distressed Real Estate Other

INVESTMENT BY ASSET CLASS

Distressed Real Estate

10% 23% 8%

6% 30%

Hedged Fixed Income High Yield Bond Strategies Private Distressed Debt Securitized Fixed Income

24%

FEATURE INVESTMENT

RMBS Long Short: This is a hedge fund strategy that is long deeply discounted senior tranche RMBS securities, and tactically short the RMBS Index. RMBSResidential Mortgage Backed Securities are essentially bonds backed by residential mortgages in the US. Most investors are familiar with how mortgages were bundled up and sold off in tranches, ranging from super-senior to mezzanine tranches to equity tranches. These are the same securities that contributed to credit bubble in 2008. However, while in hindsight they were not very attractive investments (issued at par paying a few basis points above LIBOR), the super seniors are now trading at 30-50 cents on the dollar and offer an attractive yield to maturity. The fund establishes on a granular basis what the collateral (in this case residential real estate) is worth before making a bid on an RMBS security. Based on this collateral, they estimate that the YTM is 12-15% with no change in real estate value. However, given that an underlying assumption is that these bonds will mature somewhere below par value, there is substantial upside should the real estate market recover. More importantly, the portfolio has been stress tested on the downside, and its estimated that the market would have to decline a further 42% before a loss would be incurred.

This monthly update does not constitute or purport to constitute a complete description of the G.I. Capital Corp. Alternative Hedge Strategy and is in all respects subject to the more detailed provisions found in the fund's declaration of trust. The Alternative Hedge Strategy is only available to GI clients who have engaged GI to manage their account under the alternative income/hedge mandate as outlined in their investment policy statement. The returns above are net of all fees, other than management fees. The references to the target rates of return are provided for illustrative purposes only and there can be no assurance that the fund will be able to achieve the targeted rates of return.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Equal OwnershipDokument4 SeitenEqual Ownershipkevina8Noch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Exercise 6 CDokument1 SeiteExercise 6 Csubhi_dugarNoch keine Bewertungen

- GI Report January 2012Dokument3 SeitenGI Report January 2012Bill HallmanNoch keine Bewertungen

- As A Buyer For A Discount Retail Chain You FindDokument1 SeiteAs A Buyer For A Discount Retail Chain You FindAmit PandeyNoch keine Bewertungen

- Corporate Innovation and EntrepreneurshipDokument16 SeitenCorporate Innovation and EntrepreneurshipPavithra RatenomNoch keine Bewertungen

- Alt Hedge Strategies May 2013Dokument1 SeiteAlt Hedge Strategies May 2013Bill HallmanNoch keine Bewertungen

- Alt Inc Fund Feb 2013 - FinalDokument1 SeiteAlt Inc Fund Feb 2013 - FinalBill HallmanNoch keine Bewertungen

- Alt Inc Fund Nov 2012Dokument1 SeiteAlt Inc Fund Nov 2012Bill HallmanNoch keine Bewertungen

- Alt Inc Fund May 2013Dokument1 SeiteAlt Inc Fund May 2013Bill HallmanNoch keine Bewertungen

- Alt Hedge Strategies August 2012Dokument1 SeiteAlt Hedge Strategies August 2012Bill HallmanNoch keine Bewertungen

- Alt Inc Fund Sept 2012Dokument1 SeiteAlt Inc Fund Sept 2012Bill HallmanNoch keine Bewertungen

- Alt Inc Fund June 2012Dokument1 SeiteAlt Inc Fund June 2012Bill HallmanNoch keine Bewertungen

- Alt Inc Fund Jan 2012Dokument1 SeiteAlt Inc Fund Jan 2012Bill HallmanNoch keine Bewertungen

- Alt Inc Fund Mar 2012Dokument1 SeiteAlt Inc Fund Mar 2012Bill HallmanNoch keine Bewertungen

- GI Report May 2012Dokument3 SeitenGI Report May 2012Bill HallmanNoch keine Bewertungen

- Alt Inc Fund Sep 2011Dokument1 SeiteAlt Inc Fund Sep 2011Bill HallmanNoch keine Bewertungen

- Alt Inc Fund July 2012Dokument1 SeiteAlt Inc Fund July 2012Bill HallmanNoch keine Bewertungen

- Alt Inc Fund May 2012Dokument1 SeiteAlt Inc Fund May 2012Bill HallmanNoch keine Bewertungen

- Alt Inc Fund Apr 2012Dokument1 SeiteAlt Inc Fund Apr 2012Bill HallmanNoch keine Bewertungen

- Alt Inc Fund Feb 2012Dokument1 SeiteAlt Inc Fund Feb 2012Bill HallmanNoch keine Bewertungen

- Alt Inc Fund Oct 2011Dokument1 SeiteAlt Inc Fund Oct 2011Bill HallmanNoch keine Bewertungen

- Alt Inc Fund Nov 2011Dokument1 SeiteAlt Inc Fund Nov 2011Bill HallmanNoch keine Bewertungen

- GI Report February 2012Dokument3 SeitenGI Report February 2012Bill HallmanNoch keine Bewertungen

- Alt Inc Fund July 2011Dokument1 SeiteAlt Inc Fund July 2011Bill HallmanNoch keine Bewertungen

- Alt Inc Fund June 2011Dokument1 SeiteAlt Inc Fund June 2011Bill HallmanNoch keine Bewertungen

- Alt Inc Fund Aug 2011Dokument1 SeiteAlt Inc Fund Aug 2011Bill HallmanNoch keine Bewertungen

- C10 InventoriesDokument53 SeitenC10 InventoriesKenzel lawasNoch keine Bewertungen

- Cost II AssignmentDokument4 SeitenCost II AssignmentmeazadgafuNoch keine Bewertungen

- Inventory ManagementDokument74 SeitenInventory ManagementSonia LawsonNoch keine Bewertungen

- Chapter 21Dokument19 SeitenChapter 21Yvhette Mycah GodaNoch keine Bewertungen

- Section III - Numerical Ability - Attempt ReviewDokument7 SeitenSection III - Numerical Ability - Attempt ReviewHameed BashaNoch keine Bewertungen

- 2 Kasus SouthwestDokument9 Seiten2 Kasus SouthwestFitri AriantiNoch keine Bewertungen

- Unit 4Dokument8 SeitenUnit 4Aditya SinghNoch keine Bewertungen

- A Brighter Outlook: International Construction Cost Survey 2013Dokument62 SeitenA Brighter Outlook: International Construction Cost Survey 2013abhigupta08Noch keine Bewertungen

- DCLG Letter Re Second Homes and Empty Homes Sept 14Dokument2 SeitenDCLG Letter Re Second Homes and Empty Homes Sept 14LeedsCommunityHomesNoch keine Bewertungen

- GEPCO - Gujranwala Electric Power CompanyDokument2 SeitenGEPCO - Gujranwala Electric Power CompanyZulfqar AhmadNoch keine Bewertungen

- 2 Exchange Rate DeterminationDokument28 Seiten2 Exchange Rate Determinationshakil zibranNoch keine Bewertungen

- Final Economic ExposureDokument3 SeitenFinal Economic ExposureDivakara ReddyNoch keine Bewertungen

- Cost Management Concepts and Cost BehaviorDokument55 SeitenCost Management Concepts and Cost BehaviorAnanda Satria NegaraNoch keine Bewertungen

- Absorption and Variable Costing, and Inventory ManagementDokument46 SeitenAbsorption and Variable Costing, and Inventory Managementtira sundayNoch keine Bewertungen

- STO ProcessDokument4 SeitenSTO ProcesspremsaradhiNoch keine Bewertungen

- Economics of Strategy: Sixth EditionDokument63 SeitenEconomics of Strategy: Sixth EditionRichardNicoArdyantoNoch keine Bewertungen

- Stone World 201004Dokument194 SeitenStone World 201004lorin72Noch keine Bewertungen

- Productive ConsumptionDokument15 SeitenProductive ConsumptioncfvdfvdsvNoch keine Bewertungen

- Tender For Supply of IT EquipmentsDokument38 SeitenTender For Supply of IT EquipmentsBilal AkbarNoch keine Bewertungen

- Hedging With FuturesDokument30 SeitenHedging With FuturesCT SunilkumarNoch keine Bewertungen

- VoltasDokument3 SeitenVoltasAnant VishwakarmaNoch keine Bewertungen

- Price ActionDokument11 SeitenPrice ActionAhmad Farhan Ramli100% (1)

- Oati 30 enDokument48 SeitenOati 30 enerereredssdfsfdsfNoch keine Bewertungen

- Santa Isabel College - Manila Basic Education Department - Senior High SchoolDokument6 SeitenSanta Isabel College - Manila Basic Education Department - Senior High SchoolJulia Maureen CalingoNoch keine Bewertungen

- Fundamental Analysis of Ultratech Cement: Presented By:-Rishav MalikDokument15 SeitenFundamental Analysis of Ultratech Cement: Presented By:-Rishav MalikRishav MalikNoch keine Bewertungen

- Pre-Test 12Dokument2 SeitenPre-Test 12BLACKPINKLisaRoseJisooJennieNoch keine Bewertungen