Beruflich Dokumente

Kultur Dokumente

Obama Health Care Reform

Hochgeladen von

Khaled BaagarOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Obama Health Care Reform

Hochgeladen von

Khaled BaagarCopyright:

Verfügbare Formate

What you need to know about Obama Health Reform when you go to the IV .......

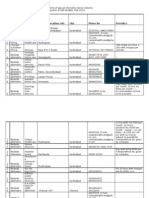

Just in case you are asked to make an opinion about Obama's plan! This is my understanding of his plan ..... it may be insufficient or incomplete! Together, Medicare and Medicaid cover approximately 87 million Americans (2004). One study found that among Americans diagnosed with colorectal cancer, those without insurance were 70 percent more likely than those with insurance to die over the next three years. HEALTH REFORM LAW: 1 in 7 has no health insurance at all. What the health reform will do: Till 2014: 1) Give part of the administrative costs back through repaid (this wont help to stop premium increase but it may help some) 2) Some services (through Medicare and new private insurance) will be free like screening and vaccination. 3) People who are on Medicare over 65 and disabled will get more help with their drug costs. 4) Young people can save money and stay insured by remaining on their parents policy by up to age 26. 5) Some small businesses will get tax breaks to help them pay for health insurance for their workers. 6) Lifetime limits on health coverage will be gone 7) It will become illegal to turn kids down for having asthma or DM. 8) Create a high risk pool to help people with pre-existing conditions who could not buy health insurance. The government will cover the costs. This wont be completed and will continue beyond 2014. 2014-2019: 1) Medicare will be expanded to cover all low income individuals and family in every stage. 2) If you lose your job, you will get health insurance tax credit. 3) If you dont have work insurance, you will use the exchange (like insurance mega mall). 32 millions will be newly insured (940 billion $ cost over 10 years) 2% of federal budget and 3% of what US is spending on health care over all. 23 millions will stay uninsured (like undocumented immigrants). Key points included in the final Act: - Cost: the Act is expected to cost $940 billion over the next 10 years but more immediately reduce the deficit by $143 billion. The costs will be offset by cutting waste and introducing higher payroll taxes, higher fees to prescription drug companies and lower payments to hospitals. - Coverage: the Act brought coverage to 32 million currently uninsured Americans by expanding Medicaid and offering subsidies to low-income earners purchasing insurance through the new exchanges - Medicare: before the Act people had to pay if their prescriptions cost more than $2700 and they only qualified for coverage again if the cost passed $6154. The Act closed this gap and also gives people rebates and discounts on brand name drugs - Medicaid: an extra 16 million people will become eligible for Medicaid as it is expanded to include families under 65 with a gross income of up to 133% of federal poverty level. - Insurance reforms: insurers can no longer deny coverage to those with pre-existing conditions and their use of annual limits will be restricted. - Insurance exchanges: the uninsured and self-employed are now able to purchase insurance through state based exchanges, which every state will have to set up. It is not compulsory to buy within the exchange but companies in the exchange are regulated (and therefore perhaps safer) and generally cheaper due to shared risk. - Subsidies: as well as subsidies offered to low-income individuals and families wanting to purchase their own health insurance, subsidies will be available for small businesses to ensure that they can afford to offer health insurance to their employees. Meanwhile, employers who have 50 or more workers could face fines if they do not provide a health insurance plan - Individual mandate: from 2014 those not covered by Medicaid or Medicare must be insured or face a fine of at least $695 a year or 2.5% of their income. - Tax: taxes on high end health plans were relaxed by the Act but the Medicare payroll tax on upper income earners was increased. From 2013 families with an income of over 250 000 will have to pay an additional 3.8% on their investment income and contribute more to Medicare from income tax.

- Young adults will be able to stay on their parents health plans until they are 26. Currently many insurance companies drop dependents when they turn 19 or finish college. Advantages: 1) Cardiac deaths have fallen by two-thirds over the past 50 years. 2) Childhood leukemia has a high cure rate 3) 8 of the top 10 medical advances of the past 20 years were developed in or had roots in US, a figure that also explains why Nobel Prizes in medicine and physiology have been awarded to more Americans than to researchers in all other countries combined 4) 8 of the 10 top-selling medical drugs in the world are made by US companies. 5) The US has some of highest breast, colon and prostate cancer survival rates in the world.

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Michigan Medicaid Claim Predictive Modeling PolicyDokument2 SeitenMichigan Medicaid Claim Predictive Modeling PolicyBeverly TranNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Jubilee Insurance & Aga Khan Launches Jilinde Afya ProductDokument2 SeitenJubilee Insurance & Aga Khan Launches Jilinde Afya ProductGeofrey Adroph100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- 4-Stacey Roberts Pta 1010 Shadowing ReflectionDokument5 Seiten4-Stacey Roberts Pta 1010 Shadowing Reflectionapi-260194026Noch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Prescription Pad 731Dokument7 SeitenPrescription Pad 731Faheem LibraryNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Management TheoryDokument63 SeitenManagement TheoryFaisal Ibrahim100% (2)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Master Training Plan-ICD10Dokument69 SeitenMaster Training Plan-ICD10Tiffani Boyd100% (1)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- MGT-341 Disaster Preparedness For Hospitals and Healthcare OrganizationsDokument2 SeitenMGT-341 Disaster Preparedness For Hospitals and Healthcare OrganizationsbillcotterNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Kenneth Thorpe's Analysis of Bernie Sanders's Single-Payer Proposal.Dokument7 SeitenKenneth Thorpe's Analysis of Bernie Sanders's Single-Payer Proposal.Dylan Matthews57% (7)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- CFO Vice President Finance in United States Resume Salmon KaplanDokument3 SeitenCFO Vice President Finance in United States Resume Salmon KaplanSalmon Kaplan1Noch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Community Health Nursing (Reflection Paper)Dokument3 SeitenCommunity Health Nursing (Reflection Paper)R-Chian Jose GermanpNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Whatley Health Services, IncDokument2 SeitenWhatley Health Services, IncElla WardNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Health Econ 2013Dokument235 SeitenHealth Econ 2013James SchneiderNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- MedITEX IVF Software - ReferencesDokument2 SeitenMedITEX IVF Software - Referencesmichael_schindl6525Noch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Standards of Medical Care For Nursing Home Residents in EuropeDokument3 SeitenStandards of Medical Care For Nursing Home Residents in EuropeAida MawaddahNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Empirical Evidence:: ApplicationDokument1 SeiteEmpirical Evidence:: ApplicationpenelopegerhardNoch keine Bewertungen

- Assistive Devices in HyderabadDokument5 SeitenAssistive Devices in HyderabadPadmanabha VyasamoorthyNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Kentucky Bannister Trufanov Aff Kentucky Round2Dokument67 SeitenKentucky Bannister Trufanov Aff Kentucky Round2aesopwNoch keine Bewertungen

- Chapter 06 Intro To CPT, HCPCS, and ModifiersDokument3 SeitenChapter 06 Intro To CPT, HCPCS, and ModifiersBernard Paul GuintoNoch keine Bewertungen

- Journal Nursing DocumentationDokument8 SeitenJournal Nursing DocumentationikaNoch keine Bewertungen

- CEO Analysis George Halvorson by Ryland HamletDokument8 SeitenCEO Analysis George Halvorson by Ryland HamletRyland HamletNoch keine Bewertungen

- Mdindia Healthcare Services (Tpa) Pvt. LTD.: Claim FormDokument5 SeitenMdindia Healthcare Services (Tpa) Pvt. LTD.: Claim FormrhvenkatNoch keine Bewertungen

- Madocs HXDokument3 SeitenMadocs HXJoren Angela GalangNoch keine Bewertungen

- Test 3 4 5Dokument8 SeitenTest 3 4 5Sayani BanerjeeNoch keine Bewertungen

- CH Capital FHA Road Show and Broker Package - SokDokument22 SeitenCH Capital FHA Road Show and Broker Package - Soksokcordell69Noch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- 2009 Health Information Technology ActDokument149 Seiten2009 Health Information Technology Actsmallsara100% (2)

- DocDokument2 SeitenDocMihaela Papusica0% (1)

- Health Management Information Systems: Computerized Provider Order Entry (CPOE) Lecture BDokument18 SeitenHealth Management Information Systems: Computerized Provider Order Entry (CPOE) Lecture BHealth IT Workforce Curriculum - 2012Noch keine Bewertungen

- Anthem Scope of App.Dokument2 SeitenAnthem Scope of App.family-instituteNoch keine Bewertungen

- Latisha Kelly Resume AssignmentDokument3 SeitenLatisha Kelly Resume Assignmentapi-324927307Noch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- QPSDokument14 SeitenQPSKevin Adam RobinsterNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)