Beruflich Dokumente

Kultur Dokumente

The Role of Mobile Banking in Pakistan

Hochgeladen von

Saad Bin MehmoodOriginaltitel

Copyright

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

The Role of Mobile Banking in Pakistan

Hochgeladen von

Saad Bin MehmoodCopyright:

The Role of Mobile Banking in Pakistan

2011

CBC-2011

Banking Project Report

[The Role of Mobile Banking In Pakistan]

Submitted To: Dr.Mohsin

MBA (Banking & Finance) Semester 2nd

Submitted By: Saad Bin Mehmood

IM Sciences Product: Mobile Banking Page 1

The Role of Mobile Banking in Pakistan

CBC-2011

Contents

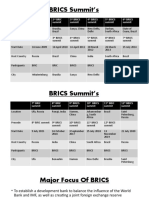

1. 2. 3. 4. I. II. III. 5. I. a. b. c. d. e. f. g. h. 6. 7. a. b. c. d. e. 8. 9. Introduction: ......................................................................................................................................... 5 History of Mobile Banking..................................................................................................................... 6 Mobile Banking as an innovation: ......................................................................................................... 6 Benefits of Mobile banking: .................................................................................................................. 7 Benefits of Mobile banking to customers: ........................................................................................ 7 Benefits of Mobile banking to Operator: .......................................................................................... 8 Benefits of Mobile banking to Banking Sector:............................................................................. 9

Technical Description of Mobile Banking Process: ............................................................................... 9 Mobile Banking Components: ........................................................................................................... 9 SIM Card: ..................................................................................................................................... 10 BMS: ............................................................................................................................................ 10 BSP: ............................................................................................................................................. 11 HSM: ............................................................................................................................................ 11 OSG: ............................................................................................................................................ 11 Adaptor: ...................................................................................................................................... 11 OTA:............................................................................................................................................. 11 SMSC: .......................................................................................................................................... 11

Impact of Mobile Banking in World: ................................................................................................... 12 Impacts of Mobile Banking in Pakistan: .............................................................................................. 12 New Job Creation: ........................................................................................................................... 13 Tax Revenue Growth:...................................................................................................................... 13 Tools for Government: .................................................................................................................... 13 Impact on Firms, Merchants, and Middlemen: .............................................................................. 14 Impact of Mobile Banking on Society: ............................................................................................ 14 Potential Market: ................................................................................................................................ 15 Mobile Banking Products in Pakistan:................................................................................................. 16 Product: Mobile Banking Page 2

IM Sciences

The Role of Mobile Banking in Pakistan

I. A. B. C. D. II. A. B. C. D.

CBC-2011

Easy Paisa: ....................................................................................................................................... 16 Easypaisa Mobile Account: ......................................................................................................... 16 Easypaisa Money Transfer: ......................................................................................................... 19 Bill Payments:.............................................................................................................................. 21 Other Services: ............................................................................................................................ 21 UBL OMNI: ...................................................................................................................................... 21 Account Opening:........................................................................................................................ 22 Money Transfer:.......................................................................................................................... 23 Bill Payments:.............................................................................................................................. 25 Other Services: ............................................................................................................................ 25

Service Fee at UBL Omni Dukaan: ....................................................................................................... 26 III. UPayments: ................................................................................................................................. 26

UPaymentCharges:.............................................................................................................................. 26 IV. A. B. C. D. E. F. G. H. I. V. 10. 11. I. II. III. IV. 12. MCB Mobile Banking:.................................................................................................................. 27 Balance Inquiry: .......................................................................................................................... 27 Mini Statements .......................................................................................................................... 27 Funds Transfer............................................................................................................................. 28 Utility Bill Payments .................................................................................................................... 28 MCB Visa Credit Card Bills Payment............................................................................................ 29 Maintain Favorites: ..................................................................................................................... 29 Report a Lost ATM card: ............................................................................................................. 29 Other Services: ............................................................................................................................ 29 How to register............................................................................................................................ 30 Upcoming Mobile Banking Products in Pakistan: ........................................................................... 31 Comparison among major Mobile Banking Products in Pakistan: .............................................. 32 SWOT Analysis: ............................................................................................................................... 32 Strengths: ........................................................................................................................................ 33 Weaknesses: ................................................................................................................................... 33 Opportunities: ............................................................................................................................. 34 Threats: ....................................................................................................................................... 34 Conclusion: ...................................................................................................................................... 34 Product: Mobile Banking Page 3

IM Sciences

The Role of Mobile Banking in Pakistan

13. 14.

CBC-2011

References: ..................................................................................................................................... 36 End Notes: ....................................................................................................................................... 37

IM Sciences

Product: Mobile Banking

Page 4

The Role of Mobile Banking in Pakistan

CBC-2011

1. Introduction:

In this modern world where everything is changing so rapidly, it is very hard for the Businesses to Survive in the todays extreme level of competition. Every Business is working on researches so that they can keep themselves change and bring something new and innovative in market to increase its Market share. The Technology is playing a key Role in the Growth and Survival of the economy. In 21st century, the sole objective of Businesses is to provide convenience and ease to their customers to meet their main objective, i-e Maximization of the Profit. Man has invented and developed so many products which have made his life easy and facilitated. It is Technology that is alleviating the standard of lives of the People among the nations. Even the economic growth of the country is also dependent heavily on the technology. So we use thousands of electronics devices in our daily life. One of these Devices is a Mobile phone. We use Mobile phone mainly for Communication purpose but now in recent few years this device has developed in very broad and positive way, and this is the reason that now this device is one of the most usable device in the entire world. More than 60% of worlds Population uses Mobile Phone on daily basis. This frequent use of the mobile has opened new doors for the next generation businesses for example every day thousands of Mobile phone applications are developing that are use by users for lots of purposes. So it wont be wrong if we say that mobile phone has provided new shape to not only businesses but economy as well. When we say that the mobile phone is very effective for the growth of a healthy economy, then numbers of questions arise in our mind that how is it possible? Or how a minor device can put an effective impact over economy of a country? The answer of all these questions is very clear if one can observe how a mobile phone device can help in the growth of financial system of a country. Although there are number of other platforms that are now using by financial institutions to provide their services to their customers on their finger tips for example Online banking or internet banking is one of those tools that are use by financial institutions to facilitate their customers but internet service cannot be use from everywhere now and the devices other than mobile phone that are use for this purpose are not easily portable. Though this service can also be use by a single Mobile phone that a person can easily carry in his pocket. Due to high level of Market potential and Mobile phones positive interaction with financial systems the numbers of innovative products are launching in market related with mobile phones. One of these innovative products that is developed in past few years and which is still in its development phase is Mobile Banking. The People living in emerging markets or remote regions, who dont

IM Sciences Product: Mobile Banking Page 5

The Role of Mobile Banking in Pakistan

CBC-2011

have a bank account or a computer still often own a mobile phone, which can provide them with access to basic financial services. Mobile phones represent a cost-effective solution for users, financial institutions and operators, allowing them to bridge the digital divide in places where traditional banking and Internet services are too expensive or simply nonexistent.

2. History of Mobile Banking

The first large-scale mobile baking rollouts deployed in South Africa and the Philippines. According to the GSM Association (GSMA), 13 million people in these countries now use mobile banking services. Another early mobile banking success is the M-PESA service launched by Safaricomi, a Vodafone partner, in Kenya in 2007. Today, M-PESA is the largest mobile banking service in the world, serving 13 million users in Kenya, Tanzania, South Africa, and Afghanistan. Mobile banking services are also now operating in Uganda and Senegal. All told, more than 40 million people now use mobile financial services worldwide, according to the GSMAii.

3. Mobile Banking as an innovation:

For Billions of lower-income people around the world, a mobile phone represents more than just a tool for communication. It can also become a means of extending financial services to people without bank accounts, setting off a virtuous circle of benefits to individuals, families, communities and nations. Only active collaboration between financial and telecom regulators, financial institutions, mobile operators and handset manufacturers will make this possible.

Figure shows features of innovation in a product

IM Sciences

Product: Mobile Banking

Page 6

The Role of Mobile Banking in Pakistan

CBC-2011

Mobile Banking is an innovation for the both the developed as well as Developing countries of the world. Especially for the developing countries of Asia, like India, Pakistan, Bangladesh etc where large number of population is still unbanked. In these countries the mobile banking is growing day by day and helping the financial institutions to provide their services where no one can even imagine. An innovative product is the product that provides its benefits to its customer without any obstacle, similarly by using Mobile Banking a customer can enjoy most of the key banking services on his finger tips. So Financial services executives are acknowledging that it is no longer only about the services they can provide, but also how and where those services are accessible in order to remain competitive and viable.For the first time ever a person can open his account by using his Mobile phone, he can also check his account balance, Account statements. Moreover a customer can also pay his utility bills and other charges from his Account by using his mobile phone. Without even visiting the bank the Mobile Banking User can enjoy most of the major functions of Bank which saves a lot of time, and Expanses. It has Low cost and better potential to cover unbanked economy which acts as a green signal for the development of the country. The combination of technology and financial services of banks has developed and promoted this one of the most innovative product to provide their services in a new way.Large banks already provide basic banking transactions through mobile technology, such as account alerts, account balances, updates and history, bill pay services and funds transfers. Peer to peer, payments, universal account access and real-time alerts are among the required capabilities for the next generation of mobile banking services.

4. Benefits of Mobile banking:

I. Benefits of Mobile banking to customers:

The practical and attractive features of mobile Banking services are a strong draw for individual customers. By accessing the mobile banking services the customer have huge extent of benefits. There is no need to visit bank for most of the services as the mobile banking customers can enjoy most of the services just by using their mobile phones. There is no need to travel or visit bank. They can now save lots of their precious time and money that they once use to spend to visit banks for the acquisition of banking services. There is no need to use any computer or internet connection to access the accounts or seek any information related to product. The main benefit of mobile Banking is its 24/7 availability and freedom of usage which means the mobile banking customer can conduct any transaction of any amount in time at anytime of the day or night from anywhere. One of the major benefits is its low cost, as and those transactions such as purchases, personal remittances, and business operations are completed instantly and at a relatively low cost. Another key benefit to the individual is how Mobile Banking, lets users spend less of their time overcoming bureaucratic obstacles. Tailored features, as well as flexible repayment plans and reduced balance requirements, give the previously unbanked the ability to open accounts and gain access to products tailored to their own needs. It also puts them in a position to build up credit histories, an important steppingstone in individual economic improvement.

IM Sciences Product: Mobile Banking Page 7

The Role of Mobile Banking in Pakistan

CBC-2011

Figure shows various Benefits of Mobile Banking

Mobile banking reduces its customers reliance on cash, a feature that brings increased convenience and savings potential into customers lives. Cash becomes unnecessary for transferring or receiving money, which reduces the inherent risks of cash handling, such as loss, theft, or fraud. With middlemen squeezed out of the transaction equation as a result of Mobile banking, customers will experience increased transparency. All of these benefits give consumers good reason to adopt mobile banking. The poor also suffer from the severe expense shocks that occur now and then in their lives. Again, access to financial services would help. Customers can obtain funds to help overcome temporary shortfalls through credit, remittances, and insurance, all of which is out of reach for the unbanked and has served to keep the poor from improving their economic situation.

II.

Benefits of Mobile banking to Operator:

Mobile banking is not only beneficial for its customers but also it is very beneficial for the operator who provides these services to its subscribers. The Mobile banking helps an operator in following ways: Expansion of service portfolio Promotion of operators brand Creation of strategic market differentiation Attraction of new customers/Subscribers

Product: Mobile Banking Page 8

IM Sciences

The Role of Mobile Banking in Pakistan

CBC-2011

On the other node, the customers who avail the financial services by using mobile banking will begin heavily to rely their operators, which is also in the benefit of operators as it will further result a major increase in customers loyalty and Attraction rate. By offering mobile banking service the customers traffic also increases on the network which leads to the high revenues for operators. In order to avail the banking and other financial services on the finger tips, the mobile banking customers use to recharge their prepaid connection with handsome and reasonable amounts more frequently which is also in the benefit of operator.

III.

Benefits of Mobile banking to Banking Sector:

Mobile Banking allows banking sector to enhance customer satisfaction and retention by offering new, better services while gaining a direct marketing channel for their products and services, which can be tailored to the specific needs of customers. At the same time, they attract new customers to the one on one bank customer relationship. As access to mobile phones grows worldwide, so does the opportunity to attract more customers and extend the reach of financial services. By turning mobile phones into their banks ATMs, banks and other financial institutions gain access to new markets, different from those traditionally served by their physical branches. Access to banking services at anytime and from anywhere also generates revenue through higher service usage, and reduces operating expenses because of fewer direct teller interactions, while maintaining or improving the level of service. Banking sector gain another important benefit by adding Mobile Banking to their existing channels. They will be with their customers at all times, ready to help them, to recharge a pre-paid mobile phone on a Saturday night, to get a new MP3 player via online credit funds, to pay a forgotten bill after leaving for a vacation, to transfer money to a spouse when at work the bank is everywhere, all the time.

5. Technical Description of Mobile Banking Process:

In Order to understand the developing and designing the mobile banking system technically, it is essential to have some knowledge about financial system and information technology. As mobile banking is enables in the mobile phone through Users SIM card. Secure transfers over the wireless network and financial transaction processing are managed by the SIM card and a distributed platform, deployed at the mobile operators site and at the financial institution.

I.

Mobile Banking Components:

The Distributed platform that is use to run the mobile Banking Process is as follows:

IM Sciences

Product: Mobile Banking

Page 9

The Role of Mobile Banking in Pakistan

CBC-2011

a. SIM Card:

A SIM Card includes GUI and security Features that assures the level of security and confidentiality of the transaction. It performs following tasks: Formats and displays mobile banking menus and data. Prompts the user for information and collects user input. Generates transaction keys, sensitive information and signs data to be sent. Provides the means for key management. Sends banking requests using SMS messages.

b. BMS:

This component is called as Business Modulation Server. It is actually Operators component. The main function of BMS is to ensure communication between the mobile subscriber and financial institution (Bank) and to route the mobile banking transaction. It performs following tasks: Receives subscribers mobile banking requests, interprets them, formats and forward the requests to the subscribers bank for processing. Maintains the status of the requests. Logs transaction results for auditing and billing purposes. Receives the banks responses and sends them to the SIM. Maintains the list of financial institutions available on that operators services.

IM Sciences

Product: Mobile Banking

Page 10

The Role of Mobile Banking in Pakistan

c. BSP:

CBC-2011

This component is called Bank Secure Platform. It is Financial institutions or Banks Component. It handles the transactions between mobile user and Bank systems.The BSP performs following tasks during Mobile Banking Process: Facilitates communication between bank systems and end-users. Authenticates mobile customers Maintains connectivity between the wireless telecom world and the banking environment Ensures that financial transactions and customer data are secure, using the services of the Host

d. HSM:

HSM means Host Security Module. Its basic function is to secure the Users transactions information. It basically performs the process of encryption and decryption of the transactions information while receiving from BMS. The HSM also performs this function on the financial institutions side.

e. OSG:

Online Service Gateway (OSG) helps operators to offer SIM card-based services to their subscribers by connecting them to remote content in a session mode. In the context of mobile banking, OSG relays mobile banking messages between the mobile phone and the BMS and translates them from SMS to HTTP format.

f. Adaptor:

The Adaptor, required only when non-standard interfaces to the bank systems are used, is a customizable module that translates messages to and from the format used by the banks backend.

g. OTA:

Over-The-Air is an optional component that offers operators the convenience of remotely provisioning and managing SIM cards.

h. SMSC:

A Short Message Service Centre, a standard GSM network element, delivers SMS messages.

IM Sciences

Product: Mobile Banking

Page 11

The Role of Mobile Banking in Pakistan 6. Impact of Mobile Banking in World:

CBC-2011

The advent of value added services offerings like Mobile Banking over mobile networks have farreaching effects. The global mobile money industry has grown significantly in size and scope since last five years. By 2015, online shoppers worldwide will spend $119 billion on goods and services purchased via mobile phones, representing about 8% of total ecommerce sales, ABI Research predicts. According to Juniper research, amount of mobile payment transaction is expected to reach 630 Billion USD by 2014, with a half a billion mobile money users globally. Mobile remittances are yet another segment of mobile Banking having a sound anticipation throughout the world. The GSMA forecasts that the 'formal' global remittance market could be grown from around US$300 billion by 2010 to over US$1 trillion in five years with the help of mobile communications. Encouragingly, According to World Bank, Pakistan is among the Top 20 remittancereceiving economies with a size of 9 Billion USD. Mobile banking is another growing phenomenon; talking on a global scenario almost billion people are unbanked with more than twothirds of the unbanked population in the worlds low and middle-income countries. However, evidence from countries like Brazil, South Africa, India, and Kenya strongly suggests that there is rapid popularity of mobile banking services.

7. Impacts of Mobile Banking in Pakistan:

Mobile banking reduces its customers reliance on cash, a feature that brings increased convenience and savings potential into Pakistanis lives. Cash becomes unnecessary for transferring or receiving money, which reduces the inherent risks of cash handling, such as loss, theft, or fraud. With middlemen squeezed out of the transaction equation as a result of Mobile Banking, customers will experience increased transparency. All of these benefits give consumers good reason to adopt mobile banking. Pakistans poor face two primary challenges that financial services can help address. First, they tend to live with a high degree of income volatility. Financial services can help smooth out their cash flow in several ways: by building a buffer through savings; by increasing inflow through remittances; and by accumulating lump sums of money through savings and credit that can be used to manage major expenses as they come up.

IM Sciences

Product: Mobile Banking

Page 12

The Role of Mobile Banking in Pakistan

a. New Job Creation:

CBC-2011

Increased access to finance facilitates entrepreneurship, new business creation, and new jobs. A World Bank study finds a 1 percent increase in financial inclusion corresponds to a 0.51 percent increase in business creation, and a 15 percent inclusion increase leads to employment growth of 1 percent. By 2020, if Mobile financial services adoption through Mobile Banking Products will increases financial inclusion by 20 percent, up to 600,000 new businesses could be created, leading to 1 million new jobs an employment increase of 1.3 percent. This is the equivalent of new jobs for 1 out of every 10 currently unemployed Pakistani.

b. Tax Revenue Growth:

The benefits of the economic growth stimulated by financial services through Mobile Banking will increase tax revenues, as well. Corporate taxes will grow as a result of new business creation along the Mobile financial Services value chain, growing profits within existing firms thanks to savings from Mobile financial services and company expansions made possible by Mobile Banking. This business growth and creation will generate new jobs, which mean increased employee income taxes. Mobile banking financial services could therefore add US$2 billion annually to Pakistans government revenues by 2020 which means an increase of 3 percent.

c. Tools for Government:

Mobile financial services through Mobile Banking can bring a distinct advantage as an efficient disbursement tool for federal welfare. The current system involves paying by checks or cash, and making use of offline points of service. Such cash payments and subsidies saddle the government with significant costs and inefficiencies, including possible delays, leakages, and risk of corruption by middlemen. To open individual bank accounts for beneficiaries would cause these problems to diminish. Mobile banking would provide beneficiaries with direct access through electronic identification and mobile accounts. They would receive their welfare and subsidy payments instantly, at low cost, with no risk of leakages. Like Telenor Easypaisa and UBL Omni. Furthermore, mobile banking would encourage the development of e-government services, benefitting both government and citizenry with a user-friendly system that would facilitate payments and ID solutions cost effectively. Canada has implemented such a system and has saved US$9 per inhabitant on public services annually, with high user satisfaction. In 2005, that nation launched mobile services meant to improve the delivery of government programs and services to Canadians. The program handles requests for Social Security numbers and passport and credit applications, and it also disburses tax and social security payments. It has provided users with a faster and easier way to access government services, even those in rural and remote locations.

IM Sciences

Product: Mobile Banking

Page 13

The Role of Mobile Banking in Pakistan

CBC-2011

d. Impact on Firms, Merchants, and Middlemen:

The adoption of mobile financial services by Mobile banking can decrease administrative costs for companies. Many firms, such as utility companies, spend significant time and money on the administration and processing of paper bills. Incorporating electronic receipts and reporting can reduce costs and improve speed and accuracy, reducing erroneous charges for arrears, for example. In addition, Mobile banking will increase transaction speeds and reduce outstanding credit times, minimizing how long it takes to collect and inquire after payments. A byproduct of companies reduced administrative duties is an increase in the flow of customer sand revenues to over-the-counter Mobile banking agents. The merchants who take on these jobs will benefit from the growing sales of financial services, larger revenues from the sales of ordinary goods, and an improved social standing as a result of their work. In Mobile Banking some middlemen have been based on the transport of money for remittances and payments, and some have worked as money collectors for informal savings and credit schemes. Thus new opportunities will arise such as jobs for formal banking agents for those willing to be trained and licensed. A wide chain of Easy paisa and Omni Agents in operating as a Middleman in Pakistan for providing mobile banking services to customers mainly transfer of remittances and payments of bills.

e. Impact of Mobile Banking on Society:

The adoption of mobile financial services can help support the achievement of Pakistans social development goals. The growth of the countrys technological infrastructure mobile, Internet, and, thus, Financial Services through Mobile Banking will be at the root of the development of rural society, education, health care, gender equality, and transparency. As these improvements occur, human capital and economic development will thrive, as will improvements in the equality of opportunity and income. MFS can support the development that leads to a higher quality of life through more equitable economic growth, helping Pakistan address some of the social goals of its Five-Year Plan (2010 to 2015) and Vision 2030.

IM Sciences

Product: Mobile Banking

Page 14

The Role of Mobile Banking in Pakistan 8. Potential Market:

CBC-2011

Our country has experienced an excelling growth for both mobile and banking sectors since their deregulation; today we are witnessing mergers of their products and services. According to State bank of Pakistan, growth and turnaround in Pakistans banking sector has been remarkable and unprecedented in recent years. Classified as Pakistans and regions best performing sector, the financial sector assets have risen to over $187 billion, its profitability is exceptional and at an all-time high, nonperforming loans (NPLs) are at an alltime low, credit is fairly diversified and bankwide system risks are wellcontained. Almost 81% of banking assets are in private hands. Similarly mobile sector in Pakistan has observed an enormous growth with a subscribers base reaching above 100 million, growing at12 to 15%, which was only 5 Million in 200405.

Despite this rapid growth, presently there are only 25 million bank accounts in the country making 14 % of the adult population with an access to formal banking services. If the opportunity relationship is mapped between the numbers of bank accounts (25 million) versus the number of mobile subscribers (102 million), there exists a comprehensible window of facilitation for the unbanked population of the country mostly living in rural and remote areas. This window of facilitation could be transformed into a realization through mobile banking services. An open, transparent and robust mobile banking regulatory framework would not only assist the population at large but would also be bridging the ability to measure undocumented economy of Pakistan. The high population density of mobile Pakistan is features auguring very well for success of a technology driven thrust in branchless banking. Five mobile phone companies have brought the entire country under comprehensive network coverage, with steady growth in number of mobile phone subscribers (already well above hundred million), and also with ample information processing capacity to engage in partnerships with licensed and regulated financial service providers to devise and introduce innovative cost effective means of introducing new segments of banking. We have already started witnessing availability of valuable mobile commerce services offering from mobile operators and financial institutes. These services have empowered mobile subscribers to deposit and withdraw cash, make utility bill payments, send or receive money, purchase mobile card vouchers, make postpaid mobile bill payment and much more by using diversified array of convenient channels. Telenor Easy Paisa and UBL Omni are featured examples of local mobile commerce solution introduced in

IM Sciences Product: Mobile Banking Page 15

The Role of Mobile Banking in Pakistan

CBC-2011

the country. The success of the financial services available in the country can be judged by the fact that by December 2010, Telenor Easypaisa service has hosted 9.9 million transactions with a total worth of PKR 19billion passed through the system. On the similar ground, last year MCB was nominated among the top four best mobile money services category for GlobalGSMA Mobile Awards.

9. Mobile Banking Products in Pakistan:

As mentioned earlier that Mobile Banking is the Product which is very effectively progressing in developing countries so in South Asia Pakistan is also a country where mobile banking is flourishing very rapidly. The banking sector in Pakistan is continuously working to cover the huge vacuum of unbanked population that is about more than 80% of Pakistans total population. Following are the products that are launched under the umbrella of Mobile banking that are implemented in Pakistan:

I.

Easy Paisa:

Easy Paisa is 1stMobile Banking product that was launched in October 2009 in Pakistan. Initially it had 2500 Outlets but now they are expanded to more than 12000 outlets throughout the country. It is a joint product of Telenor and Tameer Micro Finance Bank. The innovative product Easypaisa under the umbrella of mobile banking is a most convenient and easy way to transfer money across Pakistan and includes international remittance facility from more than 80 countries with collaboration with Xpress Money. Furthermore an Easypaisa also provides a vast field of banking services. The Easypaisa Mobile Banking structure is based on One to One business Model.

A. Easypaisa Mobile Account:

Telenor Easy paisa is offering Mobile Accounts which are basically same as actual Bank accounts. These Accounts can be easily opened by any Telenor user from any Telenor Sales and Service Centers, Telenor Franchise or Tameer Bank branch. Easypaisa Mobile Account holder can use almost same services which an actual bank account holder use for example any person who have an Easypaisa mobile account is now enable to pay bills, transfer money and use many more services from their own mobile phones, anytime, anywhere. However it is essential to have Telenor SIM to acquire Easypaisa Mobile Account.

i.

Mobile Account services:

Money Transfer Bill Payment International Home Transfer Easy Load

Product: Mobile Banking Page 16

Telenor Easy Paisa is providing the following Services under the umbrella of Mobile Banking:

IM Sciences

The Role of Mobile Banking in Pakistan

CBC-2011

Donations Funds Transfer Detail Mobile Account to Mobile Account:

Funds Transfer Detail Mobile Account to CNIC:

ii.

Level 1 Account Limits:

The Limits of Transaction Amount for customers having Level 1 Easypaisa Mobile Account is as follows:

25K for day 60K for a month

Product: Mobile Banking Page 17

IM Sciences

The Role of Mobile Banking in Pakistan

CBC-2011

500K for a year

iii.

Level 2 Account Limits:

Following are the Account Limits detail for the customers having Level 2 Accounts:

iv.

Process:

Customer has to visit nearest Franchise / Sahulatghar Tameer Bank Branch with his/her original CNIC The Customer Representative will take a customers photograph Account is registered within seconds and subscriber will have to create a 5 Digit secret PIN to be able to do transactions

IM Sciences

Product: Mobile Banking

Page 18

The Role of Mobile Banking in Pakistan

v. Service Charges:

CBC-2011

B. Easypaisa Money Transfer:

Easypaisa also provide Money transfer services through its More than 12000 outlets.Any person with a need to send money from one city to another can use this service from any Easypaisa shop. It is not necessary for the customer to be a Telenor subscriber in order to avail this service. Some features of this service are given as follows: Any person with a valid NADRA CNIC can send money or receive money This service is not limited to Telenor subscribers; other mobile network subscribers can also use this service There is no paper work or form filling required An instant SMS message will be sent to both the Sender and the Receiver on sending/receiving money Sending/Receiving can be done from 12000+ of Easypaisa shops all over Pakistan No more waiting in long lines Money Transfer can be done even at late hours

i.

Process: To Send Money:

The original and valid NADRA CNIC along with 1 Photocopy of the CNIC Receiving person's valid NADRA CNIC Number Senders own mobile phone number (optional) and the receiver's mobile phone number (Optional)

IM Sciences

Product: Mobile Banking

Page 19

The Role of Mobile Banking in Pakistan

CBC-2011

During sending, the Sender will be asked to enter a 5-digit secret pass-code on the Retailers mobile phone. This pass-code should not be told to the Retailer, and only communicated to the Receiver If the Sender and Receiver mobile phone numbers are provided, both the Sender and Receiver will receive confirmation SMS messages containing the transaction information

To Receive Money:

The Receiver needs to bring and provide the following for a Money Transfer: Their original & valid NADRA CNIC along with 1 Photocopy of the CNIC Receiver must know the Transaction ID and the 5-digit secret pass-code (communicated by the Sender)

ii.

Service Charges:

Funds Transfer CNIC to CNIC:

Slab Start

1 1001 2501 4001 6001 8001

Following is the detailed list of Service charges:

Slab End

1000 2500 4000 6000 8000 10000

Charges

51.72 103.45 155.17 206.90 258.62 310.34

FED*

8.28 16.55 24.83 33.10 41.38 49.66

Total Charges

Rs. 60 Rs. 120 Rs. 180 Rs. 240 Rs. 300 Rs. 350

All charges are subject to 16% FED

Sending & Receiving Transactional Limits: Rs.10,000 per month on a CNIC Maximum of 3 transactions per CNIC in a month

IM Sciences

Product: Mobile Banking

Page 20

The Role of Mobile Banking in Pakistan

CBC-2011

Money Transfer (From CNIC to Mobile Account)

Money Transfer (Easypaisa shop to Mobile Account) Slab Start

1 201 501 1001 2,501 4,001 6,001 8,001

Slab End

200 500 1,000 2500 4,000 6,000 8,000 10,000

Charges*

12.93 21.55 30.17 60.34 90.52 120.69 150.86 181.03

F.E.D* (16% as per Govt. Regulations)

2.07 3.45 4.83 9.66 14.48 19.31 24.14 28.97

Total Charges (inclusive of FED)

15 25 35 70 105 140 175 210

C. Bill Payments:

Easypaisa Also providing bill payment services in Pakistan due to this amazing and convenient facility anyone can pay Electricity, Gas, Telephone, Water and Internet bills in a very secure way through any Easypaisa outlet without paying any extra charges.

D. Other Services:

Easypaisa also provide some other financial services as well to its customers for these services are as follows: Easy Load Easy Pay Donations

II.

UBL OMNI:

UBL Omni is Basically Branchless banking product but it also provides Mobile Banking Facilities to its Customers. It is a product of United Bank private limited which is one of the largest banks with 1200+ branches operating in Pakistan. In 2005 UBL launched its first Mobile Banking product named as Mobile Wallet under the brand name of Orion. UBL Omni was launched in Pakistan on 19th April 2010.UBL

Omni is providing the host of banking services to customers nearest "Dukaan". These UBL Omni Dukaans are located in more than 650 Cities and Towns in Pakistan. There are more than

6500 Retail agents of UBL Omni working in various cities and towns. In current Market UBL Omni is the 2nd largest Brand that is providing various mobile banking services to customers. UBL Omni is based on One to many Business Model. Though UBL Omni has much broader scope of services but as far as mobile banking concerns UBL Omni is providing following products under its brand name:

IM Sciences

Product: Mobile Banking

Page 21

The Role of Mobile Banking in Pakistan

A. Account Opening:

CBC-2011

UBL Omni Also Provides the Account opening services to its Customers. Any Customer who wants to open his account can do so just by visiting any UBL Omni Dukaan. Omni Converts the mobile number of Account opener in to his/her Account number and after opening an Omni Account the customer can easily operate his/her account not only from a wide number of UBL Omni Dukaan but also from any UBL Branch as well. A UBL Omni Account holder can enjoy all the basic Banking services on his/her fingertips and perform transaction 24/7 from anywhere in Pakistan.

i.

How to open a UBL Omni Account:

The UBL Omni Account can be open by two ways. Either by Visiting UBL Omni Dukaan Or by Visiting any UBL Branch. Steps for each way are given below:

Account Opening from Omni Dukaan: 1.Customer has to visit nearby UBL Omni Dukaan with his/her your original CNIC, mobile number and an initial deposit amount. 2. UBL Omni Dukaandar will submit Customers request for account opening and will collect the initial deposit amount. 3. After successful account opening, UBL Omni Dukaandar will hand over printed terms and conditions along with transaction slip. 4. Customer will also receive a confirmation SMS on his/her mobile phone regarding his account opening request. 5. Within 1-2 business days, customer will receive a confirmation call from UBL Omni Contact Center for the activation of UBL Omni Account (subject to verification of Account holders CNIC information) 6. Upon activation of account, the customer will receive a confirmation SMS from 8257 Account Opening from UBL Branch: 1. Customer has to visit nearby UBL Omni Dukaan with his/her your original CNIC, mobile number and an initial deposit amount. 2. Fill the Omni account opening form and submit the initial deposit amount 3. Customer will be given a copy of the signed account opening form 4. Customer will also receive a confirmation SMS on his/her mobile phone regarding account opening request 5. Within 1 or 2 business days, customer will receive a confirmation call from UBL Omni Contact Center for the activation of UBL Omni Account. 6. Upon activation of account, customer will receive a confirmation SMS from 8257.

IM Sciences

Product: Mobile Banking

Page 22

The Role of Mobile Banking in Pakistan

ii. Charges for Account Opening:

Initial deposit requirement Rs. 100 Minimum balance requirement Rs. 100 Rs. 15 per month Minimum balance charges OMNI TRANSACTION FEE:

CBC-2011

Following are the charges that a UBL Omni Account holder while opening an Omni Account:

UBL Omni Account to Account funds transfer 2.5% of the transaction amount or Rs. 10 (whichever is higher) 2.5% of the transaction amount or Rs. 10 UBL Omni Account to Person funds transfer (whichever is higher) Cash Withdrawal from Omni account

s

1.5% of the withdrawal amount

iii.

Subscription for Omni Account Holders:

UBL Omni customer can avail all UBL Omni services wherever he/she want and whenever he/she want using multiple channels by just subscribing to any of UBL Omnis packages at the time of account opening and avail unlimited Omni account usage: Package Name Omni Monthly Omni Semi Annual Omni Annual Omni Transaction Validity (Days) Charges (in Rs.) Free Channels 30 150 SMS, Internet, WAP 180 300 SMS, Internet, WAP 360 500 SMS, Internet, WAP In this package, each transaction will be charged individually This will be the default package

B. Money Transfer:

UBL Omni is also providing Money transfer services to its customers which means that like Easypaisa, anyone can transfer money immediately in all over the Pakistan. As UBL Omni is still in its initial phase so currently money transfer services are limited to domestic remittances only. Anyone can visit his/her nearby UBL Omni Dukaan with his/her original and a copy of CNIC along with CNIC number of the recipient and send money instantly with complete peace of mind backed by the financial security of UBL.

IM Sciences

Product: Mobile Banking

Page 23

The Role of Mobile Banking in Pakistan

i. Money transfer Process: Sending Process:

CBC-2011

The Money transfer process for sending and receiving of transferred money is given below:

1. Visit any UBL Omni Dukaan with original and a copy of your CNIC to initiate the money transfer. 2. Customer(Sender) has to provide his/her following details to the UBL Omni Dukaandar which is required for sending money: a. Own CNIC number b. Own mobile number c. Senders name d. City where the money has to be transfer. e. Receiver CNIC number f. Amount 4. UBL Omni Dukaandar will enter the details on his mobile and ask Customer to submit a copy of his/her CNIC or take a digital photograph of CNIC for onward submission to UBL. 5. On successful transaction customer will receive an SMS on his/her mobile number will contain a 16 digit reference number for this transaction. It is VERY important that you provide own mobile number as: a. This reference number will be required by the beneficiary to collect the funds b. This reference number will only be sent on the mobile number 6. UBL Omni Dukandaar will also handover a printed transaction receipt containing all the transaction details the sender has to keep this slip safe until the beneficiary successfully collects the funds. 7. Sender must have to communicate the 16 digit number to the beneficiary so that he/she can collect the transferred amount by using that code.

Receiving Process:

1. Beneficiary can visit any UBL Omni Dukaan to collect funds by presenting the following: a. Original CNIC b. 16 digit reference number c. Copy of own CNIC 2. UBL Omni Dukaandar will verify the availability of original CNIC with the beneficiary and initiate the transaction. 3. On successful execution of the transaction, a confirmation SMS is sent to initiator and beneficiary mobile number 4. UBL Omni Dukaandar will hand over the transaction slip and cash to the beneficiary

IM Sciences

Product: Mobile Banking

Page 24

The Role of Mobile Banking in Pakistan

i. Money Transfer Charges:

Following table shows the UBL Omni Money transfer pricing:

CBC-2011

Slab Start (in Rs.) Slab End (in Rs.) Money Transfer Fee (in Rs.) 500 50 0 1,500 80 501 4,000 120 1,501 7,000 240 4,001 10,000 350 7,001 15,000 500 10,001

C. Bill Payments:

UBL Omni also providing one of the most basic banking services to its customers through Mobile phone, which has made their lives more easy and comfortable now , there is no need to stand in queues and wait to submit utility bills and there is no need to submit utility bills in bank working hours. Anyone can pay his/her utility bills including Electricity, Gas, Internet and even Mobile services bills by visiting any nearby UBL Omni Dukaan without any extra charges. This service is available for everyone.

How to Pay Utility Bill at UBL Omni Dukaan:

Visits UBL Omni Dukaan for utility bill payment UBL Omni Dukaandar will login to the application and enters the following details o Company o Consumer No o Depositor Mobile Number UBL Omni Dukaandar will inform customer about the transaction details and upon confirmation will provide him the an e-receipt. The e-receipt contains the transaction details Customer will also receive a confirmation SMS for the transaction from 8257

How to pay Mobile Bill:

The method of mobile bill payment is same as mentioned above.

D. Other Services:

The Mobile Financial services that are offered by UBL Omni are as follows:

IM Sciences Product: Mobile Banking Page 25

The Role of Mobile Banking in Pakistan

Purchase Mobile Voucher SMS Banking Services Donations Service Fee at UBL Omni Dukaan:

CBC-2011

Utility Bill Payment Free Free Mobile Voucher Purchase Mobile postpaid Bill Payment Free

III.

UPayments:

Recently, Habib Bank Limited, Summit Bank and Ufone jointly started a mobile phone based banking services to Ufone customers to have their bank accounts in HBL which can be operated through mobile phones having Ufone. This Mobile Banking service is not as much wider as UBL Omni and Easypaisa are. The Business model of this Mobile Banking Product is based on One to Many. The initial services that are provided by Upayments are as follows: Pay your Utility bills Make Utility bill enquiries ULoad any Ufone number Pay your Ufone Postpay bill Check your HBL/Summit bank account balance View a mini bank statement of your HBL/Summit account

UPayments allows its customers to conveniently make secure transactions directly by using any handset, without GPRS or internet, within Pakistan and abroad, with UPayments. Ufon Subscribers can easily avail UPayments Services by dialing *808# by their Ufon Numbers. UPayment users can also transfer the amounts from their HBL or Summit Bank account to seventeen 1Link member banks including Allied Bank, Askari Bank Limited, Bank Alfalah Limited, Bank Al Habib Limited, Bank Islami Pakistan, Bank of Punjab, Dawood Islamic Bank, Faysal Bank Limited etc

UPaymentCharges:

An amount of Rs 5+Tax will be charge by ufone as service charges on the payment of the utility Bills where as the amount of the bill will be deducted from the customers Account Balance at HBL or Summit Bank.

IM Sciences

Product: Mobile Banking

Page 26

The Role of Mobile Banking in Pakistan

IV. MCB Mobile Banking:

CBC-2011

Another Mobile Banking Product that was launched in Pakistan by Muslim Commercial Bank in June or July 2009 is MCB Mobile Banking. MCB Mobile Banking is very much like Online banking through Mobile phone through GPRS Service.MCB has developed an entire GUI for its Mobile Banking customers which can be operated by any internet enable Mobile phone. Its Scope is bit narrow as it is available for only MCB ATM Card holders. MCB also won MMT Award (The Best Bank Led Mobile Money Transfer Program) in October 2010 as in less than 15 months since itlaunched its customers used the service had conducted nearly 2 million transactions worth over PKR 3 billion. MCBs globally recognized and award nominated mobile payments service allows existing account holders at MCB to conduct both non financial and financial transactions such as: Balance Inquiry Mini Statements (last 6 transactions) funds Transfer to any MCB account Utility Bill Payments Pay MCB Visa Credit Card Bills Maintain Favorites Make donations to charities Report a Lost ATM card

A. Balance Inquiry:

The existing customers of MCB Mobile banking can easily check their Account Balances by logging in to the MCB mobile banking Application through their Mobile Phones by Using GPRS services of their network operators. There is no time restriction as this service can be use 24hrs a day.

B. Mini Statements:

MCB Mobile banking customer can also get access through his/her mobile phone to his/her Mini Account Statements of last 6 transactions by using MCB mobile Banking Application through GPRS.

IM Sciences Product: Mobile Banking Page 27

The Role of Mobile Banking in Pakistan

CBC-2011

C. Funds Transfer:

MCB Mobile banking customer can send money to anyone using MCB Mobile Application, by providing the complete 16-digit MCB account number or the 13/16 -digit ATM card number of the beneficiary. It is not essential for beneficiary to be MCB customer. Or in case of beneficiary is also a MCB mobile banking registered customer than funds can also be send to him by using his/her registered Mobile number.

D. Utility Bill Payments:

The registered customers of MCB mobile banking service can also pay their utility bills through their mobile phones. By using this service a customer can not only pay his/her electricity , Gas and other utility bills but also enable to pay his/her Mobile & internet bills as well.

IM Sciences

Product: Mobile Banking

Page 28

The Role of Mobile Banking in Pakistan

CBC-2011

E. MCB Visa Credit Card Bills Payment:

MCB Mobile banking customer can make MCB Visa Credit Card payments easily through this service by his/her registered number. Customer has the option of paying a minimum payment, more than minimum or the full amount.

F. Maintain Favorites:

Registered MCB Mobile users can manage their favorite payees i.e. add or remove utility companies or individual account holders to whom payments and fund transfers are made frequently.

G. Report a Lost ATM card:

Registered MCB Mobile users can report their card as lost or stolen using the service. The ATM card will automatically be de-activated for a period of 24 hours.

H. Other Services:

MCB Mobile Banking service also providing other financial services as well which are as follows:

IM Sciences Product: Mobile Banking Page 29

The Role of Mobile Banking in Pakistan

Buy Insurance Make Donations Top up prepaid mobile phones Recharge MCB Visa Prepaid cards

CBC-2011

I. How to register:

Only MCB ATM card holders are eligible for this service. In order to register for this Service a customer has to follow following procedure:

IM Sciences

Product: Mobile Banking

Page 30

The Role of Mobile Banking in Pakistan

V.

CBC-2011

Upcoming Mobile Banking Products in Pakistan:

According to the CGAP report Pakistan is one of the fastest developing market for branchless banking in the world. This is the reason that Mobile Banking is also flourishing in the financial market of Pakistan and till now showed very effective results. As mentioned earlier that the two major branchless banking models have emerged in Pakistan Easypaisa by Tameer Microfinance Bank and Omni by United Bank Limited and marked a success story with a span of just two years, the combined daily transaction volume of the two services already averages over 175 thousand, with an average size of Rs 3,700. So following figure is extracted from the CGAP report upon Pakistans Branchless Banking market which shows the current and upcoming Mobile and Branchless Banking products:

Mobilink is currently providing MMO service (Mobile Money order Service) with the cooperation of Pakistan Post Office and Providing Basic financial services like funds transfer, deposits, Bills payment services etc. Whereas recently Mobilink also acquired a Microfinance Bank named Waseela Bank to provide mobile banking services like Easypaisa. Bank Alfalah will also launch its Mobile banking Service in coming days with the cooperation of Warid Telecom. So in coming few year lots of new innovative Mobile and Branchless banking products will be launched in Pakistans financial Market.

IM Sciences

Product: Mobile Banking

Page 31

The Role of Mobile Banking in Pakistan

CBC-2011

10. Comparison among major Mobile Banking Products in Pakistan:

There are currently four major Mobile Banking Products are available in the markets of Pakistan. The Brief comparisons among these four Mobile Banking products are given in the following table:

11.

SWOT Analysis:

SWOT analyses on Mobile Banking are based on the discussion with different officials and Agents who are related to Mobile Banking Products and services. Following are the SWOT analysis on Mobile banking according to Pakistans Market:

IM Sciences

Product: Mobile Banking

Page 32

The Role of Mobile Banking in Pakistan

I. Strengths:

CBC-2011

One of the Main strength of mobile banking is its 24/7 availability. A customer who wants to avail Basic Banking Services can easily get benefits by it in anytime and anywhere in Pakistan. Mobile banking products are boosting the performance of banking and financial institutions as banking is now become very convenient and easy to understand. Account opening, Funds transfer and all other such financial services were never available in so easy way on the customers fingers tips as compare to few years before. No need to stand in queues at bank by having mobile banking customer every user can pay all his utility bills just by using his/her Mobile phone which is another strength of Mobile banking. The Overall cost of mobile banking is very Low as it is very beneficial for both Telco and Financial Institute. Another strength of Mobile banking is, its assistance to Government. Government can use it for various purposes for example collection of taxation and distribution of donations like recently done through UBL Omini for the disbursement of Benazir Income Support Program. And one of the most effective strength of mobile banking is that it is considered as one of the most effective tool to cover the large area of unbanked population in Pakistan.

II.

Weaknesses:

Mobile Banking is considered to an unsecure way of transaction as there are huge chances of fraudulence is always there. Its easy to get pin by fake SMS or Fake Call from the Mobile Banking user. Scope of mobile banking is very limited yet as the banking services offer through mobile banking are very much limited for example funds transfer limits are still very low. One of another weakness in Mobile Banking is lack of Awareness among people about these products still hundreds of people can be seen standing in queues in front of banks for number of basic banking services which can be easily acquire through mobile banking. A large portion of Pakistans Population in illiterate which is a reason that though the mobile banking products are still successful but still the level of trust and confidence of people is very low about Mobile Banking products. Another weakness of Mobile banking is its consumer cost. For example for customer who sends money by using funds transfer service have to pay high transfer charges as compare to bank branch.

IM Sciences

Product: Mobile Banking

Page 33

The Role of Mobile Banking in Pakistan

III. Opportunities:

CBC-2011

More than 102 million of mobile subscribers and only more than 80% of unbanked

population indicates the huge and effective number of opportunities for mobile banking products in Pakistan it proper strategy applied. The increasing interest and competition among Telecom companies is providing another opportunity to Mobile Banking products to flourish rapidly. Over 175 thousands transactions of average 3700 PKR by two large Mobile banking service providers is indicating an increase in public interest in Mobile banking services. Large multinational financial companies like VISA are also working on Mobile banking Products which is also an opportunity. Government support by using mobile banking services for the disbursement of donations also shows and opportunity for this product in coming few years.

IV.

Threats:

Lack of awareness among people about Mobile Banking can be a threat in long terms for these products. Intense competition among Mobile banking providers can also be a threat for Mobile banking. Security is one of the biggest threat to mobile banking as most of the people do not consider it a secure way. Hacking and system failure can also be threat for mobile banking. As few years back ufone customers faced extreme problem due to network failure as their main head office got burnt by fire. So proper planning must be needed to impose.

12.

Conclusion:

Mobile banking is an innovation which is helping banks and other financial institutions to achieve which was once consider to be something unachievable, the way it is supporting the growth of economy is really very appreciable. The role of Mobile banking as an innovation is leading the developing country like Pakistan to redesign a new and modified of economy. Although there are some hurdles that are slowing down the progress of mobile banking for example lack of awareness, trust and confidence of people but still the growth rate is above the mark. In coming few years it can be estimated and predicted that a large portion of unbanked population will be served not only mobile banking services but also enjoy other financial services as well like insurance, mobile wallet etc. All these signs are actually the evidences of the proof that mobile banking as an innovation today is the future legacy for strong and healthy economies. So as far as Pakistan is concern current performance of mobile banking products is

IM Sciences Product: Mobile Banking Page 34

The Role of Mobile Banking in Pakistan

CBC-2011

very successful. Currently Telenors Easypaisa is largest mobile banking service product with 12600 outlets which are even more than total commercial bank branches that are working in all over the Pakistan but as it is supported by a microfinance bank named Tameer Bank Ltd so though its current performance is outstanding but on long term UBL Omni is much more successful as it is supported by a commercial bank i-e United Bank Limited. Upayment is also a newly launched mobile banking service which has limited scope till yet as it is performing its operations on small scale by the support of Soneri Bank, Habib Bank and SUMMIT Bank but it is still in its early phase. Mobilink has recently acquired a Microfinance bank i-e Waseela bank to provide complete mobile banking services currently it is working with Paksitan Post office, and MCB to provide mobile banking and financial Services on limited scale. Whereas last year MCB was nominated among the top four best mobile money services category for Global GSMA Mobile Awards. So it may not be wrong to conclude that mobile banking is one of the most leading and effective product not only in present but in future as well.

IM Sciences

Product: Mobile Banking

Page 35

The Role of Mobile Banking in Pakistan

CBC-2011

13.

References:

1. http://blogs.cisco.com/cle/mobile-banking-improves-lives-and-economies-in-thedeveloping-world/ [David Deans | July 27, 2011] 2. Safaricom extends M-PESA service to KPLC customers (Press Release) [Thursday, April 30, 2009]

3. Pakistans Branchless Banking Becomes Model for World by Yasir Ameen [19 Nov 2011] 4. CIO Pakistan: Mobile Banking market dynamics for Pakistan By Dr Mohammed Yaseen Published: June 24, 2011

5. Mobile Phone Technology in Banking System: Its Economic Effect by F.I. Anyasi and P.A. Otubu August 29, 2009 6. Mobile banking and economic development: Linking adoption, impact, and use Jonathan Donner, Microsoft Research India 2008 7. Applied Marketing Strategies on Telenor Research report by Sana Munir 8. Building Inclusive Financial System in Pakistan by Dr. Shamshad Akhtar 19th June 2007 9. How to Send/Receive Money through Easy Paisa 'Money Transfer' Complete Guide By Aamir Attaa Friday, Nov 20, 2009 10. Easypaisa posts record money transfer by admin at June 18, 2011 [www.propakistani.com] 11. ECONOMIC AND LEGAL CONDITIONS FAVOURABLE FOR MOBILE BANKING PART I April 30, 2010 by Microfinance Africa 12. http://www.mobilinkworld.com 13. ICT Facts and Figures 2011 [www.ICt.com]. 14. M-banking in Pakistan By admin at June 25, 2011. 15. Mobile banking can be challenging for Banking Industry Monday, Sep 7, 2009. 16. Mobile banking in Pakistan a laboratory of innovation by AMER SIAL Thursday, 13 Oct 2011. 17. Mobile banking service with a difference Staff Report []. 18. THE ROLE OF MOBILE PHONES IN SUSTAINABLE RURAL POVERTY REDUCTION June 15, 2008 by Asheeta Bhavnani, Rowena Won-Wai Chiu, Subramaniam Janakiram, Peter Silarszky (TTL). 19. Mobile Banking The Future published on August 2007 Author: Infogile Technol. 20. Mobile phone lifeline for world's poor By Tatum Anderson. 21. Mobile banking: Overview of Regulatory framework in emerging markets by Rasheda Sultana, Grameenphone Ltd. 22. TECHNOLOGY IRELAND 09/08 23. Technology and Innovation Management: Mobile Banking As Business Strategy: Impact Of Mobile Technologies On Customer Behaviour And Its Implications For Banks by Rajnish Tiwari, Stephan Buse, Cornelius Herstatt published on January 2006, Working Paper No. 37

IM Sciences Product: Mobile Banking Page 36

The Role of Mobile Banking in Pakistan

CBC-2011

24. Mobile Banking Technology Options August 2007 25. The Socio-Economic Impact of Mobile Financial Services April 2011 26. Nokia Expanding Horizons 01 2008 web2 27. Mobile Banking Product Overview by Gemalto 28. Security Analysis of Mobile Banking Services in Pakistan By Aqeel Feroze, Asma Basharat 29. Scenarios for Branchless 2020 30. https://www.cia.gov [Dec 2011] 31. http://www.dawn.com [Dec 2011] 32. http://en.wikipedia.org [Dec 2011] 33. http://nextbigfuture.com [Dec 2011] 34. http://www.technobuffalo.com [Dec 2011] 35. http://www.telecomrecorder.com [Dec 2011] 36. http://bankinnovation.info/ [Dec 2011] 37. www.easypaisa.com.pk/ [Dec 2011] 38. www.mcb.com.pk [Dec 2011] 39. www.ufone.com [Dec 2011] 40. www.ubl.com.pk/omni/ [Dec 2011] 41. www.propakistani.pk/

14.

End Notes:

M-PESA was first launched by the Kenyan MNO Safaricom, an affiliate of Vodafone, according to http://en.wikipedia.org/wiki/M-Pesa

ii

The GSMA represents the interests of mobile operators worldwide. Spanning more than 220 countries, the GSMA unites nearly 800 of the worlds mobile operators, as well as more than 200 companies in the broader mobile ecosystem, including handset makers, software companies, equipment providers, Internet companies, and media and entertainment organizations.

IM Sciences

Product: Mobile Banking

Page 37

Das könnte Ihnen auch gefallen

- FMCG Industry AnalysisDokument20 SeitenFMCG Industry AnalysisAshish Kumar82% (33)

- Green Economy and Trade E-Course Module 1Dokument32 SeitenGreen Economy and Trade E-Course Module 1Jae Hee LeeNoch keine Bewertungen

- The Geography of Transport SystemsDokument10 SeitenThe Geography of Transport SystemsFasumus FaisalNoch keine Bewertungen

- Decision TreeDokument38 SeitenDecision TreeGaurav PareekNoch keine Bewertungen

- The Marketing Mix 7 P's On Pakistan State OilDokument11 SeitenThe Marketing Mix 7 P's On Pakistan State OilSaad Bin Mehmood75% (4)

- Janalakshmi Financial Services PVT LTD Coca ReportDokument72 SeitenJanalakshmi Financial Services PVT LTD Coca ReportSelvaKumarMbaNoch keine Bewertungen

- Project Proposal On The Establishment of Mixed Used BuildingDokument33 SeitenProject Proposal On The Establishment of Mixed Used BuildingTesfaye Degefa100% (1)

- ADYEN AND FINTECH - DRIVING CHANGE IN THE FINANCIAL SERVICES INDUSTRYDokument4 SeitenADYEN AND FINTECH - DRIVING CHANGE IN THE FINANCIAL SERVICES INDUSTRY030239230171Noch keine Bewertungen

- France PestelDokument4 SeitenFrance PestelJenab Pathan94% (16)

- Mobile Banking Adoption in Organization Review of Empirical LiteratureDokument6 SeitenMobile Banking Adoption in Organization Review of Empirical LiteratureInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Employee Satisfaction at BanglalinkDokument54 SeitenEmployee Satisfaction at Banglalinkalisha RaziNoch keine Bewertungen

- Strategic Plan 2016-2020Dokument56 SeitenStrategic Plan 2016-2020brienahNoch keine Bewertungen

- 7P's of Marketing Mix (PIA) Pakistan International Airlines Marketing ProjectDokument14 Seiten7P's of Marketing Mix (PIA) Pakistan International Airlines Marketing ProjectSaad Bin Mehmood78% (27)

- Fintech ProjectDokument11 SeitenFintech ProjectJaveria UmarNoch keine Bewertungen

- Online Relationship Onboarding Simplifies Process for Credit SuisseDokument20 SeitenOnline Relationship Onboarding Simplifies Process for Credit SuisseRobertNoch keine Bewertungen

- Sample Marketing PlanDokument27 SeitenSample Marketing Plankhuram shahzadNoch keine Bewertungen

- Driving Mobile Money UsageDokument34 SeitenDriving Mobile Money UsageSuruz AhammedNoch keine Bewertungen

- Mobile Banking by Irfan ArifDokument20 SeitenMobile Banking by Irfan ArifMuhammad Talha KhanNoch keine Bewertungen

- Final ProjectDokument91 SeitenFinal ProjectKiran BardeNoch keine Bewertungen

- Muslim Commercial Bank Internship ReportDokument45 SeitenMuslim Commercial Bank Internship Reportbbaahmad89100% (1)

- Intership Final 1Dokument30 SeitenIntership Final 1Muhammad Azeem100% (1)

- Samrudhi Micro Finance SocietyDokument42 SeitenSamrudhi Micro Finance SocietyDivyaNoch keine Bewertungen

- Report On Information System of Muslim Commercial BankDokument20 SeitenReport On Information System of Muslim Commercial Bankannieriaz63% (8)

- The Changing Face of BankingDokument12 SeitenThe Changing Face of BankingAsish Dash100% (1)

- Mobile Banking in Bangladesh: A New Way to Explore Banking ServicesDokument35 SeitenMobile Banking in Bangladesh: A New Way to Explore Banking ServicesAnupam SinghNoch keine Bewertungen

- WNS BFS Capabilities Presentation - Jan - 2013Dokument30 SeitenWNS BFS Capabilities Presentation - Jan - 2013VikasNoch keine Bewertungen

- Easy Pai Sad ArazDokument2 SeitenEasy Pai Sad Arazfaisal_ahsan7919Noch keine Bewertungen

- Internship Report On Chartered LifeDokument78 SeitenInternship Report On Chartered LifeSabila Muntaha TushiNoch keine Bewertungen

- Article HR Trends in 2022 - Human Resource ManagementDokument4 SeitenArticle HR Trends in 2022 - Human Resource ManagementZera Mae FigueroaNoch keine Bewertungen

- Internal Control Systems and Financial PDFDokument118 SeitenInternal Control Systems and Financial PDFntchang relindisNoch keine Bewertungen

- The First Annual Report of Farz FoundationDokument62 SeitenThe First Annual Report of Farz FoundationFarhat Abbas ShahNoch keine Bewertungen

- Tcs Bancs Brochure Workers-CompensationDokument2 SeitenTcs Bancs Brochure Workers-CompensationMaaruth KsNoch keine Bewertungen

- An Internship Report On:: Credit Assessment Process As Reference To Shangri-La Development Bank LTDDokument6 SeitenAn Internship Report On:: Credit Assessment Process As Reference To Shangri-La Development Bank LTDprakash Ghimire100% (1)

- 1.1 Background: " A Study On SME Banking Practices in Janata Bank Limited"Dokument56 Seiten1.1 Background: " A Study On SME Banking Practices in Janata Bank Limited"Tareq AlamNoch keine Bewertungen

- At Icici: The HR PracticesDokument9 SeitenAt Icici: The HR PracticesANJALI KAUSHALNoch keine Bewertungen

- Recruiting and Selection Process GuideDokument62 SeitenRecruiting and Selection Process GuideabyisheikNoch keine Bewertungen

- Performance Management in HDFC Bank: Presented byDokument18 SeitenPerformance Management in HDFC Bank: Presented byprerana jain100% (1)

- The Influence of Skill-Sets Offered at Kenya's NITA Training Centers On Youth Employability: A Study of NGAAF Youth Employability Program in Homa Bay and Kisumu Counties, KenyaDokument12 SeitenThe Influence of Skill-Sets Offered at Kenya's NITA Training Centers On Youth Employability: A Study of NGAAF Youth Employability Program in Homa Bay and Kisumu Counties, KenyaInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Training Development Survey at BSNL Mba HR Project ReportDokument68 SeitenTraining Development Survey at BSNL Mba HR Project ReportVenkat Rajendran50% (2)

- Supply Chain Management's Future & Educational SCM ModelDokument2 SeitenSupply Chain Management's Future & Educational SCM Modelramisa trishaNoch keine Bewertungen

- Customer Perception On Internet Banking and Their Impact On Customer Satisfaction Loyalty A Study in Indian Context PDFDokument5 SeitenCustomer Perception On Internet Banking and Their Impact On Customer Satisfaction Loyalty A Study in Indian Context PDFNayana N Nagaraj100% (1)

- Government scheme promotes BPO jobs in rural IndiaDokument8 SeitenGovernment scheme promotes BPO jobs in rural IndiaRajesh PedhamallaNoch keine Bewertungen

- Presentation - Payment BanksDokument14 SeitenPresentation - Payment BanksAstral HeightsNoch keine Bewertungen

- Building The Contextual, Pervasive Bank of The FutureDokument2 SeitenBuilding The Contextual, Pervasive Bank of The FutureSuntec SNoch keine Bewertungen

- Name: Inayatullah ID: 62809 Course: Sfad FACULTY: DR Arsalan Hashmi Assignment: 2 Case Study: Kashf Foundation Into Kasf Micro FinanceDokument4 SeitenName: Inayatullah ID: 62809 Course: Sfad FACULTY: DR Arsalan Hashmi Assignment: 2 Case Study: Kashf Foundation Into Kasf Micro FinanceAsad MemonNoch keine Bewertungen

- Customer Relationship Management in India - Case of Volkswagen IndiaDokument20 SeitenCustomer Relationship Management in India - Case of Volkswagen IndiaPratik Mohapatra94% (17)

- Customer Relationship Management of Birla Sun LifeDokument72 SeitenCustomer Relationship Management of Birla Sun LifepraveenworlNoch keine Bewertungen

- Final Internship Report - For SubbmissionDokument66 SeitenFinal Internship Report - For SubbmissionMuhammad Jamil100% (1)

- Internship ReportDokument7 SeitenInternship ReportDev TiwariNoch keine Bewertungen

- Case Study Presentation On Papa John's International: By: AminulDokument6 SeitenCase Study Presentation On Papa John's International: By: AminulSubrata RoyNoch keine Bewertungen

- India's Financial InclusionDokument8 SeitenIndia's Financial Inclusionsankalp2rioNoch keine Bewertungen

- Research Proposal On Mobile Banking PDFDokument12 SeitenResearch Proposal On Mobile Banking PDFKhalid de CancNoch keine Bewertungen

- Digital Marketing ActivitiesDokument52 SeitenDigital Marketing ActivitiesMehedi HasanNoch keine Bewertungen

- SIP ReportDokument100 SeitenSIP ReportShivendra ChauhanNoch keine Bewertungen

- Railways Mumbai - Indore Service Standards BlueprintDokument3 SeitenRailways Mumbai - Indore Service Standards Blueprintbluewall100% (1)

- BKash LimitedDokument18 SeitenBKash Limitedcrashing nishanNoch keine Bewertungen

- Bkash Marketing StrategiesDokument10 SeitenBkash Marketing StrategiesAmirat Hossain100% (1)

- Chap001 Test BankDokument65 SeitenChap001 Test Bankichigo.x introNoch keine Bewertungen

- Ibm MicrofinanceDokument12 SeitenIbm MicrofinanceRumba Guaguancò100% (1)

- Internship Report On UCBLDokument56 SeitenInternship Report On UCBLZiauddin ChowdhuryNoch keine Bewertungen

- CRM Report - HP (Group - Pijus, Raju, Srinath, Wasif)Dokument8 SeitenCRM Report - HP (Group - Pijus, Raju, Srinath, Wasif)Gurinder VirkNoch keine Bewertungen

- Telenor ReportDokument28 SeitenTelenor Reportazeem bhatti100% (1)

- MBA Thesis-The Growth & Future of Mobile PaymentsDokument57 SeitenMBA Thesis-The Growth & Future of Mobile PaymentsGrishma DangolNoch keine Bewertungen

- Aml-Cft Guidelines For The Banking Sector 0Dokument37 SeitenAml-Cft Guidelines For The Banking Sector 0Elementry YunNoch keine Bewertungen

- Developing IsDokument74 SeitenDeveloping IsPair AhammedNoch keine Bewertungen

- Attachment 2 en Putting Ethics To WorkDokument58 SeitenAttachment 2 en Putting Ethics To WorkDr Stephen jackNoch keine Bewertungen

- Why Banks in Emerging Markets Are Increasingly Providing Non-Financial Services To Small and Medium EnterprisesDokument64 SeitenWhy Banks in Emerging Markets Are Increasingly Providing Non-Financial Services To Small and Medium EnterprisesIFC SustainabilityNoch keine Bewertungen