Beruflich Dokumente

Kultur Dokumente

10000003355

Hochgeladen von

Chapter 11 DocketsOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

10000003355

Hochgeladen von

Chapter 11 DocketsCopyright:

Verfügbare Formate

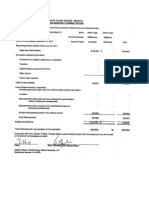

OFFICE OF THE UNITED STATES TRUSTEE - REGION 3 POST-CONFIRMATION QUARTERLY SUMMARY REPORT

This Report is to be submitted for all bank accounts that are presently maintained by the post confirmation debtor.

Debtor's Name: FastShip, Inc. et al (1) Bankruptcy Number: 12-10968 (BLS) Date of Confirmation: June 28, 2012 Reporting Period (month/year): July 1 - September 20, 2012 Beginning Cash Balance: All receipts received by the debtor: Cash Sales: Collection of Accounts Receivable:

Bank: Wells Fargo (2) Account Number: 7684241768 Account Type: Business checking

$ 159,639.41

$ $ $ $ $ $ $

4,812.38 4,812.38 $ 164,451.79

Proceeds from Litigation (settlement or otherwise): Sale of Debtor's Assets: Capital Infusion pursuant to the Plan: Other Total of cash received: Total of cash available:

Less all disbursements or payments (including payments made under the confirmed plan) made by the Debtor: Disbursements made under the plan, excluding the administrative claims of bankruptcy professionals: Disbursements made pursuant to the administrative claims of bankruptcy professionals: All other disbursements made in the ordinary course: Total Disbursements Ending Cash Balance

46,599.89

$ 102,439.58 $ $ 149,039.47 $ 15,412.32

Pursuant to 28 U.S.C. Section 1746(2), I hereby declare under penalty of perjury that the foregoing is true and correct to the best of my knowledge and belief. 09/17/12 Date Debtor: FastShip, Inc. et al Case Number: 12-10968 (BLS) NOTES: (1) This report is being filed for FastShip, Inc. and its wholly owned subsidiaries, FastShip Atlantic, Inc. (Case No. 12-10970 (BLS)) and Thornycroft, Giles & Co., Inc. (Case No. 12-10971 (BLS)). (2) The Wells Fargo account was the sole Debtor in Possession bank account during the bankruptcy. This account was closed on August 27, 2012 after payment of all professional fees; the remaining balance was transferred to the Liquidating Trust. The Liquidating Trustee has established an account for the Liquidating Trust at TD Bank, account # 42-7162748-7. The Liquidating Trustee also established an account for FastShip LLC at TD Bank, account # 42-7162747-9; $1500 dollars was transferred from the Liquidating Trust to establish this account. Disbursements and balances reported here reflect the total activity of all three accounts. (3) Disbursements include payments made on behalf of each of the debtors as follows; all other disbursements were made on behalf of FastShip, Inc.: Del. Sec'y of State US Trustee FastShip, Inc. (Case No. 12-10968 (BLS)) $ 587.13 $ 1,950.00 FastShip Atlantic, Inc. (Case No. 12-10970 (BLS)) $ 1,034.55 $ 325.00 Thornycroft, Giles & Co., Inc. (Case No. 12-10971 (BLS)) $ 219.10 $ 325.00 Kathryn Riepe Chambers, consultant to the Liquidating Trust of FastShip, Inc. et al Name/Title

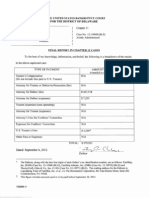

FastShip, BOOK VALUE AT Inc. et al END OF BOOK VALUE ON CURRENT ASSETS Cash (Unrestricted) Cash (Restricted) Accounts Receivable (Net) Inventory Notes Receivable Prepaid Expenses Other (Attach List) Total Current Assets Property, Plant & Equipment Real Property & Improvements Machinery & Equipment Furniture, fixtures & Office Equipment Vehicles Leasehold Improvements Less: Accumulated Depreciation/Depletion Total Property, Plant & Equipment Due from Affiliates & Insiders Other (Attach List) Total Assets Liabilities Not Subject to Compromise (Postpetition Liabilities) Accounts Payable Taxes Payable Notes Payable Professional Fees Secured Debt (DIP Loan) Due to Affiliates & Insiders Other (Payments made by parent on behalf of subsidiaries) Total Postpetition Liabilities Liabilities Subject to Compromise (Pre-petition Liabilities) Secured Debt - Per Plan Priority Debt - Per Plan Unsecured Debt - Per Plan Other (Attach List) - Per Plan Total Pre-petition Liabilities Total Liabilities Equity Common Stock Additional Paid-In Capital Retained Earnings (Deficit) Total Equity (Deficit) Total Liabilities & Owners' Equity 120,204 19,359,060 (88,187,174) (68,707,910) 15,412 120,204 19,359,060 (87,778,784) (68,299,520) 14,699 29,429,582 26,601 9,426,000 38,882,183 39,290,890 29,429,582 26,894 9,428,161 38,884,637 38,884,637 3,635 400,000 5,072 408,707 15,412 14,701 REPORTING 15,412 15,412 PETITION DATE 3,283 11,418 14,701

FastShip, Inc. BOOK VALUE AT END OF BOOK VALUE ON CURRENT REPORTING 15,412 15,412 15,412 3,635 400,000 5,072 408,707 29,429,582 24,612 9,220,791 38,674,985 39,083,692 120,204 19,359,060 (58,547,543) (39,068,279) 15,412 PETITION DATE 3,283 11,418 14,701 14,701 29,429,582 24,905 9,222,952 38,677,439 38,677,439 120,204 19,359,060 (58,142,004) (38,662,740) 14,699

FastShip Atlantic, Inc. BOOK VALUE AT END OF BOOK VALUE ON CURRENT REPORTING 1,931 1,931 1,684 64,108 65,792 67,723 (67,723) (67,723) PETITION DATE 1,684 64,108 65,792 65,792 (65,792) (65,792) -

Thornycroft, Giles BOOK VALUE AT & Co., Inc. (4) END OF BOOK VALUE ON CURRENT REPORTING 919 919 29,429,582 305 141,101 29,570,988 29,571,907 (29,571,907) (29,571,907) PETITION DATE 29,429,582 305 141,101 29,570,988 29,570,988 (29,570,988) (29,570,988) -

Eliminations BOOK VALUE AT END OF BOOK VALUE ON CURRENT REPORTING (2,850) (2,850) (29,429,582) (29,429,582) (29,432,432) PETITION DATE (29,429,582) (29,429,582) (29,429,582) -

NOTES: Thornycroft, Giles & Co., Inc. (TGC) is the owner of the intellectual property which will be the subject of the planned litigation and source of potential future value for the debtors. This intellectual property has been used as security for the secured notes issued by the parent, FastShip, Inc., and TGC is shown as codebtor for those pre-petition secured debt liabilities. These co-debtor amounts are eliminated for consolidation purposes.

Das könnte Ihnen auch gefallen

- Acct 2301 Exam 2 - v2 Key2Dokument11 SeitenAcct 2301 Exam 2 - v2 Key2iLeegendNoch keine Bewertungen

- Obscurity: Undesirability: P/E: Screening CriteriaDokument21 SeitenObscurity: Undesirability: P/E: Screening Criteria/jncjdncjdnNoch keine Bewertungen

- A Report On Internship-FinalDokument37 SeitenA Report On Internship-Finalmaitybaishakhi62% (21)

- N/A N/A: T'DwonluisDokument9 SeitenN/A N/A: T'DwonluisChapter 11 DocketsNoch keine Bewertungen

- Petters Bankruptcy Monthly Operating ReportDokument24 SeitenPetters Bankruptcy Monthly Operating ReportCamdenCanaryNoch keine Bewertungen

- Qocumeqt Expjna (Icn Tffidvit/$Qpplemnt: Rpflij1Tili) Nneilmi'NiqDokument11 SeitenQocumeqt Expjna (Icn Tffidvit/$Qpplemnt: Rpflij1Tili) Nneilmi'NiqChapter 11 DocketsNoch keine Bewertungen

- Monthly Operating ReportDokument12 SeitenMonthly Operating ReportChapter 11 DocketsNoch keine Bewertungen

- United States Bankruptcy Court Southern District of New YorkDokument11 SeitenUnited States Bankruptcy Court Southern District of New YorkChapter 11 Dockets100% (1)

- Monthly Operating Report: L1,11111 Afl (I Lmfni Q FNRM No Auhi, Aflai'Haii Aftac'HeiDokument11 SeitenMonthly Operating Report: L1,11111 Afl (I Lmfni Q FNRM No Auhi, Aflai'Haii Aftac'HeiChapter 11 DocketsNoch keine Bewertungen

- ..P,.4.Ffykp:P) Ein:Ent Fqulrd Docum Is FormDokument11 Seiten..P,.4.Ffykp:P) Ein:Ent Fqulrd Docum Is FormChapter 11 DocketsNoch keine Bewertungen

- Monthly Operating Report: MOR (O4fl)Dokument12 SeitenMonthly Operating Report: MOR (O4fl)Chapter 11 DocketsNoch keine Bewertungen

- Office of The: OperatingDokument2 SeitenOffice of The: OperatingChapter 11 DocketsNoch keine Bewertungen

- Required) Ocuments: I Na EhDokument11 SeitenRequired) Ocuments: I Na EhChapter 11 DocketsNoch keine Bewertungen

- This Report Is To Be Submitted For All Bank Accounts That Are Presently Maintained by The Post Confirmation DebtorDokument2 SeitenThis Report Is To Be Submitted For All Bank Accounts That Are Presently Maintained by The Post Confirmation DebtorChapter 11 DocketsNoch keine Bewertungen

- 10000006490Dokument17 Seiten10000006490Chapter 11 DocketsNoch keine Bewertungen

- Monthly Operating ReportDokument12 SeitenMonthly Operating ReportChapter 11 DocketsNoch keine Bewertungen

- Debtor: Unjted States Bankruptcy Court District of DelawareDokument9 SeitenDebtor: Unjted States Bankruptcy Court District of DelawareChapter 11 DocketsNoch keine Bewertungen

- Doeument L.xplauidirni Aftidavii/Suppkiiieat, R) :Ql:Jrel) Doctlients Form No. Aitached Attached AttachedDokument11 SeitenDoeument L.xplauidirni Aftidavii/Suppkiiieat, R) :Ql:Jrel) Doctlients Form No. Aitached Attached AttachedChapter 11 DocketsNoch keine Bewertungen

- 10000003278Dokument16 Seiten10000003278Chapter 11 DocketsNoch keine Bewertungen

- Monthly Operating ReportDokument9 SeitenMonthly Operating ReportChapter 11 DocketsNoch keine Bewertungen

- Status: Schedule and Disbursements MOR-1 N/A Bank Copies Bank N/ADokument9 SeitenStatus: Schedule and Disbursements MOR-1 N/A Bank Copies Bank N/AChapter 11 DocketsNoch keine Bewertungen

- 10000016855Dokument9 Seiten10000016855Chapter 11 DocketsNoch keine Bewertungen

- Ggiii X : Authori D Is Partnership A or Member If Debtor Is Limited Liability CompanyDokument14 SeitenGgiii X : Authori D Is Partnership A or Member If Debtor Is Limited Liability CompanyChapter 11 DocketsNoch keine Bewertungen

- Monthly Operating Report: MOR (O47)Dokument11 SeitenMonthly Operating Report: MOR (O47)Chapter 11 DocketsNoch keine Bewertungen

- This Report Is To Be Submitted For All Bank Accounts That Are Presently Maintained by The Post Confirmation DebtorDokument2 SeitenThis Report Is To Be Submitted For All Bank Accounts That Are Presently Maintained by The Post Confirmation DebtorChapter 11 DocketsNoch keine Bewertungen

- Doeunpnt Explaiation Afiudavit/Suppieniqnt !uequired DocumentsDokument9 SeitenDoeunpnt Explaiation Afiudavit/Suppieniqnt !uequired DocumentsChapter 11 DocketsNoch keine Bewertungen

- At Eli.y: I 'Foio A AebdDokument9 SeitenAt Eli.y: I 'Foio A AebdChapter 11 DocketsNoch keine Bewertungen

- Debtor: ReturnsDokument9 SeitenDebtor: ReturnsChapter 11 DocketsNoch keine Bewertungen

- Debtor: I I I IDokument9 SeitenDebtor: I I I IChapter 11 DocketsNoch keine Bewertungen

- Debtors Nomer Pacific Energy Resources LTD.: This Report It To Be Submlaed Fag 05 N.1Tta1Ood Coofinmitite Debt"Dokument2 SeitenDebtors Nomer Pacific Energy Resources LTD.: This Report It To Be Submlaed Fag 05 N.1Tta1Ood Coofinmitite Debt"Chapter 11 DocketsNoch keine Bewertungen

- Objection Deadline: August 29, 2012 at 4:00 P.M. (EDT) : RLF1 6560859v.1Dokument7 SeitenObjection Deadline: August 29, 2012 at 4:00 P.M. (EDT) : RLF1 6560859v.1Chapter 11 DocketsNoch keine Bewertungen

- II 327 328, 20I4 20I6 20I4-I 20I6-I: Re - DactenDokument10 SeitenII 327 328, 20I4 20I6 20I4-I 20I6-I: Re - DactenChapter 11 DocketsNoch keine Bewertungen

- United States Bankruptcy Court: RN Re: Pacific Energy Alaska Holdings. Inc. Reporting Period: Mav 2009Dokument9 SeitenUnited States Bankruptcy Court: RN Re: Pacific Energy Alaska Holdings. Inc. Reporting Period: Mav 2009Chapter 11 DocketsNoch keine Bewertungen

- Objection Deadline: October 8, 2012 at 4:00 P.M. (EDT) : RLF1 6972896v.1Dokument7 SeitenObjection Deadline: October 8, 2012 at 4:00 P.M. (EDT) : RLF1 6972896v.1Chapter 11 DocketsNoch keine Bewertungen

- Libby Financial Accounting Chapter2Dokument12 SeitenLibby Financial Accounting Chapter2Jie Bo TiNoch keine Bewertungen

- Objection Deadline: September 13, 2012 at 4:00 P.M. (EDT) : RLF1 6837975v.1Dokument7 SeitenObjection Deadline: September 13, 2012 at 4:00 P.M. (EDT) : RLF1 6837975v.1Chapter 11 DocketsNoch keine Bewertungen

- R'Loljilfld Documems Forr No Affached Attiched Attached: - 1) Quit I XPL Affldqv - Yppcn, IpntDokument9 SeitenR'Loljilfld Documems Forr No Affached Attiched Attached: - 1) Quit I XPL Affldqv - Yppcn, IpntChapter 11 DocketsNoch keine Bewertungen

- BUS 251 - Homework SolutionsDokument46 SeitenBUS 251 - Homework SolutionsJerry He0% (2)

- Stly - 10q12013.htm - Generated by SEC Publisher For SEC FilingDokument22 SeitenStly - 10q12013.htm - Generated by SEC Publisher For SEC Filingjcf129erNoch keine Bewertungen

- In The United States Bankruptcy Court For The District of DelawareDokument3 SeitenIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsNoch keine Bewertungen

- TreeHouse Foods 10-Q Report for Q2 2010 Provides Details on Financial ResultsDokument45 SeitenTreeHouse Foods 10-Q Report for Q2 2010 Provides Details on Financial ResultsSwisskelly1Noch keine Bewertungen

- Dated: September 6, 2012Dokument3 SeitenDated: September 6, 2012Chapter 11 DocketsNoch keine Bewertungen

- Binder - HCT - Collusion - MartinDokument9 SeitenBinder - HCT - Collusion - MartinMy-Acts Of-SeditionNoch keine Bewertungen

- Re: Docket Nos. 78, 110 and 124Dokument14 SeitenRe: Docket Nos. 78, 110 and 124Chapter 11 DocketsNoch keine Bewertungen

- United States Bankruptcy Court Southern District of New YorkDokument11 SeitenUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNoch keine Bewertungen

- Objection Deadline: September 12, 2012 at 4:00 P.M. (EDT) : RLF1 6813140v.1Dokument7 SeitenObjection Deadline: September 12, 2012 at 4:00 P.M. (EDT) : RLF1 6813140v.1Chapter 11 DocketsNoch keine Bewertungen

- Ii (.FR/) 1: Repmt To Be Oubni101D For All Basic Eceouma That Are Presenay Maintained Bythe Post CCR - FLRR Von DebtorDokument2 SeitenIi (.FR/) 1: Repmt To Be Oubni101D For All Basic Eceouma That Are Presenay Maintained Bythe Post CCR - FLRR Von DebtorChapter 11 DocketsNoch keine Bewertungen

- In Re: Petrocal Acquisition Corp.: If Is Is CompanyDokument9 SeitenIn Re: Petrocal Acquisition Corp.: If Is Is CompanyChapter 11 DocketsNoch keine Bewertungen

- Objection Deadline: November 8, 2012 at 4:00 P.M. (EST) : RLF1 7476230v.1Dokument7 SeitenObjection Deadline: November 8, 2012 at 4:00 P.M. (EST) : RLF1 7476230v.1Chapter 11 DocketsNoch keine Bewertungen

- Orford Creditor's ReportDokument29 SeitenOrford Creditor's Reportdyacono5452Noch keine Bewertungen

- This Rpoit Is To Be Submitted For All That Maintained by DebtorDokument2 SeitenThis Rpoit Is To Be Submitted For All That Maintained by DebtorChapter 11 DocketsNoch keine Bewertungen

- Eq'Ujr1'Bocljments Yjo":: CH ofDokument12 SeitenEq'Ujr1'Bocljments Yjo":: CH ofChapter 11 DocketsNoch keine Bewertungen

- Re: Docket Nos. 75, 107 and 123Dokument14 SeitenRe: Docket Nos. 75, 107 and 123Chapter 11 DocketsNoch keine Bewertungen

- United States Bankruptcy Court District of Delaware: MOR (041W)Dokument9 SeitenUnited States Bankruptcy Court District of Delaware: MOR (041W)Chapter 11 DocketsNoch keine Bewertungen

- IN Bankruptcy The Distri of Delaware 11 DSY TEM 1. 1 11: The United States Court FOR in Re: INC., No. IntlyDokument3 SeitenIN Bankruptcy The Distri of Delaware 11 DSY TEM 1. 1 11: The United States Court FOR in Re: INC., No. IntlyChapter 11 DocketsNoch keine Bewertungen

- Objection Deadline: November 15, 2012 at 4:00 P.M. (EST) : RLF1 7476230v.1Dokument7 SeitenObjection Deadline: November 15, 2012 at 4:00 P.M. (EST) : RLF1 7476230v.1Chapter 11 DocketsNoch keine Bewertungen

- Schedule F - Creditors Holding Unsecured Nonpriority Claims: (Continuation Sheet)Dokument500 SeitenSchedule F - Creditors Holding Unsecured Nonpriority Claims: (Continuation Sheet)Chapter 11 DocketsNoch keine Bewertungen

- Devon Energy Corporation Form 10-K Table of ContentsDokument182 SeitenDevon Energy Corporation Form 10-K Table of Contentsbmichaud758Noch keine Bewertungen

- Objection Deadline: August 2, 2012 at 4:00 P.M. (EDT) : RLF1 6295055v. 1Dokument7 SeitenObjection Deadline: August 2, 2012 at 4:00 P.M. (EDT) : RLF1 6295055v. 1Chapter 11 DocketsNoch keine Bewertungen

- Reouired Do (Ijmfn Is Form No T1iachclDokument9 SeitenReouired Do (Ijmfn Is Form No T1iachclChapter 11 DocketsNoch keine Bewertungen

- Pro Hac Vice) Pro Hac Vice) : United States Bankruptcy Court Southern District of New YorkDokument8 SeitenPro Hac Vice) Pro Hac Vice) : United States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNoch keine Bewertungen

- RosettaStone 10Q 20130807 (Deleted)Dokument48 SeitenRosettaStone 10Q 20130807 (Deleted)Edgar BrownNoch keine Bewertungen

- Regulation A+ and Other Alternatives to a Traditional IPO: Financing Your Growth Business Following the JOBS ActVon EverandRegulation A+ and Other Alternatives to a Traditional IPO: Financing Your Growth Business Following the JOBS ActNoch keine Bewertungen

- SEC Vs MUSKDokument23 SeitenSEC Vs MUSKZerohedge100% (1)

- NQ Letter 1Dokument3 SeitenNQ Letter 1Chapter 11 DocketsNoch keine Bewertungen

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Dokument28 SeitenAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNoch keine Bewertungen

- Appellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Dokument69 SeitenAppellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNoch keine Bewertungen

- NQ LetterDokument2 SeitenNQ LetterChapter 11 DocketsNoch keine Bewertungen

- Zohar 2017 ComplaintDokument84 SeitenZohar 2017 ComplaintChapter 11 DocketsNoch keine Bewertungen

- Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Dokument38 SeitenAppellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNoch keine Bewertungen

- Wochos V Tesla OpinionDokument13 SeitenWochos V Tesla OpinionChapter 11 DocketsNoch keine Bewertungen

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Dokument47 SeitenAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNoch keine Bewertungen

- City Sports GIft Card Claim Priority OpinionDokument25 SeitenCity Sports GIft Card Claim Priority OpinionChapter 11 DocketsNoch keine Bewertungen

- Republic Late Filed Rejection Damages OpinionDokument13 SeitenRepublic Late Filed Rejection Damages OpinionChapter 11 Dockets100% (1)

- Kalobios Pharmaceuticals IncDokument81 SeitenKalobios Pharmaceuticals IncChapter 11 DocketsNoch keine Bewertungen

- Ultra Resources, Inc. Opinion Regarding Make Whole PremiumDokument22 SeitenUltra Resources, Inc. Opinion Regarding Make Whole PremiumChapter 11 DocketsNoch keine Bewertungen

- Roman Catholic Bishop of Great Falls MTDokument57 SeitenRoman Catholic Bishop of Great Falls MTChapter 11 DocketsNoch keine Bewertungen

- National Bank of Anguilla DeclDokument10 SeitenNational Bank of Anguilla DeclChapter 11 DocketsNoch keine Bewertungen

- PopExpert PetitionDokument79 SeitenPopExpert PetitionChapter 11 DocketsNoch keine Bewertungen

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDokument4 SeitenUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsNoch keine Bewertungen

- Energy Future Interest OpinionDokument38 SeitenEnergy Future Interest OpinionChapter 11 DocketsNoch keine Bewertungen

- APP ResDokument7 SeitenAPP ResChapter 11 DocketsNoch keine Bewertungen

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDokument5 SeitenDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsNoch keine Bewertungen

- Zohar AnswerDokument18 SeitenZohar AnswerChapter 11 DocketsNoch keine Bewertungen

- Home JoyDokument30 SeitenHome JoyChapter 11 DocketsNoch keine Bewertungen

- Quirky Auction NoticeDokument2 SeitenQuirky Auction NoticeChapter 11 DocketsNoch keine Bewertungen

- APP CredDokument7 SeitenAPP CredChapter 11 DocketsNoch keine Bewertungen

- GT Advanced KEIP Denial OpinionDokument24 SeitenGT Advanced KEIP Denial OpinionChapter 11 DocketsNoch keine Bewertungen

- Farb PetitionDokument12 SeitenFarb PetitionChapter 11 DocketsNoch keine Bewertungen

- Fletcher Appeal of Disgorgement DenialDokument21 SeitenFletcher Appeal of Disgorgement DenialChapter 11 DocketsNoch keine Bewertungen

- Licking River Mining Employment OpinionDokument22 SeitenLicking River Mining Employment OpinionChapter 11 DocketsNoch keine Bewertungen

- Special Report On Retailer Creditor Recoveries in Large Chapter 11 CasesDokument1 SeiteSpecial Report On Retailer Creditor Recoveries in Large Chapter 11 CasesChapter 11 DocketsNoch keine Bewertungen

- A181 Tutorial 2Dokument9 SeitenA181 Tutorial 2Fatin Nur Aina Mohd Radzi33% (3)

- BankingWeb3 - Lecture 2Dokument38 SeitenBankingWeb3 - Lecture 2jk.hoipan.kNoch keine Bewertungen

- PWC Using Multiple Discount Rates BulletinDokument4 SeitenPWC Using Multiple Discount Rates BulletinElizabeth KrusemarkNoch keine Bewertungen

- CH22 IsmDokument5 SeitenCH22 IsmLeanne TehNoch keine Bewertungen

- Debt Settlement Letter SampleDokument13 SeitenDebt Settlement Letter Samplehassan789cppNoch keine Bewertungen

- Law of Negotiate in PakistanDokument14 SeitenLaw of Negotiate in PakistanMehtab MehmoodNoch keine Bewertungen

- PhonePe Statement Feb2024 Mar2024Dokument7 SeitenPhonePe Statement Feb2024 Mar2024jtularam15Noch keine Bewertungen

- "Green Finance": A Powerful Tool For SustainabilityDokument7 Seiten"Green Finance": A Powerful Tool For SustainabilitySocial Science Journal for Advanced ResearchNoch keine Bewertungen

- Capital Structure Analysis of Hero Honda, For The Year 2005 To 2010Dokument7 SeitenCapital Structure Analysis of Hero Honda, For The Year 2005 To 2010pushpraj rastogiNoch keine Bewertungen

- Peer Analysis of Major Players in Cement Industry: ACC, Ambuja, Dalmia, Shree, UltratechDokument6 SeitenPeer Analysis of Major Players in Cement Industry: ACC, Ambuja, Dalmia, Shree, Ultratechsai chandraNoch keine Bewertungen

- Savera HotelsDokument21 SeitenSavera HotelsMansi Raut Patil100% (1)

- TokenomicDokument13 SeitenTokenomicVirgo DexNoch keine Bewertungen

- ThesisDokument72 SeitenThesisRaja SekharNoch keine Bewertungen

- AA Loan Course DetailsDokument3 SeitenAA Loan Course DetailsBalaNoch keine Bewertungen

- The IS-LM ModelDokument13 SeitenThe IS-LM ModelKatherine Asis NatinoNoch keine Bewertungen

- Global Financial Crisis and Its Impact On Bangladesh's EconomyDokument55 SeitenGlobal Financial Crisis and Its Impact On Bangladesh's EconomyImroz Mahmud0% (1)

- BIRD Methodology SMCubeDokument21 SeitenBIRD Methodology SMCubeeleman13Noch keine Bewertungen

- Lease AccountingDokument7 SeitenLease AccountingSandeep Shenoy100% (1)

- Letter of Intent Between Pawtucket Red Sox and The City of WorcesterDokument35 SeitenLetter of Intent Between Pawtucket Red Sox and The City of WorcesterMelissa HansonNoch keine Bewertungen

- Chapter 3 - Investment Appraisal - DCFDokument37 SeitenChapter 3 - Investment Appraisal - DCFInga ȚîgaiNoch keine Bewertungen

- Axa World Funds IiDokument89 SeitenAxa World Funds IiGeorgio RomaniNoch keine Bewertungen

- The Cheat Sheet WelcomeDokument1 SeiteThe Cheat Sheet WelcomeDan ButuzaNoch keine Bewertungen

- Indian Capital Goods - HSBC Jan 2011Dokument298 SeitenIndian Capital Goods - HSBC Jan 2011didwaniasNoch keine Bewertungen

- Adjusting and Closing Entries - Accruals Demonstration Problem 1 Anderson ArchitectsDokument31 SeitenAdjusting and Closing Entries - Accruals Demonstration Problem 1 Anderson ArchitectsFlorenz AmbasNoch keine Bewertungen

- Watchtaxes 2008Dokument31 SeitenWatchtaxes 2008RobertNoch keine Bewertungen

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDokument1 SeiteBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountMohit SachdevNoch keine Bewertungen

- Business AdministrationDokument11 SeitenBusiness AdministrationAnggraeni RiatiNoch keine Bewertungen