Beruflich Dokumente

Kultur Dokumente

Attorneys For Midland Loan Services, A Division of PNC Bank, N.A

Hochgeladen von

Chapter 11 DocketsOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Attorneys For Midland Loan Services, A Division of PNC Bank, N.A

Hochgeladen von

Chapter 11 DocketsCopyright:

Verfügbare Formate

Lenard M. Parkins (NY Bar No. 4579124) John D. Penn (NY Bar No.

4847208) Mark Elmore (admitted pro hac vice) HAYNES AND BOONE, LLP 30 Rockefeller Plaza, 26th Floor New York, New York 10112 Telephone: (212) 659-7300 Facsimile: (212) 918-8989 Attorneys for Midland Loan Services, a Division of PNC Bank, N.A. UNITED STATES BANKRUPTCY COURT SOUTHERN DISTRICT OF NEW YORK In re: INNKEEPERS USA TRUST, et al., Debtors. ) ) ) ) ) ) Chapter 11 Case No. 10-13800 (SCC) Jointly Administered

LIMITED OBJECTION OF MIDLAND LOAN SERVICES TO THE MOTION OF STERLING PALM BEACH, LLC FOR ALLOWANCE OF ADMINISTRATIVE EXPENSE CLAIM PURSUANT TO 11 U.S.C. 503 Midland Loan Services, a division of PNC Bank, N.A. (Midland) 1 hereby files this Limited Objection of Midland Loan Services (the Objection) to the Motion of Sterling Palm Beach, LLC for Allowance of Administrative Expense Claim Pursuant to 11 U.S.C. 503 (the Motion), 2 and in support hereof, respectfully states as follows:

Midland is the special servicer pursuant to the Pooling and Servicing Agreement dated as of August 13, 2007 (the Special Servicing Agreement) for that certain secured loan in the amount of not less than $825,402,542 plus interest, costs and fees (the Fixed Rate Mortgage Loan) owed by certain of the above captioned Debtors. The Fixed Rate Mortgage Loan is secured by cross-collateralized and crossdefaulted first priority mortgages, liens and security interests on forty-five (45) hotel properties and their contents and assets related thereto (collectively, the Midland Properties) and the other collateral, including all cash collateral as such term has meaning under section 363 of the Bankruptcy Code, generated by the Midland Debtors hotel and business operations with respect to the Midland Properties (the Midland Cash Collateral), as set forth in the Fixed Rate Mortgage Loan Agreement.

2

Docket No. 1856.

1

D-1976057

Background 1. On July 8, 2011, Sterling Palm Beach, LLC (Sterling) filed the Motion. In the

Motion, Sterling requests an administrative expense claim in the amount of $257,010.05 (the Sterling Claim) based on the continued postpetition use of certain commercial property (the Property) by Innkeepers USA Trust and/or Innkeepers USA Limited Partnership. The

Property appears to be used as the corporate headquarters for Innkeepers USA Trust, and in the proof of claim filed by Sterling, 3 the original lease agreement indicates that Innkeepers Hospitality, Inc. was the original tenant for the Property. 2. While Midland has not yet seen the proposed order regarding this Motion, at the

conclusion of the Motion, Sterling requests that the Court enter an order allowing the Sterling Claim but makes no mention of which debtor or debtors would be liable for any administrative claim that might be allowed. 3. The above-captioned cases (the Cases) of the above-captioned debtors (the

Debtors) have not been substantively consolidated. Section IV.A of the Debtors Plans of Reorganization Pursuant to Chapter 11 of the Bankruptcy Code 4 expressly states that [t]he Plan does not contemplate substantive consolidation of any of the Debtors. In addition, in paragraph 7 of the Findings of Fact, Conclusions of Law, and Order Confirming Debtors Plans of Reorganization Pursuant to Chapter 11 of the Bankruptcy Code, 5 the Court notes that [b]y prior order of the Court, these Chapter 11 Cases have been consolidated for procedural purposes only . . . .

3 4 5

Claim No. 1227. Docket No. 1799. Docket No. 1804.

2

D-1976057

4.

Pursuant to the Final Order Authorizing the Debtors to (i) Use the Adequate

Protection Parties Cash Collateral and (ii) Provide Adequate Protection to the Adequate Protection Parties Pursuant to 11 U.S.C. 361, 362, and 363 (the Final Cash Collateral Order), 6 corporate overhead charges and expenses of the Innkeepers USA Trust are to be paid out of the Master Account (as defined in the Final Cash Collateral Order). Objection 5. Midland objects to the Motion to the extent that it seeks administrative priority for

the Sterling Claim without properly identifying the specific debtor or debtor(s) against which it seeks a claim. The debtors that own or operate the Midland Properties are not obligated to Sterling and there is no basis to impose an administrative expense claim solely against those debtors and their bankruptcy estates. 6. The Sterling Claim relates to a specific, individual lease of commercial property

apparently having nothing to do with the Midland Properties, and if Sterling contends otherwise, it must either specify that it qualifies as a general corporate overhead charge of the Innkeepers USA Trust or provide evidence of a specific benefit conferred upon the debtors that own or operate the Midland Properties. 7. Any order allowing a claim in favor of Sterling must identify the specific

debtor(s) liable therefore, and because the relief requested in the Motion fails to do that, it must be denied in its current form. Local Rule 9013-1(a) 8. This pleading includes citations to the applicable rules and statutory authorities

upon which relief requested herein is predicated and a discussion of their application to this

Docket No. 402.

3

D-1976057

pleading. Accordingly, Midland submits that this pleading satisfies Local Bankruptcy Rule 9013-1(a). WHEREFORE, Midland respectfully requests that the Court enter an order denying the Motion. Dated: July 25, 2011 New York, New York

HAYNES AND BOONE, LLP

/s/ John D. Penn ______ Lenard M. Parkins (NY Bar #4579124) Mark Elmore (admitted pro hac vice) 30 Rockefeller Plaza, 26th Floor New York, New York 10112 Telephone No.: (212) 659-7300 Facsimile No.: (212) 884-8211 - and John D. Penn (NY Bar # 4847208) Haynes and Boone, LLP 201 Main Street, Suite 2200 Fort Worth, Texas 76102 Telephone No.: (817) 347-6610 Facsimile No.: (817) 348-2300 ATTORNEYS FOR MIDLAND LOAN SERVICES, A DIVISION OF PNC BANK, N.A.

D-1976057

Das könnte Ihnen auch gefallen

- Supreme Court Eminent Domain Case 09-381 Denied Without OpinionVon EverandSupreme Court Eminent Domain Case 09-381 Denied Without OpinionNoch keine Bewertungen

- Attorneys For Midland Loan Services, A Division of PNC Bank, N.ADokument3 SeitenAttorneys For Midland Loan Services, A Division of PNC Bank, N.AChapter 11 DocketsNoch keine Bewertungen

- California Supreme Court Petition: S173448 – Denied Without OpinionVon EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionBewertung: 4 von 5 Sternen4/5 (1)

- Attorneys For Midland Loan Services, A Division of PNC Bank, N.ADokument5 SeitenAttorneys For Midland Loan Services, A Division of PNC Bank, N.AChapter 11 DocketsNoch keine Bewertungen

- Attorneys For Midland Loan Services, IncDokument4 SeitenAttorneys For Midland Loan Services, IncChapter 11 DocketsNoch keine Bewertungen

- Attorneys For Midland Loan Services, IncDokument8 SeitenAttorneys For Midland Loan Services, IncChapter 11 DocketsNoch keine Bewertungen

- Attorneys For Midland Loan Services, IncDokument5 SeitenAttorneys For Midland Loan Services, IncChapter 11 DocketsNoch keine Bewertungen

- Attorneys For Midland Loan Services, A Division of PNC Bank, N.ADokument21 SeitenAttorneys For Midland Loan Services, A Division of PNC Bank, N.AChapter 11 DocketsNoch keine Bewertungen

- Attorneys For Midland Loan Services, A Division of PNC Bank, N.ADokument21 SeitenAttorneys For Midland Loan Services, A Division of PNC Bank, N.AChapter 11 DocketsNoch keine Bewertungen

- Attorneys For Midland Loan Services, Inc.: Limited Objection To Motion To Approve Fee Procedures Page 1 of 6 F-283676Dokument6 SeitenAttorneys For Midland Loan Services, Inc.: Limited Objection To Motion To Approve Fee Procedures Page 1 of 6 F-283676Chapter 11 DocketsNoch keine Bewertungen

- Attorneys For Midland Loan Services, A Division of PNC Bank, N.ADokument109 SeitenAttorneys For Midland Loan Services, A Division of PNC Bank, N.AChapter 11 DocketsNoch keine Bewertungen

- Attorneys For Midland Loan Services, A Division of PNC Bank, N.ADokument5 SeitenAttorneys For Midland Loan Services, A Division of PNC Bank, N.AChapter 11 DocketsNoch keine Bewertungen

- United States Court of Appeals, Third CircuitDokument17 SeitenUnited States Court of Appeals, Third CircuitScribd Government DocsNoch keine Bewertungen

- Answer of Jason, Inc. and Pioneer Automotive Technologies, Inc. To Debtors' Motion For An Order Deeming Reclamation Claims To Be General Unsecured Claims Against The Debtors and Related ReliefDokument11 SeitenAnswer of Jason, Inc. and Pioneer Automotive Technologies, Inc. To Debtors' Motion For An Order Deeming Reclamation Claims To Be General Unsecured Claims Against The Debtors and Related ReliefChapter 11 DocketsNoch keine Bewertungen

- Attorneys For Midland Loan Services, IncDokument27 SeitenAttorneys For Midland Loan Services, IncChapter 11 DocketsNoch keine Bewertungen

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Nyx, IncorporatedDokument18 SeitenDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Nyx, IncorporatedChapter 11 DocketsNoch keine Bewertungen

- Declaration of Daniell. Fitchett in Support of Chapter 11 Petitions and First Day ReliefDokument34 SeitenDeclaration of Daniell. Fitchett in Support of Chapter 11 Petitions and First Day ReliefChapter 11 DocketsNoch keine Bewertungen

- United States Bankruptcy Court Southern District of New YorkDokument7 SeitenUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNoch keine Bewertungen

- II 327 328, 20I4 20I6 20I4-I 20I6-I: Re - DactenDokument10 SeitenII 327 328, 20I4 20I6 20I4-I 20I6-I: Re - DactenChapter 11 DocketsNoch keine Bewertungen

- Attorneys For Midland Loan Services, A Division of PNC Bank, N.ADokument5 SeitenAttorneys For Midland Loan Services, A Division of PNC Bank, N.AChapter 11 DocketsNoch keine Bewertungen

- Nunc Pro TuncDokument24 SeitenNunc Pro TuncChapter 11 DocketsNoch keine Bewertungen

- Attorneys For Midland Loan Services, IncDokument13 SeitenAttorneys For Midland Loan Services, IncChapter 11 DocketsNoch keine Bewertungen

- Attorneys For Midland Loan Services, IncDokument5 SeitenAttorneys For Midland Loan Services, IncChapter 11 DocketsNoch keine Bewertungen

- Hearing Date: March 12, 2007 at 2:00 P.M. Objection Deadline: March 12, 2007 at 12:00 P.MDokument29 SeitenHearing Date: March 12, 2007 at 2:00 P.M. Objection Deadline: March 12, 2007 at 12:00 P.MChapter 11 DocketsNoch keine Bewertungen

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To The Haartz CorporationDokument19 SeitenDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To The Haartz CorporationChapter 11 DocketsNoch keine Bewertungen

- Attorneys For Midland Loan Services, A Division of PNC Bank, N.ADokument5 SeitenAttorneys For Midland Loan Services, A Division of PNC Bank, N.AChapter 11 DocketsNoch keine Bewertungen

- Attorneys For Midland Loan Services, A Division of PNC Bank, N.ADokument75 SeitenAttorneys For Midland Loan Services, A Division of PNC Bank, N.AChapter 11 DocketsNoch keine Bewertungen

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokument5 SeitenIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNoch keine Bewertungen

- Claims Asserted by Trimont Real Estate Advisors, Inc. Against Grand Prix Holdings, LLCDokument6 SeitenClaims Asserted by Trimont Real Estate Advisors, Inc. Against Grand Prix Holdings, LLCChapter 11 DocketsNoch keine Bewertungen

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To J.R. Wortman Co., IncDokument18 SeitenDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To J.R. Wortman Co., IncChapter 11 DocketsNoch keine Bewertungen

- "Disclosure Statement" "Prior Disclosure Statement")Dokument23 Seiten"Disclosure Statement" "Prior Disclosure Statement")meischerNoch keine Bewertungen

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Emhart Teknologies, IncDokument19 SeitenDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Emhart Teknologies, IncChapter 11 DocketsNoch keine Bewertungen

- United States Bankruptcy Court Southern District of New YorkDokument19 SeitenUnited States Bankruptcy Court Southern District of New YorkTBP_Think_TankNoch keine Bewertungen

- Ref. Docket Nos. 18, 47, 50 and 179Dokument51 SeitenRef. Docket Nos. 18, 47, 50 and 179Chapter 11 DocketsNoch keine Bewertungen

- Attorneys For Midland Loan Services, A Division of PNC Bank, N.ADokument4 SeitenAttorneys For Midland Loan Services, A Division of PNC Bank, N.AChapter 11 DocketsNoch keine Bewertungen

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokument19 SeitenIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNoch keine Bewertungen

- Hearing Date: September 1, 2010 at 8:30 A.MDokument34 SeitenHearing Date: September 1, 2010 at 8:30 A.MChapter 11 DocketsNoch keine Bewertungen

- Ivory Dorsey v. Citizens & Southern Financial Corporation, 678 F.2d 137, 11th Cir. (1982)Dokument4 SeitenIvory Dorsey v. Citizens & Southern Financial Corporation, 678 F.2d 137, 11th Cir. (1982)Scribd Government DocsNoch keine Bewertungen

- In ReDokument3 SeitenIn ReChapter 11 DocketsNoch keine Bewertungen

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Solvay Engineered Polymers, IncDokument18 SeitenDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Solvay Engineered Polymers, IncChapter 11 DocketsNoch keine Bewertungen

- A F LLP: Rent OXDokument15 SeitenA F LLP: Rent OXChapter 11 DocketsNoch keine Bewertungen

- Attorneys For Midland Loan Services, IncDokument41 SeitenAttorneys For Midland Loan Services, IncChapter 11 DocketsNoch keine Bewertungen

- Hearing Date: September 1, 2010 at 8:30 A.MDokument40 SeitenHearing Date: September 1, 2010 at 8:30 A.MChapter 11 DocketsNoch keine Bewertungen

- Fox Rothschild LLP Yann Geron Kathleen Aiello 100 Park Avenue, 15 Floor New York, New York 10017 (212) 878-7900Dokument27 SeitenFox Rothschild LLP Yann Geron Kathleen Aiello 100 Park Avenue, 15 Floor New York, New York 10017 (212) 878-7900Chapter 11 DocketsNoch keine Bewertungen

- Kodak MotionDokument8 SeitenKodak Motionmelaniel_coNoch keine Bewertungen

- Objection Deadline: September 13, 2012 at 4:00 P.M. (ET) Hearing Date: September 20, 2012 at 2:00 P.M. (ET)Dokument20 SeitenObjection Deadline: September 13, 2012 at 4:00 P.M. (ET) Hearing Date: September 20, 2012 at 2:00 P.M. (ET)Chapter 11 DocketsNoch keine Bewertungen

- Attorneys For Midland Loan Services, IncDokument6 SeitenAttorneys For Midland Loan Services, IncChapter 11 DocketsNoch keine Bewertungen

- United States Bankruptcy Court Southern District of New YorkDokument9 SeitenUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNoch keine Bewertungen

- Debtors' Motion To Approve Settlement and Compromise of Claims With Respect To Solo Products Co., LLCDokument18 SeitenDebtors' Motion To Approve Settlement and Compromise of Claims With Respect To Solo Products Co., LLCChapter 11 DocketsNoch keine Bewertungen

- United States Bankruptcy Court Southern District of New YorkDokument10 SeitenUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNoch keine Bewertungen

- Black Rock's Objection To SIPA Trustees's Rejection of Customer ClaimDokument29 SeitenBlack Rock's Objection To SIPA Trustees's Rejection of Customer Claimdavejphys100% (1)

- United States Bankruptcy Court Southern District of New York For PublicationDokument16 SeitenUnited States Bankruptcy Court Southern District of New York For Publicationanna338Noch keine Bewertungen

- Holywell Corp. v. Smith, 503 U.S. 47 (1992)Dokument10 SeitenHolywell Corp. v. Smith, 503 U.S. 47 (1992)Scribd Government DocsNoch keine Bewertungen

- 10000005545Dokument49 Seiten10000005545Chapter 11 DocketsNoch keine Bewertungen

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokument9 SeitenIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNoch keine Bewertungen

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokument25 SeitenIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNoch keine Bewertungen

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDokument22 SeitenIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNoch keine Bewertungen

- United States Bankruptcy Court Western District of Texas Austin Division CASE NO. 12-50073Dokument16 SeitenUnited States Bankruptcy Court Western District of Texas Austin Division CASE NO. 12-50073Chapter 11 DocketsNoch keine Bewertungen

- Attorneys For Midland Loan Services, A Division of PNC Bank, N.ADokument5 SeitenAttorneys For Midland Loan Services, A Division of PNC Bank, N.AChapter 11 DocketsNoch keine Bewertungen

- Attorneys For Midland Loan Services, Inc.: Declaration of Ronald F. Greenspan Pagel Of3Dokument3 SeitenAttorneys For Midland Loan Services, Inc.: Declaration of Ronald F. Greenspan Pagel Of3Chapter 11 DocketsNoch keine Bewertungen

- SEC Vs MUSKDokument23 SeitenSEC Vs MUSKZerohedge100% (1)

- NQ Letter 1Dokument3 SeitenNQ Letter 1Chapter 11 DocketsNoch keine Bewertungen

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Dokument28 SeitenAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNoch keine Bewertungen

- Appellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Dokument69 SeitenAppellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNoch keine Bewertungen

- NQ LetterDokument2 SeitenNQ LetterChapter 11 DocketsNoch keine Bewertungen

- Zohar 2017 ComplaintDokument84 SeitenZohar 2017 ComplaintChapter 11 DocketsNoch keine Bewertungen

- Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Dokument38 SeitenAppellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNoch keine Bewertungen

- Wochos V Tesla OpinionDokument13 SeitenWochos V Tesla OpinionChapter 11 DocketsNoch keine Bewertungen

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Dokument47 SeitenAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNoch keine Bewertungen

- City Sports GIft Card Claim Priority OpinionDokument25 SeitenCity Sports GIft Card Claim Priority OpinionChapter 11 DocketsNoch keine Bewertungen

- Republic Late Filed Rejection Damages OpinionDokument13 SeitenRepublic Late Filed Rejection Damages OpinionChapter 11 Dockets100% (1)

- Kalobios Pharmaceuticals IncDokument81 SeitenKalobios Pharmaceuticals IncChapter 11 DocketsNoch keine Bewertungen

- Ultra Resources, Inc. Opinion Regarding Make Whole PremiumDokument22 SeitenUltra Resources, Inc. Opinion Regarding Make Whole PremiumChapter 11 DocketsNoch keine Bewertungen

- Roman Catholic Bishop of Great Falls MTDokument57 SeitenRoman Catholic Bishop of Great Falls MTChapter 11 DocketsNoch keine Bewertungen

- National Bank of Anguilla DeclDokument10 SeitenNational Bank of Anguilla DeclChapter 11 DocketsNoch keine Bewertungen

- PopExpert PetitionDokument79 SeitenPopExpert PetitionChapter 11 DocketsNoch keine Bewertungen

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDokument4 SeitenUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsNoch keine Bewertungen

- Energy Future Interest OpinionDokument38 SeitenEnergy Future Interest OpinionChapter 11 DocketsNoch keine Bewertungen

- APP ResDokument7 SeitenAPP ResChapter 11 DocketsNoch keine Bewertungen

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDokument5 SeitenDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsNoch keine Bewertungen

- Zohar AnswerDokument18 SeitenZohar AnswerChapter 11 DocketsNoch keine Bewertungen

- Home JoyDokument30 SeitenHome JoyChapter 11 DocketsNoch keine Bewertungen

- Quirky Auction NoticeDokument2 SeitenQuirky Auction NoticeChapter 11 DocketsNoch keine Bewertungen

- APP CredDokument7 SeitenAPP CredChapter 11 DocketsNoch keine Bewertungen

- GT Advanced KEIP Denial OpinionDokument24 SeitenGT Advanced KEIP Denial OpinionChapter 11 DocketsNoch keine Bewertungen

- Farb PetitionDokument12 SeitenFarb PetitionChapter 11 DocketsNoch keine Bewertungen

- Fletcher Appeal of Disgorgement DenialDokument21 SeitenFletcher Appeal of Disgorgement DenialChapter 11 DocketsNoch keine Bewertungen

- Licking River Mining Employment OpinionDokument22 SeitenLicking River Mining Employment OpinionChapter 11 DocketsNoch keine Bewertungen

- Special Report On Retailer Creditor Recoveries in Large Chapter 11 CasesDokument1 SeiteSpecial Report On Retailer Creditor Recoveries in Large Chapter 11 CasesChapter 11 DocketsNoch keine Bewertungen

- Guide To: Credit Rating EssentialsDokument19 SeitenGuide To: Credit Rating EssentialseduardohfariasNoch keine Bewertungen

- Bank Guarantee TypesDokument4 SeitenBank Guarantee TypesecpsaradhiNoch keine Bewertungen

- Importance of Conveyance Deed for Housing SocietiesDokument6 SeitenImportance of Conveyance Deed for Housing SocietiesHemant Sudhir Wavhal0% (1)

- The Credit Anstalt Crisis of 1931 Studies in Macroeconomic HistoryDokument222 SeitenThe Credit Anstalt Crisis of 1931 Studies in Macroeconomic HistoryKristoferson BadeaNoch keine Bewertungen

- Aarthi Mba Project FinalDokument20 SeitenAarthi Mba Project FinalBnaren NarenNoch keine Bewertungen

- DocxDokument7 SeitenDocxHeni OktaviantiNoch keine Bewertungen

- HDFC PDFDokument43 SeitenHDFC PDFAbhijit SahooNoch keine Bewertungen

- Mcleod Vs NLRCDokument2 SeitenMcleod Vs NLRCAnonymous DCagBqFZsNoch keine Bewertungen

- Meaning and Definition of Banking-Banking Can Be Defined As The Business Activity ofDokument32 SeitenMeaning and Definition of Banking-Banking Can Be Defined As The Business Activity ofPunya KrishnaNoch keine Bewertungen

- Bank of England's Financial Policy Committee: Powers and ProcessDokument9 SeitenBank of England's Financial Policy Committee: Powers and ProcessancasofiaNoch keine Bewertungen

- Schedule C Instructions 2012Dokument13 SeitenSchedule C Instructions 2012Dunk7Noch keine Bewertungen

- Factor of Currency Develuation PakistanDokument8 SeitenFactor of Currency Develuation PakistanjavedalyNoch keine Bewertungen

- Sadaya v. Sevilla case on accommodation partiesDokument16 SeitenSadaya v. Sevilla case on accommodation partiesAdrian HilarioNoch keine Bewertungen

- Rules of The Law Society of NamibiaDokument26 SeitenRules of The Law Society of NamibiaAndré Le Roux100% (2)

- Siebert - The Half and The Full Debt CycleDokument10 SeitenSiebert - The Half and The Full Debt CycleMarcosNoch keine Bewertungen

- ADM 2350 N Syllabus Winter 2016Dokument10 SeitenADM 2350 N Syllabus Winter 2016saadNoch keine Bewertungen

- ACI Dealing Certificate: SyllabusDokument12 SeitenACI Dealing Certificate: SyllabusKhaldon AbusairNoch keine Bewertungen

- St. Francis de Sales Pilgrimage - Canterbury PilgrimagesDokument2 SeitenSt. Francis de Sales Pilgrimage - Canterbury PilgrimagesCanterbury PilgrimagesNoch keine Bewertungen

- Exam Preparation Map4cDokument2 SeitenExam Preparation Map4capi-268810190Noch keine Bewertungen

- Essar OilsDokument1 SeiteEssar OilsvijaybhaskarreddymeeNoch keine Bewertungen

- Starbucks CaseDokument3 SeitenStarbucks CaseKiranNoch keine Bewertungen

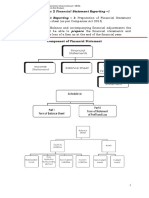

- Financial Statement ReportingDokument20 SeitenFinancial Statement ReportingAshwini Khare0% (1)

- FIN 535 Week 10 HomeworkDokument7 SeitenFIN 535 Week 10 HomeworkDonald Shipman JrNoch keine Bewertungen

- Loans and Deposits ExplainedDokument8 SeitenLoans and Deposits ExplainedVsgg NniaNoch keine Bewertungen

- Sale Deed - SampleDokument6 SeitenSale Deed - SampleManikandan NVNoch keine Bewertungen

- Service Tax ConclusionDokument9 SeitenService Tax ConclusionAbhas JaiswalNoch keine Bewertungen

- Invitation for Bids Nepal Water ProjectDokument3 SeitenInvitation for Bids Nepal Water Projectshrinath2kNoch keine Bewertungen

- ACC501-Short Notes Lec 23-45Dokument39 SeitenACC501-Short Notes Lec 23-45dani73% (11)

- EDUCATIONAL LOANS AT SBH EdditedDokument103 SeitenEDUCATIONAL LOANS AT SBH EdditedravikumarreddytNoch keine Bewertungen

- The Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesVon EverandThe Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesBewertung: 4 von 5 Sternen4/5 (1)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingVon EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingBewertung: 4.5 von 5 Sternen4.5/5 (97)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsVon EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsBewertung: 5 von 5 Sternen5/5 (24)

- Phil Gordon's Little Green Book: Lessons and Teachings in No Limit Texas Hold'emVon EverandPhil Gordon's Little Green Book: Lessons and Teachings in No Limit Texas Hold'emBewertung: 4 von 5 Sternen4/5 (64)

- Molly's Game: The True Story of the 26-Year-Old Woman Behind the Most Exclusive, High-Stakes Underground Poker Game in the WorldVon EverandMolly's Game: The True Story of the 26-Year-Old Woman Behind the Most Exclusive, High-Stakes Underground Poker Game in the WorldBewertung: 3.5 von 5 Sternen3.5/5 (129)

- Introduction to Negotiable Instruments: As per Indian LawsVon EverandIntroduction to Negotiable Instruments: As per Indian LawsBewertung: 5 von 5 Sternen5/5 (1)

- POKER MATH: Strategy and Tactics for Mastering Poker Mathematics and Improving Your Game (2022 Guide for Beginners)Von EverandPOKER MATH: Strategy and Tactics for Mastering Poker Mathematics and Improving Your Game (2022 Guide for Beginners)Noch keine Bewertungen

- Poker: A Beginners Guide To No Limit Texas Holdem and Understand Poker Strategies in Order to Win the Games of PokerVon EverandPoker: A Beginners Guide To No Limit Texas Holdem and Understand Poker Strategies in Order to Win the Games of PokerBewertung: 5 von 5 Sternen5/5 (49)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorVon EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorBewertung: 4.5 von 5 Sternen4.5/5 (63)

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpVon EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpBewertung: 4 von 5 Sternen4/5 (214)

- Poker Satellite Strategy: How to qualify for the main events of high stakes live and online poker tournamentsVon EverandPoker Satellite Strategy: How to qualify for the main events of high stakes live and online poker tournamentsBewertung: 4 von 5 Sternen4/5 (7)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorVon EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorBewertung: 4.5 von 5 Sternen4.5/5 (132)

- Poker: How to Play Texas Hold'em Poker: A Beginner's Guide to Learn How to Play Poker, the Rules, Hands, Table, & ChipsVon EverandPoker: How to Play Texas Hold'em Poker: A Beginner's Guide to Learn How to Play Poker, the Rules, Hands, Table, & ChipsBewertung: 4.5 von 5 Sternen4.5/5 (6)

- The Habits of Winning Poker PlayersVon EverandThe Habits of Winning Poker PlayersBewertung: 4.5 von 5 Sternen4.5/5 (10)

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASVon EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASBewertung: 3 von 5 Sternen3/5 (5)

- Gambling Strategies Bundle: 3 in 1 Bundle, Gambling, Poker and Poker BooksVon EverandGambling Strategies Bundle: 3 in 1 Bundle, Gambling, Poker and Poker BooksNoch keine Bewertungen

- The Business Legal Lifecycle US Edition: How To Successfully Navigate Your Way From Start Up To SuccessVon EverandThe Business Legal Lifecycle US Edition: How To Successfully Navigate Your Way From Start Up To SuccessNoch keine Bewertungen

- Alchemy Elementals: A Tool for Planetary Healing: An Immersive Audio Experience for Spiritual AwakeningVon EverandAlchemy Elementals: A Tool for Planetary Healing: An Immersive Audio Experience for Spiritual AwakeningBewertung: 5 von 5 Sternen5/5 (3)

- The Book of Card Games: The Complete Rules to the Classics, Family Favorites, and Forgotten GamesVon EverandThe Book of Card Games: The Complete Rules to the Classics, Family Favorites, and Forgotten GamesNoch keine Bewertungen

- Richardson's Growth Company Guide 5.0: Investors, Deal Structures, Legal StrategiesVon EverandRichardson's Growth Company Guide 5.0: Investors, Deal Structures, Legal StrategiesNoch keine Bewertungen

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementVon EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementBewertung: 4.5 von 5 Sternen4.5/5 (20)

- Dealing With Problem Employees: How to Manage Performance & Personal Issues in the WorkplaceVon EverandDealing With Problem Employees: How to Manage Performance & Personal Issues in the WorkplaceNoch keine Bewertungen