Beruflich Dokumente

Kultur Dokumente

Daily Agri Report Nov 15

Hochgeladen von

Angel BrokingOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Daily Agri Report Nov 15

Hochgeladen von

Angel BrokingCopyright:

Verfügbare Formate

Commodities Daily Report

Thursday| November 15, 2012

Agricultural Commodities

Content

News & Market Highlights Chana Sugar Oilseed Complex Spices Complex Kapas/Cotton

Research Team

Vedika Narvekar - Sr. Research Analyst vedika.narveker@angelbroking.com (022) 2921 2000 Extn. 6130 Anuj Choudhary - Research Analyst anuj.choudhary@angelbroking.com (022) 2921 2000 Extn. 6132

Vaishali Sheth - Research Associate vaishalij.sheth@angelbroking.com (022) 2921 2000 Extn. 6133

Angel Commodities Broking Pvt. Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Commodities Broking (P) Ltd. Your feedback is appreciated on commodities@angelbroking.com

www.angelcommodities.com

Commodities Daily Report

Thursday| November 15, 2012

Agricultural Commodities

News in brief

Wheat export prospects brighten as global supplies shrink

After months of buoyancy following crop downgrades resulting from the US Midwest drought, global agricultural commodity markets are now on a correction spree with prices of grains (mainly corn), oilseeds (mainly soyabean), sugar, coffee and cocoa to name a few weakening. One major exception has been wheat. World wheat production forecast for 2012-13 is being steadily downgraded. According to latest estimates, output could be lower by as much as 40 million tonnes (mt) from the previous years high of 694 mt. The decline is on account of lower Black Sea region crop (lower yield in EU and Kazakhstan) followed by deteriorating prospects in the southern hemisphere origins Australia and Argentina. What is more worrying is that world stocks of wheat that were hovering around 195200 mt are now set to reduce by about 25 mt. Stocks with the five major exporting countries are also set to fall by about 20 mt to a recent low of 50 mt. Estimates of the 2012-13 stocks have steadily been downgraded. With 94 mt harvest and 38 mt of government procurement, there is a humongous inventory waiting to be liquidated in India. The embargo on export was lifted a year ago. Wheat shipments from the country have totalled over 3 million tonnes. With the recent spurt in export prices and weak rupee, export prospects have brightened. (Source: Business Line)

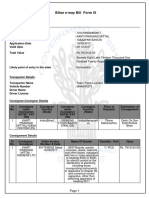

Market Highlights (% change)

Last Prev. day

as on Nov 13, 2012

WoW MoM YoY

Sensex* Nifty* INR/$* Nymex Crude Oil - $/bbl Comex Gold - $/oz

*Prices as on Nov 13, 2012

18619 5667 55 86.32 1730

-0.28 -0.29 0.22 1.10 0.31

-1.05 -1.00 1.07 2.23 0.95

-0.99 -0.72 4.46 -6.03 -1.62

8.29 9.64 10.00 -12.04 -2.72

Source: Reuters

Cardamom gains flavour as traders resume bidding

The cardamom market last week witnessed some buoyancy as all the traders resumed trading at the auctions from last Wednesday held in Kerala and Tamil Nadu. Upcountry buyers were actively buying while exporters were also seen covering. At today's auction in Bodinayakannur by the Cardamom Planters Association 37 tonnes of cardamom arrived and almost the entire quantity was sold out. The average price there was at Rs 717.39 a kg. However, the arrival trend is giving the impression that the crop is less this season due to the erratic weather conditions. This phenomenon is appears to have created a bullish sentiment in the market, trade sources told Business Line. Full participation of the traders was there from Wednesday and all were actively doing business, they said. The price trend has been good so far, when compared with last year average price at this time of the season, they said. Exporters were active in the market and they are estimated to have bought around 20 tonnes last week, trade sources said. Some in the trade believe that the inventories of the upcountry stockists must have gone empty by now as they would have liquidated them for Navaratri festival and for the Diwali. Consequently, fresh demand is likely to come up in the coming days for the winter and wedding season, they claimed. (Source: Business Line)

CACP may stick to its stand on wheat MSP

The Commission for Agricultural Costs and Prices (CACP) is likely to stick to its recommendation of not raising the minimum support price (MSP) for wheat, despite the government directing the matter be reconsidered. Recently, the Cabinet had deferred a decision on wheat MSP. The government had asked CACP to reconsider its recommendations, owing to a rise of Rs 5 a litre in diesel price in mid-September. But officials said CACP, the governments nodal agency for recommending MSP for farm commodities, might continue to recommend an MSP of Rs 1,285 a quintal for the 2013-14 season (April-March). This is because the cost of cultivating wheat, after factoring in the diesel price rise, would still be lower than the current MSP. The modified weighted cost of cultivating wheat for the 2013-14 season estimated by CACP is Rs 1,098.47 a quintal. This includes transportation, insurance and marketing costs. If we add diesel prices of Rs 30 a quintal, the cost of cultivation is Rs 1,128 a quintal, leaving farmers with a healthy margin of Rs 157 a quintal, as the prevailing MSP of wheat is Rs 1,285 a quintal, an official said. It is expected CACP would send its revised recommendations to the government in a few days. Officials said the agriculture ministry felt a bonus of 10 per cent should be paid upfront to compensate farmers for rising diesel costs. The officials added even if the Cabinet overruled CACPs recommendations and raise the MSP, the price might not be changed much. (Source: Business standard)

Cotton output seen dropping 5% this season

The Cotton Association of India (CAI) expects cotton output to fall five per cent this year to 354 lakh bales (lb) of 170 kg against 373 lb last year. The total supply including imports of 10 lb and opening stock of 53 lb works out to 417 lb, said a CAI press release issued on Monday. With the domestic consumption of 266 lb (excluding exports), the country will have a surplus of 151 lb to tap the export market, it said. Despite weak global demand, the country exported 127 lb last year. The cotton crop looks promising this year despite three per cent reduction in acreage. This was largely due to late revival of monsoon in Andhra Pradesh and Maharashtra, said the release. (Source: Business Standard)

CACP recommends 10% import duty on pulses

The Commission for Agriculture Costs and Prices (CACP) in its latest report named "Price Policy for Rabi Crops" has recommended 10 per cent import duty on pulses for next three years to encourage domestic production and also opening up of pulses exports to create a neutral trade policy. India pulses worth Rs. 8,767 crore in 2011-12.

(Source: Agriwatch)

Low-pressure area forms, likely to intensify

As expected, a low-pressure area has popped up over southeast and adjoining southwest Bay of Bengal. The India Meteorological Department (IMD) promptly put it under watch for intensification. In an evening bulletin on Wednesday, the IMD said that the low would become wellmarked over the next two days as the first in the expected rounds intensification. One could aim the Sri Lankan coast while the others might move towards north in the Bay of Bengal just off the Bangladesh and Myanmar coasts. (Source: Business Line)

Ceres to help India develop better rice varieties

Ceres Inc plans to use the $3.5-million grant from the US Agency for International Development (USAID) to develop high-yielding and stresstolerant traits in rice in Asia including India. The USAID recently extended an additional grant of $3.5 million that will extend Ceres trait work in rice for four more years. Researchers at the Nasdaq-listed biotech firm will focus specifically on combining its best high-yield and stresstolerance genes into stacks, which can amplify the benefits of individual traits, a statement said. Ceres will also continue to collaborate with a local Indian seed company to cross the best traits and trait stacks into commercial rice types adapted to the subcontinent.(Source: Business Line)

Sugar cane farmers' agitation turns violent in Maharashtra

Farmers' agitation over cane price has intensified in top sugar producer Maharashtra with the state government refusing to intervene and the sugar mills announcing first advance of cane payment much less than the demand of the farmers. The agitation turned violent from last week with the police rounding up farmers' leader Raju Shetty on Monday. The agitations have delayed the beginning of new crushing season, which usually begins by the first week of November. (Source: Economic Times)

www.angelcommodities.com

Commodities Daily Report

Thursday| November 15, 2012

Agricultural Commodities

Chana

Chana futures settled marginally lower on Tuesday on account of subdued trading activities. Spot remained closed on account of Diwali festival. Overall demand for chana will be subdued in the coming days while supplies are expected to ease amid higher shipments. Except for Wheat, minimum support price of all other Rabi crops has been increased by CCEA for 2012-13 season. MSP of Chana/Gram is raised by Rs 200 per qtl for 2012-13 season to Rs 3000. Higher returns and favorable soil condition will definitely boost acreage in the coming season. Although overall pulses sowing are lagging by 20% to 37.23 lakh ha till 9 Nov, Chana sowing is up Maharashtra and AP.

th

Market Highlights

Unit Rs/qtl Rs/qtl Last 4594 4699 Prev day 0.00 -0.02

as on Nov 13, 2012 % change WoW MoM -0.14 -2.03 2.04 -3.39 YoY 48.92 55.75

Chana Spot - NCDEX (Delhi) Chana- NCDEX Nov'12 Futures

Source: Reuters

Technical Chart - Chana

NCDEX Dec contract

In Maharashtra, Chana sowing is completed on 4.6 lakh hectares as on 9 November, which is 37.5% of the targeted 12.32 lakh ha, and up by 66% compared to last year. In AP Chana sowing is up by 41% to 3.81 lakh ha. (State Farm Departments) As per the NCDEX circular dated 9 November, the pre expiry margin on Chana November 2012 contract has been increased from the existing 3% to 7% for last 5 trading days increased on a daily basis on both buy and sell sides. In Rajasthan, the third largest Chana producing states, sowing is lagging behind by almost 55% and stands at 5.45 lakh hectares as on th 9 November, 2012.

th

th

Source: Telequote

The Commission for Agriculture Costs and Prices (CACP) has suggested 10 per cent import duty on pulses to encourage domestic production. in the first six months of the new fiscal that is from April to September this year, imports were an estimated 12 lakh tonnes.

Technical Outlook

Contract Chana Dec Futures Unit Rs./qtl Support

valid for Nov 15, 2012 Resistance 4397-4430

Sowing progress and demand supply fundamentals

Improved rains towards the end of monsoon season coupled with hike in MSP have raised prospects of Chana sowing in the 2012-13 season. Also, farm ministry has targeted 7.9 mn tn chana output for 2012-13 season, higher compared to 7.58 mn tn in 2011-12. According to the Ministry of Agriculture 99.81 Lakh hectare area has been planted under Kharif pulses in 2012-13 compared to 108.28 lakh hectare (ha) in the previous year. According to the first advance estimates of 2012-13 season, kharif pulses output is estimated lower by 14.6% at 5.26 million tonnes compared with 6.16 mn tn last year. Kharif pulses harvesting would commence from next month. Assocham estimates, 21 mn tn of pulses demand in 2012-13 and is likely to reach at 21.42 mn tn in 2013-14 and 21.91 MT in 2014-15. (Source: Agriwatch)

4285-4315

Outlook

Chana futures may remain under downside pressure on expectations of ease in supplies amid higher shipments coupled with subdued demand. Going forward, prices may also take cues from sowing progress of Rabi pulses which is expected to increase in the coming days.

www.angelcommodities.com

Commodities Daily Report

Thursday| November 15, 2012

Agricultural Commodities

Sugar

Sugar prices settled marginally lower by 0.15% on Tuesday on account of subdued trading activities. Although supplies continue to remain sufficient to meet the domestic demand, delay in crushing is seen restricting fall in the prices. Usually most factories in Maharashtra, the top sugar producer in the country, start cane crushing by the first week of November, but it has been delayed this year as farmers and mills have not yet agreed on cane prices. The sugar unions are demanding Rs 3000 per qtl. In UP too crushing normally starts in the first week of November, but this year also crushing is delayed due to disputes over cane pricing. Despite festival season, prices remained under check this season as government has released higher quota of 40 lakh tonnes for October and November, compared to 34.6 lakh tonnes during 2011. Liffe white sugar as well as ICE raw sugar closed lower on Wednesday by 1.14% and 0.5% on account of higher pace of crushing in Brazil Higher output and lower imports expectations for the 2012-13 season from China coupled with higher sugar surplus forecast for fourth straight year has led to a sharp decline in international sugar prices during the past few weeks.

Market Highlights

Unit Sugar Spot- NCDEX (Kolkata) Sugar M- NCDEX Nov '12 Futures Rs/qtl Last 3679

as on Nov 13, 2012 % Change Prev. day WoW 0.00 -2.16 MoM -3.19 YoY 9.82

Rs/qtl

3391

-0.15

0.62

-0.73

13.87

Source: Reuters

International Prices

Unit Sugar No 5- LiffeDec'12 Futures Sugar No 11-ICE Mar '13 Futures $/tonne $/tonne Last 530.9 427.56

as on Nov 14, 2012 % Change Prev day WoW -1.14 -0.57 0.95 2.12 MoM -4.22 -3.07 YoY -15.60 -19.97

Source: Reuters

Technical Chart - Sugar

NCDEX Dec contract

Domestic Production and Exports

According to the first advance estimates by agriculture ministry, Sugarcane output is pegged at 335.3 mn tn, down by 6.2% compared to 357.6 mn tn last year. Despite of higher acreage, the producers body has estimated next years sugar output lower at 24 mn tn, down by 2mn tn compared to the current year. Sugar production in India the worlds second-biggest producer touched 26 million tonne since October 1, 2011. Industry body ISMA has estimated 6 mn tn stocks for the new season beginning October 01, 2012 compared to 5.5 mn tn year ago. India may export 2.5-3 mn tn sugar in 2012-13. With the opening stocks of 6 mn tn, domestic Sugar supplies are estimated at 30mn tn against the domestic consumption of around 22.523 mln tn for 2012-13. Thus, no curbs on exports are seen as of now.

Source: Telequote

Global Sugar Updates

Sugar output in Brazil jumped 57% during the first fortnight of October. Thus, sugar output in brazil which was lower compared to last year since the beginning of the crushing season in May, is now up marginally by 0.1% at 29.3 mn tn. Brazil exported 3.998 million tons of sugar, raw value, in October up from 2687 million tons in September. Brazil has exported only 15.59 million tons of sugar this year till October which was 17.17 million tons, raw value, last year same period. The International Sugar Organization said it expected a global sugar surplus of 5.86 million tonnes in the season running from October 2012 to September 2013, up from the prior season's surplus of 5.19 million tonnes. The ISO said the stocks/consumption ratio could rise to around 40 percent in 2012/13, from 37.6 percent in 2011/12. (Source: Reuters)

Technical Outlook

Contract Sugar Dec NCDEX Futures Unit Rs./qtl Support

valid for Nov 15, 2012 Resistance 3330-3345

3280-3297

Outlook

Sugar prices may trade sideways with downward bias as supplies are sufficient to meet the festive season demand. However, delayed crushing may support prices at lower levels and thus sharp fall may be restricted.

www.angelcommodities.com

Commodities Daily Report

Thursday| November 15, 2012

Agricultural Commodities

Oilseeds

Soybean: Soybean futures declined further and settled 1.24%

lower on account of weak international markets after the USDA estimated an increase in its production forecast for soybean. However, with strong crushing figures CBOT soybean again recovered on Wednesday. Spot markets remained closed on account of Diwali festivals. Arrivals were lower considerably during the last week at around 340000 bags on Saturday. Soy meal exports during October are down 49,840 tn in October, the seventh consecutive month of fall in the current fiscal year, from 223,594 tn a year ago. This is because; most export commitments were done for forward trade like Nov-Dec amid uncertainty over supplies in October. According to first advance estimates, Soybean output is pegged at 126.2 lakh tn for 2012-13.

Market Highlights

Unit Soybean Spot- NCDEX (Indore) Soybean- NCDEX Nov '12 Futures Ref Soy oil SpotNCDEX(Indore) Ref Soy oil- NCDEX Nov '12 Futures Rs/qtl Rs/qtl Rs/10 kgs Rs/10 kgs Last 3258 3239 688.1 688.4

as on Nov 13, 2012 % Change Prev day 0.00 -1.24 0.00 0.58 WoW -2.34 -1.22 -1.20 1.56 MoM 3.00 2.34 2.19 2.43 YoY 47.15 44.19 9.25 8.26

Source: Reuters

as on Nov 14, 2012 International Prices Soybean- CBOTNov'12 Futures Soybean Oil - CBOTDec'12 Futures Unit USc/ Bushel USc/lbs Last 1433 47.67 Prev day 0.40 1.38 WoW -5.04 -1.95 MoM -4.00 -4.68

Source: Reuters

YoY 22.25 -6.93

International Markets

CBOT Soybean settled higher by 0.34% as processors are crushing at a rapid rate to meet strong global demand for soy meal, while farmer offerings of the oilseed have slowed with the harvest nearly complete and prices hovering at a 4-1/2 month low. The National Oilseed Processors Association (NOPA) reported the U.S. soybean crush for October at 153.536 million bushels, the largest monthly figure since January 2010 and the highest for October since 2009. According to the USDA November monthly report, The U.S. Department of Agriculture on Friday raised its estimate for soybean production by 4% from its forecast last month, saying that rainfall late in the growing season softened the impact of the U.S. drought. Area and production in Argentina for MY 2012-13 are maintained at 19.7 million hectares and 55 million tonnes, respectively. Brazil's government on 8 Nov 2012 edged up its forecast for a record 2012/13 soybean crop to between 80.1 and 83 million tonnes, despite concerns after dry October weather and planting delays

th

Crude Palm Oil

as on Nov 14, 2012 % Change Prev day WoW -3.50 -0.19 -5.70 0.61

Unit

CPO-Bursa Malaysia Nov '12 Contract CPO-MCX- Nov '12 Futures

Last 2150 430.2

MoM -9.66 2.53

YoY -36.76 -15.73

MYR/Tonne Rs/10 kg

Source: Reuters

RM Seed

Unit RM Seed SpotNCDEX (Jaipur) RM Seed- NCDEX Nov '12 Futures Rs/100 kgs Rs/100 kgs Last 4160 4204 Prev day 0.00 0.17

as on Nov 13, 2012 WoW -1.54 1.99 MoM -2.69 0.21

Source: Reuters

YoY 35.45 34.10

Refined Soy Oil: Ref soy oil settled marginally higher by 0.58% and

MCX CPO settled marginally lower by 0.19% on Tuesday. BMD Palm oil futures which had declined after the release of monthly stocks production and export reports by the palm oil board, opened higher today on robust exports and expected decline in yield. According to latest data from SEA, total vegetable oil imports in September were 993,912 tn, up from 897,018 tn in the previous month. As per MPOBs latest report, Malaysia's September palm oil stocks rose 17 percent to record high 2.48 million tons compared to previous month.

Technical Chart Soybean

NCDEX Dec contract

Rape/mustard Seed: Rm seed futures settled marginally higher by

0.17%on short coverings. Rabi oilseeds sowing as on 10 November was reported at 43.21 lakh ha as compared to 35.18 lakh ha in the same period last year. MSP for Mustard seed is increased by 20% from Rs 2500/Quintal to Rs 3000/Quintal for 2012-13 season.

th

Source: Telequote

Outlook

Edible oil complex may trade on a positive note during the intraday on account of higher crushing led by robust demand soy meal in the domestic as well as global markets. However, sharp gains may be capped next week onwards as arrivals are expected to improve post Diwali.

Technical Outlook

Contract Soy Oil Dec NCDEX Futures Soybean NCDEX Dec Futures RM Seed NCDEX Dec Futures CPO MCX Nov Futures Unit Rs./qtl Rs./qtl Rs./qtl Rs./qtl

valid for Nov 15, 2012 Support 663-671 3175-3215 4190-4235 433-438 Resistance 684-690 3295-3328 4295-4335 449-455

www.angelcommodities.com

Commodities Daily Report

Thursday| November 15, 2012

Agricultural Commodities

Black Pepper

Pepper futures continued to trade on a negative note Tuesday on reports of better output in the domestic as well as the international markets this season. Farmers are also trying to liquidate their stocks ahead of the commencement of arrivals of the fresh crop. Exports demand for Indian pepper in the international markets remains weak due to huge price parity. However, prices found support at lower levels due to festive as well as winter buying and recovered from lower levels towards the end. The Spot remained closed while the December Futures settled marginally lower by 0.09% on Tuesday. Pepper prices in the international market are being quoted at $8,200/tn(C&F) while Vietnam was offering Austa at $7,000/tn, Brazil Austa at $6,700/tn, and Indonesia Austa at $6,500/tn (FOB).

Market Highlights

Unit Pepper SpotNCDEX (Kochi) Pepper- NCDEX Nov '12 Futures Rs/qtl Rs/qtl Last 41094 41385 % Change Prev day 0.00 -0.55

as on Nov 13, 2012 WoW -2.25 -2.90 MoM -2.80 -3.91 YoY 18.21 17.87

Source: Reuters

Technical Chart Black Pepper

NCDEX Dec contract

Exports

According to Spices Board of India, exports of pepper in April 2012 fell by 47% and stood at 1,200 tonnes as compared to 2,266 tonnes in April 2011. India imported 1,848 tonnes of pepper till March 2012 and has become the third country to import such large quantity after UAE and Singapore. (Source: Agriwatch) According to Vietnam Ministry of Agriculture and Rural Development (MARD) exports of black pepper in 2012 are forecasted at around 1,25,000 tonnes. Exports of Pepper from Vietnam during January till September 2012 is estimated around 80,433 mt, higher by 4.3% in volume and 31.7% in value compared to corresponding year last year. Exports of Pepper from Brazil during January till May 2012 are estimated around 13369 mt. (Source: Peppertradeboard). Pepper imports by U.S. the largest consumer of the spice declined 14.8% in the first 2 months of the year (2012) to 8810 tn as compared to 10344 tn in the same period previous year. Imports of Pepper in the month of February declined by 16.8% to 3999 tn as compared to 4811 tn in the month of January 2012. Exports from Indonesia posted significant decrease of 42% as compared to previous year. Exports stood at 36,500 tonnes as compared to 62,599 tonnes in the last year. During May 2012 Brazil exported 1,705 tonnes of pepper as against 1600 tn in May 2011.

Source: Telequote

Technical Outlook

Contract Black Pepper NCDEX Dec Futures Unit Rs/qtl

valid for Nov 15, 2012 Support 40200-40530 Resistance 41100-41330

Production and Arrivals

The arrivals in the spot market were reported at 18 tonnes while offtakes were 12 tonnes on Monday. As per IPC, Global pepper production in 2012 is projected at 3.36 lk tn, up by 12.7% compared with 2.98 lk tn in 2011. Indonesian pepper output Is expected to rise by 24% and in Vietnam by 10%. According to previous estimates, report pepper output in Vietnam is estimated to be 1.35 lakh tonne as compared to 1.10 lakh tonne estimated early in the beginning of year (2012). Brazil is also expected to produce 22,000 tn this year. Domestic consumption of Pepper in the world is expected to grow by 3.03% to 1.25 lakh tonnes while exports are likely to grow by 1.48% to 2.46 lakh tonnes in 2012. (Source: Pepper trade board) On the other hand production of pepper in India in 2011-12 is expected to decline further by 5% to 43 thousand tonnes as compared to 48 thousand tonnes in the last year. Production is lowest in a decade.

Outlook

Pepper is expected to trade downwards today. Liquidation pressure from farmers as well as low export demand may pressurize prices. Good supplies in the international market from other origins may also keep prices under check. However, festive season as well as winter demand may support prices at lower levels.

www.angelcommodities.com

Commodities Daily Report

Thursday| November 15, 2012

Agricultural Commodities

Jeera

Jeera Futures opened higher on Tuesday on reports of export enquires. However, gains were capped on long liquidation at higher levels. The sowing of the crop has started and is expected to gain momentum in the coming days, thus pressuring prices. Sowing in Gujarat is currently lower by 15-20%. Festive demand is also expected to improve. Exporters have been buying due to tensions between Syria and Turkey. The spot remained closed due to Diwali while the December Futures settled 0.52% lower on Tuesday. According to markets sources about 75% exports target has already been achieved due to a supply crunch in the global markets. Supply concerns from Syria and Turkey still exists. Expectations are that export orders may still be diverted to India from the international markets due to lack of supplies from Syria on back of the ongoing civil war. Production in Syria and Turkey is being reported around 17,000 tonnes and around 4,000-5,000 tonnes, lesser than expectations. Jeera prices of Indian origin are being offered in the international market at $2,850 tn (c&f) while Syria and Turkey are not offering. Carryover stocks of Jeera in the domestic market is expected to be around 4-5 lakh bags lower by around 3 lakh bags last year.

Market Highlights

Unit Jeera SpotNCDEX(Unjha) Jeera- NCDEX Nov '12 Futures Rs/qtl Rs/qtl Last 15064 14758 Prev day 0.00 0.25

as on Nov 13, 2012 % Change WoW 0.27 1.95 MoM -0.40 -2.04 YoY 6.61 12.01

Source: Reuters

Technical Chart Jeera

NCDEX Dec contract

Production, Arrivals and Exports

Unjha markets witnessed arrivals of 8,000 bags, while off-takes stood at 8,000 bags on Saturday. Production of Jeera in 2011-12 is expected to be around 40 lakh bags as compared to 29 lakh bags in 2010-11 (each bag weighs 55 kgs). (Source: spot market traders). According to Spices Board of India, exports of Jeera in April 2012 stood at 2,500 tonnes as compared to 2,369 tonnes in April 2011, an increase of 6%.

Source: Telequote

Market Highlights

Prev day 0.00 0.44

as on Nov 13, 2012 % Change

Unit Turmeric SpotNCDEX (N'zmbad) Turmeric- NCDEX Nov '12 Futures Rs/qtl Rs/qtl

Last 5062 5446

WoW -0.60 0.81

MoM 0.79 6.08

YoY -4.88 23.38

Outlook

Jeera futures are expected to trade sideways with a negative bias today. Prices may witness downside pressure as farmers are liquidating their stocks for want of cash. However, prices may recover on fresh export demand. Festive buying may also lend support to the prices. In the medium term (November-December 2012), prices are likely to stay firm as there are limited stocks with Syria and Turkey.

Technical Chart Turmeric

NCDEX Dec contract

Turmeric

Turmeric Futures traded on a positive note on Tuesday due to good orders from the upcountry markets. Traders also expected export orders to resume in the coming days. However, stockists have good carryover stocks with them, capping sharp gains in the spot. Turmeric has been sown in 0.58 lakh hectares in A.P as on 10/10/2012. Sowing is also reported 30-35% lower during the sowing period. The Spot as remained closed on account of Diwali while the December Futures settled 1.4% higher on Tuesday. Production, Arrivals and Exports Arrivals in Erode and Nizamabad mandi stood at 10,000 bags and 700 bags respectively on Friday. Turmeric production for the year 2011-12 is projected at historical high of 90 lakh bags (1 bag= 70 kgs) compared to 69 lakh bags in 201011. Erode is expected to produce 55 lakh bags of turmeric a rise of 29% as compared to previous year. According to Spices Board of India, exports of Turmeric in April 2012 increased by 1% at 7,300 tn as compared to 7,230 tn in April 2011. Outlook Turmeric prices are expected to trade on a positive note today. Good demand from North India is expected to support prices. However, large stocks may pressurize prices.

Source: Telequote

Technical Outlook

Unit Jeera NCDEX Dec Futures Turmeric NCDEX Dec Futures Rs/qtl Rs/qtl

Valid for Nov 15, 2012

Support 14920-15045 5240-5310 Resistance 15300-15410 5430-5496

www.angelcommodities.com

Commodities Daily Report

Thursday| November 15, 2012

Agricultural Commodities

Kapas

NCDEX Kapas futures after falling in the past few days gained marginally by 0.25% on short coverings As on 4th November 2012, 13.02 lakh bales of Cotton has arrived so far, down by 29% compared to last year 18.57 lakh bales during the same period. U.S. ICE cotton futures settled higher by 1.16% to a two-week high on Wednesday taking cues from the overall commodity segment. Strength of global demand and economic sentiment will likely start setting the market tone for cotton in the coming months. Cotton harvesting has commenced in US, in all 64% is harvested as compared to 50% a week ago, versus 68% same period a year ago. Cotton crop condition is 43% in Good/Excellent state compared to 29% th same period a year ago as on 6 Nov 2012.

Market Highlights

Unit Rs/20 kgs Rs/Bale Last 974.5 16210

as on Nov 14, 2012 % Change Prev. day WoW -0.20 -0.71 0.25 0.87 MoM -0.36 0.87 YoY #N/A -2.99

NCDEX Kapas Futures* MCX Cotton Futures

*Prices as on Nov 13, 2012

Source: Reuters

International Prices

ICE Cotton Cot look A Index Unit Usc/Lbs Last 71.63 81.35

as on Nov 14, 2012 % Change Prev day WoW 1.16 2.58 0.00 0.00 MoM -0.98 0.00 YoY -28.01 -29.20

Domestic Production and Consumption

According to Cotton Advisory Boards (CAB) latest estimates for 2012-13 season that commenced in October, domestic cotton production is pegged 334 lakh bales, down 5.6% from the previous years estimates of 353 lakh bales. Lower opening stocks coupled with estimated lower output will result in lower supplies this season at 374 lakh bales, a decline of 8.7% compared with last years 410.77 lakh bales. On the consumption front, domestic consumption is estimated higher at 270 lakh bales on the back of higher mill consumption. However, after witnessing record exports in 2011-12 season, Indian exports could witness significant fall this season on the back of lower availability along with unattractive domestic cotton prices. CAB estimates cotton exports at 70 lakh bales this season, compared with 128.8 lakh bales last year.

Source: Reuters

Technical Chart - Kapas

NCDEX April contract

Global Cotton Updates

The U.S. government has raised its 2012/13 forecast for global cotton inventory to above 80 million 480-pound bales for the first time due to larger-than-expected output in the United States, the world's third largest producer, and falling demand from China, the world's largest consumer. In its monthly crop report, the U.S. Department of Agriculture increased its estimate for 2012/13 ending stocks for a fourth straight month to a new all-time high of 80.27 million bales. Higher global ending stocks are seen capping the upside in the cotton prices this year too. However, downside is also limited as prices are again nearing its 12 year average price of 65 cents per pound. Markets will now take cues from the Chinese demand for cotton and trade policies of India with respect to cotton exports. In its November monthly demand supply report, the Agriculture Department (USDA) raised its cotton crop for 2012/13 cotton crop season to 17.45 mln bales (Prev 17.29) along with upward revision in end stocks 5.80 mln 480 pounds/bales (Prev 5.60). Exports were unchanged at 11.60 mln 480 pounds/bales.

Source: Telequote

Technical Chart - Cotton

MCX Nov contract

Source: Telequote

Technical Outlook

Contract Kapas NCDEX April Kapas MCX April Cotton MCX November Unit Rs/20 kgs Rs/20 kgs Rs/bale

valid for Nov 15, 2012 Support 950-962 948-960 15950-16080 Resistance 986-997 985-995 16340-16450

Outlook

Cotton prices may trade sideways with downward bias on account of weak international markets. Although harvesting pressure may build mid November onwards, but still no major downside is expected in the domestic markets as farmers will not sell their stocks at very low prices. Also, CCI procurement at MSP levels may support prices from falling sharply.

www.angelcommodities.com

Das könnte Ihnen auch gefallen

- Daily Agri Report Nov 2Dokument8 SeitenDaily Agri Report Nov 2Angel BrokingNoch keine Bewertungen

- Daily Agri Report 20th DecDokument8 SeitenDaily Agri Report 20th DecAngel BrokingNoch keine Bewertungen

- Daily Agri Report Sep 25Dokument8 SeitenDaily Agri Report Sep 25Angel BrokingNoch keine Bewertungen

- Daily Agri Report Oct 12Dokument8 SeitenDaily Agri Report Oct 12Angel BrokingNoch keine Bewertungen

- Daily Agri Report Nov 8Dokument8 SeitenDaily Agri Report Nov 8Angel BrokingNoch keine Bewertungen

- Daily Agri Report Sep 4Dokument8 SeitenDaily Agri Report Sep 4Angel BrokingNoch keine Bewertungen

- Daily Agri Report, June 05Dokument7 SeitenDaily Agri Report, June 05Angel BrokingNoch keine Bewertungen

- Daily Agri Report, August 06 2013Dokument9 SeitenDaily Agri Report, August 06 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report, May 11Dokument7 SeitenDaily Agri Report, May 11Angel BrokingNoch keine Bewertungen

- Daily Agri Report Nov 9Dokument8 SeitenDaily Agri Report Nov 9Angel BrokingNoch keine Bewertungen

- Daily Agri Report Nov 21Dokument8 SeitenDaily Agri Report Nov 21Angel BrokingNoch keine Bewertungen

- Daily Agri Report Aug 13Dokument8 SeitenDaily Agri Report Aug 13Angel BrokingNoch keine Bewertungen

- Daily Agri Report Oct 6Dokument8 SeitenDaily Agri Report Oct 6Angel BrokingNoch keine Bewertungen

- Daily Agri Report Nov 3Dokument8 SeitenDaily Agri Report Nov 3Angel BrokingNoch keine Bewertungen

- Daily Agri Report Oct 22Dokument8 SeitenDaily Agri Report Oct 22Angel BrokingNoch keine Bewertungen

- Daily Agri Report Nov 7Dokument8 SeitenDaily Agri Report Nov 7Angel BrokingNoch keine Bewertungen

- Daily Agri Report Nov 20Dokument8 SeitenDaily Agri Report Nov 20Angel BrokingNoch keine Bewertungen

- Daily Agri Report, April 03Dokument8 SeitenDaily Agri Report, April 03Angel BrokingNoch keine Bewertungen

- Daily Agri Report Sep 20Dokument8 SeitenDaily Agri Report Sep 20Angel BrokingNoch keine Bewertungen

- Daily Agri Report, March 02Dokument8 SeitenDaily Agri Report, March 02Angel BrokingNoch keine Bewertungen

- Daily Agri Report Nov 10Dokument8 SeitenDaily Agri Report Nov 10Angel BrokingNoch keine Bewertungen

- Daily Agri Report, August 12 2013Dokument9 SeitenDaily Agri Report, August 12 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report 5th JanDokument8 SeitenDaily Agri Report 5th JanAngel BrokingNoch keine Bewertungen

- Daily Agri Report, February 12Dokument8 SeitenDaily Agri Report, February 12Angel BrokingNoch keine Bewertungen

- Daily Agri Report Sep 6Dokument8 SeitenDaily Agri Report Sep 6Angel BrokingNoch keine Bewertungen

- Daily Agri Report Oct 10Dokument8 SeitenDaily Agri Report Oct 10Angel BrokingNoch keine Bewertungen

- Daily Agri Report, May 09Dokument7 SeitenDaily Agri Report, May 09Angel BrokingNoch keine Bewertungen

- Daily Agri Report, February 27Dokument8 SeitenDaily Agri Report, February 27Angel BrokingNoch keine Bewertungen

- Daily Agri Report Oct 25Dokument8 SeitenDaily Agri Report Oct 25Angel BrokingNoch keine Bewertungen

- Daily Agri Report Nov 12Dokument8 SeitenDaily Agri Report Nov 12Angel BrokingNoch keine Bewertungen

- Daily Agri Report, June 06Dokument7 SeitenDaily Agri Report, June 06Angel BrokingNoch keine Bewertungen

- Daily Agri Report, April 26Dokument8 SeitenDaily Agri Report, April 26Angel BrokingNoch keine Bewertungen

- Daily Agri Report Sep 3Dokument8 SeitenDaily Agri Report Sep 3Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 12 2013Dokument9 SeitenDaily Agri Report September 12 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report, May 14Dokument7 SeitenDaily Agri Report, May 14Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 02 2013Dokument9 SeitenDaily Agri Report September 02 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report, May 17Dokument7 SeitenDaily Agri Report, May 17Angel BrokingNoch keine Bewertungen

- Daily Agri Report, June 12Dokument7 SeitenDaily Agri Report, June 12Angel BrokingNoch keine Bewertungen

- Daily Agri Report 31st DecDokument8 SeitenDaily Agri Report 31st DecAngel BrokingNoch keine Bewertungen

- Daily Agri Report, April 29Dokument8 SeitenDaily Agri Report, April 29Angel BrokingNoch keine Bewertungen

- Daily Agri Report Oct 18Dokument8 SeitenDaily Agri Report Oct 18Angel BrokingNoch keine Bewertungen

- Daily Agri Report Oct 3Dokument8 SeitenDaily Agri Report Oct 3Angel BrokingNoch keine Bewertungen

- Daily Agri Report Sep 29Dokument8 SeitenDaily Agri Report Sep 29Angel BrokingNoch keine Bewertungen

- Daily Agri Report, June 19Dokument9 SeitenDaily Agri Report, June 19Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 06 2013Dokument9 SeitenDaily Agri Report September 06 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report Oct 23Dokument8 SeitenDaily Agri Report Oct 23Angel BrokingNoch keine Bewertungen

- Content: News & Market Highlights Chana Sugar Oilseed Complex Spices Complex Kapas/CottonDokument8 SeitenContent: News & Market Highlights Chana Sugar Oilseed Complex Spices Complex Kapas/CottonAngel BrokingNoch keine Bewertungen

- Daily Agri Report 10th JanDokument8 SeitenDaily Agri Report 10th JanAngel BrokingNoch keine Bewertungen

- Daily Agri Report, May 07Dokument7 SeitenDaily Agri Report, May 07Angel BrokingNoch keine Bewertungen

- Daily Agri Report, 28th January 2013Dokument8 SeitenDaily Agri Report, 28th January 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report Nov 24Dokument8 SeitenDaily Agri Report Nov 24Angel BrokingNoch keine Bewertungen

- Daily Agri Report Sep 24Dokument8 SeitenDaily Agri Report Sep 24Angel BrokingNoch keine Bewertungen

- Daily Agri Report 28th DecDokument8 SeitenDaily Agri Report 28th DecAngel BrokingNoch keine Bewertungen

- Daily Agri Report September 11 2013Dokument9 SeitenDaily Agri Report September 11 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report Oct 8Dokument8 SeitenDaily Agri Report Oct 8Angel BrokingNoch keine Bewertungen

- Daily Agri Report, August 08 2013Dokument9 SeitenDaily Agri Report, August 08 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report 9th JanDokument8 SeitenDaily Agri Report 9th JanAngel BrokingNoch keine Bewertungen

- Daily Agri Report 14th JanDokument8 SeitenDaily Agri Report 14th JanAngel BrokingNoch keine Bewertungen

- Daily Agri Report, April 02Dokument8 SeitenDaily Agri Report, April 02Angel BrokingNoch keine Bewertungen

- Cambodia Agriculture, Natural Resources, and Rural Development Sector Assessment, Strategy, and Road MapVon EverandCambodia Agriculture, Natural Resources, and Rural Development Sector Assessment, Strategy, and Road MapNoch keine Bewertungen

- Technical & Derivative Analysis Weekly-14092013Dokument6 SeitenTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDokument4 SeitenRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNoch keine Bewertungen

- International Commodities Evening Update September 16 2013Dokument3 SeitenInternational Commodities Evening Update September 16 2013Angel BrokingNoch keine Bewertungen

- Oilseeds and Edible Oil UpdateDokument9 SeitenOilseeds and Edible Oil UpdateAngel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report November 12Dokument2 SeitenMetal and Energy Tech Report November 12Angel BrokingNoch keine Bewertungen

- Special Technical Report On NCDEX Oct SoyabeanDokument2 SeitenSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNoch keine Bewertungen

- WPIInflation August2013Dokument5 SeitenWPIInflation August2013Angel BrokingNoch keine Bewertungen

- Daily Metals and Energy Report September 16 2013Dokument6 SeitenDaily Metals and Energy Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 16 2013Dokument9 SeitenDaily Agri Report September 16 2013Angel BrokingNoch keine Bewertungen

- Commodities Weekly Outlook 16-09-13 To 20-09-13Dokument6 SeitenCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 14 2013Dokument2 SeitenDaily Agri Tech Report September 14 2013Angel BrokingNoch keine Bewertungen

- Currency Daily Report September 16 2013Dokument4 SeitenCurrency Daily Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 16 2013Dokument2 SeitenDaily Agri Tech Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Dokument4 SeitenDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNoch keine Bewertungen

- Derivatives Report 8th JanDokument3 SeitenDerivatives Report 8th JanAngel BrokingNoch keine Bewertungen

- Commodities Weekly Tracker 16th Sept 2013Dokument23 SeitenCommodities Weekly Tracker 16th Sept 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 16 Sept 2013Dokument3 SeitenDerivatives Report 16 Sept 2013Angel BrokingNoch keine Bewertungen

- Sugar Update Sepetmber 2013Dokument7 SeitenSugar Update Sepetmber 2013Angel BrokingNoch keine Bewertungen

- TechMahindra CompanyUpdateDokument4 SeitenTechMahindra CompanyUpdateAngel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Technical Report 13.09.2013Dokument4 SeitenTechnical Report 13.09.2013Angel BrokingNoch keine Bewertungen

- IIP CPIDataReleaseDokument5 SeitenIIP CPIDataReleaseAngel BrokingNoch keine Bewertungen

- Market Outlook 13-09-2013Dokument12 SeitenMarket Outlook 13-09-2013Angel BrokingNoch keine Bewertungen

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDokument1 SeitePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNoch keine Bewertungen

- MarketStrategy September2013Dokument4 SeitenMarketStrategy September2013Angel BrokingNoch keine Bewertungen

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDokument4 SeitenJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report Sept 13Dokument2 SeitenMetal and Energy Tech Report Sept 13Angel BrokingNoch keine Bewertungen

- MetalSectorUpdate September2013Dokument10 SeitenMetalSectorUpdate September2013Angel BrokingNoch keine Bewertungen

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDokument6 SeitenTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 06 2013Dokument2 SeitenDaily Agri Tech Report September 06 2013Angel BrokingNoch keine Bewertungen

- Predictive Maintenance Attempts To Detect The Onset of A Degradation Mechanism With The Goal of Correcting That Degradation Prior To Signiicant Deterioration in The Component or EquipmentDokument6 SeitenPredictive Maintenance Attempts To Detect The Onset of A Degradation Mechanism With The Goal of Correcting That Degradation Prior To Signiicant Deterioration in The Component or EquipmentTodd BenjaminNoch keine Bewertungen

- Zincanode 304 pc142Dokument3 SeitenZincanode 304 pc142kushar_geoNoch keine Bewertungen

- Calibration of Force ReductionDokument36 SeitenCalibration of Force Reductionvincenzo_12613735Noch keine Bewertungen

- Arts6,4, Week2, Module 2V4Dokument24 SeitenArts6,4, Week2, Module 2V4Loreen Pearl MarlaNoch keine Bewertungen

- Genie GS-1930 Parts ManualDokument194 SeitenGenie GS-1930 Parts ManualNestor Matos GarcíaNoch keine Bewertungen

- Pre RmoDokument4 SeitenPre RmoSangeeta Mishra100% (1)

- Product Stock Exchange Learn BookDokument1 SeiteProduct Stock Exchange Learn BookSujit MauryaNoch keine Bewertungen

- Apcotide 1000 pc2782Dokument1 SeiteApcotide 1000 pc2782hellmanyaNoch keine Bewertungen

- Sudip Praposal - 1Dokument20 SeitenSudip Praposal - 1Usha BbattaNoch keine Bewertungen

- The Unofficial Aterlife GuideDokument33 SeitenThe Unofficial Aterlife GuideIsrael Teixeira de AndradeNoch keine Bewertungen

- Donna Hay Magazine 2014-10-11 PDFDokument172 SeitenDonna Hay Magazine 2014-10-11 PDFlekovic_tanjaNoch keine Bewertungen

- Unit 2 - Presentations (Image, Impact and Making An Impression) 2Dokument25 SeitenUnit 2 - Presentations (Image, Impact and Making An Impression) 2LK Chiarra Panaligan100% (1)

- Chapter 10 - The Mature ErythrocyteDokument55 SeitenChapter 10 - The Mature ErythrocyteSultan AlexandruNoch keine Bewertungen

- Reactive Dyes For Digital Textile Printing InksDokument4 SeitenReactive Dyes For Digital Textile Printing InksDHRUVNoch keine Bewertungen

- American University of BeirutDokument21 SeitenAmerican University of BeirutWomens Program AssosciationNoch keine Bewertungen

- A Textual Introduction To Acarya Vasuvan PDFDokument3 SeitenA Textual Introduction To Acarya Vasuvan PDFJim LeeNoch keine Bewertungen

- Orofacial Complex: Form and FunctionDokument34 SeitenOrofacial Complex: Form and FunctionAyushi Goel100% (1)

- Modern Myth and Magical Face Shifting Technology in Girish Karnad Hayavadana and NagamandalaDokument2 SeitenModern Myth and Magical Face Shifting Technology in Girish Karnad Hayavadana and NagamandalaKumar KumarNoch keine Bewertungen

- The Joy Luck Club Book 1Dokument12 SeitenThe Joy Luck Club Book 1loronalicelNoch keine Bewertungen

- Zest O CorporationDokument21 SeitenZest O CorporationJhamane Chan53% (15)

- 04 SAMSS 005 Check ValvesDokument9 Seiten04 SAMSS 005 Check ValvesShino UlahannanNoch keine Bewertungen

- Sample Dilapidation ReportDokument8 SeitenSample Dilapidation ReportczarusNoch keine Bewertungen

- Application of PCA-CNN (Principal Component Analysis - Convolutional Neural Networks) Method On Sentinel-2 Image Classification For Land Cover MappingDokument5 SeitenApplication of PCA-CNN (Principal Component Analysis - Convolutional Neural Networks) Method On Sentinel-2 Image Classification For Land Cover MappingIJAERS JOURNALNoch keine Bewertungen

- Michelle LeBaron, Venashri - Pillay) Conflict AcrosDokument241 SeitenMichelle LeBaron, Venashri - Pillay) Conflict AcrosBader100% (2)

- Rac Question PaperDokument84 SeitenRac Question PaperibrahimNoch keine Bewertungen

- Mini Project 1 - 1Dokument9 SeitenMini Project 1 - 1Sameer BaraNoch keine Bewertungen

- YogaDokument116 SeitenYogawefWE100% (2)

- Product Recommendation Hyster Forklift Trucks, Electric J1.60XMTDokument1 SeiteProduct Recommendation Hyster Forklift Trucks, Electric J1.60XMTNelson ConselhoNoch keine Bewertungen

- RMHE08Dokument2.112 SeitenRMHE08Elizde GómezNoch keine Bewertungen