Beruflich Dokumente

Kultur Dokumente

Stock Acquisition (Reviewer2)

Hochgeladen von

ErikaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Stock Acquisition (Reviewer2)

Hochgeladen von

ErikaCopyright:

Verfügbare Formate

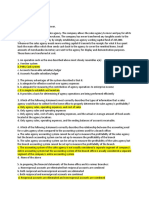

STOCK ACQUISITION Acquiree - Binili Subsidiary (Non-Controlling Interest) Acquirer - Bumili Parent (Controlling Interest) 51% and Above

ove - Dapat yung pinurchase 1. DETERMINE GOODWILL Cost of Investment PP of Cash PP of Stocks @FV PP of NCA Contingent Consideration FMV of NCI FMV of Previously Held Securities COI (Cost of Investment) IF:

vs.

FMV of NIA Assets excluding GW @FMV Less: Liabilities @FMV FMV of NIA

COI > FMV = Goodwill COI < FMV = Income from Acquisition

2 Methods of getting FMV of NCI 1. Proportionate Share Basis CNCINA (Partial Goodwill Method) 2. Fair Value Method Silent / Pag sinabi na measured at FV a. Given b. Assume c. Check i. Assumed Value = Purchase Price x NCI% CI% ii. CNCINA = FMV of NIA x NCI% 2. WORKING PAPER ENTRIES (1) Eliminate SHE (2) Update Assets of Subsidiary to FMV (3) Recognize Goodwill

Proportionate Share Basis FMV of NCI 1. Given Fair Market Value Method 2. Assumed CNCINA

Whichever is higher.

FMV of NIA x NCI%

3. Check CNCINA w/c ever is higher. (Given vs. Check; Assumed vs. Check)

Kanino yung Goodwill?

Parent Full Goodwill Partial Subsidiary

Goodwill Given Determination and allocation schedule Assumed Simple (Ratio)

Parent

CNCINA

Parent

Determination and Allocation Schedule GOODWILL CI COI PP in Cash FMV - Less: FMV of NIA (CI%) xx

NCI FMV of NCI FMV of NIA (NCI%) xx

ERIKA MAE ARMES RELLORES

Das könnte Ihnen auch gefallen

- Universal College of Parañaque: Inventories Related Standards: Pas 2 - InventoriesDokument26 SeitenUniversal College of Parañaque: Inventories Related Standards: Pas 2 - InventoriesTeresaNoch keine Bewertungen

- Gov Quiz 2Dokument3 SeitenGov Quiz 2venice cambryNoch keine Bewertungen

- Learning Objective 11-1: Chapter 11 Considering The Risk of FraudDokument25 SeitenLearning Objective 11-1: Chapter 11 Considering The Risk of Fraudlo0302100% (1)

- Theory of Accounts On Business CombinationDokument2 SeitenTheory of Accounts On Business CombinationheyNoch keine Bewertungen

- Lecture Notes: Afar - Not For Profit OrganizationsDokument5 SeitenLecture Notes: Afar - Not For Profit OrganizationsJem Valmonte100% (1)

- Mas Test Bank QuestionDokument3 SeitenMas Test Bank QuestionEricka CalaNoch keine Bewertungen

- MAS - 1416 Profit Planning - CVP AnalysisDokument24 SeitenMAS - 1416 Profit Planning - CVP AnalysisAzureBlazeNoch keine Bewertungen

- Palma Company Had 90Dokument2 SeitenPalma Company Had 90Melody Domingo BangayanNoch keine Bewertungen

- Capital BudgetingDokument4 SeitenCapital BudgetingYaj CruzadaNoch keine Bewertungen

- Mas 1.2.3 Assessment For-PostingDokument7 SeitenMas 1.2.3 Assessment For-PostingJustine CruzNoch keine Bewertungen

- Management Accounting Information For Activity and Process DecisionsDokument30 SeitenManagement Accounting Information For Activity and Process DecisionsCarmelie CumigadNoch keine Bewertungen

- CGT Drill Answers and ExplanationsDokument4 SeitenCGT Drill Answers and ExplanationsMarianne Portia SumabatNoch keine Bewertungen

- HO9 - Decentralized and Segment Reporting, Quantitative Techniques, and Standard Costing PDFDokument7 SeitenHO9 - Decentralized and Segment Reporting, Quantitative Techniques, and Standard Costing PDFPATRICIA PEREZNoch keine Bewertungen

- Fischer - Pship LiquiDokument7 SeitenFischer - Pship LiquiShawn Michael DoluntapNoch keine Bewertungen

- Financial Assets Guide - Cash, Receivables, Investments & DerivativesDokument5 SeitenFinancial Assets Guide - Cash, Receivables, Investments & DerivativesYami HeatherNoch keine Bewertungen

- Quiz BeeDokument15 SeitenQuiz BeeRudolf Christian Oliveras UgmaNoch keine Bewertungen

- Buscom Subsequent MeasurementDokument6 SeitenBuscom Subsequent MeasurementCarmela BautistaNoch keine Bewertungen

- IAS 23 Borrowing CostsDokument6 SeitenIAS 23 Borrowing CostsSelva Bavani SelwaduraiNoch keine Bewertungen

- MA Cabrera 2010 - SolManDokument4 SeitenMA Cabrera 2010 - SolManCarla Francisco Domingo40% (5)

- Sales Agency Accounting SystemDokument1 SeiteSales Agency Accounting Systemalmira garciaNoch keine Bewertungen

- Auditing and Assurance Principles Final Exam Set ADokument11 SeitenAuditing and Assurance Principles Final Exam Set APotato CommissionerNoch keine Bewertungen

- Chapter 3 Quiz KeyDokument2 SeitenChapter 3 Quiz KeyAmna MalikNoch keine Bewertungen

- AE 10 Quiz Provides Insight Into GovernanceDokument3 SeitenAE 10 Quiz Provides Insight Into GovernanceWenjunNoch keine Bewertungen

- TB Raiborn - Implementing Quality ConceptsDokument22 SeitenTB Raiborn - Implementing Quality ConceptsJoan Grachell TaguilasoNoch keine Bewertungen

- PFS: Financial Aspect - Investment CostsDokument11 SeitenPFS: Financial Aspect - Investment CostsSheena Cadiz FortinNoch keine Bewertungen

- FAR 2733 - Share-Based-Payment PDFDokument4 SeitenFAR 2733 - Share-Based-Payment PDFPHI NGUYEN HOANGNoch keine Bewertungen

- Kinney 8e - CH 17Dokument18 SeitenKinney 8e - CH 17Mr. FoxNoch keine Bewertungen

- Integration Management Advisory Services Standards and Variance AnalysisDokument6 SeitenIntegration Management Advisory Services Standards and Variance AnalysisJung JeonNoch keine Bewertungen

- Mixed PDFDokument8 SeitenMixed PDFChris Tian FlorendoNoch keine Bewertungen

- ACC 211 Review AssignmentDokument5 SeitenACC 211 Review Assignmentglrosaaa cNoch keine Bewertungen

- Summary Notes - Review Far - Part 3: 1 A B C D 2Dokument10 SeitenSummary Notes - Review Far - Part 3: 1 A B C D 2Fery AnnNoch keine Bewertungen

- MANAGEMENT ADVISORY SERVICES COST ANALYSISDokument7 SeitenMANAGEMENT ADVISORY SERVICES COST ANALYSISrochielanciolaNoch keine Bewertungen

- Instalment DISDokument4 SeitenInstalment DISRenelyn David100% (1)

- Business Combinations - Part 1 Recognition and MeasurementDokument54 SeitenBusiness Combinations - Part 1 Recognition and MeasurementJOANNE PEÑARANDANoch keine Bewertungen

- Operation Arising From Its Effective PortionDokument14 SeitenOperation Arising From Its Effective PortionShey INFTNoch keine Bewertungen

- Management Services II Final ExamDokument5 SeitenManagement Services II Final ExamBry LgnNoch keine Bewertungen

- Responsibility Accounting and Reporting: Multiple ChoiceDokument23 SeitenResponsibility Accounting and Reporting: Multiple ChoiceARISNoch keine Bewertungen

- MAS 2813 DIY Quantitative Techniques in ManagementDokument3 SeitenMAS 2813 DIY Quantitative Techniques in ManagementRamainne Chalsea RonquilloNoch keine Bewertungen

- TOA 011 - Depreciation, Revaluation and Impairment With AnsDokument5 SeitenTOA 011 - Depreciation, Revaluation and Impairment With AnsSyril SarientasNoch keine Bewertungen

- Topic 1: Statement of Financial PositionDokument10 SeitenTopic 1: Statement of Financial Positionemman neri100% (1)

- ch13 PDFDokument20 Seitench13 PDFJAY AUBREY PINEDANoch keine Bewertungen

- Handout Audit of PPE WA and IADokument9 SeitenHandout Audit of PPE WA and IAVenessa Lei Tricia G. JimenezNoch keine Bewertungen

- Chapter 6 MillanDokument57 SeitenChapter 6 MillanAngelica AllanicNoch keine Bewertungen

- MODULE 2 CVP AnalysisDokument8 SeitenMODULE 2 CVP Analysissharielles /Noch keine Bewertungen

- Process Costing ReviewerDokument46 SeitenProcess Costing ReviewerAko Si Cynthia100% (1)

- Quiz 7Dokument8 SeitenQuiz 7shivnilNoch keine Bewertungen

- 4083 EvalDokument11 Seiten4083 EvalPatrick ArazoNoch keine Bewertungen

- Ias 16 Property Plant EquipmentDokument4 SeitenIas 16 Property Plant Equipmentfaisal_zuhri100% (1)

- Asset - Inventory - For Posting PDFDokument8 SeitenAsset - Inventory - For Posting PDFNhicoleChoiNoch keine Bewertungen

- At 5906 Audit ReportDokument11 SeitenAt 5906 Audit ReportZyl Diez MagnoNoch keine Bewertungen

- 13 Consolidated Financial StatementDokument5 Seiten13 Consolidated Financial StatementabcdefgNoch keine Bewertungen

- baitap-sinhvien-IAS 21Dokument12 Seitenbaitap-sinhvien-IAS 21tonight752Noch keine Bewertungen

- Chapter 11 Illustrative SolutionsDokument7 SeitenChapter 11 Illustrative SolutionsSamantha Islam100% (2)

- Auditing Expenditure Cycle TestsDokument22 SeitenAuditing Expenditure Cycle Testsmacmac29Noch keine Bewertungen

- AISDokument11 SeitenAISJezeil DimasNoch keine Bewertungen

- Standard Costing 1.1Dokument3 SeitenStandard Costing 1.1Lhorene Hope DueñasNoch keine Bewertungen

- Business Combination: Expense ImmediatelyDokument7 SeitenBusiness Combination: Expense ImmediatelyKristel SumabatNoch keine Bewertungen

- ABC Notes Summary AccountingDokument3 SeitenABC Notes Summary AccountingSabelNoch keine Bewertungen

- NotesDokument3 SeitenNotesAuguste Anthony SisperezNoch keine Bewertungen

- Business Combination1Dokument5 SeitenBusiness Combination1Mae Ciarie YangcoNoch keine Bewertungen

- Consolidated Financial Statements (Reviewer)Dokument2 SeitenConsolidated Financial Statements (Reviewer)Erika50% (4)

- Business Combination (Statutory Merger) ReviewerDokument1 SeiteBusiness Combination (Statutory Merger) ReviewerErika100% (2)

- Installment Sales ReviewerDokument3 SeitenInstallment Sales ReviewerErika78% (9)

- Broken MarriagesDokument21 SeitenBroken MarriagesErikaNoch keine Bewertungen

- Childhood of RizalDokument41 SeitenChildhood of RizalErikaNoch keine Bewertungen

- Cooperative Feasibility Study GuideDokument31 SeitenCooperative Feasibility Study GuideRegie AtienzaNoch keine Bewertungen

- OutlineDokument1 SeiteOutlineErikaNoch keine Bewertungen

- Primary ConceptDokument1 SeitePrimary ConceptErikaNoch keine Bewertungen

- CH 1 Answers 2008Dokument1 SeiteCH 1 Answers 2008ErikaNoch keine Bewertungen

- Case Study 2 SynopsisDokument4 SeitenCase Study 2 SynopsisErikaNoch keine Bewertungen

- Romanesque ArchitectureDokument4 SeitenRomanesque ArchitectureErikaNoch keine Bewertungen

- Entity Relationship ModelDokument80 SeitenEntity Relationship ModelErikaNoch keine Bewertungen

- Structured Query LanguageDokument68 SeitenStructured Query Languagerakeshsingh1Noch keine Bewertungen

- Social EncyclicalsDokument4 SeitenSocial EncyclicalsErikaNoch keine Bewertungen

- Catholic Social TeachingDokument5 SeitenCatholic Social TeachingErikaNoch keine Bewertungen