Beruflich Dokumente

Kultur Dokumente

Finance

Hochgeladen von

Hasib AhmedOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Finance

Hochgeladen von

Hasib AhmedCopyright:

Verfügbare Formate

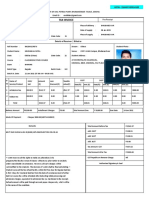

IDLC - Investment Insight Glaxo SmithKline Bangladesh Ltd.

July 21, 2011

Company Summary (DSE: GLAXOSMITH) 52-week Price Range (BDT) Current Price (21.07.2011 ) Trailing PE (LTM)* Total Number of Share (mn) Free Float (%) Free Float in Number of Shares (mn) Average Daily Volume (Last 1 Year)

[LTM*= Latest 12 Month]

Company Profile

648 - 1580 992 26.97 12.05 18% 2.17 14,404

Particulars (mn BDT) Revenue Gross Profit Operating Profit Net Profit After Tax Profitability (%) Gross Profit Margin Operating Margin Net Profit Margin Growth (%) Net Revenue Growth Operating Profit Growth NPAT Growth Per Share (BDT) Diluted EPS BVPS CFPS Declaration Cash Dividend Stock Dividend Right Share Issue Other (%) Debt/Equity Debt/ Asset ROA ROE Historical P/E Sl. No. 1 2 3 4 5 Company Name

2008 1888.11 471.67 212.63 142.95 2008 24.98% 11.26% 7.57% 2008 18.82%

2009 3023.67 944.28 431.86 323.79 2009 31.23% 14.28% 10.71% 2009 60.14%

2010 3632.10 1242.35 535.60 410.18 2010 34.20% 14.75% 11.29% 2010 20.12% 24.02% 26.68% 2010 34.05 114.65 51.07 2010 200% 2010 0.00 21% 32% 33.17 Trailing P/E (21.07.2011) 24.02 24.45 22.54 26.97 25.53 24.70

Glaxo Smith started its operation in Bangladesh as a branch of Glaxo Laboratories (Pakistan) in 1949. Later, after liberation, Glaxo Bangladesh Ltd. was formed in 1974 from the abandoned properties of Glaxo Laboratories Ltd. (Pakistan). It was listed in DSE in 1976. In 1995, after acquisition by Burroughs Wellcome, it was named as Glaxo Wellcome. Finally in 2002, following the global Mega merger with SmithKline Beecham, the firm was renamed as Glaxo SmithKline Bangladesh Limited. 81.98% of total shares are held by its sponsor, SetFirst Ltd., UK, which is 100% owned by Glaxo SmithKline plc, UK. GLAXOSMITH manufactures and markets pharmaceuticals products as well as Healthcare Products. 99% of its revenue is generated from local market sales of Pharmaceuticals products, contract manufacturing and Sales of Consumer Healthcare products. Key Revenue Drivers Core revenue drivers for GLAXOSMITH are Pharmaceuticals and consumer healthcare products. The company is growing in its consumer healthcare business, as the share of consumer healthcare in total revenue has increased from 23% (2008) to 54% (2010), while that of Pharmaceuticals has decreased from 76% (2008) to 45% (2010). As of 2010, its market share was 85% in Consumer Healthcare. Company Insight GLAXOSMITH has been experiencing increased revenue growth in Consumer Healthcare products, along with below industry average growth in Pharmaceuticals products. During 2008-2010, consumer healthcare product line achieved a growth of 110.8% per annum, mainly due to highly successful marketing campaign of Horlicks. In the pharmaceuticals business, GLAXOSMITH has strong presence in a few segments, including Vaccines (Market share of 80% in 2010), and Dextrose (Market share of 91% in 2010). However, due to slow growth nature of its segments, the company has been experiencing below industry average growth in pharmaceuticals. Financial Performance After a robust growth of 60.14% in 2009, GLAXOSMITHs revenue growth normalized to 20.12% in 2010. Operating performance saw a slight improvement, as gross profit margin increased by 3.0%, and operating profit margin increased by 0.5%. Net profit margin also increased by 0.6%. The financials reflect GLAXOSMITHs good growth in consumer healthcare and stable presence in the pharmaceuticals industry, which itself is enjoying a good growth in recent times. Recently, the company has reported net profit after tax of BDT 159.85 million with Diluted EPS of BDT 13.27 for the period of three months (Jan'2011 to March'2011) ended on 31.03.2011.

168.94% 103.11% 217.33% 126.51% 2008 11.87 75.72 5.49 2008 60% 2008 0.00 12% 17% 27.81 2009 26.88 96.60 37.68 2009 160% 2009 0.01 21% 31% 26.98

Square Pharmaceuticals Ltd. Beximco Pharmaceuticals Renata Ltd. GlaxoSmithKline Bangladesh Ltd. ACI Ltd.

Average PE of Similar Companies

Disclaimer: This Document has been prepared and issued by IDLC on the basis of the public information available in the market, internally developed data and other sources believed to be reliable. Whilst all reasonable care has been taken to ensure that the facts & information stated in the Document are accurate as on the date mentioned herein. Neither IDLC nor any of its director, shareholder, and member of the management or employee represents or warrants expressly or impliedly that the information or data of the sources used in the Document are genuine, accurate, complete, authentic and correct. Moreover, none of the director, shareholder, and member of the management or employee in any way is responsible about the genuineness, accuracy, completeness, authenticity and correctness of the contents of the sources that are publicly available to prepare the Document. It does not solicit any action based on the materials contained herein and should not be construed as an offer or solicitation to buy sell or subscribe to any security. If any person takes any action relying on this Document, shall be responsible solely by himself/herself/themselves for the consequences thereof and any claim or demand for such consequences shall be rejected by IDLC or by any court of law.

Das könnte Ihnen auch gefallen

- Square Pharma & Beximco PharmaDokument22 SeitenSquare Pharma & Beximco PharmaSummaiya Barkat50% (2)

- What Is Oligopoly?: Pharmaceutical IndustryDokument8 SeitenWhat Is Oligopoly?: Pharmaceutical IndustryGloria DimayacyacNoch keine Bewertungen

- GSK Annual Report With DetailsDokument252 SeitenGSK Annual Report With DetailsReal Will SelfNoch keine Bewertungen

- Glenmark Q1FY12 Result UpdateDokument3 SeitenGlenmark Q1FY12 Result UpdateSeema GusainNoch keine Bewertungen

- Financial Condition of Beximco Pharmaceuticals LTDDokument44 SeitenFinancial Condition of Beximco Pharmaceuticals LTDSadia SultanaNoch keine Bewertungen

- GSK Annual Report 2010Dokument216 SeitenGSK Annual Report 2010izharkhanNoch keine Bewertungen

- Equity Note - Beximco Pharmaceuticals LimitedDokument2 SeitenEquity Note - Beximco Pharmaceuticals LimitedOsmaan GóÑÍNoch keine Bewertungen

- Market Outlook 14th March 2012Dokument3 SeitenMarket Outlook 14th March 2012Angel BrokingNoch keine Bewertungen

- Financial Statement Analysis of Beximco Pharmaceuticals LTD: Md. Mahfujul Amin ID: 10364075Dokument13 SeitenFinancial Statement Analysis of Beximco Pharmaceuticals LTD: Md. Mahfujul Amin ID: 10364075Mahfujul AmenNoch keine Bewertungen

- Beximco Pharma StrategyDokument26 SeitenBeximco Pharma StrategyMarshal Richard81% (21)

- Analysis of Financial Statement - GSKDokument36 SeitenAnalysis of Financial Statement - GSKImran Sarwar100% (3)

- Cadila Health CareDokument15 SeitenCadila Health Careraushan0502Noch keine Bewertungen

- Cooper Companies Factsheet-2014Dokument2 SeitenCooper Companies Factsheet-2014IlyaLevtovNoch keine Bewertungen

- BXPHARMA - Equity Note - Updated 04-11-13 PDFDokument2 SeitenBXPHARMA - Equity Note - Updated 04-11-13 PDFRajuRahmotulAlamNoch keine Bewertungen

- Ompany Ackground: Industry SPL DifferenceDokument19 SeitenOmpany Ackground: Industry SPL DifferenceMoudud HossainNoch keine Bewertungen

- Aetna Inc.: (Source S&P, Vickers, Company Reports)Dokument10 SeitenAetna Inc.: (Source S&P, Vickers, Company Reports)sinnlosNoch keine Bewertungen

- Auto 03jun16 MoslDokument4 SeitenAuto 03jun16 Moslravi285Noch keine Bewertungen

- Assignment 1Dokument7 SeitenAssignment 1rohit77123Noch keine Bewertungen

- 2012 Annual Report PDFDokument120 Seiten2012 Annual Report PDFAnup KumarNoch keine Bewertungen

- Financial Statement Analysis of Square Pharmaceuticals LTDDokument25 SeitenFinancial Statement Analysis of Square Pharmaceuticals LTDkhair42Noch keine Bewertungen

- 1332567100research Report On Pharmaceutical Sector of BD-Initiation, June 28, 2011Dokument23 Seiten1332567100research Report On Pharmaceutical Sector of BD-Initiation, June 28, 2011Rayhan AtunuNoch keine Bewertungen

- MphasisDokument4 SeitenMphasisAngel BrokingNoch keine Bewertungen

- Project On Bharat PetroleumDokument16 SeitenProject On Bharat PetroleumSristy0% (1)

- GSK, 20th February, 2013Dokument11 SeitenGSK, 20th February, 2013Angel BrokingNoch keine Bewertungen

- Pricniple of AccountingDokument9 SeitenPricniple of AccountingUneeb AliNoch keine Bewertungen

- SQUARE Pharma Equity Note PDFDokument2 SeitenSQUARE Pharma Equity Note PDFNur Md Al HossainNoch keine Bewertungen

- Glaxosmithkline PLC: Research ReportDokument8 SeitenGlaxosmithkline PLC: Research Reportrumi2accaNoch keine Bewertungen

- Al Andalous PharmaceuticalsDokument17 SeitenAl Andalous PharmaceuticalsHatem HassanNoch keine Bewertungen

- GSK Strategic Report 2015Dokument75 SeitenGSK Strategic Report 2015nolovNoch keine Bewertungen

- Glaxo Smith Kline (GSK) PLC PESTEL and Environment AnalysisDokument16 SeitenGlaxo Smith Kline (GSK) PLC PESTEL and Environment Analysisvipul tutejaNoch keine Bewertungen

- Jul20 ErDokument5 SeitenJul20 Errwmortell3580Noch keine Bewertungen

- Wells Fargo Company and US BancorpDokument9 SeitenWells Fargo Company and US BancorpKassem MoukaddemNoch keine Bewertungen

- Sun Pharma, 12th February, 2013Dokument11 SeitenSun Pharma, 12th February, 2013Angel BrokingNoch keine Bewertungen

- Zimmer-Biomet (ZBH) JP Morgan Presentation 2017Dokument15 SeitenZimmer-Biomet (ZBH) JP Morgan Presentation 2017medtechyNoch keine Bewertungen

- Sun Pharma 1QFY2013Dokument11 SeitenSun Pharma 1QFY2013Angel BrokingNoch keine Bewertungen

- Sun Pharma: Performance HighlightsDokument12 SeitenSun Pharma: Performance HighlightsAngel BrokingNoch keine Bewertungen

- United Health GroupDokument13 SeitenUnited Health GroupNazish Sohail100% (1)

- Medfield PharmaceuticalsDokument17 SeitenMedfield PharmaceuticalsSreya De100% (1)

- Glaxosmithkline Marketing Plan 1 Running Head: Glaxosmithkline Marketing PlanDokument23 SeitenGlaxosmithkline Marketing Plan 1 Running Head: Glaxosmithkline Marketing PlanAhmed AliNoch keine Bewertungen

- Market Outlook 26th September 2011Dokument3 SeitenMarket Outlook 26th September 2011Angel BrokingNoch keine Bewertungen

- Marketing ColgateDokument21 SeitenMarketing ColgateTanuweNoch keine Bewertungen

- As Traze NecaDokument216 SeitenAs Traze NecasaandeepchandraNoch keine Bewertungen

- DHGDokument7 SeitenDHGNguyễn Mai PhươngNoch keine Bewertungen

- Market Outlook 20th December 2011Dokument4 SeitenMarket Outlook 20th December 2011Angel BrokingNoch keine Bewertungen

- SAMPLE PFG - Macinic - Madalin - Badea - Badea - Macinic - Madalin - Planning - For - GrowthDokument16 SeitenSAMPLE PFG - Macinic - Madalin - Badea - Badea - Macinic - Madalin - Planning - For - GrowthleharNoch keine Bewertungen

- Presented By:-Trivesh Tripath Divyank Gupta Vibhor Bajpai Ankit Tiwari Ravi VermaDokument22 SeitenPresented By:-Trivesh Tripath Divyank Gupta Vibhor Bajpai Ankit Tiwari Ravi VermaNishant KumarNoch keine Bewertungen

- Unichem Fullerton April 13Dokument8 SeitenUnichem Fullerton April 13vicky168Noch keine Bewertungen

- Gale Researcher Guide for: The Role of Institutions and InfrastructureVon EverandGale Researcher Guide for: The Role of Institutions and InfrastructureNoch keine Bewertungen

- Baxter Annual Report 2012Dokument140 SeitenBaxter Annual Report 2012Uzair Ul GhaniNoch keine Bewertungen

- Marketing Section - CDokument11 SeitenMarketing Section - CMark AntanyNoch keine Bewertungen

- White Paper HealthCare MalaysiaDokument28 SeitenWhite Paper HealthCare MalaysiaNamitaNoch keine Bewertungen

- GSK MMSDokument5 SeitenGSK MMSHimanshu GuptaNoch keine Bewertungen

- Pharma Industry of BangladeshDokument38 SeitenPharma Industry of BangladeshAhAd SAmNoch keine Bewertungen

- Financial Statement Analysis of Beximco Pharma LTD On 2009Dokument14 SeitenFinancial Statement Analysis of Beximco Pharma LTD On 2009Marshal RichardNoch keine Bewertungen

- Healthcare Investing: Profiting from the New World of Pharma, Biotech, and Health Care ServicesVon EverandHealthcare Investing: Profiting from the New World of Pharma, Biotech, and Health Care ServicesNoch keine Bewertungen

- Miscellaneous Insurance Related Activity Revenues World Summary: Market Values & Financials by CountryVon EverandMiscellaneous Insurance Related Activity Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Top Stocks Special Edition - Ethical, Sustainable, Responsible: A Sharebuyer's Guide to ESG for Leading Australian CompaniesVon EverandTop Stocks Special Edition - Ethical, Sustainable, Responsible: A Sharebuyer's Guide to ESG for Leading Australian CompaniesNoch keine Bewertungen

- The Art of the Heal: A Health Executive’s Guide to Innovating HospitalsVon EverandThe Art of the Heal: A Health Executive’s Guide to Innovating HospitalsNoch keine Bewertungen

- Strategies for Successful Small Business Ownership in an Unstable EconomyVon EverandStrategies for Successful Small Business Ownership in an Unstable EconomyBewertung: 5 von 5 Sternen5/5 (2)

- Measurement of Sectoral Performance of Bangladeshi CompaniesDokument1 SeiteMeasurement of Sectoral Performance of Bangladeshi CompaniesHasib AhmedNoch keine Bewertungen

- Teacher Work Sample (Advanced Programs)Dokument4 SeitenTeacher Work Sample (Advanced Programs)Hasib AhmedNoch keine Bewertungen

- Answer To The Ques. No-1: Between $ 24477.92 To $ 37295.18 and We Are 95% Confident About ItDokument8 SeitenAnswer To The Ques. No-1: Between $ 24477.92 To $ 37295.18 and We Are 95% Confident About ItHasib AhmedNoch keine Bewertungen

- InflationDokument19 SeitenInflationvadhanavarunNoch keine Bewertungen

- Bus FRMTDokument2 SeitenBus FRMTHasib AhmedNoch keine Bewertungen

- List PDFDokument4 SeitenList PDFPam Welch HeuleNoch keine Bewertungen

- Mountain State With NotesDokument12 SeitenMountain State With NotesKeenan SafadiNoch keine Bewertungen

- Mastering Financial Modelling File ListDokument1 SeiteMastering Financial Modelling File ListNamo Nishant M PatilNoch keine Bewertungen

- Fin Past Years July 2021Dokument7 SeitenFin Past Years July 2021Khairi HuzaifiNoch keine Bewertungen

- Chapter-1: Working CapitalDokument47 SeitenChapter-1: Working Capitalchhita mani sorenNoch keine Bewertungen

- Market Leader 3rd Edition - Pre-Intermediate - TB - 17 - Unit 2 - Business BriefDokument1 SeiteMarket Leader 3rd Edition - Pre-Intermediate - TB - 17 - Unit 2 - Business BriefMinh ĐứcNoch keine Bewertungen

- AuditingDokument99 SeitenAuditingWen Xin GanNoch keine Bewertungen

- Sharpe Single Index ModelDokument11 SeitenSharpe Single Index ModelSai Mala100% (1)

- The Socionomic Theory of FinanceDokument93 SeitenThe Socionomic Theory of FinanceTHE TRADING SECTNoch keine Bewertungen

- Trading Account (Factorey) : Trading and Profit & Loss A/c With Different Groups & LedgerDokument2 SeitenTrading Account (Factorey) : Trading and Profit & Loss A/c With Different Groups & Ledgersameer maddubaigariNoch keine Bewertungen

- Taxation CPALE by WMGDokument19 SeitenTaxation CPALE by WMGJona Celle Castillo100% (1)

- Grofin BrochureDokument5 SeitenGrofin Brochurerainmaker1978Noch keine Bewertungen

- Deprival Value Lecture NotesDokument7 SeitenDeprival Value Lecture NotesTosin YusufNoch keine Bewertungen

- Afm Examiner's Report March June 2022Dokument15 SeitenAfm Examiner's Report March June 2022Abha AbhaNoch keine Bewertungen

- (Colliers) APAC Cap Rate Report Q4.2022Dokument6 Seiten(Colliers) APAC Cap Rate Report Q4.2022Khoi NguyenNoch keine Bewertungen

- Louw11 (Completing The Audit 1)Dokument24 SeitenLouw11 (Completing The Audit 1)ClaraNoch keine Bewertungen

- Neuvoo Cert CanDokument4 SeitenNeuvoo Cert CaniansyaNoch keine Bewertungen

- GR 194201Dokument7 SeitenGR 194201RajkumariNoch keine Bewertungen

- Nestle India Submitted By: GARIMA BHATTDokument2 SeitenNestle India Submitted By: GARIMA BHATTakshayNoch keine Bewertungen

- EFG Hermes Final TranscriptDokument7 SeitenEFG Hermes Final TranscriptPPPnewsNoch keine Bewertungen

- Cost - CH-1 Cma-IiDokument14 SeitenCost - CH-1 Cma-IiShimelis TesemaNoch keine Bewertungen

- P24139 Noria Commercial Paper Weekly 20211105Dokument29 SeitenP24139 Noria Commercial Paper Weekly 20211105NiltonBarbosaNoch keine Bewertungen

- Unit V Responsibility Accounting: Prepared by Dr. Arvind Rayalwar Assistant Professor Department of Commerce, SSM BeedDokument13 SeitenUnit V Responsibility Accounting: Prepared by Dr. Arvind Rayalwar Assistant Professor Department of Commerce, SSM BeedArvind RayalwarNoch keine Bewertungen

- Shareholders-Equity - Part 1Dokument29 SeitenShareholders-Equity - Part 1cj bNoch keine Bewertungen

- Assignment Module 6Dokument2 SeitenAssignment Module 6Denver Ergueza100% (2)

- Accounting For Installment SalesDokument16 SeitenAccounting For Installment SalesLeimonadeNoch keine Bewertungen

- Itr3 2018 PR1Dokument148 SeitenItr3 2018 PR1Harish Kumar MahavarNoch keine Bewertungen

- Offer Shift PRODDokument5 SeitenOffer Shift PRODyuygNoch keine Bewertungen

- Vanik Education PVT LTD: GSTIN - 21AAFCV2531H1ZQDokument1 SeiteVanik Education PVT LTD: GSTIN - 21AAFCV2531H1ZQNRUSINGHA PATRANoch keine Bewertungen

- Marriott International COPORATE STRATEGYDokument5 SeitenMarriott International COPORATE STRATEGYYasir Jatoi100% (1)