Beruflich Dokumente

Kultur Dokumente

Variance Analysis and Management by Exception

Hochgeladen von

Pankaj2cOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Variance Analysis and Management by Exception

Hochgeladen von

Pankaj2cCopyright:

Verfügbare Formate

Definition of Variance Analysis In accounting, a variance is defined as the difference between the expected amount and the actual

amount of costs or revenues. Variance analysis uses this standard or expected amount versus the actual amount to judge performance. The analysis includes an explanation of the difference between actual and expected figures as well as an evaluation as to why the variance may have occurred. The purpose of this detailed information is to assist managers in determining what may have gone right or wrong and to help in future decision-making. Favorable Variance A variance can be put into the favorable category when the results are better than expected. This means that revenues were more than the expected amount or costs were below the budgeted amount. In accounting practice, a favorable variance is shown by noting a letter F in parenthesis on the reports. A favorable variance might earn a bonus for a manger, or perhaps a move up the corporate ladder. Unfavorable Variance In contrast, the variance can be judged as unfavorable if the results are worse than expected. If the revenues were below expectations or the costs were higher than standard, the variance would be termed unfavorable or adverse. This would be denoted on the reports with the letter A or U, usually in parenthesis. Consistently creating an unfavorable variance might result in a manger being reprimanded or losing their job. However, the analysis is typically used to help mangers prevent a negative situation from recurring by providing information about what went wrong.

Variance Analysis and Management By Exception:

Variance analysis and performance reports are important elements of management by exception. Simply put, management by exception means that the manager's attention should be directed toward those parts of the organization where plans are not working out for reason or another. Time and effort should not be wasted focusing on those parts of the organization where things are going smoothly. The budgets and standards explained in this section of the web site (See standard costing and Variance Analysis) reflect management's plans. If all goes according to plans, there will be little difference between actual results and the results that would be expected according to the budgets and standards. If this happens, managers can concentrate on other issues. However, if actual results do not conform to the budget and to standards, the performance reporting system sends a signal to the management that an "exception" has occurred. This signal is in the form of a variance from the budget or standards.

However, are all variances worth investigating? The answer is no. Differences between actual results and what was expected will almost always occur. If every variance were investigated, management would waste a great deal of time tracking down nickel-anddime differences. Variances may occur for any of a variety of reasons - only some of which are significant and warrant management attention. For example, hotter than normal weather in the summer may result in higher than expected electrical bills for air conditioning. Or, workers may work slightly faster or slower on a particular day. Because of unpredictable random factors, one can expect that virtually every cost category will produce a variance of some kind. How should managers decide which variances are worth investigating? One clue is the size of the variance. A variance of $5 is probably not big enough to warrant attention, whereas a variance of $5000 might well be worth tracking down. Another clue is the size of the variance relative to the amount of spending involved. A variance that is only 0.1% of spending on an item is likely to be well within the bounds one would normally expect due to random factors. On the other hand, a variance of 10% of spending is much more likely to be a signal that something is basically wrong. A more dependable approach is to plot variance data on a statistical control chart, The basic idea underlying a statistical control chart is that some random fluctuations in variances from period to period are normal and to be expected even when costs are well under control. A variance should only be investigated when it is unusual relative to that normal level of random fluctuation. Typically the standard deviation of the variance is used as the measure of the normal level of fluctuations. A rule of thumb is adopted such as "investigate all variances that are more than X standard deviations from zero." In the control chart in example below, X is 1.0. That is the rule of thumb in this company is to investigate all variances that are more than one standard deviation in either direction (favorable or unfavorable) from zero. This means that the variances in weeks 7, 11, and 17 would have been investigated, but non of others.

.

Fav. Var. 0 Unfav.

. .

+1 Standard deviation 1 Standard deviation 19

. .

... . . . ---------------------------------------------. . . . . . . .

7 8 9 10 11 12 13 14 15 16 17 18

1 2 3 4 5 6

Week What value of X (standard deviation) should be chosen? The bigger the value of X, the wider the band of acceptable variances that would not be investigated. Thus the bigger the value of X, the less time will be spent tracking down variances, but the more likely it is that a real out of control situation would be overlooked. Ordinarily, if X is selected to be 1.0, roughly 30% of all variances will trigger an investigation even when there is no real problem. If X is set at 105, the figure drops to about 13%. If X is set at 2.0, the figure drops all the way to about 5%. Don't forget, however, that selecting a big value of X will result not only in fewer investigations but also a higher probability that a real problem will be overlooked. In addition to watching for unusually large variances, the pattern of the variances should be monitored. For example, a run of steadily mounting variances should trigger an investigation even though non of the variances is large enough by itself to warrant investigation.

Das könnte Ihnen auch gefallen

- Management by Exception and Variance Analysis Advantages and LimitationsDokument31 SeitenManagement by Exception and Variance Analysis Advantages and LimitationsMd HasanNoch keine Bewertungen

- Fin544 TUTORIAL and FormulaDokument9 SeitenFin544 TUTORIAL and FormulaYumi MayNoch keine Bewertungen

- ST Mary UniversityDokument4 SeitenST Mary UniversityRobbob JahloveNoch keine Bewertungen

- Sharpe RatioDokument5 SeitenSharpe RatioAlicia WhiteNoch keine Bewertungen

- Why Forecast Accuracy Is Hiding The Truth About PerformanceDokument4 SeitenWhy Forecast Accuracy Is Hiding The Truth About PerformanceListher SanchezNoch keine Bewertungen

- Understanding Risk Measures for Mutual FundsDokument14 SeitenUnderstanding Risk Measures for Mutual FundsDrishty BishtNoch keine Bewertungen

- How To Game Your Sharpe RatioDokument21 SeitenHow To Game Your Sharpe RatioCervino InstituteNoch keine Bewertungen

- Elvy EssayDokument2 SeitenElvy EssayEulaine Ann AlcantaraNoch keine Bewertungen

- Monitor and Review Budget - ActivityDokument8 SeitenMonitor and Review Budget - Activitycharith sai t 122013601002Noch keine Bewertungen

- Sharpe Ratio: Return (R)Dokument12 SeitenSharpe Ratio: Return (R)Mochu StoresNoch keine Bewertungen

- Sensitivity Analysis and Common Size Analysis: Presented By:-Presented ToDokument16 SeitenSensitivity Analysis and Common Size Analysis: Presented By:-Presented ToKsheerod ToshniwalNoch keine Bewertungen

- BetaDokument14 SeitenBetaDrishty BishtNoch keine Bewertungen

- Management Accounting Standard Costing and Variance AnalysisDokument8 SeitenManagement Accounting Standard Costing and Variance Analysismaha AkhtarNoch keine Bewertungen

- Understanding Budget VariancesDokument2 SeitenUnderstanding Budget VariancesRohit BajpaiNoch keine Bewertungen

- Budget Variance Analysis: How To Monitor, Calculate, and AnalyzeDokument3 SeitenBudget Variance Analysis: How To Monitor, Calculate, and AnalyzegreyNoch keine Bewertungen

- International Institute of Hotel Management: TopicDokument11 SeitenInternational Institute of Hotel Management: TopicbuNnYNoch keine Bewertungen

- Understanding Horizontal AnalysisDokument2 SeitenUnderstanding Horizontal AnalysisRille Estrada CabanesNoch keine Bewertungen

- Understanding Variance, Standard Deviation and RangeDokument4 SeitenUnderstanding Variance, Standard Deviation and RangemehNoch keine Bewertungen

- Tyranny of TargetsDokument6 SeitenTyranny of TargetsEdNoch keine Bewertungen

- Financial Analytics Toolkit: Financial Statement ForecastingDokument8 SeitenFinancial Analytics Toolkit: Financial Statement ForecastingMadhav Chowdary TumpatiNoch keine Bewertungen

- BetaDokument11 SeitenBetaDrishty BishtNoch keine Bewertungen

- Budget Analysis ReportDokument7 SeitenBudget Analysis ReportRahul KumarNoch keine Bewertungen

- Project Analysis and EvaluationDokument3 SeitenProject Analysis and Evaluationsakibsultan_308Noch keine Bewertungen

- Chap 11Dokument13 SeitenChap 11Nithin BhaskaranNoch keine Bewertungen

- StufDokument2 SeitenStufDenoh MfyniestNoch keine Bewertungen

- TASK-18: Submitted By: Anjali Kanwar Junior Research Analyst 22WM60 B2Dokument14 SeitenTASK-18: Submitted By: Anjali Kanwar Junior Research Analyst 22WM60 B2Anjali KanwarNoch keine Bewertungen

- Analysis of Variance PDFDokument37 SeitenAnalysis of Variance PDFSånju Raj KumårNoch keine Bewertungen

- Budgeting and Budgetary Control: by Jan F. JacobsDokument44 SeitenBudgeting and Budgetary Control: by Jan F. JacobsBrian NyamuzingaNoch keine Bewertungen

- How to Optimize Sharpe Ratio Using DerivativesDokument21 SeitenHow to Optimize Sharpe Ratio Using Derivativespraneet singhNoch keine Bewertungen

- Understanding Mutual Fund Performance MetricsDokument12 SeitenUnderstanding Mutual Fund Performance MetricsDrishty BishtNoch keine Bewertungen

- Lecture Notes, Financial StatementDokument5 SeitenLecture Notes, Financial StatementdZOAVIT GamingNoch keine Bewertungen

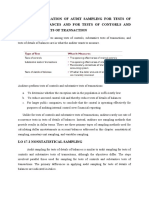

- Lo 17-1 Comparation of Audit Sampling For Tests of Details of Balances and For Tests of Contorls and Substantive Tests of TransactionDokument11 SeitenLo 17-1 Comparation of Audit Sampling For Tests of Details of Balances and For Tests of Contorls and Substantive Tests of TransactionAlfiya PutriNoch keine Bewertungen

- Cost of Goods Sold: 1. Gross Profit MarginDokument10 SeitenCost of Goods Sold: 1. Gross Profit MarginYuga ShiniNoch keine Bewertungen

- Financial AnalysisDokument49 SeitenFinancial Analysisvinay dugarNoch keine Bewertungen

- Veena Iyer FSADokument5 SeitenVeena Iyer FSAUdit BansalNoch keine Bewertungen

- MNGT Lesson 3 4Dokument5 SeitenMNGT Lesson 3 4GloryMae MercadoNoch keine Bewertungen

- Forecasting Ch. 3Dokument11 SeitenForecasting Ch. 3Shaon KhanNoch keine Bewertungen

- Budgeting and Budgetary ControlDokument44 SeitenBudgeting and Budgetary ControlPrâtèék Shâh100% (1)

- Part 8. Topics in Capital BudgetingDokument8 SeitenPart 8. Topics in Capital BudgetingLiyana ChuaNoch keine Bewertungen

- Why Projected Financial Statements Should Be A Regular Part of Your Accounting?Dokument4 SeitenWhy Projected Financial Statements Should Be A Regular Part of Your Accounting?Brill brianNoch keine Bewertungen

- DrssDokument13 SeitenDrssDrishty BishtNoch keine Bewertungen

- What Is Standard Deviation?Dokument4 SeitenWhat Is Standard Deviation?MikaNoch keine Bewertungen

- What Statistically Significant Mean in A/B TestingDokument6 SeitenWhat Statistically Significant Mean in A/B TestingMohit PalialNoch keine Bewertungen

- Calculation of Sharpe RatioDokument23 SeitenCalculation of Sharpe RatioVignesh HollaNoch keine Bewertungen

- Ratio Analysis Is Very Useful Tool of Management AccountingDokument13 SeitenRatio Analysis Is Very Useful Tool of Management AccountingSonal PorwalNoch keine Bewertungen

- Understanding MaterialityDokument2 SeitenUnderstanding MaterialitySjifa AuliaNoch keine Bewertungen

- Budget PDFDokument61 SeitenBudget PDFRanjulaNoch keine Bewertungen

- Sell Side AnalystsDokument39 SeitenSell Side Analystsmatt1208Noch keine Bewertungen

- Basic Statistical SamplingDokument5 SeitenBasic Statistical SamplingAnthony HollyNoch keine Bewertungen

- Tracking Signal and Method To Control Positive Tracking Signal BiasnessDokument4 SeitenTracking Signal and Method To Control Positive Tracking Signal BiasnessYashashvi RastogiNoch keine Bewertungen

- INTRO TO FORECASTING TECHNIQUESDokument6 SeitenINTRO TO FORECASTING TECHNIQUESGela LaceronaNoch keine Bewertungen

- Regression Analysis in Business AnalyticsDokument14 SeitenRegression Analysis in Business AnalyticsUsama NajamNoch keine Bewertungen

- Operation AS2Dokument2 SeitenOperation AS2Kpop LoversNoch keine Bewertungen

- BUS 475 Capstone Final Examination Part 2 Answers On Transweb E TutorsDokument10 SeitenBUS 475 Capstone Final Examination Part 2 Answers On Transweb E Tutorstranswebetutors3Noch keine Bewertungen

- Net Present Value - NPV: Capital BudgetingDokument4 SeitenNet Present Value - NPV: Capital BudgetingCris Marquez100% (1)

- Risk Analysis, Real Options and Capital Budgeting PDFDokument62 SeitenRisk Analysis, Real Options and Capital Budgeting PDFAMIT SINHA MA ECO DEL 2022-24Noch keine Bewertungen

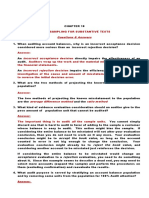

- Audit Sampling TechniquesDokument10 SeitenAudit Sampling TechniquesMjVerba100% (1)

- Farm Financial RatiosDokument10 SeitenFarm Financial Ratiosrobert_tignerNoch keine Bewertungen

- SD Final 2Dokument21 SeitenSD Final 2PRAVEENKUMAR CNoch keine Bewertungen

- Textbook of Urgent Care Management: Chapter 12, Pro Forma Financial StatementsVon EverandTextbook of Urgent Care Management: Chapter 12, Pro Forma Financial StatementsNoch keine Bewertungen

- Ans 3 Flow ProdctnDokument1 SeiteAns 3 Flow ProdctnPankaj2cNoch keine Bewertungen

- Job ProductionDokument1 SeiteJob ProductionPankaj2cNoch keine Bewertungen

- SEBI ActDokument2 SeitenSEBI ActPankaj2c100% (1)

- RegressionDokument3 SeitenRegressionPankaj2cNoch keine Bewertungen

- Objectives of Research: To Gain To Portray - To DetermineDokument4 SeitenObjectives of Research: To Gain To Portray - To DeterminePankaj2cNoch keine Bewertungen

- SamplingDokument3 SeitenSamplingPankaj2cNoch keine Bewertungen

- Payment of Wages ACT, 1936: Presented byDokument17 SeitenPayment of Wages ACT, 1936: Presented byPankaj2cNoch keine Bewertungen

- Research ProcessDokument5 SeitenResearch ProcessPankaj2cNoch keine Bewertungen

- CorrelationDokument2 SeitenCorrelationPankaj2cNoch keine Bewertungen

- Index NumberDokument3 SeitenIndex NumberPankaj2cNoch keine Bewertungen

- Non Parametric TestDokument3 SeitenNon Parametric TestPankaj2cNoch keine Bewertungen

- Characteristics of HypothesisDokument3 SeitenCharacteristics of HypothesisPankaj2cNoch keine Bewertungen

- Performance BudgetingDokument2 SeitenPerformance BudgetingPankaj2cNoch keine Bewertungen

- Parametric TestDokument2 SeitenParametric TestPankaj2cNoch keine Bewertungen

- Multi VariateDokument4 SeitenMulti VariatePankaj2cNoch keine Bewertungen

- BudgetDokument4 SeitenBudgetPankaj2cNoch keine Bewertungen

- Types of StandardDokument2 SeitenTypes of StandardPankaj2cNoch keine Bewertungen

- Financial LeverageDokument1 SeiteFinancial LeveragePankaj2cNoch keine Bewertungen

- Marginal Costing: Definition: (CIMA London)Dokument4 SeitenMarginal Costing: Definition: (CIMA London)Pankaj2cNoch keine Bewertungen

- Diff. Marginal & AbsorptnDokument2 SeitenDiff. Marginal & AbsorptnPankaj2cNoch keine Bewertungen

- Imprtnce & MSRMNT of Cost of CapitalDokument2 SeitenImprtnce & MSRMNT of Cost of CapitalPankaj2cNoch keine Bewertungen

- Absorption Costing Technique Is Also Termed As Traditional or Full Cost MethodDokument2 SeitenAbsorption Costing Technique Is Also Termed As Traditional or Full Cost MethodPankaj2cNoch keine Bewertungen

- Absorption Costing - OverviewDokument24 SeitenAbsorption Costing - OverviewEdwin LawNoch keine Bewertungen

- Zero BudgetingDokument3 SeitenZero BudgetingPankaj2cNoch keine Bewertungen

- Break-Even (Or Cost-Volume Profit) AnalysisDokument3 SeitenBreak-Even (Or Cost-Volume Profit) AnalysisPankaj2cNoch keine Bewertungen

- Standard CostingDokument4 SeitenStandard CostingPankaj2cNoch keine Bewertungen

- Operating LeverageDokument2 SeitenOperating LeveragePankaj2cNoch keine Bewertungen

- Capital StructureDokument3 SeitenCapital StructurePankaj2cNoch keine Bewertungen

- Ntre, Scope Accntng MNGMNTDokument4 SeitenNtre, Scope Accntng MNGMNTPankaj2cNoch keine Bewertungen

- CSR of Cadbury LTDDokument10 SeitenCSR of Cadbury LTDKinjal BhanushaliNoch keine Bewertungen

- 2020 Book WorkshopOnFrontiersInHighEnerg PDFDokument456 Seiten2020 Book WorkshopOnFrontiersInHighEnerg PDFSouravDeyNoch keine Bewertungen

- Environmental Science PDFDokument118 SeitenEnvironmental Science PDFJieyan OliverosNoch keine Bewertungen

- FOCGB4 Utest VG 5ADokument1 SeiteFOCGB4 Utest VG 5Asimple footballNoch keine Bewertungen

- Product Packaging, Labelling and Shipping Plans: What's NextDokument17 SeitenProduct Packaging, Labelling and Shipping Plans: What's NextShameer ShahNoch keine Bewertungen

- Step-By-Step Guide To Essay WritingDokument14 SeitenStep-By-Step Guide To Essay WritingKelpie Alejandria De OzNoch keine Bewertungen

- Statement of The Problem: Notre Dame of Marbel University Integrated Basic EducationDokument6 SeitenStatement of The Problem: Notre Dame of Marbel University Integrated Basic Educationgab rielleNoch keine Bewertungen

- GCSE Ratio ExercisesDokument2 SeitenGCSE Ratio ExercisesCarlos l99l7671Noch keine Bewertungen

- Virtue Ethics: Aristotle and St. Thomas Aquinas: DiscussionDokument16 SeitenVirtue Ethics: Aristotle and St. Thomas Aquinas: DiscussionCarlisle ParkerNoch keine Bewertungen

- RumpelstiltskinDokument7 SeitenRumpelstiltskinAndreia PintoNoch keine Bewertungen

- Transformation of Chinese ArchaeologyDokument36 SeitenTransformation of Chinese ArchaeologyGilbert QuNoch keine Bewertungen

- ACS Tech Manual Rev9 Vol1-TACTICS PDFDokument186 SeitenACS Tech Manual Rev9 Vol1-TACTICS PDFMihaela PecaNoch keine Bewertungen

- 05 Gregor and The Code of ClawDokument621 Seiten05 Gregor and The Code of ClawFaye Alonzo100% (7)

- Education: Address: Mansoura, EL Dakhelia, Egypt EmailDokument3 SeitenEducation: Address: Mansoura, EL Dakhelia, Egypt Emailmohammed sallemNoch keine Bewertungen

- Astrology - House SignificationDokument4 SeitenAstrology - House SignificationsunilkumardubeyNoch keine Bewertungen

- B2 WBLFFDokument10 SeitenB2 WBLFFflickrboneNoch keine Bewertungen

- Digi-Notes-Maths - Number-System-14-04-2017 PDFDokument9 SeitenDigi-Notes-Maths - Number-System-14-04-2017 PDFMayank kumarNoch keine Bewertungen

- Chapter 12 The Incredible Story of How The Great Controversy Was Copied by White From Others, and Then She Claimed It To Be Inspired.Dokument6 SeitenChapter 12 The Incredible Story of How The Great Controversy Was Copied by White From Others, and Then She Claimed It To Be Inspired.Barry Lutz Sr.Noch keine Bewertungen

- PIA Project Final PDFDokument45 SeitenPIA Project Final PDFFahim UddinNoch keine Bewertungen

- Bandwidth and File Size - Year 8Dokument2 SeitenBandwidth and File Size - Year 8Orlan LumanogNoch keine Bewertungen

- Contract Costing and Operating CostingDokument13 SeitenContract Costing and Operating CostingGaurav AggarwalNoch keine Bewertungen

- Classification of Boreal Forest Ecosystem Goods and Services in FinlandDokument197 SeitenClassification of Boreal Forest Ecosystem Goods and Services in FinlandSivamani SelvarajuNoch keine Bewertungen

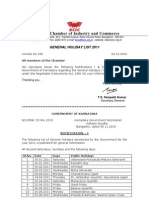

- BCIC General Holiday List 2011Dokument4 SeitenBCIC General Holiday List 2011Srikanth DLNoch keine Bewertungen

- UNIT 2 - Belajar Bahasa Inggris Dari NolDokument10 SeitenUNIT 2 - Belajar Bahasa Inggris Dari NolDyah Wahyu Mei Ima MahananiNoch keine Bewertungen

- Tata Hexa (2017-2019) Mileage (14 KML) - Hexa (2017-2019) Diesel Mileage - CarWaleDokument1 SeiteTata Hexa (2017-2019) Mileage (14 KML) - Hexa (2017-2019) Diesel Mileage - CarWaleMahajan VickyNoch keine Bewertungen

- Pale Case Digest Batch 2 2019 2020Dokument26 SeitenPale Case Digest Batch 2 2019 2020Carmii HoNoch keine Bewertungen

- Corporate Law Scope and RegulationDokument21 SeitenCorporate Law Scope and RegulationBasit KhanNoch keine Bewertungen

- Episode 8Dokument11 SeitenEpisode 8annieguillermaNoch keine Bewertungen

- Administrative Law SyllabusDokument14 SeitenAdministrative Law SyllabusKarl Lenin BenignoNoch keine Bewertungen

- Surah 25. Al-Furqan, Ayat 63-69 PDFDokument1 SeiteSurah 25. Al-Furqan, Ayat 63-69 PDFMusaab MustaphaNoch keine Bewertungen