Beruflich Dokumente

Kultur Dokumente

Module - IsA 580

Hochgeladen von

Atif RehmanOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Module - IsA 580

Hochgeladen von

Atif RehmanCopyright:

Verfügbare Formate

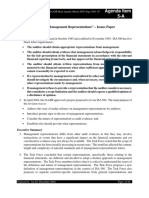

ISA 580, Written Representations ISA Implementation Support Module Notes for Select Slides The following supporting

notes accompany the PowerPoint slides for this module and do not amend or override the ISAs, the texts of which alone are authoritative. Reading these notes is not a substitute for reading the ISAs. The notes are not meant to be exhaustive and reference to the ISAs themselves should always be made. In conducting an audit in accordance with ISAs, the auditor is required to comply with all the ISAs that are relevant to the engagement.

Slide 4 Notes Basis for requiring written representations o Old approach of obtaining written representations when other audit evidence cannot reasonably be expected to exist no longer appropriate. Main reason is that this may encourage over-reliance on written representations to support audit opinion. o New standard requires written representations only to support other audit evidence. o The IAASBs view is that circumstances where other audit evidence cannot reasonably be expected to exist would be extremely rare. If these circumstances do arise, consider the effect of the inability to obtain audit evidence on the audit report. Slide 6 Notes Source of written representations o This change aligns with the public focus on greater accountability from management. o Those bearing key responsibilities for the financial statements ordinarily are the entitys CEO or CFO, or equivalent. If those charged with governance have responsibility for the financial statements, written representations may be obtained from them. o Management is not expected to know everything about the financial statements to

Module ISA 580 Notes for Select Slides

be able to provide the relevant written representations. The expectation is that management would have sufficient knowledge of the preparation of the financial statements and the assertions in them to provide the written representations. o In specialized areas, management may need to make appropriate inquiries of individuals within the entity who have relevant knowledge E.g. an actuary in relation to estimates of pension liabilities, or internal counsel in relation to provisions for legal claims o To ensure that management makes informed representations, the auditor may request management to include in the written representations a confirmation that management has made appropriate inquiries for purposes of providing the written representations. o There is no expectation that the entity should establish a new formal internal system or process to enable management to provide the written representations. Slide 7 Notes Managements responsibilities o The new standard introduces a fundamental change in approach to obtaining written representations about managements responsibilities. It no longer requires the auditor to obtain audit evidence regarding managements acknowledgement of its responsibility for fair presentation of the financial statements. This requirement has been moved to ISA 210 in the context of agreeing the terms of engagement. Instead, the standard introduces new requirements for written representations from management that it has: Fulfilled its responsibility for the preparation and, where relevant, fair presentation of the financial statements; and Provided the auditor with all relevant information and access as agreed in the terms of the engagement. o This change in approach emphasizes the importance of confirming the premise on which the audit has been conducted, i.e. that management has acknowledged and understand its responsibilities for: The preparation and fair presentation of the financial statements; Necessary related internal control; and Providing the auditor with all relevant information and access.

o It would not be possible for the auditor to judge, on the basis of other evidence alone, whether management has prepared and presented financial statements and provided all relevant information and access on the basis of the agreed acknowledgement and understanding of those responsibilities.

2/5

Module ISA 580 Notes for Select Slides

o IAASBs view is that audit evidence obtained during the audit that management has fulfilled the responsibilities in the premise cannot be sufficient on its own without direct written confirmation from management that it believes it has fulfilled those responsibilities. Slide 8 Notes No requirement for written representation regarding fulfillment of managements responsibility regarding internal control o Fulfillment of managements responsibility for internal control is implicit in managements confirmation that it has fulfilled its responsibility for the preparation and presentation of the financial statements. o Nevertheless, depending on the circumstances, it may be appropriate to consider whether written representations are needed from management that it has communicated to the auditor all deficiencies in internal control of which management is aware. Slide 9 Notes Management fails or refuses to provide the written representations regarding fulfillment of its responsibilities o Such failure would represent strong evidence that there may be unresolved issues regarding the financial statements or information provided to the auditor, even if the auditor may have formed the impression up to that point in the engagement that the financial statements are appropriate and information provided by management is complete. o Substantive audit procedures alone cannot adequately respond to these risks to completeness. o Because potential misstatements due to a lack of completeness could be pervasive to financial statements, a disclaimer of opinion is the only appropriate response. Slide 10 Notes Specific written representations required by other ISAs o Other ISAs mandate written representations for specific audit areas, guided by the overarching principles in ISA 580, e.g. ISA 240 in relation to fraud ISA 450 in relation to the effects of uncorrected misstatements ISA 550 in relation to related party transactions

Specific written representations auditor believes are necessary

3/5

Module ISA 580 Notes for Select Slides

o It may be necessary in the particular engagement circumstances to obtain specific written representations to support other audit evidence regarding: Specific aspects of the financial statements. Specific assertions in the financial statements.

o Written representations about specific aspects of the financial statements include, for example: Whether the selection and application of accounting policies are appropriate. Whether the entity has satisfactory title to, or control over, its assets.

Whether all actual and continent liabilities have been appropriately recorded or disclosed. These supplement, but do not form part of, the written representation that should be obtained regarding managements fulfillment of its responsibility for the preparation and presentation of the financial statements. o Written representations regarding specific assertions support the auditors understanding from other audit evidence regarding managements judgment or intent about specific matters, e.g. if managements intent is particularly important in relation to the valuation of specific investments. Obtaining evidence regarding management judgments and intentions may involve considering one or more of the following: Managements past history in carrying out its stated intentions. Managements reasons for choosing a particular course of action. The entitys ability to pursue a specific course of action.

The existence (or lack) of any other information that the auditor might have obtained during the audit that may be inconsistent with managements judgment or intent. Important to bear in mind that while a written representation from management regarding a specific assertion provides necessary audit evidence, it does not on its own provide sufficient appropriate audit evidence for that assertion.

Copyright October 2010 by the International Federation of Accountants (IFAC). All rights reserved. Permission is granted to make copies of this work provided that such copies are for use in academic classrooms or for personal use and are not sold or disseminated and provided that each copy bears the following credit line: Copyright October 2010 by the International Federation of Accountants (IFAC). All rights reserved. Used with permission of IFAC. Contact permissions@ifac.org for permission to reproduce, store, or transmit this work. Otherwise, written permission from IFAC is required to reproduce, store, or transmit, or to make other similar uses of, this work, except as permitted by law. Contact permissions@ifac.org. ISBN: 978-1-60815-073-1

4/5

Module ISA 580 Notes for Select Slides

5/5

Das könnte Ihnen auch gefallen

- Principles of Administrative LawDokument24 SeitenPrinciples of Administrative LawAtif Rehman100% (1)

- Acct3610 - Ups IpoDokument4 SeitenAcct3610 - Ups Iponessawho67% (6)

- CAIA Level 2Dokument82 SeitenCAIA Level 2sandyag321100% (1)

- Hilton Balanced Score Card2Dokument3 SeitenHilton Balanced Score Card2Yogesh PatelNoch keine Bewertungen

- Marriott-Corporation - HBR CaseDokument4 SeitenMarriott-Corporation - HBR CaseAsif RahmanNoch keine Bewertungen

- BMA 12e PPT Ch1Dokument20 SeitenBMA 12e PPT Ch1sachin199021Noch keine Bewertungen

- Psa 580Dokument11 SeitenPsa 580shambiruarNoch keine Bewertungen

- Question 1Dokument8 SeitenQuestion 1Gift MoyoNoch keine Bewertungen

- Evaluation of MisstatementsDokument6 SeitenEvaluation of MisstatementsAhmad FarooqNoch keine Bewertungen

- The Audit Process - Final ReviewDokument5 SeitenThe Audit Process - Final ReviewFazlan Muallif ResnuliusNoch keine Bewertungen

- Audit I - Chapter 6, Audit Report TDokument30 SeitenAudit I - Chapter 6, Audit Report TKalkayeNoch keine Bewertungen

- Management Representation Letter IAS 580Dokument20 SeitenManagement Representation Letter IAS 580Mehdi LombardoNoch keine Bewertungen

- Disclaimer: © The Institute of Chartered Accountants of IndiaDokument17 SeitenDisclaimer: © The Institute of Chartered Accountants of IndiaRakesh SoniNoch keine Bewertungen

- Audit Report: Learning OutcomesDokument63 SeitenAudit Report: Learning OutcomesChahil BapnaNoch keine Bewertungen

- Chapter 02 FSADokument21 SeitenChapter 02 FSAUmar AbbasNoch keine Bewertungen

- Solutions Manual: 1st EditionDokument29 SeitenSolutions Manual: 1st EditionJunior Waqairasari100% (3)

- Audit UNIT 6Dokument7 SeitenAudit UNIT 6Nigussie BerhanuNoch keine Bewertungen

- Aas 2Dokument3 SeitenAas 2Rishabh GuptaNoch keine Bewertungen

- Audit ReportDokument62 SeitenAudit ReportPranay NavvulaNoch keine Bewertungen

- 19 Special Audit & Non-Audit ConsiderationsDokument7 Seiten19 Special Audit & Non-Audit Considerationsrandomlungs121223Noch keine Bewertungen

- Aas 16 Going ConcernDokument5 SeitenAas 16 Going ConcernRishabh GuptaNoch keine Bewertungen

- SA 700, 705 and 706: Reporting StandardsDokument125 SeitenSA 700, 705 and 706: Reporting StandardsGopal FCANoch keine Bewertungen

- Auditing I CH 6Dokument9 SeitenAuditing I CH 6Abrha636Noch keine Bewertungen

- Isa 700Dokument8 SeitenIsa 700AdzNoch keine Bewertungen

- Audit Summary Chapter 25Dokument7 SeitenAudit Summary Chapter 25bless villahermosaNoch keine Bewertungen

- Going Concern Uncertainty DisclosureDokument4 SeitenGoing Concern Uncertainty Disclosurenancy amooNoch keine Bewertungen

- Psa 570Dokument17 SeitenPsa 570Ronald ParrenoNoch keine Bewertungen

- Types of Audit OpinionDokument2 SeitenTypes of Audit OpinionPRINCESS MAY ADAMNoch keine Bewertungen

- Week 5Dokument7 SeitenWeek 5Anonymous HlqjrhNoch keine Bewertungen

- Audit OpinionDokument39 SeitenAudit OpinionJerah TorrejosNoch keine Bewertungen

- Comprehensively_Prepared_Document_of_the_Questions_and_Answers_for_the_Interview_of_Senior_Auditor.docx_filename_= UTF-8''Comprehensively Prepared Document of the Questions and Answers for the Interview of Senior AuDokument42 SeitenComprehensively_Prepared_Document_of_the_Questions_and_Answers_for_the_Interview_of_Senior_Auditor.docx_filename_= UTF-8''Comprehensively Prepared Document of the Questions and Answers for the Interview of Senior AumalaknisarkakarNoch keine Bewertungen

- 110 - Questions Extract PDFDokument15 Seiten110 - Questions Extract PDFsamyNoch keine Bewertungen

- NajirDokument50 SeitenNajirnajirahmad.coxsNoch keine Bewertungen

- Chapter 11 Audit Reports On Financial StatementsDokument54 SeitenChapter 11 Audit Reports On Financial StatementsKayla Sophia PatioNoch keine Bewertungen

- 74767bos60492 cp8Dokument102 Seiten74767bos60492 cp8Vignesh VigneshNoch keine Bewertungen

- Audit Report and OpinionDokument6 SeitenAudit Report and Opinionspilled seasonNoch keine Bewertungen

- Claveria-Pa32 Govt AudtDokument4 SeitenClaveria-Pa32 Govt AudtEleonor ClaveriaNoch keine Bewertungen

- Isa 210Dokument14 SeitenIsa 210ranibarNoch keine Bewertungen

- Chapter 11Dokument9 SeitenChapter 11Em-em ValNoch keine Bewertungen

- AT 13 Other Assurance and Related ServicesDokument6 SeitenAT 13 Other Assurance and Related ServicesPrincess Mary Joy LadagaNoch keine Bewertungen

- FRA Auditors' ReportDokument16 SeitenFRA Auditors' ReportRafiullah MangalNoch keine Bewertungen

- Chapter - 5Dokument11 SeitenChapter - 5dejen mengstieNoch keine Bewertungen

- "Representations by Management", Issued by The Council of The Institute of CharteredDokument7 Seiten"Representations by Management", Issued by The Council of The Institute of CharteredRishabh GuptaNoch keine Bewertungen

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsVon EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNoch keine Bewertungen

- Completion and Review (Chapter 9)Dokument10 SeitenCompletion and Review (Chapter 9)Diana TuckerNoch keine Bewertungen

- Audit Practice and Assurance Services - A1.4 PDFDokument94 SeitenAudit Practice and Assurance Services - A1.4 PDFFRANCOIS NKUNDIMANANoch keine Bewertungen

- Psa 800 PDFDokument20 SeitenPsa 800 PDFshambiruarNoch keine Bewertungen

- Chapter 11 THE AUDITORS REPORT ON FINANCIALDokument95 SeitenChapter 11 THE AUDITORS REPORT ON FINANCIALJay LloydNoch keine Bewertungen

- AUDMOD5 Reports of Other Assurance and RelateDokument7 SeitenAUDMOD5 Reports of Other Assurance and RelateJohn Archie AntonioNoch keine Bewertungen

- Acctg 163 Auditing Theory Review 6 TmhsDokument11 SeitenAcctg 163 Auditing Theory Review 6 TmhsXaviery John Martinez LunaNoch keine Bewertungen

- Philippine Standard On Auditing 200Dokument4 SeitenPhilippine Standard On Auditing 200Zach RiversNoch keine Bewertungen

- Qualified Audit ReportsDokument4 SeitenQualified Audit ReportsHafinizam Nor AzmiNoch keine Bewertungen

- 13 Reports - Other Assurance and Related ServicesDokument9 Seiten13 Reports - Other Assurance and Related ServicesDia Mae GenerosoNoch keine Bewertungen

- Discussed September 17 - Extract of ISA 570 - Wording Responsibilities of Management and Auditor SeperateDokument4 SeitenDiscussed September 17 - Extract of ISA 570 - Wording Responsibilities of Management and Auditor Seperatesarmalarun20Noch keine Bewertungen

- 03 FS Audit OverviewDokument4 Seiten03 FS Audit Overviewrandomlungs121223Noch keine Bewertungen

- A Project Report On:: Third Year: Sixth SemesterDokument11 SeitenA Project Report On:: Third Year: Sixth SemesterNikhl MahajanNoch keine Bewertungen

- Types of Audit Opinions PDFDokument7 SeitenTypes of Audit Opinions PDFIamRuzehl VillaverNoch keine Bewertungen

- Auditor's ReportDokument11 SeitenAuditor's ReportLovenia M. FerrerNoch keine Bewertungen

- (At) Other ReportsDokument8 Seiten(At) Other ReportsCukeeNoch keine Bewertungen

- Audit GroupDokument17 SeitenAudit GroupYoseph MekonnenNoch keine Bewertungen

- 17the Auditor's ReportDokument8 Seiten17the Auditor's ReportIrish SanchezNoch keine Bewertungen

- The New Auditor's Report:: Revealing Key Audit MattersDokument18 SeitenThe New Auditor's Report:: Revealing Key Audit MattersMai RosaupanNoch keine Bewertungen

- Basic Concepts in AuditingDokument29 SeitenBasic Concepts in Auditinganon_672065362100% (1)

- Append To The Audit File After Final Assembly - Summary Financial Statements July 2019Dokument4 SeitenAppend To The Audit File After Final Assembly - Summary Financial Statements July 2019sona abrahamyanNoch keine Bewertungen

- Hand OutDokument8 SeitenHand OutziahnepostreliNoch keine Bewertungen

- Auditing (Arens) 14e Chapter 4 PowerPoint SlidesDokument36 SeitenAuditing (Arens) 14e Chapter 4 PowerPoint SlidesMohsin AliNoch keine Bewertungen

- Solved Assignment Intermediate English Code 386 Autumn 2018: Written by Daniyal Iqbal Present byDokument6 SeitenSolved Assignment Intermediate English Code 386 Autumn 2018: Written by Daniyal Iqbal Present byAtif RehmanNoch keine Bewertungen

- Assignment 1424 2 Autumn 2018Dokument8 SeitenAssignment 1424 2 Autumn 2018Atif Rehman33% (3)

- Assignment 1423 2Dokument7 SeitenAssignment 1423 2Atif Rehman100% (1)

- Assignment 1 B.ed Code 8603Dokument11 SeitenAssignment 1 B.ed Code 8603Atif Rehman67% (3)

- Assignment 2 B.ed Code 8601Dokument14 SeitenAssignment 2 B.ed Code 8601Atif Rehman0% (1)

- Solved Assignment Intermediate English Code 386 Autumn 2018: Written by Daniyal Iqbal Present byDokument6 SeitenSolved Assignment Intermediate English Code 386 Autumn 2018: Written by Daniyal Iqbal Present byAtif RehmanNoch keine Bewertungen

- Assignment 2 B.ed Code 8605Dokument12 SeitenAssignment 2 B.ed Code 8605Atif RehmanNoch keine Bewertungen

- Void and Voidable ContractDokument4 SeitenVoid and Voidable ContractAtif Rehman100% (1)

- Assignment 2 B.ed Code 8604Dokument15 SeitenAssignment 2 B.ed Code 8604Atif Rehman100% (5)

- Crime - Tort and Essentials of CrimeDokument4 SeitenCrime - Tort and Essentials of CrimeAtif RehmanNoch keine Bewertungen

- 1 827Dokument14 Seiten1 827Atif Rehman100% (1)

- Discharge of TortDokument3 SeitenDischarge of TortAtif Rehman100% (2)

- Assignment 1 B.ed Code 8605Dokument12 SeitenAssignment 1 B.ed Code 8605Atif RehmanNoch keine Bewertungen

- Assignment 1 B.ed Code 8604Dokument9 SeitenAssignment 1 B.ed Code 8604Atif Rehman100% (6)

- The Workmen's Compensation Act, 1923Dokument6 SeitenThe Workmen's Compensation Act, 1923Atif RehmanNoch keine Bewertungen

- 1 - 1421 - Autumn 2018Dokument13 Seiten1 - 1421 - Autumn 2018Atif Rehman100% (1)

- The Qanun-e-Shahadat Order, 1984Dokument54 SeitenThe Qanun-e-Shahadat Order, 1984Atif Rehman100% (1)

- 1 - 8617 - Autumn 2018Dokument18 Seiten1 - 8617 - Autumn 2018Atif RehmanNoch keine Bewertungen

- The Urban Rent Restriction Ordinance, 1959Dokument14 SeitenThe Urban Rent Restriction Ordinance, 1959Atif RehmanNoch keine Bewertungen

- B.ed-Ade Autumn 2018Dokument6 SeitenB.ed-Ade Autumn 2018Atif Rehman0% (1)

- The Art of PleadingsDokument29 SeitenThe Art of PleadingsAtif Rehman0% (1)

- The Suit Valuation Act, 1887Dokument2 SeitenThe Suit Valuation Act, 1887Atif RehmanNoch keine Bewertungen

- The Code of Criminal Procedure, 1898Dokument53 SeitenThe Code of Criminal Procedure, 1898Atif RehmanNoch keine Bewertungen

- The Stamp Act, 1899Dokument7 SeitenThe Stamp Act, 1899Atif RehmanNoch keine Bewertungen

- The Limitation Act, 1908Dokument6 SeitenThe Limitation Act, 1908Atif RehmanNoch keine Bewertungen

- The Court Fees Act, 1870Dokument9 SeitenThe Court Fees Act, 1870Atif Rehman100% (1)

- The West Pakistan Industrial and Commercial Employment (Standing Orders) Ordinance, 1968Dokument15 SeitenThe West Pakistan Industrial and Commercial Employment (Standing Orders) Ordinance, 1968Atif RehmanNoch keine Bewertungen

- The Industrial Relations Ordinance, 1969Dokument17 SeitenThe Industrial Relations Ordinance, 1969Atif RehmanNoch keine Bewertungen

- The Correct Answers Are in Bold TextDokument3 SeitenThe Correct Answers Are in Bold TextMichael WilsonNoch keine Bewertungen

- Journal of Business Research: Christoph Burmann, Marc Jost-Benz, Nicola RileyDokument8 SeitenJournal of Business Research: Christoph Burmann, Marc Jost-Benz, Nicola Rileykikiki123Noch keine Bewertungen

- Met Smart GoldDokument10 SeitenMet Smart GoldyatinthoratscrbNoch keine Bewertungen

- Tutorial - The Time Value of MoneyDokument6 SeitenTutorial - The Time Value of MoneyFahmi CANoch keine Bewertungen

- Accounting Standard 1 PDFDokument4 SeitenAccounting Standard 1 PDFChristopher Jacob MurmuNoch keine Bewertungen

- OTCEIDokument11 SeitenOTCEIvisa_kpNoch keine Bewertungen

- KW 4Dokument50 SeitenKW 4Roshan NanjundaiahNoch keine Bewertungen

- Investment and Portfolio Management Session 3 QuestionsDokument2 SeitenInvestment and Portfolio Management Session 3 Questions李佳南Noch keine Bewertungen

- As Unnit 5 Class NotesDokument38 SeitenAs Unnit 5 Class NotesAlishan VertejeeNoch keine Bewertungen

- FlashMemory SLNDokument6 SeitenFlashMemory SLNShubham BhatiaNoch keine Bewertungen

- Stanton Industries SolutionDokument2 SeitenStanton Industries SolutionBusi LutaNoch keine Bewertungen

- Zero Balance Form - SFLBDokument3 SeitenZero Balance Form - SFLBroshcrazyNoch keine Bewertungen

- Debt CovenantDokument5 SeitenDebt CovenantSakinKhanNoch keine Bewertungen

- Social Investment ManualDokument56 SeitenSocial Investment ManualWorld Economic Forum82% (66)

- AFAB Depreciation Run ExecutionDokument18 SeitenAFAB Depreciation Run ExecutionraghuNoch keine Bewertungen

- Compound InterestDokument16 SeitenCompound InterestJin ChorNoch keine Bewertungen

- Off Grid Industry Yearbook 2018Dokument310 SeitenOff Grid Industry Yearbook 2018birlainNoch keine Bewertungen

- Code-Sebi Insider TradingDokument58 SeitenCode-Sebi Insider Tradingpradeep936Noch keine Bewertungen

- ©2011 Pearson Education, Inc. Publishing As Prentice HallDokument72 Seiten©2011 Pearson Education, Inc. Publishing As Prentice HallSimon SebastianNoch keine Bewertungen

- Atlantic Tours General Journal Date: Account Titles and Explanation Ref: Debits Credits 2003Dokument4 SeitenAtlantic Tours General Journal Date: Account Titles and Explanation Ref: Debits Credits 2003babe447Noch keine Bewertungen

- Presentation For Business PlanDokument43 SeitenPresentation For Business PlangeraldNoch keine Bewertungen

- Factors Explaining The Rapid Economic Growth of China in Recent DecadesDokument6 SeitenFactors Explaining The Rapid Economic Growth of China in Recent DecadessakunNoch keine Bewertungen

- Shcil Depository)Dokument124 SeitenShcil Depository)akanksh842100% (1)

- Morningstar Rating Methodology: BackgroundDokument2 SeitenMorningstar Rating Methodology: Backgroundkaya nathNoch keine Bewertungen

- EntrepreneurshipDokument25 SeitenEntrepreneurshipyakarimNoch keine Bewertungen