Beruflich Dokumente

Kultur Dokumente

FDI May Be Harmful To Economic Growth

Hochgeladen von

rvaidya2000Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

FDI May Be Harmful To Economic Growth

Hochgeladen von

rvaidya2000Copyright:

Verfügbare Formate

FDI may be harmful to economic growth

The Hindu Business Line, Thursday, Feb 09, 2006

R. Vaidyanathan

The FDI mantra is considered an all-purpose panacea for the ills of the economy and society. Unfortunately, there has not been much debate about the far-reaching implications of FDI in our economy and, particularly, how it can stifle economic growth, says R. Vaidyanathan, presenting counters to the five arguments in favour of FDI and citing a research paper to buttress his stand.

DISCUSSIONS on foreign direct investment are heard as a sort of continuous background music at most seminars and conferences these days and business newspapers carry articles on it every other day. The FDI mantra is considered an all-purpose panacea for the ills of the Indian economy and society. It has become routine for our finance ministers to "showcase" India in various international forums Davos being somewhat of a premier venue and exhort the global captains of industry and commerce to come to India. Unfortunately there is not much debate, leave alone informed debate, between the academic and other policy-makers about the far-reaching implications of FDI in our economy and, particularly, how it can stifle economic growth. The debate only focusses on the so-called effect on employment and loss of " socialism" that vanished dogma of the nineteenth century. Economic growth is based on domestic savings

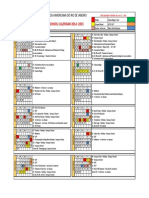

Fortunately India's economic growth over the last decade and a half has primarily been driven by savings in the economy, especially by households. Housewives from middle-class homes should be given due credit for this. The Table shows the savings and investment rate in our economy, the gap being met by foreign flows. We find from the Table that all our investments have come from our own savings in the past decade. The argument pertaining to the need for FDI is based on the following premises. If we want to grow at 10 per cent and if our capital-output ratio is 3.5, we need investment at 35 per cent and, if our savings rate is 28 per cent, then the gap has to be met by the West.

This is, to start with, spurious since the measurement of the capital-output ratio is not reliable and definitely not applicable to our service sector, which makes up nearly 60 per cent of the economy and is its growth engine. Anyone who has travelled in a taxi in the North will know that there can be passengers to the right side of the driver and the actual capacity of our buses is infinite. Made in China is not Made by China The second argument is that China is getting so much FDI. In 2006 it is expected to have a net direct investment of $51 billion of the estimated $155 billion flows to emerging markets (Capital Flows in Emerging markets by IIF, January 2006). The important and crucial point, missed by the China enthusiasts, is that China does not have a developed entrepreneurial class like India and, hence, it is dependent on the foreign capitalists and foreign capital compared to India, which has a burgeoning entrepreneurial class. Made in China is not same as made by China. India has a phenomenally well-developed capitalist class which can set up world-class automobile, steel, petrochemical and cement plants. While India's stock market has soared in recent years, the opposite has happened in China. In 2001, the Shanghai Stock Market index reached more than 2,200 points; by April 2005, nearly half of it had gone, with the Shanghai index at 1,135 points. This sharp decline occurred when the GDP was growing at 9 per cent a year. It is difficult to find another country that displays this strange combination of excellent macroeconomic performance and dismal microeconomic performance. The reasons are to be found in the structure created by foreign FDI, much of which is not even listed. China has to depend on foreign capital to set up its manufacturing facilities and is struggling hard to encourage party bureaucrats to become entrepreneurs. Active capital market The third argument is that FDI provides us with a continuous flow of funds and an active capital market. Actually, hundreds of MNCs have de-listed from the stock market in the last decade by converting to unlisted subsidiaries of foreign parents. An analysis of this alone will give a clue to the nature of the capital market due to foreign investment in our economy. Many an MNC does not even bring funding from outside sources since it can access funds in the domestic market by showing "comfort letters" from its parent company. There are many local financial institutions, both Government and private, which would lend them below prime rate since they are "global". Financial institutions in India do not deny foreigners funds. That the MNC will continuously bring funds from abroad is a statement which should be taken with tonnes of salt.

Remember Enron, which was supposedly bringing Rs 10,000 crore from outside. In reality, now, government institutions are holding more than Rs 6000 crore of worthless paper. Ms Rebecca Mark of Enron claimed that millions were spent to " educate" Indians as part of that project. We either refuse to get "educated", in the true sense, or want to be more " educated", in the Enron sense. The fourth argument is regarding technology transfer. In this age of information flows and market for technology any entrepreneur can purchase technology needed by him. In a country like India, which scores very high for "technology diffusion" or "absorption", building on technology is not an issue. If we travel in the rural areas of Punjab, we find washing machines being used for churning lassi on a mass scale. Who ever thought that washing machines have alternative uses? The Indian Diaspora can be relied upon to acquire most modern technology in complex areas, and there are already significant organic links between the NRIs and the domestic capitalists. Is it a one-way street? The fifth argument is regarding the growing global flow of funds and how nation-states cannot ignore it. Fascinatingly, when Mr Lakshmi Mittal attempted to take over Arcelor, or when China Petroleum tried to take over a Unocal of the US, the same globalisers came down like a ton of brick on the attempts. The US senate members or the ministers of France and Luxemburg wasted no time in using armtwisting to scuttle the moves. It is the white man's burden to provide global capital and not any other way. Actually, given the demographic structure and growth of pension funds in Europe and the US, we can see that funds are in search of markets, and not the other way. It means we are in a position to choose whom to invite. But we would rather continue to " sell" India. Selling India is an easy skill for most of our politicians. Which sectors are "sold" globally for FDI in India? It is the retail trade, restaurants, road transport and construction. Non-corporate, family-run businesses dominate all these activities. In most of these sectors the share of partnership/proprietorship firms is more than 80 per cent. We want global corporates to come into India and turn these millions of entrepreneurs into workers. Can there be anything more perverse than this? What they need is adequate credit at reasonable rates and less bribes demanded by government minions. What additional technological wonders will be wrought by FDI in these areas? NBER Research Paper A significant and path-breaking study was undertaken recently by three authors regarding the impact of foreign direct investment on the rate of economic growth.

This paper was published by National Bureau of Economic Research (NBER) as a working paper: "Sources for financing domestic capital: Is foreign saving a viable option for developing countries?" (Joshua Aizenman; Brian Pinto; Artur Radziwill, June 2004. Joshua Aizenman is Professor of Economics at the University of California, Santa Cruz. Brian Pinto is at the World Bank. Artur Radziwill is with the Centre for Social and Economic Research (CASE), Warsaw, Poland.) They observe that on average, 90 per cent of the stock of capital in developing countries is selffinanced, and this fraction was surprisingly stable throughout the 1990s. More importantly, they argue, "there is no evidence of any "growth bonus" associated with increasing the financing share of foreign savings. In fact, the evidence suggests the opposite: throughout the 1990s, countries with higher self-financing ratios grew significantly faster than countries with low selffinancing ratios. This result persists even after controlling growth for the quality of institutions." More interestingly, they also found that the higher volatility of the self-financing ratios are associated with lower growth rates, and that better institutions are associated with lower volatility of the self financing ratios. It completely negates the FDI mantra chanted day in and day out by India's metropolitan elite. But will we heed any empirical analysis or logic available on this score? We may not, since we are embedded with what could be called the "Colonial Gene", which has its own effect. It paralyses our ability to think straight and makes us crave, like a drug addict, the opium of FDI. (The author is Professor of Finance, Indian Institute of Management-Bangalore, and can be contacted at vaidya@iimb.ernet.in. The views are personal and do not reflect that of his organisation.)

Das könnte Ihnen auch gefallen

- NOV 2008 India PR ApprovingInvestmentDokument6 SeitenNOV 2008 India PR ApprovingInvestmentrvaidya2000Noch keine Bewertungen

- RESERVE BANK OF INDIA - : Investment in Credit Information CompaniesDokument1 SeiteRESERVE BANK OF INDIA - : Investment in Credit Information Companiesrvaidya2000Noch keine Bewertungen

- Subramanian Testimony 31313Dokument25 SeitenSubramanian Testimony 31313PGurusNoch keine Bewertungen

- National Herald NarrativeDokument2 SeitenNational Herald Narrativervaidya2000Noch keine Bewertungen

- NGO's A Perspective 31-01-2015Dokument29 SeitenNGO's A Perspective 31-01-2015rvaidya2000Noch keine Bewertungen

- Composite Resin Corporate FilingsDokument115 SeitenComposite Resin Corporate FilingsPGurus100% (2)

- Vimarsha On Indian Economy - Myth and RealityDokument1 SeiteVimarsha On Indian Economy - Myth and Realityrvaidya2000Noch keine Bewertungen

- Letter To Prof R VaidyanathanDokument2 SeitenLetter To Prof R Vaidyanathanrvaidya2000Noch keine Bewertungen

- Letter To PMDokument3 SeitenLetter To PMrvaidya2000Noch keine Bewertungen

- Ahmedabad Press Conference Nov 19 2015Dokument5 SeitenAhmedabad Press Conference Nov 19 2015PGurus100% (1)

- Brief Look at The History of Temples in IIT Madras Campus (Arun Ayyar, Harish Ganapathy, Hemanth C, 2014)Dokument17 SeitenBrief Look at The History of Temples in IIT Madras Campus (Arun Ayyar, Harish Ganapathy, Hemanth C, 2014)Srini KalyanaramanNoch keine Bewertungen

- Aranganin Pathaiyil ProfileDokument5 SeitenAranganin Pathaiyil Profilervaidya2000Noch keine Bewertungen

- Optimal Armour Corporate FilingsDokument198 SeitenOptimal Armour Corporate FilingsPGurusNoch keine Bewertungen

- Letter and Invitaion Give To Mr. r.v19!06!2015Dokument2 SeitenLetter and Invitaion Give To Mr. r.v19!06!2015rvaidya2000Noch keine Bewertungen

- SGFX FinancialsDokument33 SeitenSGFX FinancialsPGurusNoch keine Bewertungen

- TVEs Growth Engines of China in 1980s - 1990s "WWW - Geoffrey-Hodgson - Inf... - Brakes-chinese-Dev - PDF"Dokument24 SeitenTVEs Growth Engines of China in 1980s - 1990s "WWW - Geoffrey-Hodgson - Inf... - Brakes-chinese-Dev - PDF"rvaidya2000Noch keine Bewertungen

- GrantsDokument1 SeiteGrantsrvaidya2000Noch keine Bewertungen

- How Did China Take Off US China Report 2012 "Uschinareport - Com-Wp-Con... Ds-2013!05!23290284.PDF" (1) .PDF - 1Dokument25 SeitenHow Did China Take Off US China Report 2012 "Uschinareport - Com-Wp-Con... Ds-2013!05!23290284.PDF" (1) .PDF - 1rvaidya2000Noch keine Bewertungen

- Representation To PMDokument31 SeitenRepresentation To PMIrani SaroshNoch keine Bewertungen

- FDI in Retail - Facts & MythsDokument128 SeitenFDI in Retail - Facts & Mythsrvaidya2000Noch keine Bewertungen

- Why India Needs To Prepare For The Decline of The WestDokument4 SeitenWhy India Needs To Prepare For The Decline of The Westrvaidya2000Noch keine Bewertungen

- Timetable & AgendaDokument6 SeitenTimetable & Agendarvaidya2000Noch keine Bewertungen

- Shamelessness Is Paraded As ModernDokument2 SeitenShamelessness Is Paraded As Modernrvaidya2000Noch keine Bewertungen

- Sec 66ADokument5 SeitenSec 66Arvaidya2000Noch keine Bewertungen

- Why The Indian Housewife Deserves Paeans of PraiseDokument3 SeitenWhy The Indian Housewife Deserves Paeans of Praiservaidya2000Noch keine Bewertungen

- Why The Retail Revolution Is Meeting Its NemesisDokument3 SeitenWhy The Retail Revolution Is Meeting Its Nemesisrvaidya2000Noch keine Bewertungen

- Secular Assault On The SacredDokument3 SeitenSecular Assault On The Sacredrvaidya2000Noch keine Bewertungen

- Humbug Over KashmirDokument4 SeitenHumbug Over Kashmirrvaidya2000Noch keine Bewertungen

- Why Sub-Prime Is Not A Crisis in IndiaDokument4 SeitenWhy Sub-Prime Is Not A Crisis in Indiarvaidya2000Noch keine Bewertungen

- Decline of The West Is Good For Us and Them - 11 Oct 2011Dokument4 SeitenDecline of The West Is Good For Us and Them - 11 Oct 2011rvaidya2000Noch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5782)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Guruswamy Kandaswami Memo A.y-202-23Dokument2 SeitenGuruswamy Kandaswami Memo A.y-202-23S.NATARAJANNoch keine Bewertungen

- Build - Companion - HarrimiDokument3 SeitenBuild - Companion - HarrimiandrechapettaNoch keine Bewertungen

- JPM The Audacity of BitcoinDokument8 SeitenJPM The Audacity of BitcoinZerohedge100% (3)

- Achieving Excellence Guide 3 - Project Procurement LifecycleDokument27 SeitenAchieving Excellence Guide 3 - Project Procurement LifecycleMoath AlhajiriNoch keine Bewertungen

- Preventing At-Risk Youth Through Community ParticipationDokument11 SeitenPreventing At-Risk Youth Through Community ParticipationRhyolite LanceNoch keine Bewertungen

- BCM 304Dokument5 SeitenBCM 304SHIVAM SANTOSHNoch keine Bewertungen

- Mutual Fund: Advnatages and Disadvantages To InvestorsDokument11 SeitenMutual Fund: Advnatages and Disadvantages To InvestorsSnehi GuptaNoch keine Bewertungen

- XTRO Royal FantasyDokument80 SeitenXTRO Royal Fantasydsherratt74100% (2)

- Lembar Jawaban Siswa - Corona-2020Dokument23 SeitenLembar Jawaban Siswa - Corona-2020Kurnia RusandiNoch keine Bewertungen

- Politics and Culture Essay PDFDokument6 SeitenPolitics and Culture Essay PDFapi-267695090Noch keine Bewertungen

- Writ of Execution - U.S. DISTRICT COURT, NJ - Cv-Writ2Dokument2 SeitenWrit of Execution - U.S. DISTRICT COURT, NJ - Cv-Writ2Judicial_FraudNoch keine Bewertungen

- Ancient Civilizations - PACKET CondensedDokument23 SeitenAncient Civilizations - PACKET CondensedDorothy SizemoreNoch keine Bewertungen

- Show Me My Destiny LadderDokument1 SeiteShow Me My Destiny LadderBenjamin Afrane NkansahNoch keine Bewertungen

- Cecilio MDokument26 SeitenCecilio MErwin BernardinoNoch keine Bewertungen

- Hannover Messe 2011: New Marke New Con NEWDokument16 SeitenHannover Messe 2011: New Marke New Con NEWsetzen724Noch keine Bewertungen

- Political Science Assignment Sem v-1Dokument4 SeitenPolitical Science Assignment Sem v-1Aayush SinhaNoch keine Bewertungen

- CalendarDokument1 SeiteCalendarapi-277854872Noch keine Bewertungen

- Anafuda Cards Koi KoiDokument5 SeitenAnafuda Cards Koi Koii.margarida33Noch keine Bewertungen

- Ysmael vs. Executive Secretary - DigestDokument2 SeitenYsmael vs. Executive Secretary - DigestVince Llamazares LupangoNoch keine Bewertungen

- Delhi Public School Mid-Term Exam for Class 5 Students Covering English, Math, ScienceDokument20 SeitenDelhi Public School Mid-Term Exam for Class 5 Students Covering English, Math, ScienceFaaz MohammadNoch keine Bewertungen

- Impact of Information Technology On The Supply Chain Function of E-BusinessesDokument33 SeitenImpact of Information Technology On The Supply Chain Function of E-BusinessesAbs HimelNoch keine Bewertungen

- Anders LassenDokument12 SeitenAnders LassenClaus Jørgen PetersenNoch keine Bewertungen

- Tender18342 PDFDokument131 SeitenTender18342 PDFKartik JoshiNoch keine Bewertungen

- Use Case Template (Cockburn) PDFDokument8 SeitenUse Case Template (Cockburn) PDFjulian pizarroNoch keine Bewertungen

- Predictions of Naimat Ullah Shah Wali by Zaid HamidDokument55 SeitenPredictions of Naimat Ullah Shah Wali by Zaid HamidBTghazwa95% (192)

- Tealium - State of The CDP 2022Dokument16 SeitenTealium - State of The CDP 2022David StanfordNoch keine Bewertungen

- ULI Europe Reshaping Retail - Final PDFDokument30 SeitenULI Europe Reshaping Retail - Final PDFFong KhNoch keine Bewertungen

- Biswajit Ghosh Offer Letter63791Dokument3 SeitenBiswajit Ghosh Offer Letter63791Dipa PaulNoch keine Bewertungen

- 2 PBDokument17 Seiten2 PBNasrullah hidayahNoch keine Bewertungen

- Preventive MaintenanceDokument2 SeitenPreventive Maintenancedoctor_mumairkNoch keine Bewertungen