Beruflich Dokumente

Kultur Dokumente

2012 Tax Letter

Hochgeladen von

Linda GrangerOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2012 Tax Letter

Hochgeladen von

Linda GrangerCopyright:

Verfügbare Formate

Sherrin Fielder, CPA

12277 Soaring Way # 104 Truckee, CA 96161 (530) 550-9600 phone (530) 550-9621 fax Sherrin@fieldercpa.com

November 16, 2012 As in previous years, we would like to take this opportunity to review a few of the tax law changes and alert you to some tax saving moves that can still be made for the year 2012. Year-end planning will be more challenging than normal this year. Unless Congress acts, starting in 2013, individuals will see higher tax rates across the board and a number of popular deductions and credits will be gone. Estate and gift tax rates will be higher as well. Therefore, tax planning actions taken between now and year-end may be more important than ever. This letter presents some planning ideas to consider while there is still time to act before the year-end. To see the chart summarizing the major differences between 2012 and 2013 tax laws for Federal and California purposes go to: http://fieldercpa.com/pdfs/Chart%20of%20Expiring%20Tax%20Provisions%20Fed%20and%20CA.pdf.pdf If congress passes legislation, we will continue to keep you updated.

As a result of the Healthcare Act (PPACA), two new Medicare taxes will kick in starting in 2013. First, there will be a new 0.9% Medicare surtax tax (HI) on wages and self-employment earnings exceeding $200,000 ($250,000 if married filing jointly; $125,000 if married filing separately). There will also be a new 3.8% Medicare contribution tax (MIIT) that will apply to the lesser of (1) net investment income, including interest income (but not if it is tax-exempt), capital gains, dividends, annuities, rents, royalties, and passive income; or (2) modified adjusted gross income (MAGI) in excess of $200,000 ($250,000 for married filing jointly; $125,000 for married filing separately). For more information regarding the Health Care Law in general go to: http://www.healthcare.gov/law/information-for-you/index.html California passed Proposition 30 in the recent election. This created new increased tax brackets for individuals with income greater than $250,000 and married couples with income greater than $500,000. More over, it is RETROACTIVE to 1/1/2012. Also as a result of this proposition, sales tax in California will increase by .25% on 1/1/2013. Alternative Minimum Tax (AMT) This is a parallel tax calculation which must be performed each year. If your AMT taxes owed exceed your regular taxes owed then you will pay the additional amount required by AMT. If in subsequent years your AMT is lower than your regular tax, then you may receive a credit for AMT paid in prior years. Surprising to most people, is that AMT disallows many types of deductions. Personal and dependency exemptions, state taxes, real estate taxes, unreimbursed employee expenses, mortgage interest on consumer debt lines of credit are all excluded in the AMT calculation. Also AMT uses a slower method of depreciation. If you live in a state that has high income taxes you are likely affected by AMT since it is a large itemized deduction for regular tax. At this time, congress has not enacted the temporary AMT patch. This patch increases the income threshold at which individuals are subject to this parallel calculation. If no action is taken by congress, then many individuals who were not subject to AMT in 2011 may be subject now in 2012. Failure to Enact AMT Patch by Year-end: In an 11/13/13 letter to Senator Orrin Hatch, acting IRS Commissioner Steven Miller said that he had instructed his staff to leave the IRS's core systems "as-is" with respect to the AMT and hold off on any substantial design and engineering work. If Congress enacts an AMT patch, including both increased exemption amounts and the special tax credit ordering rules, by the end of 2012, the IRS "would likely be able to open the 2013 tax filing season with minimal delays for most taxpayers." If an AMT patch is not enacted by year-end, there "would be serious repercussions for taxpayers." Roughly 28 million taxpayers would be faced with a very large, unexpected tax liability for 2012. Furthermore, the IRS would have to instruct more than 60 million taxpayers that they cannot file their tax return or receive a refund until the IRS completes the necessary systems changes. Due to "the magnitude and complexity of the changes, it is entirely possible that these taxpayers would not be able to file until late March 2013, if not even later."

To view the chart of Retirement Contribution limits for 2012 and 2013: limits.php To view the chart of Depreciation for Business Equipment for 2012 and 2013 http://fieldercpa.com/pdfs/Chart%20of%20Depreciation%20Expense.pdf.pdf To view the chart of 2012 Standard Mileage Rates: http://fieldercpa.com/standard-mileage-rates.php http://fieldercpa.com/chart-of-retirement-contribution-

Foreclosure or Short Sale of Rental or Investment Properties Depending on whether your debt was recourse or non-recourse there may be taxable consequences to your debt forgiveness or loan modification. Reduction in principal owed, change in interest rates, or life of loan may all impact this calculation. Please contact us as soon as you are aware of a potential issue. Make sure you contact the lender regarding the income reporting documents. (Form 1099-A or 1099C) Estate and Gift Tax For 2012, estates over $5,120,000 will be subject to estate tax. As shown in the chart above, this exemption will decrease to $1,000,000 for 2013. You may choose to make annual exclusion gifts before year end to minimize estate tax. You can give $13,000 to an unlimited number of individuals free of gift tax. However, you may not carry over unused exclusions from one year to the next. The transfers also may save family income taxes where incomeearning property is given to family members in lower income tax brackets who are not subject to the kiddie tax. Gifts in excess of the annual exclusion may require you to report on Form 709. Nanny Tax- If you have individuals over the age of 18 performing service in your residence their earnings may be subject to payroll taxes. The threshold for this is earnings greater than $1,800 for 2012 and $1,800 for 2013. You may also be required to issue them a Form W-2. Small Employer Health Insurance Credit- If you pay at least 50% of your employees premiums and have fewer than 25 employees with an average annual salary not more than $50,000, you may qualify for this tax credit. The credit is generally 35% (50% for tax years beginning after 2013) of the contributions towards the employees health insurance premiums. If you are a non-profit organization the credit is 25%. California Proposition 30 Increase to Sales Tax Beginning on January 1, 2013 sales tax increase of .25% takes effect. General Reminders Foreign Accounts or Investments- The reporting requirements for assets held overseas are increasing and the penalties for failure to report them are significant. Foreign bank accounts, notes receivable, ownership in a foreign partnership or corporation, and interest in Canadian RRSPS are some examples. Form 8938 may be required to be attached with your annual tax return and Form TD F 90-22.1 may be required to be filed separately each June. If you have any questions about any foreign accounts please contact me. QuickBooks Mac v. Windows - If you are contemplating converting or obtaining the Mac version of QuickBooks, please call so we can discuss cost benefit issues. Versions earlier than 2010- If you are using a QuickBooks version 2009 or earlier, please call so we can discuss technology issues regarding those versions. Inventory- Make sure you take a thorough and accurately priced detail of your inventory at your business year-end. This documentation is critical in the event there is an audit. S-Corporation Shareholders- Remember to contact your payroll service for common year-end adjustments to your W-2. Health insurance paid for you by your corporation should be added to your W-2. Also, personal use of vehicles owned by your corporation may result in income to be reported by you on your W-2. This calculation should be done in early January in order to avoid amending your W-2. It may be helpful to review your investment basis in a partnership or scorporation prior to year-end in order to utilize any losses incurred. Please contact us for any year end calculations related to tax planning. IRS Email Spam Beware of any emails you receive claiming that they are from the IRS. The IRS has issued several recent consumer warnings on the fraudulent use of the IRS name or logo by scamsters trying to gain access to consumers financial information in order to steal their identity and assets. The IRS never contacts you by email. Documentation - IRS recently ruled that credit card statements are not sufficient support and that actual receipt of charges are required. Please keep 7 years of records. If assets are still owned, please keep purchase records for 7 years after the date of sale. Investment Records The IRS is requiring that your investment brokers report cost basis on sales of securities. This requirement is being phased in for years 2011-2013. It is recommended that you work closely with your brokers to determine the correct costs basis especially if you inherited stocks or are participating in a dividend reinvestment program. If you are contemplating changing your broker, it would be helpful to obtain correct cost basis prior to any change.

Form 1099s A reminder that these are due to recipients by January 31, 2013. If your trade or business pays a nonincorporated service provider greater than $600/year then you will need to issue them a Form 1099-MISC. The requirement that this would apply to landlords or payment for goods was repealed. Penalties for not filing can be $100 per each omission. Even though California does not have a separate Form 1099, you may be denied the deduction for that expense by California if no federal 1099 was issued. In addition, California requires that you submit Form DE 542 to report service providers you expect to do business with in 2013. This form is due within 20 days of paying or entering into a contract with an independent contractor. It may save time to process these in conjunction with your 1099s. Withholding for California Nonresidents- A 7% withholding is required on payments made to nonresident independent contractors for services performed in California for payments in excess of $1,500 for the calendar year. This also applies to payments made to non-resident partners or s-corporation shareholder. In addition, this withholding is required for non-resident property owners with California rental properties. Form 588 should be filed by the payee to request exemption from this requirement by agreeing to file non-resident California income tax returns. Use Tax Use tax is the amount of sales taxes that may not have been collected on a purchase you made. This often happens when you purchase items on the internet and are charged no sales taxes, or purchase items in another county and pay less sales tax than the county you live in. Most states which have a sales tax in place have a requirement for you as an individual or business owner to pay the use tax. Please visit my website www.fieldercpa.com for links to different states use tax rules. The California Board of Equalization (BOE) is sending letters to businesses with at least $100,000 in gross receipts who are not already registered and do not hold sellers permits. This means all businesses, regardless of business type, must register (even strictly service providers). The purpose is to track all businesses that may be liable for use tax. Businesses that received this letter from BOE will be subject to a filing requirement even if no use tax is due. The use tax returns are due by April 15th each year if you do not normally file sales tax returns. These returns are required even if you owe no taxes. In some cases, if you have registered and reported zero use tax owed for three years in a row the BOE is sending out notices they are closing out your registration for annual reporting. If you are unclear about your status or reporting requirement, please let me know. California individuals who owe use tax on internet or out of state purchases should report those transactions on their annual California income tax returns. Change in Ownership of California Real Estate If you transferred more than 50% interest in real estate you should file a change in ownership report with California BOE within 45 days to avoid penalties. There are some transfers which are excluded from this requirement, please check with me for your responsibilities.

Remember that your in-office tax appointments are prescheduled and included in your organizer that we will be sending out in the next few weeks. Please call us asap if the appointment time is inconvenient for you.

Sincerely,

Das könnte Ihnen auch gefallen

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCVon EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCBewertung: 4 von 5 Sternen4/5 (5)

- 9 Little Known Strategies ThatDokument4 Seiten9 Little Known Strategies ThatCaptBB250% (2)

- Form 1040-ES 2013Dokument11 SeitenForm 1040-ES 2013Zeeshan AliNoch keine Bewertungen

- Income Tax Course Manual (2021 T1) PDFDokument138 SeitenIncome Tax Course Manual (2021 T1) PDFMrDorakonNoch keine Bewertungen

- Tax Planning StrategiesDokument10 SeitenTax Planning Strategieschriswwu100% (1)

- Quick Notes on “The Trump Tax Cut: Your Personal Guide to the New Tax Law by Eva Rosenberg”Von EverandQuick Notes on “The Trump Tax Cut: Your Personal Guide to the New Tax Law by Eva Rosenberg”Noch keine Bewertungen

- A Accrual Accounting MethodDokument19 SeitenA Accrual Accounting MethodVivian Montenegro GarciaNoch keine Bewertungen

- Certificate of InsuranceDokument2 SeitenCertificate of InsuranceRobert LeeNoch keine Bewertungen

- Equity Release: Summary of Learning Outcomes Number of Questions in The ExaminationDokument3 SeitenEquity Release: Summary of Learning Outcomes Number of Questions in The ExaminationClerry SamuelNoch keine Bewertungen

- 16 Don'T-Miss Tax DeductionsDokument4 Seiten16 Don'T-Miss Tax DeductionsGon FloNoch keine Bewertungen

- Form - 1040 - ES PDFDokument12 SeitenForm - 1040 - ES PDFAnonymous JqimV1ENoch keine Bewertungen

- What Type of Information Is Necessary To Complete A Tax ReturnDokument4 SeitenWhat Type of Information Is Necessary To Complete A Tax ReturnDianna RabadonNoch keine Bewertungen

- F 1040 EsDokument12 SeitenF 1040 EsEndu EnduroNoch keine Bewertungen

- Modes of Extinguishment of AgencyDokument53 SeitenModes of Extinguishment of AgencyLibra Sun100% (3)

- Choice of Entity OutlineDokument31 SeitenChoice of Entity OutlineKent WhiteNoch keine Bewertungen

- Stauch USAADokument47 SeitenStauch USAALeigh EganNoch keine Bewertungen

- Full Download Solution Manual For Canadian Tax Principles 2019 2020 Edition Clarence Byrd Ida Chen PDF Full ChapterDokument36 SeitenFull Download Solution Manual For Canadian Tax Principles 2019 2020 Edition Clarence Byrd Ida Chen PDF Full Chapterjustinowenstzwqxfbjoa100% (22)

- ICE Manual of Construction LawDokument550 SeitenICE Manual of Construction Lawfadista75% (4)

- Spin SellingDokument15 SeitenSpin Sellingshweta.gdp100% (3)

- Tax Calculator - Overview: InstructionsDokument9 SeitenTax Calculator - Overview: InstructionsphobosanddaimosNoch keine Bewertungen

- Solutions Manual For Principles of Taxation For Business and Investment Planning 2024 27th Edition by Jones, Rhoades-Catanach, Callaghan, KubickDokument7 SeitenSolutions Manual For Principles of Taxation For Business and Investment Planning 2024 27th Edition by Jones, Rhoades-Catanach, Callaghan, KubickDiya ReddyNoch keine Bewertungen

- Independent Contractor ApplicationDokument4 SeitenIndependent Contractor Applicationamir.workNoch keine Bewertungen

- BẢO HIỂMDokument1 SeiteBẢO HIỂMVân ĐàoNoch keine Bewertungen

- Concurrent Delay ApproachDokument5 SeitenConcurrent Delay ApproachMazuan LinNoch keine Bewertungen

- A Guide To 2013 Tax Changes (And More)Dokument15 SeitenA Guide To 2013 Tax Changes (And More)Doug PotashNoch keine Bewertungen

- Last Minute Tax TipsDokument2 SeitenLast Minute Tax TipsIncome Solutions Wealth ManagementNoch keine Bewertungen

- Year End Tax Planning2011Dokument5 SeitenYear End Tax Planning2011Tracey Bass Schilling-HysjulienNoch keine Bewertungen

- Alternative Minimum TaxDokument2 SeitenAlternative Minimum TaxJeremy A. MillerNoch keine Bewertungen

- Company Tax Change in Limbo: Sneak PeekDokument6 SeitenCompany Tax Change in Limbo: Sneak PeekAnonymous bxETEAczsNoch keine Bewertungen

- Collaborative Financial Solutions, LLC Breaking Down The Taxpaying Population: Where Do You Fit In?Dokument4 SeitenCollaborative Financial Solutions, LLC Breaking Down The Taxpaying Population: Where Do You Fit In?Janet BarrNoch keine Bewertungen

- TaxHelpForParishTreasurers OCADokument13 SeitenTaxHelpForParishTreasurers OCAConnor McloudNoch keine Bewertungen

- 1 TaxPlanningStrategies2014Dokument9 Seiten1 TaxPlanningStrategies2014ExactCPANoch keine Bewertungen

- What Is Taxable Income?: Key TakeawaysDokument4 SeitenWhat Is Taxable Income?: Key TakeawaysBella AyabNoch keine Bewertungen

- Tax Law Snapshot 2014Dokument4 SeitenTax Law Snapshot 2014HosameldeenSalehNoch keine Bewertungen

- Full Solution Manual For Canadian Tax Principles 2019 2020 Edition Clarence Byrd Ida Chen PDF Docx Full Chapter ChapterDokument36 SeitenFull Solution Manual For Canadian Tax Principles 2019 2020 Edition Clarence Byrd Ida Chen PDF Docx Full Chapter Chapterforceepipubica61uxl94% (17)

- Solution Manual For Canadian Tax Principles 2019 2020 Edition Clarence Byrd Ida ChenDokument15 SeitenSolution Manual For Canadian Tax Principles 2019 2020 Edition Clarence Byrd Ida Chenmargaretdominic3h7dNoch keine Bewertungen

- Estate Tax After The Fiscal Cliff: Collaborative Financial Solutions, LLCDokument4 SeitenEstate Tax After The Fiscal Cliff: Collaborative Financial Solutions, LLCJanet BarrNoch keine Bewertungen

- Adjusted Gross Income ExplainedDokument4 SeitenAdjusted Gross Income ExplainedMarko Zero FourNoch keine Bewertungen

- 15 Tax Deductions You Should Know - E-Filing GuidanceDokument32 Seiten15 Tax Deductions You Should Know - E-Filing GuidanceErin LamNoch keine Bewertungen

- NATP TaxPro Monthly September2013Dokument16 SeitenNATP TaxPro Monthly September2013Concha Burciaga HurtadoNoch keine Bewertungen

- C CCCCCCCCDokument2 SeitenC CCCCCCCCapi-118535366Noch keine Bewertungen

- F1040es 2018Dokument18 SeitenF1040es 2018diversified1Noch keine Bewertungen

- A Look at Some Financial Changes & The Opportunities They May PresentDokument3 SeitenA Look at Some Financial Changes & The Opportunities They May Presentapi-118535366Noch keine Bewertungen

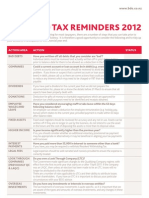

- Year-End Tax Reminders 2012: Action Area Action StatusDokument2 SeitenYear-End Tax Reminders 2012: Action Area Action Statusapi-129279783Noch keine Bewertungen

- Howdoi Adjust My Tax Withholding?: Publication 919Dokument20 SeitenHowdoi Adjust My Tax Withholding?: Publication 919randyfranklinNoch keine Bewertungen

- Cares Act Impacts On Net Operating Losses: Frequently Asked QuestionsDokument1 SeiteCares Act Impacts On Net Operating Losses: Frequently Asked QuestionsAllenNoch keine Bewertungen

- Tax Tips Newsline - March 2015Dokument16 SeitenTax Tips Newsline - March 2015Frank ZerjavNoch keine Bewertungen

- Surviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesVon EverandSurviving the New Tax Landscape: Smart Savings, Investment and Estate Planning StrategiesNoch keine Bewertungen

- The Tax Reality of NIL IncomeDokument4 SeitenThe Tax Reality of NIL IncomeNaomi Laurent - OsakaNoch keine Bewertungen

- Taxes & Health Care ReformDokument1 SeiteTaxes & Health Care Reformmck_ndiayeNoch keine Bewertungen

- Top 6 Audit Triggers To AvoidDokument10 SeitenTop 6 Audit Triggers To AvoidnnauthooNoch keine Bewertungen

- How I Improved My Fatca Form in One DayvbgmjDokument4 SeitenHow I Improved My Fatca Form in One Dayvbgmjshieldopera1Noch keine Bewertungen

- Solution Manual For Byrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1St Edition by Byrd and Chen Isbn 0133115097 9780133115093 Full Chapter PDFDokument30 SeitenSolution Manual For Byrd and Chens Canadian Tax Principles 2012 2013 Edition Canadian 1St Edition by Byrd and Chen Isbn 0133115097 9780133115093 Full Chapter PDFmary.graf929100% (11)

- Form 1040-ES (NR) : U.S. Estimated Tax For Nonresident Alien IndividualsDokument9 SeitenForm 1040-ES (NR) : U.S. Estimated Tax For Nonresident Alien IndividualsBrokerANoch keine Bewertungen

- Business Expenses: Publication 535Dokument50 SeitenBusiness Expenses: Publication 535Birgitte SangermanoNoch keine Bewertungen

- Income AssignmentDokument5 SeitenIncome Assignmentwxwgmumpd100% (1)

- Service Tax ThesisDokument7 SeitenService Tax Thesisamymilleranchorage100% (2)

- Spring 2013 Tax, Retirement & Estate PlanningDokument4 SeitenSpring 2013 Tax, Retirement & Estate PlanningBusiness Bank of Texas, N.A.Noch keine Bewertungen

- 7 Big Mistakes Small Business Owners Make at Tax Time: UPDATED 2019Dokument25 Seiten7 Big Mistakes Small Business Owners Make at Tax Time: UPDATED 2019nnauthooNoch keine Bewertungen

- Income Tax Homework HelpDokument8 SeitenIncome Tax Homework Helpafefhporo100% (1)

- Common Deductions Taxpayers OverlookDokument4 SeitenCommon Deductions Taxpayers OverlookDoug PotashNoch keine Bewertungen

- Liberty Tax HomeworkDokument9 SeitenLiberty Tax Homeworkbttvuxilf100% (1)

- UHY Government Contractor Newsletter - September 2011Dokument2 SeitenUHY Government Contractor Newsletter - September 2011UHYColumbiaMDNoch keine Bewertungen

- BUS345 Midterm 1 NotesDokument31 SeitenBUS345 Midterm 1 NotesՄարիա ՄինասեանNoch keine Bewertungen

- Theoretical FrameworkDokument14 SeitenTheoretical Frameworkfadi786Noch keine Bewertungen

- Superannuation Update 2012/13: ContributionsDokument4 SeitenSuperannuation Update 2012/13: Contributionsapi-140871676Noch keine Bewertungen

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesVon EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNoch keine Bewertungen

- Notes: Mandatory Electronic Filing and Payment of Income TaxDokument8 SeitenNotes: Mandatory Electronic Filing and Payment of Income TaxJose AlexanderNoch keine Bewertungen

- Solution Manual For Principles of Taxation For Business and Investment Planning 14th Edition Jones Catanach 0078136687 9780078136689Dokument36 SeitenSolution Manual For Principles of Taxation For Business and Investment Planning 14th Edition Jones Catanach 0078136687 9780078136689ericakaufmanctpkanfyms100% (23)

- Thi TOEIC chuẩn đầu raDokument35 SeitenThi TOEIC chuẩn đầu raĐôn100% (1)

- Rika Ristiani - Akuntansi Keuangan Menengah 2 - TM-02Dokument5 SeitenRika Ristiani - Akuntansi Keuangan Menengah 2 - TM-02MARCHO AGUSTANoch keine Bewertungen

- Insurance Case Digest: Gercio v. Sun Life Assurance Co. of Canada (1925)Dokument5 SeitenInsurance Case Digest: Gercio v. Sun Life Assurance Co. of Canada (1925)Mona LizaNoch keine Bewertungen

- 201 Great Ideas For Your Small Business Revised & Updated EditionDokument415 Seiten201 Great Ideas For Your Small Business Revised & Updated Editionapi-374530883% (6)

- OYO Traveller Insurance PlanDokument6 SeitenOYO Traveller Insurance PlanMansi VaishNoch keine Bewertungen

- GMPUA - Modderfontein Reserve PDFDokument13 SeitenGMPUA - Modderfontein Reserve PDFWillem De WetNoch keine Bewertungen

- FNA - Product Mapping - Individual - Corporate - Hot Product - June 2020Dokument1 SeiteFNA - Product Mapping - Individual - Corporate - Hot Product - June 2020Steven CW CheungNoch keine Bewertungen

- Train TicketDokument2 SeitenTrain TicketajayNoch keine Bewertungen

- ICICI Pru Shubh Raksha One 40769848 MAY 1, 2020 Mr. Mehta Kenil Pradipbhai .Dokument2 SeitenICICI Pru Shubh Raksha One 40769848 MAY 1, 2020 Mr. Mehta Kenil Pradipbhai .AbcNoch keine Bewertungen

- Social Security: Team Member Mr. Aaditya Mr. Brijesh Mr. Kumud Mr. Pushpendra Mr. Sikander XIDAS, JabalpurDokument13 SeitenSocial Security: Team Member Mr. Aaditya Mr. Brijesh Mr. Kumud Mr. Pushpendra Mr. Sikander XIDAS, JabalpurpreityzintaNoch keine Bewertungen

- Assignment 1Dokument12 SeitenAssignment 1anniekohliNoch keine Bewertungen

- 14) Dec 2004 - ADokument16 Seiten14) Dec 2004 - ANgo Sy VinhNoch keine Bewertungen

- Cmfas M 9: OduleDokument23 SeitenCmfas M 9: Odulezihan.pohNoch keine Bewertungen

- Hoc BrochureDokument4 SeitenHoc BrochureMpumelelo Greatness MokoenaNoch keine Bewertungen

- Wedding Insurance in MalaysiaDokument12 SeitenWedding Insurance in Malaysiafatimahsalleh96Noch keine Bewertungen

- Beaver Wood Pownal 248 Filing: No. 8L - Pre-Filed Testimony of Thomas Emero SDDokument10 SeitenBeaver Wood Pownal 248 Filing: No. 8L - Pre-Filed Testimony of Thomas Emero SDiBerkshires.comNoch keine Bewertungen

- Textile Ministry of IndiaDokument290 SeitenTextile Ministry of IndiaSrujan KumarNoch keine Bewertungen

- James and Megan Webb Recently Purchased A Home For 300 000Dokument1 SeiteJames and Megan Webb Recently Purchased A Home For 300 000Amit PandeyNoch keine Bewertungen

- DxwebDokument7 SeitenDxwebjamespaulgilbertNoch keine Bewertungen

- Uganda Bureau of StatisticsDokument350 SeitenUganda Bureau of Statisticssmith ndahuraNoch keine Bewertungen

- Ravi Retire and Enjoy 48y To 75yDokument4 SeitenRavi Retire and Enjoy 48y To 75yRavindranath TgNoch keine Bewertungen