Beruflich Dokumente

Kultur Dokumente

Jefferies-Crown Central Petroleum-Nov 2004-Greg Imbruce

Hochgeladen von

rpupolaOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Jefferies-Crown Central Petroleum-Nov 2004-Greg Imbruce

Hochgeladen von

rpupolaCopyright:

Verfügbare Formate

Greg Imbruce gimbruce@jefco.

com (203) 708-5804

HIGH YIELD RESEARCH

ENERGY Refining & Marketing November 11, 2004

Crown Central Petroleum Corp.

www.crownfleet.com

Coupon 10.875% Maturity 2/1/05 Principal ($MM) $125.0 Seniority Sr. Notes Ratings Caa3/NR Offer Price 97.0 YTW 25.23%

Rating: Strong Buy

Spread 2,317 Next Call Now Call Price 100.00

Update: Pension Settlement & Pasadena Sale Enhance Asset Coverage

Equity Value: Privately Held Financial Data

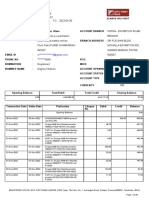

FYE 12/31: EBITDA (US$MM) Q1 Q2 Q3 Q4 Year Net Debt (WorkCap) ($MM) EBITDA/Interest (EBITDA-Capex)/Interest Net Debt/EBITDA 2003 ($10.0) $6.4 $21.5 ($15.1) $2.8 $196.7 0.2x NM 70.0x 2004E $9.8(A) $21.2(A) $11.4(E) $15.9(E) $58.3(E) $196.2 3.9x 3.4x 3.4x 2005E $9.4(E) $25.0(E) $15.8(E) $10.7(E) $61.0(E) $166.0 4.7x 3.5x 2.7x

Summary:

Crown Central Petroleum announced on 11/5/04: (i) a $45.0 mm Pension Settlement with the PBGC; and (ii) the proposed sale of the Company's Pasadena Refinery (expected to close prior to YE) for $42.5 mm. These are positive events for the Sr. Noteholders in that the values provide an incremental $22.4 mm (18 pts) of net asset value above that estimated in our 10/6/04 report, increasing the Sr. Notes' asset coverage to 1.46x from 1.28x. We continue to recommend the Sr. Notes as a Strong Buy at 97 (25.2% YTM) based on the better than expected Pension Settlement and Pasadena sale. In addition, in the case Crown is unsuccessful in selling the Tyler refinery in a timely manner, we believe the Company will use a combination of cash-on-hand and issue $55 mm of New Secured Notes (excluding any additional working capital facilities) to meet the 2/1/05 maturity. We anticipate that the unencumbered refining assets would serve as collateral for the New Notes (the Bank Facility is currently secured only by working capital) and are encouraged that such a transaction would be well received noting todays strong High Yield market and healthy Refining industry. We believe the Rosenbergs, the sole shareholder, will continue to take the necessary actions to avoid default and fund maturity of the Sr. Notes in order to preserve their equity value. Additionally, we anticipate the Noteholder Group, apparently headed by the Quadrangle Group, will provide the necessary flexibility to avoid a fire sale of the Tyler refinery and, if required exchange their $50 mm in Sr. Notes (40% of the amount outstanding) for a similar amount of New Notes. Pension Settlement The Company reached a $45.0 mm settlement with the PBGC for the underfunded Pension liability - the resolution of this lingering liability was $20.9 mm lower than our $65.9 mm estimate and well below the $121 mm and $51 mm estimated by the PBGC on a terminated basis and the Companys external actuaries on an ongoing basis, respectively. Pasadena Sale On 10/22/04, Crown executed an asset purchase agreement (Agreement) with Pasadena Refining Systems, Inc. (PRS) for the sale of the Pasadena refinery to PRS for $42.5 mm plus the value of crude and product inventory at the refinery on the date of closing. The closing may be deferred until no later than 12/31/04. In our 10/6/04 report, we valued the Pasadena refinery at $47.9 mm or $5.4 mm higher than the actual sale price. Recognize, however, that $6.9 mm (50% of Environment Liabilities - Continued Ops.) of environmental liabilities were included in the liability section of our analysis. On a net basis, therefore, the Pasadena sale was $1.5 mm higher than our estimated $41.1 mm net Pasadena value. Noteholder Approval The Agreement is subject to Sr. Noteholders of at least 70% of the outstanding principal amount effectively approving the Pasadena sale.

Source: Jefferies & Co. estimates and Company Reports

Company Description:

Crown Central Petroleum Corporation (Crown), based in Baltimore, Maryland, is an independent refiner and marketer of petroleum products in the U.S., privately owned by the Rosenberg family through its parent company, Rosemore, Inc. (Rosemore). The Company has been in liquidation mode since early 2003 and through 2Q04 sold substantially all of its retail sites (gasconvenience stations) and most of its product terminals, with the balance expected to close in 3Q04. We understand the Company is currently in negotiations on its remaining assets - the Pasadena and Tyler refineries. These two medium complexity Gulf Coast refineries have a combined capacity of 152,000 barrels of crude oil per day (BPD): Pasadena (Pasadena, TX) is a 100,000 BPD facility (8.4 Nelson Complexity), and Tyler (Tyler, TX), a 52,000 BPD facility (9.0 Nelson Complexity). During 2003, Pasadena and Tyler averaged production output of 76,075 BPD (76% Utilization) and 52,534 BPD (100%+ Utilization), respectively. Both refineries are operated to generate a product mix of approximately 88% higher margin fuels. When operating to maximize the production of light products, the product mix at both refineries is approximately 55% gasoline, 33% distillates, 6% petrochemical feedstocks, and 6% slurry oil and petroleum coke.

Please see Important Disclosure Information on the last pages of this Report

[ page 1 of 4 ]

JEFFERIES HIGH YIELD RESEARCH

Energy Refining & Marketing

Pasadena Escrow Amounts Approximately $7.0 mm of the $42.5 mm purchase price for Pasadena will be escrowed at closing for certain claims that may be made by PRS against Crown under the representations, warranties, and indemnitities contained in the Agreeement. Similarly, PRS will place $7.0 mm in escrow at closing as security for its obligation to indemnify Crown against primarily environmental liabilities which it is assuming from Crown. 50% of the amount remaining after any claims will be released on the first anniversary of the closing date and the remainder18-months after the closing date. Pasadena Refining Systems, Inc. PRS is an affiliate of Astra Oil Company, Inc. of Huntington Beach, California. PRS parent is Transcor S.A., a subsidiary of Belgiums Compagnie Nationale a Portefeuille.

Variance - Pasadena Sale & Pension Settlement (EXPECTED CASE) 10/6/04 Adj. For Adj. Est. Actual 10/6/04 ASSETS Working Capital Cash $105.1 -$105.1 +Acct. Rec. $106.4 -$106.4 +Other Asset Sales/Assets $14.2 -$14.2 -Accts. Payable & Accrued Liabilities $170.5 -$170.5 WorkCap - Cont'd Operations $55.2 -$55.2 WorkCap - Discontinued Ops. $24.7 -$24.7 Total WorkCap $79.9 -$79.9 Inventory Crude Oil Inventory Other Inventory Total Inventories Refineries Tyler Refinery Pasadena Refinery Total Refineries 2H04E FCF Total Assets LIABILITIES Pension Settlement Other/Environmental Total Liabilities Net Value to Sr. Nts. Sr. Nts. O/S Equity Value Future Recovery

Variance

--------

$62.7 $3.3 $66.0

----

$62.7 $3.3 $66.0

----

$42.7 $47.9 $90.6 $16.7 $253.2

-($5.4) ($5.4) -($5.4)

$42.7 $42.5 $85.2 $16.7 $247.8

-($5.4) ($5.4) -($5.4)

$66.1 $27.2 $93.3 $159.9 $125.0 $34.9 128%

($20.9) ($6.9) ($27.8) $22.4 $125.0 NA 18%

$45.2 $20.3 $65.5 $182.3 $125.0 $57.3 146%

($20.9) ($6.9) ($27.8) $22.4 $125.0 NA 18%

Please see Important Disclosure Information on the last pages of this Report

[ page 2 of 4 ]

J E F F E R I E S H I G H Y I E L D R E S E AR C H

Energy Refining & Marketing

I, Greg Imbruce, certify that all of the views expressed in this report accurately reflect my personal views about the subject security(ies) and subject company(ies). I also certify that no part of my compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this research report.

This material has been prepared by Jefferies & Company, Inc. ("Jefferies") a U.S.-registered broker-dealer, employing appropriate expertise, and in the belief that it is fair and not misleading. It is approved for distribution in the United Kingdom by Jefferies International Limited ("JIL") regulated by the Financial Services Authority ("FSA"). The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore except for any obligations under the rules of the FSA, we do not guarantee its accuracy. Additional and supporting information is available upon request. This is not an offer or solicitation of an offer to buy or sell any security or investment. Any opinion or estimates constitute our best judgment as of this date, and are subject to change without notice. Jefferies and JIL and their affiliates and their respective directors, officers and employees may buy or sell securities mentioned herein as agent or principal for their own account. This material is intended for use only by professional or institutional investors falling within articles 19 or 49 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2001 and not the general investing public. None of the investments or investment services mentioned or described herein are available to other persons in the U.K. and in particular are not available to "private customers" as defined by the rules of the FSA or to anyone in Canada who is not a "Designated Institution" as defined by the Securities Act (Ontario). STRONG BUY: Significant price appreciation is expected in this situation, or significant outperformance relative to the balance of the issues in thesector/industry is expected over a near term period. BUY: These bonds are expected to outperform other issues in the sector/industry group over the intermediate term. HOLD: These bonds are fairly valued currently, If owned, there is not an apparent catalyst to sell in the intermediate term. In the interim, the bond is likely to perform as well as the average bond in the sector/industry. SELL: There is a significant likelihood that these bonds will underperform relative to its sector/industry in the near term. NR: Not Rated

Please see Important Disclosure Information on the last pages of this Report

[ page 3 of 4 ]

HIGH YIELD RESEARCH

HIGH YIELD AND SPECIAL SITUATIONS GROUP RESEARCH

Brett M. Levy, Co-Director, Bob Welch, Co-Director, blevy@jefco.com bwelch@jefco.com (203) 708-5806 (203) 708-5800

TRADING

David W. Schwartz, Executive Vice President John Budish Michael Satzberg (203) 708-5800 (973) 912-2790 (310) 575-5100

Restaurant, Food and Consumer Products Kenneth Bann kbann@jefco.com Michael Schwartz maschwartz@jefco.com

(973) 912-2790 (973) 912-2790 Steve Baker Harrison Bubrosky Laury Carr Don Dizon Howard Fife Drew Hall Mark Neuner Steve Sander Michael Shapiro Tony Ulehla Paul Voigt

SALES

(203) 708-5800 (203) 708-5800 (203) 708-5800 (203) 708-5800 (203) 708-5800 (203) 708-5800 (310) 575-5128 (203) 708-5800 (203) 708-5800 (203) 708-5800 (203) 708-5800

Aerospace & Defense, Packaging, Paper and Forest Products Bradley K. Bryan bbryan@jefco.com (310) 575-5113

Gaming, Lodging and Leisure Raymond S. Cheesman rcheesman@vail.org (970) 926-5309

Maritime, Financial Services and Movie Theatres Oliver Corlett ocorlett@jefco.com (310) 575-5100

Energy, Power and Utilities Greg Imbruce gimbruce@jefco.com Metals and Mining Brett M. Levy Raymond Wu blevy@jefco.com rwu@jefco.com

(203) 708-5804

(203) 708-5806 (203) 708-5807

CAPITAL MARKETS

Eric Macy, Executive Vice President Travis Black Timothy Lepore (973) 912-2888 (973) 912-2888 (973) 912-2888

Communications and Media Romeo Reyes rreyes@jefco.com Chak K. Gude cgude@jefco.com Steve Sweeney, CFA ssweeney@jefco.com Healthcare Kyle Smith ksmith@jefco.com

(203) 708-5800 (203) 708-5803 (203) 708-5805

PRIVATE PLACEMENTS

Andrew Woolford Neil Wessan Frederick Buffone Daniel Polner Tom Tuchscher (203) 708-5878 (203) 708-5874 (203) 708-5877 (203) 708-5875 (203) 708-5810

(973) 912-2790

Industrials, Automotive Supply, Chemicals and Special Situations Joseph P. Von Meister, CFA jvm@jefco.com (973) 912-9790

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Jefferies Calpine Tiverton Report Buy Greg ImbruceDokument7 SeitenJefferies Calpine Tiverton Report Buy Greg ImbrucerpupolaNoch keine Bewertungen

- Jefferies Crown Central Petroleum Refining Research Report Oct 2004 Greg ImbruceDokument22 SeitenJefferies Crown Central Petroleum Refining Research Report Oct 2004 Greg ImbrucerpupolaNoch keine Bewertungen

- Jefferies-High Yield Best Picks 2004-Greg ImbruceDokument3 SeitenJefferies-High Yield Best Picks 2004-Greg ImbrucerpupolaNoch keine Bewertungen

- Greg White (Gregory C. White, Gregory Campbell White) Dallas Arrest - Court Records M1132850-19Dokument1 SeiteGreg White (Gregory C. White, Gregory Campbell White) Dallas Arrest - Court Records M1132850-19rpupolaNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- FirstStrike PlusDokument5 SeitenFirstStrike Plusartus14Noch keine Bewertungen

- Kyc Supplemental Form: Signature Over Printed Name / Date SignedDokument1 SeiteKyc Supplemental Form: Signature Over Printed Name / Date SignedRoan Noreen DazoNoch keine Bewertungen

- Weighted Average Cost of Capital (WACC) GuideDokument5 SeitenWeighted Average Cost of Capital (WACC) GuideJahangir KhanNoch keine Bewertungen

- 4 1ComparingAlternativesDokument59 Seiten4 1ComparingAlternativestouhidNoch keine Bewertungen

- Mahindra & Mahindra Acquires SSanYongDokument11 SeitenMahindra & Mahindra Acquires SSanYongShivam BajajNoch keine Bewertungen

- Assignment On NCC BankDokument44 SeitenAssignment On NCC Bankhasan633100% (1)

- GA502166-New Policy Welcome LetterDokument1 SeiteGA502166-New Policy Welcome LetterNelly HNoch keine Bewertungen

- MIS ReportDokument15 SeitenMIS ReportMuhammad RizwanNoch keine Bewertungen

- Birla Power Industry AnalysisDokument11 SeitenBirla Power Industry Analysissandysandy11Noch keine Bewertungen

- Man307 2017 18 Final Exam Questions SiUTDokument4 SeitenMan307 2017 18 Final Exam Questions SiUTKinNoch keine Bewertungen

- AccountingDokument8 SeitenAccountingfransiscaNoch keine Bewertungen

- Beauhurst Crowdfunding Index Q1 2017Dokument5 SeitenBeauhurst Crowdfunding Index Q1 2017CrowdfundInsiderNoch keine Bewertungen

- Abella vs. Abella GR No. 195166 July 08, 2015Dokument6 SeitenAbella vs. Abella GR No. 195166 July 08, 2015ErikEspinoNoch keine Bewertungen

- Stanley F. Allen F.C.A. (Aust.) - The Pirates of Finance (1947)Dokument69 SeitenStanley F. Allen F.C.A. (Aust.) - The Pirates of Finance (1947)bookbenderNoch keine Bewertungen

- US Internal Revenue Service: Irb98-02Dokument44 SeitenUS Internal Revenue Service: Irb98-02IRSNoch keine Bewertungen

- IDFCFIRSTBankstatement 10094802422Dokument33 SeitenIDFCFIRSTBankstatement 10094802422vikas jainNoch keine Bewertungen

- Blue Print 3-5 Years Multi Finance: Marmin MurgiantoDokument6 SeitenBlue Print 3-5 Years Multi Finance: Marmin MurgiantoRicky NovertoNoch keine Bewertungen

- Acc CH 3Dokument7 SeitenAcc CH 3Tajudin Abba RagooNoch keine Bewertungen

- Startup Accelerator Rankings Methodology & Companion Report - Kellogg School of Management NorthwesternDokument4 SeitenStartup Accelerator Rankings Methodology & Companion Report - Kellogg School of Management NorthwesternFrank Gruber50% (2)

- NCB Financial Group (NCBFG) - Unaudited Financial Results PDFDokument22 SeitenNCB Financial Group (NCBFG) - Unaudited Financial Results PDFBernewsAdminNoch keine Bewertungen

- Key Facts Missold IVA Legal PartnerDokument1 SeiteKey Facts Missold IVA Legal PartnerAnthony RobertsNoch keine Bewertungen

- You Will Get Questions From This Too 1Z0-1056-21 Oracle Financials Cloud Receivables 2021 Implementation ProfessionalDokument28 SeitenYou Will Get Questions From This Too 1Z0-1056-21 Oracle Financials Cloud Receivables 2021 Implementation ProfessionalSamima KhatunNoch keine Bewertungen

- Icici Bank Deposits Recurring Deposits: FeaturesDokument6 SeitenIcici Bank Deposits Recurring Deposits: FeaturesDhiraj AhujaNoch keine Bewertungen

- Marketing Strategy For IslamicDokument16 SeitenMarketing Strategy For IslamicTamim Arefi100% (1)

- Ates Cagdas Ozan Behavioral Finance and Sports Betting Markets MSC 2004Dokument83 SeitenAtes Cagdas Ozan Behavioral Finance and Sports Betting Markets MSC 2004yexed63889Noch keine Bewertungen

- SG ITAD Ruling No. 019-03Dokument4 SeitenSG ITAD Ruling No. 019-03Paul Angelo TombocNoch keine Bewertungen

- Loyalty Card Plus: Application FormDokument2 SeitenLoyalty Card Plus: Application FormKillah BeatsNoch keine Bewertungen

- Kumkum YadavDokument51 SeitenKumkum YadavHarshit KashyapNoch keine Bewertungen

- Chronicle of World Financial Crisis 2007-2008Dokument4 SeitenChronicle of World Financial Crisis 2007-2008Md. Azim Ferdous100% (1)

- Swift MT RulesDokument2 SeitenSwift MT RulesJit JackNoch keine Bewertungen