Beruflich Dokumente

Kultur Dokumente

Accounting 203 Chapter 12 Test

Hochgeladen von

Anbang XiaoOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Accounting 203 Chapter 12 Test

Hochgeladen von

Anbang XiaoCopyright:

Verfügbare Formate

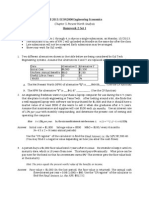

ACCOUNTING 203 Chapter 12 Practice Test

True and False Questions

1. The simple rate of return is the same as the internal rate of return. 2. If two projects require the same amount of investment, then the preference ranking computed using either the profitability index or the net present value would be the same. 3. Preference decisions attempt to determine which of many alternative investment projects would be the best for the company to accept. 4. A very useful guide for making investment decisions is: The shorter payback period, the more profitable the project. 5. The cost of capital involves blending of costs of all sources of capital funds, both debt and equity.

Multiple Choice Questions

6. Spring Company has invested $20,000 in a project. Springs discount rate is 12% and the profitability index on the project is 1.00. Which of the following statements would be true? I. The present value of the projects net cash flows is $20,000. II. The projects internal rate of return is equal to 12%. A) B) C) D) Only I. Only II. Both I and II. Neither I nor II.

7. If the internal rate of return is used as the discount rate in computing net present value, the net present value will be: A) B) C) D) positive. negative. zero. unknown.

Everett Community College Tutoring Center 1

8. The length of time required to recover the initial cash outlay for a project is determined by using: A) B) C) D) discounted cash flow method. the payback method. the net present value method. the simple rate of return method.

9. A decrease in the discount rate: A) B) C) D) will increase present values of future cash flows. is one way to compensate for greater risk in a in a project. will reduce present values of future cash flows. responses a and b are both correct.

10. A piece of new equipment will cost $70,000. The equipment will provide a cost savings of $15,000 per year for ten years, after which it will have a $3,000 salvage value. If the required rate of return is 14%, the equipments net present value is: A) B) C) D) $8,240. $(8,240). $23,888. $9,050.

11. Because Company is planning to invest in a machine with a useful life of five years and no salvage value. The machine is expected to produce cash flow from operations of $20,000 in each of the five years. Becauses required rate of return is 10%. The maximum price that the company would pay for the machine would be: A) B) C) D) $32,220. $62,100. $75,820. $122,100.

12. Bern Company is planning to invest in a two-year project that is expected to yield cash flows from operations of $50,000 in the first year and $80,000 in the second year. Bern requires a return of 14% on all investment projects. The maximum that Bern should invest in this project is: A) B) C) D) $130,000. $105,370. $120,160. $161,000.

Everett Community College Tutoring Center 2

Use the following to answer questions 13 and 14. Bates College has a telephone system that is in poor condition. The system can be either overhauled or replaced with a new system. The following data have been gathered concerning these two alternatives: Proposed New System $150,000

Purchase cost when new.. Accumulated depreciation.. Overhaul cost needed now . Annual operating costs .. Salvage value now Salvage value in 8 years . Working capital required ..

Present System $100,000 $90,000 $ 80.000 $30,000 $10,000 $2,000

$20,000 $15,000 $50,000

Bates College uses a 12% discount rate and the total cost approach to capital budgeting analysis. Both alternatives are expected to have a useful life of eight years. 13. The net present value of the overhaul alternative is: A) $(238,232). B) $(108,000). C) $(228,232). D) $(232,272). 14. The net present value of the new system alternative is: A) $(233,300). B) $(283,300). C) $(263,100). D) $(273,100).

Answers: True and False 1. F 2. T 3. T 4. F 5. T Multiple Choice 6. C 7. C 8. B 9. A 10. D 11. C 12. B 13. C 14. C

Everett Community College Tutoring Center 3

Das könnte Ihnen auch gefallen

- MAS Compre Quiz To PrintDokument3 SeitenMAS Compre Quiz To PrintJuly LumantasNoch keine Bewertungen

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Von EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Bewertung: 5 von 5 Sternen5/5 (1)

- Chapter 11 TF MC AnswersDokument6 SeitenChapter 11 TF MC AnswersAngela Thrisananda KusumaNoch keine Bewertungen

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Von EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Bewertung: 4.5 von 5 Sternen4.5/5 (5)

- MC AnswerDokument24 SeitenMC AnswerMiss MegzzNoch keine Bewertungen

- Add - L Problems CBDokument4 SeitenAdd - L Problems CBJamesCarlSantiagoNoch keine Bewertungen

- Capital BudgetingDokument19 SeitenCapital BudgetingJane Masigan50% (2)

- Assignment Capital BudgetingDokument3 SeitenAssignment Capital BudgetingGHULAM NABINoch keine Bewertungen

- FRM 3 EsatDokument0 SeitenFRM 3 EsatChuck YintNoch keine Bewertungen

- Finals Answer KeyDokument13 SeitenFinals Answer Keymarx marolinaNoch keine Bewertungen

- Afm Ch13 AnsDokument21 SeitenAfm Ch13 Ans808kailuaNoch keine Bewertungen

- Capital Projects Time Value of MoneyDokument23 SeitenCapital Projects Time Value of MoneyneerajfantasticNoch keine Bewertungen

- Q 14Dokument6 SeitenQ 14Jenn MirandaNoch keine Bewertungen

- Sample Questions of Capital BudgetingDokument17 SeitenSample Questions of Capital BudgetingFredy Msamiati100% (1)

- I. Capital Budgeting (30 Questions)Dokument26 SeitenI. Capital Budgeting (30 Questions)Joseph Prado Fernandez0% (1)

- Activity - Capital Investment AnalysisDokument5 SeitenActivity - Capital Investment AnalysisKATHRYN CLAUDETTE RESENTENoch keine Bewertungen

- Test Bank For Accounting For Decision Making and Control 8th 0078025745Dokument38 SeitenTest Bank For Accounting For Decision Making and Control 8th 0078025745fishintercur1flsg5100% (15)

- Contoh Soal Quiz MankeuDokument11 SeitenContoh Soal Quiz MankeuGregoriusAdityaNoch keine Bewertungen

- MAS Midterm Quiz 2Dokument4 SeitenMAS Midterm Quiz 2Joseph John SarmientoNoch keine Bewertungen

- Day 1 Capital BudgetingDokument12 SeitenDay 1 Capital BudgetingJohn Carlo Aquino100% (1)

- Capital Budgeting Decisions True FalseDokument18 SeitenCapital Budgeting Decisions True FalseShanen Baguilat DawongNoch keine Bewertungen

- MGTS 301 Feb 16, 2014Dokument10 SeitenMGTS 301 Feb 16, 2014subash shrestha100% (1)

- Capital Budgeting: Key Topics To KnowDokument11 SeitenCapital Budgeting: Key Topics To KnowBernardo KristineNoch keine Bewertungen

- AU12-FM-Midterm QuizDokument6 SeitenAU12-FM-Midterm QuizHan Nguyen GiaNoch keine Bewertungen

- HW 2 Set 1 KeysDokument7 SeitenHW 2 Set 1 KeysIan SdfuhNoch keine Bewertungen

- Cash Flow Estimation Problem SetDokument6 SeitenCash Flow Estimation Problem SetmehdiNoch keine Bewertungen

- Capital Budgeting 3MA3 MMD: Problem ADokument9 SeitenCapital Budgeting 3MA3 MMD: Problem AShao BajamundeNoch keine Bewertungen

- QuizDokument7 SeitenQuizHo Yuen TangNoch keine Bewertungen

- Management Accounting 2 Handout #2 TheoriesDokument4 SeitenManagement Accounting 2 Handout #2 TheoriesCyrille MananghayaNoch keine Bewertungen

- ISSM 541 Winter 2015 Assignment 5Dokument5 SeitenISSM 541 Winter 2015 Assignment 5Parul KhannaNoch keine Bewertungen

- Additional Exercises - 21Dokument9 SeitenAdditional Exercises - 21Gega XachidENoch keine Bewertungen

- Quiz Week 3 SolnsDokument7 SeitenQuiz Week 3 SolnsRiri FahraniNoch keine Bewertungen

- Economic Evaluation of Capital Expenditures: Multiple ChoiceDokument14 SeitenEconomic Evaluation of Capital Expenditures: Multiple ChoiceGweeenchanaNoch keine Bewertungen

- Chapter 6 Answer SheetDokument7 SeitenChapter 6 Answer SheetJoan Gayle BalisiNoch keine Bewertungen

- Finance 3Dokument10 SeitenFinance 3Jesfer Averie ManarangNoch keine Bewertungen

- Cap Budgeting ExerciseDokument5 SeitenCap Budgeting ExerciseripplerageNoch keine Bewertungen

- Capital Budgeting 1st PartDokument8 SeitenCapital Budgeting 1st PartPeng Guin100% (1)

- ACCTG 11 Management Accounting Part 2: Lyceum-Northwestern UniversityDokument7 SeitenACCTG 11 Management Accounting Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaNoch keine Bewertungen

- ACCTG 11 Management Accounting Part 2: Lyceum-Northwestern UniversityDokument7 SeitenACCTG 11 Management Accounting Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaNoch keine Bewertungen

- CPA BEC Mock QuestionsDokument21 SeitenCPA BEC Mock Questionsharish100% (1)

- Problem 12-1aDokument8 SeitenProblem 12-1aJose Ramon AlemanNoch keine Bewertungen

- Engineering EconomyDokument16 SeitenEngineering EconomyHazel Marie Ignacio PeraltaNoch keine Bewertungen

- Fa Finc 2302 Approved (Sem 2 2020 - 2021)Dokument9 SeitenFa Finc 2302 Approved (Sem 2 2020 - 2021)Abdullah AlziadyNoch keine Bewertungen

- AsemDokument10 SeitenAsemasem shabanNoch keine Bewertungen

- Fin622 McqsDokument25 SeitenFin622 McqsIshtiaq JatoiNoch keine Bewertungen

- C I C (CIC) دهعملا يدنكلا يلاعلا ةسدنهلل - سداسلا نم ربوتكأDokument2 SeitenC I C (CIC) دهعملا يدنكلا يلاعلا ةسدنهلل - سداسلا نم ربوتكأabdullah azayemNoch keine Bewertungen

- Capital Budgeting Decisions: Key Terms and Concepts To KnowDokument17 SeitenCapital Budgeting Decisions: Key Terms and Concepts To Knownisarg_Noch keine Bewertungen

- Investment DecisionsDokument17 SeitenInvestment Decisionssajith santyNoch keine Bewertungen

- Practice Exam - Part 3: Multiple ChoiceDokument4 SeitenPractice Exam - Part 3: Multiple ChoiceAzeem TalibNoch keine Bewertungen

- 23 Economic Evaluation of Capital ExpenditureDokument14 Seiten23 Economic Evaluation of Capital ExpenditureRicky Sibal MacalanNoch keine Bewertungen

- Test BankDokument15 SeitenTest BankBWB DONALDNoch keine Bewertungen

- Instructions. Choose The BEST Answer For Each of The Following ItemsDokument3 SeitenInstructions. Choose The BEST Answer For Each of The Following ItemsDiomela BionganNoch keine Bewertungen

- Final Review Questions SolutionsDokument5 SeitenFinal Review Questions SolutionsNuray Aliyeva100% (1)

- SunwayTes Management Accountant Mock E2Dokument10 SeitenSunwayTes Management Accountant Mock E2FarahAin FainNoch keine Bewertungen

- Worksheet For The Course Industrial Management and Engineering Economics (Engineering Economics Part) Part I: For The Following Questions Give Short Answer According To The Requirements IntendedDokument10 SeitenWorksheet For The Course Industrial Management and Engineering Economics (Engineering Economics Part) Part I: For The Following Questions Give Short Answer According To The Requirements IntendedkalNoch keine Bewertungen

- Fin622 McqsDokument25 SeitenFin622 McqsShrgeel HussainNoch keine Bewertungen

- 3rd Exam Test PrepDokument7 Seiten3rd Exam Test Prepbilly93100% (1)

- Capital Budgeting Practice QuestionsDokument5 SeitenCapital Budgeting Practice QuestionsMujtaba A. Siddiqui100% (5)

- CH01TBV7Dokument15 SeitenCH01TBV7AAAMMMBBBNoch keine Bewertungen

- Chap 009Dokument30 SeitenChap 009Anbang XiaoNoch keine Bewertungen

- Chapter 01 - The Scope and Challenge of International MarketingDokument78 SeitenChapter 01 - The Scope and Challenge of International MarketingAnbang XiaoNoch keine Bewertungen

- FINDokument10 SeitenFINAnbang XiaoNoch keine Bewertungen

- FINDokument10 SeitenFINAnbang XiaoNoch keine Bewertungen

- Guest: Help and Information CommandsDokument2 SeitenGuest: Help and Information CommandsAnbang XiaoNoch keine Bewertungen

- FINDokument16 SeitenFINAnbang Xiao50% (2)

- Accounting 203 Chapter 13 TestDokument3 SeitenAccounting 203 Chapter 13 TestAnbang XiaoNoch keine Bewertungen

- PracticeDokument20 SeitenPracticeAnbang Xiao100% (1)

- Accounting ReviewDokument68 SeitenAccounting Reviewcrazycoolnisha75% (4)

- CH03 TQ HW 7eDokument26 SeitenCH03 TQ HW 7eAnbang Xiao100% (2)

- Chapter 7 Supplement 1Dokument20 SeitenChapter 7 Supplement 1Anbang XiaoNoch keine Bewertungen

- 2009-04-03 181856 ReviewDokument18 Seiten2009-04-03 181856 ReviewAnbang XiaoNoch keine Bewertungen

- Sample Questions Chapters 1 2 3 5Dokument11 SeitenSample Questions Chapters 1 2 3 5Anbang XiaoNoch keine Bewertungen

- FM Lecture 4Dokument26 SeitenFM Lecture 4NguyenNoch keine Bewertungen

- Quiz # 14 Pre-Test Time Value of MoneyDokument1 SeiteQuiz # 14 Pre-Test Time Value of MoneyDarren Jacob EspinaNoch keine Bewertungen

- Business Valuations: Net Asset Value (Nav)Dokument9 SeitenBusiness Valuations: Net Asset Value (Nav)Artwell ZuluNoch keine Bewertungen

- Gui Me inDokument30 SeitenGui Me inThùy LinhNoch keine Bewertungen

- Financial Analysis With Microsoft Excel 2016 8th Edition Mayes Solutions ManualDokument7 SeitenFinancial Analysis With Microsoft Excel 2016 8th Edition Mayes Solutions Manuallaylasaintbq83pu100% (29)

- 6TH Notes PayableDokument9 Seiten6TH Notes PayableAnthony DyNoch keine Bewertungen

- Unit 6Dokument42 SeitenUnit 6yebegashetNoch keine Bewertungen

- ch14 Kieso IFRS4 PPTDokument83 Seitench14 Kieso IFRS4 PPTĐức HuyNoch keine Bewertungen

- MathsLR Stats Charts Quick Referencer by ICAIDokument23 SeitenMathsLR Stats Charts Quick Referencer by ICAISofiyaNoch keine Bewertungen

- 2.5.3 Theory On Notes, Loans and ImpairmentDokument8 Seiten2.5.3 Theory On Notes, Loans and ImpairmentERIC KEVIN LECAROSNoch keine Bewertungen

- Solutions of Selected Problems in Chapter 4 - The Time Value of Money (Part 2)Dokument10 SeitenSolutions of Selected Problems in Chapter 4 - The Time Value of Money (Part 2)Sana Khan100% (1)

- Car Parking - 2 Davies AvenueDokument8 SeitenCar Parking - 2 Davies AvenueBen RossNoch keine Bewertungen

- Problem Set For Exam 1 - SolutionsDokument4 SeitenProblem Set For Exam 1 - SolutionsInesNoch keine Bewertungen

- Chapter 6 Bond ValuationDokument50 SeitenChapter 6 Bond ValuationAnanth Krishnan100% (1)

- Cheatsheet MTDokument3 SeitenCheatsheet MT01dynamic0% (1)

- Corporate Finance Practice ExamDokument11 SeitenCorporate Finance Practice ExamPeng Jin100% (1)

- Mid-Exam Pre-TestDokument36 SeitenMid-Exam Pre-TestRizki RamdaniNoch keine Bewertungen

- 15 11 22 PracticeDokument5 Seiten15 11 22 PracticeАнна Миколаївна МасовецьNoch keine Bewertungen

- G11 General-Mathematics Q2 L2Dokument7 SeitenG11 General-Mathematics Q2 L2Maxine ReyesNoch keine Bewertungen

- Acquisition and Disposition of Property, Plant, and Equipment - Amjad O. Asfour1Dokument58 SeitenAcquisition and Disposition of Property, Plant, and Equipment - Amjad O. Asfour1amjad asfourNoch keine Bewertungen

- ACC 210P - Chapter 9 Lab Exercise SolutionsDokument3 SeitenACC 210P - Chapter 9 Lab Exercise SolutionscyclonextremeNoch keine Bewertungen

- Chapter - 2: Concepts of Value and ReturnDokument25 SeitenChapter - 2: Concepts of Value and ReturnAkash saxenaNoch keine Bewertungen

- Course Outline in Mathematics of InvestmentDokument2 SeitenCourse Outline in Mathematics of InvestmentMary UmitenNoch keine Bewertungen

- Jethro S. Cortado BSA 1B Property and EquipmentDokument9 SeitenJethro S. Cortado BSA 1B Property and EquipmentJi Eun VinceNoch keine Bewertungen

- Intro Leases by LesseesDokument62 SeitenIntro Leases by LesseesWing YanNoch keine Bewertungen

- 1 Semester, 2014/2015 Examination Fin 210: Introduction To Finance Time Allowed 90 Minutes Use For Questions 1 To 5Dokument22 Seiten1 Semester, 2014/2015 Examination Fin 210: Introduction To Finance Time Allowed 90 Minutes Use For Questions 1 To 5Daniel AdegboyeNoch keine Bewertungen

- 20081MS Ibs535Dokument12 Seiten20081MS Ibs535anuragrp1988@gmail.comNoch keine Bewertungen

- ACF 5101-Financial Management and Accounting-Asad Alam-Syed Mubashir AliDokument12 SeitenACF 5101-Financial Management and Accounting-Asad Alam-Syed Mubashir Alinetflix accountNoch keine Bewertungen

- MCQs 100 QuestionsDokument39 SeitenMCQs 100 QuestionsG JhaNoch keine Bewertungen

- NPV IRR ExplainedDokument8 SeitenNPV IRR ExplainedkumarnramNoch keine Bewertungen

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsVon EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNoch keine Bewertungen

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantVon EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantBewertung: 4 von 5 Sternen4/5 (104)

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Von EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Bewertung: 5 von 5 Sternen5/5 (91)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassVon EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNoch keine Bewertungen

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsVon EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsBewertung: 4 von 5 Sternen4/5 (4)

- How To Budget And Manage Your Money In 7 Simple StepsVon EverandHow To Budget And Manage Your Money In 7 Simple StepsBewertung: 5 von 5 Sternen5/5 (4)

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationVon EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationBewertung: 4.5 von 5 Sternen4.5/5 (18)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsVon EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNoch keine Bewertungen

- CAPITAL: Vol. 1-3: Complete Edition - Including The Communist Manifesto, Wage-Labour and Capital, & Wages, Price and ProfitVon EverandCAPITAL: Vol. 1-3: Complete Edition - Including The Communist Manifesto, Wage-Labour and Capital, & Wages, Price and ProfitBewertung: 4 von 5 Sternen4/5 (6)

- Swot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessVon EverandSwot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessBewertung: 4.5 von 5 Sternen4.5/5 (4)

- The Best Team Wins: The New Science of High PerformanceVon EverandThe Best Team Wins: The New Science of High PerformanceBewertung: 4.5 von 5 Sternen4.5/5 (31)

- The Financial Planning Puzzle: Fitting Your Pieces Together to Create Financial FreedomVon EverandThe Financial Planning Puzzle: Fitting Your Pieces Together to Create Financial FreedomBewertung: 4.5 von 5 Sternen4.5/5 (2)

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Von EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Bewertung: 3.5 von 5 Sternen3.5/5 (9)

- Basic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonVon EverandBasic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonBewertung: 5 von 5 Sternen5/5 (9)

- The Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitVon EverandThe Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitNoch keine Bewertungen

- Budgeting: The Ultimate Guide for Getting Your Finances TogetherVon EverandBudgeting: The Ultimate Guide for Getting Your Finances TogetherBewertung: 5 von 5 Sternen5/5 (14)

- Rich Nurse Poor Nurses: The Critical Stuff Nursing School Forgot To Teach YouVon EverandRich Nurse Poor Nurses: The Critical Stuff Nursing School Forgot To Teach YouBewertung: 4 von 5 Sternen4/5 (2)

- Debt Freedom: A Realistic Guide On How To Eliminate Debt, Including Credit Card Debt ForeverVon EverandDebt Freedom: A Realistic Guide On How To Eliminate Debt, Including Credit Card Debt ForeverBewertung: 3 von 5 Sternen3/5 (2)

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyVon EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyBewertung: 5 von 5 Sternen5/5 (1)

- Radically Simple Accounting: A Way Out of the Dark and Into the ProfitVon EverandRadically Simple Accounting: A Way Out of the Dark and Into the ProfitBewertung: 4.5 von 5 Sternen4.5/5 (9)

- Inflation Hacking: Inflation Investing Techniques to Benefit from High InflationVon EverandInflation Hacking: Inflation Investing Techniques to Benefit from High InflationBewertung: 4.5 von 5 Sternen4.5/5 (5)