Beruflich Dokumente

Kultur Dokumente

Fs Q2fy13cr

Hochgeladen von

Aisha HusaainOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Fs Q2fy13cr

Hochgeladen von

Aisha HusaainCopyright:

Verfügbare Formate

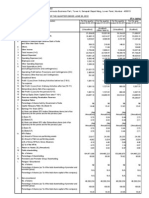

BIOCON GROUP

FACT SHEET

September-12

H1 FY 2013 vs. H1 FY 2012 Q2 FY 2013 vs. Q2 FY 2012

BIOCON LIMITED (CONSOLIDATED) UNAUDITED BALANCE SHEET September 30, 2012 EQUITY AND LIABILITIES Shareholder's Funds (a) Share capital (b)Reserves and surplus Minority interest Non-current liabilities (a) Long-term borrowings (b)Deferred tax liability (net) (c)Other long-term liabilities (d) Long-term provisions

(Rs. Crores) March 31, 2012

100 2,347 2,447 4

100 2,172 2,272 4

125 39 450 4 618

70 583 653

Current liabilities (a)Short-term borrowings (b)Trade payables (c)Other current liabilities (d)Short-term provisions

129 311 364 68 872 3,941

187 348 269 212 1,016 3,945

TOTAL ASSETS Non-current assets (a) Fixed assets (b) Good will on consolidation (c) Non-current investments (d) Deferred tax asset (net) (e) Long term loans and advances (f) Other non-current assets

1,683 12 78 206 186 2,165

1,648 12 64 8 185 29 1,946

Current assets (a) Current Investments (b) Inventories (c)Trade receivables (d)Cash and cash equivalents (e)Short term loans and advances (f)Other current assets

406 405 503 341 82 39 1,776 3,941

492 378 492 523 79 35 1,999 3,945

TOTAL

BIOCON LIMITED (CONSOLIDATED) UNAUDITED PROFIT & LOSS STATEMENT

H1 Particulars FY 13 H1 FY 12

(Rs. Crores)

Variance

INCOME

Biopharmaceuticals Branded formulations - India Total Biopharmaceuticals Contract research Total Sales Other income Total Revenue 734 178 912 252 1,164 71 1,235 570 172 79 109 930 305 4 88 213 43 170 1 169 8.5 640 122 762 180 942 59 1,001 449 137 51 83 720 281 7 88 186 30 156 156 7.8

15% 45% 20% 40% 24% 20% 23%

EXPENDITURE

Material & Power Costs Staff costs Research & Development Other Expenses Manufacturing, staff & other expenses PBDIT /EBITDA Interest and finance charges Depreciation & Amortisation PBT Taxes NET PROFIT FOR THE PERIOD Minority Interest NET PROFIT FOR THE PERIOD, AFTER MINORITY EPS Rs.

2. Figures of the Comparative period have been regrouped wherever necessary Biopharmaceuticals Income includes: Licensing development fees Licensing Income 14 51 27% 26% 54% 31% 29% 8% -36% -1% 14% 44% 9% 8%

Note: 1.The figures are rounded off to the nearest crores, percentages are based on absolute numbers

BIOCON LIMITED (CONSOLIDATED) UNAUDITED PROFIT & LOSS STATEMENT

Q2 Particulars FY 13 Q2 FY 12

(Rs. Crores) Variance

INCOME

Biopharmaceuticals Branded formulations - India Total Biopharmaceuticals Contract research Total Sales Other income Total Revenue 372 91 463 129 592 50 642 291 88 43 54 476 166 1 45 120 30 90 90 4.5 345 65 410 93 503 35 538 237 72 31 49 389 149 2 42 105 19 86 86 4.3 8% 42% 13% 39% 18% 43% 19% 23% 22% 40% 9% 22% 11% -39% 4% 15% 62% 5% 5%

EXPENDITURE

Material & Power Costs Staff costs Research & Development Other Expenses Manufacturing, staff & other expenses PBDIT /EBITDA Interest and finance charges Depreciation & Amortisation PBT Taxes NET PROFIT FOR THE PERIOD Minority Interest NET PROFIT FOR THE PERIOD, AFTER MINORITY EPS Rs.

2. Figures of the Comparative period have been regrouped wherever necessary Biopharmaceuticals Income includes: Licensing development fees Licensing Income 37 -

Note: 1.The figures are rounded off to the nearest crores, percentages are based on absolute numbers

Das könnte Ihnen auch gefallen

- Audit Report BDODokument18 SeitenAudit Report BDO16110121Noch keine Bewertungen

- Financial StatementDokument115 SeitenFinancial Statementammar123Noch keine Bewertungen

- Re Ratio AnalysisDokument31 SeitenRe Ratio AnalysisManish SharmaNoch keine Bewertungen

- Difference Between Economic Life and Useful Life of An AssetDokument3 SeitenDifference Between Economic Life and Useful Life of An Assetgdegirolamo100% (1)

- Analysis of Apollo TiresDokument12 SeitenAnalysis of Apollo TiresTathagat ChatterjeeNoch keine Bewertungen

- Islamic Meditation Manual PDFDokument30 SeitenIslamic Meditation Manual PDFSuaibatulislamiahAbdulNasir100% (2)

- Islamic Meditation Manual PDFDokument30 SeitenIslamic Meditation Manual PDFSuaibatulislamiahAbdulNasir100% (2)

- Tax Invoice for Designing & Adaptation ChargesDokument1 SeiteTax Invoice for Designing & Adaptation ChargesPrem Kumar YadavalliNoch keine Bewertungen

- 2Q12 Financial StatementsDokument47 Seiten2Q12 Financial StatementsFibriaRINoch keine Bewertungen

- Fibria Celulose S.ADokument68 SeitenFibria Celulose S.AFibriaRINoch keine Bewertungen

- MMDZ Audited Results For FY Ended 31 Dec 13Dokument1 SeiteMMDZ Audited Results For FY Ended 31 Dec 13Business Daily ZimbabweNoch keine Bewertungen

- Profit and Loss Account For The Year Ended 31 March, 2012Dokument6 SeitenProfit and Loss Account For The Year Ended 31 March, 2012Sandeep GalipelliNoch keine Bewertungen

- APQ3FY12Dokument19 SeitenAPQ3FY12Abhigupta24Noch keine Bewertungen

- Tut 4 - Reliance Financial StatementsDokument3 SeitenTut 4 - Reliance Financial StatementsJulia DanielNoch keine Bewertungen

- 3Q12 Financial StatementsDokument50 Seiten3Q12 Financial StatementsFibriaRINoch keine Bewertungen

- Chinasoft International Limited: Annual Results Announcement For The Year Ended 31 December 2012Dokument50 SeitenChinasoft International Limited: Annual Results Announcement For The Year Ended 31 December 2012alan888Noch keine Bewertungen

- Tute3 Reliance Financial StatementsDokument3 SeitenTute3 Reliance Financial Statementsvivek patelNoch keine Bewertungen

- PhilipsFullAnnualReport2013 EnglishDokument250 SeitenPhilipsFullAnnualReport2013 Englishjasper laarmansNoch keine Bewertungen

- JUL'Sep'12 Jul-Sep'11 Rupees RupeesDokument8 SeitenJUL'Sep'12 Jul-Sep'11 Rupees RupeesMansoor AliNoch keine Bewertungen

- Berger ReportsDokument17 SeitenBerger ReportsanaqshabbirNoch keine Bewertungen

- 2Q13 Financial StatementsDokument52 Seiten2Q13 Financial StatementsFibriaRINoch keine Bewertungen

- BJE Q1 ResultsDokument4 SeitenBJE Q1 ResultsTushar DasNoch keine Bewertungen

- Third Quarter March 31 2014Dokument18 SeitenThird Quarter March 31 2014major144Noch keine Bewertungen

- DemonstraDokument74 SeitenDemonstraFibriaRINoch keine Bewertungen

- UBL Financial Statement AnalysisDokument17 SeitenUBL Financial Statement AnalysisJamal GillNoch keine Bewertungen

- ONGC Financial Analysis: India's Top Oil Producer Saw Revenue Rise in 2013Dokument34 SeitenONGC Financial Analysis: India's Top Oil Producer Saw Revenue Rise in 2013Apeksha SaggarNoch keine Bewertungen

- Qfs 1q 2012 - FinalDokument40 SeitenQfs 1q 2012 - Finalyandhie57Noch keine Bewertungen

- Infosys Balance SheetDokument28 SeitenInfosys Balance SheetMM_AKSINoch keine Bewertungen

- 2012 Annual Financial ReportDokument76 Seiten2012 Annual Financial ReportNguyễn Tiến HưngNoch keine Bewertungen

- 28 Consolidated Financial Statements 2013Dokument47 Seiten28 Consolidated Financial Statements 2013Amrit TejaniNoch keine Bewertungen

- WCL Annual Report 2011 - 12Dokument92 SeitenWCL Annual Report 2011 - 12shah1703Noch keine Bewertungen

- FXCM Q3 Slide DeckDokument20 SeitenFXCM Q3 Slide DeckRon FinbergNoch keine Bewertungen

- Reliance Industries Ltd. FY 2012 Profit and Loss StatementDokument10 SeitenReliance Industries Ltd. FY 2012 Profit and Loss StatementJuhi BansalNoch keine Bewertungen

- Half Yearly Dec09-10 PDFDokument15 SeitenHalf Yearly Dec09-10 PDFSalman S. ZiaNoch keine Bewertungen

- 4.JBSL AccountsDokument8 Seiten4.JBSL AccountsArman Hossain WarsiNoch keine Bewertungen

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- ASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedDokument14 SeitenASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedASX:ILH (ILH Group)Noch keine Bewertungen

- 1Q13 Financial StatementsDokument52 Seiten1Q13 Financial StatementsFibriaRINoch keine Bewertungen

- Hinopak Motors Limited Balance Sheet As at March 31, 2013Dokument40 SeitenHinopak Motors Limited Balance Sheet As at March 31, 2013nomi_425Noch keine Bewertungen

- TCS Ifrs Q3 13 Usd PDFDokument23 SeitenTCS Ifrs Q3 13 Usd PDFSubhasish GoswamiNoch keine Bewertungen

- First-Half Earnings at Record: DBS Group Holdings 2Q 2013 Financial ResultsDokument23 SeitenFirst-Half Earnings at Record: DBS Group Holdings 2Q 2013 Financial ResultsphuawlNoch keine Bewertungen

- Financial Results For Sept 30, 2015 (Standalone) (Result)Dokument2 SeitenFinancial Results For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Padaeng FS Dec2011Dokument35 SeitenPadaeng FS Dec2011reine1987Noch keine Bewertungen

- Karnataka Bank Results Sep12Dokument6 SeitenKarnataka Bank Results Sep12Naveen SkNoch keine Bewertungen

- MRF PNL BalanaceDokument2 SeitenMRF PNL BalanaceRupesh DhindeNoch keine Bewertungen

- DemonstraDokument74 SeitenDemonstraFibriaRINoch keine Bewertungen

- PI Industries Q1FY12 Result 1-August-11Dokument6 SeitenPI Industries Q1FY12 Result 1-August-11equityanalystinvestorNoch keine Bewertungen

- MitchellsDokument22 SeitenMitchellsSHAHZADI AQSANoch keine Bewertungen

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokument6 SeitenStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- 5ead0financial RatiosDokument3 Seiten5ead0financial RatiosGourav DuttaNoch keine Bewertungen

- Annual ReportDokument92 SeitenAnnual ReportKumar PrinceNoch keine Bewertungen

- Company Information and Directors' ReportDokument13 SeitenCompany Information and Directors' ReportZahid Khan BabaiNoch keine Bewertungen

- Preeti 149Dokument16 SeitenPreeti 149Preeti NeelamNoch keine Bewertungen

- Bank Alfalah Q1 2012 Quarterly ReportDokument66 SeitenBank Alfalah Q1 2012 Quarterly ReportShahid MehmoodNoch keine Bewertungen

- Afm PDFDokument5 SeitenAfm PDFBhavani Singh RathoreNoch keine Bewertungen

- Financial Status-Somany Ceramics LTD 2011-12Dokument15 SeitenFinancial Status-Somany Ceramics LTD 2011-12Roshankumar S PimpalkarNoch keine Bewertungen

- Annual Report OfRPG Life ScienceDokument8 SeitenAnnual Report OfRPG Life ScienceRajesh KumarNoch keine Bewertungen

- System LimitedDokument11 SeitenSystem LimitedNabeel AhmadNoch keine Bewertungen

- TSL Audited Results For FY Ended 31 Oct 13Dokument2 SeitenTSL Audited Results For FY Ended 31 Oct 13Business Daily ZimbabweNoch keine Bewertungen

- Sushrut Yadav PGFB2156 IMDokument15 SeitenSushrut Yadav PGFB2156 IMAgneesh DuttaNoch keine Bewertungen

- Auditors' Report To The MembersDokument59 SeitenAuditors' Report To The MembersAleem BayarNoch keine Bewertungen

- Cash Flow Statements - FinalDokument18 SeitenCash Flow Statements - FinalAchal GuptaNoch keine Bewertungen

- Financial Results For The Quarter Ended 30 June 2012Dokument2 SeitenFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaNoch keine Bewertungen

- Credit Union Revenues World Summary: Market Values & Financials by CountryVon EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryVon EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- FeedbackDokument2 SeitenFeedbackAisha HusaainNoch keine Bewertungen

- Exam Notice CGLE 12-02-2016Dokument54 SeitenExam Notice CGLE 12-02-2016Saicharan BashabathiniNoch keine Bewertungen

- RahatDokument3 SeitenRahatAisha HusaainNoch keine Bewertungen

- Housing Delivery Process & Government AgenciesDokument29 SeitenHousing Delivery Process & Government AgenciesPsy Giel Va-ayNoch keine Bewertungen

- Poster-Nike and BusinessDokument2 SeitenPoster-Nike and BusinessK. PaulNoch keine Bewertungen

- MFAP Performance Summary ReportDokument17 SeitenMFAP Performance Summary ReportKhizar Hayat JiskaniNoch keine Bewertungen

- NoitesDokument4 SeitenNoitesEdwinJugadoNoch keine Bewertungen

- PPT ch1Dokument40 SeitenPPT ch1RayYong100% (1)

- Marketing Management Case AnalysisDokument6 SeitenMarketing Management Case AnalysisRajat BishtNoch keine Bewertungen

- Staff WelfareDokument2 SeitenStaff Welfaremalikiamcdonald23Noch keine Bewertungen

- Vascon Engineers - Kotak PCG PDFDokument7 SeitenVascon Engineers - Kotak PCG PDFdarshanmadeNoch keine Bewertungen

- Business Plan of Electronic BicycleDokument9 SeitenBusiness Plan of Electronic BicycleSabdi AhmedNoch keine Bewertungen

- FNCE 101: DR Chiraphol New Chiyachantana Problem Set # 6 (Chapter 14)Dokument2 SeitenFNCE 101: DR Chiraphol New Chiyachantana Problem Set # 6 (Chapter 14)Vicky HongNoch keine Bewertungen

- Change in Demand and Supply Due To Factors Other Than PriceDokument4 SeitenChange in Demand and Supply Due To Factors Other Than PriceRakesh YadavNoch keine Bewertungen

- Financial InstrumentsDokument3 SeitenFinancial InstrumentsGeeta LalwaniNoch keine Bewertungen

- Group 12 - Gender and Diversity - RITTER SPORT BIODokument40 SeitenGroup 12 - Gender and Diversity - RITTER SPORT BIOIsabel HillenbrandNoch keine Bewertungen

- 2022 Logistics 05 Chap 08 PlanningRes CapaMgmt Part 1Dokument37 Seiten2022 Logistics 05 Chap 08 PlanningRes CapaMgmt Part 1Chíi KiệttNoch keine Bewertungen

- Quiz On Global Production and Supply Chain Management Name: Section: Date: ScoreDokument2 SeitenQuiz On Global Production and Supply Chain Management Name: Section: Date: ScoreDianeNoch keine Bewertungen

- TB 14Dokument67 SeitenTB 14Dang ThanhNoch keine Bewertungen

- Calculate Arb's investment income from Tee CorpDokument7 SeitenCalculate Arb's investment income from Tee CorpYOHANNES WIBOWONoch keine Bewertungen

- Niti Aayog PDFDokument4 SeitenNiti Aayog PDFUppamjot Singh100% (1)

- Weeks 3 & 4Dokument46 SeitenWeeks 3 & 4NursultanNoch keine Bewertungen

- Principlesofmarketing Chapter2 170810162334Dokument67 SeitenPrinciplesofmarketing Chapter2 170810162334PanpanpanNoch keine Bewertungen

- Sustainable Development Statement Arupv-2023Dokument1 SeiteSustainable Development Statement Arupv-2023James CubittNoch keine Bewertungen

- Measuring Effectiveness of Airtel's CRM StrategyDokument82 SeitenMeasuring Effectiveness of Airtel's CRM StrategyChandini SehgalNoch keine Bewertungen

- Chapter-1 (NP)Dokument28 SeitenChapter-1 (NP)Prachiti PatilNoch keine Bewertungen

- Mini CaseDokument18 SeitenMini CaseZeeshan Iqbal0% (1)

- Irrevocable Corporate Purchase Order (Aluminum Ingot A7) : (Bauxited Smelted)Dokument2 SeitenIrrevocable Corporate Purchase Order (Aluminum Ingot A7) : (Bauxited Smelted)Kalo MbauhNoch keine Bewertungen

- Mcqs Cuet Ch-1 Acc 12Dokument7 SeitenMcqs Cuet Ch-1 Acc 12khushisingh9972Noch keine Bewertungen

- Eric Stevanus - LA28 - Cost AnalysisDokument8 SeitenEric Stevanus - LA28 - Cost Analysiseric stevanusNoch keine Bewertungen