Beruflich Dokumente

Kultur Dokumente

Exam 1

Hochgeladen von

김현중Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Exam 1

Hochgeladen von

김현중Copyright:

Verfügbare Formate

Vu Lai ACCOUNTING 203 ON-LINE EXAM #1 (CHAPTERS 14,15) 150 PTS.

DUE DATE: Thursday, October 7 (by 11:00 P.M.) 30 Multiple-choice 3.8 pts. each Problem #1: 15 pts. Problem #2: 21 pts. Good luck! Please highlight your answers in any color except red (color blind teacher) 1. The major reporting standard for presenting managerial accounting information is A) relevance. B) generally accepted accounting principles. C) the cost principle.

D) the current tax law.

2. Which of the following is not classified as direct labor? A) Bottlers of beer in a brewery B) Copy machine operators at a copy shop C) Wages of supervisors

D) Bakers in a bakery

3. Product costs consist of A) direct materials and direct labor only. B) direct materials, direct labor, and manufacturing overhead. C) selling and administrative expenses.

D) period costs.

Page 1

4. Which one of the following represents a period cost? A) The VP of Sales' salary and benefits B) Overhead allocated to the manufacturing operations C) Labor costs associated with quality control

D) Fringe benefits associated with factory workers

5. Hollern Combines, Inc. has $10,000 of ending finished goods inventory as of December 31, 2010. If beginning finished goods inventory was $5,000 and cost of goods sold was $20,000, how much would Hollern report for cost of goods manufactured? A) $22,500 B) $5,000 C) $25,000

D) $15,000

6. If the amount of "Cost of goods manufactured" during a period exceeds the amount of "Total manufacturing costs" for the period, then A) ending work in process inventory is greater than or equal to the amount of the beginning work in process inventory. B) ending work in process is greater than the amount of the beginning work in process inventory. C) ending work in process is equal to the cost of goods manufactured.

D) ending work in process is less than the amount of the beginning work in process inventory.

7. Carly Manufacturing Company's accounting records reflect the following inventories: Dec. 31, 2010 Dec. 31, 2009 Raw materials inventory $310,000 $260,000 Work in process inventory 300,000 160,000 Finished goods inventory 190,000 150,000

During 2010, $500,000 of raw materials were purchased, direct labor costs amounted to $600,000, and manufacturing overhead incurred was $480,000. Carly Manufacturing Company's total manufacturing costs incurred in 2010 amounted to A) $1,530,000. B) $1,490,000. C) $1,390,000.

D) $1,580,000.

Page 3

8. Given the following information: Raw materials inventory, January 1 $ Raw materials inventory, December 31 40,000 Work in process, January 1 18,000 Work in process, December 31 12,000 Finished goods, January 1 40,000 Finished goods, December 31 32,000 Raw materials purchases 1,000,000 Direct labor 460,000 Factory utilities 150,000 Indirect labor 50,000 Factory depreciation 400,000 Selling and administrative expenses 420,000 20,000

A) $1,060,000. B) $1,020,000. C) $1,000,000.

D) $980,000.

9. Given the following data for Mehring Company, compute (A) total manufacturing costs and (B) costs of goods manufactured: Direct materials used $180,000 Beginning work in process $30,000 Direct labor 75,000 Ending work in process 15,000 Manufacturing overhead 225,000 Beginning finished goods 38,000 Operating expenses 263,000 Ending finished goods 23,000

(A) c. $480,000

(B) $480,015

Page 5

10. Which one of the following does not appear on the balance sheet of a manufacturing company? A) Finished goods inventory B) Work in process inventory C) Cost of goods manufactured

D) Raw materials inventory

11. Which one of the following characteristics would likely be associated with a just-in-time inventory method? A) Ending inventory of work in process that would allow several production runs. B) A backlog of inventory orders not yet shipped. C) Minimal finished goods inventory on hand.

D) An understanding with customers that they may come to the showroom and select from inventory on hand.

12. If the cost of goods manufactured is less than the cost of goods sold, which of the following is correct? A) Finished Goods Inventory has increased. B) Work in Process Inventory has increased. C) Finished Goods Inventory has decreased.

D) Work in Process Inventory has decreased.

13. When a job is completed and all costs have been accumulated on a job cost sheet, the journal entry that should be made is A) Finished Goods Inventory Direct Materials Direct Labor Manufacturing Overhead B) Work In Process Inventory Direct Materials Direct Labor Manufacturing Overhead C) Raw Materials Inventory Work In Process Inventory

D) Finished Goods Inventory Work In Process Inventory

Page 7

14. A materials requisition slip showed that direct materials requested were $53,000 and indirect materials requested were $9,000. The entry to record the transfer of materials from the storeroom is

A) Work In Process Inventory 53,000

Raw Materials Inventory 53,000

B)

Direct Materials 53,000

Indirect Materials 9,000

Work In Process Inventory 62,000

C)

Manufacturing Overhead 62,000

Raw Materials Inventory 62,000

Page 9

D) Work In Process Inventory 53,000

Manufacturing Overhead 9,000

Raw Materials Inventory 62,000

15. Which one of the following should be equal to the balance of the work in process inventory account at the end of the period? A) The total of the amounts transferred from raw materials for the current period B) The sum of the costs shown on the job cost sheets of unfinished jobs C) The total of manufacturing overhead applied to work in process for the period

D) The total manufacturing costs for the period

16. The following information is available for completed Job No. 402: Direct materials, $60,000; direct labor, $90,000; manufacturing overhead applied, $45,000; units produced, 5,000 units; units sold, 4,000 units. The cost of the finished goods on hand from this job is A) $30,000. B) $195,000. C) $39,000.

D) $156,000.

17. Madison Inc. uses job order costing for its brand new line of sewing machines. The cost incurred for production during 2010 totaled $12,000 of materials, $6,000 of direct labor costs, and $4,000 of manufacturing overhead applied. The company ships all goods as soon as they are completed which results in no finished goods inventory on hand at the end of any year. Beginning work in process totaled $10,000, and the ending balance is $6,000. During the year, the company completed 40 machines. How much is the cost per machine? A) $450 B) $650 C) $550

D) $800

18. Hill Mfg. provided the following information from its accounting records for 2008: Expected production 30,000 labor hours Actual production 28,000 labor hours Budgeted overhead $900,000 Actual overhead $870,000 How much is the overhead application rate if Hill bases the rate on direct labor hours? A) $31.07 per hour B) $30.00 per hour C) D)

$29.00 per hour $28.00 per hour

Page 11

19. Kinney Company applies overhead on the basis of 150% of direct labor cost. Job No. 176 is charged with $50,000 of direct materials costs and $60,000 of manufacturing overhead. The total manufacturing costs for Job No. 176 is A) $110,000. B) $200,000. C) $150,000.

D) $135,000.

20. The labor costs that have been identified as indirect labor should be charged to A) manufacturing overhead. B) direct labor. C) the individual jobs worked on.

D) salary expense.

21. If annual overhead costs are expected to be $750,000 and direct labor costs are expected to be $1,000,000, then A) $1.33 is the predetermined overhead rate. B) for every dollar of manufacturing overhead, 75 cents of direct labor will be assigned. C) for every dollar of direct labor, 75 cents of manufacturing overhead will be assigned.

D) a predetermined overhead rate cannot be determined.

22. In a job order cost system, a credit to Manufacturing Overhead will be accompanied by a debit to A) Cost of Goods Manufactured. B) Finished Goods Inventory. C) Work in Process Inventory.

D) Raw Materials Inventory.

23. During 2010, Lawson Manufacturing expected Job No. 26 to cost $600,000 of overhead, $1,000,000 of materials, and $400,000 in labor. Lawson applied overhead based on direct labor cost. Actual production required an overhead cost of $560,000, $1,100,000 in materials used, and $440,000 in labor. All of the goods were completed. What amount was transferred to Finished Goods? A) $2,000,000 B) $2,100,000 C) $2,140,000

D) $2,200,000

24. Debits to Work in Process Inventory are accompanied by a credit to all but which one of the following accounts? A) Raw Materials Inventory B) Factory Labor C) Manufacturing Overhead

D) Cost of Goods Sold

Page 13

25. Kimble Company applies overhead on the basis of machine hours. Given the following data, compute overhead applied and the under- or overapplication of overhead for the period: Estimated annual overhead cost $1,200,000 Actual annual overhead cost $1,145,000 Estimated machine hours 300,000 Actual machine hours 280,000

A) $1,120,000 applied and $25,000 overapplied B) $1,200,000 applied and $25,000 overapplied C) $1,120,000 applied and $25,000 underapplied

D) $1,145,000 applied and neither under- nor overapplied

26. A company assigned overhead to work in process. At year end, what does the amount of overapplied overhead mean? A) The overhead assigned to work in process is greater than the estimated overhead costs. B) The overhead assigned to work in process is less than the estimated overhead costs. C) The overhead assigned to work in process is less than the actual overhead.

D) The overhead assigned to work in process is greater than the overhead incurred.

27. If the Manufacturing Overhead account has a debit balance at the end of a period, it means that A) actual overhead costs were less than overhead costs applied to jobs. B) actual overhead costs were greater than overhead costs applied to jobs. C) actual overhead costs were equal to overhead costs applied to jobs.

D) no jobs have been completed.

28. At the end of the year, any balance in the Manufacturing Overhead account is generally eliminated by adjusting A) Work In Process Inventory. B) Finished Goods Inventory. C) Cost of Goods Sold.

D) Raw Materials Inventory.

29. The Manufacturing Overhead account shows debits of $30,000, $24,000, and $28,000 and one credit for $86,000. Based on this information, manufacturing overhead A) has been overapplied. B) has been underapplied. C) has not been applied.

D) shows a zero balance.

30. If manufacturing overhead has been underapplied during the year, the adjusting entry at the end of the year will show a A) debit to Manufacturing Overhead. B) credit to Cost of Goods Sold. C) debit to Work in Process Inventory.

D) debit to Cost of Goods Sold.

Page 15

Problem #1: 15 pts. Presented below is a list of costs and expenses incurred in the factory by Nu-Way Corporation, a manufacturer of recreational vehicles. MO__ 1. Property taxes on the factory land ____ 2. Nails and glue used in production ____ 3. Cabinet maker's wages ____ 4. Factory supervisors' salaries ____ 5. Metal used in manufacturing ____ 6. Depreciation on factory machines ____ 7. Factory utilities ____ 8. Carpeting for the recreational vehicles ____ 9. Property taxes on the factory building

Page 17

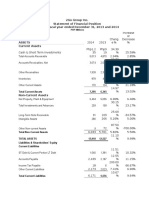

Problem #2 (21 pts.):Manufacturing costs for Carson Company for selected

months are as follows: April July October Beginning work in process $ 80,000 (f) $ 98,000 Direct materials used 280,000 $190,000 155,000 Direct labor 195,000 170,000 (j) Manufacturing overhead (a) 150,000 90,000 Total manufacturing costs 720,000 510,000 470,000 Total cost of work in process (b) 650,000 (k) Ending work in process 75,000 (g) (l)

Page 19

Das könnte Ihnen auch gefallen

- Corporate Financial Analysis with Microsoft ExcelVon EverandCorporate Financial Analysis with Microsoft ExcelBewertung: 5 von 5 Sternen5/5 (1)

- Stracos Module 1 Quiz Cost ConceptsDokument12 SeitenStracos Module 1 Quiz Cost ConceptsGemNoch keine Bewertungen

- I B H E A F: Exercises in Cost - Volume - Profit Analysis Ex. 1Dokument4 SeitenI B H E A F: Exercises in Cost - Volume - Profit Analysis Ex. 1I am JacobNoch keine Bewertungen

- CHAPTER-3 Small BusinessDokument18 SeitenCHAPTER-3 Small BusinessmohammedkasoNoch keine Bewertungen

- CHAPTER - 5 Capital Budgeting & Investment DecisionDokument40 SeitenCHAPTER - 5 Capital Budgeting & Investment Decisionethnan lNoch keine Bewertungen

- MachineryDokument20 SeitenMachineryeulhiemae arongNoch keine Bewertungen

- Capital BudgetingDokument4 SeitenCapital Budgetingrachmmm0% (3)

- Inacct3 Module 3 QuizDokument7 SeitenInacct3 Module 3 QuizGemNoch keine Bewertungen

- Act08 Inventory ManagementDokument3 SeitenAct08 Inventory ManagementJomar Villena100% (1)

- Accounting For Labor ExercisesDokument6 SeitenAccounting For Labor ExercisesNichole Joy XielSera TanNoch keine Bewertungen

- Master Budget ProblemDokument2 SeitenMaster Budget ProblemCillian ReevesNoch keine Bewertungen

- CH 13Dokument15 SeitenCH 13alfiNoch keine Bewertungen

- 0405 MAS Preweek Quizzer PDFDokument22 Seiten0405 MAS Preweek Quizzer PDFTokkiNoch keine Bewertungen

- 1205 Sa1 10FDokument7 Seiten1205 Sa1 10Fchloe1337Noch keine Bewertungen

- Answers Chapter 1Dokument43 SeitenAnswers Chapter 1Maricel Inoc FallerNoch keine Bewertungen

- Cost Accounting - 2019 Chapter 2 - Costs - Concepts and ClassificationDokument4 SeitenCost Accounting - 2019 Chapter 2 - Costs - Concepts and Classification?????Noch keine Bewertungen

- Assignment 1Dokument2 SeitenAssignment 1Betheemae R. MatarloNoch keine Bewertungen

- Spoilage, Rework, and Scrap: Learning ObjectivesDokument12 SeitenSpoilage, Rework, and Scrap: Learning ObjectivesKelvin John RamosNoch keine Bewertungen

- Absorption and Variable Costing: Strategic Cost ManagementDokument3 SeitenAbsorption and Variable Costing: Strategic Cost ManagementMarites AmorsoloNoch keine Bewertungen

- Illustrative Problem 12.8. Use of CVP in Decision Making: Solution: Woodstock CampanyDokument2 SeitenIllustrative Problem 12.8. Use of CVP in Decision Making: Solution: Woodstock CampanyShane LAnuzaNoch keine Bewertungen

- ABC Costing Lecture NotesDokument12 SeitenABC Costing Lecture NotesMickel AlexanderNoch keine Bewertungen

- Mas Test Bank SolutionDokument14 SeitenMas Test Bank SolutionLyzaNoch keine Bewertungen

- Activitybased Costing May 20 GMSISUCCESSDokument29 SeitenActivitybased Costing May 20 GMSISUCCESSChetan BasraNoch keine Bewertungen

- P2 Process CostingDokument9 SeitenP2 Process CostingGanessa RolandNoch keine Bewertungen

- Under What Conditions May A Foreigner Be Allowed TDokument3 SeitenUnder What Conditions May A Foreigner Be Allowed TANGELU RANE BAGARES INTOLNoch keine Bewertungen

- Chap 8 Responsibility AccountingDokument51 SeitenChap 8 Responsibility AccountingXel Joe BahianNoch keine Bewertungen

- Sol Q5Dokument3 SeitenSol Q5Shubham RankaNoch keine Bewertungen

- Chapter 8 - Standard CostingDokument8 SeitenChapter 8 - Standard CostingJoey LazarteNoch keine Bewertungen

- 8MAS 08 ABC Balanced Scorecard ModuleDokument4 Seiten8MAS 08 ABC Balanced Scorecard ModuleKathreen Aya ExcondeNoch keine Bewertungen

- Chapter 9Dokument10 SeitenChapter 9Caleb John SenadosNoch keine Bewertungen

- MS 3407 Balanced Scorecard and Responsibility AccountingDokument7 SeitenMS 3407 Balanced Scorecard and Responsibility AccountingMonica GarciaNoch keine Bewertungen

- Audit Evidence and Documentation: The FrameworkDokument23 SeitenAudit Evidence and Documentation: The FrameworkJeane Mae BooNoch keine Bewertungen

- Inventory MGMT ComprehensiveDokument4 SeitenInventory MGMT ComprehensivebigbaekNoch keine Bewertungen

- Chapter 6 MNGT 4Dokument5 SeitenChapter 6 MNGT 4bryan lluismaNoch keine Bewertungen

- CH 14Dokument4 SeitenCH 14Hoàng HuyNoch keine Bewertungen

- Test Bank Management 8th Edition BatemanDokument40 SeitenTest Bank Management 8th Edition BatemanIris DescentNoch keine Bewertungen

- Green Handwritten Course Syllabus Education PresentationDokument24 SeitenGreen Handwritten Course Syllabus Education PresentationCamela Jane Dela PeñaNoch keine Bewertungen

- Partnership Chapter 1Dokument7 SeitenPartnership Chapter 1shenayeeNoch keine Bewertungen

- Cost Accounting MidtermDokument4 SeitenCost Accounting MidtermMieryle DioctonNoch keine Bewertungen

- Chapter 4 GEDokument12 SeitenChapter 4 GEYenny Torro100% (1)

- 2go Group IncDokument7 Seiten2go Group IncSheenah FerolinoNoch keine Bewertungen

- Accounting For LaborDokument6 SeitenAccounting For LaborBernard FernandezNoch keine Bewertungen

- Standard Costs and Variance Analysis Mcqs by Hilario TanDokument18 SeitenStandard Costs and Variance Analysis Mcqs by Hilario TanAhmadnur JulNoch keine Bewertungen

- ABC and Standard CostingDokument16 SeitenABC and Standard CostingCarlo QuinlogNoch keine Bewertungen

- Chapter 10 v2Dokument15 SeitenChapter 10 v2Sheilamae Sernadilla Gregorio0% (1)

- Chapter 1 Standard Costs and Operating PerformanceDokument5 SeitenChapter 1 Standard Costs and Operating PerformanceSteffany RoqueNoch keine Bewertungen

- Basic Features of The New Government Accounting SystemDokument4 SeitenBasic Features of The New Government Accounting SystemabbiecdefgNoch keine Bewertungen

- ASSIGNMENT 2.1 CASH FLOWS StudentDokument4 SeitenASSIGNMENT 2.1 CASH FLOWS StudentMichael Angelo CatubigNoch keine Bewertungen

- Chapter 7 Inventory ManagementDokument24 SeitenChapter 7 Inventory ManagementAMNoch keine Bewertungen

- Make Buy Special Order TutorialDokument5 SeitenMake Buy Special Order TutorialMickel Alexander100% (1)

- Quiz Process CostingDokument3 SeitenQuiz Process CostingBonnie Kim VillavendeNoch keine Bewertungen

- A 6. C 2. B 7. C 3. D 8. A 4. A 9. A 5. A 10. C: Answers To Multiple Choice - TheoreticalDokument6 SeitenA 6. C 2. B 7. C 3. D 8. A 4. A 9. A 5. A 10. C: Answers To Multiple Choice - Theoreticalsweetwinkle09Noch keine Bewertungen

- 10 ACCT 1A&B Mfg.Dokument14 Seiten10 ACCT 1A&B Mfg.Shannon MojicaNoch keine Bewertungen

- TEST BANK Cost Accounting 14E by Carter Ch08 TEST BANK Cost Accounting 14E by Carter Ch08Dokument16 SeitenTEST BANK Cost Accounting 14E by Carter Ch08 TEST BANK Cost Accounting 14E by Carter Ch08mEOW SNoch keine Bewertungen

- Andrea Florence G. Vidal Bsa 4 Acctg 16: Exercise 2: Multiple ChoiceDokument4 SeitenAndrea Florence G. Vidal Bsa 4 Acctg 16: Exercise 2: Multiple ChoiceAndrea Florence Guy VidalNoch keine Bewertungen

- MKTG ArmDokument10 SeitenMKTG Armapi-368157253Noch keine Bewertungen

- HMWK 1 AcctDokument12 SeitenHMWK 1 AcctCody IrelanNoch keine Bewertungen

- Acct202Exam 1 - 2Dokument9 SeitenAcct202Exam 1 - 2Tanvir AhmedNoch keine Bewertungen

- ExamDokument8 SeitenExamDestruelNoch keine Bewertungen

- Part 1: Introduction To Managerial AccountingDokument7 SeitenPart 1: Introduction To Managerial AccountingJoemel F. RizardoNoch keine Bewertungen

- Cost of Poor MaintenanceDokument11 SeitenCost of Poor MaintenanceSaulo CabreraNoch keine Bewertungen

- 2.06 SIPOC DiagramDokument4 Seiten2.06 SIPOC DiagramJulioRomeroNoch keine Bewertungen

- The Perfect Plant in SAP PMDokument48 SeitenThe Perfect Plant in SAP PMvishaltambolkarNoch keine Bewertungen

- Checkweighing Guide enDokument74 SeitenCheckweighing Guide enjrlr65Noch keine Bewertungen

- Marginal Costing and Its Application - ProblemsDokument5 SeitenMarginal Costing and Its Application - ProblemsAAKASH BAIDNoch keine Bewertungen

- Conveyor System & SafetyDokument54 SeitenConveyor System & SafetyINDRAJIT SAO100% (1)

- Management and Cost Accounting: Part Two: Cost Accumulation For Inventory Valuation and Profit MeasurementDokument24 SeitenManagement and Cost Accounting: Part Two: Cost Accumulation For Inventory Valuation and Profit MeasurementNghĩa Nguyễn TrọngNoch keine Bewertungen

- LO720 - QM in Discrete and Repetitive ManufacturingDokument157 SeitenLO720 - QM in Discrete and Repetitive ManufacturingSatheeshNoch keine Bewertungen

- In Pursuit of The Perfect Plant WebcastDokument15 SeitenIn Pursuit of The Perfect Plant WebcastAhmed TalaatNoch keine Bewertungen

- A001 Lean A Key Success Factor in Automobile IndustryDokument7 SeitenA001 Lean A Key Success Factor in Automobile Industryarvindchopra3kNoch keine Bewertungen

- Mech Lathe Machine ReportDokument15 SeitenMech Lathe Machine ReportHassan TalhaNoch keine Bewertungen

- Case Study Xerox - Benchmarking A Key To SuccessDokument2 SeitenCase Study Xerox - Benchmarking A Key To SuccessSmile HouseNoch keine Bewertungen

- Flexible Manufacturing SystemDokument16 SeitenFlexible Manufacturing Systemm_er100Noch keine Bewertungen

- Quality Tools at MarutiDokument3 SeitenQuality Tools at Marutinilesh_deo4481Noch keine Bewertungen

- Detail TyreDokument1 SeiteDetail TyreMohammed AliNoch keine Bewertungen

- Short-Run Costs and Output Decisions: Fernando & Yvonn QuijanoDokument31 SeitenShort-Run Costs and Output Decisions: Fernando & Yvonn QuijanoCharles Reginald K. HwangNoch keine Bewertungen

- ISO 9001 Clauses Simply ExplainedDokument26 SeitenISO 9001 Clauses Simply Explainedpooja.dayal3930Noch keine Bewertungen

- Intouch Service GuideDokument16 SeitenIntouch Service GuideAftab AhmadNoch keine Bewertungen

- Managerial Economics & Business StrategyDokument31 SeitenManagerial Economics & Business StrategyNono ButonNoch keine Bewertungen

- 1stF 2nd Yr Cost Accounting and Control VerifiedDokument34 Seiten1stF 2nd Yr Cost Accounting and Control VerifiedMika MolinaNoch keine Bewertungen

- Managing QualityDokument37 SeitenManaging QualityAnne GerzonNoch keine Bewertungen

- This Study Resource Was: Activity #7-ReflectionDokument2 SeitenThis Study Resource Was: Activity #7-ReflectionAnonymousNoch keine Bewertungen

- Batch ProductionDokument9 SeitenBatch Productionraj chopdaNoch keine Bewertungen

- Pharma Book Final-1Dokument270 SeitenPharma Book Final-1Anil Kumar87% (31)

- Using Cost of Quality To Improve Business ResultsDokument4 SeitenUsing Cost of Quality To Improve Business ResultsMiguel BradshawNoch keine Bewertungen

- DecathlonDokument14 SeitenDecathlonDivyanshu Shahi100% (2)

- p2 - Guerrero Ch14Dokument46 Seitenp2 - Guerrero Ch14JerichoPedragosa50% (18)

- Preventive Maintenance - PRINTINGDokument205 SeitenPreventive Maintenance - PRINTINGm_alodat6144100% (2)

- PRTC MAS 2015 May Preboards 140Dokument17 SeitenPRTC MAS 2015 May Preboards 140NillChrisTurbanadaDoroquez100% (3)

- Foundry TechnologyDokument28 SeitenFoundry TechnologyVp Hari NandanNoch keine Bewertungen