Beruflich Dokumente

Kultur Dokumente

Mitra Notification

Hochgeladen von

Ujas TrivediOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Mitra Notification

Hochgeladen von

Ujas TrivediCopyright:

Verfügbare Formate

?

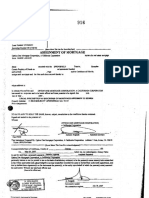

{ ______________________ RESERVE BANK OF INDIA____________________

www.rbi.org.in

RBI/2004/98 DBS. CO. FGV(F) No. 1306 /23.08.001/2003-04 To all scheduled commercial banks (excluding RRBs and LABs) Dear Sir, Guidelines on Implementation of Best Practices Code in Banks.

March 15,2004

Please refer to our circular DBS.FGV(F) No. 12/23.08.001/2001-2002 dated May 3, 2002, regarding implementation of the recommendations of the Committee on Legal Aspects of Bank Frauds (Mitra Committee) and the High Level CVC Group. We had, among other things, commended to banks implementation of Best Practices Code (BPC) as a measure to prevent frauds. 2. On an examination of the BPC as developed by certain select banks, it was observed that there was no uniformity in their content and coverage. The documents were not prepared as envisaged by the Mitra Committee. It has, therefore, been decided to issue the following guidelines which may be kept in view while preparing the BPC. The guidelines have been prepared with a view to bringing about a certain minimum level of uniformity with regard to the content and coverage of the BPC. 3. The BPC, as envisaged by the Mitra Committee, relates to detailed procedural rules for entering into transactional relations. The main objective is that such procedures, especially those in all fraudprone areas, should be well documented, compared with national and international best practices, experimented with, and improved upon in the light of the experience gained. Preparation of BPC should involve examination of all procedures, processes, products, activities and systems, existing and future (as and when a new product/process is introduced). The BPC should be integrated with the overall risk management strategy of the bank. Apart from it being viewed in the context of prevention of frauds, it should also be considered as a part of the strategy to mitigate all possible operational risk losses. 4.Banks may keep the following guidelines in view while compiling the BPC: (a) The BPC should be a comprehensive and homogenous document. (b) While the manual of instructions / circulars issued by banks from time to time could be consolidated and incorporated, this by itself would not constitute 'BPC'.

, , 1, , , 400005 _________________________________________________________________________________________________________________________________________________ Department of Banking Supervision, Central Office, Centre 1, Cuffe Parade, Colaba,Mumbai,400005 /Tel No:022-22189131 /Fax No:022-22180157 Email ID:cgmicdbsco@rbi.org.in

- - ,

(c) The BPC should take into account the instructions relating to the common fraud prone areas and their prevention issued to banks by RBI from time to time. (d) The BPC should also highlight the recommendations of the Ghosh Committee and the Mitra Committee advised to banks by RBI for implementation vide our circular DBOD.BC.20/17.04.001/92 dated August 25,1992 and DBS.FGV(F) No.BC 12/23.08.001/2001-02 dated May 3,2002 respectively. . (e) The BPC should take into account the relevant recommendations of the Narang Committee on study of large value frauds, Narasimham Committee on Banking Sector Reforms, recommendations of the Estimate Committee on prevention of frauds in public sector banks, etc. advised to banks for implementation vide our circulars DBS. FGV.BC.56/23.04.001/98-99 dated June 21,1999, DBOD. BP. BC. 29/21,01,023/99 dated April 16, 1999 and DOS.No.GC.BC.13/17.04.001/94 dated October 17,1994 respectively. (f) The BPC should also take into account the instructions of the CVC, if any, issued from time to time. (g) The 'BPC' should, at a minimum, cover all the functional areas like cash, safe custody of other valuables (DD/TT/LC/Guarantee forms, etc.), deposit accounts, investment portfolio, credit portfolio, foreign exchange transactions, treasury operations, bills portfolio, remittances, cash receipts and payments, issue/payment of demand drafts, clearing transactions, government transactions, LCs/ Guarantees, etc. (h) The BPC may also incorporate practices that would help prevention of losses to its customers and include suitable guidance to such customers. Banks may therefore, codify the precautions to be taken by customers and the same should be publicised by placing on their website or through any other medium. (i) The BPC should be periodically revised and updated in the light of the experience gained, fresh instructions from the Reserve Bank and suggestions made by internal/external auditors. Banks which have already prepared the BPC may carry out the necessary changes in the document in the light of the above guidelines. 5. Please acknowledge receipt. Yours faithfully,

( K. V. Subba Rao) Chief General Manager

Das könnte Ihnen auch gefallen

- Major Observations - Gap Study by DeloitteDokument2 SeitenMajor Observations - Gap Study by DeloitteShaurya SinghNoch keine Bewertungen

- ALMDokument15 SeitenALMGaurav PandeyNoch keine Bewertungen

- Asset - Liability Management System in Banks - Guidelines: 4. ALM Information SystemsDokument12 SeitenAsset - Liability Management System in Banks - Guidelines: 4. ALM Information SystemsKevin VazNoch keine Bewertungen

- Introduction To The GuidelinesDokument11 SeitenIntroduction To The GuidelinesGeetika GargNoch keine Bewertungen

- Reserve Bank of IndiaDokument3 SeitenReserve Bank of Indiaajinkyan2000Noch keine Bewertungen

- Reserve Bank of India: Systemically Important Core Investment CompaniesDokument19 SeitenReserve Bank of India: Systemically Important Core Investment CompaniesBhanu prasanna kumarNoch keine Bewertungen

- Audit ProcedureDokument61 SeitenAudit ProcedureTadeleNoch keine Bewertungen

- Business Continuity Plan and Disaster Management in BanksDokument5 SeitenBusiness Continuity Plan and Disaster Management in BanksVenkatesh MudgerikarNoch keine Bewertungen

- Investment Risk ManagementDokument37 SeitenInvestment Risk ManagementAnupam ShahidNoch keine Bewertungen

- Structure of The Nepal Rastra BankDokument3 SeitenStructure of The Nepal Rastra Bankjack johnsonNoch keine Bewertungen

- ARM SolDokument32 SeitenARM SolRizwan AhmadNoch keine Bewertungen

- Account Opening Guidence-BaselDokument13 SeitenAccount Opening Guidence-Baselanoobk.qNoch keine Bewertungen

- Interest Rate Risk in The Banking Book (BIS)Dokument51 SeitenInterest Rate Risk in The Banking Book (BIS)Ji_yNoch keine Bewertungen

- Disclosure Under Basel Ii As On 31-12-2013: Disclosure Framework The General Qualitative Disclosure RequirementsDokument9 SeitenDisclosure Under Basel Ii As On 31-12-2013: Disclosure Framework The General Qualitative Disclosure RequirementsBijoy SalahuddinNoch keine Bewertungen

- Basel Committee On Banking Supervision: Customer Due Diligence For BanksDokument23 SeitenBasel Committee On Banking Supervision: Customer Due Diligence For BanksavinashavalaNoch keine Bewertungen

- FRTBDokument3 SeitenFRTBrevola28Noch keine Bewertungen

- Guidelines On Banks' Asset Liability Management Framework - Interest Rate RiskDokument35 SeitenGuidelines On Banks' Asset Liability Management Framework - Interest Rate RiskMouBunchiNoch keine Bewertungen

- RBI New Capital Adequacy Norm1Dokument224 SeitenRBI New Capital Adequacy Norm1Saurabh JainNoch keine Bewertungen

- Module VIII Reading Material Branch Managers TNGDokument273 SeitenModule VIII Reading Material Branch Managers TNGIrshadAhmedNoch keine Bewertungen

- Risk Management in Indian Banking IndustryDokument5 SeitenRisk Management in Indian Banking Industryarpit55Noch keine Bewertungen

- Basel Committee On Banking Supervision: Guidelines For Computing Capital For Incremental Risk in The Trading BookDokument14 SeitenBasel Committee On Banking Supervision: Guidelines For Computing Capital For Incremental Risk in The Trading BookmeikyNoch keine Bewertungen

- Basel Committee On Banking Supervision: Microfinance Activities and The Core Principles For Effective Banking SupervisionDokument64 SeitenBasel Committee On Banking Supervision: Microfinance Activities and The Core Principles For Effective Banking SupervisionchalaNoch keine Bewertungen

- Interim Union Budget Proposals: 2014-15Dokument8 SeitenInterim Union Budget Proposals: 2014-15Mohit AnandNoch keine Bewertungen

- Background: Bangladesh Bank'S Supervision On Banking SectorDokument11 SeitenBackground: Bangladesh Bank'S Supervision On Banking Sectorrajin_rammsteinNoch keine Bewertungen

- Guidelines To Establish Digital Bank EnglishDokument36 SeitenGuidelines To Establish Digital Bank EnglishMarjuk RahibNoch keine Bewertungen

- Framework For The Preparation and Presentation of Financial StatementsDokument26 SeitenFramework For The Preparation and Presentation of Financial StatementsAulia Irfan MuftiNoch keine Bewertungen

- Revisions Ops Risk 202011 PDFDokument23 SeitenRevisions Ops Risk 202011 PDFsh_chandraNoch keine Bewertungen

- Ebrd Risk AppetiteDokument16 SeitenEbrd Risk AppetiteleonciongNoch keine Bewertungen

- Guidelines For InspectionDokument132 SeitenGuidelines For InspectiondineshmarginalNoch keine Bewertungen

- Reserve Bank of India - : All Commercial Banks (Including Rrbs and Labs)Dokument7 SeitenReserve Bank of India - : All Commercial Banks (Including Rrbs and Labs)IrshadAhmedNoch keine Bewertungen

- The Audit of International Commercial Ba NksDokument61 SeitenThe Audit of International Commercial Ba NkswveterrNoch keine Bewertungen

- BSPDokument159 SeitenBSPHoneyleth TinamisanNoch keine Bewertungen

- BASEL 3 - Interest Rate Risk in The Banking BookDokument51 SeitenBASEL 3 - Interest Rate Risk in The Banking BookJenny DangNoch keine Bewertungen

- Progress Since The Pittsburgh Summit in Implementing The G20 Recommendations For Strengthening Financial StabilityDokument14 SeitenProgress Since The Pittsburgh Summit in Implementing The G20 Recommendations For Strengthening Financial Stabilitypaulomcateer5345Noch keine Bewertungen

- Introduction of IFRS-Issues and ChallengesDokument12 SeitenIntroduction of IFRS-Issues and ChallengesAbhisshek GautamNoch keine Bewertungen

- Project On UCO Bank FinalDokument69 SeitenProject On UCO Bank FinalMilind Singh100% (1)

- Asset Liability ManagementDokument8 SeitenAsset Liability ManagementAvinash Veerendra TakNoch keine Bewertungen

- FN 307 FinalDokument8 SeitenFN 307 FinalJasco JohnNoch keine Bewertungen

- ALM Policy PDFDokument49 SeitenALM Policy PDFAđńaŋ NèeþuNoch keine Bewertungen

- Economics Project Cas Study: Central Banking Monetary Policy Indian Rupee Reserve Bank of India Act, 1934Dokument4 SeitenEconomics Project Cas Study: Central Banking Monetary Policy Indian Rupee Reserve Bank of India Act, 1934Aryan WinnerNoch keine Bewertungen

- CBS Selection - GartnerDokument6 SeitenCBS Selection - GartnerSIYONA CHAMOLANoch keine Bewertungen

- ICICI Group AML Policy April 2008 FinalDokument24 SeitenICICI Group AML Policy April 2008 FinalbhaskarlalamNoch keine Bewertungen

- RBI Circular On Financing SMEDokument14 SeitenRBI Circular On Financing SMEImran AkbarNoch keine Bewertungen

- Annex 2A - ICAAP Report - Recommended StructureDokument15 SeitenAnnex 2A - ICAAP Report - Recommended StructureNithin NallusamyNoch keine Bewertungen

- NPA CompromiseSettlementDokument42 SeitenNPA CompromiseSettlementVikram YadavNoch keine Bewertungen

- RMCBDokument36 SeitenRMCBSharvil Vikram SinghNoch keine Bewertungen

- Operational Risk ManagementDokument23 SeitenOperational Risk Managementmifadzil0% (1)

- Risk PDFDokument44 SeitenRisk PDFTathi GuerreroNoch keine Bewertungen

- Asset-Liability-Management FOR NBFCDokument7 SeitenAsset-Liability-Management FOR NBFCDr. Prafulla RanjanNoch keine Bewertungen

- Practical Ifrs 09Dokument10 SeitenPractical Ifrs 09Farooq HaiderNoch keine Bewertungen

- Guidance Note On Market Risk ManagementDokument63 SeitenGuidance Note On Market Risk ManagementSonu AgrawalNoch keine Bewertungen

- A. Nature of Operations (PSA 315 A22)Dokument8 SeitenA. Nature of Operations (PSA 315 A22)HUERTAZUELA ARANoch keine Bewertungen

- Concurrent Audit ProcessDokument7 SeitenConcurrent Audit Processsukumar basuNoch keine Bewertungen

- Central Bank Digital Currencies - Financial Stability Implications (BIS)Dokument30 SeitenCentral Bank Digital Currencies - Financial Stability Implications (BIS)Ji_yNoch keine Bewertungen

- Handbook on Anti-Money Laundering and Combating the Financing of Terrorism for Nonbank Financial InstitutionsVon EverandHandbook on Anti-Money Laundering and Combating the Financing of Terrorism for Nonbank Financial InstitutionsBewertung: 5 von 5 Sternen5/5 (2)

- International Public Sector Accounting Standards Implementation Road Map for UzbekistanVon EverandInternational Public Sector Accounting Standards Implementation Road Map for UzbekistanNoch keine Bewertungen

- ASEAN+3 Multi-Currency Bond Issuance Framework: Implementation Guidelines for the PhilippinesVon EverandASEAN+3 Multi-Currency Bond Issuance Framework: Implementation Guidelines for the PhilippinesNoch keine Bewertungen

- Common Understanding on International Standards and Gateways for Central Securities Depository and Real-Time Gross Settlement (CSD–RTGS) Linkages: Cross-Border Settlement Infrastructure ForumVon EverandCommon Understanding on International Standards and Gateways for Central Securities Depository and Real-Time Gross Settlement (CSD–RTGS) Linkages: Cross-Border Settlement Infrastructure ForumNoch keine Bewertungen

- Financial Steering: Valuation, KPI Management and the Interaction with IFRSVon EverandFinancial Steering: Valuation, KPI Management and the Interaction with IFRSNoch keine Bewertungen

- 2018 Financial Planning Challenge Case Study PDFDokument7 Seiten2018 Financial Planning Challenge Case Study PDFakashNoch keine Bewertungen

- Terri Williams BankruptcyDokument59 SeitenTerri Williams BankruptcyThe Greenville Guardian100% (1)

- Case StudyDokument2 SeitenCase Studymae tuazonNoch keine Bewertungen

- Housing LoanDokument36 SeitenHousing LoanHabeeb UppinangadyNoch keine Bewertungen

- Performance of Banks With Special Reference To BangladeshDokument15 SeitenPerformance of Banks With Special Reference To BangladeshMd. Mesbah UddinNoch keine Bewertungen

- Banking Industry in The Age of FraudDokument9 SeitenBanking Industry in The Age of FraudShailendra Nath GodsoraNoch keine Bewertungen

- CIO LatestDokument5 SeitenCIO Latestshriya shettiwarNoch keine Bewertungen

- Blueprint of Banking SectorDokument33 SeitenBlueprint of Banking SectormayankNoch keine Bewertungen

- NW Search For PolicyDokument2 SeitenNW Search For PolicymayankcNoch keine Bewertungen

- Most Active Stocks NSE - May 2020Dokument4 SeitenMost Active Stocks NSE - May 2020AnandNoch keine Bewertungen

- Form No. 10H: Certificate of Foreign Inward RemittanceDokument1 SeiteForm No. 10H: Certificate of Foreign Inward RemittanceDas AyyappadasNoch keine Bewertungen

- Money Banking Generic Elective Third Sem. 5.5 PDFDokument3 SeitenMoney Banking Generic Elective Third Sem. 5.5 PDFAkistaaNoch keine Bewertungen

- SBI Card Statement - 8994 - 05-04-2024Dokument7 SeitenSBI Card Statement - 8994 - 05-04-2024Ratan YadavNoch keine Bewertungen

- Insurance Law Notes: Concealment in Marine InsuranceDokument3 SeitenInsurance Law Notes: Concealment in Marine InsuranceJohn SanchezNoch keine Bewertungen

- Oracle FLEXCUBE Universal Banking Primer - CoreDokument23 SeitenOracle FLEXCUBE Universal Banking Primer - CoremuruganandhanNoch keine Bewertungen

- On Banking Sector For PresentationDokument23 SeitenOn Banking Sector For Presentationvaishali haritNoch keine Bewertungen

- Hampel Committee, 1995Dokument16 SeitenHampel Committee, 1995Ayush Todi83% (6)

- Larace Blank Assignment of Mortgage - 03/26/2005Dokument1 SeiteLarace Blank Assignment of Mortgage - 03/26/2005RussinatorNoch keine Bewertungen

- Historic Returns - Large Cap Fund, Large Cap Fund Performance Tracker Mutual Funds With Highest ReturnsDokument3 SeitenHistoric Returns - Large Cap Fund, Large Cap Fund Performance Tracker Mutual Funds With Highest ReturnsA.J NATIONAL SECURENoch keine Bewertungen

- Invoice - Seasky International Business Travel Gde0902Dokument1 SeiteInvoice - Seasky International Business Travel Gde0902Hank ZhouNoch keine Bewertungen

- ISDA Standard CDS Contract Converter Specification - Sept 4, 2009Dokument4 SeitenISDA Standard CDS Contract Converter Specification - Sept 4, 2009Ymae AlmonteNoch keine Bewertungen

- CV Emmanuel ClaessensDokument1 SeiteCV Emmanuel ClaessensAnonymous 67Gz377rsANoch keine Bewertungen

- Revised Form 3CD by Pankaj GargDokument17 SeitenRevised Form 3CD by Pankaj GargAditya HalderNoch keine Bewertungen

- Geographical RiddlesDokument3 SeitenGeographical RiddlesMs. WarmuthNoch keine Bewertungen

- Applicant InformationDokument1.326 SeitenApplicant Informationmunaff0% (1)

- Chase Bank StatementDokument4 SeitenChase Bank StatementJoe SFNoch keine Bewertungen

- Extra Judicial ForeclosureDokument3 SeitenExtra Judicial ForeclosureJhoana Parica Francisco100% (2)

- Internal Audit Checklist of Scrap MaterialDokument1 SeiteInternal Audit Checklist of Scrap MaterialVijay Kumar Varanasi0% (1)

- Multi Page PDFDokument164 SeitenMulti Page PDFAung Zaw HtweNoch keine Bewertungen

- Provisional Receipt 2019 20 IDokument1 SeiteProvisional Receipt 2019 20 IPriyanka VermaNoch keine Bewertungen