Beruflich Dokumente

Kultur Dokumente

2011 Annual Report

Hochgeladen von

Howard KnopfOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2011 Annual Report

Hochgeladen von

Howard KnopfCopyright:

Verfügbare Formate

annualreport

ACCESS COPYRIGHT

2011 Annual Report

2011

began with the implementation of The Copyright Board of Canada Interim Tariff that maintained the status quo of the existing post-secondary licence. The Copyright Board felt that it was reasonable for Access Copyright to file a tariff, given the unwillingness of the Association of Universities and Colleges Canada (AUCC) to negotiate with Access Copyright. We were disturbed by the tone and misinformation in some published descriptions of the work that Access Copyright does. To counter this, the Access Copyright Board struck a Post-Secondary Task Force to address these issues. We must thank the Board members that made up the Post-Secondary Task Force for their excellent work in supporting staff and participating directly to counter that misinformation. Listening is important. So is speaking out. We thank all fellow Board members for their candour and camaraderie in these sometimes challenging times. Access Copyright is unusual among cultural industries, in that it has a dual Board that represents both publishers and creators. Listening and speaking candidly are essential skills that result in an effective Board that speaks with one voice, not two. The Supreme Court of Canada heard the appeal of the K-12 tariff. Success in tariff applications will uphold the principle of copyright as well as providing Access Copyright and its affiliates with a stable revenue stream. The fact is that Access Copyright has had to deal with a lot of bad news during 2011. Revenue fell sharply when several universities opted to try to source their copyright usage permissions directly with rightsholders rather than accept the terms of the Interim Tariff. In a time of reduced revenues, Access Copyright staff have concentrated on reducing costs and streamlining distribution, licensing, affiliate service processes and internal functions that help maintain or improve the way Access Copyright delivers its core purposes. Of great concern is the re-introduced Bill C-32, now called Bill C-11, which retains fair dealing for education on the long list of exceptions to copyright. As we write this, Access Copyright is supporting creator and publisher groups in lobbying the government to introduce appropriate amendments to the fair dealing provisions in C-11. We feel strongly that C-11 is so poorly drafted and so contrary to international norms that if it becomes law, with the original wording, the main result will be more litigation in the future. Communication has been a key concern for the Board this year. Weve tried hard to keep people informed of how were handling these turbulent times. Access Copyright has maintained constant communication on key issues through e-blasts, e-newsletters, the Access Copyright website and direct mailings to those rightsholders most affected by the tariff process. Finally, the Access Copyright Foundation (ACF) is entering its third year of providing grants to writers, visual artists, publishers and organizations working to promote published content. The Saskatchewan Arts Board convenes juries and handles administration at arms length from Access Copyright and the Access Copyright foundation, as it does for numerous other organizations. In 2011, the ACF awarded a total of $300,000 in grants for projects in research, professional development, and events. This is just another way that Access Copyrights presence enriches the Canadian cultural scene.

CO-CHAIRS REPORT MARCH 2012

Nancy Gerrish

Penney Kome

ACCESS COPYRIGHT

2011 Annual Report

EXECUTIVE DIRECTORS REPORT

ccess Copyright faced a culmination of licensing and legislative challenges in 2011. It was a year that saw us stand our ground and make tough choices, while looking forward to the future with promise. In an environment of adversity and revenue challenges we were still able to achieve some victories that delivered tangible benefits to our affiliates. Our affiliates, whether they are authors, artists, photographers or publishers, are each a meaningful part of something bigger. Every work that is created and used in elementary schools, colleges and universities adds value to the overall Canadian educational experience. Our affiliates knowledge and expertise help Canadian businesses, governments and other organizations get their jobs done every day. Access Copyright is proud to be a part of this valuable community of talent and through the licences we offer, our affiliates are intertwined in the collective issues that face us every day. Effective January 2011, the Copyright Board Interim Tariff for the post-secondary education sector maintained the status quo of the previous post-secondary licence. Access Copyright worked hard to promote a solution that provides clarity to post-secondary institutions. Some institutions decided not to participate in the Interim Tariff, causing a predictable decline in revenues. However, by late in the year, others had opened direct negotiations with Access Copyright to remove themselves from the tariff process and re-establish voluntary licences that now include digital uses. This important development confirms the value that Access Copyrights extensive global repertoire delivers to our respected Canadian educational institutions. In the fall, Bill C-32 changed its name when it returned to the parliamentary agenda but it didnt change its colours. As the new Copyright Modernization Act, Bill C-11 retains all of the same proposed new exceptions, including the expansion of fair dealing to cover education, that could have serious implications for Canadas publishing industry and drastically reduce revenues on which creators and publishers depend for their income and continued investments. In early December, the Supreme Court of Canada heard the appeal of the K-12 tariff decision, rendered by the Copyright Board in June 2009, which awarded a royalty increase to Access Copyright. I believe that we put our best case forward and I am cautiously optimistic as we await the decision of the Supreme Court.

Maureen Cavan

Payback had another successful year distributing $3,959,144 to 9,342 individual writers and visual artists. 78% of all creator affiliates received a supplementary payment in 2011, an impressive 5% increase over last year, when Payback was first introduced. A Payback satisfaction survey conducted in the fall revealed an overall participant satisfaction level of 83%. Total distributions to rightsholders remained steady at $23,540,374. ae Publisher and ae Creator were successfully launched allowing creators to access their content anywhere at any time with a password protected web based service, and offering publishers a cost effective solution to store digital content securely. These are a few examples of how Access Copyrights powerful online digital repository will allow affiliates to take advantage of and participate in the digital delivery of content. Overall revenues declined to $29,853,518 or 11.6% below the previous year. Operating costs were well controlled and declined 8.5% from the previous year. Tariff process costs continue to be a drain on the resources of the agency and we are grateful for the extra financial support provided by all affiliates to sustain these necessary legal challenges. A financial loss of $600,000 was incurred in 2011. Over the year several process efficiencies were implemented into the operations of the agency. One result of these new efficiencies was the distribution of $1.5 million in royalties that had previously been difficult to match to rightsholders. To counter declining revenues several cost control measures were implemented and savings were recognized in almost all cost centres. A hiring freeze implemented in 2010 remained in place and to ensure future cost-savings our office space was downsized by thirty percent. To say that we live in challenging times is an understatement. The confusion caused by the intersection of ease of access to content delivered through exciting new technologies with the need to ensure ongoing investment in creative energy and content production, tests us collectively. Our goal must be to embrace change and jointly develop responsive solutions to the needs of users for seamless access at a fair price through the licences we offer.

ACCESS COPYRIGHT

2011 Annual Report

ccess Copyright knows that users of copyright protected materials need access to published content. Access Copyright effectively meets the needs of educational institutions, businesses, governments and other organizations across Canada with innovative copyright licensing solutions.

Founded in 1988 as a not-for-profit organization, by a group of authors and publishers, Access Copyright strives to protect the value of their intellectual property by ensuring fair compensation when their works are copied. Through agreements with other copyright organizations around the world, Access Copyright provides licensees with access to a growing repertoire of more than 20 million books, magazines, newspapers and other publications. Access Copyright represents the reproduction rights and distributes royalties to over 10,000 Canadian authors and visual artists and 600 publishers. Since its inception, Access Copyright has distributed over $300 million in royalties to rightsholders. Operating as a member guided organization, our elected Board of Directors (nine representing publisher member organizations and nine representing creator member organizations) is the driving force behind our organizations policies. For more information on our governance structure and the roles and responsibilities of our Board of Directors, please contact us or visit our website, www.accesscopyright.ca.

ABout Access copyright

O A

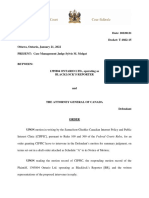

n March 16, 2011, after careful consideration of arguments and concerns from all interested parties, the Copyright Board of Canada issued reasons for its December 23, 2010 decision to grant the Access Copyright Interim Post-Secondary Educational Institutions Tariff, 2011-2013. As a result of this interim tariff, post-secondary educational institutions could continue to make photocopies from portions of published works on the same terms as the institutions previous licence agreements with Access Copyright, while ensuring that creators and publishers continue to be fairly compensated for the use of their works. The Copyright Board also examined the history of the relationship and negotiations between Access Copyright and the educational institutions and found that Access Copyright had acted reasonably during the process.

Access copyright interim postsecondAry educAtionAl institutions tAriff, 2011-2013

number of post-secondary educational institutions decided to try to operate without the need of the Interim Tariff. But in order to do so, many of them needed to replace the Interim Tariff with individual transactional licences, and in June 2011 asked the Copyright Board to force Access Copyright to clear works on a transactional basis.

On September 23, 2011, the Copyright Board issued its decision on transactional licensing. The Board refused to force Access Copyright to clear works on a one-off, transactional basis. The Copyright Board agreed with Access Copyright that, for now, transactional licences are not well suited to a digital environment. The Board stated that based on the information available, in this market and for the time being, a digital transactional business model does not ensure that rights holders get paid for the uses of their works. The Educational Institutions have since applied for judicial review of this decision.

the copyright BoArds decision on trAnsActionAl licensing

Access Copyright continues to demonstrate strong leadership on many critical issues, including copyright reform and licensing, that should be of real concern to all members of Canadas cultural community as well as consumers of the content we produce. We are stronger collectively and in this challenging environment I am grateful for the informed advocacy provided by Access Copyright on several fronts.

- Greg Nordal, President & CEO, Nelson Education Ltd.

ACCESS COPYRIGHT

2011 Annual Report

K-12 tAriff

copyright reform WorKing together to mAKe chAnges to Bill c-11

n December 2011, the Supreme Court of Canada heard the appeal of the K-12 tariff by the Council of Ministers of Education (excluding Quebec) and the Ontario school boards. We were very happy with how we were represented, believe that we put our best case forward and are cautiously optimistic as we await the decision of the Supreme Court, which is expected sometime in 2012.

ill C-11 was introduced on September 29, 2011 and is a carbon copy of its predecessor Bill C-32. The new copyright bill proposes to expand the Copyright Acts existing fair dealing exceptions to add three new allowable purposes. At the top of the list is education. Without a clear, practical amendment to the bill, this significant change would create marketplace uncertainty costing writers and publishers millions in lost revenue at the same time that they will need to undertake costly and longdrawn-out litigation to have the courts interpret the new law. Groups such as the Association of Canadian Publishers (ACP), Association National des diteurs de livres (ANEL), Canadian Authors Association (CAA), the Canadian Society of Childrens Authors Illustrators and Performers (CANSCAIP), the Canadian Educational Resources Council (CERC), COPIBEC, the Canadian Publishers Council (CPC), Literary Press Group (LPG), Playwrights Guild of Canada (PGC), the Professional Writers Association of Canada (PWAC), the Writers Union of Canada (TWUC), Unions des crivaines et des crivains Qubcois (UNEQ) and many others have been galvanized to work together as a result of this legislation. The motivation to work together is due in part to the concerns that these groups have about the bill. Copyright is important for writers, says Greg Hollingshead, an Edmonton-based writer and chair of TWUC. Its a very crucial component of this relatively small income that each of us cobbles together each year, and if it is diminished which it is likely to be, if educational uses of material become devalued or even non-existent then youre going to see even fewer writers writing.

Access Copyright is a great service to writers. We need organizations like Access Copyright to look after our interests, its good to know that someone is attempting to protect and honour the creative work that you have produced and that makes you feel that your work is appreciated.

- Priscila Uppal, Poet, Novelist and Professor, Access Copyright affiliate since 2002

Jackie Hushion, executive director of the CPC, believes the exception could seriously hurt the industry she represents: The educational publishing sector wouldnt shrink or disappear immediately, but over time, I think youd see a remarkable decline in publishing outputs. Youd see a lot of projects that had been in the works halted and put on the shelf because publishers would have no confidence in the marketplace and wouldnt be able to justify spending money to produce new resources in print or digital or to further innovate in digital materials. Sandy Crawley, executive director of PWAC, has been following copyright for over a quarterof-a-century. His passion for copyright is perhaps only eclipsed by his passion for Canadas cultural workers. The cultural sector makes a huge contribution to the economy. Its a $46 billion a year industry, says Crawley. Its not just the inherent value of cultural expression, its a big economic contribution and its a very clean industry and its a highly motivated industry and cultural workers could probably be making more money doing something else, but they do it out of passion and unfortunately, some people take unfair advantage of that.

ACCESS COPYRIGHT

2011 Annual Report

11

To the Members of The Canadian Copyright Licensing Agency

INDEPENDENT AUDITORs REPORT

We have audited the accompanying financial statements of The Canadian Copyright Licensing Agency, which comprise the statement of financial position as at December 31, 2011, and the statements of changes in net assets, operations and cash flow for the year then ended, and a summary of significant accounting policies and other explanatory information. Managements responsibility for the financial statements Management is responsible for the preparation and fair presentation of these financial statements in accordance with Canadian generally accepted accounting principles, and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error. Auditors responsibility Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with Canadian generally accepted auditing standards. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditors judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entitys preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entitys internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Basis of qualified opinion In common with other reproduction rights organizations, the corporation derives a portion of its revenue from license fees that are based on actual copies made at the licensees premises domestically and internationally, the completeness of which is not susceptible to satisfactory audit verification. Accordingly, our verification of these revenues was limited to the amounts recorded in the records of the corporation, and we were unable to determine whether any increase might be necessary to licence fee revenue, provision for royalties for distribution, excess of revenues over expenses for the year, accounts receivable, undistributed royalties and net assets. Qualified opinion In our opinion, except for the effect of the matter described in the Basis of Qualified Opinion paragraph, the financial statements present fairly, in all material respects, the financial position of The Canadian Copyright Licensing Agency as at December 31, 2011, and its financial performance and its cash flows for the year then ended in accordance with Canadian generally accepted accounting principles. Other matter The financial statements of The Canadian Copyright Licensing Agency for the year ended December 31, 2010 were audited by another auditor who expressed a qualified opinion on those statements on February 25, 2011.

Toronto, Canada February 28, 2012

Chartered accountants Licensed Public Accountant

12

ACCESS COPYRIGHT

2011 Annual Report

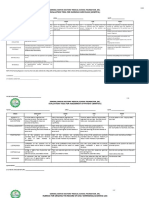

STATEMENT OF FINANCIAL POSITION

(In thousands of dollars) December 31 Assets Current Cash and cash equivalents Investments (Note 3) Accounts receivable and prepaid expenses Tariff under appeal: Cash and cash equivalents (Note 4) Accounts receivable (Note 4) Investments (Note 3) Capital assets (Note 5) $ 2011 2010

10,055 16,202 3,195 67,210 322 96,984 15,297 752 113,033

6,947 18,028 6,395 56,630 354 88,354 14,753 1,093

104,200

Liabilities Current Undistributed royalties (Note 6) Accounts payable and accrued liabilities Deferred revenue Contributions payable to Access Copyright Foundation (Note 7) Deferred capital contributions (Note 8) Tariff under appeal deferred revenue (Note 4) Undistributed royalties (Note 6) Deferred lease inducements and rent liability Deferred capital contributions (Note 8) Net Assets Net assets invested in capital assets (Note 9) Net assets internally restricted for contingencies (Note 10) Net assets internally restricted for tariff fund (Note 11) Unrestricted net assets

25,524 1,592 2,378 70 50 67,490 97,104 2,532 81 25 99,742 677 2,000 856 9,758 13,291 $ 113,033

22,000 1,259 1,323 244 50 56,941 81,817 8,282 114 75 90,288 968 2,000 907 10,037 13,912 $ 104,200

Commitments (Note 14) Contingencies (Note 15) On behalf of the Board

Nancy Gerrish, Director

Penney Kome, Director

See accompanying notes to financial statements.

12

ACCESS COPYRIGHT

2011 Annual Report

13

STATEMENT OF ChANgES IN NET ASSETS

(In thousands of dollars) Year ended December 31, 2011 Internally restricted for contingencies (Note 10) $ 2,000 Internally restricted for tariff fund (Note 11) $ 907

Invested in capital assets (Note 9) Net Assets Balance, beginning of year Excess of (expenses over revenues) revenues over expenses for the year Interfund transfer Investment in capital assets Balance, end of year $ $ 968

Unrestricted $ 10,037

2011 Total $ 13,912

2010 Total $ 13,365

(411) 120 677 $

2,000 $

(1,459) 1,408 856 $

1,249 (1,408) (120) 9,758

(621) $ 13,291

547 $ 13,912

See accompanying notes to financial statements.

STATEMENT OF OPERATIONS

(In thousands of dollars) Year ended December 31 Revenues Licence fees Interest income Other 2011 2010

28,833 901 119 29,853

32,751 868 158 33,777 6,283 851 730 383 305 129 23 8,704 25,073 24,035 491 24,526

Expenses General and administrative Professional fees Copyright Board applications Amortization of capital assets Travel, meetings, staff and directors costs Foreign exchange (gain) loss Development of future projects

6,175 595 1,459 461 284 (237) 1 8,738

Excess of revenue over expenses before the undernoted Provision for royalties for distribution Allocated to Access Copyright Foundation (Note 7)

21,115 21,310 426 21,736

Excess of (expenses over revenue) revenue over expenses for the year

See accompanying notes to financial statements.

(621)

547

13

14

ACCESS COPYRIGHT

2011 Annual Report

STATEMENT OF CASh FLOwS

(In thousands of dollars) Year ended December 31 Increase (decrease) in cash and cash equivalents Operating activities Excess of (expenses over revenue) revenue over expenses for the year Amortization of capital assets Amortization of lease inducements and rent liability Amortization of deferred capital contributions Change in non-cash components of working capital: Accounts receivable and prepaid expenses Undistributed royalties Accounts payable and accrued liabilities Deferred revenue Contributions payable to Access Copyright Foundation 2011 2010

(621) 461 (81) (50) (291) 3,232 (2,226) 333 11,652 (174) 12,817 12,526

547 383 (48) (25) 857 15,773 711 (476) 9,186 (120) 25,074 25,931 (24,203) 10,953 (179) (13,429) 12,502 51,075

Investing activities Purchase of investments Proceeds on maturity of investments Purchase of capital assets Increase in cash and cash equivalents Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year Cash and cash equivalents represented by: Cash and cash equivalents Tariff under appeal: Cash and cash equivalents $ $

(16,485) 17,767 (120) 1,162 13,688 63,577 77,265 10,055 67,210 $ 77,265 $ $ $

63,577 6,947 56,630 63,577

Cash and cash equivalents are comprised of: Cash Investments in money market funds

$ $

4,638 72,627 77,265

$ $

291 63,286 63,577

See accompanying notes to financial statements.

14

ACCESS COPYRIGHT

2011 Annual Report

15

Notes to the FiNaNcial statemeNts

(In thousands of dollars) December 31, 2011 1. organization The Canadian Copyright Licensing Agency (the Corporation) is an organization whose purpose is: a) To advocate, protect and advance the interests of creators and publishers, and other copyright owners who have legal rights in copyright works which are subject to reproduction, including reprographic, digital and analogue copying, performance, exhibition and presentation, and transmission, including retransmission; and to facilitate their participation in the digital marketplace for copyright works; To facilitate authorized public access to copyright works by licensing and other services and by collecting and distributing royalties and other compensation for use of copyright works to copyright owners individually and for collective social and cultural purposes; To research and study copyright questions relating particularly to collective administration and management of copyright in the context of economic, social, cultural and technological developments; and to provide information to creators and publishers, users and the public generally about copyright; To increase public awareness and understanding of copyright including the collective administration and management of e) copyright, to monitor unauthorized use or infringement of copyright material, and to promote compliance with licensing arrangements and copyright laws; In carrying out the above purposes, to cooperate with Canadian and foreign reproduction rights organizations, international organizations representing reproduction rights organizations or promoting copyright protection, Canadian, foreign and international societies which represent creators and publishers, and others interested in copyright, literacy, incentive for literary and artistic creation and the wider dissemination of copyright works; and For the further attainment of the above objectives, to accept grants, donations and bequests, to receive and maintain funds, and to use, apply, give, devote or distribute from time to time some or all of funds of the Corporation and the income therefrom.

b)

f)

c)

The corporation was incorporated under the laws of Canada by letters patent on August 23, 1988, without share capital. It is a not-for-profit organization with national jurisdiction excluding Quebec and, as such, is exempt from income taxes under 149(1)(l).

d)

2. Summary of significant accounting policies The Corporation follows accounting policies that conform with Canadian Generally Accepted Accounting Principles for not-for-profit organizations. The following is a summary of significant accounting policies adopted by the Corporation in the preparation of the financial statements. Basis of Accounting The Corporation shares certain common objectives with another not-for-profit organization Access Copyright Foundation (the Foundation). The Corporation is currently the sole member and only source of funding of the Foundation. The Corporation has decided not to consolidate the Foundation, and will instead provide the required disclosures (Note 7) in accordance with Canadian Institute of Chartered Accountants (CICA) Handbook Section 4450. Financial Instruments i) Financial instruments are measured at fair value upon initial recognition. Investments are classified as held-to-maturity and are measured at amortized cost. Investments maturing within twelve months from the year-end date are classified as current assets. The Corporation has designated cash and cash equivalents as held-for-trading, accounts receivable is classified as loans and receivables, and accounts payable and accrued liabilities, undistributed royalties and contributions payable to the Foundation are classified as other financial liabilities. As allowed by the Accounting Standards Board, the Corporation has chosen to apply CICA Handbook Section 3861 Financial Instruments Disclosure and Presentation, in place of Section 3862 Financial Instruments Disclosure and Section 3863 Financial Instruments Presentation. Cash and Cash Equivalents Cash and cash equivalents represent cash on hand, bank balances and investments in money market funds which are readily convertible to cash and have maturity dates three months or less from the date of acquisition. Capital Assets and Amortization Capital assets are stated at cost less accumulated amortization. Amortization is provided at rates designed to charge to operations the cost of the capital assets, on a straight line basis, over their estimated useful lives, as follows: Office equipment Computer Computer Leasehold five years hardware three years software three years improvements term lease

Capitalization of software under development will cease when the software is substantially complete and available for use. Amortization will commence upon initial utilization of the software.

ii)

16

ACCESS COPYRIGHT

2011 Annual Report

Notes to the FiNaNcial statemeNts

(In thousands of dollars) December 31, 2011 2. Summary of significant accounting policies - contd Impairment of Long-Lived Assets The Corporation reviews, when circumstances indicate it to be necessary, the carrying values of its long-lived assets by comparing the carrying amount of the asset or group of assets to the expected future, undiscounted cash flows to be generated by the asset or group of assets. An impairment loss is recognized when the carrying amount of an asset or group of assets held for use exceeds the sum of the undiscounted cash flows expected from its use and eventual disposition. The impairment loss is measured as the amount by which the assets carrying amount exceeds its fair value, based on quoted market prices, when available, or on the estimated present value of future cash flows. Undistributed Royalties Undistributed royalties represent the balance of licence fees to be distributed to rightsholders. The annual provision for royalties for distribution is dependent upon decisions made by the Board of Directors. Deferred Revenue Licence fee revenue applicable to future periods and the current portion of deferred lease inducements and rent liability are recorded as deferred revenue. Tariff Under Appeal Deferred Revenue Licence fees in excess of the applicable rate under the previously executed licence with the Elementary and Secondary Schools, together with related interest, are recorded as tariff under appeal deferred revenue. Deferred Capital Contributions Deferred capital contributions represent government assistance received for the development or purchase of capital assets. This assistance is deferred and amortized to income on the same basis as the related capital assets. Deferred Lease Inducements and Rent Liability Deferred lease inducements represent cash benefits received from the landlord pursuant to lease agreements for premises occupied by the Corporation. These lease inducements are amortized against rent expense over the terms of the leases. Rent liability represents the difference between minimum rent as specified in the leases and rent calculated on a straight line basis over the term of the lease. Revenue Recognition The Corporation follows the deferral method of accounting for contributions. Restricted contributions are recognized as revenue in the year in which the related expenses are incurred. Licence fees, other than those related to full-reporting licences, are recognized as revenue on a monthly basis, over the terms as specified in the licence agreements. Licence fees from Elementary and Secondary Schools are recognized as revenue to the extent of the applicable rate under the previously executed licence. For the years commencing 2005, this rate is subject to leave of appeal (Note 4), the resolution of which may result in the reduction of revenues previously recognized. Full-reporting licence fees, which are based on actual copies made at the licensees premises, are recognized as revenue when received, or receivable if the amount to be received is confirmed by the licensees. Investment income is comprised of interest from cash and cash equivalents and interest from other fixed income investments. Interest from cash and cash equivalents and guaranteed investment certificates is recognized on an accrual basis. Interest income on other fixed income investments is recognized using the effective interest method, which includes premiums incurred or discounts earned. Foreign Currency Translation Monetary assets and liabilities denominated in foreign currencies are translated to Canadian dollars at the exchange rate in effect at the balance sheet date. Non-monetary assets and liabilities denominated in foreign currencies are translated at the rates in effect on the transaction date. Revenues and expenses denominated in foreign currencies are translated at the exchange rate in effect on the date of each transaction. Foreign currency gains or losses are included in the determination of the excess of revenues over expenses for the year. Estimates and Measurement Uncertainty The preparation of financial statements in conformity with Canadian generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Items requiring significant estimates and subject to measurement uncertainty include determination of the rate used to recognize Elementary and Secondary School licence fee revenue, determination of the allowance for doubtful accounts receivable, useful lives of capital assets and impairment of capital assets. By their nature, these estimates are subject to measurement uncertainty. Actual results could differ from those estimates. These estimates are reviewed periodically, and, as adjustments become necessary, they are reported in the statement of operations in the period in which they become known. Future accounting changes On December 31, 2010, the Accounting Standards Board (AcSB) issued Part III of the Accounting Handbook: Accounting Standards for Not-for-Profit Organizations (ASNPO). The standards are effective for annual financial statements relating to fiscal years beginning on or after January 1, 2012. The standards are applicable to all not-forprofit organizations. Not-for-profit organizations maintain the option to adopt International Financial Reporting Standards. Early adoption is permitted. The Corporation has decided to adopt Part III ASNPO for the fiscal year beginning January 1, 2012.

ACCESS COPYRIGHT

2011 Annual Report

17

Notes to the FiNaNcial statemeNts

(In thousands of dollars) December 31, 2011 3. Investments 2011 Fair Value 2011 Amortized cost 2010 Amortized Cost

Corporate bonds and notes Interest at various rates ranging from 2.0% to 6.1% per annum, maturing on various dates to February 10, 2014 Guaranteed investment certificates Interest at various rates ranging from 1.31% to 3.2% per annum, maturing on various dates to May 6, 2013 Government bonds Interest at 5.75% and 1.875% per annum, maturing on Feb. 27, 2012 and Nov. 19, 2012, respectively

24,294

23,974

31,081

6,534

6,500

1,500

1,029 $ 32,057

1,025 31,499 (16,202) $ 15,297 $

200 32,781 (18,028) 14,753

Less: Current portion

4. Tariff under appeal Following a decision issued by the Copyright Board of Canada in 2009, the Corporation invoiced the Elementary and Secondary Schools based on the certified tariff for the years 2005 to 2009. This decision was confirmed by the Federal Court of Appeal with a question related to a minor value in the tariff calculation referred back to the Copyright Board for re-consideration; however, the Federal Court of Appeal decision was appealed to the Supreme Court of Canada (SCC). The SCC hearing was held in December 2011. A ruling on this matter is expected in 2012. All licence fees invoiced to the Elementary and Secondary Schools for the years 2005 to 2011, in excess of the applicable rate under the previous licence, together with related interest, in the amount of $67,490 (2010 - $56,941) have been recorded as deferred revenue and segregated by the Corporation pending the outcome of the SCC appeal.

5. Capital assets Cost Office equipment Computer hardware Computer software Leasehold improvements Software under development $ 425 1,140 6,305 416 145 8,431 $ Accumulated Amortization 375 1,101 5,891 312 7,679 $

2011 Net Book Value 50 39 414 104 145 752 $

2010 Net Book Value 76 78 718 166 55 1,093

6. Undistributed royalties Balance, beginning of year Provision for royalties for distribution Distribution to rightsholders Other Balance, end of year Less: Current portion $ $

2011 30,282 21,310 51,592 (23,540) 4 28,056 (25,524) 2,532 $ $

2010 29,571 24,035 53,606 (23,324) 30,282 (22,000) 8,282

18

ACCESS COPYRIGHT

2011 Annual Report

Notes to the FiNaNcial statemeNts

(In thousands of dollars) December 31, 2011 7. Related party transactions On June 25, 2009, the Corporation established the Foundation, a not-for-profit organization whose purpose is to promote Canadian culture through providing grants intended to encourage the understanding, development and promotion of literary and visual arts in Canada. The Foundation was initially funded by an allocation of undistributed royalties in the amount of $3,237 representing a portion of licence fees received for which the rightsholders could not be identified. The Corporation continues to search for the rightsholders specific to these undistributed royalties on an ongoing basis. Commencing in 2009, 1.5% of gross licence fees received by the Corporation are being allocated for contribution to the Foundation up to a specified maximum amount to be determined by the Board of Directors. During the year, $426 (2010 - $491) was allocated for contribution to the Access Copyright Foundation (thousands of dollars) Statement of financial position Total assets Total liabilities Net assets $ $ $ Statement of operations Total revenues Total expenses Excess of revenues over expenses $ $ Foundation, of which $70 remained unpaid at December 31, 2011 (December 31, 2010 - $244). The Corporation is currently the sole member and only source of funding of the Access Copyright Foundation. In 2010, the Corporation appointed two of three directors to the Foundation. A maximum of five directors can be appointed in any one year, of which the Corporation may appoint two. The Foundation has not been consolidated in the Corporations financial statements. Financial statements of the Foundation are available upon request. Financial summaries of the Foundation as at December 31, 2011 and 2010 and for the years ended December 31, 2011 and 2010 are as follows: 2011 4,342 1 4,341 4,342 471 367 104 $ $ $ $ $ 2010 4,251 14 4,237 4,251 522 55 467

Total revenues include contribution revenue of $426 (2010 - $491) received from the Corporation. Statement of cash flows Cash from operations Increase in cash equivalents $ $ 266 266 $ $ 594 594

8. Deferred capital contributions Deferred capital contributions represent the unamortized amount of funding received from the Ontario Media Development Corporation (OMDC) through the OMDC Entertainment and Creative Cluster Partnership Fund, for the development of an online portal containing copyrighted material for the production of customized coursepacks for post secondary educational institutions. Under the agreement, $150 was received, and is being amortized over the same three year period as the related software, commencing in July, 2010.

9. Investment in capital assets Net assets invested in capital assets are compromised as follows: Capital assets Deferred capital contributions

2011

2010

$ $

752 (75) 677

$ $

1,093 (125) 968

ACCESS COPYRIGHT

2011 Annual Report

19

Notes to the FiNaNcial statemeNts

(In thousands of dollars) December 31, 2011 9. Investment in capital assets - contd The excess of expenses over revenues attributable to capital assets is calculated as follows: 2011 Amortization of capital assets Amortization of deferred capital contributions $ $ (461) 50 (411) $ $ 2010 (383) 25 (358)

10. Net assets internally restricted for contingencies Net assets internally restricted for contingencies represent amounts designated by the Board of Directors to finance any material costs arising from the Corporations indemnifications as described in Note 15, and any future legal actions concerning the Corporation or brought by the Corporation against others in respect of alleged copyright infringements.

11. Net assets internally restricted for tariff fund Net assets internally restricted for tariff fund represents 5% of gross licence fees received or receivable by the Corporation to finance costs of submitting applications to the Copyright Board of Canada (the Board) with respect to tariff disputes by licensees and defending any appeals resulting from Board decisions.

12. Fair value The carrying amounts of cash and cash equivalents, accounts receivable, undistributed royalties, accounts payable and accrued liabilities and contributions payable to the Foundation approximate fair value because of the short term maturity of these financial instruments. The carrying amount of investments and their fair value are disclosed in Note 3.

13. Risk management Risk management relates to the understanding and active management of risks associated with all areas of the business and the associated operating environment. The Corporations financial instruments are primarily exposed to credit, interest rate and foreign currency risks. The Corporation has formal policies and procedures that establish target asset mix. The Corporations policies also require diversification of investments within categories, and set limits on exposure to individual investments. Credit risk Financial instruments that potentially subject the Corporation to concentrations of credit risk consist primarily of cash and cash equivalents, investments and accounts receivable. Cash and cash equivalents consist of money market funds with a major Canadian financial institution and deposits with a major Canadian banking institution which may exceed federally insured limits. Investments consist of corporate bonds and notes, guaranteed investment certificates and government bonds which carry an investment grade credit rating and are administered by a major Canadian financial institution. Accounts receivable are primarily due from government and educational institutions which have high credit worthiness. Interest rate risk Interest rate risk arises from the possibility that changes in interest rates will affect the value of fixed income securities and money market funds held by the Corporation. The Corporation manages this risk by holding a large portion of its securities in investment grade corporate and government bonds and notes and by staggering the terms of the securities held. Foreign currency risk The Corporation maintains a bank account and investments denominated in U.S. funds. As such, it is subject to foreign currency risk due to fluctuations in U.S./Canadian exchange rates. The following amounts, denominated in U.S. funds are translated at 1.017 (2010 0.9946) and are included in the following financial statement items:

20

ACCESS COPYRIGHT

2011 Annual Report

Notes to the FiNaNcial statemeNts

(In thousands of dollars) December 31, 2011 13. Risk management - contd 2011 Cash and cash equivalents (U.S. dollars) Investments (U.S. dollars) $ $ 1,311 2,553 $ $ 2010 2,085 834

14. Commitments The Corporation has entered into two operating agreements for the lease of its premises and office equipment for a term expiring on August 31, 2015. The future minimum lease payments, exclusive of executor costs, in the aggregate and in each of the succeeding fiscal years, net of recoveries from other parties are as follows: 2012 2013 2014 2015 $ 155 160 164 117 596 The Corporation is contingently liable for the future rents of its sub-tenant in the amount of approximately $95, expiring on August 31, 2015.

15. Contingencies In accordance with certain licence agreements, the Corporation indemnifies its licensees against any legal actions that may be brought against them as a result of their exercise of the permission granted therein. The Corporation is not aware of any outstanding claims with respect to the aforementioned indemnifications.

16. Capital management The Corporations objectives when managing capital are: a) b) c) To safeguard the Corporations ability to continue as a going concern. To maintain appropriate cash reserves on hand to meet ongoing operating costs. To invest cash on hand in highly liquid and highly rated financial instruments. In the management of capital, the Corporation includes net assets in the definition of capital. The Corporation manages the capital structure and makes adjustments to it in light of changes in economic conditions and the risk characteristics of the underlying assets. The Corporation is not subject to externally imposed capital requirements. There has been no change with respect to the overall capital risk management strategy during the year.

17. Comparative figures Certain comparative figures have been reclassified to conform with the current years presentation.

ACCESS COPYRIGHT

2011 Annual Report

21

ACCess COPyrights 2011 BOArd Of direCtOrs

1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. Penney Kome, Co-Chair, Calgary, AB Brian Henderson, Waterloo, ON Lezlie Lowe, Halifax, NS Greg Nordal, Toronto, ON Mark Jamison, Toronto, ON Ron Brown, Toronto, ON Rowland Lorimer, Coquitlam, BC George Fetherling, Vancouver, BC Sylvia McNicoll, Burlington, ON Nancy Gerrish, Co-Chair, Whitby, ON Anita Purcell, Coldwater, ON James Romanow, Saskatoon, SK Jeff Miller, Toronto, ON John Hinds, Toronto, ON Sandy Crawley, Toronto, ON Kevin Williams, Vancouver, BC Michael Visser, Toronto, ON

10

11

12

13

14

15

16

17

Creator Member Organizations

Canadian Artists Representation (CARFAC), Canadian Association of Photographers and Illustrators in Communications (CAPIC), Canadian Association of University Teachers (CAUT), Canadian Authors Association (CAA), Canadian Society of Childrens Authors, Illustrators and Performers (CANSCAIP), Crime Writers of Canada (CWC), Federation of British Columbia Writers (FBCW), League of Canadian Poets (LCP), Manitoba Writers Guild (MWG), Outdoor Writers of Canada (OWC), Playwrights Guild of Canada (PGC) Professional Writers Association of Canada (PWAC), Saskatchewan Writers Guild (SWG), The Writers Union of Canada (TWUC), Writers Guild of Alberta (WGA), Writers Alliance of Newfoundland & Labrador (WANL), Writers Federation of New Brunswick (WFNB), Writers Federation of Nova Scotia (WFNS)

Publisher Member Organizations

Alberta Magazine Publishers Association (AMPA), Association of Book Publishers of British Columbia (ABPBC), Association of Canadian Publishers (ACP), Association of Canadian University Presses (ACUP), Association of Manitoba Book Publishers (AMBP), Atlantic Publishers Marketing Association (APMA), Book Publishers Association of Alberta (BPAA), Canadian Association of Learned Journals (CALJ), Canadian Business Press (CBP), Canadian Community Newspaper Association (CCNA), Canadian Educational Resources Council (CERC), Canadian Music Publishers Association (CMPA), Canadian Newspaper Association (CNA), Canadian Publishers Council (CPC), Literary Press Group (LPG), Magazine Association of BC (MABC), Magazines Canada, Organization of Book Publishers of Ontario (OBPO), Saskatchewan Publishers Group (SPG)

Board of Directors photos by: Gregory Varano. Lezlie Lowe, Sylvia McNichol and Kevin Williams by: John Provenzano.

22

ACCESS COPYRIGHT

2011 Annual Report

ACCess COPyrights 2011 eXeCUtiVe teAM

1. Maureen Cavan, Executive Director 2. Brian ODonnell, Director, Business & International Development 3. Roanie Levy, General Counsel, Director, Policy & External Affairs 4. Margaret McGuffin, Director, Licensing & Distribution

Management team

Heather Brunstad, Manager, Bibliographic & Permissions Services, Valerie Bulanda, Manager, Affiliate Relations, Kerrie Duncan, Manager, Accounting, Andy Dybczynski, Manager, Information Technology, Erin Finlay, Manager, Legal Services, Silvia Grunberg, Manager, Licensing & Distribution, Jennifer Lamantia, Manager, Education Licensing Development, John Provenzano, Manager, Communications, Rob Weisberg, Manager, Corporate Licensing Development

Directors and Management photos by: Gregory Varano.

One Yonge Street, Suite 800, Toronto, Ontario M5E 1E5 tel 416.868.1620 fax 416.868.1621 toll free 1.800.893.5777 www.accesscopyright.ca

ISSN 1713-5664

Das könnte Ihnen auch gefallen

- AMENDED Statement of Defence and Counterclaim - Defendant - Easy Group Inc. - 18 - AUG - 2022Dokument26 SeitenAMENDED Statement of Defence and Counterclaim - Defendant - Easy Group Inc. - 18 - AUG - 2022Howard KnopfNoch keine Bewertungen

- t-948-22 Doc1 SOCDokument25 Seitent-948-22 Doc1 SOCHoward KnopfNoch keine Bewertungen

- T-948-22 6 24 22 - SoD and CCDokument25 SeitenT-948-22 6 24 22 - SoD and CCHoward KnopfNoch keine Bewertungen

- T-1862!15!20220121 CMJ Molgat Order Re CIPPIC InterventionDokument7 SeitenT-1862!15!20220121 CMJ Molgat Order Re CIPPIC InterventionHoward KnopfNoch keine Bewertungen

- CIPPIC Leave To Intervene T-1862-15 Doc43Dokument31 SeitenCIPPIC Leave To Intervene T-1862-15 Doc43Howard KnopfNoch keine Bewertungen

- A-129-22 - A's Memo - ID 16 - 20220926103349Dokument36 SeitenA-129-22 - A's Memo - ID 16 - 20220926103349Howard KnopfNoch keine Bewertungen

- Katz ABC Conference Keynote 2022Dokument53 SeitenKatz ABC Conference Keynote 2022Howard KnopfNoch keine Bewertungen

- T-513-18 - Plaintiff's Written RepresentationsDokument34 SeitenT-513-18 - Plaintiff's Written RepresentationsHoward KnopfNoch keine Bewertungen

- Woods CAN - DMS - 141680031 - v1 - 2021 09 27 Notice of AppealDokument7 SeitenWoods CAN - DMS - 141680031 - v1 - 2021 09 27 Notice of AppealHoward KnopfNoch keine Bewertungen

- AG MR Aug 10 2021 T-1862-15-Doc57Dokument45 SeitenAG MR Aug 10 2021 T-1862-15-Doc57Howard KnopfNoch keine Bewertungen

- T 513 18 (Letter Plaintiff) 20 JUL 2021Dokument1 SeiteT 513 18 (Letter Plaintiff) 20 JUL 2021Howard KnopfNoch keine Bewertungen

- T-1862-15 1395804 Ontario Ltd. v. Attorney General of Canada Order and Reasons Fed CT 25-AUG-2021Dokument15 SeitenT-1862-15 1395804 Ontario Ltd. v. Attorney General of Canada Order and Reasons Fed CT 25-AUG-2021Howard KnopfNoch keine Bewertungen

- T-513-18 Voltage Holdings V Doe-OrderAndReasons-Oct 22 2021Dokument15 SeitenT-513-18 Voltage Holdings V Doe-OrderAndReasons-Oct 22 2021Howard KnopfNoch keine Bewertungen

- T-513-18 Doc.158 - Notice of MotionDokument12 SeitenT-513-18 Doc.158 - Notice of MotionHoward KnopfNoch keine Bewertungen

- Response-Second PDFDokument151 SeitenResponse-Second PDFHoward KnopfNoch keine Bewertungen

- York University - A D - Reply Réplique - Suitable For Posting - FIRST APPLICATION PDFDokument2 SeitenYork University - A D - Reply Réplique - Suitable For Posting - FIRST APPLICATION PDFHoward KnopfNoch keine Bewertungen

- Wiseau T-1057-21 Doc 1Dokument16 SeitenWiseau T-1057-21 Doc 1Howard KnopfNoch keine Bewertungen

- Wiseau OCA M52604 (C68580) .ReenDokument8 SeitenWiseau OCA M52604 (C68580) .ReenHoward KnopfNoch keine Bewertungen

- Access Copyright - Notice of Application LTA SCC PDFDokument6 SeitenAccess Copyright - Notice of Application LTA SCC PDFHoward Knopf100% (2)

- York University - Notice of Application LTA SCC PDFDokument3 SeitenYork University - Notice of Application LTA SCC PDFHoward KnopfNoch keine Bewertungen

- Allarco Alberta Order of ACJ Nielsen Jan 9, 2020 - Filed Jan 16, 2020 PDFDokument3 SeitenAllarco Alberta Order of ACJ Nielsen Jan 9, 2020 - Filed Jan 16, 2020 PDFHoward KnopfNoch keine Bewertungen

- Access Copyright - Memorandum of Argument LTA SCC PDFDokument26 SeitenAccess Copyright - Memorandum of Argument LTA SCC PDFHoward Knopf100% (1)

- Trademark Info Corp PDFDokument1 SeiteTrademark Info Corp PDFHoward KnopfNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Compare Visual Studio 2013 EditionsDokument3 SeitenCompare Visual Studio 2013 EditionsankurbhatiaNoch keine Bewertungen

- Syllabus For Final Examination, Class 9Dokument5 SeitenSyllabus For Final Examination, Class 9shubham guptaNoch keine Bewertungen

- 1 Intro To Society, Community and EducationDokument29 Seiten1 Intro To Society, Community and EducationMaria Michelle A. Helar100% (1)

- Neolms Week 1-2,2Dokument21 SeitenNeolms Week 1-2,2Kimberly Quin CanasNoch keine Bewertungen

- Value Chain AnalaysisDokument100 SeitenValue Chain AnalaysisDaguale Melaku AyeleNoch keine Bewertungen

- Sorsogon State College: Republic of The Philippines Bulan Campus Bulan, SorsogonDokument4 SeitenSorsogon State College: Republic of The Philippines Bulan Campus Bulan, Sorsogonerickson hernanNoch keine Bewertungen

- National Healthy Lifestyle ProgramDokument6 SeitenNational Healthy Lifestyle Programmale nurseNoch keine Bewertungen

- Grade 10 Science - 2Dokument5 SeitenGrade 10 Science - 2Nenia Claire Mondarte CruzNoch keine Bewertungen

- The Structure of The Nazi Economy - Maxine Yaple SweezyDokument273 SeitenThe Structure of The Nazi Economy - Maxine Yaple Sweezygrljadus100% (2)

- Mythologia: PrologueDokument14 SeitenMythologia: ProloguecentrifugalstoriesNoch keine Bewertungen

- Mangaid CoDokument50 SeitenMangaid CoFk Fit RahNoch keine Bewertungen

- AX Series Advanced Traffic Manager: Installation Guide For The AX 1030 / AX 3030Dokument18 SeitenAX Series Advanced Traffic Manager: Installation Guide For The AX 1030 / AX 3030stephen virmwareNoch keine Bewertungen

- Corrugated Board Bonding Defect VisualizDokument33 SeitenCorrugated Board Bonding Defect VisualizVijaykumarNoch keine Bewertungen

- Facilities Strategic Asset Management Plan TemplateDokument85 SeitenFacilities Strategic Asset Management Plan Templateoli mohamedNoch keine Bewertungen

- Forensic BallisticsDokument23 SeitenForensic BallisticsCristiana Jsu DandanNoch keine Bewertungen

- Safe Britannia PDFDokument2 SeitenSafe Britannia PDFeden4872Noch keine Bewertungen

- PEDIA OPD RubricsDokument11 SeitenPEDIA OPD RubricsKylle AlimosaNoch keine Bewertungen

- Rotation and Revolution of EarthDokument4 SeitenRotation and Revolution of EarthRamu ArunachalamNoch keine Bewertungen

- Sultan Omar Ali Saifuddin IIIDokument14 SeitenSultan Omar Ali Saifuddin IIISekolah Menengah Rimba100% (3)

- Guidebook On Mutual Funds KredentMoney 201911 PDFDokument80 SeitenGuidebook On Mutual Funds KredentMoney 201911 PDFKirankumarNoch keine Bewertungen

- Acitve and Passive VoiceDokument3 SeitenAcitve and Passive VoiceRave LegoNoch keine Bewertungen

- Ham (Son of Noah) - WikipediaDokument3 SeitenHam (Son of Noah) - Wikipediamike bNoch keine Bewertungen

- Skylab Our First Space StationDokument184 SeitenSkylab Our First Space StationBob AndrepontNoch keine Bewertungen

- Journal of The Folk Song Society No.8Dokument82 SeitenJournal of The Folk Song Society No.8jackmcfrenzieNoch keine Bewertungen

- Surat Textile MillsDokument3 SeitenSurat Textile MillsShyam J VyasNoch keine Bewertungen

- Alankit Assignments LTD.: Project Report ONDokument84 SeitenAlankit Assignments LTD.: Project Report ONmannuNoch keine Bewertungen

- EMP Step 2 6 Week CalendarDokument3 SeitenEMP Step 2 6 Week CalendarN VNoch keine Bewertungen

- IKEA AyeshaDokument41 SeitenIKEA AyeshaAYESHAREHMAN100Noch keine Bewertungen

- Succession CasesDokument17 SeitenSuccession CasesAmbisyosa PormanesNoch keine Bewertungen

- Baixar Livro Draw With Jazza Creating Characters de Josiah Broo PDFDokument5 SeitenBaixar Livro Draw With Jazza Creating Characters de Josiah Broo PDFCarlos Mendoza25% (4)