Beruflich Dokumente

Kultur Dokumente

Sme

Hochgeladen von

Taqbir TalhaOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Sme

Hochgeladen von

Taqbir TalhaCopyright:

Verfügbare Formate

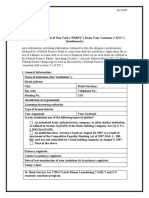

SME Foundation

The SME Foundation is an independent center of excellence created and generously capitalized by the Government of Bangladesh to the tune of a total endowment of Tk. 2 billion. The women entrepreneurs represented, with some visible angst, how difficult it is to succeed in the highly competitive world of SMEs in Bangladesh when ones bank charges on interest rates as high as 17% to 22%. Legal base of establishing SME Foundation Small and Medium Enterprise Foundation got registration from the Ministry of Commerce on 1211-2006 and from the Registrar of Joint Stock Companies and Firms on 26-11-2006 under the Companies Act (Act XXVIII), 1994 . A resolution (Gazette notification) was circulated on 30-052007 regarding the establishment of SME Foundation. It is an independent and unique non-profit organization. Vision Fostering industrialization through SME promotion for employment generation, economic development finally poverty alleviation of Bangladesh. Mission Undertake and implement multi sectoral action plan for proper growth of SMEs and make them competitive in the free market economy. Objectives 1. Implementing SME Policy Strategy adopted by the Government of Bangladesh. 2. Recommending SME friendly policies to different government ministries and agencies. 3. Providing business support services to the SME entrepreneurs. 4. Providing information and proper guidance for establishing new SMEs. 5. Conducting sectoral study to ensure availability of latest information, identify challenges and recommend preventing measures.. 6. Operating credit wholesaling programs for the SMEs through different banking and nonbanking financial institutions. 7. Conducting training programs to create skilled labor for different SME sub-sector based on their demands. 8. Technology development, adopting new technology, conducting reverse engineering and supporting SMEs to get quality certifications. 9. Supporting SMEs in marketing their products and promotion of services. 10. Bringing women entrepreneurs into the mainstream of development and helping them to achieve economic self dependency. 11. Assisting SMEs in creating institutional bondage with foreign companies for capacity building, technology transfer and improving productivity. 12. Training up and motivating SMEs in using ICT tools for more productivity and improving quality. Activities

Implementation of SME Policy Strategies adopted by the Government of Bangladesh Implementation of the SME Policy Strategies adopted by the Government of Bangladesh is one of the main responsibilities of SME Foundation. SME Foundation continuously assist the government in core issues mentioned in the policy strategy like: recommend rational budget structure for SMEs, advice on fiscal and financial issues, assist to ensure quality of SME products, assist in capacity development, techno-entrepreneurship development, information support through web portal, establishment of virtual SME front office, assist in technology transfer activities at international level etc. Policy Advocacy & Research Policy advocacy & research is one of the most important mandates of SME Foundation aims to sustainable SME development in the country. The main activities of Policy Advocacy & Research Wing are to facilitate for growing enabling environment to run SME business smoothly in the country. The Foundation is very much keen to extend their policy supports for creating better environment on credit lending in SME sectors. The regulatory barriers appear as challenges for the growth of SME sectors and therefore, SME Foundation works to identify and resolve the challenges on legal and administrative regimes like regulatory barriers on trade license, patent and trademark, product certification, environmental issues etc. Credit Wholesaling Program Credit wholesaling is one of the major activities of SME Foundation to ensure easy access to finance for the SME entrepreneurs. SME Foundation has already taken credit wholesaling program as pilot scheme with its own fund. SME Foundation helps the SME entrepreneurs by providing collateral free loan at 9% interest rate to the technology based potential SME manufacturing industries along with agro-based industries. Capacity Building & Skill Development SME Foundation organize training program in public-private partnership module to enhance the skill of SME entrepreneurs as well as to create new entrepreneur. Training programs like entrepreneurship development, SME cluster wise skill based, technology based, ICT based, ToT, productivity and quality improvement, marketing, management, financial management etc. are conducted by signing a MoU between training institute or SME related association. Besides, SME Foundation also assists trade bodies/ associations as an important part of capacity building to develop their skills. Access to Technology SME Foundation is committed to improve competiveness of SMEs through technology upgradation, adaptation of advanced technology, diffusion of appropriate technology, moving towards reverse engineering, and compliances and product certification. SME Foundation is also devoted to enable SMEs to energy efficient and environmentally sound. Access to Information SME Foundation provide update information and data through its own web portal (http://www.smef.org.bd) to the government, planner, decision maker, executive, researcher, investor, policy maker and to the SME entrepreneurs to establish new business or run business in a profitable manner. Establishment of a data bank with different information, data, findings and strategy for the development of SMEs at local and international level is an important activity of SME Foundation. Women Entrepreneurship Development

Bring the women entrepreneur to main stream development process and facilitate them for women empowerment is one of the prioritized activity of SME Foundation. Main activities are: institutional capacity building of women chamber/ trade bodies, formulate gender action plan, encourage bankers for finance to women entrepreneurs, conduct study on women entrepreneurs, organize women entrepreneur conference, national SME women entrepreneurship award, SME product fair for women entrepreneur etc. Business Support Service SME Foundation provides different kinds of business support service for entrepreneurship development. These are: promotion and market expansion of SME product, establish linkage between buyer and seller, provide advice and guideline with information support for new business development, publish SME business manual, organize SME product fair etc.

Bangladesh Banks SME Credit Policies & Programmes Excerpt from Bangladesh Banks Small and Medium Enterprise (SME) Credit Policies & Programmes 1. For small entrepreneurs credit limit will be ranged from BDT 50,000 (USD 617.28) to BDT 5,000,000 (USD 61,728). 2. Banks and financial institutions may sanction up to BDT 2,500,000 (USD30,864) to women entrepreneurs against personal guarantee. In that case, group security/social security may be considered. 3. Each bank/financial institution shall fix the interest rate on SME loan sector/sub-sector wise. 4. However, bank/financial institution will inform Bangladesh Bank sector/sub-sector wise rate of interest immediately and ensure disbursement of refinanced fund to the clients (women entrepreneurs) at Bank rate +5% interest. 5. Banks/financial institutions may provide collateral free credit facilities up to BDT 2,500,000 (USD 30,864) against Personal Guarantee in SME sector especially for small and women entrepreneurs. Credit can also be provided against hypothecation of products and machineries, if needed. 6. However, banks and financial institutions shall follow their own rules and banker-customer relationship to determine collateral for credit facilities more than BDT 2,500,000 (USD 30,864). Banks and financial institutions shall apply their own due diligence method in selecting clients/entrepreneurs. 7. Bangladesh Bank is providing refinance facility to banks and financial institutions at bank rate (at present 5%) in SME sector. The fund obtained at bank rate through BB refinance window should be disbursed at bank rate + not more than 5% interest to the client level (in case of women entrepreneurs).

Eligibility for equity support from the Equity and Entrepreneurship Fund Unit (EEF):

1.

The project will have to be a new one and belong to either of the sectors viz., software industry or food processing and agro-based industry.

2.

The sponsors/entrepreneurs applying for EEF support will have to be a private limited company registered under the Companies Act, 1994 and established old companies can also apply for EEF support by setting-up a subsidiary new private limited company. But in case of a software company registered on or after 01 January, 1997 will be treated as a new company. The total project cost ( including net working capital ) of the proposed project will have to be of minimum 0.50 (half) core for both IT and agro-based industries and that of the maximum is Taka 5.00 Crore for IT& Taka 10.00 Crore for agro based industries . Project proposal with bank loan is not allowed for agro based industries but allowed for IT industries. The project shall have to be viable technically & financially .It should be environment friendly. Importance shall be given on the appraisal of the entrepreneurship such as educational qualification in the relevant discipline, knowledge in the technology/ process operating such project, track records in financial conduct specially with Banks/FI. In case of ratio analysis the project has to offer minimum IRR (Internal Rate of Return) of 15%, Return on equity (ROE) of 15% Debt service coverage Ratio 1.50:1 Current ratio 1.50:1 and Fixed asset coverage ratio 1.50: 1 and SWOT analysis should have to be acceptable.4. The project shall have to be viable technically & financially .It should be environment friendly. Importance shall be given on the appraisal of the entrepreneurship such as educational qualification in the relevant discipline, knowledge in the technology/ process operating such project, track records in financial conduct specially with Banks/FI. In case of ratio analysis the project has to offer minimum IRR (Internal Rate of Return) of 15%, Return on equity (ROE) of 15% Debt service coverage Ratio 1.50:1 Current ratio 1.50:1 and Fixed asset coverage ratio 1.50: 1 and SWOT analysis should have to be acceptable. The non-resident Bangladeshis will be given preference subject to the fulfillment of the terms & conditions mentioned in the above paragraphs. Any defaulter (as defined by Bangladesh Bank) cannot apply for EEF. Where a sponsor of a project needs term-loan and /or working capital loan from any Bank/FI and also equity support form the EEF, he has to submit application to the Bank/FI concerned. The Bank/FI will have to be satisfied that the project has fulfilled all the terms and conditions required. Where the sponsors/entrepreneurs need only equity support from EEF without any bank loan a Bank/FI will be nominated as representative of EEF for appraisal of the project by Bangladesh Bank(EEF) . To nominate such Bank/FI, previous business relationship of entrepreneur with the Bank/FI will be considered. The concerned Bank (which will also act as monitoring bank) will make thorough appraisal of the project in accordance with EEF rules and guidelines and if the bank is satisfied about the viability of the project they shall send the project proposal with specific recommendation to Bangladesh Bank. The Bank/FI may determine their project examination fee according to their existing rules. Bangladesh Bank, EEF Unit will re-examine the project appraisal and perform pre-sanction visit if necessary. Then EEF Unit will place it with specific recommendation before the Technical Advisory Committee (TAC). TAC is a four member expert Committee under the chairmanship of the Governor of the Bangladesh Bank. This Committee is the ultimate authority to approve the projects. When a project is approved by the TAC, EEF Unit will issue a sanction letter to the concerned entrepreneur instructing them to invest their portion of equity within a certain period of time.

3.

4.

5.

6. 7.

A Summary of Rules & Regulations of Equity and Entrepreneurship Fund (EEF) Administered by Bangladesh Bank. -----------------------------------------------Introduction : The Government of Bangladesh has recognized that the role of Small & Medium Enterprises (SMEs) is extremely important in the development of private sector entrepreneurs, human development poverty reduction and employment generation. For the development of agro-product

processing and software industries by the SMEs the government allocated Tk. 100 crore to EEF in 2005-06. As on 8 June, 2006, 212 projects have been financed from this fund. In the National Budget 2006-07, the Fund was enhanced to Tk. 200 crore. A Summary of the Rules & Regulations of EEF is given below so that the SMEs may be aware of the facilities and use the same. 2. What is EEF In accordance with the Agency Agreement of December 26, 2000, executed between the Government of Bangladesh and the Bangladesh Bank, in pursuance of sub-clause (b) of clause (18) of Article 16 of the Bangladesh Bank order, 1972, Bangladesh Bank is acting as the agent to the Government of Bangladesh to administer the Equity and Entrepreneurship Fund. EEF is being utilized for extending equitysupport to the eligible companies with a view to encouraging the investors to invest in the risky but otherwise promising two sectors, viz., software industry, and food processing and agro-based industry. EEF is being administered through all the scheduled commercial banks and financial institutions. 3. What is the rate of interest No interest. The profit or loss of the project should be divided according to the ratio of the entrepreneurs capital and EEF capital. 4. What is the minimum project cost Project having total cost (including the net working capital) of less than Tk. 5.00 (Five) million will not be eligible for equity-support from the EEF. 5. How much EEF Fund a company may get (a) Equity-support from the EEF to any eligible company will not exceed 49% (forty nine percent) of the total project cost of the company. (b) In case of companies having total project cost in excess of Tk. 100.00 (one hundred) million, the percentage of equity-support will not exceed 33.33% of the total cost of the project (including the net working capital) and in such cases the entrepreneur should have loan facility from bank/financial institution to implement the project in addition to having EEF assistance. Any Defaulter will not be able to get EEF Fund.

6. How should you do EEF is being administered through all the scheduled commercial

banks

and

financial

institutions.

The sponsors'/entrepreneurs' corporate set-up will have to be a private limited company registered under the Companies Act, 1994. Entrepreneurs seeking EEF assistance will submit project profile to a bank or financial institution of their choice and in case the entrepreneurs are unable to make any choice, Bangladesh Bank may help them to make choice of a suitable bank or Financial Institution. The concerned bank will make thorough appraisal of the project and if satisfied about the viability of the project they shall send the project proposal with specific recommendation to Bangladesh Bank. 7. Project's viability tests In appraising a project the highest importance shall be accorded to the appraisal of the sponsors/entrepreneurs, which shall include inter alia a) b) their their educational knowledge qualifications in the in the relevant discipline; involved;

technology/process

c) their skill in marketing of the products/services in question; d) their proven track record in implementing and operating any project; e) f) their their track track record record of in financial with any conduct; Bank/Fl;

relationship

g) the project shall be technically sound and technologically appropriate for Bangladesh and environment friendly; In respect of financial analysis, the project should have minimum projected IRR 15%, ROE 150, Debt Service Coverage Ratio 1.50, Current Ratio 1.50: 1, Fixed asset coverage ratio 1.50 : 1, SWOT analysis should be acceptable. The project shall generally generate a minimum of 15% per annum after tax return on its paid up capital from the 3rd year of operation. Before disbursement of the equity-support to any eligible company on behalf of the Bangladesh Bank (EEF), the Bank/Financial Institutions concerned will have to enter into an Investment

Agreement in triplicate with such company and send one copy thereof to the Bangladesh Bank (EEF) and complete all other legal documentations. Before the actual disbursement of the equity-support to any eligible company on behalf of the Bangladesh Bank (EEF), the Bank/Financial Institutions concerned will have to ensure that the sponsors' share of equity, and the concerned Bank's/Financial Institutions loans (particularly term-loans), if any, have been fully invested in the project and the physical progress of the project is satisfactory in the opinion of the Bank/Financial Institution concerned. The share certificates will have to be issued by the assisted company in the name of the Government of the People's Republic of Bangladesh (GOB) at par representing the EEF's equity-support to that company and collected and held by the Bank/Financial Institution concerned on behalf of the Bangladesh Bank (EEF)/Government of Bangladesh and an intimation sent in this regard to the Bangladesh Bank (EEF). The assisted company will pay dividend on the EEF's equity-support at such rate as may be declared by the company in accordance with the rules/procedures of EEF and that of companies Act, 1994 from time to time. The Bank/Financial Institution concerned holding physically the assisted company's share certificates on behalf of the Bangladesh Bank (EEF)/Government of Bangladesh will not sell, transfer or dispose of in any other manner such shares without prior approval in writing of the Bangladesh Bank (EEF). The sponsors of the project/company will buy-back the shares issued in the name of the Government of Bangladesh within a period of 8 (eight) years from the date of first disbursement of EEF assistance. During the first 3 (three) years, the sponsors will buy-back such shares at face value and after the expiry of first 3 (three) years and within the next 5 (five) years at break-up value of the shares as shall be determined by the nominated eligible Chartered Accountants. If the sponsors of the company fails to buy-back the shares issued in the name of Government of Bangladesh within the 8 (eight) year period as mentioned above, Bangladesh Bank shall have the right to sell such shares to the interested parties or companies. If Bangladesh Bank fails to sell the shares, these shall be converted into debt of the sponsors and interest rate of such debt shall be determined by

Bangladesh

Bank.

During subsistence of the Equity support the sponsors of the company will not sell, transfer or otherwise dispose of their shareholdings in the company without prior approval in writing of the Bangladesh Bank (EEF) through the concerned Bank/Financial Institutions. 8. What should the Bank/Financial Institution do During the subsistence of the Equity support the Bank / Financial Institution concerned will represent the Bangladesh Bank (EEF) on the company's Board of Directors and/or at the meetings of the company's shareholders and a provision to this effect will have to be made in the company's Memorandum and Articles of Association and a certified copy thereof made available to the Bangladesh Bank (EEF), and the representative of the Bank/Financial Institution concerned will not be required to hold any shares of the assisted company in his/her personal name. The Bank/Financial Institution concerned will follow-up/monitor the company during the subsistence of the equity-support in matters of implementation of the project and its operational performance in the following manner. The assisted company will maintain all books of accounts properly which may be inspected by the concerned Bank/Financial Institution and /or the Bangladesh Bank (EEF) as and when considered necessary. The EEF sanctioned project shall submit quarterly progress report on the project regularly to the Bank/DFI/FI on the prescribed pro-forma. The EEF sanctioned project shall submit to the Bank/DFI/FI the audited Balance Sheel, together with the profit and loss accounts of the company for every financial year within four months from the date of closure of the Company's financial year. The EEF sanctioned project shall furnish to the Banks/FIs such other information/data on the project as and when required by the Banks/FIs and/or the Bangladesh Bank (EEF Unit). The EEF assisted company will not enter into any agreement with any bank or financial institutions/company or person which contravenes with the rules and regulations of EEF. The EEF assisted

company without the prior approval of Bangladesh Bank (a) shall not appoint any managing agent (b) shall not make any change in the Memorandum and Articles of Association of the company and (c) shall not provide any loan to any person/company.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- PELS Exam For 4311Dokument9 SeitenPELS Exam For 4311Jorge CastilloNoch keine Bewertungen

- A Summary of Thick DescriptionDokument11 SeitenA Summary of Thick DescriptionTaqbir Talha100% (1)

- CBPForm6059B English (Fillable) - 0Dokument1 SeiteCBPForm6059B English (Fillable) - 0pipul360% (1)

- Sand FlyDokument25 SeitenSand FlyTaqbir Talha33% (3)

- Sand FlyDokument25 SeitenSand FlyTaqbir Talha33% (3)

- Mergers and Acquisitions Guide: 2020 EDITIONDokument67 SeitenMergers and Acquisitions Guide: 2020 EDITIONharyaNoch keine Bewertungen

- Barangay Nutrition Scholar Ordinances DraftDokument4 SeitenBarangay Nutrition Scholar Ordinances Draftcorinabasubas91% (11)

- Guide For The Fusion Welding of Titanium and Titanium AlloysDokument58 SeitenGuide For The Fusion Welding of Titanium and Titanium AlloysNilton Raúl Santillán Ortega100% (1)

- Blank 4506TDokument2 SeitenBlank 4506TRoger PeiNoch keine Bewertungen

- Reviewer RESA LAWDokument34 SeitenReviewer RESA LAWMadonna P. EsperaNoch keine Bewertungen

- Food LawsDokument59 SeitenFood LawsJyoti JhaNoch keine Bewertungen

- En 10021Dokument15 SeitenEn 10021Rui Mendes100% (1)

- PaharpurDokument10 SeitenPaharpurTaqbir TalhaNoch keine Bewertungen

- Overview of AOLDokument14 SeitenOverview of AOLTaqbir TalhaNoch keine Bewertungen

- It Is With Great Interest That I Submit This Letter As An Application For The Position of Research AssistantDokument4 SeitenIt Is With Great Interest That I Submit This Letter As An Application For The Position of Research AssistantTaqbir TalhaNoch keine Bewertungen

- Overview of AOLDokument14 SeitenOverview of AOLTaqbir TalhaNoch keine Bewertungen

- Panam NagarDokument4 SeitenPanam NagarTaqbir TalhaNoch keine Bewertungen

- Asadullah - Habib ModifiedDokument3 SeitenAsadullah - Habib ModifiedTaqbir TalhaNoch keine Bewertungen

- Definitions of StatisticsDokument109 SeitenDefinitions of StatisticsTaqbir TalhaNoch keine Bewertungen

- Wari BateshwarDokument3 SeitenWari BateshwarTaqbir TalhaNoch keine Bewertungen

- Panam NagarDokument4 SeitenPanam NagarTaqbir TalhaNoch keine Bewertungen

- Summary of Sarah White's Arguing With The CrocodileDokument5 SeitenSummary of Sarah White's Arguing With The CrocodileTaqbir Talha100% (1)

- Human EvolutionDokument25 SeitenHuman EvolutionTaqbir TalhaNoch keine Bewertungen

- Curriculum VitaeDokument2 SeitenCurriculum VitaeTaqbir TalhaNoch keine Bewertungen

- How Are Parasites TransmittedDokument5 SeitenHow Are Parasites TransmittedTaqbir TalhaNoch keine Bewertungen

- Summary of Sarah White's Arguing With The CrocodileDokument5 SeitenSummary of Sarah White's Arguing With The CrocodileTaqbir Talha100% (1)

- Classification of SandflyDokument11 SeitenClassification of SandflyTaqbir Talha100% (1)

- Md. Taqbir Us Samad Talha: ObjectiveDokument1 SeiteMd. Taqbir Us Samad Talha: ObjectiveTaqbir TalhaNoch keine Bewertungen

- Role of Women in TVCS: Views From Indian SubcontinentDokument4 SeitenRole of Women in TVCS: Views From Indian SubcontinentTaqbir TalhaNoch keine Bewertungen

- BB Meets With Airtel For SME PromotionDokument1 SeiteBB Meets With Airtel For SME PromotionTaqbir TalhaNoch keine Bewertungen

- Sylvia Chant and The Household SystemDokument2 SeitenSylvia Chant and The Household SystemTaqbir TalhaNoch keine Bewertungen

- Public Procurement Rules 2008 EnglishDokument180 SeitenPublic Procurement Rules 2008 EnglishSukarna Barua100% (2)

- Human Biocultural EvolutionDokument2 SeitenHuman Biocultural EvolutionTaqbir TalhaNoch keine Bewertungen

- Dependent VariableDokument1 SeiteDependent VariableTaqbir TalhaNoch keine Bewertungen

- FAA Emergency Airworthiness Directive 2011-08-51Dokument4 SeitenFAA Emergency Airworthiness Directive 2011-08-51AvtipsNoch keine Bewertungen

- 0220 Frbny Handbook Appendix A Kyc QuestionnaireDokument24 Seiten0220 Frbny Handbook Appendix A Kyc QuestionnaireMasterNoch keine Bewertungen

- Air Conditioning Residential Best Practice Guideline: (Brisbane - Queensland)Dokument35 SeitenAir Conditioning Residential Best Practice Guideline: (Brisbane - Queensland)Dowlutrao GangaramNoch keine Bewertungen

- Hearing Committee On Agriculture House of RepresentativesDokument179 SeitenHearing Committee On Agriculture House of RepresentativesScribd Government DocsNoch keine Bewertungen

- MS RegAffairs FY13Dokument2 SeitenMS RegAffairs FY13Gyanendra SinghNoch keine Bewertungen

- Chapter Two Tra and Dev PDFDokument11 SeitenChapter Two Tra and Dev PDFAsmish EthiopiaNoch keine Bewertungen

- Adjudication Order Against Yes Investments in The Matter of Dealings of Mr. Vishal Kishore BhatiaDokument20 SeitenAdjudication Order Against Yes Investments in The Matter of Dealings of Mr. Vishal Kishore BhatiaShyam SunderNoch keine Bewertungen

- Bison Pre Cast Ancillary Items SpecificationDokument2 SeitenBison Pre Cast Ancillary Items SpecificationEd SixzeroeightNoch keine Bewertungen

- Securities and Exchange Board of India (SEBI)Dokument10 SeitenSecurities and Exchange Board of India (SEBI)Utkarsh SethiNoch keine Bewertungen

- Dot SP 11808Dokument8 SeitenDot SP 11808روشان فاطمة روشانNoch keine Bewertungen

- C.H. Robinson Code of Ethics (English) PDFDokument44 SeitenC.H. Robinson Code of Ethics (English) PDFLovely FabilaNoch keine Bewertungen

- V4s46A Cement Quality AssuranceDokument22 SeitenV4s46A Cement Quality AssuranceDilnesa EjiguNoch keine Bewertungen

- Republic V High Court (Fast Track Div) Accra Ex Parte A-G-1Dokument25 SeitenRepublic V High Court (Fast Track Div) Accra Ex Parte A-G-1BernetAnimNoch keine Bewertungen

- Company Token Holder AgreementDokument8 SeitenCompany Token Holder AgreementLjutko MeisterNoch keine Bewertungen

- CMSL REVISION NOTES DECEMBER 2020 AMENDED-Executive-RevisionDokument332 SeitenCMSL REVISION NOTES DECEMBER 2020 AMENDED-Executive-RevisionT.V.B.M CHAITANYANoch keine Bewertungen

- Audit Non Conformance Report: Nonconformity ObservedDokument2 SeitenAudit Non Conformance Report: Nonconformity ObservedMohamedNoch keine Bewertungen

- 1 ANZA Food Fraud MR v2Dokument25 Seiten1 ANZA Food Fraud MR v2Elvira NurmalasariNoch keine Bewertungen

- Partner Agreement CGE - Front SheetDokument17 SeitenPartner Agreement CGE - Front SheetJimmy SilvaNoch keine Bewertungen

- MCGM EoI BiominingDokument8 SeitenMCGM EoI BiominingNish PandyaNoch keine Bewertungen

- Practical Guide On Biocidal Products RegulationDokument117 SeitenPractical Guide On Biocidal Products RegulationnertNoch keine Bewertungen

- European Tour Operators AnalysisDokument8 SeitenEuropean Tour Operators AnalysisrandoalboNoch keine Bewertungen