Beruflich Dokumente

Kultur Dokumente

TheSun 2009-02-06 Page16 HSBC Survey Shows Contraction in Local Economy

Hochgeladen von

Impulsive collectorOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

TheSun 2009-02-06 Page16 HSBC Survey Shows Contraction in Local Economy

Hochgeladen von

Impulsive collectorCopyright:

Verfügbare Formate

16 theSun | FRIDAY FEBRUARY 6 2009

business

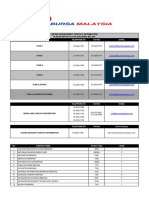

Hang Seng S&P/ASX200 TSEC KLCI STI KOSPI Nikkei KL market summary

13,178.90 3,428.60 4,363.25 879.95 1,704.60 1,177.88 7,949.65 FEBRUARY 5, 2009

115.01 9.30 26.72 3.15 2.79 17.49 89.29 INDICES CHANGE

FBMEMAS 5,759..38 +17.07

COMPOSITE 879.95 +3.15

INDUSTRIAL 2,064.41 +4.15

HSBC survey shows

CONSUMER PROD 285.83 +1.14

INDUSTRIAL PROD 66.26 +0.11

CONSTRUCTION 165.72 -1.03

TRADING SERVICES 115.01 +0.20

FINANCE 6,983.07 +82.18

PROPERTIES 526.65 +4.68

Cheah PLANTATIONS 4,398.58 -58.24

(right) with MINING 233.04 unch

contraction in local economy

the bank’s FBMSHA 5,959.38 - 5.29

commercial FBM2BRD 3,906.82 + 9.20

banking TECHNOLOGY 13.35 + 0.10

planning

TURNOVER VALUE

and product

315.914mil RM466.514mil

development

director Fong

by Loo Sim Ee Regional results of the survey showed ues to go through difficult times. But it is

newsdesk@thesundaily.com that SMEs in Bangladesh, Vietnam and

India are the most optimistic, with plans

good to see that these challenges are not

translating into job cuts, so these busi-

Chia Ping at

a briefing to CI buoyed by

announce

KUALA LUMPUR: Malaysia’s small and

medium enterprises (SME) are expecting

to increase their capital expenditure and

expectations to increase trade volumes

nesses could improve conditions later in

the year,” he said.

the survey

findings.

selected blue chips

a contraction in the local economy for the with Asia and the rest of the world, SHARE prices on Bursa Malaysia closed

first half of the year but most of them do whereas SMEs in Singapore, Taiwan and lower yesterday as investors took cue from the

not plan to retrench any employee. Hongkong are expecting to face economic downtrend on Wall Street with the losses led

This is according to the HSBC Asia-Pa- contractions. by selected plantation-related stocks, dealers

cific Small Business Confidence Monitor, Most of the Asian regional SMEs’ re- said.

a survey conducted by research company cruitment plans remain unchanged with The benchmark KLCI however closed 3.15

TNS from October to November last year a stable employment and little to no plans points higher at 879.95 supported by selected

in Hongkong, China, Taiwan, Bangla- for retrenchment. blue chips such as Maybank.

desh, Singapore, India, Vietnam, Korea, Cheah also said the local GDP growth Maybank increased 15 sen to RM5.40

Malaysia and Indonesia. is expected to be 1.7% for the first half of yesterday.

At a briefing to announce the survey the year and 4.7% for the second half. A dealer said the global economic outlook

findings, HSBC Bank Malaysia Bhd direc- He said while the survey findings may remained the main concern for investors and

tor for SMEs, insurance and investment, not reflect the latest developments in they were reluctant to take position in the

Peter Cheah, said this year will be a January, where jobs are slashed, they are market.

difficult year for many businesses, but still useable due to the change in condi- Among the actives, PETROCH-C8 declined

Malaysia and Asia have withstood many tions such as the fuel price drop and the half sen to one sen, KNM eased 1.5 sen to 42.5

difficulties in the last decade, and the announcement of reduction in Overnight sen and IOI Corp lost 24 sen to RM3.68.

survey results support what HSBC has Policy Rate (OPR) by Bank Negara, which As for the heavyweights, Sime Darby rose

seen among their customers. proved beneficial for SMEs. five sen to RM5.40, Tenaga gained five sen to

The survey was based on a random “There are great challenges ahead in RM5.40 and Telekom increased four sen to

sample, with pollings scattered randomly early 2009 as the global economy contin- RM3.20. – Bernama

in different business sectors.

The survey asked SME decision-mak-

ers about their local economic outlook for

the next six months, their plans on capital

briefs

investment and staffing levels and their IPPs are prepared to give. We hope was due to a decrease in market In the PricewaterhouseCoopers

expectations for trade volumes with China, the agreements with the IPPs can be demand, the company said in an (PwC) 12th annual global CEO survey,

the rest of Asia and the rest of the world. revisited,” he told reporters on the email reply to Bernama yesterday. nearly 31% of Asia Pacific CEOs were

The figures show SMEs’ confidence sidelines of the power utility giant’s It also said the closure was part very confident of growing revenues

has declined since 2007, based on the TNB proposes review Chinese New Year celebrations held of its Japanese parent company’s during the next 12 months compared

responses to the questions on economic here. effort to increase manufacturing to the global average of 21%.

outlook, capital investment plans and of pacts with IPPs He was responding to comments efficiency. However, the confidence levels

staff recruitment plans. KUALA LUMPUR: Tenaga Nasional from former prime minister Tun Dr “Our sales contribution will re- are significantly lower compared with

Fifty-six per cent of Malaysian SMEs Bhd (TNB) has recommended fresh Mahathir Mohamad to review the main the same after the closure of 2007, where 56% of the Asia Pacific

are expecting negative economic growth plans to the government to improve power supply contracts with the IPPs the Malacca plant. We consolidate and 50% of global CEOs felt confident

for the first half of the year, and 31% are certain areas in the power supply as the huge power reserves are a our plants for better efficiency about achieving short-term growth,

expecting the Malaysian economy to agreements with the independent burden to TNB. – Bernama and results,” the company said. said PwC in a statement yesterday.

maintain the same pace of growth. power producers (IPPs) for the peo- – Bernama “Despite the challenges imposed

Notable from the survey is the stable ple’s benefit, president and chief ex- Panasonic M’sia still by the global financial crisis, Asia

employment, with 85% of the local SMEs ecutive officer Datuk Seri Che Khalib

upbeat on sales Asia Pacific CEOs bullish Pacific business leaders are still fo-

planning to keep their staff despite the Mohamad Noh said yesterday. cused on long-term growth,” said PwC

negative outlook, and 88% are not plan- “Whatever benefit and savings we KUALA LUMPUR: Panasonic Malay- on short-term growth Global CEO Samuel A DiPiazza Jr.

ning to expand their businesses. get from the renegotiations with the sia, which employs 20,000 workers, KUALA LUMPUR: Asia Pacific chief Nearly all the Asia Pacific CEOs

Trade outlooks with China, the rest IPPs will definitely translate to tariff expects its sales to be unaffected executive officers (CEOs) remain more believed that attracting and retaining

of Asia and the world are expected to be reduction,” he said but declined to despite the closure of its manufac- upbeat than their global counterparts key talent, high quality customer serv-

slow, with more than 50% of SMEs plan- reveal the details of the plans. turing plant in Malacca. about short-term growth prospects ice offerings and brand strength and

ning to decrease their trade volumes for “It can be substantial, depending The closure, which resulted in amid a looming world economic slow- reputation are critical to sustaining

the first half of the year. on the quantum of reduction the 490 workers being retrenched, down, according to a survey. long-term growth. – Bernama

Das könnte Ihnen auch gefallen

- TheSun 2009-03-20 Page15 Fed To Buy Treasuries To Boost EconomyDokument1 SeiteTheSun 2009-03-20 Page15 Fed To Buy Treasuries To Boost EconomyImpulsive collectorNoch keine Bewertungen

- Thesun 2008-12-18 Page20 Msias rm2Dokument1 SeiteThesun 2008-12-18 Page20 Msias rm2Impulsive collectorNoch keine Bewertungen

- Thesun 2009-04-15 Page14 Analysts Upbeat About TNBDokument1 SeiteThesun 2009-04-15 Page14 Analysts Upbeat About TNBImpulsive collectorNoch keine Bewertungen

- Thesun 2009-03-19 Page19 Klci May Hit Bottom in Second Half CimbDokument1 SeiteThesun 2009-03-19 Page19 Klci May Hit Bottom in Second Half CimbImpulsive collectorNoch keine Bewertungen

- Thesun 2009-03-16 Page18 Banks Committed To Supporting Customers Despite SlowdownDokument1 SeiteThesun 2009-03-16 Page18 Banks Committed To Supporting Customers Despite SlowdownImpulsive collectorNoch keine Bewertungen

- Thesun 2008-12-19 Page30 All-New City Set To Boost Honda SalesDokument1 SeiteThesun 2008-12-19 Page30 All-New City Set To Boost Honda SalesImpulsive collectorNoch keine Bewertungen

- Thesun 2009-03-26 Page15 Japanese Exports Suffer Record PlungeDokument1 SeiteThesun 2009-03-26 Page15 Japanese Exports Suffer Record PlungeImpulsive collectorNoch keine Bewertungen

- Thesun 2009-03-18 Page14 Maybanks Rights Shares A Good Buy PNBDokument1 SeiteThesun 2009-03-18 Page14 Maybanks Rights Shares A Good Buy PNBImpulsive collectorNoch keine Bewertungen

- Thesun 2009-03-12 Page16 Malaysias Capital Market Fundamentally Strong Says SCDokument1 SeiteThesun 2009-03-12 Page16 Malaysias Capital Market Fundamentally Strong Says SCImpulsive collectorNoch keine Bewertungen

- TheSun 2008-11-25 Page16 Bank Negara Reduces OPR To 3.25%Dokument1 SeiteTheSun 2008-11-25 Page16 Bank Negara Reduces OPR To 3.25%Impulsive collectorNoch keine Bewertungen

- Thesun 2008-12-24 Page18 Bcorp Proposes Interim Divident in SpecieDokument1 SeiteThesun 2008-12-24 Page18 Bcorp Proposes Interim Divident in SpecieImpulsive collectorNoch keine Bewertungen

- TheSun 2008-12-17 Page26 MAS in Partnership Talks With QantasDokument1 SeiteTheSun 2008-12-17 Page26 MAS in Partnership Talks With QantasImpulsive collectorNoch keine Bewertungen

- Thesun 2009-02-17 Page18 Govt Urged To Help Local Construction IndustryDokument1 SeiteThesun 2009-02-17 Page18 Govt Urged To Help Local Construction IndustryImpulsive collectorNoch keine Bewertungen

- TheSun 2008-11-20 Page17 China Holds Key To Stabilising Global Economy MAS ChairmanDokument1 SeiteTheSun 2008-11-20 Page17 China Holds Key To Stabilising Global Economy MAS ChairmanImpulsive collectorNoch keine Bewertungen

- TheSun 2008-10-31 Page25: Berjaya All Out To Woo Mid-East TouristsDokument1 SeiteTheSun 2008-10-31 Page25: Berjaya All Out To Woo Mid-East TouristsImpulsive collectorNoch keine Bewertungen

- TheSun 2008-11-05 Page21 Plastic Industry To Achieve 8 PCT GrowthDokument1 SeiteTheSun 2008-11-05 Page21 Plastic Industry To Achieve 8 PCT GrowthImpulsive collectorNoch keine Bewertungen

- TheSun 2008-12-16 Page24 MAS Offers Four Fare Options For Economy Class TravelDokument1 SeiteTheSun 2008-12-16 Page24 MAS Offers Four Fare Options For Economy Class TravelImpulsive collectorNoch keine Bewertungen

- Thesun 2009-04-30 Page17 Mahathir Urges Asia To Devise Own RemedyDokument1 SeiteThesun 2009-04-30 Page17 Mahathir Urges Asia To Devise Own RemedyImpulsive collectorNoch keine Bewertungen

- TheSun 2008-11-28 Page22 AirAsia X Weighing Options For EuropeDokument1 SeiteTheSun 2008-11-28 Page22 AirAsia X Weighing Options For EuropeImpulsive collectorNoch keine Bewertungen

- Thesun 2009-03-27 Page16 Proton Records 300pct Increase in Xchange PlanDokument1 SeiteThesun 2009-03-27 Page16 Proton Records 300pct Increase in Xchange PlanImpulsive collectorNoch keine Bewertungen

- TheSun 2008-11-19 Page14 UEM Land Needs RM500m To Develop NusajayaDokument1 SeiteTheSun 2008-11-19 Page14 UEM Land Needs RM500m To Develop NusajayaImpulsive collectorNoch keine Bewertungen

- Thesun 2009-08-05 Page15 Global Automakers Beat Forecasts Remain CautiousDokument1 SeiteThesun 2009-08-05 Page15 Global Automakers Beat Forecasts Remain CautiousImpulsive collectorNoch keine Bewertungen

- Thesun 2009-05-11 Page14 Ci Expected To Stay Up On Positive SentimentDokument1 SeiteThesun 2009-05-11 Page14 Ci Expected To Stay Up On Positive SentimentImpulsive collectorNoch keine Bewertungen

- Thesun 2009-04-21 Page17 Rudd Says Australian Recession InevitableDokument1 SeiteThesun 2009-04-21 Page17 Rudd Says Australian Recession InevitableImpulsive collectorNoch keine Bewertungen

- Thesun 2009-04-28 Page16 Msia Exports Picking Up Says MuhyiddinDokument1 SeiteThesun 2009-04-28 Page16 Msia Exports Picking Up Says MuhyiddinImpulsive collector100% (2)

- Angel One Limited (Formerly Known As Angel Broking Limited)Dokument1 SeiteAngel One Limited (Formerly Known As Angel Broking Limited)PRADIPKUMAR PATELNoch keine Bewertungen

- Thesun 2009-08-04 Page13 Emerging Markets Power Ahead Japan Gloom DarkensDokument1 SeiteThesun 2009-08-04 Page13 Emerging Markets Power Ahead Japan Gloom DarkensImpulsive collectorNoch keine Bewertungen

- Thesun 2009-05-07 Page13 Imf Sees Long and Severe Recession For AsiaDokument1 SeiteThesun 2009-05-07 Page13 Imf Sees Long and Severe Recession For AsiaImpulsive collectorNoch keine Bewertungen

- TheSun 2008-12-04 Page20 No Plan To Cut Back On Exploration Petronas ChiefDokument1 SeiteTheSun 2008-12-04 Page20 No Plan To Cut Back On Exploration Petronas ChiefImpulsive collectorNoch keine Bewertungen

- TheSun 2009-02-04 Page16 RM10bil Likely For Second Stimulus PackageDokument1 SeiteTheSun 2009-02-04 Page16 RM10bil Likely For Second Stimulus PackageImpulsive collectorNoch keine Bewertungen

- Thesun 2009-03-04 Page13 Japan To Tap Forex Reserves To Help FirmsDokument1 SeiteThesun 2009-03-04 Page13 Japan To Tap Forex Reserves To Help FirmsImpulsive collectorNoch keine Bewertungen

- TheSun 2008-11-10 Page19 Share Prices Likely To Be Higher This WeekDokument1 SeiteTheSun 2008-11-10 Page19 Share Prices Likely To Be Higher This WeekImpulsive collectorNoch keine Bewertungen

- Thesun 2009-03-05 Page16 Malaysia On Brink of Recession Says MierDokument1 SeiteThesun 2009-03-05 Page16 Malaysia On Brink of Recession Says MierImpulsive collectorNoch keine Bewertungen

- TheSun 2008-11-04 Page14 ARMF Invests RM1.1b in Four Malls in MalaysiaDokument1 SeiteTheSun 2008-11-04 Page14 ARMF Invests RM1.1b in Four Malls in MalaysiaImpulsive collectorNoch keine Bewertungen

- Thesun 2009-01-19 Page16 EON Bank Set For Talks To Acquire MCIS ZurichDokument1 SeiteThesun 2009-01-19 Page16 EON Bank Set For Talks To Acquire MCIS ZurichImpulsive collectorNoch keine Bewertungen

- TheSun 2009-02-18 Page17 Msia Still Attractive FDI Destination Says US EnvoyDokument1 SeiteTheSun 2009-02-18 Page17 Msia Still Attractive FDI Destination Says US EnvoyImpulsive collectorNoch keine Bewertungen

- Thesun 2009-05-06 Page14 Ramunia Takeover Seen Positive For Sime DarbyDokument1 SeiteThesun 2009-05-06 Page14 Ramunia Takeover Seen Positive For Sime DarbyImpulsive collectorNoch keine Bewertungen

- Thesun 2009-03-11 Page16 Japan Set For Double Digit Contraction in q1 SurveyDokument1 SeiteThesun 2009-03-11 Page16 Japan Set For Double Digit Contraction in q1 SurveyImpulsive collectorNoch keine Bewertungen

- Annual Report Profit and Loss StatementDokument14 SeitenAnnual Report Profit and Loss StatementMishti WadheraNoch keine Bewertungen

- Thesun 2009-10-28 Page15 Petrol Price May Follow Market Price Next YearDokument1 SeiteThesun 2009-10-28 Page15 Petrol Price May Follow Market Price Next YearImpulsive collectorNoch keine Bewertungen

- Thesun 2009-05-21 Page13 Malaysia Up One Notch in Global CompetitivenessDokument1 SeiteThesun 2009-05-21 Page13 Malaysia Up One Notch in Global CompetitivenessImpulsive collectorNoch keine Bewertungen

- TheSun 2009-11-03 Page15 Us Lender Cit Files For BankruptcyDokument1 SeiteTheSun 2009-11-03 Page15 Us Lender Cit Files For BankruptcyImpulsive collectorNoch keine Bewertungen

- Thesun 2009-03-03 Page13 Property Mart Likely To Be BearishDokument1 SeiteThesun 2009-03-03 Page13 Property Mart Likely To Be BearishImpulsive collectorNoch keine Bewertungen

- TheSun 2009-02-13 Page14 Tariff Cut Low Demand To Dent TNB TurnoverDokument1 SeiteTheSun 2009-02-13 Page14 Tariff Cut Low Demand To Dent TNB TurnoverImpulsive collectorNoch keine Bewertungen

- August 2009 Chicago Airport StatisticsDokument1 SeiteAugust 2009 Chicago Airport StatisticsGavin CunninghamNoch keine Bewertungen

- TheSun 2008-11-07 Page26 Europe Set To Slash Rates As Economic Gloom DeepensDokument1 SeiteTheSun 2008-11-07 Page26 Europe Set To Slash Rates As Economic Gloom DeepensImpulsive collectorNoch keine Bewertungen

- TheSun 2008-12-11 Page20 New Measures Draw More Investors To PenangDokument1 SeiteTheSun 2008-12-11 Page20 New Measures Draw More Investors To PenangImpulsive collectorNoch keine Bewertungen

- Indices Other Stories:: FRI 23 DEC 2016Dokument3 SeitenIndices Other Stories:: FRI 23 DEC 2016JajahinaNoch keine Bewertungen

- TheSun 2009-08-28 Page16 Ci Stays in Positive TerritoryDokument1 SeiteTheSun 2009-08-28 Page16 Ci Stays in Positive TerritoryImpulsive collectorNoch keine Bewertungen

- Authorised Signatories for Angel One LimitedDokument1 SeiteAuthorised Signatories for Angel One LimitedPRADIPKUMAR PATELNoch keine Bewertungen

- TheSun 2009-01-09 Page18 TNB Open To All Energy OptionsDokument1 SeiteTheSun 2009-01-09 Page18 TNB Open To All Energy OptionsImpulsive collectorNoch keine Bewertungen

- Thesun 2009-05-05 Page13 Ci Breaches 1000 Point Psychological BarrierDokument1 SeiteThesun 2009-05-05 Page13 Ci Breaches 1000 Point Psychological BarrierImpulsive collectorNoch keine Bewertungen

- MEG and EMP lead top stories on office, commercial projects and whisky expansionDokument3 SeitenMEG and EMP lead top stories on office, commercial projects and whisky expansionJajahinaNoch keine Bewertungen

- Thesun 2009-05-08 Page13 TM Mulls Bidding For Digital SpectrumDokument1 SeiteThesun 2009-05-08 Page13 TM Mulls Bidding For Digital SpectrumImpulsive collectorNoch keine Bewertungen

- TheSun 2008-12-03 Page14 YTL Buys Temaseks Power Firm For RM9bDokument1 SeiteTheSun 2008-12-03 Page14 YTL Buys Temaseks Power Firm For RM9bImpulsive collectorNoch keine Bewertungen

- DRG ServiceDokument3 SeitenDRG ServiceAgnaldo ConradoNoch keine Bewertungen

- Consolidated Statement of Profit and LossDokument1 SeiteConsolidated Statement of Profit and LossSukhmanNoch keine Bewertungen

- Mpi: Mpi Files For Php83Bil Ipo of Hospital Group, Adding Mpi To Coling The Shots Stock PicksDokument3 SeitenMpi: Mpi Files For Php83Bil Ipo of Hospital Group, Adding Mpi To Coling The Shots Stock PicksSanya HelinoNoch keine Bewertungen

- Top Story:: CHP: Parent To Streamline Operations in The Next 3 YearsDokument4 SeitenTop Story:: CHP: Parent To Streamline Operations in The Next 3 YearsJNoch keine Bewertungen

- KPMG CEO StudyDokument32 SeitenKPMG CEO StudyImpulsive collectorNoch keine Bewertungen

- Coaching in OrganisationsDokument18 SeitenCoaching in OrganisationsImpulsive collectorNoch keine Bewertungen

- Global Added Value of Flexible BenefitsDokument4 SeitenGlobal Added Value of Flexible BenefitsImpulsive collectorNoch keine Bewertungen

- HayGroup Rewarding Malaysia July 2010Dokument8 SeitenHayGroup Rewarding Malaysia July 2010Impulsive collectorNoch keine Bewertungen

- Emotional or Transactional Engagement CIPD 2012Dokument36 SeitenEmotional or Transactional Engagement CIPD 2012Impulsive collectorNoch keine Bewertungen

- Hay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewDokument4 SeitenHay Group Guide Chart - Profile Method of Job Evaluation - Intro & OverviewImpulsive collector100% (1)

- IGP 2013 - Malaysia Social Security and Private Employee BenefitsDokument5 SeitenIGP 2013 - Malaysia Social Security and Private Employee BenefitsImpulsive collectorNoch keine Bewertungen

- Islamic Financial Services Act 2013Dokument177 SeitenIslamic Financial Services Act 2013Impulsive collectorNoch keine Bewertungen

- HayGroup Job Measurement: An IntroductionDokument17 SeitenHayGroup Job Measurement: An IntroductionImpulsive collector100% (1)

- Global Talent 2021Dokument21 SeitenGlobal Talent 2021rsrobinsuarezNoch keine Bewertungen

- Stanford Business Magazine 2013 AutumnDokument68 SeitenStanford Business Magazine 2013 AutumnImpulsive collectorNoch keine Bewertungen

- Futuretrends in Leadership DevelopmentDokument36 SeitenFuturetrends in Leadership DevelopmentImpulsive collector100% (1)

- Hay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewDokument15 SeitenHay Group Guide Chart & Profile Method of Job Evaluation - An Introduction & OverviewAyman ShetaNoch keine Bewertungen

- Hay Group Guide Chart - Profile Method of Job EvaluationDokument27 SeitenHay Group Guide Chart - Profile Method of Job EvaluationImpulsive collector75% (8)

- Developing An Enterprise Leadership MindsetDokument36 SeitenDeveloping An Enterprise Leadership MindsetImpulsive collectorNoch keine Bewertungen

- Megatrends Report 2015Dokument56 SeitenMegatrends Report 2015Cleverson TabajaraNoch keine Bewertungen

- Compensation Fundamentals - Towers WatsonDokument31 SeitenCompensation Fundamentals - Towers WatsonImpulsive collector80% (5)

- Flexible Working Good Business - How Small Firms Are Doing ItDokument20 SeitenFlexible Working Good Business - How Small Firms Are Doing ItImpulsive collectorNoch keine Bewertungen

- CLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesDokument117 SeitenCLC Building The High Performance Workforce A Quantitative Analysis of The Effectiveness of Performance Management StrategiesImpulsive collector100% (1)

- Managing Conflict at Work - A Guide For Line ManagersDokument22 SeitenManaging Conflict at Work - A Guide For Line ManagersRoxana VornicescuNoch keine Bewertungen

- 2016 Summer Strategy+business PDFDokument116 Seiten2016 Summer Strategy+business PDFImpulsive collectorNoch keine Bewertungen

- Strategy+Business - Winter 2014Dokument108 SeitenStrategy+Business - Winter 2014GustavoLopezGNoch keine Bewertungen

- Talent Analytics and Big DataDokument28 SeitenTalent Analytics and Big DataImpulsive collectorNoch keine Bewertungen

- Strategy+Business Magazine 2016 AutumnDokument132 SeitenStrategy+Business Magazine 2016 AutumnImpulsive collector100% (3)

- 2012 Metrics and Analytics - Patterns of Use and ValueDokument19 Seiten2012 Metrics and Analytics - Patterns of Use and ValueImpulsive collectorNoch keine Bewertungen

- TalentoDokument28 SeitenTalentogeopicNoch keine Bewertungen

- 2015 Summer Strategy+business PDFDokument104 Seiten2015 Summer Strategy+business PDFImpulsive collectorNoch keine Bewertungen

- HBR - HR Joins The Analytics RevolutionDokument12 SeitenHBR - HR Joins The Analytics RevolutionImpulsive collectorNoch keine Bewertungen

- Deloitte Analytics Analytics Advantage Report 061913Dokument21 SeitenDeloitte Analytics Analytics Advantage Report 061913Impulsive collectorNoch keine Bewertungen

- IBM - Using Workforce Analytics To Drive Business ResultsDokument24 SeitenIBM - Using Workforce Analytics To Drive Business ResultsImpulsive collectorNoch keine Bewertungen

- MICARE PANEL GP LIST FOR AMGENERAL INSURANCE BHD (JUNE 2018) (Done Excel, Pending CC)Dokument120 SeitenMICARE PANEL GP LIST FOR AMGENERAL INSURANCE BHD (JUNE 2018) (Done Excel, Pending CC)Chyh KunNoch keine Bewertungen

- PKO Mill Information and Certification StatusDokument88 SeitenPKO Mill Information and Certification StatusKoko HadiwanaNoch keine Bewertungen

- Cim B ClicksDokument18 SeitenCim B ClicksNethiyaNoch keine Bewertungen

- Main Market - Bursa Malaysia MarketDokument15 SeitenMain Market - Bursa Malaysia MarketAbdul Kadir Al JailaniNoch keine Bewertungen

- PC 1041100Dokument4 SeitenPC 1041100Azmi MahamadNoch keine Bewertungen

- Book 5Dokument8 SeitenBook 5shaluNoch keine Bewertungen

- The Richest and Poorest Countries of Southeast AsiaDokument271 SeitenThe Richest and Poorest Countries of Southeast AsiaDeeo123Noch keine Bewertungen

- Prubsn Panel Hospital Updated As of 28082023 For CorpWebsite 2023Dokument10 SeitenPrubsn Panel Hospital Updated As of 28082023 For CorpWebsite 2023m.abubaker1992Noch keine Bewertungen

- Malaysian Ringgit and CoinsDokument2 SeitenMalaysian Ringgit and CoinsAhmad SutraNoch keine Bewertungen

- FUJI OIL Group Palm Oil Mill List (June 2021-December 2021)Dokument17 SeitenFUJI OIL Group Palm Oil Mill List (June 2021-December 2021)rezaNoch keine Bewertungen

- Company Sim Card Authorization Letter CompleteDokument1 SeiteCompany Sim Card Authorization Letter CompleteLoGan Ben100% (5)

- Brian Daily Itenary PlanDokument2 SeitenBrian Daily Itenary PlanVince LaiNoch keine Bewertungen

- Dmeg 6013 Malaysian Economy: Chapter 1: Background of Economic Development in MalaysiaDokument27 SeitenDmeg 6013 Malaysian Economy: Chapter 1: Background of Economic Development in MalaysiaNur Suraya AliasNoch keine Bewertungen

- Programme: Communication Engineering List of Recommended Companies For Eit 2013Dokument14 SeitenProgramme: Communication Engineering List of Recommended Companies For Eit 2013Talent BeaNoch keine Bewertungen

- Malaysia Petrochemical Country Report 2018: Presented ToDokument49 SeitenMalaysia Petrochemical Country Report 2018: Presented TorexNoch keine Bewertungen

- UMP Student LI ListDokument77 SeitenUMP Student LI ListWai Kit Cheng0% (2)

- MBBsavings - 110041 019774 - 2022 03 31Dokument23 SeitenMBBsavings - 110041 019774 - 2022 03 31Mohd HasrieNoch keine Bewertungen

- Reporte Corporativo de Louis Dreyfus Company (LDC)Dokument21 SeitenReporte Corporativo de Louis Dreyfus Company (LDC)OjoPúblico Periodismo de InvestigaciónNoch keine Bewertungen

- Financial Sector Blueprint 2011-2020 PDFDokument198 SeitenFinancial Sector Blueprint 2011-2020 PDFHanifIzanNoch keine Bewertungen

- Bursa Data - ContactList-14January2020Dokument19 SeitenBursa Data - ContactList-14January2020AdamZain788Noch keine Bewertungen

- Agarwood Myr My01Dokument23 SeitenAgarwood Myr My01Fatih Zaganosh Pasha100% (2)

- List of Service Provider and Agency For Microwave Clearance - November 2019Dokument8 SeitenList of Service Provider and Agency For Microwave Clearance - November 2019Teo Yan TeeNoch keine Bewertungen

- Construction Drawings Layout PlanDokument1 SeiteConstruction Drawings Layout PlanProject ConnectionNoch keine Bewertungen

- Uniten Comdir-EpDokument25 SeitenUniten Comdir-EpKaven BalaNoch keine Bewertungen

- List Pemenang EDC TV LED 32 PDFDokument1 SeiteList Pemenang EDC TV LED 32 PDFAri SuharjantoNoch keine Bewertungen

- Corporate Information: Scan To VerifyDokument23 SeitenCorporate Information: Scan To VerifyNana RosliNoch keine Bewertungen

- TNG Ewallet TransactionsDokument12 SeitenTNG Ewallet Transactionspro5manommNoch keine Bewertungen

- Lokasi pemasangan sistem perangkap hadlaju di lebuh raya MalaysiaDokument2 SeitenLokasi pemasangan sistem perangkap hadlaju di lebuh raya Malaysiaelzan5398Noch keine Bewertungen

- MSPO Certified Area August 2019Dokument89 SeitenMSPO Certified Area August 2019Job Zine'dine100% (1)

- Company ListDokument10 SeitenCompany ListShopee LazadaNoch keine Bewertungen