Beruflich Dokumente

Kultur Dokumente

Partnership

Hochgeladen von

Múhåmmäð YoúnúsOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

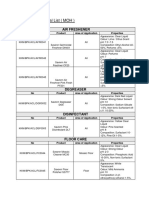

Partnership

Hochgeladen von

Múhåmmäð YoúnúsCopyright:

Verfügbare Formate

An association of two or more persons engaged in a business enterprise in which the profits and losses are shared proportionally.

The legal definition of a partnership is generally stated as "an association of two or more persons to carry on as co-owners a business for profit" A type of business organization in which two or more individuals pool money, skills, and other resources, and share profit and loss in accordance with terms of the partnership agreement. In absence of such agreement, a partnership is assumed to exit where the participants in an enterprise agree to share the associated risks and rewards proportionately . A type of unincorporated business organization in which multiple individuals, called general partners, manage the business and are equally liable for its debts; other individuals called limited partners may invest but not be directly involved in management and are liable only to the extent of their investments. Unlike a Limited Liability Company or a corporation, in a partnership each partner shares equal responsibility for the company's profits and losses, and its debts and liabilities. The partnership itself does not pay income taxes, but each partner has to report their share of business profits or losses on their individual tax return. Estimated tax payments are also necessary for each of the partners for the year in progress. advantages of partnership: Partnership is preferred to other forms of business due to the following advantageous points. 1. Ease of Organization

Partnership can be organized without any legal formalities. There is no license fee, registration fee, registration fee for the formation of this type of organization. No formal documents are required to be submitted to the Registrar's Office. Two or more persons may start this type of business at any time. But the formation of the Joint Stock Company is needed long complicated process. 2. Sufficient Capital

In the sole proprietorship the capital remains limited but this problem does not arise in the partnership firm due to number of partners i.e. 20 in ordinary business and 10 banking business. As such partner contributes his share in the business so capital volume can be sufficiently increased for business activities. 3. Borrowing Facilities

The partnership firm is considered safe organization for providing credit facilities due to unlimited liability of partners. Thus sufficient funds in terms of credit can be: procured from financial institutions or other sources in time of need. 4. Simplicity in Dissolution

There are no complicated legal requirements for the dissolution of the partnership firm. Partners may dissolve their business very easily at any time. On the other side, Joint Stock Company cannot be dissolved without fulfillment of the long process of the company ordinance 1984. 5. Combined Abilities

A firm may enjoy the combined abilities of several heads. There may be different abilities of partners i.e. purchaser, administrator, accountant and Technician. So the firm is in a position to utilize their services for product1ve purposes.

6.

Skilled Workers

As the firm enjoys larger financial sources therefore, it is possible for the organization to hire the services of qualified and competent persons for indefinite period of time. Thus capital and financial sources of firm may be utilized maximum in profitable sector. 7. Minority Protection

Minority protection in a partnership cannot be neglected by law. All the policy matters are decided with the consent of each partner. If any matter is disposed of without the willingness of one partner, the dis-agreement partner may withdraw his share and may dissolve the firm. Thus there is no risk of any conspiracy against the minority partners on behalf of the majority partners. 8. Personal Interest

The partnership firm is in a better position in respect of personal element as compared with Joint Stock Company. As number of members in ordinary business cannot exceed 20, so all the benefit is confined among these partners. This factor creates the effective motivation to efficiency, economy, production and strong financial position. 9. Minimum Legal Restrictions

This form of organization is fee from following restrictions: (a) (b) (c) (d) (e) (f) (g) Declaration of Profit. Submission of the Report to the Registrar's office. To audit the annual accounts. To call the meeting. To dispose of the Resolution. To maintain the statutory books. To publish certain statements.

On the other hand, public company has to follow strictly the above mentioned restrictions by law. But partnership may operate freely without interference from any legal authority. 10. Public Trust People show more confidence on partnership firm than sole tradership. If firm is registered they think .these are working under the supervision of the government. So people feel no risk in creating relation with such business. Thus goodwill is established in the market which increases the income earning capacity of the firm. 11. Expansion of Business There are more chances to expand the business volume due to the following factors: (a) (b) Large number of partners. Combine judgment and abilities.

(c) (d) (e) (f)

Personal interest of each partner. Fore-sight element due to unlimited liability. Administrative and technical abilities. Borrowing facilities.

But some important factor are not found in sole tradership. So its business cannot be expanded comparatively. 12. Flexible Management This organization is considered flexible as compared with Joint Stock Company. Partners can change their business policy with mutual consultation. They thus make immediate decision, since there is no necessity of disposing of resolution. The quickness of action is the most important element in the field of management as well as in marketing. 13. Secrecy As there is no compulsion to publish its accounts for partnership firm so the business secrecy remains confined within the partners. This sector is important for successful operation of the business. But Public Company has to publish all types of accounts by law. 14. Moral Promotion Partnership is the best organization for small investors and to show themselves the proprietors of the firm. This factor promotes the moral courage of partners. 15. Absence of Fraudulent As every partner is allowed to participate in the affairs of the business, therefore each partner may look into the activities of firm. There is no risk of fraud or misrepresentation on behalf of the working partner. According to provision of the partnership every partner may check the accounts. So this provision minimizes the chances of manipulation in accounts.

Advantages of Partnership Capital Due to the nature of the business, the partners will fund the business with start up capital. This means that the more partners there are, the more money they can put into the business, which will allow better flexibility and more potential for growth. It also means more potential profit, which will be equally shared between the partners. Flexibility A partnership is generally easier to form, manage and run. They are less strictly regulated than companies, in terms of the laws governing the formation and because the partners have the only say in the way the business is run (without interference by shareholders) they are far more flexible in terms of management, as long as all the partners can agree. Shared Responsibility Partners can share the responsibility of the running of the business. This will allow them to make the most of their abilities. Rather than splitting the management and taking an equal share of each business task, they might well split the work according to their skills. So if one partner is good with figures, they might deal with the book keeping and accounts, while the other partner might have a flare for sales and therefore be the main sales person for the

business. Decision Making Partners share the decision making and can help each other out when they need to. More partners means more brains that can be picked for business ideas and for the solving of problems that the business encounters. Business Partnership Advantages Partnerships are relatively easy to establish. With more than one owner, the ability to raise funds may be increased, both because two or more partners may be able to contribute more funds and because their borrowing capacity may be greater. Prospective employees may be attracted to the business if given the incentive to become a partner. A partnership may benefit from the combination of complimentary skills of two or more people. There is a wider pool of knowledge, skills and contacts. Partnerships can be cost-effective as each partner specializes in certain aspects of their business. Partnerships provide moral support and will allow for more creative brainstorming.

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Robot MecanumDokument4 SeitenRobot MecanumalienkanibalNoch keine Bewertungen

- CRM - Final Project GuidelinesDokument7 SeitenCRM - Final Project Guidelinesapi-283320904Noch keine Bewertungen

- UT & TE Planner - AY 2023-24 - Phase-01Dokument1 SeiteUT & TE Planner - AY 2023-24 - Phase-01Atharv KumarNoch keine Bewertungen

- Atul Bisht Research Project ReportDokument71 SeitenAtul Bisht Research Project ReportAtul BishtNoch keine Bewertungen

- GAJ Mod 18 Ace Your InterviewDokument12 SeitenGAJ Mod 18 Ace Your InterviewAnjela SantiagoNoch keine Bewertungen

- Thesis FulltextDokument281 SeitenThesis FulltextEvgenia MakantasiNoch keine Bewertungen

- PMS Past Paper Pakistan Studies 2019Dokument3 SeitenPMS Past Paper Pakistan Studies 2019AsmaMaryamNoch keine Bewertungen

- Reith 2020 Lecture 1 TranscriptDokument16 SeitenReith 2020 Lecture 1 TranscriptHuy BuiNoch keine Bewertungen

- Abnormal PsychologyDokument13 SeitenAbnormal PsychologyBai B. UsmanNoch keine Bewertungen

- Chapter One Understanding Civics and Ethics 1.1.defining Civics, Ethics and MoralityDokument7 SeitenChapter One Understanding Civics and Ethics 1.1.defining Civics, Ethics and Moralitynat gatNoch keine Bewertungen

- Developing Global LeadersDokument10 SeitenDeveloping Global LeadersDeepa SharmaNoch keine Bewertungen

- Why Do Firms Do Basic Research With Their Own Money - 1989 - StudentsDokument10 SeitenWhy Do Firms Do Basic Research With Their Own Money - 1989 - StudentsAlvaro Rodríguez RojasNoch keine Bewertungen

- Nature, and The Human Spirit: A Collection of QuotationsDokument2 SeitenNature, and The Human Spirit: A Collection of QuotationsAxl AlfonsoNoch keine Bewertungen

- Assignment Class X Arithmetic Progression: AnswersDokument1 SeiteAssignment Class X Arithmetic Progression: AnswersCRPF SchoolNoch keine Bewertungen

- OglalaDokument6 SeitenOglalaNandu RaviNoch keine Bewertungen

- Grammar Reference With Practice Exercises: Unit 1Dokument25 SeitenGrammar Reference With Practice Exercises: Unit 1violet15367% (3)

- 221-240 - PMP BankDokument4 Seiten221-240 - PMP BankAdetula Bamidele OpeyemiNoch keine Bewertungen

- ACE Resilience Questionnaires Derek Farrell 2Dokument6 SeitenACE Resilience Questionnaires Derek Farrell 2CATALINA UNDURRAGA UNDURRAGANoch keine Bewertungen

- How To Develop Innovators: Lessons From Nobel Laureates and Great Entrepreneurs. Innovation EducationDokument19 SeitenHow To Develop Innovators: Lessons From Nobel Laureates and Great Entrepreneurs. Innovation Educationmauricio gómezNoch keine Bewertungen

- Research ProposalDokument45 SeitenResearch ProposalAaliyah Marie AbaoNoch keine Bewertungen

- Final Report - Solving Traveling Salesman Problem by Dynamic Programming Approach in Java Program Aditya Nugroho Ht083276eDokument15 SeitenFinal Report - Solving Traveling Salesman Problem by Dynamic Programming Approach in Java Program Aditya Nugroho Ht083276eAytida Ohorgun100% (5)

- Approved Chemical ListDokument2 SeitenApproved Chemical ListSyed Mansur Alyahya100% (1)

- Apache Hive Essentials 2nd PDFDokument204 SeitenApache Hive Essentials 2nd PDFketanmehta4u0% (1)

- Barangay Sindalan v. CA G.R. No. 150640, March 22, 2007Dokument17 SeitenBarangay Sindalan v. CA G.R. No. 150640, March 22, 2007FD BalitaNoch keine Bewertungen

- Syllabus/Course Specifics - Fall 2009: TLT 480: Curricular Design and InnovationDokument12 SeitenSyllabus/Course Specifics - Fall 2009: TLT 480: Curricular Design and InnovationJonel BarrugaNoch keine Bewertungen

- Counselling Goes To The Movies: Antwone Fisher (2002)Dokument12 SeitenCounselling Goes To The Movies: Antwone Fisher (2002)Azizul MohamadNoch keine Bewertungen

- KAHOOT - Assignment 4.1 Lesson PlanDokument3 SeitenKAHOOT - Assignment 4.1 Lesson PlanJan ZimmermannNoch keine Bewertungen

- Essay EnglishDokument4 SeitenEssay Englishkiera.kassellNoch keine Bewertungen

- GearsDokument14 SeitenGearsZulhilmi Chik TakNoch keine Bewertungen

- Final PS-37 Election Duties 06-02-24 1125pm)Dokument183 SeitenFinal PS-37 Election Duties 06-02-24 1125pm)Muhammad InamNoch keine Bewertungen