Beruflich Dokumente

Kultur Dokumente

Electronic Manufacturing Industry

Hochgeladen von

Gilbert G. Asuncion Jr.Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Electronic Manufacturing Industry

Hochgeladen von

Gilbert G. Asuncion Jr.Copyright:

Verfügbare Formate

lectronic Manufacturing Industry: Market Research Reports, Statistics and Analysis

Global Electronics Manufacturing Industry

The global electronics manufacturing industry involves the assembling of electronic goods for domestic, professional, State and military use. Electronics are also used in other industries in the manufacture of a range of goods including appliances, vehicles and toys. Manufacturing companies can be broken down into categories according to what they produce. The main categories of products include: equipment used in the fields of telecommunications, engineering, laser processing, photography and medicine, machinery components, lighting and consumer electronics. Manufacturing companies are obliged to deal with other manufacturers as much of the raw materials they use involves intermediate components. Apart from nurturing a strong business relationship, these companies often locate near one another to cut transport and inventory costs and to afford smooth collaboration for research and development. One such example is Silicon Valley in California where a cluster of companies operates in close proximity to manufacture software and computers. The global electronics manufacturing industry is comprised of relatively small companies for the most part. Electronics products are becoming cheaper and being produced faster thanks to the industrys supply chain, which is becoming more and more globalized. Much of the electronic goods manufactured by the industry come from Asia, with China the number one country in terms of production. Outsourcing is common amongst US electronics manufacturers, allowing them to capitalize on profits by cutting production costs. The industry relies on technological innovation, with heavy investment in research and development projects involving highly qualified engineers and technical experts. An increasing degree of automation is making the production of electronics equipment faster and helping to keep the pace of production up with that of constantly evolving designs.

Key Segments

The global consumer electronics industry has an estimated worth of close to $7 trillion, according to Business Insights. This highly competitive industry is seeing extensive convergence of market, products and technologies, fuelled by miniaturization, digitalization, and mobility. The global electronic manufacturing services industry is expected to grow by almost 9% yearly throughout the five-year period ending in 2015, according to MarketLine, at which point the market would be worth almost $300 billion. Most electronic equipment manufacturers are at the service of original equipment manufacturers. Electronics materials and chemicals refer to substances necessary to make printed circuit boards and semiconductors, and exist in liquid, gaseous, and solid forms. According to BCC Research, demand for these substances will enjoy an annual growth rate in excess of 12.5% through 2015.

Regional Market Share

The EU electronic manufacturing services industry is expected to grow by almost 6.5% in 2011, with a lower rate inferior to 3% in Western Europe, and a higher rate of over 9% in Central & Eastern Europe, according to Reed Electronics Research. The region comprised of Central and Eastern Europe and other is expected to represent 60% of overall EU electronic production by 2015, a 3% increase compared with 2010.

Industry Leaders

Samsung and Hewlett-Packard are two important players in the electronics industry. Samsung had net sales of almost $173 billion in 2010, with assets worth around $295 billion. California-based Hewlett-Packards customer base is over one billion, and it operates in over 170 countries. The company employs almost 325,000 people worldwide, and was number 11 in the 2010 list of Fortune 500 companies. Its 2010 revenue was in excess of $125 billion. Other leading companies on the global electronics manufacturing market include Sony, LG, Toshiba, Nokia, Panasonic, Apple, Microsoft and Dell.

Market Outlook

As the electronic manufacturing industry is increasingly globalized, with US companies outsourcing factory activities abroad, it is difficult to delineate company boundaries; design, manufacture and assembly of products can span three different countries. The industry is driven by technological innovation, with cost competitiveness proving to be a key factor. According to private research firm Business Insights, South Korean companies LG and Samsung are fuelling commoditization of the industry, with other companies striving to hold their own in the face of these emerging corporate powers. Japanese competitors are looking to diversification into fields such as environment and energy to stimulate growth. Apple, on the other hand, is managing to keep its profits high through the tactic of disruptive innovations.

Leading Industry Associations

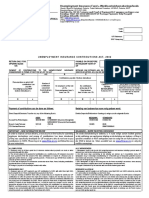

Electronics Components Association http://ec-central.org Consumer Electronics Association www.ce.org Global Standards for the Microelectronics Industry www.jedec.org Global Electronics Trade Association www.ipc.org American Engineering Association www.aea.org Institute of Electrical and Electronic Engineers www.ieee.org National Electrical Manufactures Association www.nema.org Exports General Imports General Imports Consumption Imports

Consumption

F.A.S.Value Basic Electronic Computers Computer Storage Devices Other Computer Equipment Telephone Apparatus Radio and Television Broadcasting And Wireless Communications Equipment Other Communications Equipment Audio and Video Equipment Picture, Microwave, Amplifier, Electron, Cathode Ray & Similar Tubes Printed Circuits Semiconductors and Related Devices Electronic Capacitors and Parts Electronic Resistor And Parts Electronic Coils, Transformers, and Other Inductors Electronic Connectors Printed Circuit Assemblies (Electronic Assemblies) Other Electronic Components Electromedical and Electrotherapeutic Apparatus Search, Detection, Navigation, Guidance, Aeronautical, and Nautical Systems and Instruments Automatic Environmental Controls for Residential, Commercial, and Appliance Use Instruments and Related Products for Measuring, Displaying, and Controlling Industrial Process Variables Totalizing Fluid Meters And Counting Devices Instruments For Measuring And Testing Electricity And Electrical Signals Analytical Laboratory Instruments Irradiation Apparatus Watches, Clocks, and Parts Other Measuring and Controlling Devices Prerecorded Compact Discs (except Software), Tapes, and Records Unrecorded Magnetic and Optical Media Total << Minimize 11,810,560 4,783,116 23,102,553 774,602 24,838,205 599,014 8,621,767 276,918 1,412,310 37,660,442 1,308,666 558,277 595,505 3,992,503 523,787 5,390,837 8,369,603 3,196,887 360,697 6,163,388 303,552 6,289,788 6,820,967 3,406,620 873,934 3,521,826 186,042 424,368 166,166,731

Customs Value Basis C.I.F Value Basis 48,172,292 8,458,859 23,129,838 2,352,102 68,338,947 817,189 32,715,020 291,207 1,607,844 32,503,933 1,069,487 725,712 922,881 3,265,686 11,604,077 9,311,696 6,994,181 4,576,939 792,051 5,929,185 395,27 5,003,719 4,521,574 3,100,890 3,793,676 1,701,209 112,569 964,633 283,172,669 49,101,153 8,679,485 23,663,930 2,401,730 69,094,278 830,788 33,175,523 294,626 1,674,740 32,781,463 1,089,878 743,106 951,333 3,348,553 11,759,397 9,559,909 7,070,181 4,627,735 803,935 6,035,233 402,646 5,086,918 4,594,299 3,143,250 3,870,904 1,731,691 119,299 995,258 287,631,238

Customs Value Basis 48,085,058 8,462,698 23,538,084 2,345,304 67,991,190 818,092 32,513,530 291,194 1,582,149 32,477,055 1,102,614 722,334 913,084 3,240,595 11,595,749 9,092,878 6,966,246 4,400,023 784,466 5,789,813 394,9 5,000,959 4,505,424 3,092,710 3,368,138 1,699,310 112,567 970,088 281,856,250

C.I.F Value B 49,011,792 8,684,553 24,072,102 2,397,828 68,846,595 831,777 32,976,686 294,613 1,648,714 32,756,796 1,123,079 739,63 941,295 3,322,967 11,749,528 9,332,909 7,042,035 4,448,619 796,224 5,891,121 402,256 5,083,581 4,577,618 3,135,008 3,429,975 1,729,694 119,296 1,002,759 286,389,050

The purpose of a SWOT analysis of the manufacturing industry is to identify the key factors that affect the success of the industry. The four factors considered a part of a SWOT analysis are: strengths, weaknesses, opportunities and threats. A SWOT analysis estimates the risks for a particular industry.

Other People Are Reading

PPT for SWOT Analysis

How to Do a Basic SWOT Analysis

Print this article

Strengths

o

The strengths of the manufacturing industry are that it is relatively stable. Although the demand for manufacturing tends to fluctuate with the ups and downs of the economy, it is characterized by regular periods of

recovery following any downturns. Moreover, manufacturing has become highly efficient over the last century, with the ability to maximize both the productivity of the workers and machines to maximize profits.

Weaknesses

o

A weakness of the manufacturing industry is that much of it is built on the production of non-essential goods. This means that a severe downturn in the economy can have a crippling effect on it. Another weakness is that it is a mature industry. This means that there is heavy competition and little room for growth. As a result, the manufacturing industry can be a cash cow for those who are already in it but may be unattractive to new entrants.

Opportunities

o

Opportunities in the manufacturing industry are in the technology and bio-technology areas. These are growing market segments with higher profit margins. Additionally, they are knowledge-dependent market segments that require highly specialized workers, which makes it difficult for low wage countries to compete in this market segment, thereby providing an edge to more industrialized countries. Foreign markets with a growing middle class are providing opportunities for technology and bio-technology manufacturers to increase their profitability through exports.

Threats

o

The largest threats to the manufacturing industry in developed nations are from low wage countries. The low wages of these countries have made it impossible for many businesses in developed nations to compete, requiring them to either close or move overseas to find cheap labor. Increasingly, India is an even bigger threat to the manufacturing industry, with its ability to supply highly educated workers at low wages to fill roles in the hightech manufacturing market segment.

Warning

o

Be aware that a SWOT analysis of the manufacturing industry does not necessarily reflect the position of your firm within the industry. It is recommended that you conduct a SWOT analysis of your particular manufacturing firm to understand the strengths, weaknesses, opportunities and threats inherent to your business. It is possible that your firm could be in a stronger position than the manufacturing industry as a whole or that it could be much worse off.

Das könnte Ihnen auch gefallen

- (796958755) Electronics & Semiconductor Market Research PDFDokument10 Seiten(796958755) Electronics & Semiconductor Market Research PDFAlex Hales PerryNoch keine Bewertungen

- Fourth Industrial Revolution A Complete Guide - 2021 EditionVon EverandFourth Industrial Revolution A Complete Guide - 2021 EditionNoch keine Bewertungen

- Return On Investment A Complete Guide - 2019 EditionVon EverandReturn On Investment A Complete Guide - 2019 EditionNoch keine Bewertungen

- Product Design Specification A Complete Guide - 2021 EditionVon EverandProduct Design Specification A Complete Guide - 2021 EditionNoch keine Bewertungen

- ERP And Agile Methodologies A Complete Guide - 2020 EditionVon EverandERP And Agile Methodologies A Complete Guide - 2020 EditionNoch keine Bewertungen

- Defensive Strategy – Apple's Overlooked Key to SuccessVon EverandDefensive Strategy – Apple's Overlooked Key to SuccessNoch keine Bewertungen

- AEON SWOT Analysis & MatricDokument6 SeitenAEON SWOT Analysis & MatricJanet1403Noch keine Bewertungen

- 4.1 Note On Developing - Start-Up - StrategiesDokument19 Seiten4.1 Note On Developing - Start-Up - StrategiesSamarth SharmaNoch keine Bewertungen

- Cisco Grand StrategyDokument12 SeitenCisco Grand StrategyKumar Kishore KalitaNoch keine Bewertungen

- Sample Bussiness Plan For EntruprenerDokument21 SeitenSample Bussiness Plan For EntruprenerRavi BotveNoch keine Bewertungen

- Customer Analysis: Strategic Market SegmentationDokument25 SeitenCustomer Analysis: Strategic Market SegmentationWan Muhammad Abdul HakimNoch keine Bewertungen

- Blockbuster CaseDokument9 SeitenBlockbuster CasemskrierNoch keine Bewertungen

- The Seven Domains Model - JabDokument27 SeitenThe Seven Domains Model - JabpruthirajpNoch keine Bewertungen

- TDC Case FinalDokument3 SeitenTDC Case Finalbjefferson21Noch keine Bewertungen

- Inside Intel InsideDokument5 SeitenInside Intel InsideShahriar Alam RifatNoch keine Bewertungen

- Fluctuations Occur When One Is Unable To Precisely Predict Events or Quantities (GoldrattDokument6 SeitenFluctuations Occur When One Is Unable To Precisely Predict Events or Quantities (GoldrattVinay Dabholkar100% (1)

- Logitech Case Study (International Trade)Dokument3 SeitenLogitech Case Study (International Trade)Uswa AfzalNoch keine Bewertungen

- Best BuyDokument4 SeitenBest BuyKareem El FoulyNoch keine Bewertungen

- Cisco Case StudyDokument10 SeitenCisco Case Studywillie.erasmus7023Noch keine Bewertungen

- Consumer Decision ProcessDokument9 SeitenConsumer Decision ProcessMuhammad Zarin MislanNoch keine Bewertungen

- Business Security Lenovo Case StudyDokument2 SeitenBusiness Security Lenovo Case StudyLunguLavi100% (1)

- E-Commerce & E-Buisness-1Dokument26 SeitenE-Commerce & E-Buisness-1Samkit ShahNoch keine Bewertungen

- Avery Dennison Case Study2Dokument6 SeitenAvery Dennison Case Study2bossdzNoch keine Bewertungen

- FTF Firmware Files Using XperiFirm and FlashTool (Guide) - Xperia BlogDokument21 SeitenFTF Firmware Files Using XperiFirm and FlashTool (Guide) - Xperia BlogTrungVũNguyễnNoch keine Bewertungen

- One-Plus and WaltonDokument16 SeitenOne-Plus and WaltonSudipto Tahsin AurnabNoch keine Bewertungen

- Ryff Inc. - Disrupting Product PlacementDokument16 SeitenRyff Inc. - Disrupting Product PlacementBrittany WoodsNoch keine Bewertungen

- Consumer Behaviour On Individual ProductDokument16 SeitenConsumer Behaviour On Individual ProductZeeshan MirzaNoch keine Bewertungen

- DellDokument7 SeitenDellJune SueNoch keine Bewertungen

- Questions For Sale ProjectDokument4 SeitenQuestions For Sale ProjectLaGracious100% (3)

- Strategic Marketing PlanDokument43 SeitenStrategic Marketing PlanArham ZeshanNoch keine Bewertungen

- Pim05 2012 Pmw1131812shuangzhouDokument16 SeitenPim05 2012 Pmw1131812shuangzhouShu ZhouNoch keine Bewertungen

- SWOT Volkswagen Group of AmericaDokument5 SeitenSWOT Volkswagen Group of Americacodyllink100% (1)

- Formulating Business Strategy Using SWOT AnalysisDokument3 SeitenFormulating Business Strategy Using SWOT AnalysisMark Kenneth BarrenoNoch keine Bewertungen

- Nintendo Wii Supply Chain PaperDokument12 SeitenNintendo Wii Supply Chain PaperTamer Aladin Sergany100% (2)

- Donner Company 2Dokument6 SeitenDonner Company 2Nuno Saraiva0% (1)

- Samsung Electronics CompanyDokument4 SeitenSamsung Electronics CompanyAlexis SolisNoch keine Bewertungen

- Tyndall Furniture Company (B) EnglishDokument2 SeitenTyndall Furniture Company (B) EnglishProcusto LNoch keine Bewertungen

- Database Design & Application-ProductionDokument6 SeitenDatabase Design & Application-ProductiondrosbeastNoch keine Bewertungen

- Principles of Marketing-HpDokument23 SeitenPrinciples of Marketing-HpVarun KumarNoch keine Bewertungen

- AI PresentationDokument25 SeitenAI PresentationFawaz MughniNoch keine Bewertungen

- RivalryDokument5 SeitenRivalryJanani NagendranNoch keine Bewertungen

- Airvent FansDokument17 SeitenAirvent FansPamela ValleNoch keine Bewertungen

- Lego Study CaseDokument4 SeitenLego Study CaseAngel OenNoch keine Bewertungen

- About IBM PDFDokument30 SeitenAbout IBM PDFadharav malikNoch keine Bewertungen

- Semi-Final Short Case Study: Woodcorp IncDokument4 SeitenSemi-Final Short Case Study: Woodcorp IncbaralbjNoch keine Bewertungen

- Auto and Car Parts Production: Can The Philippines Catch Up With Asia?Dokument38 SeitenAuto and Car Parts Production: Can The Philippines Catch Up With Asia?ERIA: Economic Research Institute for ASEAN and East AsiaNoch keine Bewertungen

- Precise Software Solution: Group 10Dokument6 SeitenPrecise Software Solution: Group 10Anonymous 8PR2MCqmqHNoch keine Bewertungen

- The Potential Shake-Up in Semiconductor Manufacturing Business ModelsDokument5 SeitenThe Potential Shake-Up in Semiconductor Manufacturing Business ModelsFelipe RegisNoch keine Bewertungen

- Business Plan 2006: Genieview IncDokument32 SeitenBusiness Plan 2006: Genieview IncMariia LevytskaNoch keine Bewertungen

- Discopress Case SolutionDokument4 SeitenDiscopress Case SolutionumarzNoch keine Bewertungen

- Industry 1.0 To 4.0Dokument6 SeitenIndustry 1.0 To 4.0Wenuri Kasturiarachchi100% (1)

- Axel Springer Case Study 3Dokument35 SeitenAxel Springer Case Study 3Hamza MoshrifNoch keine Bewertungen

- (C10) Solectron From Contract Manufacturer To Global Supply Chain Integrator2009Dokument48 Seiten(C10) Solectron From Contract Manufacturer To Global Supply Chain Integrator2009Gaurav AroraNoch keine Bewertungen

- 08 Office DepotDokument13 Seiten08 Office Depotmskrier0% (1)

- Nucor ADokument15 SeitenNucor Adharma_1001Noch keine Bewertungen

- Porter Worksheet - Pontier E-CigarettesDokument4 SeitenPorter Worksheet - Pontier E-CigarettesCharlesPontier100% (1)

- Consultancy Management (Recovered)Dokument30 SeitenConsultancy Management (Recovered)Gilbert G. Asuncion Jr.Noch keine Bewertungen

- Capacity Planning at Shouldice HospitalDokument9 SeitenCapacity Planning at Shouldice HospitalGilbert G. Asuncion Jr.Noch keine Bewertungen

- Dec Sci PresentationDokument66 SeitenDec Sci PresentationGilbert G. Asuncion Jr.Noch keine Bewertungen

- MncsDokument29 SeitenMncsGilbert G. Asuncion Jr.Noch keine Bewertungen

- Cost Volume Profit Analysis As A Management Tool For Decision MakingDokument15 SeitenCost Volume Profit Analysis As A Management Tool For Decision MakingGilbert G. Asuncion Jr.100% (3)

- Placement Calendar of Complete Year (Core Branches)Dokument3 SeitenPlacement Calendar of Complete Year (Core Branches)Mikey SanoNoch keine Bewertungen

- Lean Think PDFDokument13 SeitenLean Think PDFசரவணகுமார் மாரியப்பன்Noch keine Bewertungen

- Construction HSE ManualDokument16 SeitenConstruction HSE ManualAndika Apish67% (3)

- Epcmd 2 Qm00 Jep Ci 004 - 01Dokument4 SeitenEpcmd 2 Qm00 Jep Ci 004 - 01Rakesh RanjanNoch keine Bewertungen

- Workplace Inspection ChecklistDokument60 SeitenWorkplace Inspection ChecklistANILNoch keine Bewertungen

- Cover PanelDokument27 SeitenCover Panelapi-3736287Noch keine Bewertungen

- User Guide TemplateDokument12 SeitenUser Guide TemplateClass InstructorNoch keine Bewertungen

- Railway Reservation System DocumentationDokument19 SeitenRailway Reservation System DocumentationSaroj Cipher80% (5)

- Form - U17 - UIF - Payment AdviceDokument2 SeitenForm - U17 - UIF - Payment Advicesenzo scholarNoch keine Bewertungen

- Applying eTOM (Enhanced Telecom Operations Map) Framework To Non-Telecommunications Service Companies - An Product/Service/Solution Innovation ExampleDokument45 SeitenApplying eTOM (Enhanced Telecom Operations Map) Framework To Non-Telecommunications Service Companies - An Product/Service/Solution Innovation ExampleorigigiNoch keine Bewertungen

- Smart Investment E Copy Vol 17 Issue No 1 11th February 2024Dokument88 SeitenSmart Investment E Copy Vol 17 Issue No 1 11th February 2024Kundariya MayurNoch keine Bewertungen

- 2012 Q3 - McKinsey Quarterly - Leading in The 21 Century PDFDokument136 Seiten2012 Q3 - McKinsey Quarterly - Leading in The 21 Century PDFBayside BlueNoch keine Bewertungen

- Introduction To Operations ManagementDokument40 SeitenIntroduction To Operations ManagementDanielGómezNoch keine Bewertungen

- Test Bank For Horngrens Financial Managerial Accounting 4e by Nobles 0133359840Dokument55 SeitenTest Bank For Horngrens Financial Managerial Accounting 4e by Nobles 0133359840JonathanHicksnrmo100% (36)

- Manufacturing Processes Ch.6 (20) Sheet Metal WorkingDokument73 SeitenManufacturing Processes Ch.6 (20) Sheet Metal Workingashoku24007100% (1)

- Renault Nissan AllianceDokument5 SeitenRenault Nissan AllianceColin Farley100% (1)

- Annual Report2015-2016 HCL PDFDokument204 SeitenAnnual Report2015-2016 HCL PDFbhupendraNoch keine Bewertungen

- New Features in Allplan 2008Dokument192 SeitenNew Features in Allplan 2008galati12345Noch keine Bewertungen

- Customer Relationship ManagementDokument4 SeitenCustomer Relationship ManagementWebster CarrollNoch keine Bewertungen

- PM 10Dokument76 SeitenPM 10Luis ManzoNoch keine Bewertungen

- Primer 1 PDFDokument3 SeitenPrimer 1 PDFTomislav JovanovicNoch keine Bewertungen

- J.2.8 Subcontracting PlanDokument2 SeitenJ.2.8 Subcontracting Planameerm_abdullahNoch keine Bewertungen

- 04) ZEEPod & Other Project ExperienceDokument72 Seiten04) ZEEPod & Other Project Experiencebapaobao100% (1)

- Risk Assessment Mwanza Oct 2014Dokument2 SeitenRisk Assessment Mwanza Oct 2014Rashid BumarwaNoch keine Bewertungen

- Quick Fields 8Dokument11 SeitenQuick Fields 8Khaled ElayyanNoch keine Bewertungen

- NJ Lemon LawDokument2 SeitenNJ Lemon Lawscd9750Noch keine Bewertungen

- Douglas C-47Dokument5 SeitenDouglas C-47Emerson URNoch keine Bewertungen

- Transportation Manager or International Manager or Logistics SupDokument3 SeitenTransportation Manager or International Manager or Logistics Supapi-78592002Noch keine Bewertungen

- Weighbridge Integration With SapDokument9 SeitenWeighbridge Integration With SapSandip SarodeNoch keine Bewertungen

- STD1 Crimping Chart March 2020 Final 2Dokument1 SeiteSTD1 Crimping Chart March 2020 Final 2Bernd RichterNoch keine Bewertungen