Beruflich Dokumente

Kultur Dokumente

Bargain Hunting

Hochgeladen von

Matt BrennanCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bargain Hunting

Hochgeladen von

Matt BrennanCopyright:

Verfügbare Formate

Bargain Hunting

Matt Brennan Whether it is in the majestic plains of the Serengeti, or in the throngs of the Wall Street trading floor, the thrill of hunting down something special makes even the most veteran monk chortle with glee. This December proved not only how short sighted the Mayans were, but how undervalued the Australian market was. The ASX 200 as an index rose a further 3% in December, with interest rates being at their lowest levels since April 2009 and the US being confident it will avoid the fiscal cliff (for more information on the fiscal cliff refer to one of my previous articles: Cliff Hanger The US Fiscal Cliff), also being key proponents of the surge. The ASX 200 has in fact been producing month on month gains since June 2012. The most enlightening facet of this bargain season however, is that the personalities of people seeking to capitalise on the value that is widely present in the Australian share market, all fit snuggly into the four systemic hunting categories.

The Recreational Hunter

This is the hunter who opts for the small game like rabbits, where there is a sense of safety in knowing that there is no need to acquire expensive tags to hunt one moose in Alberta Canada for instance, costs a non-Canadian a minimum of $270, this is before large firearm and other hunting license costs are factored in. Additionally, only a small amount of firearm knowledge is necessary to hunt a rabbit. This is what characterises the relative risk free approach of the share market recreational hunter, who adopts a Fisher & Paykel My First Share Portfolio approach to investing. These individuals usually only have a small amount of funds to invest, and are typically too time poor to do the necessary background research and would rather just go with the flow and pick the shares that everyone else is investing in. In Australia, these are the ones with the largest market capitalisation (BHP, RIO, the big 4 banks, Telstra, Wesfarmers and Woolworths).

The Sports Hunter

To the sports hunter, dead fish go with the flow, and in the hunting realm, this means that the sports hunter goes after the largest, most challenging animals, like moose and grizzly bears. This type of hunter recognises their important role in society as stated by the National Shooting Sports Foundation (NSSF) late last year, Hunters play a vital role in wildlife conservation. They are also typically not adverse to the hefty financial remuneration and ego gratification derived from winning hunting competitions. In the share market conversely, the sports hunter goes after the smallest shares in size (in Australia, typically junior mining stocks), as these have the greatest potential to make huge windfalls. These companies are invariably riskier and require a strong background knowledge and capital base, expert timing, and luck. The Sports hunters importance in the share market cannot be understated either, as these investors are the catalysts in the Australian share market, which help trigger growth driven profits through their financial backing of companies looking for that initial seed capital before they reach a breakthrough.

Poachers

In the share market, poachers are the day traders and short sellers that ASIC (Australian Securities and Investment Commission) and the ASX try to target with new legislation involving hefty financial penalties, in some cases even criminal liability. A recent example of poaching occurred with ANZ shares on the 18th of October, 2012. ANZ opened at $25.96 and with no market news or announcements surged to $27.63 (thats a 6.4% gain) within the first hour of trade. By the second hour of trade the price corrected itself to a level slightly above opening and at the end of the day ANZ closed at the price it opened at, despite positive economic news out of China which buoyed the rest of the market up by nearly 1%. Poaching erodes the integrity of the market place and saps investor confidence, proven by the fact that very few investors were willing to go near ANZ for the remainder of that trading day. This example of poaching is known as pump and dump, where ANZ was purposely inflated and then sold off heavily with those buying in cheaply within the first hour selling by the second and enjoying a healthy windfall. What exacerbated the situation was that options for ANZ were also expiring on this day so the poacher(s) would stand to have made a considerable amount if they traded these as well. The ASX & ASIC understandably was reluctant to admit that poaching occurred, as they were unable to find the culprit(s) and desperately wanted to avoid copycat perpetrators. Instead they blamed a computer glitch that they vowed wouldnt ever happen again.

Trappers

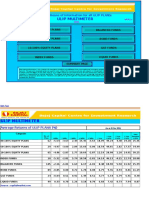

From the picture below the trapper employs a laissez faire (hands-off) approach to hunting, which secures the desired result, with reduced uncertainty. This contraption has a motion detection camera which can be set to beam real time images directly to a computer. With night vision mode and an impressive range of 32 feet, when combined with baiting tools to lure the animal into the designated zone, this device can be quite a valuable investment. The camera aspect reduces chances of misfiring on the wrong animal which looks similar to the target, (coyote are fair game provided that the hunter has relevant tags and licenses, but wolves are a protected species in North America).

Trappers are an intriguing breed in the share market world. Trappers adopt the philosophy that strong performing companies in the past will generally rebound out of a slump if given time. The trapper sets their target price (i.e.; the trap) at a level they believe is likely to be the rebound point, based on historical trends, current market sentiment and other fundamental factors. A spider-web is only effective when the fly is in the room, in the same way there is no point setting a trap for say BHP at $5, when they are currently trading at $38.00 (when this article was written). To increase their success rate, a trapper sets multiple traps with a realistic price drop across a variety of sectors due to the counter-cyclical nature of certain industries (Over the course of the financial crisis, the healthcare sector as an index slumped 14% at its worst point in March 2009, whilst this compared to a whopping 67% decline from the energy sector). When the price drops to the desired level (i.e.; the trap is triggered), the investor will then assess whether their trap was set at the right level and then execute a buy order. Timing is critical, the trapper would normally have a reserve of capital ready to deploy, and opt to receive the updated information by sms, to be sure that they can go in for the kill before everyone else does and the price re-stabilises. This approach allows the trapper to enter into the market at what is hopefully the ground floor, which provides entitlement to the largest gains upon recovery. This practise has been described as trying to catch a falling sword, so to minimise the ramifications of premature acquisition, only what is commonly known as blue-chip companies, the strongest performing companies are monitored. These companies have reduced volatility in negative times due to their underlying value and have a proven dividend history. Stocking up on these companies at an inexpensive price ensures the maximum dividend yield is achieved regardless of price fluctuations. Engaging in share buying, like hunting, requires a vast reserve of patience. Good decisions are normally based on knowing when to move in on investment as opposed to simply jumping on an investment the quickest, which is why the proverb says the second mouse usually gets the cheese. The other salient aspect of both hunting and share buying is that there is an inherent element of risk, regardless of personality type. There is the legitimate chance that things will not go the way of the individual, with some mistakes and events that could not be controlled or foreseen, causing more harm than a mere wounding of pride. The song Drops of Jupiter, by Train, encapsulates this dilemma and expresses it best when the male in the song, upon his girlfriends return from a soul searching space voyage, Does not want to be plain old Jane who told a story about a man who was too afraid to fly so he never did land.

Das könnte Ihnen auch gefallen

- Ruthless: How Enraged Investors Reclaimed Their Investments and Beat Wall StreetVon EverandRuthless: How Enraged Investors Reclaimed Their Investments and Beat Wall StreetBewertung: 2 von 5 Sternen2/5 (1)

- 10 Rules of InvestingDokument2 Seiten10 Rules of InvestingSaravanan KNoch keine Bewertungen

- Sangamo Biotechx PDFDokument57 SeitenSangamo Biotechx PDFEdgar RNoch keine Bewertungen

- Markets in Profile: Profiting from the Auction ProcessVon EverandMarkets in Profile: Profiting from the Auction ProcessBewertung: 5 von 5 Sternen5/5 (1)

- Taming the Bear: The Art of Trading a Choppy MarketVon EverandTaming the Bear: The Art of Trading a Choppy MarketBewertung: 3.5 von 5 Sternen3.5/5 (2)

- Stocks Sstrategies and Common Sense - DR D-EbookDokument76 SeitenStocks Sstrategies and Common Sense - DR D-EbookCarlos Treseme100% (1)

- Financial Speculation: Trading financial biases and behaviourVon EverandFinancial Speculation: Trading financial biases and behaviourBewertung: 5 von 5 Sternen5/5 (3)

- Guru LessonsDokument12 SeitenGuru LessonsSergio Olarte100% (1)

- Are Markets Efficient - NoDokument3 SeitenAre Markets Efficient - Noits4krishna3776Noch keine Bewertungen

- Selector June 2004 Quarterly NewsletterDokument5 SeitenSelector June 2004 Quarterly Newsletterapi-237451731Noch keine Bewertungen

- Warren Buffett Invests Like a Girl: And Why You Should, Too: 8 Essential Principles Every Investor Needs to Create a Profitable PortfolioVon EverandWarren Buffett Invests Like a Girl: And Why You Should, Too: 8 Essential Principles Every Investor Needs to Create a Profitable PortfolioBewertung: 3 von 5 Sternen3/5 (4)

- Lessons in Investment WarfareDokument4 SeitenLessons in Investment WarfareTim PriceNoch keine Bewertungen

- WorkbookDokument16 SeitenWorkbookImran VarsariyaNoch keine Bewertungen

- Forecasting in Financial and Sports Gambling Markets: Adaptive Drift ModelingVon EverandForecasting in Financial and Sports Gambling Markets: Adaptive Drift ModelingNoch keine Bewertungen

- Module 1 Behavioral Finance - AutosavedDokument30 SeitenModule 1 Behavioral Finance - AutosavedKarnik sahilNoch keine Bewertungen

- Quote of The DayDokument19 SeitenQuote of The DaykalliagrasNoch keine Bewertungen

- Your Money and Your Brain: How the New Science of Neuroeconomics Can Help Make You RichVon EverandYour Money and Your Brain: How the New Science of Neuroeconomics Can Help Make You RichBewertung: 4 von 5 Sternen4/5 (44)

- 10 Investing Don'ts From Seth Klarman PDFDokument3 Seiten10 Investing Don'ts From Seth Klarman PDFPook Kei JinNoch keine Bewertungen

- Cautionary tales for the modern investor: The seven deadly sins of multi-asset investingVon EverandCautionary tales for the modern investor: The seven deadly sins of multi-asset investingNoch keine Bewertungen

- InsuranceDokument38 SeitenInsuranceDivaxNoch keine Bewertungen

- NSE Stocks Trading at Nominal Value - Beyond Crisis 160911Dokument10 SeitenNSE Stocks Trading at Nominal Value - Beyond Crisis 160911ProshareNoch keine Bewertungen

- The Long and Short Of Hedge Funds: A Complete Guide to Hedge Fund Evaluation and InvestingVon EverandThe Long and Short Of Hedge Funds: A Complete Guide to Hedge Fund Evaluation and InvestingNoch keine Bewertungen

- Predict the Next Bull or Bear Market and Win: How to Use Key Indicators to Profit in Any MarketVon EverandPredict the Next Bull or Bear Market and Win: How to Use Key Indicators to Profit in Any MarketBewertung: 4.5 von 5 Sternen4.5/5 (6)

- Black Swan - Naylor - Wongchoti - ChenDokument34 SeitenBlack Swan - Naylor - Wongchoti - Chenfreebanker777741Noch keine Bewertungen

- The Worlds Most Valuable Asset in Times of Crisis - FarmlandDokument5 SeitenThe Worlds Most Valuable Asset in Times of Crisis - FarmlandMichael BonnieNoch keine Bewertungen

- The Simplified Futures and Options Trading StrategyDokument93 SeitenThe Simplified Futures and Options Trading StrategyNaitik80% (5)

- (David Dreman) Contrarian Investment Strategies - OrgDokument34 Seiten(David Dreman) Contrarian Investment Strategies - Orgarunpdn80% (5)

- Option Sellers v2Dokument64 SeitenOption Sellers v2obrocofNoch keine Bewertungen

- Who Gambles in The Stock MarketDokument45 SeitenWho Gambles in The Stock MarketDebNoch keine Bewertungen

- Preparing For The Next 'Black Swan'Dokument5 SeitenPreparing For The Next 'Black Swan'Edward Chai Ming HuaNoch keine Bewertungen

- 10 Investment Rules From Investing LegendsDokument7 Seiten10 Investment Rules From Investing LegendseliforuNoch keine Bewertungen

- Wyckoff Money ManagementDokument11 SeitenWyckoff Money ManagementRafi Khattak100% (3)

- Understand Trading in 2 Hours SteveRyanDokument63 SeitenUnderstand Trading in 2 Hours SteveRyanAkash Biswal100% (2)

- Sharing Wisdom (20th Feb 2012)Dokument3 SeitenSharing Wisdom (20th Feb 2012)Winston Wisdom KohNoch keine Bewertungen

- The Suntory and Toyota International Centres For Economics and Related Disciplines, The London School of Economics and Political Science, Wiley EconomicaDokument11 SeitenThe Suntory and Toyota International Centres For Economics and Related Disciplines, The London School of Economics and Political Science, Wiley EconomicasjbladenNoch keine Bewertungen

- PDF Created With Pdffactory Trial VersionDokument3 SeitenPDF Created With Pdffactory Trial Versionjohn_zambrano_5Noch keine Bewertungen

- 10 Golden Rules To Become RichDokument39 Seiten10 Golden Rules To Become RichAlmas K ShuvoNoch keine Bewertungen

- Value Investing RawalDokument12 SeitenValue Investing RawalprabuanandNoch keine Bewertungen

- False Breaks: The Fakeout: (Tricks of The Trade)Dokument10 SeitenFalse Breaks: The Fakeout: (Tricks of The Trade)Una AfendiNoch keine Bewertungen

- Mean Markets and Lizard Brains: How to Profit from the New Science of IrrationalityVon EverandMean Markets and Lizard Brains: How to Profit from the New Science of IrrationalityBewertung: 3.5 von 5 Sternen3.5/5 (5)

- Investing in Frontier Markets: Opportunity, Risk and Role in an Investment PortfolioVon EverandInvesting in Frontier Markets: Opportunity, Risk and Role in an Investment PortfolioNoch keine Bewertungen

- It's All A Big MistakeDokument10 SeitenIt's All A Big MistakeAntonis VatousiosNoch keine Bewertungen

- Macroeconomia Latinoamericana 2011Dokument11 SeitenMacroeconomia Latinoamericana 2011JeanPaulEspinoNoch keine Bewertungen

- What To Do in Todays MarketDokument5 SeitenWhat To Do in Todays MarketSecure PlusNoch keine Bewertungen

- The 10-Minute Millionaire: The One Secret Anyone Can Use to Turn $2,500 into $1 Million or MoreVon EverandThe 10-Minute Millionaire: The One Secret Anyone Can Use to Turn $2,500 into $1 Million or MoreBewertung: 4.5 von 5 Sternen4.5/5 (4)

- Writing Band Descriptors Task 1Dokument168 SeitenWriting Band Descriptors Task 1Santhosh Kumar100% (2)

- Mental Mistakes - Whitney TilsonDokument73 SeitenMental Mistakes - Whitney TilsonDong-up SukNoch keine Bewertungen

- Sold Short: Uncovering Deception in the MarketsVon EverandSold Short: Uncovering Deception in the MarketsBewertung: 3.5 von 5 Sternen3.5/5 (3)

- One Up On Wall Street Book ReviewDokument7 SeitenOne Up On Wall Street Book ReviewChinmay PanhaleNoch keine Bewertungen

- The Complete Guide to Investing During Retirement: Turn Your Savings Into EarningsVon EverandThe Complete Guide to Investing During Retirement: Turn Your Savings Into EarningsNoch keine Bewertungen

- Letter To The Inexperienced Investor and SpeculatorDokument2 SeitenLetter To The Inexperienced Investor and Speculatorfasasi kolaNoch keine Bewertungen

- Code Cracking - A Breakdown of The ASX (The Intrepid Investor Series Part 4)Dokument3 SeitenCode Cracking - A Breakdown of The ASX (The Intrepid Investor Series Part 4)Matt BrennanNoch keine Bewertungen

- Wall Street Chronicle - November 2013 PDFDokument10 SeitenWall Street Chronicle - November 2013 PDFMatt BrennanNoch keine Bewertungen

- Piñata Investments - The Intrepid Investor Series (Part 3)Dokument3 SeitenPiñata Investments - The Intrepid Investor Series (Part 3)Matt BrennanNoch keine Bewertungen

- 2012 Wall Street ChronicleDokument4 Seiten2012 Wall Street ChronicleMatt BrennanNoch keine Bewertungen

- Russian Roulette - Doing Business in RussiaDokument2 SeitenRussian Roulette - Doing Business in RussiaMatt BrennanNoch keine Bewertungen

- Pulp Fiction: The Juicy Tale of The Australian Citrus IndustryDokument2 SeitenPulp Fiction: The Juicy Tale of The Australian Citrus IndustryMatt BrennanNoch keine Bewertungen

- Youth Policy - The Future of Perth Business Has Never Looked BrighterDokument4 SeitenYouth Policy - The Future of Perth Business Has Never Looked BrighterMatt BrennanNoch keine Bewertungen

- The Art of The Candlestick Chart - The Intrepid Investor Series (Part 2)Dokument3 SeitenThe Art of The Candlestick Chart - The Intrepid Investor Series (Part 2)Matt BrennanNoch keine Bewertungen

- The Naked Truth: Disrobing The Energy and Clean Tech SectorsDokument2 SeitenThe Naked Truth: Disrobing The Energy and Clean Tech SectorsMatt BrennanNoch keine Bewertungen

- There's Something About DairyDokument2 SeitenThere's Something About DairyMatt BrennanNoch keine Bewertungen

- Confessions of A Share Trader - The Intrepid Investor Series (Part 1)Dokument2 SeitenConfessions of A Share Trader - The Intrepid Investor Series (Part 1)Matt BrennanNoch keine Bewertungen

- Currency SwapDokument3 SeitenCurrency SwapMatt BrennanNoch keine Bewertungen

- MISmanagedDokument3 SeitenMISmanagedMatt BrennanNoch keine Bewertungen

- The Truffle KerfuffleDokument2 SeitenThe Truffle KerfuffleMatt BrennanNoch keine Bewertungen

- Cliff Hanger - The US Fiscal CliffDokument2 SeitenCliff Hanger - The US Fiscal CliffMatt BrennanNoch keine Bewertungen

- Bargain HuntingDokument3 SeitenBargain HuntingMatt BrennanNoch keine Bewertungen

- The Matrix (BCG Edition)Dokument2 SeitenThe Matrix (BCG Edition)Matt BrennanNoch keine Bewertungen

- Mined, Sealed, Withered - WA's Resource Boom Aftermath.Dokument2 SeitenMined, Sealed, Withered - WA's Resource Boom Aftermath.Matt BrennanNoch keine Bewertungen

- Advice You Can Bank OnDokument2 SeitenAdvice You Can Bank OnMatt BrennanNoch keine Bewertungen

- Mined, Sealed, Withered - WA's Resource Boom Aftermath.Dokument2 SeitenMined, Sealed, Withered - WA's Resource Boom Aftermath.Matt BrennanNoch keine Bewertungen

- Cliff Hanger - The US Fiscal CliffDokument2 SeitenCliff Hanger - The US Fiscal CliffMatt BrennanNoch keine Bewertungen

- Cliff Hanger - The US Fiscal CliffDokument2 SeitenCliff Hanger - The US Fiscal CliffMatt BrennanNoch keine Bewertungen

- Stamp of ApprovalDokument2 SeitenStamp of ApprovalMatt BrennanNoch keine Bewertungen

- EOS B Group 11 The Disposable Diaper Industry in 1974Dokument7 SeitenEOS B Group 11 The Disposable Diaper Industry in 1974aabfjabfuagfuegbfNoch keine Bewertungen

- Stock Market Price Prediction Analysis - RemovedDokument54 SeitenStock Market Price Prediction Analysis - RemovedHemanth Kumar PV100% (3)

- 11 Entrepreneurship - Module 2Dokument8 Seiten11 Entrepreneurship - Module 2Sir AkhieNoch keine Bewertungen

- Organization Case: Qualtrics: Scaling An Inside-Sales SolutionDokument2 SeitenOrganization Case: Qualtrics: Scaling An Inside-Sales SolutionSaranya VsNoch keine Bewertungen

- Risk PoolingDokument3 SeitenRisk PoolingÄyušheë TŸagïNoch keine Bewertungen

- Overview of Integrated Marketing CommunicationsDokument40 SeitenOverview of Integrated Marketing Communicationshhunter530Noch keine Bewertungen

- CHAPTER 2 Markets and TransactionDokument29 SeitenCHAPTER 2 Markets and TransactionTika TimilsinaNoch keine Bewertungen

- MRA Guidance-NotesDokument25 SeitenMRA Guidance-NotesAnkush BusawahNoch keine Bewertungen

- Revenue Growth - Car Rental Company: Problem Statement and QuestionsDokument4 SeitenRevenue Growth - Car Rental Company: Problem Statement and QuestionsRafaelNoch keine Bewertungen

- Sample Notes For Public AdministrationDokument20 SeitenSample Notes For Public AdministrationHarsimran Kaur100% (1)

- Dcomprehensiveexam DDokument12 SeitenDcomprehensiveexam DDominic SociaNoch keine Bewertungen

- Marketing Plan Vinasoy CollagenDokument24 SeitenMarketing Plan Vinasoy CollagenNguyễn Ngọc Quỳnh AnhNoch keine Bewertungen

- Seminar 12 - Intangible Assets and Impairment Testing1Dokument36 SeitenSeminar 12 - Intangible Assets and Impairment Testing1Celine LowNoch keine Bewertungen

- Mekidelawit Tamrat MBAO9550.14BDokument4 SeitenMekidelawit Tamrat MBAO9550.14BHiwot GebreEgziabherNoch keine Bewertungen

- IFM M.Com NotesDokument36 SeitenIFM M.Com NotesViraja GuruNoch keine Bewertungen

- Block-3 - Distribution & Promotion DecisionsDokument140 SeitenBlock-3 - Distribution & Promotion DecisionsSachin JunejaNoch keine Bewertungen

- 8, BeaDokument33 Seiten8, BeaÎßhû ẞhåñdèlNoch keine Bewertungen

- Marketvision Luxury 2012 PDFDokument23 SeitenMarketvision Luxury 2012 PDFNuman AliNoch keine Bewertungen

- Ulip MultimeterDokument17 SeitenUlip MultimeterRaghu RaoNoch keine Bewertungen

- SWOT AnalysisDokument3 SeitenSWOT AnalysisAngel KiraNoch keine Bewertungen

- Managerial Economics and Business Strategy - Ch. 6 - The Organization of The FirmDokument22 SeitenManagerial Economics and Business Strategy - Ch. 6 - The Organization of The FirmRayhanNoch keine Bewertungen

- Infosys - Journey To Capital MarketsDokument28 SeitenInfosys - Journey To Capital MarketsSaurabh AryaNoch keine Bewertungen

- Financial ServicesDokument24 SeitenFinancial ServicesPrashant GamanagattiNoch keine Bewertungen

- Gap PDFDokument201 SeitenGap PDFREXIL M. LADIGOHONNoch keine Bewertungen

- Customer Acquisition TemplateDokument20 SeitenCustomer Acquisition TemplateJia LaoNoch keine Bewertungen

- Monte Carlo (Oswal Woollen Mills LTD.) (Sales and Distribution Strategies)Dokument30 SeitenMonte Carlo (Oswal Woollen Mills LTD.) (Sales and Distribution Strategies)Ankita KushwahaNoch keine Bewertungen

- 5C AnalysisDokument24 Seiten5C AnalysisgirmaNoch keine Bewertungen

- Unit 7 Business StrategyDokument12 SeitenUnit 7 Business StrategyRameza RahmanNoch keine Bewertungen

- Digital Marketing A ReviewDokument5 SeitenDigital Marketing A ReviewEditor IJTSRDNoch keine Bewertungen

- Chapter 6 Pricing StrategiesDokument51 SeitenChapter 6 Pricing StrategiesSHS LEI COLLEEN P. QUINDOZANoch keine Bewertungen