Beruflich Dokumente

Kultur Dokumente

Macro Update: Weak GDP in Sweden Going Into 2013

Hochgeladen von

SEB GroupOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Macro Update: Weak GDP in Sweden Going Into 2013

Hochgeladen von

SEB GroupCopyright:

Verfügbare Formate

Sweden: Weak GDP going into 2013

GDP expected to grow by 1.3% in 2013 and 2.5% in 2014, unchanged compared to the forecast in the November Nordic Outlook. GDP is expected to decline by 0.5% q/q in Q4, partly as a reaction to stronger growth earlier in 2012. Current low levels for sentiment among both corporations and households is a downside risk for growth, but improvements for growth indicators in the US and emerging markets are expected to be reflected in Swedish indicators over the next 3-4 months. The labour market is starting to slow more markedly and unemployment is now trending higher. So far the upturn is driven by labour supply, but employment is expected to decline in the first half of this year. CPIF inflation will remain subdued and be below the Riksbanks target through-out the forecasting period. Lower mortgage rates are expected to push headline CPI below zero in the first half of 2013. Government finances have been weaker than expected but still look strong in an international comparison. We predict general government savings to be -1.0 - -1.5% of GDP in 2013 and 2014 with risks skewed towards larger deficits. The government is expected to present fiscal policy measures amounting to another SEK 2-3bn in 2013 and SEK 25bn in 2014. Together with measures presented in the budget bill the total fiscal expansion in 2013 will be ~25bn or 0.7% of GDP. The Riksbank will cut its key interest rate in February to 0.75%, but could possibly also wait until April. Low inflation and rising unemployment are driving forces.

THURSDAY JANUARY 10, 2013 Olle Holmgren SEB Trading Strategy olle.holmgren@seb.se +46 8 763 80 79

Key data

2011 2012 2013 2014 GDP* GDP working day adjusted* Unemployment** Inflation* Government savings***

Source: SEB

3.9 3.9 7.5 3.0 0.2

0.7 1.0 7.6 0.9 -0.4

1.3 1.3 8.3 0.1 -1.5

2.5 2.6 8.3 1.3 -1.2

* Percentage change ** Per cent of labour force *** Per cent of GDP

Economic Insights

BUSINESS SENTIMENT AND PRODUCTION Manufacturing sentiment indicates downside risks for manufacturing sector. However, better sentiment in the US and emerging markets are expected to lift sentiment over the next 3-4 months. Industrial production and export of goods will be weak over the next 3-4 months. The strong krona is putting downward pressure on exports, but the high percentage of exports to relatively strong Nordic countries and Germany is supportive. Manufacturing indicators are largely in line with Germany, but hard data has been slightly weaker. Sentiment in the service and retail sector has declined, but is still at growth levels. Declining housing starts are putting downward pressure on the construction sector. Rising investments in utilities and infrastructure are providing some support, but construction sector confidence is at cyclical lows.

Swe: GDP and economic sentiment

3 2 1 0 -1 -2 -3 01 02 03 04 05 06 07 08 09 10 11 12

% q/q (RHS) Economic sentiment (NIER)

3 2 1 0 -1 -2 -3

Merchandise exports to different regions Percentage of total merchandise exports, 2010 Germany European Union GIIPS countries France Germany Nordic countries Outside the EU United States China Japan

Source: Statistics Sweden, SEB

Sweden 56 5 5 10 22 44 6 4 1

59 11 10 5 41 7 6 1

Economic Insights

HOUSEHOLD SECTOR AND LABOUR MARKET The household sector has become more concerned over the economic outlook and consumer confidence has declined to levels slightly below the lows from late 2011 driven by labour market concerns. Consumer confidence is expected to recover slightly over next 3-4 months in line with higher international risk appetite. House prices are trending sideways. Prices have increased over the last 3-4 months, but short-term indicators have declined slightly indicating stable prices going forward. Lending to households is trending lower, and residential construction is declining. Employment is still moving higher but at a decreasing pace while unemployment is clearly rising. There is a marked upturn in notices of lay-offs, but other short-term indicators, such as employment plans in the NIER survey and new vacancies are weakening more gradually. We think unemployment will rise to almost 8.5% in the first half of 2013, while employment will decline slightly. Household income and consumption

Year-on-year percentage growth 2011 Consumption Income Savings ratio, % of disp. income 10.2 10.4 10.3 10.5 2.1 3.5 2012 1.5 2.6 2013 2.0 2.1 2014 2.3 2.4

Source: Statistics Sweden, SEB

Economic Insights

INFLATION, CAPACITY UTILISATION AND THE RIKSBANK Inflation has been surprisingly low in the last 3 months driven mainly by lower prices on imported goods. CPIF inflation expected to trend sideways in 2013 around 1% y/y. The Riksbanks estimate is below our own in 2013 after a downward revision in December, due to a lower forecast for energy prices. Headline CPI is expected to decline to -0.5% y/y driven by declining mortgage rate costs. Swedens already low resource utilisation is likely to have declined further in Q4. The Riksbank will cut to 0.75% in February, but it is possible that they will wait until April. The probability for an early move has increased after the latest minutes showing that a 50bps rate cut in December was considered by several board members. The repo rate is expected to stay at 0.75% until the end of 2014. The National Debt Office raised its forecast for central government borrowing for 2013 by SEK ~30bn in 2013 to SEK 55bn (1.5% of GDP) and expect borrowing at this level also in 2014. Our forecast is in line with the NDOs, but risks are skewed to the upside. Also, the Riksbank wants to (temporarily) borrow another SEK 100bn in foreign currency to increase the currency reserve, which will increase borrowing by a further 3% of GDP.

Das könnte Ihnen auch gefallen

- Eastern European Outlook 1503: Baltics and Central Europe Showing ResilienceDokument23 SeitenEastern European Outlook 1503: Baltics and Central Europe Showing ResilienceSEB GroupNoch keine Bewertungen

- Investment Outlook 1412: Slowly, But in The Right DirectionDokument38 SeitenInvestment Outlook 1412: Slowly, But in The Right DirectionSEB GroupNoch keine Bewertungen

- Nordic Outlook 1502: Central Banks and Oil Help Sustain GrowthDokument52 SeitenNordic Outlook 1502: Central Banks and Oil Help Sustain GrowthSEB GroupNoch keine Bewertungen

- Investment Outlook 1409: Bright Outlook For Those Who Dare To Take RisksDokument39 SeitenInvestment Outlook 1409: Bright Outlook For Those Who Dare To Take RisksSEB GroupNoch keine Bewertungen

- CFO Survey 1409: More Cautious View On Business ClimateDokument16 SeitenCFO Survey 1409: More Cautious View On Business ClimateSEB GroupNoch keine Bewertungen

- Insights From 2014 of Significance For 2015Dokument5 SeitenInsights From 2014 of Significance For 2015SEB GroupNoch keine Bewertungen

- Nordic Outlook 1411: Increased Stress Squeezing Global GrowthDokument40 SeitenNordic Outlook 1411: Increased Stress Squeezing Global GrowthSEB GroupNoch keine Bewertungen

- Economic Insights:"Sanctions War" Will Have Little Direct Impact On GrowthDokument3 SeitenEconomic Insights:"Sanctions War" Will Have Little Direct Impact On GrowthSEB GroupNoch keine Bewertungen

- Asia Strategy Focus:Is The Indonesia Rally Over?Dokument17 SeitenAsia Strategy Focus:Is The Indonesia Rally Over?SEB GroupNoch keine Bewertungen

- Investment Outlook 1405: The Road To Reasonable ExpectationsDokument37 SeitenInvestment Outlook 1405: The Road To Reasonable ExpectationsSEB GroupNoch keine Bewertungen

- Nordic Outlook 1408: Continued Recovery - Greater Downside RisksDokument53 SeitenNordic Outlook 1408: Continued Recovery - Greater Downside RisksSEB GroupNoch keine Bewertungen

- Deloitte/SEB CFO Survey Finland 1405: Closing The GapDokument12 SeitenDeloitte/SEB CFO Survey Finland 1405: Closing The GapSEB GroupNoch keine Bewertungen

- Economic Insights: Riksbank To Lower Key Rate, While Seeking New RoleDokument3 SeitenEconomic Insights: Riksbank To Lower Key Rate, While Seeking New RoleSEB GroupNoch keine Bewertungen

- SEB Report: Brazil - Back To Grey Economic Reality After The World CupDokument2 SeitenSEB Report: Brazil - Back To Grey Economic Reality After The World CupSEB GroupNoch keine Bewertungen

- SEB Report: Change of Government in India Creates Reform HopesDokument2 SeitenSEB Report: Change of Government in India Creates Reform HopesSEB GroupNoch keine Bewertungen

- Economic Insights: Subtle Signs of Firmer Momentum in NorwayDokument4 SeitenEconomic Insights: Subtle Signs of Firmer Momentum in NorwaySEB GroupNoch keine Bewertungen

- Nordic Outlook 1405: Recovery and Monetary Policy DivergenceDokument48 SeitenNordic Outlook 1405: Recovery and Monetary Policy DivergenceSEB GroupNoch keine Bewertungen

- Swedish Housing Price Indicator Signals Rising PricesDokument1 SeiteSwedish Housing Price Indicator Signals Rising PricesSEB GroupNoch keine Bewertungen

- Optimism On Swedish Home Prices Fading A LittleDokument1 SeiteOptimism On Swedish Home Prices Fading A LittleSEB GroupNoch keine Bewertungen

- Economic Insights: The Middle East - Politically Hobbled But With Major PotentialDokument5 SeitenEconomic Insights: The Middle East - Politically Hobbled But With Major PotentialSEB GroupNoch keine Bewertungen

- Eastern European Outlook 1403: Continued Recovery in Eastern Europe Despite TurmoilDokument24 SeitenEastern European Outlook 1403: Continued Recovery in Eastern Europe Despite TurmoilSEB GroupNoch keine Bewertungen

- SEB's China Tracker: Top 7 FAQ On China's SlowdownDokument11 SeitenSEB's China Tracker: Top 7 FAQ On China's SlowdownSEB GroupNoch keine Bewertungen

- Investment Outlook 1403: Markets Waiting For Earnings ConfirmationDokument39 SeitenInvestment Outlook 1403: Markets Waiting For Earnings ConfirmationSEB GroupNoch keine Bewertungen

- Economic Insights: Global Economy Resilient To Geopolitical UncertaintyDokument31 SeitenEconomic Insights: Global Economy Resilient To Geopolitical UncertaintySEB GroupNoch keine Bewertungen

- China Financial Index 1403: Better Business Climate AheadDokument6 SeitenChina Financial Index 1403: Better Business Climate AheadSEB GroupNoch keine Bewertungen

- CFO Survey 1403: Improving Swedish Business Climate and HiringDokument12 SeitenCFO Survey 1403: Improving Swedish Business Climate and HiringSEB GroupNoch keine Bewertungen

- Nordic Outlook 1402: Recovery With Shift in Global Growth EnginesDokument49 SeitenNordic Outlook 1402: Recovery With Shift in Global Growth EnginesSEB GroupNoch keine Bewertungen

- Asia Strategy Comment: Tokyo Election May Affect YenDokument3 SeitenAsia Strategy Comment: Tokyo Election May Affect YenSEB GroupNoch keine Bewertungen

- SEB Report: More Emergency Actions Needed in UkraineDokument2 SeitenSEB Report: More Emergency Actions Needed in UkraineSEB GroupNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- RAMS EvaluationDokument3 SeitenRAMS EvaluationAnandu AshokanNoch keine Bewertungen

- Importance of Accounting and Finance For IndustryDokument16 SeitenImportance of Accounting and Finance For IndustryDragosNoch keine Bewertungen

- JDF Procurement Expenditure Policy (G4 & QM)Dokument27 SeitenJDF Procurement Expenditure Policy (G4 & QM)Jez MusikNoch keine Bewertungen

- Renewallist Postmatric 2012-13 PDFDokument472 SeitenRenewallist Postmatric 2012-13 PDFImraz khanNoch keine Bewertungen

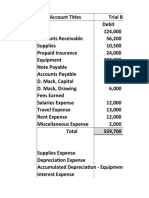

- Trial Balance Accounting RecordsDokument8 SeitenTrial Balance Accounting RecordsKevin Espiritu100% (1)

- ILOCOS SUR POLYTECHNIC STATE COLLEGE MODULE ON SMALL BUSINESSDokument6 SeitenILOCOS SUR POLYTECHNIC STATE COLLEGE MODULE ON SMALL BUSINESSWynnie RondonNoch keine Bewertungen

- 21 Cost Volume Profit AnalysisDokument31 Seiten21 Cost Volume Profit AnalysisBillal Hossain ShamimNoch keine Bewertungen

- Mcpe ProgramDokument6 SeitenMcpe ProgramdoparindeNoch keine Bewertungen

- Designing A Microsoft SharePoint 2010 Infrastructure Vol 2Dokument419 SeitenDesigning A Microsoft SharePoint 2010 Infrastructure Vol 2Angel Iulian PopescuNoch keine Bewertungen

- Trading Wti and Brent 101Dokument7 SeitenTrading Wti and Brent 101venkateswarant0% (1)

- Guidelines for Granting IT Course PermitsDokument20 SeitenGuidelines for Granting IT Course Permitsanislinek15Noch keine Bewertungen

- Configure MSS (WDA) Settings in SAP NetWeaver BCDokument6 SeitenConfigure MSS (WDA) Settings in SAP NetWeaver BCThandile FikeniNoch keine Bewertungen

- Unit 32 QCF Quality Management in BusinessDokument6 SeitenUnit 32 QCF Quality Management in BusinessdrakhtaraliNoch keine Bewertungen

- Postpaid Postpaid Plans & ServicesDokument8 SeitenPostpaid Postpaid Plans & ServicesTrinnah Rose ReyesNoch keine Bewertungen

- Entry Test Sample Paper ForDokument5 SeitenEntry Test Sample Paper ForShawn Parker100% (3)

- 100 Best Businesses FreeDokument34 Seiten100 Best Businesses Freemally4dNoch keine Bewertungen

- Boost Your Profile in PrintDokument45 SeitenBoost Your Profile in PrintJaya KrishnaNoch keine Bewertungen

- EPU GuidelineDokument11 SeitenEPU GuidelineHani Adyanti AhmadNoch keine Bewertungen

- RM Doberman ContractDokument8 SeitenRM Doberman Contractapi-234521777Noch keine Bewertungen

- Halbwachs Collective MemoryDokument15 SeitenHalbwachs Collective MemoryOana CodruNoch keine Bewertungen

- Start-Ups LeadDokument275 SeitenStart-Ups Leadsachin m33% (3)

- Tax Invoice SummaryDokument1 SeiteTax Invoice SummaryAkshay PatilNoch keine Bewertungen

- Strategic Financial Management 1 70Dokument70 SeitenStrategic Financial Management 1 70Tija NaNoch keine Bewertungen

- Cooperative Training ModuleDokument38 SeitenCooperative Training ModuleAndreline AnsulaNoch keine Bewertungen

- Bosch Quality CertificationDokument7 SeitenBosch Quality CertificationMoidu ThavottNoch keine Bewertungen

- ERC Non-Conformance Corrective ProcedureDokument13 SeitenERC Non-Conformance Corrective ProcedureAmanuelGirmaNoch keine Bewertungen

- Merits and DemeritsDokument2 SeitenMerits and Demeritssyeda zee100% (1)

- TRACKING#:89761187821: BluedartDokument2 SeitenTRACKING#:89761187821: BluedartStone ColdNoch keine Bewertungen

- Kalapatti Project - Apartment - 24 Flats: Sno Description UOM Option 1Dokument15 SeitenKalapatti Project - Apartment - 24 Flats: Sno Description UOM Option 1Vishnuhari DevarajNoch keine Bewertungen