Beruflich Dokumente

Kultur Dokumente

Final Project On General Study On Indian Eqiuty Market

Hochgeladen von

Sagar KavaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Final Project On General Study On Indian Eqiuty Market

Hochgeladen von

Sagar KavaCopyright:

Verfügbare Formate

General Study On Indian Equity Market

CHAPTER 1 INTRODUCTION TO INDIAN MARKET

1.1 Introduction 1.2 Objective of Study 1.3 Share 1.4 Stock Exchange 1.5 Types of Market

General Study On Indian Equity Market

CHAPTER 1 INTRODUCTION TO INDIAN MARKET

1.1 Introduction To Indian Markets

Of all the modern service institutions, stock exchanges are perhaps the industrial revolution, as the size of business enterprises grew, it was no longer possible for proprietors or partnerships to raise colossal amount of money required for undertaking large entrepreneurial ventures. Such huge requirement of capital could only be met by the participation of a very large number of investors; their numbers running into hundreds, thousands and even millions, depending on the size of business venture. In general, small time proprietors, or partners of a proprietary or partnership firm, are likely to find it rather difficult to get out of their business should they for some reason wish to do so. This is so because it is not always possible to find buyers for an entire business or a part of business, just when one wishes to sell it. Similarly, it is not easy for someone with savings, especially with a small amount of savings, to readily find an appropriate business opportunity, or a part thereof, for investment. These problems will be even more magnified in large proprietorships and partnerships. Nobody would like to invest in such partnerships in the first place, since once invested, their savings would be very difficult to convert into cash. And most

2

General Study On Indian Equity Market people have lots of reasons, such as better investment opportunity, marriage, education, death, health and so on for wanting to convert their savings into cash. Clearly then, big enterprises will be able to raise capital from the public at large only if there were some mechanism by which the investors could purchase or sell their share of business as and they wished to do so. This implies that ownership in business has to be broken up into a larger number of small units, such that each unit may be independently & easily bought and sold without hampering the business activity as such. Also, such breaking of business ownership would help mobilize small savings in the economy into entrepreneurial ventures. This end is achieved in a modern business through the mechanism of shares.

1.2 Objective of Study a) To learn about Indian Stock Market b) To learn about Its various aspects c) To learn about benefits of investing in Indian Stock Market d) To learn how to invest in Indian Stock Market e) To measure market movements f) Proper understanding and analysis of share market firm

General Study On Indian Equity Market

1.3 Share:A share represents the smallest recognized fraction of ownership in a publicly held business. Each such fraction of ownership is represented in the form of a certificate known as a share certificate. The breaking up of total ownership of a business into small fragments, each fragment represented by a share certificate, enables them to be easily bought and sold.

1.4 Stock exchange:The institution where this buying and selling of shares essentially takes place is the Stock Exchange. In the absence of stock exchanges, i.e. Institutions where small chunks of businesses could be traded, there would be no modern business in the form of publicly held companies. Today, owing to the stock exchanges, one can be part owners of one company today and another company tomorrow; one can be part owners in several companies at the same time; one can be part owner in a company hundreds or thousands of miles away; one can be all of these things. Thus by enabling the convertibility of ownership in the product market into financial assets, namely shares, stock exchanges bring together buyers and sellers (or their representatives) of fractional ownerships of companies. And for that very reason, activities relating to stock exchanges are also appropriately enough, known as stock market or security market. Also a stock exchange is distinguished by a specific locality and characteristics of its own; mostly a stock exchange is also distinguished by a physical location and characteristics of its own. In fact, according to H.T.Parekh, the earliest location of the Bombay Stock Exchange, which for a long period was known as the native share and stock brokers association, was probably under a tree around 1870!The stock exchanges are the exclusive centers for the trading of securities. The regulatory framework encourages this by virtually banning trading of securities outside exchanges. Until recently, the area of operation/ jurisdiction of exchange were specified at the time of its recognition, which in effect precluded competition among the exchanges. These are called regional exchanges. In order to provide an opportunity to investors to invest/ trade in the securities of local companies, it is mandatory foe the companies, wishing to list their securities, to list on the regional stock exchange nearest to their registered office.

General Study On Indian Equity Market

1.5 Types of Markets:There are two types of market in India:A) Money Market:Money market is a market for debt securities that pay off in the short term usually less than one year, for example the market for 90-days treasury bills. This market encompasses the trading and issuance of short term non equity debt instruments including treasury bills, commercial papers, bankers acceptance, certificates of deposits, etc other word we can also say that the Money Market is basically concerned with the issue and trading of securities with short term maturities or quasi-money instruments. The Instruments traded in the moneymarket are Treasury Bills, Certificates of Deposits (CDs), Commercial Paper (CPs), Bills of Exchange and other such instruments of short-term maturities (i.e. not exceeding 1 year with regard to the original maturity) B) Capital Market:Capital market is a market for long-term debt and equity shares. In this market, the capital funds comprising of both equity and debt are issued and traded. This also includes private placement sources of debt and equity as well as organized markets like stock exchanges.

Capital market can be divided into Primary and Secondary Markets. 1 Primary Market 2 Secondary Market Primary Market:In the primary market, securities are offered to public for subscription for the purpose of raising capital or fund. Secondary market is an equity trading avenue in which already existing/pre- issued securities are traded amongst investors. Secondary market could be either auction or dealer market. While stock exchange is the part of an auction market, Over-the-Counter (OTC) is a part of the dealer market. In addition to the traditional sources of capital from family and friends, startup firms are created and nurtured by Venture Capital Funds

5

General Study On Indian Equity Market and Private Equity Funds. According to the Indian Venture Capital Association Yearbook (2003), investments of $881million were injected into 80 companies in 2002, and investments of $470 million were injected into 56 companies in 2003. The firms which received these investments wiredrawn from a wide range of industries,including finance, consumer goods and health. The growth of the venture capital and private equity mechanisms in India is critically linked to their track record for successful exits. Investments by these funds only commenced in recent years, and we are seeing a rapid buildup in a full range of channels for exit, with a mix of profitable and unprofitable outcomes. This success with Exit suggests that investors will allocate increased resources to venture funds and private equity funds operating in India, who will (in turn) be able to fund the creation of new firms.

Secondary Market:Secondary Market refers to a market where securities are traded after being initially offered to the public in the primary market and/or listed on the Stock Exchange. Majority of the trading is done in the secondary market. Secondary market comprises of equity markets and the debt markets. For the general investor, the secondary market provides an efficient platform for trading of his securities. For the management of the company, Secondary equity markets serve as a monitoring and control conduitby facilitating value-enhancing control activities, enabling implementation of incentive-based management contracts, and aggregating information (via price discovery) that guides management decisions.

SOURCES - WWW.EQUITYMASTER.COM WWW.FINANCIALEXPRESS.COM

General Study On Indian Equity Market

CHAPTER 2 RESEARCH METHODOLOGY

2.1 Meaning Of Research 2.2 Types Of Research 2.3 Research Objective 2.4 Data Analysis

General Study On Indian Equity Market

CHAPTER 2 RESEARCH METHODOLOGY

2.1 Meaning of Research:Research is the application of scientific method to add to the personal pool of knowledge. Financial research is a systematic design collection & analysis of data & finding relevance to specific financial aspect of the company. Data are fact figures & other relevant materials for the study and analysis

2.2 Types of Research:-

Data Is Primarily Of Two Kinds:A) Primary Data B) Secondary Data

General Study On Indian Equity Market

a) Primary data sources

Primary data can be collected through the questionnaire. Which contain the different question about the investment behavior and investment strategy. Primary data sources are very helpful for research. This provides information related to the investors investment behavior & investment strategy.

b) Secondary data sources

Secondary data can be collected through e-learning. It provides information regarding Geojit Financial Services Limited

2.3 Research Objectives:Main Objective of the Research is The objective of my research is TO STUDY INVESTOR INVESTMENT BEHAVIOR IN STOCK MARKET & SUGGESTING GOOD INVESTMENT STRATEGY

OTHER OBJECTIVES a) To study the investment habit of the people in the stock market. b) To know about the peoples preference for investment whether investment or trading c) To understand the frequency of investment in the market d) To analyze from total saving how much portion of amount people invest in stock market e) To understand how much people invest at a time f) To know that for how much period people invest in stock market g) To understand the expected return of people from investment

9

General Study On Indian Equity Market

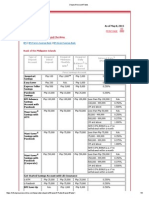

2.4 Data Analysis:1. From how many years you are in the stock market? 0-2 year 4-6 year 2-4 year more than 6 year

No. years 0-2 year 2-4 year 4-6 year

of No. of persons 21 24 9 6

more than 6 year

45% 40% 35% 30% 25% 20% 15% 10% 5% 0%

40% 35%

15% 10%

0-2 YEAR

2-4 YEAR

4-6 YEAR

MORE THAN 6 YEAR

As shown above 35 % persons of my study have experience of about 2 years, about 40 % persons of my study have experience about 2 to 4 years, 15 % persons of my study have experience about 4 to 6 years, about 10 % persons of my study have experience of more than 6 years in stock market.

10

General Study On Indian Equity Market

2. How much investment have you made in the market? (Approximate) 0-2 lakh 4-6 lakh 2-4 lakh more than 6 lakh

Investment 0-2 lack 2-4 lack 4-6 lack more than 6 lack

No. persons 30 18 9 3

of

60% 50% 50% 40% 30% 30% 20% 10% 0% 0-2 LAKH 2-4 LAKH 4-6 LAKH MORE THAN 6 LAKH 15% 5%

As per my research about 50 % persons would like to invest up to 2 lack while 30 % persons would like to invest 2 to 4 lack and about 15 % persons would like to invest 4 to 6 lack while only 5 % persons would like to invest more than 6 lack. So company should focus on those customers who would like to invest more in stock market.

11

General Study On Indian Equity Market 3. Who brings you in stock market?

Friends & Relativ Advertise

News paper Mega public issue

Source Friends & Relative News paper Advertise Mega public issue

No. persons 42 12 0 6

of

80% 70% 60% 50% 40% 30% 20% 10% 0%

70%

20% 10% 0% FRIENDS & RELATIVE NEWSPAPER & MAGAZINE ADVERTISE MEGA PUBLIC ISSUE

As per above chart about 70 % persons would like to invest in stock market as per opinion of their friends and relatives while 20 % persons would like to invest as per newspaper and magazines and persons do not like to invest through advertising and about 10 % persons would like to invest as per mega public issue. So it can be conclude that most of the people invest as per opinion of their friends and relatives.

12

General Study On Indian Equity Market 4. How frequently do you invest in the market?

Weekly Quarterly

Monthly Half yearly

Frequency investment Weekly Monthly Quarterly Half yearly

of No. persons 24 18 8 10

of

45% 40% 35% 30% 25% 20% 15% 10% 5% 0%

40% 30%

13.33%

16.67%

WEEKLY

MONTHLY

QUARTERLY

HALF YEARLY

As per my research about 40 % persons would like to invest weekly in stock market while 30% persons would like to invest monthly in stock market and about 13.33% persons would like to invest quarterly in stock market while about 16.67% persons would like to invest half yearly in stock market.

13

General Study On Indian Equity Market 5. From total saving how much portion of amount you invest in stock market? 10-20% 60-80% 20-40% 80-100% 40-60%

Investment stock market 10-20% 20-40% 40-60% 60-80% 80-100%

in No. of persons 10 24 18 4 4

45.00% 40.00% 35.00% 30.00% 25.00% 20.00% 15.00% 10.00% 5.00% 0.00% 10-20 % 16.66%

40%

30%

6.67%

6.67%

20-40%

40-60%

60-80%

80-100%

As per above chart about 16.66% persons invest 10 to 20% of their saving while about 40% persons invest 20 to 40% of their saving and about 30% persons invest 40 to 60% of their saving and about 6.67% persons invest 60 to 80% of their saving while about 6.67% persons invest 80 to 100% of their saving.

14

General Study On Indian Equity Market 6. How much do you invest at a time? (In1000Rs.) Up to 5 10-15 20-25 5-10 15-20 More than 25

Up to 5 5-10 10-15 15-20 20-25 More than 25

20 20 10 2 2 6

40.00% 35.00% 30.00% 25.00% 20.00% 15.00% 10.00% 5.00% 0.00% to 5

33.34%

33.34%

16.66% 10% 3.33% Up 5-10 10-15 15-20 3.33% 20-25 MORE THAN 25

As per my research about 33.34% persons invest up to 5000 Rs. At a time and about 33.345 persons invest 5000 to 10000 Rs. At a time while about 16.66% persons invest 10000 to 15000 Rs. At a time and about 3.33% persons invest 15000 to 20000 Rs. At a time while another 3.33% persons would like to invest 20000 to 25000 Rs. At a time and about 10% persons invest more than 25000 Rs. At a time.

15

General Study On Indian Equity Market

7. How much return you expect on your investment decision? 8-12% 16-20% 12-16% More than 20%

Expected return 8-12% 12-16% 16-20% More than 20%

No. of persons 18 11 16 15

35% 30% 30% 25% 20% 15% 10% 5% 0% 8-12% 12-16% 16-20% MORE THAN 20% 18.33% 26.67% 25%

As per my research 30% persons expect 8 to 12% return while 18.33% persons expect 12 to 16% return and about 26.67% expect 16 to 20% return while 25% persons expect more than 2

16

General Study On Indian Equity Market

8. On what basis you take your investment decision?

Brokers advise Tips, paid service Companys news, Result

Market situation News paper, Maga Own study

Base Brokers advise Market situation Tips, paid service News paper, Magazine Companys news, Result Own study

No.of persons 12 12 6 8 6 16

Brokers advise 20% 26.67% 20% Market situation 20% Tips, paid service 10% 20% 10% News paper, Magazine 13.33% Companys news, Result 10% Own study 26.67% 13.33% 10%

Above chart shown the various factors and its impact on investment and how investor consider such factors while investing. The chart suggest that people much like to invest according to their own study of stock m

17

General Study On Indian Equity Market 9. From below mentioned share price range which range do you prefer for Buying share? Below Rs.50 Rs100-500 Rs.50-10 More than Rs.500

Price range Below Rs.50 Rs.50-100 Rs100-500 More than Rs.500

No.of persons 6 26 20 8

50% 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% Rs.50-100 More than Rs.500 13.33% 10% 33.33% 43.34%

Above chart shows the price range preferred by various persons. From the above chart it can be conclude that majority of people prefer the price of share from 50 to 10

18

General Study On Indian Equity Market For preparing the project report, I have visited the Businessdictinory.com and Investorword.com from last many weeks wherein I put my basic question related to my project and I got many review from this and then I research the information and data which I used for analysis. I have filled up the questionnaire with the customers of Businessdictinory.com and

Investorword.com. The blend of learning and knowledge acquired during my practical studies at the above websites is presented in this project report. The project report starts with the research objectives, I have used simple random sampling method for my research and the sources for data collection is both primary sources and secondary sources., after this I have shown the data analysis of each question and for analysis I have used percentile method. I hope that the information incorporated in this project report would be appreciated as I have put in may be efforts in leaving no stone unturned as I consider it to be true, fair and relevant in its content and context to the best of my knowledge and ability.

Sources : www.businessdictionary.com www.investorword.com

CHAPTER 3

19

General Study On Indian Equity Market

DATA COLLECTION

3.1 BSE 3.2 NSE 3.3 NSE Family 3.4 Listing of Security 3.5 Membership Administration 3.6 Dematerlization 3.7 Investment 3.8 Broker & Sub Broker 3.9 Auction

CHAPTER: 3

20

General Study On Indian Equity Market

DATA COLLECTION

3.1 Bombay Stock Exchange Of India Limited:Bombay Stock Exchange Limited is the oldest stock exchange in Asia with a rich heritage. Popularly known as "BSE", it was established as "The Native Share & Stock Brokers Association" in 1875. It is the first stock exchange in the country to obtain permanent recognition in 1956 from the Government of India under the Securities Contracts (Regulation) Act, 1956. The Exchange's pivotal and pre-eminent role in the development of the Indian capital market is widely recognized and its index, SENSEX, is tracked worldwide. Earlier an Association of Persons (AOP), the Exchange is now a demutualised and corporative entity incorporated under the provisions of the Companies Act, 1956, pursuant to the BSE (Corporatization and Demutualization) Scheme, 2005 notified by the Securities and Exchange Board of India (SEBI). With demutualization, the trading rights and ownership rights have been de-linked effectively addressing concerns regarding perceived and real conflicts of interest. The Exchange is professionally managed under the overall direction of the Board of Directors. The Board comprises eminent professionals, representatives of Trading Members and the Managing Director of the Exchange. The Board is inclusive and is designed to benefit from the

21

General Study On Indian Equity Market

participation of market intermediaries. In terms of organization structure, the Board formulates larger policy issues and exercises over-all control. The committees constituted by the Board are broad-based. The day-to-day operations of the Exchange are managed by the Managing Director and a management team of professionals. The Exchange has a nation- wide reach with a presence in 417 cities and towns of India. During the year 2004-2005, the trading volumes on the Exchange showed robust growth. The Exchange provides an efficient and transparent market for trading in equity, debt instruments and derivatives. The BSE's On Line Trading System (BOLT) is a proprietary system of the Exchange and is BS 7799-22002 certified. The surveillance and clearing & settlement functions of the Exchange are ISO 9001:2000 certified. Bombay Stock Exchange Limited (BSE) which was founded in 1875 with six brokers has now grown into a giant institution with over 874 registered Broker-Members spread over 380 cities across the country. Today, BSE's Wide Area Network (WAN) connecting over 8000 BSE Online Trading (BOLT) System Trader Work Stations (TWS) is one of the largest of its kind in the country. With a view to provide efficient and integrated services to the investing public through the members and their associates in the operations pertaining to the Exchange, Bombay Stock Exchange Limited (BSE) has set up a unique Member Services and Development to attend to the problems of the Broker-Members. Member Services and Development Department is the single point interface for interacting with the Exchange Administration to address to Members' issues. The Department takes care of various problems and constraints faced by the Members in various products such as Cash, Derivatives, Internet Trading, and Processes such as Trading, Technology, Clearing and Settlement, Surveillance and Inspection, Membership, Training, Corporate Information, etc.

Vision of BSE:22

General Study On Indian Equity Market Emerge as the premier Indian stock exchange byEstablishing global benchmarks" OBJECTIVES OF BSE:The BSE SENSEX is the benchmark index with wide acceptance among individual investors, institutional investors, foreign investors, foreign investors and fund managers. The objectives of the index are:A. To measure market movements:Given its long history and its wide acceptance, no other index matches the BSE SENESX in the reflecting market movements and sentiments. SENSEX is widely used to describe the mood in the Indian stock markets. B. Benchmark for funds performance:The inclusion of blue chip companies and the wide and balanced industry Representation in the SENSEX makes it the ideal benchmark for fund managers to compare the performance of their funds. C. For index based derivatives products:Institutional investors, money managers and small investors, all refer to the BSE SENSEX for their specific purposes. The BSE SENSEX is in effect the proxy for the Indian stock markets. Since SENSEX comprises of the leading companies in all the significant sectors in the economy, we believe that it will be the most liquid contract in the Indian market and will garner a predominant market share.

COMMODITY EXCHANGES:-

The three exchanges are:

23

General Study On Indian Equity Market 1. National Commodity & Derivatives Exchange Limited (NCDEX) 2. Multi Commodity Exchange of India Limited (MCX) 3. National Multi-Commodity Exchange of India Limited (NMCEIL) All the exchanges have been set up under overall control of Forward Market Commission (FMC) of Government of India. D. National Commodity & Derivatives Exchange Limited (NCDEX):National Commodity & Derivatives Exchange Limited (NCDEX) located in Mumbai is a public limited company incorporated on April 23, 2003 under the Companies Act, 1956 and had commenced its operations on December 15, 2003.This is the only commodity exchange in the country promoted by national level institutions. It is promoted by ICICI Bank Limited, Life Insurance Corporation of India (LIC), National Bank for Agriculture and Rural Development (NABARD) and National Stock Exchange of India Limited (NSE). It is a professionally managed online multi commodity exchange. NCDEX is regulated by Forward Market Commission and is subjected to various laws of the land like the Companies Act, Stamp Act, Contracts Act, Forward Commission (Regulation) Act and various other legislations. E. Multi Commodity Exchange of India Limited (MCX):Headquartered in Mumbai Multi Commodity Exchange of India Limited (MCX), is an independent and de-metalized exchange with a permanent recognition from Government of India. Key shareholders of MCX are Financial Technologies (India) Ltd., State Bank of India, Union Bank of India, Corporation Bank, Bank of India and Canada Bank. MCX facilitates online trading, clearing and settlement operations for commodity futures markets across the country. MCX started offering trade in November 2003 and has built strategic alliances with Bombay Bullion Association, Bombay Metal Exchange, Solvent Extractors Association of India, Pulses Importers Association and Shetkari Sanghatana.

24

General Study On Indian Equity Market

F. National Multi-Commodity Exchange of India Limited (NMCEIL):National Multi Commodity Exchange of India Limited (NMCEIL) is the first demutualized, Electronic Multi-Commodity Exchange in India. On 25th July, 2001, it was granted approval by the Government to organize trading in the edible oil complex. It has operationalised from November 26, 2002. It is being supported by Central Warehousing Corporation Ltd., Gujarat State Agricultural Marketing Board and Neptune Overseas Limited. It got its recognition in October 2000. Commodity exchange in India plays a Important role where the prices of any commodity are not fixed, in an organized way. Earlier only the buyer of produce and its seller in the market judged upon the prices. Others never had a say. Today, commodity exchanges are purely speculative in nature. Before discovering the Price, they reach to the producers, end-users, and even the retail investors, at a grassroots level. It brings a price transparency and risk management in the vital market. A big difference between a typical auction, where a single auctioneer announces the bids and the Exchange is that people are not only competing to buy but also to sell. By Exchange rules and by law, no one can bid under a higher bid, and no one can offer to sell higher than someone elses lower offer. That keeps the market a efficient as possible, and keeps the traders on their toes to make sure no one gets the purchase or sale before they do.

Sources:-www.bseindia.com

3.2 NSE National Stock Exchange Of India :25

General Study On Indian Equity Market

Capital market reforms in India have outstripped the process of liberalization in most other sectors of the economy. However, the creation of an independent capital market regulator was the initiation of this reform process. After the formation of the Securities Market regulator, the Securities and Exchange Board of India (SEBI), attention were drawn towards the inefficiencies of the bourses and the need was felt for better regulation, discipline and accountability. A Committee recommended the creation of a 2nd stock exchange in Mumbai called the "National Stock Exchange". The Committee suggested the formation of an exchange which would provide investors across the country a single, screen based trading platform, operated through a VSAT network. It was on this recommendation that setting up of NSE as a technology driven exchange was conceptualized. NSE has set up its trading system as a nation-wide, fully automated screen based trading system. It has written for itself the mandate to create a world-class exchange and use it as an instrument of change for the industry as a whole through competitive pressure. NSE was incorporated in 1992 and was given recognition as a stock exchange in April 1993. It started operations in June 1994, with trading on the Wholesale Debt Market Segment. Subsequently it launched the Capital Market Segment in November 1994 as a trading platform for equities and the Futures and Options Segment in June 2000 for various derivative instruments.

Objectives of NSE:A. Establishing a nationwide trading facility for all types of securities;

26

General Study On Indian Equity Market

B. Ensuring equal access to investors all over the country through an appropriate communication network; C. Providing a fair, efficient and transparent securities market using electronic trading system; D. Enabling shorter settlement cycles and book entry settlements; and E. Meeting international benchmarks and standards. NSE has been able to take the stock market to the doorsteps of the investors. The technology has been harnessed to deliver the services to the investors across the country at the cheapest possible cost. It provides a nation-wide, screen-based, automated trading system, with a high degree of transparency and equal access to investors irrespective of geographical location. The high level of information dissemination through on-line system has helped in integrating retail investors on a nation-wide basis. The standards set by the exchange in terms of market practices, products, technology and service standards have become industry benchmarks and are being replicated by other market participants. Within a very short span of time, NSE has been able to achieve all the objectives for which it was set up. It has been playing a leading role as a change agent in transforming the Indian Capital Markets to its present form.

The Exchange provides trading in 3 different segments viz. A. Wholesale debt market (WDM) B. Capital market (CM) segment and C. The futures & options (F&O) segment.

A. Wholesale Debt Market:-

27

General Study On Indian Equity Market The Wholesale Debt Market segment provides the trading platform for trading of a wide range of debt securities which includes State and Central Government securities, T-Bills, PSU Bonds, Corporate Debentures, CPs, and CDs etc. However, along with these financial instruments, NSE has also launched various products (e.g. FIMMDA-NSE MIBID/MIBOR) owing to the market need. A reference rate is said to be an accurate measure of the market price. In the fixed income market, it is the interest rate that the market respects and closely matches. In response to this, NSE started computing and disseminating the NSE Mumbai Inter-bank Bid Rate (MIBID) and NSE Mumbai Inter- Bank Offer Rate (MIBOR). Owing to the robust methodology of computation of these rates and its extensive use, this product has become very popular among the market participants. Keeping in mind the requirements of the banking industry, FIs, MFs, insurance companies, who have substantial investments in sovereign papers, NSE also started the dissemination of its yet another product, the Zero Coupon Yield Curve. This helps in valuation of sovereign securities across all maturities irrespective of its liquidity in the market. The increased activity in the government securities market in India and simultaneous emergence of MFs (Gilt MFs) had given rise to the need for a well Defined bond index to measure the returns in the bond market. NSE constructed such an index the, NSE Government Securities Index. This index provides a benchmark for portfolio management by various investment managers and gilt funds.

B. Capital Market Segment:The Capital Market segment offers a fully automated screen based trading system, known as the National Exchange for Automated Trading (NEAT) system. This operates on a price/time priority basis and enables members from across the country to trade with enormous ease and efficiency. Various types of securities e.g. equity shares, warrants, debentures etc. are traded on this system. The average daily turnover in the CM Segment of the Exchange during 2008-09 was nearly Rs. 4,506 crs. NSE started trading in the equities segment (Capital Market segment) on November 3, 1994 and within a short span of 1 year became the largest exchange in India in terms of volumes transacted. The Equities section provides you with an insight into the equities segment of NSE and also provides realtime quotes and statistics of the equities market. In-depth information regarding

28

General Study On Indian Equity Market listing of securities, trading systems & processes, clearing and settlement, risk management, trading statistics etc are available here.

C. Future & Option Segment:Futures & Options segment of NSE provides trading in derivatives instruments like Index Futures, Index Options, Stock Options, Stock Futures and Futures on interstates. Though only four years into its operations, the futures and options segment of NSE has made a mark for itself globally. In the Futures and Options segment, trading in Nifty and CNX IT index and 53 single stocks are available. futures and options would be available on 118 single stocks.

3.3 NSE Family:A. NSCCL:-

National Securities Clearing Corporation Ltd. (NSCCL), a wholly-owned subsidiary of NSE, was incorporated in August 1995 and commenced clearing operations in April 1996. It was the first clearing corporation in the country to provide notation/settlement guarantee that revolutionized the entire concept of settlement system in India. It was set up to bring and 9 sustain confidence in clearing and settlement of securities; to promote and maintain short and consistent settlement cycles; to provide counter-party Risk guarantee, and to operate a tight risk containment system. It carries out the clearing and settlement of the trades executed in the equities and derivatives segments of the NSE. It operates a well-defined settlement cycle and there are no deviations or deferments from this cycle. It aggregates trades over a trading period T, nets the positions to determine the liabilities of members and ensures movement of funds and securities to meet respective liabilities. It also operates a Subsidiary General Ledger (SGL) for settling trades in government securities for its

29

General Study On Indian Equity Market constituents. It has been managing clearing and settlement functions since its inception without a Single failure or clubbing of settlements. It assumes the counter-party risk of each member and guarantees financial settlement. It has tied up with 10 Clearing Banks viz., Canara Bank, HDFC Bank, IndusInd Bank, ICICI Bank, UTI Bank, Bank of India, IDBI Bank and Standard Chartered Bank for funds settlement while it has direct connectivity with depositories for settlement of securities. It has also initiated a working capital facility in association with the clearing banks that helps clearing members to meet their working capital requirements. Any clearing bank interested in utilizing this facility has to enter into an agreement with NSCCL and with the clearing member. NSCCL has also introduced the facility of direct payout to clients account on both the depositories. It ascertains from each clearing member, the beneficiary account details of their respective clients who are due to receive pay out of securities. It has provided its members with a front-end for creating the file through which the information is provided to NSCCL. Based on the information received from members, it sends payout instructions to the depositories, so that the client receives the pay out of securities directly to their accounts on the pay-out day. NSCCL currently settles trades under T+2 rolling settlement. It has the credit of continuously upgrading the clearing and settlement procedures and has also brought Indian financial markets in line with international markets. It has put in place online real-time monitoring and surveillance system to keep track of the trading and clearing members outstanding positions and each member is allowed to trade/operate within the pre-set limits fixed according to the funds available with the Exchange on behalf of the member. The online surveillance mechanism also generates various alerts/reports on any price/volume movements of securities

not in line with the normal trends/patterns.

B. IISL:30

General Study On Indian Equity Market

India Index Services and Products Limited (IISL), a joint venture of NSE and Credit Rating Information Services of India Limited (CRISIL), was set up in May 1998 to provide indices and index services. It has a consulting and licensing agreement with Standard and Poor's (S&P), the world's leading provider of invest able equity indices, for co-branding equity indices. IISL pools the index development efforts of NSE and CRISIL into a coordinated whole. It is India's first specialized company which focuses upon the index as a core product. It provides a broad range of products and professional index services. It maintains over 70 equity indices comprising broad based benchmark indices, sectoral indices and customized indices. Many investment and risk management products based on IISL indices have been developed in the recent past. These include index based derivatives on NSE, a number of index funds and India's first exchange traded fund.

C. NSDL:-

Prior to trading in a dematerialized environment, settlement of trades required moving the securities physically from the seller to the ultimate buyer, through the seller's broker and buyer's broker, which involved lot of time and the risk of delay somewhere along the chain. Further, the system of transfer of ownership was grossly inefficient as every transfer involved physical movement of paper to the issuer for registration, with the change of ownership being evidenced by an endorsement on the security certificate. In many cases, the process of transfer took much longer than stipulated in the then regulations. Theft, forgery,

31

General Study On Indian Equity Market mutilation of certificates and other irregularities were rampant. All these added to the costs and delays in settlement and restricted liquidity. To obviate these problems and to promote dematerialization of securities, NSE joined hands with UTI and IDBI to set up the first depository in India called the "National Securities Depository Limited" (NSDL). The depository system gained quick acceptance and in a very short span of time it was able to achieve the objective of eradicating paper from the trading and settlement of securities, and was also able to get rid of the risks associated with fake/forged/stolen/bad paper. Dematerialized delivery today constitutes almost 100% of the total delivery based settlement.

D. NSE.IT:-

NSE.IT Limited, a 100% technology subsidiary of NSE, was incorporated in October 1999 to provide thrust to NSEs technology edge, concomitant with its overall goal of harnessing latest technology for optimum business use. It provides the securities industry with technology that ensures transparency and efficiency in the trading, clearing and risk management systems. Additionally, NSE.IT provides consultancy services in the areas of data warehousing, internet and business continuity plans. Amongst various products launched by NSE.IT are NEAT XS, a Computer-ToComputer Link (CTCL) order routing system, NEAT iXS, an internet trading system and Promos, professional brokers back office system. NSE.IT also offers an e learning oral, invarsitywww.finvarsity.com) dedicated to the finance sector. The site is powered by Enlister - a learning management system developed by NSE.IT jointly with an e-learning partner. New initiatives include payment gateways, products for derivatives segments and Enterprise Management Services (EMSs).

32

General Study On Indian Equity Market E. NCDEX:NSE joined hand with other financial institutions in India viz., ICICI Bank, NABARD, LIC, PNB, CRISIL, Canara Bank and IFFCO to promote the NCDEX which provide a platform for market participants to trade in wide spectrum of commodity derivatives. Currently NCDEX facilitates trading of 37 agro based commodities, 1 base metal and 2 precious metal.

3.4 listing Of Securities:The stocks, bonds and other securities issued by issuers require listing for providing liquidity to investors. Listing means formal admission of a security to the trading platform of the Exchange. It provides liquidity to investors without compromising the need of the issuer for capital and ensures effective monitoring of conduct of the issuer and trading of the securities in the interest of investors. The issuer wishing to have trading privileges for its securities satisfies listing requirements prescribed in the relevant statutes and in the listing regulations of the Exchange. It also agrees to pay the listing fees and comply with listing requirements on a continuous basis. All the issuers who list their securities have to satisfy the corporate governance requirement framed by regulators. A. Listing Criteria:The Exchange has laid down criteria for listing of new issues by companies, companies listed on other exchanges, and companies formed by amalgamation/restructuring, etc. in conformity with the Securities Contracts (Regulation) Rules, 1957 and directions of the Central Government and the Securities and Exchange Board of India (SEBI). The criteria include minimum paid-up capital and market capitalization, project appraisal, company/promoter's track record, etc. The issuers of securities are required to adhere to provisions of the Securities Contracts (Regulation) Act, 1956, the Companies Act, 1956, the Securities and Exchange Board of India Act, 1992, and the rules, circulars, notifications, guidelines, etc. prescribed there under.

33

General Study On Indian Equity Market B. Listing Agreement:All companies seeking listing of their securities on the Exchange are required to enter into a listing agreement with the Exchange. The agreement specifies all the requirements to be continuously complied with by the issuer for continued listing. The Exchange monitors such compliance. Failure to comply with the requirements invites suspension of trading, or withdrawal/delisting, in addition to penalty under the Securities Contracts (Regulation) Act, 1956. The agreement is being increasingly used as a means to improve corporate governance C. Benefits of Listing on NSE:a. NSE provides a trading platform that extends across the length and breadth of the country. Investors from approximately 345 centers can avail of trading facilities on the NSE trading network. Listing on NSE thus, enables issuers to reach and service investors across the country. b. NSE being the largest stock exchange in terms of trading volumes, the Securities trade at low impact cost and are highly liquidity. This in turn reduces the cost of trading to the investor. c. The trading system of NSE provides unparallel level of trade and post-trade information. The best 5 buy and sell orders are displayed on the trading system and the total number of securities available for buying and selling is also displayed. This helps the investor to know the depth of the market. Further, corporate announcements, results, corporate actions etc are also available on the trading system, thus reducing scope for price manipulation or misuse. d. The facility of making initial public offers (IPOs), using NSE's network and software, results in significant reduction in cost and time of issues. e. NSE's web-site www.nseindia.com provides a link to the web-sites of the companies that are listed on NSE, so that visitors interested in any company can visit that company's web-site from the NSE site. f. Listed companies are provided with monthly trade statistics for the securities of the company listed on the Exchange.

34

General Study On Indian Equity Market

3.5 Membership Administration:The trading in NSE has a three tier structure-the trading platform provided by the Exchange, the broking and intermediary services and the investing community. The trading members have been provided exclusive rights to trade subject to their continuously fulfilling the obligation under the Rules, Regulations, Byelaws, Circulars, etc. of the Exchange. The trading members are subject to its regulatory discipline. Any entity can become a trading member by complying with the prescribed eligibility criteria and exit by surrendering trading membership. There are no entry/exit barriers to trading membership. Eligibility Criteria:The Exchange stresses on factors such as corporate structure, capital adequacy, track record, education, experience, etc. while granting trading rights to its members. This reflects a conscious effort by the Exchange to ensure quality broking services which enables to build and sustain confidence in the Exchange's operations. The standards stipulated by the Exchange for trading membership are substantially in excess of the minimum statutory requirements as also in comparison to those stipulated by other exchanges in India. The exposure and volume of transactions that can be undertaken by a trading member are linked to liquid assets in the form of cash, bank guarantees, etc. deposited by the member with the Exchange as part of the membership requirements. The trading members are admitted to the different segments of the Exchange subject to the provisions of the Securities Contracts (Regulation) Act, 1956, the Securities and Exchange Board of India Act, 1992, the rules, circulars, notifications, guidelines, etc., issued there under and the byelaws, Rules and Regulations of the Exchange. All trading members are registered with SEBI.

35

General Study On Indian Equity Market

3.6 Dematerialisation (DEMAT):A. MEANING:Dematerialization is the process by which physical certificates of an investor are converted to an equivalent number of securities in electronic form and credited into the investor's account with his/her DP. B. Dematerializing securities (physical holding into electronic holding):In order to dematerialize physical securities one has to fill in a DRF (Demat Request Form) which is available with the DP and submit the same along with physical certificates one wishes to dematerialize. Separate DRF has to be filled for each ISIN Number. The complete process of dematerialization is outlined below: Surrender certificates for dematerialization to your depository participant. Depository participant intimates Depository of the request through the system. Depository participant submits the certificates to the registrar of the Issuer Company. Registrar confirms the dematerialization request from depository. After dematerializing the certificates, Registrar updates accounts and informs depository of the completion of dematerialization. Depository updates its accounts and informs the depository participant. Depository participant updates the demat account of the investor.

C. Procedure for buying & selling dematerialized securities:The procedure for buying and selling dematerialized securities is similar to the procedure for buying and selling physical securities. The difference lies in the process of delivery (in case of sale) and receipt (in case of purchase) of securities.

A. In case of purchase:1. The broker will receive the securities in his account on the payout day 2. The broker will give instruction to its DP to debit his account and credit Investors account

36

General Study On Indian Equity Market

3. Investor will give Receipt Instruction to DP for receiving credit by filling Appropriate form. However one can give standing instruction for credit Into ones account that will obviate the need of giving Receipt Instruction every time.

B. In case of sale:The investor will give delivery instruction to DP to debit his account and credit the brokers account. Such instruction should reach the DPs office at least 24 hours before the pay-in as otherwise DP will accept the instruction only at the investors risk.

3.7 Investment:-

Investment means the use of money for the purpose of making more money, to gain income or increase capital, or both.

37

General Study On Indian Equity Market 1) Short Term Investment 2) Long Term Investment

1)Short Term Investment: It is more risky A successful short term trading mindset instead requires iron discipline, intense focus and steely devotion. Short term trading can be divided in 3 sections. A. B. C. Day Trading Swing Trading Position Trading

A. Day Trading:Day traders buy and sell stocks throughout the day in the hope that the price of the stocks will fluctuate in value during the day, allowing them to earn quick profits. A day trader will hold a stock anywhere from a few seconds to few hours, but will always sell all of those stocks close of the day. The day trader will therefore not own any position at the close of the each day, and there is overnight risk. The objective of day trading is to quickly get in and out of any particular stock for profits anywhere from few cents to several points per share on an intra-day basis. Day trading can be further sub-divided into number of styles, including.

I.

II.

Scalpers: This style of day trading involves the rapid and repeated buying and selling of a large volume of stocks within seconds or minutes. The objective is to earn a small per share profit on each transaction while minimizing the risk. Momentum Traders: This style of day trading involves identifying and trading stocks that are in a moving pattern during the day, in an attempt to buy stocks at bottoms and sell at tops.

38

General Study On Indian Equity Market B. Swing Trading:The principal difference between day trading and swing trading is that swing traders will normally have a slightly longer time horizon than day traders for holding a position in a stock. As is the case with day traders, swing traders also attempt to predict the short term fluctuation in a stocks price. However swing traders are willing to hold the stocks for more than one day, if necessary, to give to stock price some time to move or to capture additional momentum in the stocks price. Swing traders will generally hold on to their stock positions anywhere from a few hours to several days.

Swing trading has the capability of providing higher returns than day trading. However, unlike day traders who liquidate their positions at the end of each day, swing traders assume overnight risk. There are some significant risks in carrying positions overnight. For example news events and earnings warnings announced after the closing bell can result in large, unexpected and possibly adverse changes to a stock's price

C. Position Trading:Position trading is similar to swing trading, but with a longer time horizon. Position traders hold stocks for a time period anywhere from one day to several weeks or months. These traders seek to identify stocks where the technical trends suggest a possible large movement in price is likely to occur, but which may not be fully played out for several weeks or months.

2) Long Term Investment:A successful long term trading mindset requires, above all, patience and perseverance. These are more difficult attributes to develop in the average trader. Too often the average short-term trader succumbs to the markets lure and develops a frantic, get-it-now mindset believing every price blip represents a trading opportunity. As this attitude is fanned by the media and brokerage industry, more and more long term traders have become aggressive swing

39

General Study On Indian Equity Market traders and swing traders become rabid day traders - more often than not with disastrous consequences. Long term trading results in less trades with fewer mistakes and lower commission and slippage costs because overtrading is one of the biggest sources of losses facing both new and established traders. Why is this so? Obviously, more trades mean more commissions and more slippage. Few short-term traders realize, however, that their total commission and slippage costs in any year often exceed their total losses for the year. In other words, many losing shortterm traders would have actually made money on an annual basis had they not incurred the exorbitant commission and slippage costs of trading throughout the year. Fewer trades mean fewer mistakes. Long term trading unlike short term requires dramatically reduced time for analysis and trading. If you are trading using weekly data, only one to two hours each weekend are required to implement a sophisticated long term trading system for 21 or more commodities. This includes the time to completely download your quotes and update your data files, verify which are the correct months to trade for each commodity, figure out if you have any positions to rollover, generate your trading signals, and write down orders to your broker. On the contrary a typical successful day trader literally becomes a slave to their quote machines during market hours.

3.8 Broker & Sub-Broker Broker:-

40

General Study On Indian Equity Market

Broker:A broker is a member of a recognized stock exchange, who is permitted to do trades on the screen-based trading system of different stock exchanges. He is enrolled as a member with the concerned exchange and is registered with SEBI.

Sub broker:A sub broker is a person who is registered with SEBI as such and is affiliated to a member of a recognized stock exchange. A. Client Agreement Form:This form is an agreement entered between client and broker in the presence of witness where the client agrees (is desirous) to trade/invest in the securities listed on the concerned Exchange through the broker after being satisfied of brokers capabilities to deal in securities. The member, on the other hand agrees to be satisfied by the genuineness and financial soundness of the client and making client aware of his (brokers) liability for the business to be conducted. B. Details of Client Registration form:The brokers have to maintain a database of their clients, for which you have to fill client registration form. In case of individual client registration, you have to broadly provide following information: 1. Your name, date of birth, photograph, address, educational qualifications, occupation, residential status(Resident Indian/ NRI/others) 2. Unique Identification Number (wherever applicable) 3. Bank and depository account details 4. Income tax No. (PAN/GIR) which also serves as unique client code. 5. If you are registered with any other broker, then the name of broker and concerned Stock exchange and Client Code Number. 6. Proof of identity submitted either as MAPIN UID Card/Pan No./Passport/Voter ID/Driving license/Photo Identity card issued by Employer registered under MAPIN

41

General Study On Indian Equity Market C. For proof of address (any one of the following):1. Passport 2. Voter ID 3. Driving license 4. Bank Passbook 5. Rent Agreement 6. Ration Card 7. Flat Maintenance Bill 8. Telephone Bill 9. Electricity Bill 10. Certificate issued by employer registered under MAPIN 11. Insurance Policy

Each client has to use one registration form. In case of joint names /family members, a separate form has to be submitted for each person.

D. Unique Client Code:In order to facilitate maintaining database of their clients, it is mandatory for all brokers to use unique client code which will act as an exclusive identification for the client. For this purpose, PAN number/passport number/driving License/voters ID number/ ration card number coupled with the frequently used bank account number and the depository beneficiary account can be used for identification, in the given order, based on availability. E. Maximum brokerage that a broker/sub broker can charge:The maximum brokerage that can be charged by a broker has been specified in the Stock Exchange Regulations and hence, it may differ from across various exchanges. As per the BSE & NSE Bye Laws, a broker cannot charge more than 2.5% brokerage from his clients. This maximum brokerage is inclusive of the brokerage charged by the sub-broker. Further, SEBI (Stock brokers and Sub

42

General Study On Indian Equity Market brokers) Regulations, 1992 stipulates that sub broker cannot charge from his clients, a commission which is more than 1.5% of the value mentioned in the respective purchase or sale note. F. Charges that can be levied on the investor by a stock broker/sub broker:The trading member can charge: 1. Brokerage charged by member broker. 2. Penalties arising on specific default on behalf of client (investor) 3. Service tax as stipulated. 4. Securities Transaction Tax (STT) as applicable. The brokerage, service tax and STT are indicated separately in the contract note. G. STT (Securities Transaction Tax):Securities Transaction Tax (STT) is a tax being levied on all transactions done on the stock exchanges at rates prescribed by the Central Government from time to time. Pursuant to the enactment of the Finance (No.2) Act, 2004, the Government of India notified the Securities Transaction Tax Rules, 2004 and STT came into effect from October 1, 2004. H. Rolling Settlement:In a Rolling Settlement trades executed during the day are settled based on the net obligations for the day. Presently the trades pertaining to the rolling settlement are settled on a T+2 day basis where T stands for the trade day. Hence, trades executed on a Monday are typically settled on the following Wednesday (considering 2 working days from the trade day). The funds and securities pay-in and pay-out are carried out on T+2 day.

43

General Study On Indian Equity Market

3.9 Auction:-

A. What Is An AUCTION? The Exchange purchases the requisite quantity in the Auction Market and gives them to the buying trading member. The shortages are met through auction process and the difference in price indicated in contract note and price received through auction is paid by member to the Exchange, which is then liable to be recovered from the client. B. What happens if the shares are not bought in the auction? If the shares could not be bought in the auction i.e. if shares are not offered for sale in the auction, the transactions are closed out as per SEBI guidelines. The guidelines stipulate that the close out Price will be the highest price recorded in that scrip on the exchange in the settlement in which the concerned contract was entered into and up to the date of auction/close out OR 20% above the official closing price on the exchange on the day on which auction offers are called for

44

General Study On Indian Equity Market (and in the event of there being no such closing price on that day, then the official closing price on the immediately preceding trading day on which there was an official closing price), whichever is higher. Since in the rolling settlement the auction and the close out takes place during trading hours, the reference price in the rolling settlement for close out procedures would be taken as the previous days closing price.

Sources:-www.nseindia.com www.bseindia.com

45

General Study On Indian Equity Market

CHAPTER 4 DATA ANALYSIS

4.1 Fundamental Analysis 4.2 Economic Analysis 4.3 Company Analysis 4.4 Technical Analysis

46

General Study On Indian Equity Market

CHAPTER 4 DATA ANALYSIS

4.1 Fundamental Analysis:The investor while buying stock has the primary purpose of gain. If he invests for a short period of time it is speculative but when he holds it for a fairly long period of time the anticipation is that he would receive some return on his investment. Fundamental analysis is a method of finding out the future price of a stock, which an investor wishes to buy. The method for forecasting the future behavior of investments and the rate of return on them is clearly through an analyze of the broad economic forces in which they operate. The kind of industry to which they belong and the analysis of the company's internal working through statements like income statement, balance sheet and statement of changes of income.

47

General Study On Indian Equity Market

4.2 Economic Analysis:Investors are concerned with those forces in the economy, which affect the performance of organizations in which they wish to participate, through purchase of stock. A study of the economic forces would give an idea about future corporate earnings and the payment of dividends and interest to investors. Some of the broad forces within which the factors of investment operate are: A. Population: Population gives an idea of the kind of labor force in a country. In some countries the population growth has slowed down whereas in India and some other third world countries there has been a population explosion. Population explosion will give demand for more industries like hotels, residences, service industries like health, consumer demand like refrigerators and cars. Likewise, investors should prefer to invest in industries, which have a large amount of labor force because in the future such industries will bring better rates of return. B. Research And Technological Developments: The economic forces relating to investments would be depending on the amount of resources spent by the government on the particular technological development affecting the future. Broadly the investor should invest in those industries which are getting a large amount of share in the funds of the development of the country. For example, in India in the present context automobile industries and spaces technology are receiving a greater attention. These may be areas, which the investor may consider for investments. C. Capital Formation: Another consideration of the investor should be the kind of investment that a company makes in capital goods and the capital it invests in modernization and replacement of assets. A particular industry or a particular company which an investor would like to invest can also be viewed at with the help of the economic indicators such as the place, value and property position of the industry, group to which it 110ngs and the year-to-year returns through corporate profits.

48

General Study On Indian Equity Market D. Natural Resources And Raw Materials: The natural resources are to a large extent responsible for a country's economic development and overall improvement in the condition of corporate growth. In India, technological discoveries recycling of materials, nuclear and solar energy and new synthetics should give the investor an opportunity to invest in untapped or recently tapped resources which would also produce higher investment opportunity.

4.3 Company Analysis:Company analysis is a study of the variables that influence the future of a firm both qualitatively and quantitatively. It is a method of assessing the competitive position of a firm earning and profitability, the efficiency with which it operates its financial position and its ful1l with respect to the earning of its shareholders. The fundamental nature of this analysis is that each share of a company has an intrinsic value, which is dependent on the company's financial performance, quality of management and record of its earnings and dividend. They believe that the market price of share in a period of time will move towards its intrinsic value. If the market price of a share is lower than the intrinsic value, as evaluated by the fundamental analysis, then the share is supposed to be undervalued and it should be purchased but if the current market price shows that it is more than intrinsic value then according to the theory the share should be sold. This basic approach is analyzed through the financial statements of an organization. The basic financial statements, which are required as tools of the fundamental analyst, are the income statement, the balance sheet, and the statement of changes in financial position. These statements are useful for investors, creditors as well as internal management of a firm and on the basis these statements the future course of action may be taken by the investors of the firm.

49

General Study On Indian Equity Market

4.4 Technical Analysis:Technical analysis is simply the study of prices as reflected on price charts. Technical analysis assumes that current prices should represent all known information about the markets. Prices not only reflect intrinsic facts, they also represent human emotion and the pervasive mass psychology and mood of the moment. Prices are, in the end, a function of supply and demand. However, on a moment to moment basis, human emotionsfear, greed, panic, hysteria, elation, etc. also dramatically effect prices. Markets may move based upon peoples expectations, not necessarily facts. A market "technician" attempts to disregard the emotional component of trading by making his decisions based upon chart formations, assuming that prices reflect both facts and emotion. Analysts use their technical research to decide whether the current market is a BULL MARKET or a BEAR MARKET. TECHNICAL ANALYSIS OF INDIAN STOCK MARKET BSE SENSEX INDEX:The BSE SENSEX is not only scientifically designed but also based on globally accepted construction and review methodology. First compiled in 1986, SENSEX is a basket of 30 constituent stocks representing a sample of large, liquid and representative companies. The base year of SENSEX is 1978-79 and the base value is 100. The index is widely reported in both domestic and international markets through print as well as electronic media. Technical Analysis of Indian stock market BSE Sensex Index The Index was initially calculated based on the "Full Market Capitalization" methodology but was shifted to the free-float methodology with effect from September 1, 2003. The "Free-float Market Capitalization" methodology of index construction is regarded as an industry best practice globally. All major index providers like MSCI, FTSE, STOXX, S& and Dow Jones use the Free-float methodology. Due to is wide acceptance amongst the Indian investors; SENSEX is regarded to be the pulse of the Indian stock market. As the oldest index in the country, it provides the time series data over a fairly long period of time (From 1979 onwards). Small wonder, the SENSEX has over the years become one of the most prominent brands in the country.

50

General Study On Indian Equity Market

1 Day Technical Analysis Chart of Indian stock market BSE Sensex Index

5 Day Technical Analysis Chart of Indian stock market BSE Sensex Index

51

General Study On Indian Equity Market

1 Year Technical Analysis Chart of Indian stock market BSE Sensex Index

SOURCES Www.Equitymaster.Com

www.financialexpress.com

52

General Study On Indian Equity Market

CHAPTER 5 CONCLUSION

Share market is a high risk-high reward, permanent source of long term finance for corporate enterprises and short term earning for shareholders. The investors, who desire to share the risk, return and control associated with ownership of companies would invest in equity capital. Today, the Indian Equity Market is one of the most technologically developed in the world and is on par with other developed markets abroad. The introduction of on-line trading system, dematerialization, and introduction of rolling settlement have facilitated quick trading and settlements which lead to larger volumes. NSE is the only stock exchange which covers majority equity investments every day. Also equity capital market encourages capital formation in the country. The specific factor, which influences equity market, is the investors sentiment towards the stock market as a whole. So investor first has to analyze and invest and not speculate in shares. The introduction of online trading has given a much-needed impetus to the Indian equity markets. In this technological world things are needed to move at a faster pace, and with the introduction of methods of marketing securities in the stock exchange has expanded its business at a tremendous speed. According to economic times, the research states the major reason behind the irregularities of market (up and down in sale and purchase, price of share) is mainly because of forcasting mid set of equity investors. So, the stock exchanges must disregards the emotional component of trading by making investors decisions based upon chart formations, assuming that prices reflect both facts and emotion. And also by creating the awareness of fundamental analysis (Fundamental analysis is a method of finding out the future price of a stock, which an investor wishes to buy) among the investors to avoid the irregularities while trading. So to increase the volume of equity investment, the stock exchanges should strive to increase transparency, strictly enforce corporate governance norms, provide more value-added services to investors, and take steps to increase investor confidence.

53

General Study On Indian Equity Market

Suggestion & Recommendation

Investment strategy:1. Dont invest more than 40% of your income. 2. Intention (market) environment based selection of sector and in that sector invest in powerful companies 3. Installment type investment like SIP 4. Invest at every decline 5. Invest for long term 6. Invest in Blue Chip Company with good management. 7. More investment, more money 8. Invest in company which give good return to shareholder & have good performance. 9. Invest in short term profit making companies. 10.Take delivery and wait up to sufficient return

Mistakes made by common investors:-

1. 2. 3. 4. 5. 6. 7. 8.

Buy when price of share is high Dont buy when price of share is low Purchase according to others views & tips Not buying in correction Buying speculative shares Buy at every upside and sell at every decline Invest money without understanding risk factor of sector and company Investors do not have patience.

Views for making money in stock market:-

1. Long term investment in powerful companies in recession time 2. Buy in correction 3. Avoid penny and speculative shares

54

General Study On Indian Equity Market 4. 5. 6. 7. Buy at every decline and sell at every upside Give more time to your investment Invest your money systematically Study the companies, make your own policies for investment and do not fall victim of fear and greed 8. To make money, take chances 9. Buy shares when people sell and sell shares when people buy

Opinion reasons for this major correction:-

1. World recession 2. Forth coming political elections 3. Excessive rise of equities market in recent time 4. Global financial crisis 5. American subprime issue 6. Lowest consumers and industrial demand 7. Historical recession in world market 8. Stock loss their trust in public 9. Change in normal investors thinking regarding stock 10.Inflation 11.Foreign investor

55

General Study On Indian Equity Market

BIBLIOGRAPHY

Websites:1. www.nseindia.com 2. www.indiainfoline.com 3. www.equitymaster.com 4. www.bseindia.com 5. www.sebi.gov.in 6. www.financialexpress.com 7. www.investorword.com 8. www.businessdictionary.com

56

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- FAKE Atm RECEIPT TEMPLATEDokument2 SeitenFAKE Atm RECEIPT TEMPLATEDrop That Beat50% (2)

- San Diego County Sheriff's Detention Service Policy and Procedure ManualDokument640 SeitenSan Diego County Sheriff's Detention Service Policy and Procedure Manualsilverbull8Noch keine Bewertungen

- Oracle R12 Payables Interview QuestionsDokument13 SeitenOracle R12 Payables Interview QuestionsPrashanth KatikaneniNoch keine Bewertungen

- Triple V v. Filipino MerchantsDokument2 SeitenTriple V v. Filipino MerchantsRem Serrano100% (2)

- Final Project On General Study On Indian Eqiuty MarketDokument55 SeitenFinal Project On General Study On Indian Eqiuty MarketSagar KavaNoch keine Bewertungen

- Internet Banking 2Dokument82 SeitenInternet Banking 2Sagar KavaNoch keine Bewertungen

- Strtategic Management Question BankDokument3 SeitenStrtategic Management Question BankSagar KavaNoch keine Bewertungen

- National Is Ed Banks in IndiaDokument13 SeitenNational Is Ed Banks in IndiaSagar KavaNoch keine Bewertungen

- Mandate PDFDokument3 SeitenMandate PDFM AzeemNoch keine Bewertungen

- S. 604 Federal Reserve Sunshine Act - Senate Contact InfoDokument5 SeitenS. 604 Federal Reserve Sunshine Act - Senate Contact InfojofortruthNoch keine Bewertungen

- Corporate Guarantee and Bank GuaranteeDokument1 SeiteCorporate Guarantee and Bank GuaranteeChaitanya SharmaNoch keine Bewertungen

- Business - Public Storage Insurance Is A ScamDokument2 SeitenBusiness - Public Storage Insurance Is A ScamEmpresarioNoch keine Bewertungen

- Project Allotment SheetDokument20 SeitenProject Allotment SheetRoushan RajNoch keine Bewertungen

- Sbi Homeloan ProjectDokument63 SeitenSbi Homeloan Projectrncreation &photoghraphyNoch keine Bewertungen

- Fee Decleration FormDokument2 SeitenFee Decleration FormMohit MohanNoch keine Bewertungen

- 34 Analysis of Demat Account and Online Trading HimanshuDokument74 Seiten34 Analysis of Demat Account and Online Trading HimanshuVasant Kumar VarmaNoch keine Bewertungen

- OPM Part - B Volume - 1 ENGDokument42 SeitenOPM Part - B Volume - 1 ENGkiflesemusimaNoch keine Bewertungen

- 1 LicDokument1 Seite1 LicAshish BatraNoch keine Bewertungen

- Chap-6-Verification of Assets and LiabilitiesDokument48 SeitenChap-6-Verification of Assets and LiabilitiesAkash GuptaNoch keine Bewertungen

- BPI Deposit Account RatesDokument5 SeitenBPI Deposit Account Ratesparekoy1014Noch keine Bewertungen

- PCIB vs. CADokument3 SeitenPCIB vs. CAdave_88opNoch keine Bewertungen

- Performance Evaluation of Bancassurance - Bankers POV PDFDokument10 SeitenPerformance Evaluation of Bancassurance - Bankers POV PDFcrescidaNoch keine Bewertungen

- Proposal Eta Theke BanaisiDokument109 SeitenProposal Eta Theke BanaisiMaruf Hasibul IslamNoch keine Bewertungen

- White Paper Auriga Smart AtmsDokument2 SeitenWhite Paper Auriga Smart AtmsirwinohNoch keine Bewertungen

- Acknowledgement (Tanzil Khan - 14-97982-2)Dokument3 SeitenAcknowledgement (Tanzil Khan - 14-97982-2)Md. Saiful IslamNoch keine Bewertungen

- 1642335769414loosciwbpgxnvjdbpdf Original-3Dokument1 Seite1642335769414loosciwbpgxnvjdbpdf Original-3Gopichand YadavNoch keine Bewertungen

- Continuing Guaranty - TemplateDokument4 SeitenContinuing Guaranty - TemplateRamon UntalanNoch keine Bewertungen

- Robert Kiyosaki 60 Menit Jadi KayaDokument11 SeitenRobert Kiyosaki 60 Menit Jadi KayaAnas ApriyadiNoch keine Bewertungen

- Assured Savings Plan 1Dokument12 SeitenAssured Savings Plan 1DnGNoch keine Bewertungen

- Reddy Ice Disclosure StatementDokument757 SeitenReddy Ice Disclosure Statementbankrupt0Noch keine Bewertungen

- Avenir 022011monthlyreportDokument2 SeitenAvenir 022011monthlyreportchicku76Noch keine Bewertungen

- Car InsuranceDokument13 SeitenCar InsuranceDipayan SatpathyNoch keine Bewertungen

- HDFC Life Annual Report 10-11Dokument162 SeitenHDFC Life Annual Report 10-11Dasari Chandra Kanth ReddyNoch keine Bewertungen

- Usa Courtney Downs Leaseco, LLC Balance Sheet Books Accrual May 2008Dokument58 SeitenUsa Courtney Downs Leaseco, LLC Balance Sheet Books Accrual May 2008MarcyNoch keine Bewertungen