Beruflich Dokumente

Kultur Dokumente

Untitled

Hochgeladen von

Chicky JiOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Untitled

Hochgeladen von

Chicky JiCopyright:

Verfügbare Formate

Financial Performance The word Performance is derived from the word parfourmen, which means to do, to carry out

or to render. It refers the act of performing; execution, accomplishment, fulfi llment, etc. In border sense, performance refers to the accomplishment of a give n task measured against preset standards of accuracy, completeness, cost, and sp eed. In other words, it refers to the degree to which an achievement is being or has been accomplished. In the words of Frich Kohlar The performance is a general term applied to a part or to all the conducts of activities of an organization over a period of time often with reference to past or projected cost efficiency, management responsibility or accountability or the like. Thus, not just the pre sentation, but the quality of results achieved refers to the performance. Perfor mance is used to indicate firms success, conditions, and compliance. Financial performance refers to the act of performing financial activity. In bro ader sense, financial performance refers to the degree to which financial object ives being or has been accomplished. It is the process of measuring the results of a firm s policies and operations in monetary terms. It is used to measure fir m s overall financial health over a given period of time and can also be used to compare similar firms across the same industry or to compare industries or sect ors in aggregation. FINANCIAL PERFORMANCE ANALYSIS In short, the firm itself as well as various interested groups such as managers, shareholders, creditors, tax authorities, and others seeks answers to the follo wing important questions: 1. What is the financial position of the firm at a given point of time? 2. How is the Financial Performance of the firm over a given period of time? These questions can be answered with the help of financial analysis of a firm. F inancial analysis involves the use of financial statements. A financial statemen t is an organized collection of data according to logical and consistent account ing procedures. Its purpose is to convey an understanding of some financial aspe cts of a business firm. It may show a position at a moment of time as in the cas e of a Balance Sheet, or may reveal a series of activities over a given period o f time, as in the case of an Income Statement. Thus, the term financial statement s generally refers to two basic statements: the Balance Sheet and the Income Stat ement. The Balance Sheet shows the financial position (condition) of the firm at a give n point of time. It provides a snapshot and may be regarded as a static picture. Balance sheet is a summary of a firms financial position on a given date that sho ws Total assets = Total liabilities + Owners equity. The income statement (referred to in India as the profit and loss statement) ref lects the performance of the firm over a period of time. Income statement is a su mmary of a firms revenues and expenses over a specified period, ending with net i ncome or loss for the period. However, financial statements do not reveal all the information related to the financial operations of a firm, but they furnish som e extremely useful information, which highlights two important factors profitabi lity and financial soundness. Thus analysis of financial statements is an import ant aid to financial performance analysis. Financial performance analysis includ es analysis and interpretation of financial statements in such a way that it und ertakes full diagnosis of the profitability and financial soundness of the busin ess. The analysis of financial statements is a process of evaluating the relation ship between component parts of financial statements to obtain a better understa nding of the firms position and performance. The financial performance analysis identifies the financial strengths and weakne sses of the firm by properly establishing relationships between the items of the balance sheet and profit and loss account. The first task is to select the info rmation relevant to the decision under consideration from the total information contained in the financial statements. The second is to arrange the information in a way to highlight significant relationships. The final is interpretation and drawing of inferences and conclusions. In short, financial performance analysis is the process of selection, relation, and evaluation.

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- DISCHARGE PLAN CuyosDokument6 SeitenDISCHARGE PLAN CuyosShaweeyah Mariano BabaoNoch keine Bewertungen

- Internship ReportDokument36 SeitenInternship ReportM.IMRAN0% (1)

- Sample Cross-Complaint For Indemnity For CaliforniaDokument4 SeitenSample Cross-Complaint For Indemnity For CaliforniaStan Burman75% (8)

- Dissertation 7 HeraldDokument3 SeitenDissertation 7 HeraldNaison Shingirai PfavayiNoch keine Bewertungen

- Packet Unit 3 - Atomic Structure-Answers ChemistryDokument11 SeitenPacket Unit 3 - Atomic Structure-Answers ChemistryMario J. KafatiNoch keine Bewertungen

- Final Prmy Gr4 Math Ph1 HWSHDokument55 SeitenFinal Prmy Gr4 Math Ph1 HWSHKarthik KumarNoch keine Bewertungen

- Minuets of The Second SCTVE MeetingDokument11 SeitenMinuets of The Second SCTVE MeetingLokuliyanaNNoch keine Bewertungen

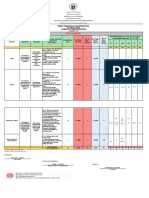

- Revised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10Dokument6 SeitenRevised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10May Ann GuintoNoch keine Bewertungen

- Morse Potential CurveDokument9 SeitenMorse Potential Curvejagabandhu_patraNoch keine Bewertungen

- Avid Final ProjectDokument2 SeitenAvid Final Projectapi-286463817Noch keine Bewertungen

- A Review of Mechanism Used in Laparoscopic Surgical InstrumentsDokument15 SeitenA Review of Mechanism Used in Laparoscopic Surgical InstrumentswafasahilahNoch keine Bewertungen

- ATADU2002 DatasheetDokument3 SeitenATADU2002 DatasheethindNoch keine Bewertungen

- Metalcor - 1.4507 - Alloy - F255 - Uranus 52N - S32520Dokument1 SeiteMetalcor - 1.4507 - Alloy - F255 - Uranus 52N - S32520NitinNoch keine Bewertungen

- Course Projects PDFDokument1 SeiteCourse Projects PDFsanjog kshetriNoch keine Bewertungen

- 10 Essential Books For Active TradersDokument6 Seiten10 Essential Books For Active TradersChrisTheodorou100% (2)

- Dehn Brian Intonation SolutionsDokument76 SeitenDehn Brian Intonation SolutionsEthan NealNoch keine Bewertungen

- Nuclear Power Engineering (MEE 2027) : Fall Semester (2020-2021)Dokument13 SeitenNuclear Power Engineering (MEE 2027) : Fall Semester (2020-2021)AllNoch keine Bewertungen

- PreviewpdfDokument83 SeitenPreviewpdfJohana GavilanesNoch keine Bewertungen

- War at Sea Clarifications Aug 10Dokument4 SeitenWar at Sea Clarifications Aug 10jdageeNoch keine Bewertungen

- OVDT Vs CRT - GeneralDokument24 SeitenOVDT Vs CRT - Generaljaiqc100% (1)

- Tachycardia Algorithm 2021Dokument1 SeiteTachycardia Algorithm 2021Ravin DebieNoch keine Bewertungen

- Project Manager PMP PMO in Houston TX Resume Nicolaas JanssenDokument4 SeitenProject Manager PMP PMO in Houston TX Resume Nicolaas JanssenNicolaasJanssenNoch keine Bewertungen

- Assignment 3Dokument2 SeitenAssignment 3Debopam RayNoch keine Bewertungen

- TW BT 01 - Barstock Threaded Type Thermowell (Straight) : TWBT - 01Dokument3 SeitenTW BT 01 - Barstock Threaded Type Thermowell (Straight) : TWBT - 01Anonymous edvYngNoch keine Bewertungen

- Aquaculture - Set BDokument13 SeitenAquaculture - Set BJenny VillamorNoch keine Bewertungen

- Agile ModelingDokument15 SeitenAgile Modelingprasad19845Noch keine Bewertungen

- College of Computer Science Software DepartmentDokument4 SeitenCollege of Computer Science Software DepartmentRommel L. DorinNoch keine Bewertungen

- Presentation Municipal Appraisal CommitteeDokument3 SeitenPresentation Municipal Appraisal CommitteeEdwin JavateNoch keine Bewertungen

- Health and Safety For The Meat Industry: Guidance NotesDokument198 SeitenHealth and Safety For The Meat Industry: Guidance NotesPredrag AndjelkovicNoch keine Bewertungen

- TRICARE Behavioral Health Care ServicesDokument4 SeitenTRICARE Behavioral Health Care ServicesMatthew X. HauserNoch keine Bewertungen