Beruflich Dokumente

Kultur Dokumente

Matching Dell

Hochgeladen von

Neeraj Partety100%(2)100% fanden dieses Dokument nützlich (2 Abstimmungen)

661 Ansichten23 Seitenmatching dell matching dell matching dell matching dell matching dell matching dell matching dell

Originaltitel

matching dell

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenmatching dell matching dell matching dell matching dell matching dell matching dell matching dell

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

100%(2)100% fanden dieses Dokument nützlich (2 Abstimmungen)

661 Ansichten23 SeitenMatching Dell

Hochgeladen von

Neeraj Partetymatching dell matching dell matching dell matching dell matching dell matching dell matching dell

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 23

Matching Dell

Case Commentary by C3

‘Nathan Lyons-Smith, Brilliant Manyere, Bill Green

11/18/2009

Contents

Executive Summary.

Background

Problem...

Financial Analysis

Market Pricing Analysis.

‘Segment Analysis,

Deli’s Competitive Advantage...

Conclusion 9

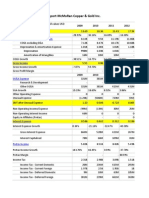

Appendix 1 - FY 1998 Inventory Turnover and Days in Inventory Ratio AnalYSiS...nnnneseseeiees 10

Appendix 2 ~ Profit Margin Ratio Analysis. 10

Appendix 3 - Average Monthly Rate of Change of Dell Stock 1996 - 1999 10

‘Appendix 4 —FY 1996 Competitive Advantage Analysis. ed

Appendix 5 - FY 1998 Competitive Advantage Analysis. 12

‘Appendix 6 ~ SWOT Analysis of Dell. w3

Appendix 7 — Dell DuPont Analysis 14

Appendix 8 ~ Dell Market Value Analysis. oS

Appendix 9 — Dell Income Statement 16

Appendix 10 - Dell Balance Sheet ..... wel

Appendix 11 ~ Dell Sources and Uses Statement 18

Appendix 12 - Selected Financial Statements as a Percentage of SaleS ..-.cccnnnnnneensesnnnnes 1B

Appendix 13 ~ Calculation of Beta 19

Appendix 14 — Calculation of Discount Rate. 20

‘Appendix 15 ~ S&P 500 Returns oe

Appendix 16 ~ Dell Monthly Stack Price. 22

Appendix 17 ~ Beta Estimation of Dell Computer. 23

Executive Summary

Dell has been incredibly profitable and experienced astounding growth over the last several

years. We are now in 1999 and we must decide if we should buy, sell, or hold Dell stock.

Strategically, Dell has run the table on the market. They have capitalized on a new business

model and forged their profits in an industry with very slim profit margins. They benefitted greatly from

the expansion of computer use in the late 90s, the explosion of the internet, and the health of the

economy. Dell's competitive advantages come from:

1.__Just In Time (JIT) purchasing of components (avoiding falling prices)

2. Lower inventory costs (avoiding carrying and inventory costs based on cost of capital)

3. Distribution channel related costs and markups (which increases prices to the customer)

Dell’s startup mentality and lean business operations have made it a great company. Their inventory

turnover ratio is around 52 and they keep their inventory for an average of only 7 days. These are

astounding figures for any company and Dell will have to work very hard to leverage JIT and their

distributor network to ensure they remain at this level. Now, the market for new computers has slowed

down because everyone has one. Dell has fewer growth options and its stock likely will not continue to

grow at the same rate. Additionally, profits continue to remain razor thin, new companies can enter

easily, and Dell must continue to run its operations tightly if they wish to continue making a profit. Dell

has traditionally targeted its products to a small number of segments, Future success for Dell will

involve breaking into new segments that are controlled by its competitors, IBM and HP.

Financially, Dell is in a very good position. After collecting relevant data, we conclude that the

estimated value of Dell stock is $46.83 per share. Dell has traditionally not paid dividends for a reason.

Our opinion is that the company’s earnings will stabilize in 2004, Long term investors of stocks are

encouraged to accumulate the company stock and hold for about four years

Das könnte Ihnen auch gefallen

- Matching Dell Group 2 v2Dokument11 SeitenMatching Dell Group 2 v2Sandala Aditya Ramakrishna PadmavathiNoch keine Bewertungen

- Matching DellDokument5 SeitenMatching DellPrashanthi Priyanka ReddyNoch keine Bewertungen

- Matching Dell FinalDokument14 SeitenMatching Dell FinalBraveMatthias100% (3)

- Matching Dell Case SolutionDokument20 SeitenMatching Dell Case SolutionYOJAN SAININoch keine Bewertungen

- Matching Dell Competitive AdvantageDokument3 SeitenMatching Dell Competitive AdvantageVetriventhanNoch keine Bewertungen

- Apparel Distribution: Inter-Firm Contracting and Intra-FirmorganizationDokument13 SeitenApparel Distribution: Inter-Firm Contracting and Intra-FirmorganizationAnirudh GhoshNoch keine Bewertungen

- Assignment Article-Apparel DistributionDokument28 SeitenAssignment Article-Apparel Distributionmonk0062006Noch keine Bewertungen

- Intel Case StudyDokument30 SeitenIntel Case StudyNisshu RainaNoch keine Bewertungen

- Advantage Dell - Relative Cost AnalysisDokument2 SeitenAdvantage Dell - Relative Cost AnalysisLokesh Sharma0% (1)

- Matching DellDokument10 SeitenMatching DellOng Wei KiongNoch keine Bewertungen

- Matching Dell Case NotesDokument23 SeitenMatching Dell Case NotesdukomaniacNoch keine Bewertungen

- Matching Dell HBS CaseDokument6 SeitenMatching Dell HBS CasePabitra DangolNoch keine Bewertungen

- Matching Dell - Cost AnalysisDokument1 SeiteMatching Dell - Cost AnalysisVivek Kumar100% (2)

- Volkswagen in India Case SolutionDokument9 SeitenVolkswagen in India Case SolutionManav Lakhina100% (1)

- HUL - RM B - Group12Dokument10 SeitenHUL - RM B - Group12DEWASHISH RAINoch keine Bewertungen

- Matching DELL CaseDokument8 SeitenMatching DELL CaseKee-yong ChungNoch keine Bewertungen

- About Nykaa: Success StoryDokument9 SeitenAbout Nykaa: Success StorySrinkhala Maheshwari0% (1)

- Icici CaseDokument2 SeitenIcici CaseDebi PrasannaNoch keine Bewertungen

- Japanese Apparel Case StudyDokument4 SeitenJapanese Apparel Case StudyShreyo Chakraborty100% (2)

- Amore Case Group 33Dokument3 SeitenAmore Case Group 33TatineniRohitNoch keine Bewertungen

- Xiaomi: Entering International Markets: Presented By: Prashant Shukla Sumit SharmaDokument13 SeitenXiaomi: Entering International Markets: Presented By: Prashant Shukla Sumit Sharmasandeep eNoch keine Bewertungen

- Internationalizing The Cola Wars (A)Dokument9 SeitenInternationalizing The Cola Wars (A)dcphilNoch keine Bewertungen

- Ford Motor Company: Supply Chain StrategyDokument14 SeitenFord Motor Company: Supply Chain StrategyShivani Rahul GuptaNoch keine Bewertungen

- Apple Case Study AnalysisDokument13 SeitenApple Case Study AnalysisKalyan Kumar100% (1)

- Zara Fast Fashion CaseDokument2 SeitenZara Fast Fashion CaseAakanksha Mishra100% (1)

- Callaway Golf Company Case AnalysisDokument2 SeitenCallaway Golf Company Case AnalysisSam Narjinary0% (1)

- Matching Dell AssignmentDokument7 SeitenMatching Dell AssignmentMuthamil Selvan Chellappan100% (2)

- Honda A: Group-Karthik, Mohit, Ramya, Rishabh, Sharvani, ShouvikDokument8 SeitenHonda A: Group-Karthik, Mohit, Ramya, Rishabh, Sharvani, ShouvikKarthik BhandaryNoch keine Bewertungen

- 07 Eldor SodaDokument9 Seiten07 Eldor SodaDeepthiNoch keine Bewertungen

- Group AssignmentDokument16 SeitenGroup AssignmentUtkarsh GurjarNoch keine Bewertungen

- The Failure of Amazon in Chinese Market and Prediction For Emerging MarketDokument11 SeitenThe Failure of Amazon in Chinese Market and Prediction For Emerging MarketDo Thu Huong50% (2)

- Reinventing Best Buy: Group 1: Akash Khemka DM22106 Aman Pathak DM22108 Dinakaran S DM22118Dokument4 SeitenReinventing Best Buy: Group 1: Akash Khemka DM22106 Aman Pathak DM22108 Dinakaran S DM22118Shubham ThakurNoch keine Bewertungen

- Virgin Mobile Pricing and Launch in UsaDokument5 SeitenVirgin Mobile Pricing and Launch in UsaHiamanshu SinghNoch keine Bewertungen

- Ford Motor Company: Supply Chain StrategyDokument43 SeitenFord Motor Company: Supply Chain StrategyKristiadi HimawanNoch keine Bewertungen

- Nestle RowntreeDokument6 SeitenNestle RowntreemantoshkinasjNoch keine Bewertungen

- Rizal Abdullah Nur Fadly Sudirman Mars Ega LP Rohimat EfendiDokument16 SeitenRizal Abdullah Nur Fadly Sudirman Mars Ega LP Rohimat EfendiRizal AbdullahNoch keine Bewertungen

- KidzaniacaseDokument5 SeitenKidzaniacaseVickyBetancourtNoch keine Bewertungen

- Zara-IT For Fast Fashion - Group 4Dokument7 SeitenZara-IT For Fast Fashion - Group 4Mohit SharmaNoch keine Bewertungen

- Matching DellDokument5 SeitenMatching DellAmol Deherkar100% (2)

- SchindlerDokument7 SeitenSchindlerShaina DewanNoch keine Bewertungen

- Times PaywallDokument11 SeitenTimes PaywallGaurav SharmaNoch keine Bewertungen

- Group 1 British MotorcycleDokument11 SeitenGroup 1 British MotorcycleDebanjali Pal PGP 2017-19Noch keine Bewertungen

- Cola Wars ContinueDokument4 SeitenCola Wars ContinueharishNoch keine Bewertungen

- Base CampDokument1 SeiteBase CampPranav TyagiNoch keine Bewertungen

- Learnings From Coffee Wars in India - 20021141085 - PushpakSinghalDokument1 SeiteLearnings From Coffee Wars in India - 20021141085 - PushpakSinghalDubaree ChoudhuryNoch keine Bewertungen

- Mi CaseDokument3 SeitenMi CaseVaibhav DograNoch keine Bewertungen

- Presentation EcomDokument29 SeitenPresentation EcomNishtha JainNoch keine Bewertungen

- S01 G03 Emerging NokiaDokument11 SeitenS01 G03 Emerging NokiaArunachalamNoch keine Bewertungen

- Data VastDokument11 SeitenData VastHimesh AnandNoch keine Bewertungen

- Case Study: Appex Corporation: Team # 9Dokument10 SeitenCase Study: Appex Corporation: Team # 9Shreya GhoradkarNoch keine Bewertungen

- Section-B Group-2 MM2 Case ProjectDokument11 SeitenSection-B Group-2 MM2 Case ProjectSusheel MenonNoch keine Bewertungen

- Aqualisa Quartz Case Study AnalysisDokument1 SeiteAqualisa Quartz Case Study AnalysisSumedh Kakde50% (2)

- PropeciaDokument3 SeitenPropeciamiguelrojash0% (2)

- Copia de FCXDokument16 SeitenCopia de FCXWalter Valencia BarrigaNoch keine Bewertungen

- Swan-Davis Inc. (1) FinalDokument12 SeitenSwan-Davis Inc. (1) FinalRomina Isa Losser100% (1)

- Case 3 - Ratio Analysis and AcquisitionsDokument1 SeiteCase 3 - Ratio Analysis and AcquisitionsNinis Solichah100% (1)

- Rosario Acero S.A - LarryDokument12 SeitenRosario Acero S.A - LarryStevano Rafael RobothNoch keine Bewertungen

- PPG CORP. BALANCE SHEETS, 1991-2000 (Million $) : Assets 2000 1999 1998 1997 1996Dokument47 SeitenPPG CORP. BALANCE SHEETS, 1991-2000 (Million $) : Assets 2000 1999 1998 1997 1996Syed Ameer Ali ShahNoch keine Bewertungen

- PPG CORP. BALANCE SHEETS, 1991-2000 (Million $) : Assets 2000 1999 1998 1997 1996Dokument46 SeitenPPG CORP. BALANCE SHEETS, 1991-2000 (Million $) : Assets 2000 1999 1998 1997 1996José Carlos GBNoch keine Bewertungen

- Word Note The Body Shop International PLC 2001: An Introduction To Financial ModelingDokument9 SeitenWord Note The Body Shop International PLC 2001: An Introduction To Financial Modelingalka murarka100% (2)

- Productivity Monitoring & Resource Leveling Problem StatementDokument1 SeiteProductivity Monitoring & Resource Leveling Problem StatementNeeraj PartetyNoch keine Bewertungen

- A Study On Critical Success Factors of Itc LTDDokument81 SeitenA Study On Critical Success Factors of Itc LTDthayumanavarkannan100% (1)

- FMCG IndustryDokument7 SeitenFMCG Industrysaurav0975% (8)

- Consolidated Sectors Report.Dokument68 SeitenConsolidated Sectors Report.Neeraj PartetyNoch keine Bewertungen

- World WatchDokument4 SeitenWorld WatchNeeraj PartetyNoch keine Bewertungen

- Stephanie SchleimerDokument4 SeitenStephanie SchleimerNeeraj PartetyNoch keine Bewertungen