Beruflich Dokumente

Kultur Dokumente

Daily Metals and Energy Report 14th Jan

Hochgeladen von

Angel BrokingCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Daily Metals and Energy Report 14th Jan

Hochgeladen von

Angel BrokingCopyright:

Verfügbare Formate

Commodities Daily Report

Monday| January 14, 2013

International Commodities

Content

Overview Precious Metals Energy Base Metals Important Events for today

Research Team

Nalini Rao - Sr. Research Analyst nalini.rao@angelbroking.com (022) 2921 2000 Extn. 6135

Anish Vyas - Research Analyst anish.vyas@angelbroking.com (022) 2921 2000 Extn. 6104view:

D Vijiya Rao - Research Analyst vijiya.d@angelbroking.com (022) 2921 2000 Extn. 6134view

Angel Commodities Broking Pvt. Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Commodities Broking (P) Ltd. Your feedback is appreciated on commodities@angelbroking.com

www.angelcommodities.com

Commodities Daily Report

Monday| January 14, 2013

International Commodities

Overview

US trade deficit widened to -48.7B in November. NIESR GDP Estimate of the UK declined to -0.3 percent in December India IIP contracted to 0.1 percent in the month of November UK manufacturing production grew to -0.3 percent in November. Bank of Japan announces stimulus package of 10.3 trillion yen.

Market Highlights (% change)

Last INR/$ (Spot) 54.86 Prev day -0.8

as on 11 January, 2013

w-o-w 0.1

m-o-m -1.1

y-o-y -5.6

Asian markets outside Japan are trading on a mixed note as Singapore property developers slumped as the government announced cooling measures. US trade deficit widened in the month of November to -48.7B as American retailers stocked up on imported goods and demand for foreign automobiles increased after super storm Sandy hit the US. US Dollar Index (DX) fell 1.2 percent week on week due to rise in the risk appetite in the global markets as European Central Bank President Mario Draghi said that the economy is expected to recover in 2013.This created positive market sentiments and reduced the demand for the low yielding currency that is US Dollar Index. Better start of the US corporate earnings of the fourth quarter also supported the market sentiments. US equities settled higher taking cues from positive global market sentiments resulting from the optimism that the economies are on the path of recovery. European Central Bank President also said that the economy is likely to witness growth in 2013 raising hopes that the debt crisis of the region might be stemmed. Additionally, hopes of positive earnings in the fourth quarter of some more US companies also added to the gains. However, sharp gains in the stock futures were capped as trade deficit of the nation widened. The index touched a weekly low of 79.49 and closed at 79.61 on Friday. The Indian Rupee appreciated week on week and ended 0.1 percent higher on Friday. The currency appreciated due to sustained capital inflows along with positive global market sentiments. Weakness in the DX also led appreciation in the currency. However, the currency depreciated on Friday due to decline in the industrial output of the nation and rise in the trade deficit due to decline in the exports. The rupee closed at 54.86 after touching a weekly high of 54.345 on Friday. Index of Industrial production contracted to 0.1 percent in November as compared to increase of 8.3 percent in October 2012. For the current month 2013 FII inflows totaled at Rs 8,813.30 crores till 11th January 2013. While year to date basis, net capital inflows for the year 2013 stood at Rs. 8813.30 crores.

$/Euro (Spot)

1.3343

0.6

2.1

2.6

5.0

Dollar Index* NIFTY

79.61

-0.3

-1.2

-0.6

-2.5

5951.3

-0.3

-1.1

3.9

22.4

SENSEX

19663.6

0.0

-0.6

4.4

21.6

DJIA

13488.43

0.1

0.4

1.8

8.3

S&P

1472.05

0.00

0.38

3.10

13.89

Source: Reuters

Euro gained 2.1 percent as the European Central Bank President said that the region is likely to witness growth in the later part of the 2013 which created positive market sentiments and supported an upside in the currency. Weakness in the DX also added to the gains in currency. The currency touched a weekly high of 1.3365 and closed at 1.3343 on Friday.

www.angelcommodities.com

Commodities Daily Report

Monday| January 14, 2013

International Commodities

Bullion Gold

Spot gold prices gained 0.4 percent week on week on the back of positive market sentiments after European Central Bank President said that the Euro region is expected to recover in 2013. This raised hopes that the debt concerns in the region might be stemmed. Weakness in the US Dollar Index also added to the gains in the yellow metal prices. Further, stimulus measures announced by the Bank of Japan also pushed prices upwards. However, prices witnessed selling pressure on Friday due to weak data from the China which led to risk aversion in the global markets. The yellow metal touched a weekly high of $ 1,678.6/oz and closed at $ 1,662.4 per ounce on Friday. On the MCX, Gold February contract ended 0.3 percent lower week on week due to appreciation in the rupee. Gold prices on the MCX closed at Rs. 30,757/10 gms on Friday after touching a low of Rs. 30,625/ 10gms. Market Highlights - Gold (% change)

Gold Gold (Spot) Gold (Spot -Mumbai) Gold (LBMA-PM Fix) Comex Gold (Feb13) MCX Gold (Feb13) Unit $/oz Rs/10 gms $/oz 1660.0 $/oz Rs /10 gms 30757.0 -0.6 -0.3 -2.0 11.2 -1.0 0.7 -2.8 1.3 Last 1662.4 30495.0 1657.5 Prev day -0.7 0.6 -1.0

as on 11 January, 2013 WoW 0.4 1.6 0.6 MoM -2.8 -1.6 -3.1 YoY 1.3 10.9 1.4

Source: Reuters

Market Highlights - Silver (% change)

Silver Silver (Spot) Silver (Spot Mumbai) Silver (LBMA) Comex Silver (Mar13) MCX Silver (Mar13) Unit $/oz 58500.0 Rs/1 kg $/oz $/ oz Rs / kg 58105.0 -1.0 3067.0 3036.7 0.6 -1.6 0.5 Last 30.4 Prev day -1.3

as on 11 January, 2013 WoW 0.7 2.3 MoM -7.6 -5.4 YoY 1.7 13.3

Silver

Spot silver prices ended 0.7 percent higher taking cues from firmness in the spot gold prices and weakness in the DX. However, weakness in the base metals pack restricted sharp gains in the silver prices in last week. The white metal touched a weekly high of $ 30.91/oz and closed at $ 30.4 per oz on Friday. In the Indian markets, MCX silver prices gained 0.3 percent and closed at Rs. 58,105/kg on Friday and touched a weekly high of Rs. 58,730/ kg. Appreciation in the Indian rupee however, restricted sharp gains in the silver prices on MCX.

4.6 1.6

-7.5 -7.8

2.9 1.7

0.3

-6.8

10.5

Outlook

In todays session, we expect precious metals to trade higher due to mixed global market sentiments along with weakness in the DX. Expectation of demand from the Asian buyers and stimulus measures by the Bank of Japan is likely to add to the gains in the gold prices. In the domestic markets, depreciation in the rupee is expected to act as supportive factor for the MCX precious metals. Technical Outlook

Unit Spot Gold MCX Gold Feb13 Spot Silver MCX Silver Mar13 $/oz Rs/10 gms $/oz Rs/kg valid for January 14, 2013 Support 1660/1655 30700/30600 30.40/30.20 57800/57500 Resistance 1669/1674 30860/30960 30.70/30.95 58400/58900

Source: Reuters

Technical Chart Spot Gold

Source: Telequote

www.angelcommodities.com

Commodities Daily Report

Monday| January 14, 2013

Energy Crude Oil

International Commodities

Market Highlights - Crude Oil (% change)

Crude Oil WTI (Spot) Brent (Spot) Nymex Crude (Feb13) ICE Brent Crude (Feb13) MCX Crude (Jan13) Unit $/bbl $/bbl $/bbl

110.6 -1.1 -0.6 2.4 -1.4

Nymex crude oil prices rose around 0.5 percent in the last week on the back of less than expected increase in the US crude oil inventories along with weakness in the DX. Additionally, rise in the Chinese exports raised the expectations of increase in demand for the fuel also supported an upside in the prices. Crude oil prices touched a weekly high of $94.26/bbl and closed at $94.17/bbl in the last trading session of the week. On the domestic bourses, prices gained by 0.3 percent and closed at Rs.5,136/bbl on Friday after touching a high of Rs.5,175/bbl in the last week. However, sharp upside in the prices was capped as result of appreciation in the Indian Rupee.

as on 11 January, 2013 WoW

0.5 -2.6 0.5

Last

93.6 111.0 93.6

Prev. day

-0.2 -3.0 -0.3

MoM

9.7 2.2 9.1

YoY

-7.2 -1.2 -7.2

$/bbl

5120.0 -0.2 1.8 9.6 -3.1

Rs/bbl

Source: Reuters

Natural Gas

On a weekly basis, Nymex natural gas prices rose by more than 1 percent on the back of more than expected decline in the US natural gas inventories along with weakness in the DX. Apart from that expectations of cooler winter weather also acted as a positive factor for the natural gas prices. Gas prices touched a weekly high of $3.4/mmbtu and closed at $3.365/mmbtu in the last trading session of the week. On the domestic front, prices gained but appreciation in the Indian Rupee prevented sharp upside and closed at Rs.182.2/mmbtu after touching a high of Rs.186.2/mmbtu in the last week. Outlook In the intra-day we expect crude oil prices to trade higher due to mixed global market sentiments along with weakness in the DX. Decline in the crude oil production in the month of December along with hopes of rise in the demand from the key consuming nations as the economies recover is likely to support an upside in the crude oil prices. In the domestic markets, depreciation in the rupee is expected to act as a positive factor for the upside in the MCX Crude oil prices. Technical Outlook

Unit NYMEX Crude Oil MCX Crude Jan 13 $/bbl Rs/bbl valid for January 14, 2013

Market Highlights - Natural Gas

Natural Gas (NG) Nymex NG MCX NG (Jan 13) Unit $/mmbtu Rs/ mmbtu Last 3.327 181

(% change)

as on 11 January, 2013

Prev. day 4.20 3.96

WoW 1.22 0.00

MoM -2.49 -3.47

YoY 0.30 3.49

Source: Reuters

Technical Chart NYMEX Crude Oil

Source: Telequote

Technical Chart NYMEX Natural Gas

Support 93.40/92.60 5100/5060

Resistance 94.60/95.20 5170/5200

www.angelcommodities.com

Commodities Daily Report

Monday| January 14, 2013

International Base Metals Commodities

Base metal prices traded on a mixed note during the previous week. Base metals rose during the beginning of the week due to hopes of rise in the demand from the major consuming nation as the manufacturing activity witnessed a steadily rising trend and European Central bank President said that the region might witness a rise in later part of 2013. Weakness in the DX supported an upside on the metal prices. But, the worries over the curtailing of the stimulus measures by the US kept a lid on the prices of the metal prices In the domestic markets appreciation in the rupee added to the bearishness on the metal prices. Market Highlights - Base Metals (% change)

Unit LME Copper (3 month) MCX Copper (Feb13) LME Aluminum (3 month) MCX Aluminum (Jan13) LME Nickel (3 month) MCX Nickel (Jan13) LME Lead (3 month) MCX Lead (Jan13) LME Zinc (3 month) MCX Zinc (Jan13)

Source: Reuters

as on 11 January, 2013 WoW

-0.8

Last

8039.0

Prev. day

-1.4

MoM

-0.6

YoY

5.5

$/tonne

Rs/kg

445.4

-0.8

-1.2

-0.2

9.3

$/tonne

2099.8

-1.0

1.6

-0.6

4.0

Copper

Copper prices declined 1.4 percent in the last week. The fall in the copper prices is attributed to the expectations that the further monetary loosening by China might not happen as the CPI from the nation displayed an increase thus signalling economic growth. Rise in the LME inventories also supported the decline in the copper prices. However, Japans stimulus plan to spend 10.3 trillion yen ($116 billion) to boost the economic growth restricted the fall. Weakness in the DX also limited the decline in the metal prices. Chinese exports and imports also showed increase which lent support to the prices of copper. LME Copper inventories increased 3.45 percent in last week and stood at 330, 450 tonnes on Friday as against 319,400 tonnes on 04th January 2013. Prices of Copper on LME touched a weekly low of $8,025 per tonne and closed at $ 8,039 /tonne on Friday. In the domestic markets MCX copper declined 0.8 percent tracing bearishness in the international prices and depreciation in the Indian rupee. In the domestic markets prices of Copper on MCX touched a weekly low of Rs. 445 per kg and closed at Rs. 454.40 per kg on Friday. Outlook In the intra-day, base metal prices are expected to trade higher due to mixed global market sentiments along with weakness in the DX. However, unfavorable imports data from China in the last week along with expectation of rise in the global stocks of the Copper might limit gains in the red metal prices. In the domestic market, base metal prices on MCX are expected to trade higher due to depreciation in the rupee. Technical Outlook

Unit MCX Copper Feb13 MCX Zinc Jan13 MCX Lead Jan 13 MCX Aluminum Jan13 MCX Nickel Jan 13 Rs /kg Rs /kg Rs /kg Rs /kg Rs /kg valid for January 14, 2013 Support 443/441 109.5/108.8 125.5/124.8 113.5/112.8 957/950 Resistance 447/450 110.8/111.5 126.8/127.5 115/115.8 970/977

Rs /kg

114.1

-0.3

1.1

-0.2

2.2

$/tonne

17561.0

0.4

0.6

-1.2

-5.4

Rs /kg

962.8

0.9

0.1

-0.4

-4.3

$/tonne

2305.0

-1.8

-1.6

0.7

13.8

Rs /kg

126.2

-1.2

-1.8

1.7

21.9

$/tonne

2020.5

-1.5

-1.1

-2.4

8.9

Rs /kg

110.1

-0.8

-1.6

-1.7

9.9

LME Inventories

Unit Copper Aluminum Nickel Zinc Lead tonnes tonnes tonnes tonnes tonnes 11 January

330450 5180475 144246 1215650 303075

th

10 January

326575 5191900 144342 1215275 304650

th

Actual Change 3,875 -11,425 -96 375 -1,575

(%) Change 1.2 -0.2 -0.1 0.0 -0.5

Source: Reuters

Technical Chart MCX Copper

Source: Telequote

www.angelcommodities.com

Commodities Daily Report

Monday| January 14, 2013

International Commodities

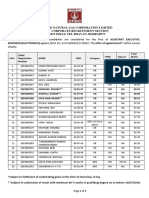

Important Events for Today

Indicator Bank Holiday FOMC Member Evans Speaks German WPI m/m Italian Industrial Production m/m Industrial Production m/m

Country JPY US EUR EUR EUR

Time (IST) All Day 6:50 am 12:30 pm 2:30 pm 3:30pm

Actual -

Forecast 0.5 % -0.1% 0.2%

Previous -0.7% -1.1% -1.4%

Impact Low Medium Low Medium Medium

www.angelcommodities.com

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- DTV Call Flow and Sample ScriptsDokument11 SeitenDTV Call Flow and Sample ScriptsAqo Cee Mae0% (1)

- #Last Will and TestamentDokument3 Seiten#Last Will and Testamentmatsumoto100% (1)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- 50 KWord EbookDokument247 Seiten50 KWord EbookLio PermanaNoch keine Bewertungen

- Globalization and International BusinessDokument14 SeitenGlobalization and International BusinesskavyaambekarNoch keine Bewertungen

- Technical & Derivative Analysis Weekly-14092013Dokument6 SeitenTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- FAO Statistics Book PDFDokument307 SeitenFAO Statistics Book PDFknaumanNoch keine Bewertungen

- Documents - Tips Chopra Scm5 Tif Ch05Dokument23 SeitenDocuments - Tips Chopra Scm5 Tif Ch05shahad100% (2)

- Adm ANI 2005Dokument15 SeitenAdm ANI 2005Paul GalanNoch keine Bewertungen

- 2018 Case and Course Outline in Banking Laws - Dean DivinaDokument14 Seiten2018 Case and Course Outline in Banking Laws - Dean DivinaA.A DizonNoch keine Bewertungen

- Oilseeds and Edible Oil UpdateDokument9 SeitenOilseeds and Edible Oil UpdateAngel BrokingNoch keine Bewertungen

- Daily Metals and Energy Report September 16 2013Dokument6 SeitenDaily Metals and Energy Report September 16 2013Angel BrokingNoch keine Bewertungen

- Special Technical Report On NCDEX Oct SoyabeanDokument2 SeitenSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNoch keine Bewertungen

- WPIInflation August2013Dokument5 SeitenWPIInflation August2013Angel BrokingNoch keine Bewertungen

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDokument4 SeitenRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNoch keine Bewertungen

- International Commodities Evening Update September 16 2013Dokument3 SeitenInternational Commodities Evening Update September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 14 2013Dokument2 SeitenDaily Agri Tech Report September 14 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 16 2013Dokument2 SeitenDaily Agri Tech Report September 16 2013Angel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report November 12Dokument2 SeitenMetal and Energy Tech Report November 12Angel BrokingNoch keine Bewertungen

- Commodities Weekly Outlook 16-09-13 To 20-09-13Dokument6 SeitenCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNoch keine Bewertungen

- Market Outlook 13-09-2013Dokument12 SeitenMarket Outlook 13-09-2013Angel BrokingNoch keine Bewertungen

- Commodities Weekly Tracker 16th Sept 2013Dokument23 SeitenCommodities Weekly Tracker 16th Sept 2013Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Dokument4 SeitenDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNoch keine Bewertungen

- Derivatives Report 16 Sept 2013Dokument3 SeitenDerivatives Report 16 Sept 2013Angel BrokingNoch keine Bewertungen

- Currency Daily Report September 16 2013Dokument4 SeitenCurrency Daily Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 16 2013Dokument9 SeitenDaily Agri Report September 16 2013Angel BrokingNoch keine Bewertungen

- Sugar Update Sepetmber 2013Dokument7 SeitenSugar Update Sepetmber 2013Angel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- IIP CPIDataReleaseDokument5 SeitenIIP CPIDataReleaseAngel BrokingNoch keine Bewertungen

- Derivatives Report 8th JanDokument3 SeitenDerivatives Report 8th JanAngel BrokingNoch keine Bewertungen

- Technical Report 13.09.2013Dokument4 SeitenTechnical Report 13.09.2013Angel BrokingNoch keine Bewertungen

- TechMahindra CompanyUpdateDokument4 SeitenTechMahindra CompanyUpdateAngel BrokingNoch keine Bewertungen

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDokument1 SeitePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report Sept 13Dokument2 SeitenMetal and Energy Tech Report Sept 13Angel BrokingNoch keine Bewertungen

- MetalSectorUpdate September2013Dokument10 SeitenMetalSectorUpdate September2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 06 2013Dokument2 SeitenDaily Agri Tech Report September 06 2013Angel BrokingNoch keine Bewertungen

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDokument6 SeitenTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNoch keine Bewertungen

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDokument4 SeitenJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNoch keine Bewertungen

- MarketStrategy September2013Dokument4 SeitenMarketStrategy September2013Angel BrokingNoch keine Bewertungen

- 2018 RsetDokument500 Seiten2018 RsetMilagros Aro RimandoNoch keine Bewertungen

- Economy 4aaDokument3 SeitenEconomy 4aaabraham benitezNoch keine Bewertungen

- Evaluasi Penerapan Tarif Angkutan Umum Kereta Api (Studi Kasus Kereta Api Madiun Jaya Ekspres)Dokument8 SeitenEvaluasi Penerapan Tarif Angkutan Umum Kereta Api (Studi Kasus Kereta Api Madiun Jaya Ekspres)sekar arinNoch keine Bewertungen

- BillDokument1 SeiteBillZeeshan Haider RizviNoch keine Bewertungen

- Aee Electronics 1Dokument2 SeitenAee Electronics 1Rashi SharmaNoch keine Bewertungen

- Tugas ToeflDokument3 SeitenTugas ToeflIkaa NurNoch keine Bewertungen

- DisinvestmentDokument2 SeitenDisinvestmentBhupendra Singh VermaNoch keine Bewertungen

- Comp Data2312 PDFDokument338 SeitenComp Data2312 PDFkunalNoch keine Bewertungen

- Overview of Energy Systems in Northern CyprusDokument6 SeitenOverview of Energy Systems in Northern CyprushaspyNoch keine Bewertungen

- Four Steps To Writing A Position Paper You Can Be Proud ofDokument6 SeitenFour Steps To Writing A Position Paper You Can Be Proud ofsilentreaderNoch keine Bewertungen

- Far East Agricultural Supply, Inc. Vs Jimmy LebatiqueDokument2 SeitenFar East Agricultural Supply, Inc. Vs Jimmy LebatiqueAbdulateef SahibuddinNoch keine Bewertungen

- Chapter OneDokument2 SeitenChapter OnebundeNoch keine Bewertungen

- Final Draft of Toledo City LSPDokument21 SeitenFinal Draft of Toledo City LSPapi-194560166Noch keine Bewertungen

- Nghe HSG 4Dokument3 SeitenNghe HSG 4GiangNoch keine Bewertungen

- Ratio Analysis & Financial Benchmarking-Bob Prill & Tori BrysonDokument38 SeitenRatio Analysis & Financial Benchmarking-Bob Prill & Tori BrysonRehan NasirNoch keine Bewertungen

- Irma Irsyad - Southwest Case StudyDokument27 SeitenIrma Irsyad - Southwest Case StudyIrma IrsyadNoch keine Bewertungen

- Report User DSDokument99 SeitenReport User DSPrabuNoch keine Bewertungen

- Jittipat Poonkham - Russia's Pivot To Asia: Visionary or Reactionary?Dokument8 SeitenJittipat Poonkham - Russia's Pivot To Asia: Visionary or Reactionary?Jittipat PoonkhamNoch keine Bewertungen

- Disney Ceramic Reusable Bottle 34oz 1,000ml - Frank Green AustraliaDokument1 SeiteDisney Ceramic Reusable Bottle 34oz 1,000ml - Frank Green Australiad96677q568Noch keine Bewertungen

- Secretary Industries & Managing Director - KSIDC LTD: Alkesh SharmaDokument28 SeitenSecretary Industries & Managing Director - KSIDC LTD: Alkesh SharmaMurali KrishnanNoch keine Bewertungen

- TOFELDokument18 SeitenTOFELNata SchönNoch keine Bewertungen