Beruflich Dokumente

Kultur Dokumente

George Soros, S Secrets

Hochgeladen von

corneliusflavius7132Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

George Soros, S Secrets

Hochgeladen von

corneliusflavius7132Copyright:

Verfügbare Formate

GURUFOLIO REPORT

SOROS FUND MANAGEMENT LLC

Portfolio:

SA M

Fund Type: Portfolio Date: 13D/13G Date: Equity Value: Number of Stocks: 727 Number of New Buys: 221 Q/Q Turnover:

Copyright 2011 by GuruFocus.com LLC. Any reproduction or divulgence without written consent is prohibited. The use of this confidential report is strictly limited to authorized readers.

PL E

Portfolio Date: 2011-05-20 Updated on 2011-06-14

GEORGE SOROS PORTFOLIO

Portfolio Overview

Hedge Fund 2011-03-31 2011-05-20 $6.42 Billion 30%

Soros Fund Management LLC

GuruFocus.com, LLC Plano, TX 75023-7843 Phone: 469-248-6885

3400 Silverstone Dr., Suite 172

Website: http://www.gurufocus.com E-mail: gurufocus@gurufocus.com

Table of Content Table of Content I. Portfolio Overview, Profile II. Historical Total Value ($Billion) of Filings III. Industry/Sector Shift in Past 12 Months V. Top Purchases of George Soros VI. Top Sales of George Soros 2 3 3 3 5 6 6 7 8 8 9 10 10 11 11 12 12 13 14 15 16 17 18 20 21 21

VII. Top Bargain Candidates of George Soros IX. Stocks at Close to 52-Week Lows

VIII. Consenus Picks of George Soros and Other Gurus

X. Overview of Sector/Industry Trend of George Soros's Trades XI. No. 1 Bought Industry - Industrial Goods & Services XIII. No. 3 Bought Industry - Banks XII. No. 2 Bought Industry - Personal & Household Goods XIV. No. 1 Sold Industry - Oil & Gas Producers XV. 13D/13G/Form 4 Filings After 2011-03-31

XVI. Undervalued Stocks Based on Discounted Cash Flow Model

SA M

XVIII. Top Growth Companies XIX. Stocks with Heavy Insider Buys XX. Stocks that George Soros Keeps Buying XXII. International Stocks XXIII. ETF Holdings XXIV. Preferred Stocks XXI. Stocks that George Soros Keeps Selling XXV. Call/Put Option Holdings

XVII. Top Yield Stocks

PL E

IV. Top Holdings (Up to 25)

GuruFolio Reports

http://GuruFocus.com

I. Portfolio Overview, Profile

Portfolio Overview Portfolio: Firm Type: Portfolio Date: 13D/13G Date: Number of Stocks: Equity Value: Number of New Buys: Q/Q Turnover: Soros Fund Management LLC Hedge Fund 2011-03-31 2011-05-20 727 $6.42 Billion 221 30%

George Soros is known for the unmatched success of his Quantum Fund. A hedge fund guru, he is recognized for having the best performance record of any investment fund in the world over its 26-year history. A mere $1000 invested in 1969 when Soros established the Quantum Fund would have been worth $4 million by the year 2000. During that time he achieved a cumulative 32% annual return. Investing Philosophy

Copyright 2011 by GuruFocus.com LLC

SA M

His basic theory of investing is that financial markets are chaotic. The prices of stocks, bonds and currencies depend on the human beings who buy and sell them, and those traders often act out of highly emotional reactions rather than coolly logical calculations. Opportunities can be found by carefully studying the value and the market prices of assets. He focuses on a theory of "reflexivity," which is based on the premise that individual investor biases affect market transactions and the economy.

II. Historical Total Value ($Billion) of Filings

III. Industry/Sector Shift in Past 12 Months

3/21

PL E

Profile

GuruFolio Reports

http://GuruFocus.com

Copyright 2011 by GuruFocus.com LLC

SA M

4/21

PL E

GuruFolio Reports

http://GuruFocus.com

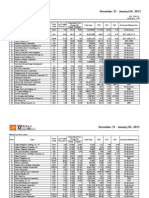

IV. Top Holdings (Up to 25)

These are the top holdings of George Soros as of 2011-03-31 in the order of significance.

Ticker Company Adecoagro SA InterOil Motorola Solutions Monsanto Co. Dendreon Corp. Visteon Corp. Citigroup Inc. Westport Innovations Inc Emdeon Wells Fargo & Co. Teva Pharmaceutical Industries Ltd. CVS Caremark Danaher Corp. Apple Inc. Weatherford International Ltd. Comcast Corp. Shares (1000) ($Mil) Value Weighting (%) Share # Change from Last Period Current Price ($) Price Change Since Quarter End (%)

AGRO IOC MSI MON DNDN VC C WPRT EM WFC TEVA CVS DHR AAPL WFT

27,159 4,047 4,481 2,659 4,672 2,134 2,939 5,548 7,152 3,505 2,134 2,927 1,872 230

366

5.7%

New Buy -8.72% New Buy -19.21%

12.1 56.6 45.43 68.7

-10.2% -24.2% 1.7% -4.9% 5.1% -4.5% -11.4% -6.2% -17.4% -15.1% -2.1% 8.7% -1.1% -6.3% -23.1% -4.1% -7.6% 0.3% -14.0% -7.6% -2.6% -5.9% 3.4% -6.7% -4.6%

302 4.71% 200 3.12% 192 2.99% 175 2.72% 133 2.08% 130 2.02% 122 1.9%

SA M

3,499 3,194 6,261 1,319 116 79 1.23% 79 1.23% 76 1.18% 73 1.14% 68 1.06% 65 1.01% 61 0.96% 58 0.91% 53 0.82% 51 0.8% CMCSA LWSN ESRX

Lawson Software Inc. Express Scripts Inc. Google Inc.

GOOG VZ

Verizon Communications Inc. Polo Ralph Lauren Corp. Gilead Sciences Inc. Amazon.com Inc.

1,685 496

RL

GILD

1,376 293

AMZN ACTG NIHD

Acacia Research Corp. NII Holdings Inc

1,494 1,213

Copyright 2011 by GuruFocus.com LLC

PL E

+11.27% 39.35 59.7 New Buy +174.20% +22.56% -8.16% 39.17 20.62 13.3 26.9 115 1.79% 111 1.73% 107 1.67% 100 1.56% 97 1.51% 80 1.25% +516.23% -15.54% 49.14 37.31 51.33 326.6 17.38 23.71 11.18 55.76 504.73 35.63 120.46 39.96 186.29 31.93 39.76 +918.68% +462.26% -24.41% +103.46% +61.20% +6.54% +704.09% +85.40% +61.79% +9,265.43% +760.06% +831.43% +179.65% +1,719.34% 51 0.79%

5/21

GuruFolio Reports

http://GuruFocus.com

V. Top Purchases of George Soros

These are the top purchases of George Soros as of 2011-03-31 in the order of significance.

Ticker Company Adecoagro S.a. Motorola Solutions Inc. New Visteon Corp. Wells Fargo & Co. Cvs Caremark Corp. Citigroup Inc. Danaher Corp. Express Scripts Inc. Polo Ralph Lauren Corp. Gilead Sciences Inc. Current Shares (1000) Value ($Mil) Impact to Portfolio (%) Share # Change from Last Period New holding New holding New holding Add 516.23% Add 918.68% Add 174.2% Average Cost Current Price ($) Change(%) Price

AGRO MSI VC WFC CVS C DHR ESRX RL GILD

27,159 4,481 2,134 3,505 2,927

329 204 127 94

4.36% 2.38% 1.59% 1.11% 1.08% 0.98% 0.95% 0.76% 0.72% 0.62%

$12.73 $39.86 $69.72 $32.23 $33.91 $47.29 $49.27 $55.84

$12.1 $45.43 $59.7 $26.9

-4.9% 14.0% -14.4% -16.5% 10.0% -17.2% 4.2% -0.1% 3.0% 1.9%

29,385 1,151 1,872 1,319 496 1,376 96 74 60 55

VI. Top Sales of George Soros

SA M

Ticker Company Current Shares (1000) Value ($Mil)

These are the top sales of George Soros as of 2011-03-31 in the order of significance.

Impact to Portfolio (%) Share # Change from Last Period Reduce -98.95% Sold Out Reduce -88.03% Reduce -72.94% Sold Out Sold Out Reduce -97.76% Sold Out Sold Out Reduce -65.19% Average Cost Current Price ($) Price Change(%)

GLD PXP DAL NG

Spdr Gold Trust Spdr Gold

PL E

109 $37.31 $39.17 $51.33 $55.76

Add 462.26% Add 704.09% Add 9265.43% Add 760.06%

$116.94 $120.46 $39.2 $39.96

49 0

7 0

-7.54% -1.97% -1.54% -1.46% -0.94% -0.9%

$135.37 $147.77 $35.5 $11.33 $13.58 $33.21 $13.56 $25.82 $53.98 $9.09 $16.42 $35.25

9.2% -0.7%

Plains Exploration & Production Company Delta Air Lines Inc.

1,763 3,492 0 0

16 32 0 0 1 0 0

$9.26 -18.3% $9.15 -32.6% $28.82 -13.2% $14.8 $28.15 $52.62 $9.11 $15.5 9.1% 9.0% -2.5% 0.2% -5.6%

Novagold Resources Inc. Best Buy Company Inc.

BBY IAU

Ishares Comex Gold Trust Cocacola Enterprises Inc. Walmart Stores Inc. Motorola Inc.

CCE

53 0 0

-0.87% -0.66% -0.52% -0.49%

WMT MOT KGC

Kinross Gold Corp.

1,379

21

Copyright 2011 by GuruFocus.com LLC

6/21

GuruFolio Reports

http://GuruFocus.com

VII. Top Bargain Candidates of George Soros

George Soros bought these stocks in the quarter ended on 2011-03-31. You can buy these stocks at lower prices.

Ticker Company North American Palladium Ltd. Kv Pharmaceutical Cla Isoftstone Holdings Ltd. Ehouse Holdings Ltd. Nokia Corp. Camelot Information Systems Inc. Community Health S. Rentrak Corp. Clearwire Corp. Youku.com Winnebago Industries Inc. Ruby Tuesday Inc. Skyworks Solutions Inc. Broadcom Corp. Rf Micro Devices Inc. Current Shares (1000) Value ($Mil) Impact to Portfolio (%) Share # Change from Last Period Add 3900% New holding Add 283.53% Add 894.53% New holding New holding Average Cost Current Price ($) Price Change(%)

PAL KV.A ISS EJ NOK CIS CYH RENT CLWR YOKU WGO RT SWKS BRCM RFMD MRVL WFT

2,000 200 690 497 384 125 19

7 1 8 4 2 2 0 6 1 1 6 0 3 9

0.15% 0.01% 0.11% 0.06% 0.04% 0.02% 0.01% 0.05% 0.02% 0.03% 0.1%

$6.87 $5.86 $19.27 $13.52 $9.63

$3.69 $3.24 $11.14 $7.78 $6.11

-46.3% -44.7% -42.2% -42.5% -36.6% -35.9% -32.5% -29.8% -29.7% -30.1% -28.7% -29.1% -28.0% -24.8% -24.6% -23.3% -23.3% -23.1% -22.7% -21.5%

SA M

4,367 219 24 3

Marvell Technology Group Ltd. Weatherford Intl. Ltd.

ANR

Alpha Natural Resources Inc. Wabash National Corp.

WNC

YTEC

Yucheng Technologies Ltd.

Copyright 2011 by GuruFocus.com LLC

PL E

$21.09 $38.16 $26.99 $5.43 $13.51 $25.76 $18.95 $3.82

Add 173.53% Add 99.94%

342 270 50

New holding New holding New holding New holding Add 99.89% Add 32.79% Add 102.8%

$38.29 $14.8

$26.78 $10.55 $9.59

600 41

0.01% 0.02% 0.03% 0.17% 0.04% 0.48% 0.06% 0.26% 0.01%

$13.53

114 283

$32.68 $23.515 $42.95 $7.24 $18.39 $22.66 $56.95 $11.36 $3.95 $32.3 $5.46 $14.11 $17.38 $43.78 $8.78 $3.1

Add 795.69% Add 103.46% Add 1405.45% New holding New holding

3,499 83

61 4

1,900 162

17 1

7/21

GuruFolio Reports

http://GuruFocus.com

VIII. Consenus Picks of George Soros and Other Gurus

These are the stocks that George Soros bought. They are also bought by other Gurus tracked by GuruFocus.

Ticker Company Motorola Solutions Inc. New Visteon Corp. Nii Holdings Inc Urs Corp. Hca Holdings Inc. Priceline.com Inc. Powerone Inc. Noble Energy Inc. Dendreon Corp. Swift Transportation Co. Rf Micro Devices Inc. American Superconductor Corp. Current Shares (1000) ($Mil) Value Impact to Portfolio (%) Share # Change from Last Period New holding New holding Average Cost Price ($) Current Change(%) Price

MSI VC NIHD URS HCA PCLN PWER NBL DNDN SWFT RFMD AMSC

4,481 2,134 1,213 1,095 700 47

204 127 48 46 24 22 23 15

2.38% 1.59% 0.57% 0.4%

$39.86 $69.72 $41.09 $44.46 $32.28

$45.43

14.0%

PL E

Add 1719.34% Add 205.35% New holding

$59.7 -14.4% -3.2% -5.6% 4.2% 7.6%

$39.76 $41.98 $33.65

0.28% 0.27% 0.22% 0.21% 0.21% 0.17% 0.17% 0.16%

Add 4974.37% Add 255.54% New holding Add 11.27%

$448.15 $482.13 $9.47

2,835 180

$8.1 -14.5% -4.4% 13.8%

$89.18 $34.58 $14.2 $7.24

$85.22 $39.35

4,672 1,000 4,367 541

184 12 24 4

New holding Add 102.8%

$12.4 -12.7% $5.46 -24.6% $7.73 -71.2%

New holding

$26.83

SA M

Ticker Company Current Price ($) High

IX. Stocks at Close to 52-Week Lows

These are the stocks George Soros that are within 5% of 52-week lows.

% off 52-Week Shares (1000) Value ($Mil) Weighting (%) Share # Change from Last Period

VC

Visteon Corp.

59.7 32.9 9.26 3.04 7.73

21.8 23.3 37.2 54.6 80.2 47.9 52.8 63.8 38.7 36.4 44.3

2,134 1,110 1,763 2,644 541 690 1,425 2,500 342 371 482

133 2.08% 45 0.7%

New Buy +88.65% -88.03% -45.15% New Buy +283.53%

PBR DAL BPZ

PETROLEO BRASILEIIRO SA PETROBRAS Delta Air Lines

17 0.27% 14 0.22% 13 0.21% 13 0.2%

BPZ Resources

AMSC ISS

American Superconductor Corp. iSoftStone Holdings

11.14 4.1

CTE

SinoTech Energy Ltd. ADS SatCon Technology Corp. Rentrak Corp.

11 0.18% 10 0.15% 9 0.14% 9 0.14% 7 0.11% +82.68% +99.94% New Buy -0.21%

SATC

1.99

RENT MMI RDA

18.95 23.28 9.95

Motorola Mobility Holdings RDA Microelectronics Inc.

Copyright 2011 by GuruFocus.com LLC

8/21

GuruFolio Reports

http://GuruFocus.com

X. Overview of Sector/Industry Trend of George Soros's Trades

This is the overview of the industries that George Soros was buying into and selling out in the quarter ended on 2011-03-31.

Industry Impact to Portfolio due to Sales (%) Impact to Portfolio due to Buys (%)

Industrial Goods & Services Personal & Household Goods Banks Automobiles & Parts Software & Computer Services Pharmaceuticals & Biotechnology Health Care Equipment & Services Media Financial Services Mobile Telecommunications Fixed Line Telecommunications Basic Resources Chemicals Travel & Leisure Insurance Retail Food & Beverage Electricity

0.45% 0.07% 0.07% 0% 1.86% 2.74%

3.9% 3.48%

Technology Hardware & Equipment

Oil Equipment, Services & Distribution

SA M

Gas, Water & Multiutilities Construction & Materials Oil & Gas Producers

Copyright 2011 by GuruFocus.com LLC

PL E

0.18% 1.83% 0.14% 0.14% 0.2% 1.73% 1.66% 0.04% 1.03% 1.18% 0% 0.72% 0.07% 0.68% 0.01% 0.6% 0.27% 0.58% 0.18% 0.47% 0.09% 0.32% 0% 0.16% 0.04% 0.07% 2.38% 2.41% 0.02% 0.01% 0.02% 0% 0.02% 0% 0.09% 0% 0.99% 2.32%

9/21

GuruFolio Reports

http://GuruFocus.com

XI. No. 1 Bought Industry - Industrial Goods & Services

Industrial Goods & Services is the No. 1 indutrsty that George Soros purchased in the quarter ended on 2011-03-31. These are the companies.

Ticker Company Danaher Corp. Urs Corp. Moodys Corp. Westport Innovations Inc Wabash National Corp. Powerone Inc. Be Aerospace Inc. Fedex Corp. Swift Transportation Co. Coinstar Inc. Current Shares (1000) Value ($Mil) Impact to Portfolio (%) Share # Change from Last Period Add 462.26% Add 205.35% Average Cost Current Price ($) Price Change(%)

DHR URS MCO WPRT WNC PWER BEAV FDX SWFT CSTR

1,872 1,095 735 5,548 1,900 2,835 508 167 1,000 337

96 46 30

0.95% 0.4% 0.3%

$49.27 $44.46 $30.5

$51.33 $41.98 $41.21 $20.62 $8.78 $8.1

4.2% -5.6% 35.1% 19.0% -22.7% -14.5% -0.2% -6.6% -12.7% 3.4%

SA M

Ticker Company Current Shares (1000) ($Mil) Value (%)

XII. No. 2 Bought Industry - Personal & Household Goods

Personal & Household Goods is the No. 1 indutrsty that George Soros purchased in the quarter ended on 2011-03-31. These are the companies.

Impact to Portfolio Share # Change from Last Period New holding Add 9265.43% Add 87.31% New holding New holding Average Cost Price ($) Current Change(%) Price

MSI RL

Motorola Solutions Inc. New Polo Ralph Lauren Corp. Stanley Works

4,481 496 491 600 625

PL E

Add 8654.76% Add 22.56%

114 17 23 19 14 12 16

0.27% 0.26% 0.22% 0.21% 0.19% 0.17% 0.17%

$17.33 $11.36 $9.47

New holding

Add 255.54% New holding New holding New holding

$36.67 $91.97 $14.2

$36.59 $85.92 $12.4

Add 1412.11%

$45.48

$47.03

204 60 33 6 6

2.38% 0.72% 0.21% 0.1%

$39.86

$45.43

14.0% 3.0% -7.8% -28.7% 4.3%

$116.94 $120.46 $72.38 $14.8 $9.58 $66.72 $10.55 $9.99

SWK

WGO TIVO

Winnebago Industries Inc. Tivo Inc.

0.07%

Copyright 2011 by GuruFocus.com LLC

10/21

GuruFolio Reports

http://GuruFocus.com

XIII. No. 3 Bought Industry - Banks

Banks is the No. 1 indutrsty that George Soros purchased in the quarter ended on 2011-03-31. These are the companies.

Ticker Company Wells Fargo & Co. Citigroup Inc. Itau Unibanco Banco Multiplo S.a. Suntrust Banks Inc. Pnc Financial Services Group Credicorp Ltd Keycorp Current Shares (1000) ($Mil) Value Impact to Portfolio (%) Share # Change from Last Period Add 516.23% Add 174.2% New holding New holding New holding New holding New holding Average Cost Current Price ($) Change(%) Price

WFC C ITUB STI PNC BAP KEY

3,505

94

1.11% 0.98% 0.39% 0.09% 0.08% 0.06% 0.03%

$32.23 $47.29 $22.44 $29.84 $62.07

$26.9 $39.17 $22.13 $25.52 $59.25 $91.45 $8

-16.5% -17.2% -1.4% -14.5% -4.5% -14.2% -11.4%

29,385 1,151 1,352 277 104 48 30 7 6 4 2

XIV. No. 1 Sold Industry - Oil & Gas Producers

Oil & Gas Producers is the No. 1 indutrsty that George Soros sold in the quarter ended on 2011-03-31. These are the companies.

Ticker Company Plains Exploration & Production Company Gran Tierra Energy Inc. Bpz Resources Inc. Current Shares (1000) Value ($Mil) Impact to Portfolio (%) Share # Change from Last Period Sold Out Sold Out Reduce -45.15% Sold Out Sold Out Reduce -38.33% Sold Out Sold Out Sold Out Sold Out Average Cost Current Price ($) Price Change(%)

SA M

PXP GTE BPZ 0 0 0 0 8 0 0 3 0 0 0 0 2,644 0 0 MHR

Magnum Hunter Resources Corp. Toreador Resources Corp. Range Resources Corp Valero Energy Corp. Sunoco Inc.

PL E

$106.59 $9.03 284 -1.97% -0.19% -0.14% -0.05% -0.03% -0.02% -0.01% -0.01% -0.01% -0.01% $35.5 $8.52 $5.63 $7.2 $14.53 $49.62 $35.25 55 0 0 0 0 $51.3 $26.86 $24.33 $42.42 $39.56 $38.91 $41.74

-0.7%

$6.3 -26.1% $3.04 -46.0% $6.27 -12.9% $4.81 -66.9% 3.4% -9.4% -6.7%

TRGL RRC VLO

SUN SFY

Swift Energy

$41.91 $33.65 -19.7% 7.3%

BBG

Bill Barrett Corp.

Copyright 2011 by GuruFocus.com LLC

11/21

GuruFolio Reports

http://GuruFocus.com

XV. 13D/13G/Form 4 Filings After 2011-03-31

These are the trades of George Soros after 2011-03-31. These are from 13D/13G/Form 4 filings.

Ticker Shares (1000) Date from Last Period Share # Change % of the company Filing Type

EXAR MSTR EXAR GMLP

6,657 455 6,620 1,175

2011-05-16 2011-05-10 2011-05-09 2011-05-04

+0.50% +34.34% +0.20% 5.67%

4 13G 4

XVI. Undervalued Stocks Based on Discounted Cash Flow Model

These are the stocks that appear to be undervalued based on the calculation with Discounted Cash Flow model. The calculation is based on the past business performance of the company. The discount rate is 12%. The terminal growth rate is 4%. The growth rate of the next ten years is assumed to be equal to that of the previous 10 years.

SA M

Ticker Company Price ($)

AFL

AFLAC Inc.

CMTL ACE OII

Comtech Telecommunications Corp. ACE Ltd.

Oceaneering International Inc. Bob Evans Farms Inc.

BOBE CXW

Corrections Corp. of America

MRVL AIT

Marvell Technology Group Ltd.

Applied Industrial Technologies Inc. Target Corp.

TGT

MUR INTC VZ

Murphy Oil Corp. Intel Corp.

Verizon Communications Inc. Cisco Systems Inc.

CSCO

Copyright 2011 by GuruFocus.com LLC

PL E

New Buy 5.08%

Margin of Safety (%) Shares (1000) Value ($Mil) Weighting (%)

13G

Share # Change

45.28 23.62 65.74 35.91 32.45 21.35 14.11 33.09 46.43 63.95

65% 51% 49% 39% 26% 21% 17% 15% 14% 7% 7% 6% 6%

20.0 9.9 24.0 5.2 8.1 30.2 219.4 14.6 8.7 19.0 142.1 1,685.4 308.6

1.1 0.3 1.6 0.2 0.3 0.7 3.4 0.5 0.4 1.4 2.9 65.0 5.3

0.02% 0% 0.02% 0% 0% 0.01% 0.05% 0.01% 0.01% 0.02% 0.04% 1.01% 0.08%

+412.82% +22.22% +500.00% -7.14% New Buy +13.53% +795.69% New Buy -97.20% -19.49% +434.18% +61.79% +12.38%

21.385 35.63 15.06

12/21

GuruFolio Reports

http://GuruFocus.com

XVII. Top Yield Stocks

These are the stocks with the highest dividend yield in the portfolio of George Soros.

Ticker Company SeaCube Container Leasing Chimera Investment Two Harbors Investment Penn West Petroleum Ltd. PDL BioPharma Inc. MCG Capital Corp. Vodafone Group Plc CenturyLink THL Credit Inc. Nokia Corp. ADS MackCali Realty Corp. AT&T Verizon Communications Inc. R.R. Donnelley & Sons Company NutriSystem Inc Brandywine Realty Trust BCE Inc. Yield (%) Price ($) Shares (1000) Value ($Mil) Weighting as of 2011-0331 (%) Share # Change from Last Period

BOX CIM TWO PWE PDLI MCGC VOD CTL TCRD NOK CLI T VZ RRD NTRI BDN BCE PHI

16.3% 16.17 15.9% 3.53

14 20 13 512 17 12

0.2 0.1 0.1 14.2 0.1 0.1 5.1

0% 0% 0% 0.22% 0% 0%

New Buy New Buy New Buy New Buy New Buy New Buy -2.73%

15.2% 10.51 14% 23.15 5.74 6.16

SA M

5.3% 5.1% 5% 5% 5% 11.24 38.73 52.94 41.8 9.54

Philippine Long Distance Telephone Company ADS Exelon Corp.

EXC

SBGI

Sinclair Broadcast Group Inc.

Copyright 2011 by GuruFocus.com LLC

PL E

10.5% 9.7% 7.3% 7.3% 7.1% 6.7% 5.7% 5.6% 5.5% 26.27 39.85 12.91 6.11 178 314 14 0.08% 0.2% 0% 13.1 0.2 3.3 0.2 384 6 0.05% 0% 31.72 30.55 35.63 1,599 1,685 108 22 17 19 46 22 48 48.9 65.0 2.0 0.3 0.2 0.7 2.5 0.9 0.6 0.76% 1.01% 0.03% 0.01% 0% 0.01% 0.04% 0.01% 0.01% 5.4% 19.425 5.3% 13.3

+9.53%

+29.80% New Buy New Buy +42.96% +61.79%

+230.06% New Buy New Buy

New Buy -56.66% New Buy

13/21

GuruFolio Reports

http://GuruFocus.com

XVIII. Top Growth Companies

These are the stocks with the highest growth rate in the past 5 years among the holdings of George Soros.

Ticker Company Deckers Outdoor Corp. Immucor Inc. Pioneer Drilling Co. UnitedHealth Group Inc. Cognizant Technology Solutions Corp. ACE Ltd. Teva Pharmaceutical Industries Ltd. Potash Corp. Of Saskatchewan Marvell Technology Group Ltd. Coach Inc. Goldcorp Inc. Suncor Energy Inc. Express Scripts Inc. Health Management Associates Inc. Cl A Turkcell Iletisim Hizmetleri A.S. ADS Alliance Data Systems Corp. eBay Inc. 10-Year EBITDA Growth Rate (%) Price ($) Shares (1000) Value ($Mil) Weighting as of 2011-03-31 (%) Share # Change from Last Period

DECK BLUD PDC UNH CTSH ACE TEVA POT MRVL COH GG SU ESRX HMA TKC

49.1% 48.3% 46.8% 40.7% 39.7% 38.8% 37.1% 35.8% 33.9% 33.5% 32.5% 29.6% 28.6% 27.7% 27.4% 27.3% 27.3% 27.1% 25.7% 25.1%

78.57 20.17 13

2.4 21.0 15.0

0.2 0.4 0.2

0% 0.01% 0%

New Buy -51.05% New Buy +20.02% -35.23%

SA M

ADS EBAY QSFT

Quest Software Inc.

CMTL BLK

Comtech Telecommunications Corp. Blackrock Inc

Copyright 2011 by GuruFocus.com LLC

PL E

49.11 70.71 65.74 314.2 14.2 93.4 24.0 7.6 1.6 0.22% 0.12% 0.02% 1.67% 0.17% 0.05% 0.71% 0.01% 0.01% 1.14% 0.11% 0.02% 0% 0.01% 0.01% 0% 0.07% 49.14 2,134.0 107.1 54.32 14.11 58.76 46.24 38.57 184.3 10.9 219.4 3.4 875.7 45.6 7.6 9.8 0.4 0.4 55.76 1,318.7 73.3 10.1 629.1 86.5 3.3 17.4 22.1 9.9 23.2 6.9 1.3 0.3 0.5 0.6 0.3 4.7 13.37 86.9 29.86 20.765 23.62 188.93

+500.00% -15.54%

+1,128.83% +795.69% +250.79% New Buy +84.91%

+704.09%

+5,276.79% +20.98% New Buy +9.43% +130.21% +22.22% +711.47%

14/21

GuruFolio Reports

http://GuruFocus.com

XIX. Stocks with Heavy Insider Buys

These are the stocks that have the largest unique insider buys over the past 3 months.

Ticker Company Two Harbors Investment HCA Holdings Rex Energy Corp. THL Credit Inc. Cenveo Inc. Aeroflex Holdings Pioneer Drilling Co. Flagstar Bancorp Inc. General Motors Hyatt Hotels Regions Financial Corp. Citigroup Inc. Lender Processing Services Nalco Holding Co. Grand Canyon Education Inc. MBIA Inc. Synovus Financial Corp # of Insider buys (3 months) Shares (1000) Value ($Mil) Weighting as of 2011-03-31 (%) Share # Change

TWO HCA REXX TCRD CVO ARX PDC FBC GM H RF C LPS NLC LOPE MBI

9 7 6 5 5 5 4 4 4 3 3 3 3 3 3 3 3 3 3 3

13.1 700.0 12.7 13.9 19.5

0.1 23.7 0.1 0.2 0.1

0% 0.37% 0% 0% 0%

New Buy New Buy +6.72% +29.80% +14.71% -16.38%

SA M

SNV GGP HRB

General Growth Properties Inc. H&R Block Inc.

PPHM

Peregrine Pharmaceuticals Inc.

Copyright 2011 by GuruFocus.com LLC

PL E

1,614.4 15.0 39.6 29.4 0.2 0.1 3.8 0.3 0.3 0.46% 0% 0% 123.7 6.2 0.06% 0% 46.9 0.01% 2.02% 0% 0% 0% 2,938.5 6.9 9.1 129.9 0.2 0.2 0.2 0.4 0.1 0.5 1.8 0.0 10.4 40.5 55.6 29.2 108.9 18.7 0.01% 0% 0.01% 0.03% 0%

New Buy New Buy -87.01% -18.42%

+11.67%

+174.20% -61.02% -51.85%

New Buy -38.26% -32.85% -31.34% -39.61% New Buy

15/21

GuruFolio Reports

http://GuruFocus.com

XX. Stocks that George Soros Keeps Buying

These are the stocks that George Soros keeps adding to the existing positions in the past quarters.

Ticker Shares (1000) ($Mil) Value Weighting as of 2011-0331 (%) History

DNDN 4,671.7

174.9

2.72%

2,938.5

129.9

2.02%

Copyright 2011 by GuruFocus.com LLC

SA M

WFC 3,505.1 111.1 1.73%

16/21

WPRT 5,547.6

121.9

1.9%

PL E

GuruFolio Reports

http://GuruFocus.com

XXI. Stocks that George Soros Keeps Selling

These are the stocks that George Soros keeps reducing in the past quarters.

Ticker Shares (1000) Value ($Mil) Weighting as of 2011-03-31 (%) History

MON 2,659.0

192.1

2.99%

CVA

1,048.5

17.9

0.28%

BPZ

2,644.0

14.0

0.22%

Copyright 2011 by GuruFocus.com LLC

SA M

PFE 570.9 11.6 0.18%

17/21

PL E

GuruFolio Reports

http://GuruFocus.com

XXII. International Stocks

These are the international stocks in the portfolio of George Soros.

Ticker Company MercadoLibre Inc. InterOil InterOil Accenture Cl A Golar Lng Ltd PartnerRe Ltd. Everest Re Group Ltd. Marvell Technology Group Ltd. XL Group Axis Capital Holdings Ltd. IngersollRand Assured Guaranty Ltd. Aspen Insurance Holdings Ltd. Maiden Hldgs Ltd Montpelier Re Holdings Ltd. Country/Region Shares (1000) Value ($Mil) Weighting as of 2011-03-31 (%) Share # Change from Last Period

MELI IOC IOC ACN GLNG PRE RE MRVL XL AXS IR AGO AHL MHLD MRH PBR PBR

ARGENTINA AUSTRALIA AUSTRALIA BERMUDA BERMUDA BERMUDA BERMUDA BERMUDA BERMUDA BERMUDA BERMUDA BERMUDA BERMUDA BERMUDA BERMUDA BRAZIL BRAZIL BRAZIL

3.3

0.3

0% 4.71% 0.58% 0.08% 0.07% 0.06% 0.06% 0.05% 0.04% 0.03% 0.02% 0.01% 0.01% 0% 0%

-29.79% -8.72%

4,047.3 302.1 500.0 90.8 37.3 5.0 4.5 4.2 4.1 3.4 2.3 1.9 1.6 0.5 0.4 0.2 0.2

SA M

PETROLEO BRASILEIIRO SA PETROBRAS PETROLEO BRASILEIIRO SA PETROBRAS Petroleo Brasileiro S/A ADS A Westport Innovations Inc

PBR.A WPRT NG

NovaGold Resources Inc. Kinross Gold Corp.

KGC PLG

Platinum Group Metals Ltd. Penn West Petroleum Ltd.

PWE PAL

North American Palladium Ltd.

POT

Potash Corp. Of Saskatchewan Brookfield Office Properties Research In Motion Ltd.

BPO

RIMM BAM

Brookfield Asset Management Westport Innovations Inc BCE Inc.

WPRT BCE CNQ ABX SU GG

Canadian Natural Resources Ltd. Barrick Gold Corp. Suncor Energy Inc. Goldcorp Inc.

Copyright 2011 by GuruFocus.com LLC

PL E

175.0 52.5 46.3 219.4 95.0 54.3 32.1 31.9 14.0 28.4 11.2 1,110.2 500.0 0.9 44.9 20.2 0.0 0.7% 0.31% 0% 1.9% 0.71% 0.34% 0.26% 0.22% 0.2% 0.17% 0.03% 0.03% 0.02% 0.01% 0.01% 0.01% 0.01% 0.01% 0.01% CANADA CANADA CANADA CANADA CANADA CANADA CANADA CANADA CANADA CANADA CANADA CANADA CANADA CANADA CANADA CANADA 5,547.6 121.9 3,492.1 1,379.4 8,420.8 512.1 2,000.0 184.3 102.3 30.0 39.5 33.0 19.0 13.9 8.5 9.8 7.6 45.4 21.7 16.5 14.2 13.0 10.9 1.8 1.7 1.3 0.7 0.7 0.7 0.4 0.4 0.4

-21.04%

New Buy -9.95% -1.07%

+795.69% -80.54% -2.69%

+435.00% -52.03%

New Buy +39.22% New Buy +88.65%

-47.06% +22.56% -72.94% -65.19% -33.86% New Buy +3,900.00% +1,128.83%

-45.17%

-36.53% +77.08% +84.91% New Buy

18/21

GuruFolio Reports

http://GuruFocus.com

Eldorado Gold Corp. Toronto-Dominion Bank TransCanada Cameco Corp. AbitibiBowater Sun Life Financial Inc. Northern Dynasty Minerals Ltd. MI Developments Inc. Cl A Mercer International Inc. Magna International Inc. Rubicon Mineral North American Energy Partners Cott Corp. Research In Motion Ltd. Herbalife

EGO TD TRP CCJ ABH SLF NAK MIM MERC MGA RBY NOA COT RIMM HLF BIDU ISS FMCN CISG KH

CANADA CANADA CANADA CANADA CANADA CANADA CANADA CANADA CANADA CANADA CANADA CANADA CANADA CANADA

21.3 3.9 8.4 11.2 11.9 10.2 21.0 10.7 21.5 5.6

0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.2 0.2 0.1 0.0 1.8

0.01% 0.01% 0.01% 0.01% 0.01% 0.01% 0% 0% 0% 0% 0% 0% 0% 0%

New Buy -71.53% -65.29% New Buy New Buy

New Buy -62.59% New Buy New Buy New Buy +12.12% New Buy New Buy +87.09% New Buy

Baidu Inc. ADS iSoftStone Holdings Focus Media Holding Ltd. CNinsure Inc. China Kanghui Holdings Ctrip.com International Ltd.

SA M

CTRP EJ CHINA CHINA CHINA CHINA CHINA CHINA CHINA CHINA CHINA

EHouse Holdings Ltd. ADS NetEase.com Inc.

NTES WX

Wuxi Pharmatech Inc. ADS Youku.com

YOKU JASO CIS

JA Solar Holdings Co. Ltd. ADS Camelot Information Systems Yucheng Technologies Ltd. AsiaInfoLinkage Inc DemandTec Inc.

YTEC ASIA

DMAN NOK

Nokia Corp. ADS

GBG DSX

Great Basin Gold Ltd. Cl A Diana Shipping Inc. DryShips Inc.

DRYS LFT TEVA CKSW PKX

LONGTOP FINANCIAL TECHNOLOGIES Ltd. Teva Pharmaceutical Industries Ltd. ClickSoftware Technologies Ltd. POSCO ADS

Copyright 2011 by GuruFocus.com LLC

PL E

42.4 14.8 15.4 0.7 CAYMAN ISLANDS CHINA CHINA CHINA CHINA CHINA 87.0 0.03% 0.3% 0.2% 139.7 690.3 400.0 853.9 592.0 244.0 497.3 88.2 250.0 50.0 300.0 125.0 162.0 9.7 795.4 383.9 6,000.0 15.5 21.4 32.7 19.3 12.8 12.3 11.1 10.4 10.1 5.8 4.4 3.9 2.4 2.1 2.1 0.7 0.2 10.5 3.3 15.8 0.2 0.1 1.0 0.19% 0.17% 0.16% 0.16% 0.09% 0.07% 0.06% 0.04% 0.03% 0.03% 0.01% 0% 0.16% 0.05% 0.25% 0% 0% 0.02% 1.67% 0.17% 0% DOMINICA FINLAND GEORGIA GREECE GREECE Hong Kong ISRAEL ISRAEL KOREA, SOUTH 2,134.0 107.1 1,293.4 2.2 11.1 0.3

+283.53% New Buy -42.87%

+83.70% +894.53% New Buy New Buy New Buy -40.00% New Buy New Buy New Buy +0.61% New Buy +17.65% +33.62% New Buy -12.10% -15.54% +75.57% -31.25%

19/21

GuruFolio Reports

http://GuruFocus.com

Adecoagro SA Nielsen Holdings LyondellBasell Industries Cl A NXP Semiconductors N.V. CNH Global N.V. Credicorp Ltd. Philippine Long Distance Telephone Company ADS Itau Unibanco Holding S.A. ADS Banco Santander Brazil S.A. ADS Flextronics International Ltd. Verigy Ltd. Autoliv Inc. Weatherford International Ltd. ACE Ltd. Tyco International Ltd. Turkcell Iletisim Hizmetleri A.S. ADS Approach Resources Inc.

AGRO NLSN LYB NXPI CNH BAP PHI ITUB BSBR FLEX VRGY ALV WFT ACE TYC TKC AREX VOD AMRN SIG BP

LUXEMBOURG NETHERLANDS NETHERLANDS NETHERLANDS NETHERLANDS PERU PHILIPPINES SAO PAULO SAO PAULO SINGAPORE SINGAPORE SWEDEN

27,158.7 366.1 150.0 29.5 11.1 6.6 47.6 46.0 1,352.0 16.2 105.8 6.1 4.0 4.1 1.2 0.3 0.3 5.0 2.5 32.5 0.2 0.8 0.1 0.3

5.7% 0.06% 0.02% 0.01% 0.01% 0.08% 0.04% 0.51% 0% 0.01% 0% 0%

New Buy New Buy -88.20% New Buy -17.50% New Buy New Buy New Buy New Buy +9.87%

Vodafone Group Plc Amarin Corp. PLC Signet Jewelers BP PLC ADS

SA M

UTIW

UTi Worldwide Inc.

XXIII. ETF Holdings

These are the ETF stocks in the portfolio of George Soros.

Ticker ETF Shares (1000) Value ($Mil) Weighting as of 2011-03-31 (%) Share # Change from Last Period

OIH

Merrill Lynch Oil Service HOLDRS Trust SPDR Gold Trust

GLD FXI

iShares FTSE/Xinhua China 25 Index Fund

GDX

Market Vectors ETF Trust Market Vectors Gold Miner

Copyright 2011 by GuruFocus.com LLC

PL E

SWITZERLAND SWITZERLAND SWITZERLAND TURKEY 3,498.7 24.0 4.9 79.1 1.6 0.2 1.3 0.2 5.1 4.7 0.8 0.3 0.2 1.23% 0.02% 0% 86.5 6.5 0.02% 0% UNITED ARAB EMIRATES UNITED KINGDOM UNITED KINGDOM UNITED KINGDOM UNITED KINGDOM VIRGIN ISLANDS (US) 178.3 650.0 17.1 6.0 10.4 0.08% 0.07% 0.01% 0% 0% 75.0 49.4 12.3 6.9 6.7 0.6 0.19% 0.11% 0.1% 0.01% 150.0 9.8

New Buy

+103.46% +500.00% -65.25%

+20.98% -96.75% -2.73%

-42.66% -34.73% -34.07%

New Buy

+2,578.57% -98.95% New Buy -31.94%

20/21

GuruFolio Reports

http://GuruFocus.com

XXIV. Preferred Stocks

These are the preferred stocks in the portfolio of George Soros.

Ticker ETF General Motors Co. Mand. Conv. Jr. Pfd. Series B Shares (1000) Value ($Mil) Weighting as of 2011-03-31 (%) Share # Change from Last Period

GM.PB

450.7

21.8

0.34%

+32.29%

XXV. Call/Put Option Holdings

These are the option holdings in the portfolio of George Soros.

Ticker Company Apple Inc. FedEx Corp. Citigroup Inc. InterOil SPDR S&P 500 ETF Call/Put Shares (1000) Value ($Mil)

AAPL FDX C IOC SPY PBR ETN T GOOG HSP IWM DAL

PETROLEO BRASILEIIRO SA PETROBRAS Eaton Corp. AT&T Google Inc. Hospira Inc.

SA M

call call call call call call call call call call call put put put put

iShares Trust Russell 2000 Index Fund Delta Air Lines

EWJ S

iShares Japan Index Fund Sprint Nextel

BMY MSI

BristolMyers Squibb Co. Motorola Solutions

RIMM HNR

Research In Motion Ltd.

Harvest Natural Resources Inc. Akamai Technologies Inc. Westport Innovations Inc SPDR S&P 500 ETF

AKAM

WPRT SPY

EEM IWM

iShares MSCI Emerging Market Income ETF iShares Trust Russell 2000 Index Fund Apple Inc.

AAPL

Copyright 2011 by GuruFocus.com LLC

PL E

call call call call call call call call call 210.0 610.0 73.2 57.1 44.2 37.3 37.1 20.2 13.5 13.5 13.2 11.0 10.3 9.8 9.4 9.3 5.3 2.6 1.7 1.5 1.3 0.7 279.0 162.0 117.1 97.6 1.14% 0.8889% 0.6885% 0.5813% 0.5783% 0.3149% 0.2098% 0.2098% 0.2056% 0.172% 0.1606% 0.1526% 0.1463% 0.1445% 0.0823% 0.0399% 0.0264% 0.0237% 0.0201% 0.0113% 4.3453% 2.5229% 1.8241% 1.52% 1,000.0 500.0 280.0 500.0 243.0 440.0 22.5 200.0 122.5 1,000.0 910.5 2,000.0 200.0 57.3 30.0 100.0 34.0 33.0 2,104.0 3,328.0 1,391.3 280.0

Weighting as of 2011-03-31 (%)

21/21

Das könnte Ihnen auch gefallen

- Tailspin: The People and Forces Behind America's Fifty-Year Fall--and Those Fighting to Reverse It: Discussion PromptsVon EverandTailspin: The People and Forces Behind America's Fifty-Year Fall--and Those Fighting to Reverse It: Discussion PromptsNoch keine Bewertungen

- George Soros: The Central Banks' Secret Weapon (EIR Economics, Vol. 20 No. 28 - Published July 23 1993)Dokument2 SeitenGeorge Soros: The Central Banks' Secret Weapon (EIR Economics, Vol. 20 No. 28 - Published July 23 1993)Christopher Foley100% (1)

- George Soros v2Dokument47 SeitenGeorge Soros v2Piaget ModelerNoch keine Bewertungen

- Bowie: Rock God or Tax Genius?: Emma Channing, Draft: 02/07/2016 LL.M. Stanford Law School, 2010 Cell: 650 283 6241Dokument10 SeitenBowie: Rock God or Tax Genius?: Emma Channing, Draft: 02/07/2016 LL.M. Stanford Law School, 2010 Cell: 650 283 6241Luka AjvarNoch keine Bewertungen

- How George Soros Made $8 BillionDokument2 SeitenHow George Soros Made $8 BillionAnanda rizky syifa nabilahNoch keine Bewertungen

- The Biggest Trades of All TimeDokument4 SeitenThe Biggest Trades of All TimeChrisTheodorouNoch keine Bewertungen

- Deutsche Bank Long Term Asset Return Study - Journey Into The Unknown - 2012Dokument76 SeitenDeutsche Bank Long Term Asset Return Study - Journey Into The Unknown - 2012Colin BairdNoch keine Bewertungen

- Silicon Valley Elites Plan Immortality Through Young Blood TransfusionsDokument10 SeitenSilicon Valley Elites Plan Immortality Through Young Blood TransfusionsDomingo MartínezNoch keine Bewertungen

- E IBD100908Dokument24 SeitenE IBD100908cphanhuyNoch keine Bewertungen

- The Proud Internationalist 2006Dokument88 SeitenThe Proud Internationalist 2006rhawk301Noch keine Bewertungen

- 100 Hedge Funds To WatchDokument6 Seiten100 Hedge Funds To WatchArjun GhoseNoch keine Bewertungen

- The Most Dangerous Man in The WorldDokument2 SeitenThe Most Dangerous Man in The WorldJames Artre100% (2)

- Peter Teal Discusses the Enlightenment, Politics, and the Shift to EntertainmentDokument12 SeitenPeter Teal Discusses the Enlightenment, Politics, and the Shift to EntertainmentprasannnaNoch keine Bewertungen

- George SorosDokument2 SeitenGeorge Soroshttp://besthedgefund.blogspot.comNoch keine Bewertungen

- Descendants of Andre Mouledous 7genDokument4 SeitenDescendants of Andre Mouledous 7genJohn Durst100% (1)

- China S Successors Special ReportDokument8 SeitenChina S Successors Special ReportNenad PetrövicNoch keine Bewertungen

- Marc Fabers The Gloom Boom Doom ReportDokument20 SeitenMarc Fabers The Gloom Boom Doom ReportMikle196950% (2)

- Icahn Letter To AppleDokument14 SeitenIcahn Letter To Applejmurrell4037Noch keine Bewertungen

- We Believe Innovation Is Key To Growth: ARK Investment Management LLCDokument4 SeitenWe Believe Innovation Is Key To Growth: ARK Investment Management LLCDarriall PortilloNoch keine Bewertungen

- Howard Marks Fourth Quarter 2009 MemoDokument12 SeitenHoward Marks Fourth Quarter 2009 MemoDealBook100% (3)

- Secret Societies and Their Power in The 20th Century - 10Dokument16 SeitenSecret Societies and Their Power in The 20th Century - 10Anonymous qZNimTMNoch keine Bewertungen

- The Money Masters PDFDokument31 SeitenThe Money Masters PDFvenurao1100% (6)

- George Soros On Soverign CrisesDokument8 SeitenGeorge Soros On Soverign Crisesdoshi.dhruvalNoch keine Bewertungen

- Faber ReportDokument43 SeitenFaber ReportgrneNoch keine Bewertungen

- Wall Street and The Bolshevik RevolutionDokument2 SeitenWall Street and The Bolshevik Revolutionyoutube watcherNoch keine Bewertungen

- Economic Warfare Risks and Responses by Kevin D FreemanDokument111 SeitenEconomic Warfare Risks and Responses by Kevin D FreemanYedidiahNoch keine Bewertungen

- Sitges, Spain 3-6 June 2010 Final List of ParticipantsDokument8 SeitenSitges, Spain 3-6 June 2010 Final List of ParticipantsbürotigerNoch keine Bewertungen

- Happy Gold MT4 Manual ENDokument10 SeitenHappy Gold MT4 Manual ENHengky SetiawanNoch keine Bewertungen

- The Rothschild NWO ElitesDokument2 SeitenThe Rothschild NWO ElitesMario Chalup0% (1)

- George Soros and The Rothschilds Connection (R)Dokument7 SeitenGeorge Soros and The Rothschilds Connection (R)Francis Proulx100% (1)

- George Soros - The Bubble of American SupremacyDokument7 SeitenGeorge Soros - The Bubble of American SupremacyAshraf BorzymNoch keine Bewertungen

- George Soros ReflexivityDokument41 SeitenGeorge Soros ReflexivityClay DriskillNoch keine Bewertungen

- SECRET SHADOW GOVERNMENT The Council On Foreign Relations and The Trilateral Commission-30Dokument30 SeitenSECRET SHADOW GOVERNMENT The Council On Foreign Relations and The Trilateral Commission-30Keith KnightNoch keine Bewertungen

- Surviving The Cataclysm - Your Guide Through The Greatest Financial Crisis in Human History (1999) - Webster Griffin TarpleyDokument700 SeitenSurviving The Cataclysm - Your Guide Through The Greatest Financial Crisis in Human History (1999) - Webster Griffin TarpleyNicoleNoch keine Bewertungen

- The Case of George SorosDokument13 SeitenThe Case of George SorosGlinta CataNoch keine Bewertungen

- IIMagazine March 2006 Secrets of SovereignDokument13 SeitenIIMagazine March 2006 Secrets of Sovereigntjl84Noch keine Bewertungen

- Austrian PrimerDokument128 SeitenAustrian PrimerLewis MacdonaldNoch keine Bewertungen

- CFR and The New World Order 1996Dokument5 SeitenCFR and The New World Order 1996Kim HedumNoch keine Bewertungen

- George Soros The Queens Drug PusherDokument4 SeitenGeorge Soros The Queens Drug PusherJorge VasconcelosNoch keine Bewertungen

- Take Responsibility For Workers and Families ActDokument1.119 SeitenTake Responsibility For Workers and Families ActSara100% (4)

- 2010 Bilderberg CFR Trilateral Chart-BackDokument1 Seite2010 Bilderberg CFR Trilateral Chart-BackEtienne De La Boetie2100% (1)

- This Is A Powerpoint Presentation: Please Feel Free To Download For Group PresentationsDokument129 SeitenThis Is A Powerpoint Presentation: Please Feel Free To Download For Group Presentationsapi-3771665Noch keine Bewertungen

- Ek Chadar Maile Se.Dokument32 SeitenEk Chadar Maile Se.PradeepPariharNoch keine Bewertungen

- Day 8 - Technocracy and Central BanksDokument4 SeitenDay 8 - Technocracy and Central Banksocigran100% (1)

- Tips For Raising CapitalDokument1 SeiteTips For Raising CapitalYasumasa KikuchiNoch keine Bewertungen

- Bloomberg Markets Magazine The Worlds 100 Richest Hedge Funds February 2011Dokument8 SeitenBloomberg Markets Magazine The Worlds 100 Richest Hedge Funds February 2011VALUEWALK LLCNoch keine Bewertungen

- Baturina Burnham Investors Trust Board Meeting Aug 2014Dokument7 SeitenBaturina Burnham Investors Trust Board Meeting Aug 2014Matthew TyrmandNoch keine Bewertungen

- Warren Buffett ReportDokument15 SeitenWarren Buffett ReportsuleymonmonNoch keine Bewertungen

- Momentum Growth & Value: (F) (F) (F) (F)Dokument3 SeitenMomentum Growth & Value: (F) (F) (F) (F)api-254669145Noch keine Bewertungen

- ValuEngine Weekly Newsletter September 21, 2012Dokument10 SeitenValuEngine Weekly Newsletter September 21, 2012ValuEngine.comNoch keine Bewertungen

- Chapter 1: Introduction To CompanyDokument27 SeitenChapter 1: Introduction To CompanyarunNoch keine Bewertungen

- DMG Small CapsDokument9 SeitenDMG Small Capscentaurus553587Noch keine Bewertungen

- wk01 Jan2013mktwatchDokument3 Seitenwk01 Jan2013mktwatchsrichardequipNoch keine Bewertungen

- Upward Climb in ASPI Amidst Crossings Adding 54% To TurnoverDokument6 SeitenUpward Climb in ASPI Amidst Crossings Adding 54% To TurnoverRandora LkNoch keine Bewertungen

- MakalotDokument20 SeitenMakalotKuang HuangNoch keine Bewertungen

- Dividend Payout, IPOs and Bearish Market Trend - 200512Dokument8 SeitenDividend Payout, IPOs and Bearish Market Trend - 200512ProshareNoch keine Bewertungen

- BAM Balyasny 200809Dokument6 SeitenBAM Balyasny 200809jackefellerNoch keine Bewertungen

- Michael Kors PresentationDokument21 SeitenMichael Kors PresentationJeremy_Edwards11Noch keine Bewertungen

- MSDokument36 SeitenMSJason WangNoch keine Bewertungen

- ValuEngine Weekly Newsletter July 27, 2012Dokument9 SeitenValuEngine Weekly Newsletter July 27, 2012ValuEngine.comNoch keine Bewertungen

- Catalog Componente Depasite (Obsolete)Dokument2.433 SeitenCatalog Componente Depasite (Obsolete)corneliusflavius713257% (7)

- RBRconcerto Thermistor StringDokument2 SeitenRBRconcerto Thermistor Stringcorneliusflavius7132Noch keine Bewertungen

- Lock-In Amplifier ExperimentDokument40 SeitenLock-In Amplifier ExperimentlljjbbeeNoch keine Bewertungen

- Que Es Un Lock-In AmplifierDokument4 SeitenQue Es Un Lock-In AmplifierlljjbbeeNoch keine Bewertungen

- Ad834 PDFDokument20 SeitenAd834 PDFLasithaNoch keine Bewertungen

- Program PIC and dsPIC Microcontrollers with PICKit3Dokument4 SeitenProgram PIC and dsPIC Microcontrollers with PICKit3corneliusflavius7132Noch keine Bewertungen

- Urban Survival GuideDokument23 SeitenUrban Survival Guidecorneliusflavius7132Noch keine Bewertungen

- MC 1496 Rev 4 FDokument12 SeitenMC 1496 Rev 4 Fcorneliusflavius7132Noch keine Bewertungen

- SFC Advanced-The Ultimate Disaster Survival GuideDokument29 SeitenSFC Advanced-The Ultimate Disaster Survival Guidecorneliusflavius7132Noch keine Bewertungen

- DsPIC Getting StartedDokument58 SeitenDsPIC Getting Startedcorneliusflavius7132100% (1)

- El 84Dokument3 SeitenEl 84corneliusflavius7132Noch keine Bewertungen

- DL Instruments: 233 Cecil A. Malone Drive, Ithaca, NY 14850 Phone 607-277-8498 Fax 607-277-8499Dokument2 SeitenDL Instruments: 233 Cecil A. Malone Drive, Ithaca, NY 14850 Phone 607-277-8498 Fax 607-277-8499corneliusflavius7132Noch keine Bewertungen

- Cyclone Engine White PaperDokument38 SeitenCyclone Engine White Papercorneliusflavius7132Noch keine Bewertungen

- PICkit™3 In-Circuit Debugger-Programmer User's GuideDokument94 SeitenPICkit™3 In-Circuit Debugger-Programmer User's Guidecorneliusflavius7132Noch keine Bewertungen

- c30 Users Guide 51284fDokument248 Seitenc30 Users Guide 51284fcorneliusflavius7132Noch keine Bewertungen

- Magnetic Pulses To The Brain Make It Impossible To LieDokument1 SeiteMagnetic Pulses To The Brain Make It Impossible To Liecorneliusflavius7132Noch keine Bewertungen

- PL-2303 USB To Serial Adapter User Installation Manual: For Windows 98/ME/2000/XPDokument10 SeitenPL-2303 USB To Serial Adapter User Installation Manual: For Windows 98/ME/2000/XPcorneliusflavius7132Noch keine Bewertungen

- An 1295Dokument12 SeitenAn 1295corneliusflavius7132Noch keine Bewertungen

- Prolific PL2303 DatasheetDokument18 SeitenProlific PL2303 DatasheetmernokurNoch keine Bewertungen

- Scope of The Standard: A DB-25 Connector As Described in The RS-232 StandardDokument11 SeitenScope of The Standard: A DB-25 Connector As Described in The RS-232 Standardcorneliusflavius7132100% (3)

- PID Loop Simulator: DownloadDokument8 SeitenPID Loop Simulator: Downloadcorneliusflavius7132Noch keine Bewertungen

- D Sars 0032835Dokument1 SeiteD Sars 0032835corneliusflavius7132Noch keine Bewertungen

- PL-2303 Mac Driver Install GuideDokument12 SeitenPL-2303 Mac Driver Install Guidecorneliusflavius7132Noch keine Bewertungen

- KD - Auto Tuning To Module Based RulesDokument10 SeitenKD - Auto Tuning To Module Based Rulescorneliusflavius7132Noch keine Bewertungen

- Homeopathic Cure For Breast CancerDokument2 SeitenHomeopathic Cure For Breast Cancercorneliusflavius7132Noch keine Bewertungen

- Homoeopathy Real CureDokument3 SeitenHomoeopathy Real Curecorneliusflavius7132Noch keine Bewertungen

- Beneficial Effect of Homeopathic Medicines On Breast Cancer CellsDokument2 SeitenBeneficial Effect of Homeopathic Medicines On Breast Cancer Cellscorneliusflavius7132Noch keine Bewertungen

- Ua741 Metal Can PDFDokument9 SeitenUa741 Metal Can PDFcorneliusflavius7132Noch keine Bewertungen

- Electrical Breakdown PDFDokument4 SeitenElectrical Breakdown PDFcorneliusflavius7132100% (1)

- 2SC2570ADokument5 Seiten2SC2570Acorneliusflavius7132Noch keine Bewertungen

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDokument79 SeitenInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownzeeshanNoch keine Bewertungen

- Derivative SeiesDokument18 SeitenDerivative SeiesCourage Craig KundodyiwaNoch keine Bewertungen

- Barron 39 S 29 June 2020 PDFDokument88 SeitenBarron 39 S 29 June 2020 PDFAD StrategoNoch keine Bewertungen

- Platinum Gazette 30 AprilDokument16 SeitenPlatinum Gazette 30 AprilAnonymous w8NEyXNoch keine Bewertungen

- ETF Trading Strategies RevealedDokument44 SeitenETF Trading Strategies Revealedpsoonek100% (1)

- 2015 Trust Technology Buyers Guide PDFDokument31 Seiten2015 Trust Technology Buyers Guide PDFPurnendu MaityNoch keine Bewertungen

- Globalization and The Multinational Firm: Chapter OneDokument28 SeitenGlobalization and The Multinational Firm: Chapter OneiMQSxNoch keine Bewertungen

- Breaking Barriers - Hard Fork - Special Series - Thought Leadership Doc Ver 1.0Dokument42 SeitenBreaking Barriers - Hard Fork - Special Series - Thought Leadership Doc Ver 1.0Shantanu SharmaNoch keine Bewertungen

- USSIF ImpactofSRI FINALDokument64 SeitenUSSIF ImpactofSRI FINALmansavi bihaniNoch keine Bewertungen

- Capital Letter Capital Letter: Greetings From Fundsindia! Greetings From Fundsindia!Dokument4 SeitenCapital Letter Capital Letter: Greetings From Fundsindia! Greetings From Fundsindia!satish kumarNoch keine Bewertungen

- TC Trading1Dokument45 SeitenTC Trading1hhhNoch keine Bewertungen

- Lessons From Cycles, Crises, Clients and Colleagues: The Conceptual IssuesDokument18 SeitenLessons From Cycles, Crises, Clients and Colleagues: The Conceptual IssuesJoyce Dick Lam Poon100% (2)

- Effectiveness of Etfs in Indexing: The Mean For Equity Investments by Employees' Provident Funds in IndiaDokument5 SeitenEffectiveness of Etfs in Indexing: The Mean For Equity Investments by Employees' Provident Funds in IndiaShivangi AgarwalNoch keine Bewertungen

- FM04 Equity MKT 0217Dokument62 SeitenFM04 Equity MKT 0217Derek LowNoch keine Bewertungen

- IIFL Nifty ETF PresentationDokument25 SeitenIIFL Nifty ETF Presentationrkdgr87880Noch keine Bewertungen

- Investing and Finance PresentationDokument22 SeitenInvesting and Finance Presentationanmol goelNoch keine Bewertungen

- Wealth ManagementDokument144 SeitenWealth ManagementVedant BhansaliNoch keine Bewertungen

- Annual Report RBCDokument219 SeitenAnnual Report RBC5variaraNoch keine Bewertungen

- Country Risk: Determinants, Measures and Implications - The 2015 EditionDokument40 SeitenCountry Risk: Determinants, Measures and Implications - The 2015 EditionBunker BopsNoch keine Bewertungen

- Non Deposit IntermediariesDokument20 SeitenNon Deposit IntermediariesSanlyn BurceNoch keine Bewertungen

- Check2Dokument58 SeitenCheck2dreadpiratelynxNoch keine Bewertungen

- Shankarlal Agrawal College OF Management Studies, GondiaDokument40 SeitenShankarlal Agrawal College OF Management Studies, GondiaRavi JoshiNoch keine Bewertungen

- Vanguard FTSE All-World UCITS ETF: (USD) Accumulating - An Exchange-Traded FundDokument4 SeitenVanguard FTSE All-World UCITS ETF: (USD) Accumulating - An Exchange-Traded FundYanto TanNoch keine Bewertungen

- 2024DAO ReportDokument79 Seiten2024DAO ReportmatyasherrmannNoch keine Bewertungen

- Vaibhav FMCG Sector Black Book 1Dokument69 SeitenVaibhav FMCG Sector Black Book 1Kevin PatelNoch keine Bewertungen

- Portfolio Diversification: Building A Passive Portfolio With EtfsDokument5 SeitenPortfolio Diversification: Building A Passive Portfolio With EtfsJeremy LoobsNoch keine Bewertungen

- Privileged (1) 1Dokument16 SeitenPrivileged (1) 1vishalsablok2017Noch keine Bewertungen

- BSE 2019 ReportDokument214 SeitenBSE 2019 Reportalpha34567Noch keine Bewertungen

- Risk, Returns and Resilience:: Integrating ESG in The Financial SectorDokument41 SeitenRisk, Returns and Resilience:: Integrating ESG in The Financial SectorBiswajit SikdarNoch keine Bewertungen

- Project On Risk & Return Analysis of Reliance Mutual FundDokument74 SeitenProject On Risk & Return Analysis of Reliance Mutual FundPiya Bhatnagar0% (1)