Beruflich Dokumente

Kultur Dokumente

Hs BC

Hochgeladen von

Fakir TajulOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Hs BC

Hochgeladen von

Fakir TajulCopyright:

Verfügbare Formate

Chapter 4: HSBC: Organization overview

SBC Holdings plc (HSBC), incorporated on January 1, 1959, is a global banking and financial services company. Through its subsidiaries and associates, HSBC provides a range of banking and related financial services. The products and

services of the Company include personal financial services, commercial banking, global banking and markets, and private banking. In February 2009, it sold its stake in Modern Asia Environmental Holdings Inc. to Japans Dowa Eco-system Co. In May 2009, the Company completed the acquisition of 88.89% of PT Bank Ekonomi Raharja Tbk in Indonesia.

Headquartered in London, HSBC Holdings plc is one of the largest banking and financial services organizations in the world. It began operations in Hong Kong more than 130 years ago. The HSBC Group's international network comprises some 10,000 offices in 82 countries and territories in Europe, the Asia-Pacific region, the Americas, the Middle East and Africa.

With listings on the London, Hong Kong, New York and Paris stock exchanges, around 200000 shareholders in some 100 countries and territories hold shares in HSBC Holdings plc. The shares are traded on the New York Stock Exchange in the form of American Depository Receipts. Through a global network linked by advanced technology, including a rapidly growing ecommerce capability, HSBC provides a comprehensive range of financial services: personal, commercial, corporate, investment and private banking; trade services; cash management; treasury and capital markets services; insurance; consumer and business finance; pension and investment fund management; trustee services; and securities and custody services.

4.1.

Foundation & growth of HSBC

The HSBC Group is named after its founding member, The Hong Kong and Shanghai Banking Corporation Limited (HSBC), which was established in 1865 in Hong Kong and Shanghai to finance the growing trade between China and Europe. The inspiration behind the founding of the

bank was Mr. Thomas Sutherland, a Scot who was then working as the Hong Kong Superintendent of the Peninsular and Oriental Steam Navigation Company. He realized that there was considerable demand for local banking facilities both in Hong Kong and along the China coast and he helped to establish the bank in March 1865. Then, as now, the bank's headquarters were at 1 Queen's Road Central in Hong Kong and a branch was opened one month later in Shanghai.

Throughout the late nineteenth and the early twentieth centuries, the bank established a network of agencies and branches based mainly in China and South East Asia but also with representation in the Indian sub-continent, Japan, Europe and North America. In many of its branches the bank was the pioneer of modern banking practices. From the outset, trade finance was a strong feature of the bank's business with bullion, exchange and merchant banking also playing an important part. Additionally, the bank issued notes in many countries throughout the Far East.

During the Second World War the bank was forced to close many branches and its head office was temporarily moved to London. However, after the war the bank played a key role in the reconstruction of the Hong Kong economy and began to further diversify the geographical spread of the bank. The group expanded primarily through offices established in the banks name until the mid 1950s when it began to create or acquire subsidiaries. This strategy culminated in 1992 with one of the largest bank acquisitions in history when HSBC holdings acquired Midland Bank plc, which was founded in UK in 1836. The following are some key developments in the group since 1955:

4.2.

History of Hong Kong and Shanghai Banking Corporation

1955 The Hong Kong and Shanghai Banking Corporation of California was founded. 1959 The Hong Kong and Shanghai Banking Corporation acquires The British Bank of the Middle East (formerly the Imperial Bank of Persia, now called HSBC Bank Middle East) and The Mercantile Bank (originally the Chartered Mercantile Bank of India, London & China). 1960 Wayfoong Finance Limited, a Hong Kong hire purchase and personal finance subsidiary, is established.

1965 The Hong Kong and Shanghai Banking Corporation acquires a majority shareholding in Hang Seng Bank Limited, now the second-largest bank incorporated in Hong Kong. 1967 Midland Bank purchases a one-third share in the parent of London Merchant bank Samuel Montagu & Co. Limited (soon to be renamed HSBC Republic Bank (UK) Limited). 1971 The Cyprus Popular Bank Limited (now Laiki Bank) becomes an associated company of the Group. 1972 The Hong Kong and Shanghai Banking Corporation forms merchant-banking subsidiary, Wardley Limited (now called HSBC Investment Bank Asia Limited). Midland Bank acquires a shareholding in UBAF Bank Limited (now known as British Arab Commercial Bank Limitd). 1974 Samuel Montagu becomes a wholly owned subsidiary of Midland. 1978 The Saudi British Bank is established under local control to take over The British Bank of the Middle East's branches in Saudi Arabia. 1980 The Hongkong and Shanghai Banking Corporation acquires 51% of New York State's Marine Midland Bank, N.A. (now called HSBC Bank USA), with a controlling interest in Concord Leasing. UK-based merchant bank Antony Gibbs becomes a wholly owned subsidiary. Midland acquires a controlling interest in leading German private bank Trinkaus & Burkhardt KgaA (now HSBC Trinkaus & Burkhardt KgaA).

1981 Hongkong Bank of Canada (Now HSBC Bank Canada) is established in Vancouver. The Group acquires a controlling interest in Equator Holdings Limited. 1982 Egyptian British Bank S.A.E. is formed, with the Group holding a 40% interest. 1983 Marine Midland Bank acquires Carroll McEntee & McGinley (now HSBC Securities (USA) Inc.), a New York based primary dealer in US government securities. 1985 New Head office building opened at Hong Kong. 1986 The Hong Kong and Shanghai Banking Corporation establishes Hong Kong Bank of Australia Limited (now HSBC Bank Australia Limited) and acquires James Capel & Co. Limited, a leading London-based international securities company. 1987 The Hong Kong and Shanghai Banking Corporation acquires the remaining shares of Marine Midland and a 14.9% equity interest in Midland Bank.

1989 A strategic alliance is entered into between The Hong Kong and Shanghai Banking Corporation and California-based Wells Fargo Bank. Midland Bank Launches First Direct, the UK's first 24-hour telephone banking service. 1991 HSBC Holdings is established; its shares are traded on the London and Hong Kong stock exchanges. 1992 HSBC Holdings purchases the remaining equity in Midland Bank. HSBC Investment Bank plc is formed. 1993 The HSBC Group's Head Office moves to London. Forward Trust Group Limited (now HSBC Asset Finance (UK) Limited), a Midland subsidiary, acquires Swan National Leasing, establishing the UK's third largest vehicle contract hire company. 1994 The Hong Kong and Shanghai Banking Corporation is the first foreign bank to incorporate locally in Malaysia, forming Hong Kong Bank Malaysia Berhad (now HSBC Bank Malaysia Berhad). 1995 Wells Fargo & Co. and HSBC Holdings establish Wells Fargo HSBC Trade Bank, N.A. in California to provide customers of both companies with trade finance and international banking services. 1997 HSBC Holdings and Wachovia Corporation of the United States form a non-equity alliance to market corporate financial services worldwide. Forward Trust acquires Eversholt (now HSBC Rail (UK) Limited), a rail rolling-stock leasing company and the largest owner of electric trains operating on the UK mainline network. Marine Midland Bank acquires First Federal Savings and Loan Association of Rochester in New York. In Latin America, the Group establishes a new subsidiary in Brazil, Banco HSBC Bamerindus S.A. and completes the acquisition of Roberts 01S.A. de Inversiones in Argentina (now HSBC Argentina Holdings S.A.). 1999 Shares in HSBC Holdings begin trading on a third stock exchange, New York. HSBC Holdings acquires Republic New York Corporation (now integreted with HSBC USA Inc.) and its sister company Safra Republic Holdings S.A. (now HSBC Republic Holdings (Luxembourg) S.A.). Midland Bank acquires a 70.03% interest in Mid-Med Bank p.l.c. (Now called HSBC Bank Malta p.l.c.), Malta's largest commercial bank. 2000 HSBC and Merrill Lynch form a joint venture to launch the first international online banking and investment services company. HSBC reaches an agreement in principle to acquire

75% of the issued shares of Bangkok Metropolitan Bank, the eighth largest bank in Thailand. HSBC acquires Credit Commercial de France (CCF), a major French banking group. Shares in HSBC Holdings are listed on a fourth stock exchange, in Paris. 2001 Agreement is reached for HSBC to acquire Barclays Banks branches and fund Management Company in Greece. New 44-floor Headquarter building at Londons Canary Wharf is due to be ready for occupation.

4.3.

HSBC international network

The HSBC Group's international network comprises of some 9,500 offices in 79 countries and territories. A brief list is presented below: Table 1: HSBC international network

Region Americas Asia-Pacific Europe Middle East & Africa Number of offices 5,708 693 2,897 172

4.4.

HSBC's business principle and values

The HSBC Group is committed to five Business Principles: Outstanding customer service; Effective and efficient operations; Strong capital liquidity; Conservative lending policy; Strict expense discipline;

HSBC also operates according to certain Key Business Values:

The highest personal standards of integrity at all levels; Commitment to truth and fair dealing; Hand-on management at all levels; Openly esteemed commitment to quality and competence; A minimum of bureaucracy; Fast decisions and implementation; Putting the Group's interests ahead of the individual's; The appropriate delegation of authority with accountability; Fair and objective employer; A merit approach to recruitment/selection/promotion; A commitment to complying with the spirit and letter of all laws and regulations;

The promotion of good environmental practice and sustainable development and commitment to the welfare and development of each local community.

4.5.

Services of HSBC

It is already explored that, HSBC has global operations over the continents of the worlds. Its services are varying based on the geographical structure, economic condition and market conditions etc. in this section, some generalized services of HSBC are elaborated. 4.5.1. Personal Financial Services

Personal Financial Services provides 98 million individual and self-employed customers with financial services in over 60 markets globally. The offerings include personal banking products (current and savings accounts, mortgages and personal loans, credit cards, and local and international payment services) and wealth management services (insurance and investment products and financial planning services). HSBC Premier (Premier) provides banking services to its customers, including personalized relationship management, a single online view of all international accounts, free international

funds transfer between HSBC accounts, 24-hour priority telephone access, global travel assistance and wealth management services. HSBC Advance offers a range of services including preferential day-to-day and international banking while allowing solutions to be customized to meet local requirements. Insurance products distributed by HSBC through its direct channels and branch networks include life, property and health insurance, as well as pensions and credit protection. HSBC also makes available a range of investment products. HSBC is a global credit card issuer with over 100 million credit cards in force in over 50 markets. 4.5.2. Commercial Banking HSBC is an international bank with over three million commercial banking customers in 63 countries and territories. HSBC divides its commercial banking business into corporate, midmarket, business banking upper and business banking mass segments, allowing the development of tailored customer propositions while adopting a view of the entire commercial banking sector. HSBC provides a range of short and longer-term financing options for commercial banking customers, both domestically and cross-border, including overdrafts, receivables finance, term loans and property finance. It offers forms of asset finance in selected sites and has established specialized divisions providing leasing and installment finance for vehicles, plant and equipment. HSBC is a provider of domestic and cross-border payments, collections, liquidity management and account services globally. Deposits are attracted through current accounts and savings products, in local and foreign currencies. HSBC finances and facilitates significant volumes of international trade, under both open account terms and traditional trade finance instruments. HSBC also provides international factoring, commodity and insured export finance, and forfaiting services. The Company utilizes its international network to build customer relationships at both ends of trade flows, and through knowledge in document checking and processing, and highly automated systems. Commercial Banking customers are volume users of the Companys foreign exchange, derivatives and structured product capabilities, including sophisticated currency and interest rate options.

HSBC offers commercial card issuing and acquiring services. Commercial card issuing helps customers enhance cash management, improve cost control and streamline purchasing processes. HSBCs card acquiring services enable merchants to accept credit and debit card payments either in person or when the cardholder is not present. HSBC offers a range of commercial insurance products and services to enable customers and company owners to trade and grow safely. Products include key person and life insurance, employee benefits and a range of commercial risks, such as property, liability, and cargo and trade credit insurance. The wealth management services include advice and products related to savings and investments provided to commercial banking customers and their employees through HSBCs global network, with clients being referred to premier and private banking where appropriate. The Company also provides finance and advisory support for the customers. HSBC deploys a range of delivery channels, including specific online and direct banking offerings, such as HSBCnet and Business Internet Banking. 4.5.3. Global Banking and Markets Global Banking and Markets provides tailored financial solutions to the government, corporate and institutional clients globally. Global Banking and Markets is managed as four principal business lines: Global Markets, Global Banking, Global Asset Management and Principal Investments. HSBCs operations in Global Markets consist of treasury and capital markets services for supranational, central banks, corporations, institutional and private investors, financial institutions and other market participants. The products include foreign exchange; currency, interest rate, bond, credit, equity and other derivatives; government and non-government fixed income and money market instruments; precious metals and exchange traded futures; equity services, including research, sales and trading for institutional, corporate and private clients and asset management services; distribution of capital markets instruments, including debt, equity and structured products, utilizing HSBCs global network, and securities services. HSBCs operations in Global Banking consist of financing, advisory and transaction services for corporations, institutional and private investors, financial institutions, and governments and their

agencies. The products include financing and capital markets, which comprises capital raising, including debt and equity capital, corporate finance and advisory services, bilateral and syndicated lending, leveraged and acquisition finance, structured and project finance, lease finance, and non-retail deposit-taking; international, regional and domestic payments and cash management services, and other transaction services, including trade services, factoring and banknotes. HSBCs operations in asset management consist of products and services for institutional investors, intermediaries and individual investors and their advisers. The private investments include private equity, which comprises HSBCs captive private equity funds, strategic relationships with third-party private equity managers and other investments. 4.5.4. Private Banking The products and services offered by the Company include private banking services, private wealth management and private wealth solutions. Private banking services comprise multicurrency deposit accounts and fiduciary deposits, credit and specialist lending, treasury trading services, cash management, securities custody and clearing. In addition, HSBC Private Bank works to ensure that its clients have full access to other products and services available throughout HSBC, such as credit cards, Internet banking, corporate banking, and investment banking. Private wealth management includes both advisory and discretionary investment services. A range of investment vehicles is covered, including bonds, equities, derivatives, options, futures, structured products, mutual funds and alternatives (hedge funds, private equity and real estate). Corporate finance solutions help provides clients with cross-border solutions for their companies, working in conjunction with Global Banking & Markets. Private wealth solutions comprise inheritance planning, trustee and other fiduciary services designed to protect wealth and preserve it for future generations through structures tailored to meet the individual needs of each family. Areas of expertise include trusts, foundation and company administration, charitable trusts and foundations, insurance, family office advisory and philanthropy. 4.6. Global operation of HSBC

HSBCs principal banking operations in Europe are HSBC Bank plc (HSBC Bank) in the United Kingdom, HSBC France, HSBC Bank A.S. in Turkey, HSBC Bank Malta p.l.c., HSBC Private Bank (Suisse) S.A. (HSBC Private Bank (Suisse)) and HSBC Trinkaus & Burkhardt AG. Through these operations HSBC provides a range of banking, treasury and financial services to personal, commercial and corporate customers across Europe. HSBCs principal banking subsidiaries in Hong Kong are The Hongkong and Shanghai Banking Corporation Limited (The Hongkong and Shanghai Banking Corporation) and Hang Seng Bank Limited (Hang Seng Bank). HSBC offers personal, commercial, global banking and markets services in the Peoples Republic of China, through its local subsidiary, HSBC Bank (China) Company Limited (HSBC Bank China). HSBC also participates indirectly in mainland China through its four associates, Bank of Communications (19.01 %owned), Ping An Insurance (16.78%), Industrial Bank (12.78%) and Yantai City Commercial Bank (20%) and has a further interest of 8% in Bank of Shanghai. Outside Hong Kong and the Peoples Republic of China, HSBC conducts business in 20 countries in the Asia-Pacific region, primarily through branches and subsidiaries of The Hongkong and Shanghai Banking Corporation, with coverage in Australia, India, Indonesia, Malaysia, South Korea, Singapore and Taiwan. HSBCs presence in Australia is led by HSBC Bank Australia Limited and in Malaysia by HSBC Bank Malaysia Berhad (HSBC Bank Malaysia). In the Middle East, the network of branches of HSBC Bank Middle East Limited (HSBC Bank Middle East), together with HSBCs subsidiaries and associates, gives coverage in the region. HSBCs North American businesses are located in the United States, Canada and Bermuda. Operations in the United States are primarily conducted through HSBC Bank USA, N.A. (HSBC Bank USA), which is concentrated in New York State, and HSBC Finance, a national consumer finance company based in the Chicago metropolitan area. HSBC Markets (USA) Inc. is the intermediate holding company of, inter alia, HSBC Securities (USA) Inc., a registered broker

and dealer of securities and a registered futures commission merchant. HSBC Bank Canada and The Bank of Bermuda Limited (Bank of Bermuda) operate in their respective countries. HSBCs operations in Latin America comprises HSBC Mxico, S.A. (HSBC Mexico), HSBC Bank Brasil S.A.-Banco Mltiplo (HSBC Bank Brazil), HSBC Bank Argentina S.A. (HSBC Bank Argentina) and HSBC Bank (Panama) S.A. (HSBC Bank Panama), which owns subsidiaries in Costa Rica, Honduras, Colombia and El Salvador. HSBC is also represented by subsidiaries in Chile, the Bahamas, Peru, Paraguay and Uruguay. In addition to banking services, HSBC operates insurance businesses in Mexico, Argentina, Brazil, Panama, Honduras and El Salvador. In Brazil, HSBC offers consumer finance products through its subsidiary, Losango Promocoes e Vendas Ltda.

4.7.

HSBC in Bangladesh

HSBC obtained license from BANGLADESH BANK on The HSBC Asia Pacific group 1 April 1996 to conduct banking business in the country and commenced formal banking operations on 3 December 1996 through opening a branch at Dhaka .In Bangladesh , the HSBC Group is represented by Hong Kong bank , which has its head office in Hong Kong and a holding company, HSBC holding plc, which is incorporated in England .on 41 December 2000 , total capital and reserve of HSBC in Bangladesh were BDT 535.7 million , which comprised capital BDT. 441.6 million and supplementary capital BDT. 94.2 million.

Realizing the huge potential and growth in personal banking industry in Bangladesh, HSBC extended its operation to the personal banking sector in Bangladesh and within a very short span of time it was able to build up a huge client base. Extending its operation further, HSBC opened a branch at Chittagong, seven branch offices at Dhaka (Gulshan, Mothijheel , Dhanmondi, Uttara and Banani) and Sylhet the number of employees of this bank in Bangladesh was 257. At Present number of employee is around 835.

In 2002, paid-up capital of this bank was BDT 380 million. Deposit of this bank was BDT 4,980 million. Among this deposit, called deposit was BDT 487 million and fixed deposit was BDT

1,323 million. The amount of advance and investment was BDT 1,180 million and BDT 100 million respectively. In 2002, this bank operated foreign exchange business of BDT 8,234 million.

HSBC Bangladesh is under strict supervision of HSBC Asia Pacific Group, Hong Kong. The Chief Executive Officer of HSBC Bangladesh manages the whole banking operation of HSBC in Bangladesh. Under the CEO there are heads of departments who manage specific banking functions e.g. Personal banking, corporate banking, etc.

Currently HSBC Bangladesh is providing a wide range of services both two individual and corporate level customers. In the year 2000, the bank launched a wide array of personal banking products designed for all kinds of (middle and higher-middle income) individual customers. Some such products were Personal loans, car loans, etc. Recently the bank launched three of its personal banking products Tax loan, Personal secured loan & Automated Tele Banking (ATB) service. These products are designed to meet the diverse customer needs more completely.

HSBC in Bangladesh also specializes in self-service banking through providing 24-hour ATM services. Recently it has introduced Day & Night banking by installing Easy-pay machines in Banani, Uttara and Dhanmondi to better satisfy the needs of both customers and non-customers. In total HSBC currently has 22 ATMs of Dhaka & Chittagong. Table 2: HSBC at a glance

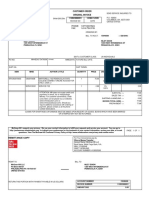

HSBC in Bangladesh at a glance The Hong Kong Shanghai Banking Corporation BD. Ltd. 1996 Multinational Company with subsidiary group in BD. Paid up capital: BDT. 4380 million Deposit BDT. 4,980 million Advance BDT. 3,255 million HSBC group shareholders Anchor Tower, 1/1-B Sonargaon Road, Dhaka 1205, Bangladesh. 8 27 835

Name of the Organization Year of Establishment Nature of the Organization Capital

Shareholders Head Office Number of Offices Number of ATMs Number of employees

Technology Service Coverage & Customers

Offers Phone Banking Services and full online banking from branch to branch. Serves individuals and corporate customers within Dhaka, Chittagong and Sylhet

4.8.

HSBC in United Kingdom

HSBC Bank plc is one of the major banking organizations in the United Kingdom which founde in 1836. It has a significant role in clearing activities of a bank in this country. This bank known to be most wealthy bank in UK as it has more assets than any other banks in this region. The business of HSBC in UK are of various financial services which ranges from traditional high street roles of personal finance and commercial banking to private bank with consumer finance, corporate and merchant banking as well. This bank has turned to a good profitable condition in 1987, which lead it to acquire a 14.9 percent share of Midland bank and later took the full ownership. It was the largest acquisition in the banking history. HSBC has its UK headquarters at Canada Square in the Canary Wharf area of east London. This building known as HSBC tower which has 42 levels with 8000 staffs working there. HSBC performs well in the UK market. It is only bank among five big banks that hold more deposits than loans. For this reason, investors and customer see this bank as less risky than other banks. This policy helps the bank to fund its own operations without taking from others. Moreover, during the credit crunch, this bank was maintained its value in the capital market, in terms of its share price. This bank has a huge network of branch banking throughout the England and Wales, but smaller presence in other regions in United Kingdom, such as Scotland and Northern Ireland. The reason behind the smaller presence is the dominance of local banks. In UK, several attempts are taken to improve service quality and competitiveness. These initiatives includes Undergoing a rolling program of refurbishment Trying to improve retail experiences with formulating policies and programs

Rebranding existing branches as stores Arrange more open areas for the staffs of HSBC to meet the customers

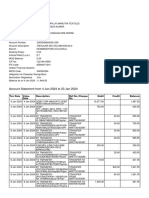

Along with the regular banking operations, HSBC started Islamic banking in mid-2003 which is branded as HSBC Amanah. It is the first bank among the UK high street lender who provides homebuying products under the Islamic banking with Sharia. In this system, the charging or payment of interest is prohibited. Now the ranges of banking service are increasing, such as bank account, home insurance policy (Takaful) etc. There are some other operations exists in UK by the HSBC, these are not direct service, but done with the agents. Among them, some major operations are highlighted here. In 1989, it launched first direct, which was the concept of telephone banking. This concept is now emerges with internet banking or online banking. This first direct service makes the HSBC as the most recommended bank for 15 long years in UK. One of the acquired bank of HSBC, HFC bank started consumer finance in 1973, which was the largest consumer finance companies of UK. It gives retail credit to national retailers and other point of sale loan provider. This operation enables to give loan both through branches and direct channels. Here some instruments can be used as mediums, such as co-branded and loyalty credit cards. These operations are now rebranded with Beneficial Finance, Marbles and the GM card etc.The current financial performances of HSBC bank in UK are shown in the following table. Financial Highlights 2009 m Profit on ordinary activities before tax Profit attributable to shareholders of the parent company Source: HSBC (UK) annual report, 2009 The financial highlights of profit trends are shown in the later figure of the years starting form 2005 to 2009 in the value of millions of pound sterling. 4,014 3,092 2008 m 4,366 3,441 2007 m 4,063 3,209 2006 m 3,796 2,722 2005 m 3,731 2,842

5,000 4,000 3,000 2,000 1,000 0 2009 m 2008 m 2007 m 2006 m 2005 m Profit attributable to shareholders of the parent company Profit on ordinary activities before tax

Figure: trends of profitability of HSBC UK.

4.8.1. Controversies in banking operations There are some controversies of banking operations of HSBC in UK. The bank takes some notorious decisions which can be placed as malpractice of banking operation in that region. Moreover these controversies can reduce the value of the market reputation and can be stimuli to deterioration to service quality. Among these controversies, some are highlighted here. HSBC had special facilities for students in UK. Students can overdrafts and pay it without any interest. But in July 2007, the bank abruptly declares the facilities to be ineffective. It was resulted the graduate students who are graduating that year, to face unexpected bills of 140 a year. And one month later, it had reversed the declaration because of the heavy protest of students. Sometimes this bank is proved as the careless bank. In the year of 2008, they loss a huge amount of unencrypted data, which contain life insurance detail of half million customers. They are careless to culture also. In the same year, this bank accused of cultural insensitivity for launching an advertising campaign. In this campaign the Japanese community in UK were neglected by showing overweight white man trying to be looked like a Sumo.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Customer order detailsDokument1 SeiteCustomer order detailsNiley DixonNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Indigency Application (Completed) - Part2 PDFDokument2 SeitenIndigency Application (Completed) - Part2 PDFdcarson90Noch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Secretary's Certificate ResolutionDokument4 SeitenSecretary's Certificate ResolutionLeida Kristin A. Garde100% (1)

- Card Transaction History and FeesDokument3 SeitenCard Transaction History and FeesJEAN LAFORTUNENoch keine Bewertungen

- Citibank Client Services 000 PO Box 769013 San Antonio, TXDokument3 SeitenCitibank Client Services 000 PO Box 769013 San Antonio, TXsevmem100% (2)

- Cash Correspondent BanksDokument4 SeitenCash Correspondent BanksJessNoch keine Bewertungen

- 14 First Metro InvestmentDokument2 Seiten14 First Metro InvestmentCristelle Elaine ColleraNoch keine Bewertungen

- Estafa case resolutionDokument3 SeitenEstafa case resolutionJhudith De Julio BuhayNoch keine Bewertungen

- Assignment FormatDokument7 SeitenAssignment FormatFakir TajulNoch keine Bewertungen

- Carers in Partnership Mental Health CommissioningDokument6 SeitenCarers in Partnership Mental Health CommissioningFakir TajulNoch keine Bewertungen

- Human Resource Management Practices in A Local Organization of BangladeshDokument12 SeitenHuman Resource Management Practices in A Local Organization of BangladeshisanNoch keine Bewertungen

- Liquidity StatementDokument10 SeitenLiquidity StatementFakir TajulNoch keine Bewertungen

- What Is CRR & SLR Position and What Are The Components of CRR & SLR?Dokument8 SeitenWhat Is CRR & SLR Position and What Are The Components of CRR & SLR?Fakir TajulNoch keine Bewertungen

- Differences RAM ROM GivenDokument6 SeitenDifferences RAM ROM GivenFakir TajulNoch keine Bewertungen

- Service Quality Bank v1 Sent 2Dokument12 SeitenService Quality Bank v1 Sent 2Fakir TajulNoch keine Bewertungen

- Mod Te Ha Ge Liaison Office of BDDokument37 SeitenMod Te Ha Ge Liaison Office of BDFakir TajulNoch keine Bewertungen

- Fund Management Practices of Nationalized Bangladeshi BanksDokument13 SeitenFund Management Practices of Nationalized Bangladeshi BanksFakir TajulNoch keine Bewertungen

- Just For UploadDokument1 SeiteJust For UploadFakir TajulNoch keine Bewertungen

- Classification of Computers GivenDokument5 SeitenClassification of Computers GivenFakir TajulNoch keine Bewertungen

- Irr SolveDokument1 SeiteIrr SolveFakir TajulNoch keine Bewertungen

- Profitability An v1 Sent 2Dokument9 SeitenProfitability An v1 Sent 2Fakir TajulNoch keine Bewertungen

- Differences RAM ROM GivenDokument6 SeitenDifferences RAM ROM GivenFakir TajulNoch keine Bewertungen

- Uu Co MacroeconomicsDokument3 SeitenUu Co MacroeconomicsFakir TajulNoch keine Bewertungen

- Chronic Condition Self-Management Approaches Research and EvaluationDokument50 SeitenChronic Condition Self-Management Approaches Research and EvaluationFakir TajulNoch keine Bewertungen

- Rex Research ProposalDokument20 SeitenRex Research ProposalFakir TajulNoch keine Bewertungen

- 5 BP White Paper Engagement 2Dokument10 Seiten5 BP White Paper Engagement 2Fakir TajulNoch keine Bewertungen

- MTB Millionaire PlanDokument5 SeitenMTB Millionaire PlanFakir TajulNoch keine Bewertungen

- Rex - Research Proposal SentDokument15 SeitenRex - Research Proposal SentFakir TajulNoch keine Bewertungen

- Rumki - Managing Finance in Public Sector 3500 - April 13 Sent Plaz SolveDokument12 SeitenRumki - Managing Finance in Public Sector 3500 - April 13 Sent Plaz SolveFakir TajulNoch keine Bewertungen

- Jahid e Business Jan5 SentDokument6 SeitenJahid e Business Jan5 SentFakir TajulNoch keine Bewertungen

- Rumki - Vision and Strategic Direction 3500 - April 13 - Sent Black Plaz SolvedDokument16 SeitenRumki - Vision and Strategic Direction 3500 - April 13 - Sent Black Plaz SolvedFakir Tajul100% (1)

- GK - Headquaters of OrganizationsDokument1 SeiteGK - Headquaters of OrganizationsFakir TajulNoch keine Bewertungen

- Subject CoverageDokument1 SeiteSubject CoverageFakir TajulNoch keine Bewertungen

- MTB Millionaire PlanDokument5 SeitenMTB Millionaire PlanFakir TajulNoch keine Bewertungen

- Unit 8Dokument1 SeiteUnit 8Fakir TajulNoch keine Bewertungen

- Management skills and organizational behaviorDokument1 SeiteManagement skills and organizational behaviorFakir TajulNoch keine Bewertungen

- CFA Exam Calendar and FeesDokument12 SeitenCFA Exam Calendar and FeesFakir TajulNoch keine Bewertungen

- UnusedDokument2 SeitenUnusedFakir TajulNoch keine Bewertungen

- Allied-Bank-Internship-Report (Final Report)Dokument59 SeitenAllied-Bank-Internship-Report (Final Report)qaisranisahibNoch keine Bewertungen

- Operational DefinitionDokument6 SeitenOperational DefinitionPaolo GubotNoch keine Bewertungen

- Receipt ReportDokument1 SeiteReceipt Reportjowie james octatNoch keine Bewertungen

- Faqs of Islamic Naya Pakistan Certificates (Inpcs)Dokument3 SeitenFaqs of Islamic Naya Pakistan Certificates (Inpcs)Ajmal AfzalNoch keine Bewertungen

- Foreign Currency Accounts ICICI BankDokument13 SeitenForeign Currency Accounts ICICI BankbahlkartikNoch keine Bewertungen

- Introduction To Bank ReconciliationDokument8 SeitenIntroduction To Bank ReconciliationNath Bongalon100% (1)

- Business CommunicationDokument56 SeitenBusiness CommunicationDipayan_luNoch keine Bewertungen

- SWATI SBI - OrganizedDokument5 SeitenSWATI SBI - OrganizedVinod MNoch keine Bewertungen

- Tutorial Program Tute 2 (Week 3)Dokument2 SeitenTutorial Program Tute 2 (Week 3)mavisNoch keine Bewertungen

- Paypal Case Study 2020Dokument1 SeitePaypal Case Study 2020RyanNoch keine Bewertungen

- Digital Journey IndiaDokument2 SeitenDigital Journey IndiaAlaukik VarmaNoch keine Bewertungen

- Kwalityautomobiles 31014124640Dokument62 SeitenKwalityautomobiles 31014124640crmassociates.financeNoch keine Bewertungen

- Account StatementDokument5 SeitenAccount StatementAabi GujjarNoch keine Bewertungen

- STRBI Table No. 01 Liabilities and Assets of Scheduled Commercial BanksDokument550 SeitenSTRBI Table No. 01 Liabilities and Assets of Scheduled Commercial Banksayush singlaNoch keine Bewertungen

- Account Statement From 4 Jan 2024 To 23 Jan 2024: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument4 SeitenAccount Statement From 4 Jan 2024 To 23 Jan 2024: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancerangaswamy8194Noch keine Bewertungen

- The Evolution of Bank Architecture and DesignDokument8 SeitenThe Evolution of Bank Architecture and DesignJessica CadarinNoch keine Bewertungen

- Annex 6 - RCB - CabangtalanDokument15 SeitenAnnex 6 - RCB - CabangtalanLikey PromiseNoch keine Bewertungen

- Jpso 061915Dokument8 SeitenJpso 061915theadvocate.comNoch keine Bewertungen

- INTERNSHIP REPORT UpDokument50 SeitenINTERNSHIP REPORT UpFact BeamNoch keine Bewertungen

- Answers To Some Important Questions Asked in The BB Viva Board in 2017Dokument21 SeitenAnswers To Some Important Questions Asked in The BB Viva Board in 2017shopno100% (1)

- AudithaccDokument3 SeitenAudithaccTk KimNoch keine Bewertungen

- AC Power Booster - SBI PO CLERK BOB PO 2018 PDFDokument112 SeitenAC Power Booster - SBI PO CLERK BOB PO 2018 PDFPrathyusha KunaparajuNoch keine Bewertungen