Beruflich Dokumente

Kultur Dokumente

Chapter 9 & 10 Financial (FAR) Notes

Hochgeladen von

FutureMsCPACopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chapter 9 & 10 Financial (FAR) Notes

Hochgeladen von

FutureMsCPACopyright:

Verfügbare Formate

1. When determining if a fund qualifies as a major fund, aggregate bund balance/equity is not used in either test a.

The general fund will always be a major fund b. Internal service fund will not be considered in the evaluation of major and non-major funds 2. Budgetary comparison schedules a. Show the original original budget, amended budget, and actual budgets i. Computation of avariances between budget and actual is optional ii. Computation of differences between original and final amended budget is optional 3. Other supplementary info (optional) a. Variance b. Combining statements for non-major funds 4. Non-reciprocal interfund activity a. Non exchange between funds b. Interfund transfer c. Interfund reimbursements i. Not in interfund transactions 5. Not for Profits --- FASB a. Full accrual basis accounting b. Emphasis: basic information for the organization as a whole i. Classification of net assets: unrestricted, temporarily restricted, and permanently restricted ii. Revenue recognition concepts related to unconditional pledges and support iii. Dist b/w restricted revenue & conditional pledges iv. Dist b/w restricted revenue and the absence of variance power c. Required f/s i. Statement of Financial Position (B/S) ii. Statement of Activity (I/S) iii. Statemetn of CF iv. Statement of Functional Exepnses 1. Voluntary health and welfare organizational d. Net Assets (restricted & Unrestricted) - PUT i. Internal board-designated funds unrestricted e. Expense classification in statement of activities i. Expenses 1. Decreases in unrestricted net assets 2. Program services 3. Support services a. Staff, fundraising, admin mgmt, leadership dvt 4. Combined costs f. Stmt of cf

6. 7. 8.

9.

10.

11.

12.

13. 14. 15. 16. 17. 18.

19.

i. Required ii. Direct or indirect Contribution of unrestricted revenue later earmarked (board designated) for construction or purchase of long-lived assets operating statement of CF Not for profit CF- O,F&I FASB a. GAB 4 Functional support services - re voluntary health and welfare org a. Program support expenses b. Fundarising expenses c. Mgmt and general costs d. Multiple cost items Unconditional pledges a. Written/oral b. Revenue when promise made Multi year pledges a. Now-revenue b. Future- tem restricted revenue Unconditional pledges. Either a. Restricted b. Unrestricted Conditional pledges a. Not recorded as venue b. Liability Donated materials FMV Receipts restricted by a donor specific purposes restricted revenue. Inc restricted net assets Receipts restricted by a donor specific beneficiaries liabilities org has no variance power Losses securities decrease unrestricted Dividends, interest, other investment income a. Increase unrestricted unless investment is restricted Endowment Fund a. Permanent endowment i. Principal not permitted to be spent b. Term endowment i. Must be held for a specified term ii. Temp restricted net assets c. Quasi-endowment i. Internal governing board of institution (not donor) has det funds are to be retained and invested for specified purposes ii. Unrestricted net assets 1. Since internal governing board made decision Fund accounting a. Not for external reporting or non profits

20.

21. 22.

23. 24.

b. Entity reported in total. Emphasis: classification of net assets c. PUT funds Health care org a. Revenue (3) i. Patient Service Revenue 1. Accrual even if all not expected to be collected 2. Charity care not recorded as receivable or as revenue 3. Deductions a. Contractual adjustments to third-party payments b. Policy discounts c. Administrative adjustments ii. Other operating income 1. Tuition from schools 2. Rev from educational programs 3. Donated supplies & equip 4. Parking fees 5. Cafeteria revenue 6. Gift shop iii. Non-operating revenue & support g&L 1. Unrestricted int/divds/grants 2. Donated services Health care a. PUT Voluntary Health and welfare orgs a. Obtain most of their operating funds by donations from general public b. Ex: American red cross c. Full Accrual d. Income: large part. Pledges. e. Mandatory: Stmt of functional expenses f. Fundraising expenses associated with fundraising appeals must be shown separately on the face of the f/s either as i. Expense or ii. Deduction from revenue g. Fundraising support may not be displayed as a simple net amount Smt of activities operational accountability Budgetary schedules required supplementary info a. A schedule showing i. Original budget ii. Final appropriations budget & iii. Actual inflows, outflows & balances on the budgetary basis F10

1. FV a. Market based b. Does not include transactions costs i. May include transportation costs c. Orderly transaction i. Cannot be a forced transaction ii. Willing buyer/seller d. Transaction costs are not included in the final Fair value measurement e. Transaction costs are used to find the most advantageous market Valuation techniques a. A change in technique = change is estimate (prospectively) b. Market approach i. Prices, other relevant info from identical/similar A 0r L c. Income approach i. Pv (discounted CF) d. Cost approach i. Replacement cost e. Market approach i. Level 1 inputs identical. Most reliable ii. Level 2 similar iii. Level 3 discounted CF. unobservable inputs for A or L 1. Only use when no observable info (1 or 2) Formation of partnership a. Partners capital account i. Diff b/w Fv A contributed & FV L assumed b. Creation of new partnership interest investment of addtl capital i. Exact method (= BV) 1. No goodwill 2. Old partners capital account dollars stay the same a. % ownership changes ii. Bonus method 1. Recognize intercapital transfer 2. Do not affect partnership assets iii. Goodwill 1. Recognize intangible asset 2. Recognized based upon the total value of the partnership implied by the new partners contribution 3. Based on going investment (dollars) Partnership accts may be different than their perspective P&L ratios. Distributions/withdrawals will be at diff times and for diff reasons Withdrawal of partner a. Bonus method

2.

3.

4. 5.

6.

7. 8.

9.

10.

11. 12.

i. Step 1: revalue asset to FV 1. (Debit) asset adjustment 2. Credit: capital accounts ii. Step 2: pay off withdrawing partner Liquidation Partnership a. Order of preference distribution of assets i. Creditors ii. Partners capital Charge possible losses depending on partnership agreement before any distribution can be made to partners Capital deficiency a. Debit balance in partners capital account i. Partnership has a claim against the partner for the amount in the deficiency ii. Partnership has a legal right to offset iii. May use the loan acct to satisfy the capital deficiency The primary beneficiary of a variable interest entity must consolidate the variable entity. US GAAP all consolidation decisions are evaluated first under the VIE model. If consolidation is not required under the VIE model, then the investor (parent) determines whether consolidation is necessary under the voting interest model (own > 50%) Examples of variable interests: a. Explicit investments at risk b. Explicit guarantees of debt, the values of assets, or residual values of leased assets c. Implicit guarantees with related party involvement d. Most L, excluding sht term trade payables e. Most forward contracts to sell A owned by the entity f. Options to acquire leased A at the end of the lease term at specified prices g. Explicit in writing/legally enforceable An entity is a VIE if some of the equity investors have disaproportionate voting rights in comparison to their economic interest US GAAP a. VIE i. Primary beneficiary consolidates if 1. Has power and 2. Absorves P & L b. IFRS i. Focuses on the accounting for special purpose entities (specific type of VIE) often structured for financing purposes ii. Sponsoring company controls and must consolidate an SPE when: 1. Is benefited by the SPEs activities

13.

14.

15.

16. 17. 18.

19.

20. 21.

2. Has decision-making powers that allow it to benefit from the SPE 3. Absorbs the risks and rewards of the SPE 4. Has a residual interest in the SPE Asset Retirement Obligation (ARO) a. Recognize when i. Duty or responsibility ii. Little or no discretion to avoid iii. Obligating event Asset Retirement Cost (ARC) a. Amount capitalized (A) that increases the carrying amt of the long-lived asset when a liability for an ARO is recognized b. Asset retirement obligation i. Recorded at a discounted amount c. Acretion expense i. Growth of the liability over time ii. Reported at its total non-discounted value Other liabilities and debt covenants a. Sales taxes payable i. Sales taxes payable should be credited to a payable account after collection and until remitted ii. Sales taxes are not an expense of the company collecting the sales taxes from customers Unemployment taxes & employers share of payroll taxes a. Kept on books until remission Notes record at PV Non interest bearing payable a. Report at PV of CF b. Remaining is discount or prem No required PV calc a. Receivables and payables i. Arising from ordinary course of business (sht note < 1 year) b. Paid in property or services (not in cash) Under IFRS, FV option may only be applied on certain dates, if doing so eliminates, or significantly reduces a measurement or recognition inconsistency FV disclosures req for f/s a. Concentration of credit risk Required i. Of all financial instruments b. Market risk i. Changes in economic circumstances Beta ii. US GAAP 1. Disclosure encouraged but not required

iii. IFRS 1. Required: a. Disclosure of nature and extent of rising form financial instruments. Including i. Credit risk for each class ii. Liquidity risk iii. Market risk iv. Note: Disclosure Market risk is not optional under IFRS but is under GAAP 22. Common Derivatives a. OFFS i. O Options ii. F - Forwards iii. F- Futures iv. S Swaps 23. Market and credit risks inherent risks of all derivative instruments

24. k

Das könnte Ihnen auch gefallen

- Far Final ReviewDokument13 SeitenFar Final ReviewFutureMsCPA100% (1)

- CPA Chapter 4 FAR Notes Inventories & CA/CLDokument5 SeitenCPA Chapter 4 FAR Notes Inventories & CA/CLjklein2588Noch keine Bewertungen

- FAR Notes CH1: Revenue Recognition 1.0 (Becker 2017)Dokument12 SeitenFAR Notes CH1: Revenue Recognition 1.0 (Becker 2017)charlesNoch keine Bewertungen

- FAR Notes CH1: Standards & Framework 1.0 (Becker 2017)Dokument4 SeitenFAR Notes CH1: Standards & Framework 1.0 (Becker 2017)charlesNoch keine Bewertungen

- Chapter 2 FAR CPA NotesDokument4 SeitenChapter 2 FAR CPA Notesjklein2588Noch keine Bewertungen

- FAR Notes CH1: Comprehensive Income Statement 1.0 (Becker 2017)Dokument2 SeitenFAR Notes CH1: Comprehensive Income Statement 1.0 (Becker 2017)charlesNoch keine Bewertungen

- FAR Notes Chapter 3Dokument3 SeitenFAR Notes Chapter 3jklein2588Noch keine Bewertungen

- AUD Notes Chapter 2Dokument20 SeitenAUD Notes Chapter 2janell184100% (1)

- Wiley CPAexcel - FAR - 13 Disclosure RequirementsDokument2 SeitenWiley CPAexcel - FAR - 13 Disclosure RequirementsAimeeNoch keine Bewertungen

- CPA Exam REG - S-Corporation Taxation.Dokument2 SeitenCPA Exam REG - S-Corporation Taxation.Manny MarroquinNoch keine Bewertungen

- BEC CPA Notes Chapter 48 Partnership SummaryDokument48 SeitenBEC CPA Notes Chapter 48 Partnership SummaryJame NgNoch keine Bewertungen

- BEC 3 Outline - 2015 Becker CPA ReviewDokument4 SeitenBEC 3 Outline - 2015 Becker CPA ReviewGabrielNoch keine Bewertungen

- Microeconomics and Financial FormulasDokument20 SeitenMicroeconomics and Financial FormulassasyedaNoch keine Bewertungen

- FAR CPA Notes Accounting ChangesDokument4 SeitenFAR CPA Notes Accounting Changesjklein2588Noch keine Bewertungen

- BEC 1 Outline Corporate Governance and Operations ManagementDokument4 SeitenBEC 1 Outline Corporate Governance and Operations ManagementGabriel100% (1)

- BEC Study Guide 4-19-2013Dokument220 SeitenBEC Study Guide 4-19-2013Valerie Readhimer100% (1)

- Chapter 7 CPA FAR NotesDokument5 SeitenChapter 7 CPA FAR Notesjklein2588Noch keine Bewertungen

- Accounting Study Guide PDFDokument8 SeitenAccounting Study Guide PDFgetasewNoch keine Bewertungen

- REG NotesDokument41 SeitenREG NotesNick Huynh75% (4)

- CPA BEC 1 - Corporate GovernanceDokument3 SeitenCPA BEC 1 - Corporate GovernanceGabrielNoch keine Bewertungen

- Corporate Governance FrameworkDokument38 SeitenCorporate Governance FrameworksheldonNoch keine Bewertungen

- CPA FAR Pensions TaxesDokument4 SeitenCPA FAR Pensions Taxesjklein2588Noch keine Bewertungen

- Written Communications Memo on IFRS BenefitsDokument9 SeitenWritten Communications Memo on IFRS Benefitscpa2014Noch keine Bewertungen

- CPA Regulation Notes - ChapDokument23 SeitenCPA Regulation Notes - ChapSteve DolphNoch keine Bewertungen

- FAR Review NotesDokument2 SeitenFAR Review NotesFutureMsCPANoch keine Bewertungen

- Business Combinations - ASPEDokument3 SeitenBusiness Combinations - ASPEShariful HoqueNoch keine Bewertungen

- BEC Notes Chapter 3Dokument13 SeitenBEC Notes Chapter 3bobby100% (1)

- Regulation MyNotesDokument50 SeitenRegulation MyNotesaudalogy100% (1)

- BEC 4 Outline - 2015 Becker CPA ReviewDokument6 SeitenBEC 4 Outline - 2015 Becker CPA ReviewGabrielNoch keine Bewertungen

- AUD TxtbookDokument50 SeitenAUD TxtbookGrant Kenneth D. FloresNoch keine Bewertungen

- Contracts Notes Chapter 5 SummaryDokument9 SeitenContracts Notes Chapter 5 SummarybrisketbackNoch keine Bewertungen

- Auditing and Attestation Content Specification OutlineDokument5 SeitenAuditing and Attestation Content Specification OutlineLisa GoldmanNoch keine Bewertungen

- CMA FormulaDokument4 SeitenCMA FormulaKanniha SuryavanshiNoch keine Bewertungen

- BEC Demo CompanionDokument23 SeitenBEC Demo Companionalik711698100% (1)

- Cost Measurement GuideDokument6 SeitenCost Measurement Guidexcrunner87Noch keine Bewertungen

- Aud NotesDokument75 SeitenAud NotesClaire O'BrienNoch keine Bewertungen

- Regulation of Tax Return Preparers and Practice before the IRSDokument5 SeitenRegulation of Tax Return Preparers and Practice before the IRSLE AicragNoch keine Bewertungen

- Aicpa 040212far SimDokument118 SeitenAicpa 040212far SimHanabusa Kawaii IdouNoch keine Bewertungen

- Notes Chapter 5 FARDokument6 SeitenNotes Chapter 5 FARcpacfa100% (10)

- Agency: REG - Notes Chapter 7Dokument9 SeitenAgency: REG - Notes Chapter 7mohit2ucNoch keine Bewertungen

- 655 Week 12 Notes PDFDokument63 Seiten655 Week 12 Notes PDFsanaha786Noch keine Bewertungen

- Financial Accounting - TheoriesDokument5 SeitenFinancial Accounting - TheoriesKim Cristian MaañoNoch keine Bewertungen

- Chapter 3 FARDokument4 SeitenChapter 3 FARZee DrakeNoch keine Bewertungen

- 2020 - Far SampleDokument21 Seiten2020 - Far SamplesuryaNoch keine Bewertungen

- Charging All Costs To Expense When IncurredDokument27 SeitenCharging All Costs To Expense When IncurredAnonymous N9dx4ATEghNoch keine Bewertungen

- CPA Reg Practice Individual TaxationDokument2 SeitenCPA Reg Practice Individual TaxationMatthew AminiNoch keine Bewertungen

- Part 3 - Understanding Financial Statements and ReportsDokument7 SeitenPart 3 - Understanding Financial Statements and ReportsJeanrey AlcantaraNoch keine Bewertungen

- BEC CPA Formulas November 2015 Becker CPA ReviewDokument3 SeitenBEC CPA Formulas November 2015 Becker CPA ReviewsasyedaNoch keine Bewertungen

- Bec Flash CardsDokument4.310 SeitenBec Flash Cardsmohit2uc100% (1)

- NINJA Book Reg 1 EthicsDokument38 SeitenNINJA Book Reg 1 EthicsJaffery143Noch keine Bewertungen

- Notes Chapter 9 FARDokument8 SeitenNotes Chapter 9 FARcpacfa100% (9)

- New-Reg-2023 (N)Dokument2 SeitenNew-Reg-2023 (N)saramohamed5137Noch keine Bewertungen

- Audit Report TypesDokument5 SeitenAudit Report TypesFarhanChowdhuryMehdiNoch keine Bewertungen

- BEC NotesDokument17 SeitenBEC NotescsugroupNoch keine Bewertungen

- CPA TestDokument22 SeitenCPA Testdani13_335942Noch keine Bewertungen

- Management Reporting A Complete Guide - 2019 EditionVon EverandManagement Reporting A Complete Guide - 2019 EditionNoch keine Bewertungen

- Abo Royce Stephen Cfas Activities AnswersDokument37 SeitenAbo Royce Stephen Cfas Activities Answerscj gamingNoch keine Bewertungen

- Chapter 16 Summary: Accounting for Non-Profit OrganizationsDokument27 SeitenChapter 16 Summary: Accounting for Non-Profit OrganizationsEllen MNoch keine Bewertungen

- English To Math and VocabDokument10 SeitenEnglish To Math and VocabezaNoch keine Bewertungen

- IA 3 ReviewerDokument23 SeitenIA 3 ReviewerLarra NarcisoNoch keine Bewertungen

- F9 Part 2Dokument3 SeitenF9 Part 2FutureMsCPANoch keine Bewertungen

- Chapter 1 Financial (FAR) NotesDokument5 SeitenChapter 1 Financial (FAR) NotesFutureMsCPANoch keine Bewertungen

- FAR Review NotesDokument2 SeitenFAR Review NotesFutureMsCPANoch keine Bewertungen

- FAR Review NotesDokument2 SeitenFAR Review NotesFutureMsCPANoch keine Bewertungen

- F1 NotesDokument6 SeitenF1 NotesFutureMsCPANoch keine Bewertungen

- Retake NotesDokument6 SeitenRetake NotesFutureMsCPANoch keine Bewertungen

- Law ExamDokument13 SeitenLaw Examraj5720Noch keine Bewertungen

- Money Monster (Reaction Paper)Dokument1 SeiteMoney Monster (Reaction Paper)Kersteen JoyNoch keine Bewertungen

- Money Supply - IndiaDokument20 SeitenMoney Supply - IndiaShrey SampatNoch keine Bewertungen

- Chapter 7Dokument22 SeitenChapter 7trevorsum123Noch keine Bewertungen

- Goldman Sachs $Leveraged EURO STOXX 50 NotesDokument140 SeitenGoldman Sachs $Leveraged EURO STOXX 50 Notes黄健Noch keine Bewertungen

- SWIFT SR2021 MT BusinessHighlightsDokument13 SeitenSWIFT SR2021 MT BusinessHighlightsmelol40458Noch keine Bewertungen

- Keown 23 RP3Dokument24 SeitenKeown 23 RP3ausantNoch keine Bewertungen

- 1-The Following Table Shows The Sex of The Respondents Sex Respondents PercentageDokument36 Seiten1-The Following Table Shows The Sex of The Respondents Sex Respondents Percentageletter2lalNoch keine Bewertungen

- Indah Kiat Pulp & Paper TBK.: Company Report: July 2014 As of 25 July 2014Dokument3 SeitenIndah Kiat Pulp & Paper TBK.: Company Report: July 2014 As of 25 July 2014btishidbNoch keine Bewertungen

- Daftar Akun Nomor Nama Akun Fungsi Untuk Mencatat Mutasi NilaiDokument4 SeitenDaftar Akun Nomor Nama Akun Fungsi Untuk Mencatat Mutasi NilaiFhina LarioNoch keine Bewertungen

- Fera and Fema: Foreign Exchange Regulation Act & Foreign Exchange Management ActDokument8 SeitenFera and Fema: Foreign Exchange Regulation Act & Foreign Exchange Management ActMayank JainNoch keine Bewertungen

- Knowledge Appropriateness Test Ebook - AU - v4 - With ZH LinkDokument9 SeitenKnowledge Appropriateness Test Ebook - AU - v4 - With ZH LinkBeverly HillsNoch keine Bewertungen

- Richey Rosemary. - English For Banking & Finance 1Dokument82 SeitenRichey Rosemary. - English For Banking & Finance 1Debby Mulya100% (13)

- Mergers and Acquisitions - A Beginner's GuideDokument8 SeitenMergers and Acquisitions - A Beginner's GuideFforward1605Noch keine Bewertungen

- Bill Ackman's Presentation On Corrections Corp of America (CXW) at The Value Investing CongressDokument40 SeitenBill Ackman's Presentation On Corrections Corp of America (CXW) at The Value Investing Congressmarketfolly.comNoch keine Bewertungen

- Turpin BankruptcyDokument83 SeitenTurpin Bankruptcytom cleary100% (1)

- 6-2 Affidavit of Mailing Notice - Shareholders Annual MeetingDokument1 Seite6-2 Affidavit of Mailing Notice - Shareholders Annual MeetingDanielNoch keine Bewertungen

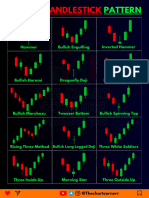

- Chart Pattern Cheat Sheet-1Dokument18 SeitenChart Pattern Cheat Sheet-1YASHANK VISHWAKARMANoch keine Bewertungen

- Investment in PSX Project. Investment Portfolio Management.: Group Members. Rabee Shahzad Zahid Ch. Arslan WattooDokument14 SeitenInvestment in PSX Project. Investment Portfolio Management.: Group Members. Rabee Shahzad Zahid Ch. Arslan WattooAhmad MalikNoch keine Bewertungen

- Beta SecuritiesDokument5 SeitenBeta SecuritiesZSNoch keine Bewertungen

- CH 20 The Mutual Fund IndustryDokument51 SeitenCH 20 The Mutual Fund IndustrynikowawaNoch keine Bewertungen

- Advac2 MidtermDokument5 SeitenAdvac2 MidtermgeminailnaNoch keine Bewertungen

- The Phantom Shares' Menace: Naked Short Selling Distorts Shareholder ControlDokument10 SeitenThe Phantom Shares' Menace: Naked Short Selling Distorts Shareholder ControlsgdividendsNoch keine Bewertungen

- Moontrading PDFDokument2 SeitenMoontrading PDFNiraj Kothar0% (1)

- Capital Market Questions BankDokument11 SeitenCapital Market Questions Bankdev12_lokesh100% (1)

- 2 Financial Marek T and ServicesDokument2 Seiten2 Financial Marek T and Servicesbhaskarganesh0% (1)

- FI504 Case Study 1Dokument17 SeitenFI504 Case Study 1Scott SmithNoch keine Bewertungen

- Value Line Research Report GuideDokument23 SeitenValue Line Research Report GuideCarl HsiehNoch keine Bewertungen

- Bastida v. Menzi and Co.Dokument2 SeitenBastida v. Menzi and Co.Crisanta Leonor ChianpianNoch keine Bewertungen

- Uniform Loan and Mortgage Agreement (Real Estate) : Pangasinan Bank, IncDokument7 SeitenUniform Loan and Mortgage Agreement (Real Estate) : Pangasinan Bank, IncCampbell HezekiahNoch keine Bewertungen