Beruflich Dokumente

Kultur Dokumente

IRS Publication Form 8867

Hochgeladen von

Francis Wolfgang UrbanOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

IRS Publication Form 8867

Hochgeladen von

Francis Wolfgang UrbanCopyright:

Verfügbare Formate

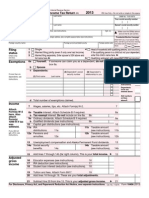

Form

8867

Paid Preparer's Earned Income Credit Checklist

Information

OMB No. 1545-1629

Department of the Treasury Internal Revenue Service

To be completed by preparer and filed with Form 1040, 1040A, or 1040EZ. about Form 8867 and its separate instructions is at www.irs.gov/form8867.

Attachment Sequence No. 177

2012

Taxpayer name(s) shown on return

Taxpayer's social security number

For the definitions of the following terms, see Pub. 596. Investment Income Qualifying Child Earned Income Full-time Student

Part I

1 2

All Taxpayers

Enter preparer's name and PTIN Is the taxpayers filing status married filing separately? .

Yes

No

If you checked Yes on line 2, stop; the taxpayer cannot take the EIC. Otherwise, continue.

Does the taxpayer (and the taxpayers spouse if filing jointly) have a social security number (SSN) that allows him or her to work or is valid for EIC purposes? See the instructions before answering

If

Yes

No

you checked No on line 3, stop; the taxpayer cannot take the EIC. Otherwise, continue.

Is the taxpayer filing Form 2555 or Form 2555-EZ (relating to the exclusion of foreign earned income)? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If

Yes

No

you checked Yes on line 4, stop; the taxpayer cannot take the EIC. Otherwise, continue.

5a

Was the taxpayer a nonresident alien for any part of 2012?

If

Yes

No

you checked Yes on line 5a, go to line 5b. Otherwise, skip line 5b and go to line 6. . . . . . . . . . . . . . . . . Yes No

b Is the taxpayers filing status married filing jointly?

If

you checked Yes on line 5a and No on line 5b, stop; the taxpayer cannot take the EIC. Otherwise, continue. Yes No

Is the taxpayers investment income more than $3,200? See Rule 6 in Pub. 596 before answering

If

you checked Yes on line 6, stop; the taxpayer cannot take the EIC. Otherwise, continue.

Could the taxpayer, or the taxpayers spouse if filing jointly, be a qualifying child of another person for 2012? If the taxpayer's filing status is married filing jointly, check No. Otherwise, see Rule 10 (Rule 13 if the taxpayer does not have a qualifying child) in Pub. 596 before answering . . . .

If

Yes

No

you checked Yes on line 7, stop; the taxpayer cannot take the EIC. Otherwise, go to Part II or Part III, whichever applies.

Cat. No. 26142H Form

For Paperwork Reduction Act Notice, see separate instructions.

8867 (2012)

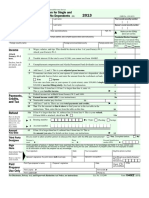

Form 8867 (2012)

Page 2

Part II

Taxpayers With a Child

Child 1 Child 2 Child 3

Caution. If there is more than one child, complete lines 8 through 14 for one child before going to the next column. 8 9 10 Childs name . . . . . . . . . . . . . . . . . . . . . Is the child the taxpayers son, daughter, stepchild, foster child, brother, sister, stepbrother, stepsister, half brother, half sister, or a descendant of any of them? Is either of the following true? The child is unmarried, or The child is married, can be claimed as the taxpayers dependent, and is not filing a joint return (or is filing it only as a claim for refund). Did the child live with the taxpayer in the United States for over half of the year? See the instructions before answering . . . . . . . . . . Was the child (at the end of 2012) Under age 19 and younger than the taxpayer (or the taxpayers spouse, if the taxpayer files jointly), Under age 24, a full-time student, and younger than the taxpayer (or the taxpayers spouse, if the taxpayer files jointly), or Any age and permanently and totally disabled? . . . . . . . . If you checked Yes on lines 9, 10, 11, and 12, the child is the taxpayers qualifying child; go to line 13a. If you checked No on line 9, 10, 11, or 12, the child is not the taxpayers qualifying child; see the instructions for line 12. 13a Could any other person check Yes on lines 9, 10, 11, and 12 for the child? you checked No on line 13a, go to line 14. Otherwise, go to line 13b.

If

Yes

No

Yes

No

Yes

No

Yes Yes

No No

Yes Yes

No No

Yes Yes

No No

11 12

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

Yes

No

b Enter the childs relationship to the other person(s) . . . . . . . . c Under the tiebreaker rules, is the child treated as the taxpayers qualifying child? See the instructions before answering . . . . . . . . . .

If you checked Yes on line 13c, go to line 14. If you checked No, the taxpayer cannot take the EIC based on this child and cannot take the EIC for taxpayers who do not have a qualifying child. If there is more than one child, see the Note at the bottom of this page. If you checked Dont know, explain to the taxpayer that, under the tiebreaker rules, the taxpayers EIC and other tax benefits may be disallowed. Then, if the taxpayer wants to take the EIC based on this child, complete lines 14 and 15. If not, and there are no other qualifying children, the taxpayer cannot take the EIC, including the EIC for taxpayers without a qualifying child; do not complete Part III. If there is more than one child, see the Note at the bottom of this page.

Yes No Dont know

Yes No Dont know

Yes No Dont know

14

Does the qualifying child have an SSN that allows him or her to work or is valid for EIC purposes? See the instructions before answering . . . . If you checked No on line 14, the taxpayer cannot take the EIC based on this child and cannot take the EIC available to taxpayers without a qualifying child. If there is more than one child, see the Note at the bottom of this page. If you checked Yes on line 14, continue. Are the taxpayers earned income and adjusted gross income each less than the limit that applies to the taxpayer for 2012? See Pub. 596 for the limit . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Yes

No

Yes

No

15

Yes

No

If you checked No on line 15, stop; the taxpayer cannot take the EIC. If you checked Yes on line 15, the taxpayer can take the EIC. Complete Schedule EIC and attach it to the taxpayers return. If there are two or three qualifying children with valid SSNs, list them on Schedule EIC in the same order as they are listed here. If the taxpayers EIC was reduced or disallowed for a year after 1996, see Pub. 596 to see if Form 8862 must be filed. Go to line 20.

Note. If you checked No on line 13c or 14 but there is more than one child, complete lines 8 through 14 for the other child(ren) (but for no more than three qualifying children). Also do this if you checked Dont know on line 13c and the taxpayer is not taking the EIC based on this child.

Form 8867 (2012)

Form 8867 (2012)

Page 3

Part III

16

Taxpayers Without a Qualifying Child

Was the taxpayers main home, and the main home of the taxpayers spouse if filing jointly, in the United States for more than half the year? (Military personnel on extended active duty outside the United States are considered to be living in the United States during that duty period. See Pub. 596.)

Yes

No

If you checked No on line 16, stop; the taxpayer cannot take the EIC. Otherwise, continue. Yes No

17

Was the taxpayer, or the taxpayers spouse if filing jointly, at least age 25 but under age 65 at the end of 2012? See the instructions before answering . . . . . . . . . . . . . . . .

If

you checked No on line 17, stop; the taxpayer cannot take the EIC. Otherwise, continue.

18

Is the taxpayer, or the taxpayers spouse if filing jointly, eligible to be claimed as a dependent on anyone elses federal income tax return for 2012? If the taxpayer's filing status is married filing jointly, check No . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If you checked Yes on line 18, stop; the taxpayer cannot take the EIC. Otherwise, continue. Yes No

19

Are the taxpayers earned income and adjusted gross income each less than the limit that applies to the taxpayer for 2012? See Pub. 596 for the limit . . . . . . . . . . . . .

If you checked No on line 19, stop; the taxpayer cannot take the EIC. If you checked Yes on line 19, the taxpayer can take the EIC. If the taxpayers EIC was reduced or disallowed for a year after 1996, see Pub. 596 to find out if Form 8862 must be filed. Go to line 20.

Part IV

20 21 22 23

Due Diligence Requirements

Yes No

Did you complete Form 8867 based on current information provided by the taxpayer or reasonably obtained by you? . . . . . . . . . . . . . . . . . . . . . . . . . . . Did you complete the EIC worksheet found in the Form 1040, 1040A, or 1040EZ instructions (or your own worksheet that provides the same information as the 1040, 1040A, or 1040EZ worksheet)? . . If any qualifying child was not the taxpayer's son or daughter, did you ask why the parents were not claiming the child and document the answer? . . . . . . . . . . . . . . . . . . If the answer to question 13a is Yes (indicating that the child lived for more than half the year with someone else who could claim the child for the EIC), did you explain the tiebreaker rules and possible consequences of another person claiming your client's qualifying child? . . . . . . Did you ask this taxpayer any additional questions that are necessary to meet your knowledge requirement? See the instructions before answering . . . . . . . . . . . . . . . . To comply with the EIC knowledge requirement, you must not know or have reason to know that any information used to determine the taxpayer's eligibility for, and the amount of, the EIC is incorrect. You may not ignore the implications of information furnished to or known by you, and you must make reasonable inquiries if the information furnished appears to be incorrect, inconsistent, or incomplete. At the time you make these inquiries, you must document in your files the inquiries you made and the taxpayer's responses.

Yes No Yes No Does not apply Yes No Does not apply Yes No Does not apply

24

25

Did you document the additional questions you asked and your client's answers? .

Yes No Does not apply

Form 8867 (2012)

Form 8867 (2012)

Page 4

26

Which documents below, if any, did you rely on to determine EIC eligibility for the qualifying child(ren) listed on Schedule EIC? Check all that apply. Keep a copy of any documents you relied on. See the instructions before answering. If there is no qualifying child, check box a. If there is no disabled child, check box o.

Residency of Qualifying Child(ren)

a b c d e f g h No qualifying child School records or statement Landlord or property management statement Health care provider statement Medical records Child care provider records Placement agency statement Social service records or statement i j k l Place of worship statement Indian tribal official statement Employer statement Other (specify)

Disability of Qualifying Child(ren)

o p q r No disabled child Doctor statement Other health care provider statement Social services agency or program statement

m Did not rely on any documents, but made notes in file n Did not rely on any documents s Other (specify)

t Did not rely on any documents, but made notes in file u Did not rely on any documents

27

If a Schedule C is included with this return, which documents or other information, if any, did you rely on to confirm the existence of the business and to figure the amount of Schedule C income and expenses reported on the return? Check all that apply. Keep a copy of any documents you relied on. See the instructions before answering. If there is no Schedule C, check box a. a b c d e f g

Documents or Other Information

No Schedule C Business license Forms 1099 Records of gross receipts provided by taxpayer Taxpayer summary of income Records of expenses provided by taxpayer Taxpayer summary of expenses

h Bank statements i Reconstruction of income and expenses j Other (specify)

k Did not rely on any documents, but made notes in file l Did not rely on any documents

You have complied with all the due diligence requirements if you:

1. Completed the actions described on lines 20 and 21 and checked "Yes" on those lines, 2. Completed the actions described on lines 22, 23, 24, and 25 (if they apply) and checked "Yes" (or "Does not apply") on those lines, 3. Submit Form 8867 in the manner required, and 4. Keep all five of the following records for 3 years from the latest of the dates specified in the instructions under Document Retention: a. Form 8867, Paid Preparer's Earned Income Credit Checklist, b. The EIC worksheet(s) or your own worksheet(s), c. Copies of any taxpayer documents you relied on to determine eligibility for or amount of EIC, d. A record of how, when, and from whom the information used to prepare the form and worksheet(s) was obtained, and e. A record of any additional questions you asked and your client's answers.

If you checked No on line 20, 21, 22, 23, 24, or 25, you have not complied with all the due diligence requirements and may

have to pay a $500 penalty for each failure to comply.

Form 8867 (2012)

Das könnte Ihnen auch gefallen

- Paid Preparer's Earned Income Credit ChecklistDokument4 SeitenPaid Preparer's Earned Income Credit Checklistanon_294216815Noch keine Bewertungen

- Innocent Spouse Relief: How You May Not Have To Pay Your Taxes!Von EverandInnocent Spouse Relief: How You May Not Have To Pay Your Taxes!Noch keine Bewertungen

- Taxes Are FunDokument2 SeitenTaxes Are Funlfoirirjrkjbghghg999Noch keine Bewertungen

- Next Level Tax Course: The only book a newbie needs for a foundation of the tax industryVon EverandNext Level Tax Course: The only book a newbie needs for a foundation of the tax industryNoch keine Bewertungen

- Information To Claim Certain Credits After DisallowanceDokument4 SeitenInformation To Claim Certain Credits After DisallowanceJane DoeNoch keine Bewertungen

- 2011 Irs Tax Form 1040 A Individual Income Tax ReturnDokument3 Seiten2011 Irs Tax Form 1040 A Individual Income Tax ReturnscribddownloadedNoch keine Bewertungen

- F1040ez PDFDokument2 SeitenF1040ez PDFjc75aNoch keine Bewertungen

- The Trump Tax Cut: Your Personal Guide to the New Tax LawVon EverandThe Trump Tax Cut: Your Personal Guide to the New Tax LawNoch keine Bewertungen

- 2011 Federal 1040Dokument2 Seiten2011 Federal 1040Swati SarangNoch keine Bewertungen

- Mikeandjennykelly@Gmail - Com 2011Dokument6 SeitenMikeandjennykelly@Gmail - Com 2011Melanie RoseNoch keine Bewertungen

- Income Tax Return For Single and Joint Filers With No DependentsDokument2 SeitenIncome Tax Return For Single and Joint Filers With No DependentsmarahmaneNoch keine Bewertungen

- U.S. Individual Income Tax ReturnDokument2 SeitenU.S. Individual Income Tax Returnapi-173610472Noch keine Bewertungen

- 1040 NR EzDokument2 Seiten1040 NR EzElena Alexandra CărăvanNoch keine Bewertungen

- F1040ez 2008Dokument2 SeitenF1040ez 2008jonathandeauxNoch keine Bewertungen

- Getting Your Interest Without Tax Taken Off: Account DetailsDokument1 SeiteGetting Your Interest Without Tax Taken Off: Account DetailsjonyelyNoch keine Bewertungen

- Form 1040Dokument3 SeitenForm 1040Peng JinNoch keine Bewertungen

- 1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No DependentsDokument2 Seiten1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No Dependentspixel986Noch keine Bewertungen

- Child Benefits FormDokument9 SeitenChild Benefits FormIoan-Daniel HustiuNoch keine Bewertungen

- CH2 CH3 Combined For Web EnglishDokument9 SeitenCH2 CH3 Combined For Web EnglishIoana AndreeaNoch keine Bewertungen

- U.S. Individual Income Tax Return 1040A: Filing StatusDokument3 SeitenU.S. Individual Income Tax Return 1040A: Filing StatusYosbanyNoch keine Bewertungen

- U.S. Individual Income Tax ReturnDokument2 SeitenU.S. Individual Income Tax ReturnadrianaNoch keine Bewertungen

- Basic Certification - Study Guide (For Tax Season 2017)Dokument6 SeitenBasic Certification - Study Guide (For Tax Season 2017)Center for Economic ProgressNoch keine Bewertungen

- Monica L Lindo Tax FormDokument2 SeitenMonica L Lindo Tax Formapi-299234513Noch keine Bewertungen

- Form 8862Dokument2 SeitenForm 8862Francis Wolfgang UrbanNoch keine Bewertungen

- CSO-2399B Benefit Screen ToolDokument3 SeitenCSO-2399B Benefit Screen ToolMichelle Morgan100% (1)

- Form 9465 (Installment Agreement Request)Dokument2 SeitenForm 9465 (Installment Agreement Request)Benne JamesNoch keine Bewertungen

- U.S. Individual Income Tax Return: John Public 0 0 0 0 0 0 0 0 0 Jane Public 0 0 0 0 0 0 0 0 1Dokument2 SeitenU.S. Individual Income Tax Return: John Public 0 0 0 0 0 0 0 0 0 Jane Public 0 0 0 0 0 0 0 0 1Renee Leon100% (1)

- f1040 Draft 2015Dokument3 Seitenf1040 Draft 2015Anonymous IpryXQAKZNoch keine Bewertungen

- AlaAL ZAALIG2011Dokument5 SeitenAlaAL ZAALIG2011Ala AlzaaligNoch keine Bewertungen

- The Q Word: Balance DueDokument5 SeitenThe Q Word: Balance DueCenter for Economic ProgressNoch keine Bewertungen

- Form 9465-PDF Reader ProDokument2 SeitenForm 9465-PDF Reader ProEdward FederisoNoch keine Bewertungen

- Glacier Tax User GuideDokument5 SeitenGlacier Tax User Guideinter4ever77Noch keine Bewertungen

- Solution Manual For Fundamentals of Taxation 2015 8Th Edition by Cruz Isbn 0077862309 9780077862305 Full Chapter PDFDokument36 SeitenSolution Manual For Fundamentals of Taxation 2015 8Th Edition by Cruz Isbn 0077862309 9780077862305 Full Chapter PDFpete.salazar966100% (11)

- 2011 1040NR-EZ Form - SampleDokument2 Seiten2011 1040NR-EZ Form - Samplefrankvanhaste100% (1)

- Test Bank For Prentice Halls Federal Taxation 2014 Comprehensive 27th Edition Rupert Pope Anderson 0133450112 9780133450118Dokument36 SeitenTest Bank For Prentice Halls Federal Taxation 2014 Comprehensive 27th Edition Rupert Pope Anderson 0133450112 9780133450118kimberlymullinsjqmaepixtz100% (19)

- Sfe Application For Dependants Grants Form 1819 oDokument5 SeitenSfe Application For Dependants Grants Form 1819 omatuskova.lucie012Noch keine Bewertungen

- F 1040Dokument2 SeitenF 1040Sue BosleyNoch keine Bewertungen

- Income-Driven Repayment Plan Request How To Complete YourDokument13 SeitenIncome-Driven Repayment Plan Request How To Complete YourAnonymous 6jR6DuNoch keine Bewertungen

- Solution Manual For Fundamentals of Taxation 2014 7Th Edition by Cruz Isbn 0077862295 9780077862299 Full Chapter PDFDokument36 SeitenSolution Manual For Fundamentals of Taxation 2014 7Th Edition by Cruz Isbn 0077862295 9780077862299 Full Chapter PDFsusan.lemke155100% (10)

- Chapter 12 TR Assignment Kelsey EwellDokument22 SeitenChapter 12 TR Assignment Kelsey Ewellapi-272863459Noch keine Bewertungen

- Step by Step InstructionsDokument35 SeitenStep by Step InstructionsAlishaNoch keine Bewertungen

- Fernando Vazquez567935467Dokument21 SeitenFernando Vazquez567935467Richivee100% (2)

- F 1040Dokument2 SeitenF 1040Kevin RowanNoch keine Bewertungen

- 1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No DependentsDokument2 Seiten1040NR-EZ: U.S. Income Tax Return For Certain Nonresident Aliens With No DependentsRajesh Kumar ReddyNoch keine Bewertungen

- Beta 1040 EzDokument2 SeitenBeta 1040 EzLeonard RosentholNoch keine Bewertungen

- Income Driven Repayment FormDokument13 SeitenIncome Driven Repayment Formtumi50Noch keine Bewertungen

- Tax Compliance Survey QuestionnaireDokument4 SeitenTax Compliance Survey QuestionnaireJennelyn Abella76% (21)

- Value Added Tax (VAT) Number Registration / ApplicationDokument4 SeitenValue Added Tax (VAT) Number Registration / ApplicationLedger Domains LLCNoch keine Bewertungen

- F 1040 NRDokument5 SeitenF 1040 NRsrao_919525Noch keine Bewertungen

- 2012 Federal ReturnDokument1 Seite2012 Federal Return24male86Noch keine Bewertungen

- Income Tax Fundamentals Chapter 4 Comprehensive Problem 1Dokument2 SeitenIncome Tax Fundamentals Chapter 4 Comprehensive Problem 1AU Sharma0% (1)

- Form 1040nrez 2010Dokument2 SeitenForm 1040nrez 2010David A. VestNoch keine Bewertungen

- Taxation 1Dokument101 SeitenTaxation 1jane100% (2)

- Efmb1cs Es2420230301225157mwhDokument5 SeitenEfmb1cs Es2420230301225157mwh江宗朋Noch keine Bewertungen

- Shed PlansDokument1 SeiteShed PlansFrancis Wolfgang UrbanNoch keine Bewertungen

- Shed PlansDokument1 SeiteShed PlansFrancis Wolfgang UrbanNoch keine Bewertungen

- Shed Material List Part (1 of 9)Dokument2 SeitenShed Material List Part (1 of 9)nwright_besterNoch keine Bewertungen

- Figure E Small Roof: 2x4 Nailers 2x4 Rafter 2x4 Subfascia 1x2 Fascia Trim 24" 32" 29-3/4"Dokument1 SeiteFigure E Small Roof: 2x4 Nailers 2x4 Rafter 2x4 Subfascia 1x2 Fascia Trim 24" 32" 29-3/4"Francis Wolfgang UrbanNoch keine Bewertungen

- Shed PlansDokument1 SeiteShed PlansFrancis Wolfgang Urban50% (2)

- Shed PlansDokument1 SeiteShed PlansFrancis Wolfgang UrbanNoch keine Bewertungen

- Shed PlansDokument1 SeiteShed PlansFrancis Wolfgang UrbanNoch keine Bewertungen

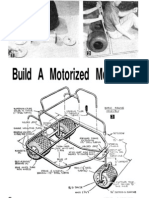

- 3 Wheel 2Dokument5 Seiten3 Wheel 2jii_907001Noch keine Bewertungen

- Figure A Trusses: Inner (Common) Truss (9 Req'd)Dokument1 SeiteFigure A Trusses: Inner (Common) Truss (9 Req'd)Francis Wolfgang UrbanNoch keine Bewertungen

- Shed PlansDokument16 SeitenShed PlansFrancis Wolfgang Urban100% (7)

- 25 Foot CabinDokument28 Seiten25 Foot Cabinapi-3708365100% (1)

- 15 Foot SailDokument4 Seiten15 Foot SailjdogheadNoch keine Bewertungen

- 10 Dollar Telescope PlansDokument9 Seiten10 Dollar Telescope Planssandhi88Noch keine Bewertungen

- 6 Inch Reflector PlansDokument12 Seiten6 Inch Reflector PlansSektordrNoch keine Bewertungen

- 3inchrefractorDokument6 Seiten3inchrefractorGianluca SalvatoNoch keine Bewertungen

- IRS Publication Form Instructions 8853Dokument8 SeitenIRS Publication Form Instructions 8853Francis Wolfgang UrbanNoch keine Bewertungen

- IRS Publication Form Instructions 2106Dokument8 SeitenIRS Publication Form Instructions 2106Francis Wolfgang UrbanNoch keine Bewertungen

- IRS Publication Form Instructions 1099 MiscDokument10 SeitenIRS Publication Form Instructions 1099 MiscFrancis Wolfgang UrbanNoch keine Bewertungen

- IRS Publication Form 8919Dokument2 SeitenIRS Publication Form 8919Francis Wolfgang UrbanNoch keine Bewertungen

- Listahan NG Benepisyaryo NG Tupad ProgramDokument1 SeiteListahan NG Benepisyaryo NG Tupad ProgramAina M. InidalNoch keine Bewertungen

- Ownership of A Work Created in The Course of Employment' by A Person Under A Contract of Service': Critical AnalysisDokument30 SeitenOwnership of A Work Created in The Course of Employment' by A Person Under A Contract of Service': Critical AnalysisMr KkNoch keine Bewertungen

- Tenancy Agreement.1Dokument16 SeitenTenancy Agreement.1Yeuw Munn ChanNoch keine Bewertungen

- PHYSICS Engineering (BTech/BE) 1st First Year Notes, Books, Ebook - Free PDF DownloadDokument205 SeitenPHYSICS Engineering (BTech/BE) 1st First Year Notes, Books, Ebook - Free PDF DownloadVinnie Singh100% (2)

- Peoria County Booking Sheet 03/10/15Dokument8 SeitenPeoria County Booking Sheet 03/10/15Journal Star police documentsNoch keine Bewertungen

- Andhra Pradesh Agricultural Land (Conversion For Non-Agricultural Purposes) (Amendment) Act, 2012Dokument3 SeitenAndhra Pradesh Agricultural Land (Conversion For Non-Agricultural Purposes) (Amendment) Act, 2012Latest Laws TeamNoch keine Bewertungen

- 25 Cir v. Bicolandia Drug CorpDokument11 Seiten25 Cir v. Bicolandia Drug CorpMabelle ArellanoNoch keine Bewertungen

- SampleDokument4 SeitenSampleCarlMarkInopiaNoch keine Bewertungen

- What Is Code of Ethics of Professional Teachers?: Presentation TranscriptDokument8 SeitenWhat Is Code of Ethics of Professional Teachers?: Presentation TranscriptFernadez RodisonNoch keine Bewertungen

- DIFC-DP-GL-08 Rev.02 GUIDE TO DATA PROTECTION LAWDokument44 SeitenDIFC-DP-GL-08 Rev.02 GUIDE TO DATA PROTECTION LAWMustafa ÇıkrıkcıNoch keine Bewertungen

- Republic of The Philippines Regional Trial Court 6 Judicial Region Iloilo City Othoniel Padrones SRDokument8 SeitenRepublic of The Philippines Regional Trial Court 6 Judicial Region Iloilo City Othoniel Padrones SRKirby Jaguio LegaspiNoch keine Bewertungen

- Abacan Vs NorthwesternDokument5 SeitenAbacan Vs NorthwesternJENNY BUTACANNoch keine Bewertungen

- The Hebrew Republic - E.C WinesDokument292 SeitenThe Hebrew Republic - E.C WinesJosé Villalobos GuerraNoch keine Bewertungen

- Value Added TaxDokument2 SeitenValue Added TaxBon BonsNoch keine Bewertungen

- Transportation Law: I. Article 1732 of The Civil CodeDokument2 SeitenTransportation Law: I. Article 1732 of The Civil CodeSAMANTHA NICOLE BACARONNoch keine Bewertungen

- Magdusa vs. AlbaranDokument3 SeitenMagdusa vs. AlbaranAaron CariñoNoch keine Bewertungen

- Law On DonationsDokument5 SeitenLaw On DonationslchieSNoch keine Bewertungen

- STRS Class Action ComplaintDokument16 SeitenSTRS Class Action ComplaintFinney Law Firm, LLCNoch keine Bewertungen

- EP Referral AgreementDokument3 SeitenEP Referral AgreementJohnNoch keine Bewertungen

- The BART CaseDokument2 SeitenThe BART Caseblack_hole34Noch keine Bewertungen

- Intro To Law Syllabus - LawDokument3 SeitenIntro To Law Syllabus - Lawkeeshia hernanNoch keine Bewertungen

- Section 1737 Transient Commercial Use of Residential Property - Prohibited - The Purpose of This Chapter Is ToDokument2 SeitenSection 1737 Transient Commercial Use of Residential Property - Prohibited - The Purpose of This Chapter Is ToinforumdocsNoch keine Bewertungen

- MLU 5 Year BA LLB Prospectus 1 1Dokument13 SeitenMLU 5 Year BA LLB Prospectus 1 1Birakishore SahooNoch keine Bewertungen

- Seth JudgmentDokument8 SeitenSeth Judgmentshilpasingh1297Noch keine Bewertungen

- Camacho V CADokument12 SeitenCamacho V CAarnyjulesmichNoch keine Bewertungen

- Industrial Licensing Act 1951Dokument28 SeitenIndustrial Licensing Act 1951MOHD.ARISHNoch keine Bewertungen

- Kerala Land Assignment Act - James Joseph Adhikarathil Realutionz - Your Property Problem Solver 9447464502Dokument57 SeitenKerala Land Assignment Act - James Joseph Adhikarathil Realutionz - Your Property Problem Solver 9447464502James Joseph AdhikarathilNoch keine Bewertungen

- Appguide Family MembersDokument26 SeitenAppguide Family MembersTipu SultanNoch keine Bewertungen

- Deed of Undertaking - NewDokument6 SeitenDeed of Undertaking - NewHanna Mae GabrielNoch keine Bewertungen

- Other Privileged Class Deviance SDokument21 SeitenOther Privileged Class Deviance SDEBJIT SAHANI100% (1)