Beruflich Dokumente

Kultur Dokumente

SM Chap011

Hochgeladen von

Nicky 'Zing' NguyenOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

SM Chap011

Hochgeladen von

Nicky 'Zing' NguyenCopyright:

Verfügbare Formate

Chapter 11 - porting and Interpreting Stockholders Equity

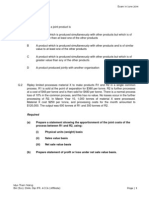

Authorized Currently Issued Treasury Stock 20,000 shares

300,000 shares 267,000 shares Outstanding 247,000 shares

Chapter 11

Reporting and Interpreting Stockholders Equity

ANSWERS TO MINI-EXERCISES M113 The number of issued shares cannot exceed the number authorized. The number authorized is given in the exercise (300,000). Currently issued shares consist of those outstanding with investors (247,000) and those in treasury (20,000). Thus, the number of currently issued shares is 267,000 (= 247,000 + 20,000). This implies the company can issue 33,000 additional shares (300,000 267,000) before it reaches the maximum authorized of 300,000. Prior to the new issuance, the number of authorized, currently issued, and treasury and outstanding shares can be illustrated as: M115 Cash Assets +7,500,000 Liabilities NE Stockholders Equity Common Stock +7,500,000

11-1

Chapter 11 - porting and Interpreting Stockholders Equity

dr Cash (+A) (100,000 $75).............................................. 7,500,000 cr Common Stock (+SE) (100,000 $75)........................

7,500,000

Assuming the no-par value stock is issued for the same price as the par value stock ($75 per share), the effects on total assets, total liabilities, and total stockholders equity do not differ between no-par and par value stock.

11-2

Chapter 11 - porting and Interpreting Stockholders Equity

M116 Common stock is the basic voting stock issued by a corporation. It ranks after preferred stock for dividends and assets distributed upon liquidation of the corporation. The dividend rate for common stock is determined by the board of directors, and is based on the companys profitability. The dividend rate for preferred stock often is fixed by a contract. Common stock has more potential for growth than preferred stock if the company is profitable. On the other hand, the investor may lose more money with common stock than with preferred stock if the company is not profitable. It is advisable to invest in the common stock. If the company is similar to National Beverage Corp., it will most likely be profitable, which will lead to greater dividends and share price appreciation. If this is the case, common stock likely will generate a greater return on the $100,000 than preferred stock would. M117 Total Assets 1. Sold 5,000 shares 2. Sold 10,000 shares 3. Purchased 20,000 shares of treasury stock Cash: increase by $250,000 Cash: increase by $370,000 Cash: decrease by $900,000 Total Liabilities No change No change Total Stockholders Equity Increase by $250,000 Increase by $370,000 Decrease by $900,000 Net Income No change No change

No change

No change

11-3

Chapter 11 - porting and Interpreting Stockholders Equity

M119 April 15, 2010: dr Dividends Declared (+D,-SE) (500,000 x 0.40)................ 200,000 cr Dividends Payable (+L)................................................. May 20, 2010: No journal entry is recorded on the date of record. June 14, 2010: dr Dividends Payable (-L)..................................................... 200,000 cr Cash (-A)....................................................................... M1110 Stock Dividend (1) (2) (3) (4) No change in total assets No change in total liabilities Increase in common stock No change in total stockholders equity: retained earnings decrease is equal to the increase in common stock. (5) Decrease in market value M1112 dr Retained Earnings (-SE)................................................... 100,000 cr Common Stock (+SE).................................................... (200,000 shares x 50% x $1 par value) M1113 Past Year 100,000 shares $2 Current Year 100,000 shares $2 Total to Preferred Stockholders Remainder Available for Common Stock Dividends Total Dividends = = $ 200,000 200,000 400,000 600,000 $1,000,000 100,000 M1111 Stock Split No change in total assets No change in total liabilities No change in common stock No change in total stockholders equity Decrease in market value

200,000

200,000

11-4

Chapter 11 - porting and Interpreting Stockholders Equity

M1114 EPS = Net Income Average Number of Common Shares Outstanding $23,000 11,500 = $2.00

ROE

= =

Net Income Average Stockholders' Equity $23,000 (240,000 + 220,000) 2 = 10.0%

A competing company could have higher net income but lower EPS and ROE ratios if it had more shares outstanding, which generated more stockholders equity when issued.

ANSWERS TO EXERCISES E114 Stockholders Equity December 31, 2010 Contributed Capital: Preferred Stock, 6%, par $8, authorized 50,000 shares, issued and outstanding, 15,000 shares................................................ $120,000 Additional Paid-in Capital, Preferred Stock*............................................. 255,000 Common Stock, par $1, authorized 200,000 shares, 20,000 issued and outstanding, 20,000 shares................................................ Additional Paid-in Capital, Common Stock**............................................ 380,000 Total Contributed Capital................................................................... 775,000 Retained Earnings*.......................................................................................... 30,000 Total Stockholders Equity........................................................................ $805,000

* $255,000 = ($25 - $8 par) x 15,000 shares ** $380,000 = ($40,000 x 10 organizers) (2,000 shares x $1 par x 10 organizers) ***$30,000 = $40,000 $10,000

11-5

Chapter 11 - porting and Interpreting Stockholders Equity

E1114 Comparative results: Items Number of shares outstanding Par per share Common Stock Additional Paid-in Capital Retained Earnings Total Stockholders Equity Before Stock Transactions 150,000 $1 $150,000 88,000 172,000 $ 410,000 Case 1 After 10% Stock Dividend 165,000 $1 $ 165,000 193,000 52,000 $ 410,000 Case 2 After 100% Stock Dividend 300,000 $1 $ 300,000 88,000 22,000 $ 410,000 Case 3 After Stock Split 300,000 $0.50 $ 150,000 88,000 172,000 $ 410,000

Case 1: The 10% stock dividend is a small stock dividend, which is recorded at the market value of the stock at the time of the dividend. Consequently, $120,000 is transferred out of Retained Earnings (10% x 150,000 shares x $8 market price), with $15,000 going to Common Stock (10% x 150,000 shares x $1 par) and the $105,000 excess going into Additional Paid-in Capital. Case 2: The 100% stock dividend is a large stock dividend, which is recorded at the par value of the stock. Consequently, $150,000 (100% x 150,000 shares x $1 par) is moved from Retained Earnings to the Common Stock account. Case 3: The stock split did not change any account balances; its only effects were to (1) double the shares outstanding and (2) decrease par value per share from $1.00 to $0.50. Note: None of the cases changed total stockholders equity ($410,000) because they did not involve the disbursement of assets.

11-6

Chapter 11 - porting and Interpreting Stockholders Equity

E1119 Req. 1 Assets Stockholders Equity (Treasury Stock) - $60,000,000 - $60,000,000

Treasury Stock account is a contra-equity account, meaning that it is subtracted from the total stockholders equity. Cash also decreases on the balance sheet by the same amount. Req. 2 Winnebago may have decided to repurchase its stock from existing stockholders for a number of reasons: (1) to send a signal to investors that the company itself believes its own stock is worth purchasing, (2) to obtain shares that can be reissued as payment for purchases of other companies, and (3) to obtain shares to reissue to employees as part of employee stock plans that provide workers with shares of the companys stock as part of their pay. Because of Securities and Exchange Commission regulations concerning newly issued shares, it is generally less costly for companies to give employees repurchased shares than to issue new ones. Req. 3 Shares that are held in treasury stock do not participate in dividend payments. As a result, the purchase of treasury stock will reduce the amount of dividends that Winnebago pays in future years. Req. 4 At the time, Winnebago likely believed its future was bright; the company was not concerned with the fact that a stock dividend causes a reduction in Retained Earnings (a true stock split doesnt cause a reduction in Retained Earnings). A company needs to have an adequate balance in retained earnings to declare cash dividends in the future. So, if Winnebago was expecting some financial struggles, the company would likely have used a 2-for-1 stock split because it doesnt reduce Retained Earnings, which means it doesnt reduce the ability to declare cash dividends in the future. Based on its strong financial history, Winnebago is likely expecting financial success in the near future, and does not care that Retained Earnings is reduced by a stock dividend because its future earnings will rebuild sufficient Retained Earnings to allow cash dividends to be declared again.

11-7

Chapter 11 - porting and Interpreting Stockholders Equity

E1119 (continued) Req. 5 This 100% stock dividend would decrease Retained Earnings by the par value of the shares, but it would not affect total stockholders equity because the Common Stock account would be increased by the same amount. The EPS ratio would decrease because the number of outstanding shares doubled. The ROE ratio would not change because as mentioned earlier, the total stockholders equity does not change when a 100% stock dividend is declared and issued.

11-8

Chapter 11 - porting and Interpreting Stockholders Equity

ANSWERS TO SKILLS DEVELOPMENT CASES S114 Req. 1 There are at least two reasons why this is appropriate. First, for investors who bought Activision stock in the initial public offering on June 9, 1983, the current market price (about $22) would be more than they initially contributed to the company. Second, even if investors had purchased their investments above the current market price, Activision is not undercutting the current market price nor is the company requiring existing stockholders to sell their stock back to the company. Consequently, stockholders who do not care to sell at the current market price are not required to, and those who do want to sell will be indifferent between selling the stock back to the company versus selling it to another stockholder. Req. 2 No, the answer would not be different because Activision still is offering to repurchase at the going market price. Req. 3 Generally speaking, when management purchases stock in the company they run, its a sign that theyre confident in the companys ability to perform well into the future and that the current market price of the companys stock (in their judgment) is too low. So, this seems to be a positive sign overall. Req. 4 Yes, this would be a concern because it suggests that management might be acting opportunistically buying when the stock price is low (at $13.32 in December 2002) and selling when the price is high (at $26.08 earlier in the year). Although this kind of behavior is what you could expect from other investors, management is in a position to know far more about the companys prospects than other outside investors. Because of this access to inside information, the timing of stock purchases and sales seems overly fortunate and somewhat suspicious. Also, by knowing that management is willing to sell the companys stock when the price is high, it weakens the credibility of managements stock purchase as a sign of expected future financial success for the company.

11-9

Das könnte Ihnen auch gefallen

- SM Chap010Dokument5 SeitenSM Chap010Nicky 'Zing' NguyenNoch keine Bewertungen

- SM Chap009Dokument7 SeitenSM Chap009Nicky 'Zing' NguyenNoch keine Bewertungen

- SM Chap007Dokument7 SeitenSM Chap007Nicky 'Zing' NguyenNoch keine Bewertungen

- SM Chap008Dokument5 SeitenSM Chap008Nicky 'Zing' NguyenNoch keine Bewertungen

- SM Chap013Dokument6 SeitenSM Chap013Nicky 'Zing' NguyenNoch keine Bewertungen

- SM Chap005Dokument5 SeitenSM Chap005Nicky 'Zing' NguyenNoch keine Bewertungen

- SM Chap006Dokument8 SeitenSM Chap006Nicky 'Zing' NguyenNoch keine Bewertungen

- SM Chap004Dokument18 SeitenSM Chap004Nicky 'Zing' NguyenNoch keine Bewertungen

- SM Chap002Dokument11 SeitenSM Chap002Nicky 'Zing' NguyenNoch keine Bewertungen

- SM Chap001Dokument8 SeitenSM Chap001Nicky 'Zing' NguyenNoch keine Bewertungen

- Solutions Images Bingham 11-02-2010Dokument46 SeitenSolutions Images Bingham 11-02-2010Nicky 'Zing' Nguyen100% (7)

- SM Chap003Dokument13 SeitenSM Chap003Nicky 'Zing' NguyenNoch keine Bewertungen

- Chapter 6 PreDokument1 SeiteChapter 6 PreNicky 'Zing' NguyenNoch keine Bewertungen

- Sample DocumentDokument1 SeiteSample DocumentNicky 'Zing' NguyenNoch keine Bewertungen

- Chapter 6 PreDokument1 SeiteChapter 6 PreNicky 'Zing' NguyenNoch keine Bewertungen

- Chapter 6 PostDokument1 SeiteChapter 6 PostNicky 'Zing' NguyenNoch keine Bewertungen

- Chapter 5aDokument1 SeiteChapter 5aNicky 'Zing' NguyenNoch keine Bewertungen

- Chapter 4cDokument2 SeitenChapter 4cNicky 'Zing' NguyenNoch keine Bewertungen

- Chapter 4cDokument2 SeitenChapter 4cNicky 'Zing' NguyenNoch keine Bewertungen

- Sample DocumentDokument1 SeiteSample DocumentNicky 'Zing' NguyenNoch keine Bewertungen

- Chapter 6 PostDokument1 SeiteChapter 6 PostNicky 'Zing' NguyenNoch keine Bewertungen

- Chapter 5aDokument1 SeiteChapter 5aNicky 'Zing' NguyenNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Problems Faced in Marketing of Foreign Goods by Multinational CompaniesDokument7 SeitenProblems Faced in Marketing of Foreign Goods by Multinational Companiesdipabali chowdhuryNoch keine Bewertungen

- Tax Invoice: Dtwelve Spaces Pvt. LTDDokument3 SeitenTax Invoice: Dtwelve Spaces Pvt. LTDChanchal MadankarNoch keine Bewertungen

- Muhammad Alfarizi - 142200278 - Ea-J - Tugas 2 Ap2Dokument4 SeitenMuhammad Alfarizi - 142200278 - Ea-J - Tugas 2 Ap2Muhammad AlfariziNoch keine Bewertungen

- Sole Proprietorship Quiz Bee1Dokument5 SeitenSole Proprietorship Quiz Bee1Dethzaida AsebuqueNoch keine Bewertungen

- Unit C RevisionDokument3 SeitenUnit C RevisionDavid Cerón Pérez100% (2)

- Aaj ArticleDokument5 SeitenAaj ArticlepaulNoch keine Bewertungen

- BankingDokument13 SeitenBankingPranav SethNoch keine Bewertungen

- F2 Joint CostDokument3 SeitenF2 Joint CostMyo NaingNoch keine Bewertungen

- Reviewer Chapter 1 - Book 1 - Comprehensive ExamDokument5 SeitenReviewer Chapter 1 - Book 1 - Comprehensive ExamKrizel Dixie ParraNoch keine Bewertungen

- Credit Risk PlusDokument14 SeitenCredit Risk PlusAliceNoch keine Bewertungen

- ATRAM Phil Equity Smart Index Fund Fact Sheet Apr 2020Dokument2 SeitenATRAM Phil Equity Smart Index Fund Fact Sheet Apr 2020anton clementeNoch keine Bewertungen

- AddDokument166 SeitenAddsadfaNoch keine Bewertungen

- Cluster University of Jammu Cluster University of Jammu: Candidate's Copy College/SchoolDokument1 SeiteCluster University of Jammu Cluster University of Jammu: Candidate's Copy College/SchoolNitin SharmaNoch keine Bewertungen

- Account Balance Statement As On 30-JUN-2020 For (03525-103672)Dokument1 SeiteAccount Balance Statement As On 30-JUN-2020 For (03525-103672)IkramNoch keine Bewertungen

- Project Report: "A Descriptive Analysis of Depository Participant WithDokument97 SeitenProject Report: "A Descriptive Analysis of Depository Participant WithJOMONJOSE91Noch keine Bewertungen

- Sold By: Tax InvoiceDokument1 SeiteSold By: Tax Invoiceneerajkori932Noch keine Bewertungen

- PFM3063 - Advanced Financial Management Quiz 2 and 3 (Dec 2023)Dokument5 SeitenPFM3063 - Advanced Financial Management Quiz 2 and 3 (Dec 2023)Putri YaniNoch keine Bewertungen

- 21st Century Debt ReliefDokument2 Seiten21st Century Debt ReliefOxfamNoch keine Bewertungen

- Calculating Contractors MarkupDokument3 SeitenCalculating Contractors MarkupHorace Prophetic DavisNoch keine Bewertungen

- 2013 Annual Report EditorialDokument55 Seiten2013 Annual Report EditorialbabydreaNoch keine Bewertungen

- β β X, X σ X X X: Simposium Nasional Akuntansi ViDokument12 Seitenβ β X, X σ X X X: Simposium Nasional Akuntansi ViNicholas AlexanderNoch keine Bewertungen

- Recruitment and Selection Process For 1st Level Officer in Bank AlfalahDokument28 SeitenRecruitment and Selection Process For 1st Level Officer in Bank AlfalahArslan Nawaz100% (1)

- Emergency Powers Act: Chapter 1 - Purpose of The ActDokument14 SeitenEmergency Powers Act: Chapter 1 - Purpose of The Actcyber_leeNoch keine Bewertungen

- An Analysis of The Budget of Bangladesh For The Fiscal Year 2015-16 Along With Its Previous Trend of Growth and ReductionDokument26 SeitenAn Analysis of The Budget of Bangladesh For The Fiscal Year 2015-16 Along With Its Previous Trend of Growth and ReductionSekender AliNoch keine Bewertungen

- Decision Areas in Financial ManagementDokument15 SeitenDecision Areas in Financial ManagementSana Moid100% (3)

- Ordinance Resolution 2024Dokument2 SeitenOrdinance Resolution 2024Weng KayNoch keine Bewertungen

- Robert Mundel & Mercus Fleming Model (IS LM BP Model) PDFDokument11 SeitenRobert Mundel & Mercus Fleming Model (IS LM BP Model) PDFSukumar SarkarNoch keine Bewertungen

- 2021 JCI Philippines Awards ManualDokument42 Seiten2021 JCI Philippines Awards ManualKing Erlano100% (1)

- Corporate Liquidation Problem SolvingDokument21 SeitenCorporate Liquidation Problem SolvingRujean Salar AltejarNoch keine Bewertungen

- Provision For DDDokument3 SeitenProvision For DDCooking Classes with Zainab 12Noch keine Bewertungen