Beruflich Dokumente

Kultur Dokumente

Section A.1 Problems: © 2009 The Infinite Actuary, LLC 1 Joint Exam 3F/MFE (A.1 Problems)

Hochgeladen von

Michael Sta BrigidaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Section A.1 Problems: © 2009 The Infinite Actuary, LLC 1 Joint Exam 3F/MFE (A.1 Problems)

Hochgeladen von

Michael Sta BrigidaCopyright:

Verfügbare Formate

Section A.

1 Problems

1. Determine the price of a put option on a stock with strike $85 expiring in 12 months given the following information: the current stock price is $70, the stock is going to pay a dividend of $5 in 6 months, the risk-free rate of interest is 3%, and a call option on the stock with strike $85 expiring in 12 months costs $7.49. 2. A call and a put both with the same strike expiring in 15 months cost $20.00 and $1.65, respectively. If the risk-free rate is 7%, the stocks current price is $55, and it pays no dividends, what is the strike? 3. A call and put both with strike 25 and time to expiration 36 months cost $7.83 and $10.00, respectively. If the stock pays no dividends and is currently priced at $20, what is the risk-free rate? 4. Describe what portfolio is needed to synthetically create a put option with strike $40 expiring in 6 months given that the current risk-free rate is 5.50% and the stock pays no dividends. 5. Describe what portfolio is needed to synthetically create a zero-coupon bond maturing with face value of $1000 in 9 months, given that the only options available expiring in 9 months have strike $50 and the stock pays no dividends. 6. Describe the security synthetically created with the following portfolio: A put option expiring in 18 months, a share of stock which pays fixed dividends at 6 and 12 months, and a short call option. The dividends each have a value of $20 and the strike is equal to $1020. 7. Determine the price of a put option on a stock with strike $60 expiring in 6 months given the following information: the current stock price is $40, the stock pays no dividends, the risk-free is 7%, and a call option on the stock with strike $60 expiring in 6 months costs $2.75. 8. Determine the price of a put option on a stock with strike $20 expiring in 36 months given the following information: the current stock price is $10, the stock pays no dividends, the risk-free is 6%, and a call option on the stock with strike $20 expiring in 36 months costs $7.70.

2009 The Infinite Actuary, LLC

Joint Exam 3F/MFE (A.1 Problems)

9. Determine the price of a call option on a stock with strike $55 expiring in 18 months given the following information: the current stock price is $90, the stock is going to pay a dividend of $10 in 12 months, the risk-free rate is 8%, and a put option on the stock with strike $55 expiring in 18 months costs $1.13. 10. A call and put both with strike $45 and time to expiration 18 months cost $3.45 and $13.46, respectively. If the stocks current price is $35 and it pays a dividend in 6 months, what is the value of the dividend if the risk-free rate is 6%? 11. A call and a put expiring at the same time with strike $40 on a non-dividend-paying stock differ in price, the call option being worth $4 more than the put option. If the time to expiration remains the same but the option strikes change to $60, however, the call is worth $8 less than the corresponding put option. Determine the initial stock price. For problems 12-14, describe the portfolio required to synthetically create the security given: 12. A put option with strike $60 expiring in 9 months; the current risk-free rate is 4%, and the stock pays no dividends. 13. A call option with strike $125 expiring in 18 months; the current risk-free rate is 8%, and the stock pays no dividends. 14. A 1-year bond maturing with a face value of $1000 that pays semi-annual coupons at an annual rate of 8%. The stock pays a single dividend in 6 months of $1. For problems 15-17, describe the security which has been synthetically created with the given portfolio: 15. A call option and a short put option (with the same strike and maturity) and some cash invested at the risk-free rate. 16. A call option expiring in 12 months, a short share of stock which pays a fixed dividend in 6 months, and a short put option expiring in 12 months. 17. 20 put options (costing $7.02 apiece) with strike 50 expiring in 1 year, 20 shares of a stock which pays no dividends (and costs $55 per share) and short 20 call options (costing $15.40 apiece) with strike 50 expiring in 1 year. What other piece of information can we derive?

2009 The Infinite Actuary, LLC

Joint Exam 3F/MFE (A.1 Problems)

Das könnte Ihnen auch gefallen

- Can Slim A Growth Approach Using Technical and Fundamental Data PDFDokument4 SeitenCan Slim A Growth Approach Using Technical and Fundamental Data PDFWan ShahmisufiNoch keine Bewertungen

- Bond and Stock Valuation Practice Problems and SolutionsDokument7 SeitenBond and Stock Valuation Practice Problems and Solutionsalice horan100% (2)

- The+Pizza+Food+Truck+ +exercise+Dokument15 SeitenThe+Pizza+Food+Truck+ +exercise+SADHANA KUMARINoch keine Bewertungen

- A Beginner's Guide to Growth Stock InvestingVon EverandA Beginner's Guide to Growth Stock InvestingBewertung: 4 von 5 Sternen4/5 (1)

- (Corpo) (Berks Broadcasting v. Craumer) (Luciano)Dokument2 Seiten(Corpo) (Berks Broadcasting v. Craumer) (Luciano)noel8938lucianoNoch keine Bewertungen

- Chapter 7 Test BankDokument93 SeitenChapter 7 Test BankM.Talha100% (1)

- 2009-04-03 181856 ReviewDokument18 Seiten2009-04-03 181856 ReviewAnbang XiaoNoch keine Bewertungen

- How To Make Money In Stocks Value Investing StrategiesVon EverandHow To Make Money In Stocks Value Investing StrategiesNoch keine Bewertungen

- AR& Inventory Management AR& Inventory ManagementDokument11 SeitenAR& Inventory Management AR& Inventory Managementchesca marie penarandaNoch keine Bewertungen

- 2018 - GAR Annual ReportDokument211 Seiten2018 - GAR Annual ReportKirstie ImeldaNoch keine Bewertungen

- Advanced Corporate Finance Group Assignment PDFDokument8 SeitenAdvanced Corporate Finance Group Assignment PDFaddisie temesgenNoch keine Bewertungen

- CH 07Dokument19 SeitenCH 07Ahmed Al EkamNoch keine Bewertungen

- Topic - Week 2 Valuation of Bonds MCQDokument6 SeitenTopic - Week 2 Valuation of Bonds MCQmail2manshaaNoch keine Bewertungen

- 9501期中黃瑞靜財務管理 (一)Dokument6 Seiten9501期中黃瑞靜財務管理 (一)অচেনা একজনNoch keine Bewertungen

- Derivatives Problem SetDokument6 SeitenDerivatives Problem SetNiyati ShahNoch keine Bewertungen

- Mid Term TestDokument4 SeitenMid Term TestHarryNoch keine Bewertungen

- Chapter 3: Valuing Bond: Consider The Following Three StocksDokument2 SeitenChapter 3: Valuing Bond: Consider The Following Three StocksQuân VõNoch keine Bewertungen

- (Realized Rate of Return) (Overvalued) (FALSE. The Price Will Also Increase) (FALSE. Required Rate of Return)Dokument3 Seiten(Realized Rate of Return) (Overvalued) (FALSE. The Price Will Also Increase) (FALSE. Required Rate of Return)mikaelaNoch keine Bewertungen

- Fin304 1midterm2Dokument5 SeitenFin304 1midterm2darkhuman343Noch keine Bewertungen

- RoDokument7 SeitenRopersonaliserNoch keine Bewertungen

- Extension ExercisesDokument10 SeitenExtension Exercisesjackie.chanNoch keine Bewertungen

- Chapter 05 Sample QsDokument3 SeitenChapter 05 Sample QsSourovNoch keine Bewertungen

- FG2233Dokument11 SeitenFG2233Hassan Sheikh0% (1)

- 2009-03-11 142055 TholmesDokument14 Seiten2009-03-11 142055 TholmesSirVicNYNoch keine Bewertungen

- Problem Set 02Dokument2 SeitenProblem Set 02jimbojojoNoch keine Bewertungen

- Assignment 1Dokument4 SeitenAssignment 1Motivational speaker Pratham GuptaNoch keine Bewertungen

- Introduction To Finance BUSFIN 1030: Problem Set 2Dokument3 SeitenIntroduction To Finance BUSFIN 1030: Problem Set 2ΧριστόςκύριοςNoch keine Bewertungen

- FIN 370 Final Exam (29/30 Correct Answers)Dokument13 SeitenFIN 370 Final Exam (29/30 Correct Answers)KyleWalkeer0% (1)

- Test 2Dokument6 SeitenTest 2William FisherNoch keine Bewertungen

- Homework Assignment - Week 2Dokument5 SeitenHomework Assignment - Week 2Kristine LaraNoch keine Bewertungen

- FNCE2000 Chapter6 Valuing Shares & Bonds QuestionsDokument3 SeitenFNCE2000 Chapter6 Valuing Shares & Bonds QuestionsJaydenaus0% (1)

- 74 - Quiz Equity and Options PDFDokument3 Seiten74 - Quiz Equity and Options PDFAdri Aswin AzhariNoch keine Bewertungen

- ExercisesDokument12 SeitenExercisesTôn AnhNoch keine Bewertungen

- DocxDokument6 SeitenDocxMeshack MathembeNoch keine Bewertungen

- Af 325 QuestionDokument6 SeitenAf 325 QuestionHiepXick100% (1)

- Final Examination Preparation ScheduleDokument4 SeitenFinal Examination Preparation ScheduleRebecca HopkinsNoch keine Bewertungen

- Tutorial 6 Valuation - SVDokument6 SeitenTutorial 6 Valuation - SVHiền NguyễnNoch keine Bewertungen

- Chapter 8 - CFA - QDokument3 SeitenChapter 8 - CFA - QPatricia Melissa AdisuryaNoch keine Bewertungen

- Practice Problem Set With Answers-Updated-Module-2 PDFDokument6 SeitenPractice Problem Set With Answers-Updated-Module-2 PDFGhoul GamingNoch keine Bewertungen

- Bonds AssignmentDokument2 SeitenBonds Assignmentsyed.12727Noch keine Bewertungen

- Practica Modulo 6 EnunciadosDokument3 SeitenPractica Modulo 6 EnunciadosJulian Brescia2Noch keine Bewertungen

- Exercises ValuationDokument3 SeitenExercises ValuationQP1100 Nguyen Nhat MinhNoch keine Bewertungen

- Extra Ex For Mid TermDokument5 SeitenExtra Ex For Mid TermQuân VõNoch keine Bewertungen

- Mid-Term Review QuestionsDokument5 SeitenMid-Term Review QuestionsHarryNoch keine Bewertungen

- 111 Practice Final ExamsDokument27 Seiten111 Practice Final ExamsJohnNoch keine Bewertungen

- E120 Fall14 HW6Dokument2 SeitenE120 Fall14 HW6kimball_536238392Noch keine Bewertungen

- Problem Set Solutions v3Dokument3 SeitenProblem Set Solutions v3Bockarie LansanaNoch keine Bewertungen

- Topic 3 Practice QuestionsDokument2 SeitenTopic 3 Practice Questionstijopaulose00Noch keine Bewertungen

- FMII Review of FM I Assignment 1Dokument1 SeiteFMII Review of FM I Assignment 1Muhammad HamzaNoch keine Bewertungen

- FM - Bond & Stock ValuationDokument10 SeitenFM - Bond & Stock ValuationSeneca GonzalesNoch keine Bewertungen

- Practice QuestionsDokument8 SeitenPractice QuestionschrisNoch keine Bewertungen

- HW Assignment 3Dokument6 SeitenHW Assignment 3Jeremiah Faulkner0% (1)

- Topic 2 Tutorial ProblemsDokument4 SeitenTopic 2 Tutorial Problemsda.arts.ttNoch keine Bewertungen

- Week 7 Revision Exercise (Quest)Dokument4 SeitenWeek 7 Revision Exercise (Quest)Eleanor ChengNoch keine Bewertungen

- Question and Answer - 52Dokument31 SeitenQuestion and Answer - 52acc-expertNoch keine Bewertungen

- Cost of CapitalDokument4 SeitenCost of CapitalNusratJahanHeabaNoch keine Bewertungen

- 2022-Sesi 8-Bond Valuation-Ed 12Dokument3 Seiten2022-Sesi 8-Bond Valuation-Ed 12Gabriela ClarenceNoch keine Bewertungen

- Practice QuestionsDokument30 SeitenPractice QuestionsmichmagsalinNoch keine Bewertungen

- 2020 Spring BADM 301N 02 Homework 4 (Revised)Dokument2 Seiten2020 Spring BADM 301N 02 Homework 4 (Revised)Olome Emenike0% (1)

- Chapter 5 ExercisesDokument2 SeitenChapter 5 ExercisesTranh Meow MeowNoch keine Bewertungen

- 2023 Tute 6 ValuationDokument6 Seiten2023 Tute 6 ValuationThảo TrươngNoch keine Bewertungen

- 4 - Security Valuation - Assignment (07-05-19)Dokument5 Seiten4 - Security Valuation - Assignment (07-05-19)AakashNoch keine Bewertungen

- Preferred Shares vs. Common Stocks: Welcome to Dividend Royalty: Financial Freedom, #86Von EverandPreferred Shares vs. Common Stocks: Welcome to Dividend Royalty: Financial Freedom, #86Noch keine Bewertungen

- Investing for Interest 10: Bond Buying is Back Baby!: Financial Freedom, #61Von EverandInvesting for Interest 10: Bond Buying is Back Baby!: Financial Freedom, #61Noch keine Bewertungen

- Investing for Beginners: The Ultimate Stock Market Guide to Teach You How to Make Money (Achieve Financial Freedom by Investing Like the Best in the World)Von EverandInvesting for Beginners: The Ultimate Stock Market Guide to Teach You How to Make Money (Achieve Financial Freedom by Investing Like the Best in the World)Noch keine Bewertungen

- Modern Algebra Notes (Normal and Subnormal Series)Dokument104 SeitenModern Algebra Notes (Normal and Subnormal Series)Michael Sta Brigida100% (1)

- Bivariate Correlation TestDokument2 SeitenBivariate Correlation TestMichael Sta BrigidaNoch keine Bewertungen

- Rami Shakarchi, Serge Lang-Problems and Solutions For Complex Analysis-Springer (2008)Dokument259 SeitenRami Shakarchi, Serge Lang-Problems and Solutions For Complex Analysis-Springer (2008)Michael Sta Brigida100% (3)

- List 01272014Dokument165 SeitenList 01272014Michael Sta BrigidaNoch keine Bewertungen

- Bstm2-2 Stat1 Elem Stat 2013-2014Dokument28 SeitenBstm2-2 Stat1 Elem Stat 2013-2014Michael Sta BrigidaNoch keine Bewertungen

- Schedule Code 201313470 Subject Code Math 2 College Algebra Units 3 Subject Type Section BSISA1-1 Day MW 08:30 - 10:00Dokument3 SeitenSchedule Code 201313470 Subject Code Math 2 College Algebra Units 3 Subject Type Section BSISA1-1 Day MW 08:30 - 10:00Michael Sta BrigidaNoch keine Bewertungen

- Resume Update1 Doni Sta BrigidaDokument5 SeitenResume Update1 Doni Sta BrigidaMichael Sta BrigidaNoch keine Bewertungen

- Andrew J. Siducon: ST ND RD TH TH TH THDokument8 SeitenAndrew J. Siducon: ST ND RD TH TH TH THMichael Sta BrigidaNoch keine Bewertungen

- Addition and Subtraction of PolynomialsDokument1 SeiteAddition and Subtraction of PolynomialsMichael Sta Brigida100% (1)

- Schedule Code 201313292 Subject Code Math 2 College Algebra Units 3 Subject Type Section BSRM1-1 Day TTH 08:30 - 10:00Dokument3 SeitenSchedule Code 201313292 Subject Code Math 2 College Algebra Units 3 Subject Type Section BSRM1-1 Day TTH 08:30 - 10:00Michael Sta BrigidaNoch keine Bewertungen

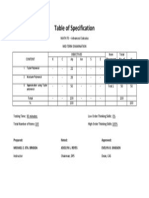

- Table of Specification: 1. Taylor Polynomial 2. Maclaurin Polynomial 3. Approximation Using Taylor PolynomialDokument1 SeiteTable of Specification: 1. Taylor Polynomial 2. Maclaurin Polynomial 3. Approximation Using Taylor PolynomialMichael Sta BrigidaNoch keine Bewertungen

- Republic of The PhilippinesDokument2 SeitenRepublic of The PhilippinesMichael Sta BrigidaNoch keine Bewertungen

- Ch. 13 Financial Risk Management (Part 1)Dokument5 SeitenCh. 13 Financial Risk Management (Part 1)Daud AminNoch keine Bewertungen

- CH 01 Hull OFOD9 TH EditionDokument36 SeitenCH 01 Hull OFOD9 TH EditionPhonglinh WindNoch keine Bewertungen

- Eih Limited: West Bengal, India Delhi 110 054, India S.N. Sridhar, Company Secretary and Compliance OfficerDokument4 SeitenEih Limited: West Bengal, India Delhi 110 054, India S.N. Sridhar, Company Secretary and Compliance Officerudeybeer7045Noch keine Bewertungen

- Aditya Birla Mutual Fund Statement 19-20Dokument2 SeitenAditya Birla Mutual Fund Statement 19-20Kiran DandileNoch keine Bewertungen

- FINA 2330 Assignment 5Dokument4 SeitenFINA 2330 Assignment 5rebaNoch keine Bewertungen

- BAB 16 v2Dokument10 SeitenBAB 16 v2rahmat lubisNoch keine Bewertungen

- WindAcre Nielsen PresentationDokument70 SeitenWindAcre Nielsen PresentationAndrei FilippovNoch keine Bewertungen

- 32 Daggu Srinivasa Chakravarthi D'Souza Abner Aldrich Damarla Geetha Susmitha Greenlam Industries LTD Stylam Industries LTDDokument16 Seiten32 Daggu Srinivasa Chakravarthi D'Souza Abner Aldrich Damarla Geetha Susmitha Greenlam Industries LTD Stylam Industries LTDDAGGU SRINIVASA CHAKRAVARTHINoch keine Bewertungen

- Daftar Akun UD Buana (Lisa Nabila)Dokument1 SeiteDaftar Akun UD Buana (Lisa Nabila)Lisa NabilaNoch keine Bewertungen

- Case 1 New Signal Cable CompanyDokument6 SeitenCase 1 New Signal Cable Companymilk teaNoch keine Bewertungen

- Pre-Feasibility Study: Bangle Making WorkshopDokument15 SeitenPre-Feasibility Study: Bangle Making WorkshopRohs VantageNoch keine Bewertungen

- Chapter 5 - Capital Structure and Cost of CapitalDokument12 SeitenChapter 5 - Capital Structure and Cost of CapitalTAN YUN YUNNoch keine Bewertungen

- Identifying and Analyzing Business TransactionsDokument2 SeitenIdentifying and Analyzing Business TransactionsMardy DahuyagNoch keine Bewertungen

- Paint IndustryDokument28 SeitenPaint IndustryRAJNI SHRIVASTAVANoch keine Bewertungen

- DirectorDokument19 SeitenDirectorA random humanNoch keine Bewertungen

- TM 1 - Definition, Aspects, Structure and Corporate Governance SourcesDokument5 SeitenTM 1 - Definition, Aspects, Structure and Corporate Governance SourcesMuh Rizky HendrawanNoch keine Bewertungen

- S&P Debt Rating DefinitionsDokument6 SeitenS&P Debt Rating DefinitionsilyakostNoch keine Bewertungen

- FinancialStatement 2019Dokument298 SeitenFinancialStatement 2019Tonga ProjectNoch keine Bewertungen

- Evaluating Mutual Fund Investment Information: Source Source Source Criteria Evaluation 1 2 3Dokument2 SeitenEvaluating Mutual Fund Investment Information: Source Source Source Criteria Evaluation 1 2 3Joel Christian MascariñaNoch keine Bewertungen

- Companies Act 1965Dokument512 SeitenCompanies Act 1965Yus Shahril FeezrieNoch keine Bewertungen

- Establishing A Business and More (Role of The Entrepreneur)Dokument7 SeitenEstablishing A Business and More (Role of The Entrepreneur)Monique McfarlaneNoch keine Bewertungen

- Request For Fee Quotation - Private & Confidential 1.0Dokument7 SeitenRequest For Fee Quotation - Private & Confidential 1.0Manggala MahardhikaNoch keine Bewertungen

- Commercial PapersDokument3 SeitenCommercial PapersSandia EspejoNoch keine Bewertungen

- Quiz 12 Budgeting and Profit Planning SolutionsDokument6 SeitenQuiz 12 Budgeting and Profit Planning Solutionsralphalonzo100% (1)