Beruflich Dokumente

Kultur Dokumente

1

Hochgeladen von

Edward Kenneth KungOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

1

Hochgeladen von

Edward Kenneth KungCopyright:

Verfügbare Formate

Art.

1767: By the contract of partnership two or more persons bind themselves to contribute money, property, or industry to a common fund, with the intention of dividing profits among themselves. Two or more persons may also for a partnership for the exercise of a profession. Evangelista, et al v. CIR Facts: Eufemia Evangelista, Manuela Evangelista and Francisca Evangelista (Petitioners) borrowed money from their father and with their personal money used it to purchase real properties. a) Feb. 2, 1943 lot including improvements from Mrs. Josefina Florentino. b) April 3, 1944 21 parcels of land including improvements from Mrs. Josefa Oppus. c) April 28, 1944 lot including improvements from Insular Investments Inc. d) April 28, 1944 lot including improvements from Mrs. Valentina Afable. After buying the properties, they rented and leased it to various tenants. In a document dated Aug. 16, 1945, they appointed their brother, Simeon Evangelista to manage the properties with the power: a) To lease; b) To collect and receive rents; c) To bring suits against the defaulting tenants; d) To sign all letters, contracts, etc. for and in their behalf; and e) To endorse and deposit all notes and checks for them. In a letter, the Collector of Internal Revenue (CIR; Respondent) demanded payment of income tax on corporations, real estate dealers fixed tax and corporation residence tax. The petitioners filed a petition praying that they be absolved from payment of the taxes, among their arguments being that they are mere co-owners, not co-partners, for in consequence of the acts performed by them, a legal entity, with a personality independent of that of its members, did not come into existence. Issue: Whether petitioners are subject to the tax on corporations as provided in section 24 of Commonwealth Act No. 468 (National Internal Revenue Code, as well as to residence tax for corporations? Sec. 24, National Internal Revenue Code: Rate of tax on corporations. There shall be levied, assessed, collected, and paid annually upon the total net income received in the preceding taxable year from all sources by every corporation organized in, or existing under the laws of the Philippines, no matter how created or organized but not including duly registered general co-partnerships, a tax upon such income equal to the sum of the following XXX Ruling: Yes. The petitioners are subject to the taxes the CIR is demanding them to pay. Sec. 84(b), National Internal Revenue Code: The term corporation includes partnerships, no matter how created or organized, joint-stock companies, joint accounts, associations or insurance companies, but does not include duly registered general copartnerships. Art. 1767: By the contract of partnership two or more persons bind themselves to contribute money, property, or industry to a common fund, with the intention of dividing the profits among themselves. o 2 Essential Elements of a Partnership: 1) Agreement to contribute money, property or industry to a common fund; and Present in case Petitioners have agreed to, and did contribute money and property to a common fund. 2) Intent to divide the profits among the contracting parties. Also present Court was satisfied that the purpose of petitioners was to engage in real estate transactions for monetary gain and then divide it among themselves for the following reasons taken together: 1) Common fund was purposely created, jointly borrowing a substantial portion of it. 2) They invested the common fund in a series of transactions. o The number of lots (24) acquired and transactions undertaken as well as the brief interregnum between each is strongly indicative of a pattern or common design that was not limited to the conservation and preservation of the common fun or even the property acquired. 3) The lots were not devoted to residential purposes or to other personal uses but instead, was leased to several persons who paid rentals. 4) Properties were under the management of one person, Simeon, with full power to lease, collect rents, issue receipts, bring suits, sign letters and contracts, and indorse and deposit notes and checks. Affairs of the

properties have been handled as if the same belonged to a corporation or business and enterprise operated for profit. 5) Conditions have existed for over 15 years. 6) Petitioners have not introduce evidence on their purpose on creating the set up. When the National Internal Revenue Code includes partnerships among the entities subject to tax on corporations, it refers to organizations not necessarily partnerships in the technical sense of the term. o Sec. 84 defined corporation as including partnerships, no matter how created o A joint venture need not be undertaken in any of the standard forms, or in conformity with the usual requirements of the law on partnerships, in order that one could be deemed constituted for purposes of the tax on corporations. o Personality is not an essential condition to the existence of the partnerships referred to. o In fact, duly registered general copartnerships which are possessed of the aforementioned personality have been expressly excluded by Sec. 24 and 84(b) from the connotation of the term corporation. In American Law, partnership includes not only a partnership as known at common law, but as well as, a syndicate, group, pool, joint venture, or other unincorporated organization which carries on any business financial operation, or venture, which is not, within the meaning of the Code, a trust, estate or a corporation. Finally, as regards the residence tax for corporations required by Commonwealth Act No. 465, the said law is analogous to Sec. 24 and 84(b) of the National Internal Revenue Code.

Art. 1771: A partnership may be constituted in any form, except where immovable property or real rights are contributed thereto, in which case a public instrument is necessary. Fernandez v. Dela Rosa Facts: o Jose Fernandez (Petitioner) and Francisco Dela Rosa (Respondent) entered a verbal agreement to form a partnership for the purchase of cascoes and the carrying on of the business of letting the same for hire in Manila, Dela Rosa to buy the cascoes and each partner to furnish for that purpose such amount of money as he could, the profits to be divided proportionately. o Dela Rosa purchased a casco designated as No.1515 for P500 from Dona Isabel Vales and Fernandez furnished P300 for its repairs. o Dela Rosa took the title of the casco in his own name. nd o A 2 casco, designated as No. 2089, was purchased by Dela Rosa, also in his own name. o Parties undertook to draw up articles of partnership for the purpose of embodying it in an authentic document, but because Dela Rosa proposed a draft which materially differed from the terms of the verbal agreement and refused to include casco No. 2089 in the partnership, they were unable to come to any understanding and no written agreement was executed. o When Fernandez demanded an accounting, Dela Rosa refused and denied the existence of the partnership. Issue: Did a partnership exist between the parties? Ruling: Yes. A complete and perfect contract of partnership was entered into the parties. o Partnership is a contract by which two or more persons bind themselves to contribute money, property or industry to a common fund, with the intention of dividing the profits among themselves. o Elements of a partnership: 1) Mutual contribution of a common stock; and This element was present Money was furnished by Fernandez and received by Dela Rosa with the understanding that it was to be used for the purchase of the 2 cascoes. 2) Joint interest in the profits. Intention to share profits appears to be an unavoidable deduction from the fact of the purchase of the cascoes in common, in the absence of any other explanation of the object of st the parties in making the purchase in that form, and that prior to the purchase of the 1 cascoe, the formation of a partnership had been the subject of negotiation between them. o The execution of a written agreement was not necessary in order to give efficacy to the verbal contract of partnership as a civil contract, the contribution of the partners not having been in the form of immovable or rights in immovable.

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1091)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- How To Hack The StockmarketDokument56 SeitenHow To Hack The Stockmarketgritchard3Noch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- (Camp, 2002) Venture Capital Due Diligence PDFDokument267 Seiten(Camp, 2002) Venture Capital Due Diligence PDFlalall100% (2)

- SPecial Penal LawsDokument35 SeitenSPecial Penal LawsEdward Kenneth KungNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Rule On Custody of Minors and Writ of Habeas CorpusDokument5 SeitenRule On Custody of Minors and Writ of Habeas CorpusMelody May Omelan Arguelles100% (2)

- Lean Amazon Six Sigma Case StudyDokument5 SeitenLean Amazon Six Sigma Case StudyDavid Sebastin100% (2)

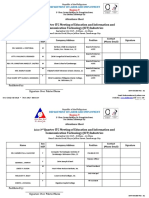

- Attendance Sheet Itc MeetingDokument9 SeitenAttendance Sheet Itc MeetingKeAnn BucoNoch keine Bewertungen

- Last Minute Tips in CIVIL LAWDokument19 SeitenLast Minute Tips in CIVIL LAWEdward Kenneth KungNoch keine Bewertungen

- Retail Trade Liberalization Act of 2000 (RA 8762)Dokument20 SeitenRetail Trade Liberalization Act of 2000 (RA 8762)Myron GutierrezNoch keine Bewertungen

- Articles of Partnership of Superfast Internet Center, LTDDokument2 SeitenArticles of Partnership of Superfast Internet Center, LTDSj EclipseNoch keine Bewertungen

- Labor Procedure Charts (Edited)Dokument11 SeitenLabor Procedure Charts (Edited)Edward Kenneth KungNoch keine Bewertungen

- Labor Procedure Charts (Edited)Dokument11 SeitenLabor Procedure Charts (Edited)Edward Kenneth KungNoch keine Bewertungen

- Union Bank VDokument2 SeitenUnion Bank VEdward Kenneth KungNoch keine Bewertungen

- 4 Lean Operation and JitDokument35 Seiten4 Lean Operation and JitEdward Kenneth KungNoch keine Bewertungen

- Deductive and Inductive ArgumentsDokument5 SeitenDeductive and Inductive ArgumentsEdward Kenneth KungNoch keine Bewertungen

- Contracts NotesDokument6 SeitenContracts NotesEdward Kenneth KungNoch keine Bewertungen

- Verification FINALDokument1 SeiteVerification FINALEdward Kenneth KungNoch keine Bewertungen

- C. Independent Contractors and Labor-Only Contractors: NotesDokument1 SeiteC. Independent Contractors and Labor-Only Contractors: NotesEdward Kenneth KungNoch keine Bewertungen

- Insider Trading: The LawDokument5 SeitenInsider Trading: The LawEdward Kenneth KungNoch keine Bewertungen

- Part II. Issues in M&A A) Public CompaniesDokument2 SeitenPart II. Issues in M&A A) Public CompaniesEdward Kenneth KungNoch keine Bewertungen

- Organizational Behavior Why Is Org Bev Important To Me As A Proprietor?Dokument1 SeiteOrganizational Behavior Why Is Org Bev Important To Me As A Proprietor?Edward Kenneth KungNoch keine Bewertungen

- The Manila Hotel CorpDokument18 SeitenThe Manila Hotel CorpEdward Kenneth KungNoch keine Bewertungen

- Tobacco. - The Financial Support Given by The National Government For The BeneficiaryDokument1 SeiteTobacco. - The Financial Support Given by The National Government For The BeneficiaryEdward Kenneth KungNoch keine Bewertungen

- ANTONIO G. TADY-Y, Petitioner-AppellantDokument4 SeitenANTONIO G. TADY-Y, Petitioner-AppellantEdward Kenneth KungNoch keine Bewertungen

- Facts Issues Ruling: Quezon City vs. ABS-CBN Broadcasting Corporation (October 6, 2008)Dokument1 SeiteFacts Issues Ruling: Quezon City vs. ABS-CBN Broadcasting Corporation (October 6, 2008)Edward Kenneth KungNoch keine Bewertungen

- In The Matter of The Probate of The Last Will and Testament of The Deceased Brigido AlvaradoDokument3 SeitenIn The Matter of The Probate of The Last Will and Testament of The Deceased Brigido AlvaradoEdward Kenneth KungNoch keine Bewertungen

- Section 247. General Provisions. - : Sections 247-252, Tax CodeDokument2 SeitenSection 247. General Provisions. - : Sections 247-252, Tax CodeEdward Kenneth KungNoch keine Bewertungen

- Quezon City vs. ABS-CBN Broadcasting Corporation (October 6, 2008)Dokument1 SeiteQuezon City vs. ABS-CBN Broadcasting Corporation (October 6, 2008)Edward Kenneth KungNoch keine Bewertungen

- Commissioner of Internal Revenue VsDokument1 SeiteCommissioner of Internal Revenue VsEdward Kenneth KungNoch keine Bewertungen

- Chapter 10 Internal Control and COSO FramewoDokument7 SeitenChapter 10 Internal Control and COSO Framewoاحمد العربيNoch keine Bewertungen

- PresentationDokument16 SeitenPresentationVishal TokasNoch keine Bewertungen

- Entrepreneurship DevelopmentDokument7 SeitenEntrepreneurship Developmentcadsathis100% (2)

- 2010 List of ExhibitorsDokument20 Seiten2010 List of ExhibitorsfortysixetwoNoch keine Bewertungen

- The Product Keys For Autodesk 2013Dokument5 SeitenThe Product Keys For Autodesk 2013angelmejiasNoch keine Bewertungen

- Lfpoky : V.Meku RFKK Fudksckj Iz'KkluDokument13 SeitenLfpoky : V.Meku RFKK Fudksckj Iz'Kklujeevan820Noch keine Bewertungen

- Maruti Suzuki Project ReportDokument80 SeitenMaruti Suzuki Project Reportrajwarmanish1980362Noch keine Bewertungen

- The First KFC Restaurant Was Opened in 1973 On Jalan Tunku Abdul RahmanDokument13 SeitenThe First KFC Restaurant Was Opened in 1973 On Jalan Tunku Abdul RahmanaaaNoch keine Bewertungen

- History RecordDokument3 SeitenHistory RecordDilawar HayatNoch keine Bewertungen

- PM600 Unit 1 IPDokument6 SeitenPM600 Unit 1 IPdiya allieNoch keine Bewertungen

- Media Kit - FinalDokument30 SeitenMedia Kit - Finalapi-278928596Noch keine Bewertungen

- CR, Er, Ecr, Ecor, NR, NCR, Ner, NFR, NWR, SR, SCR, Ser, Secr, SWR, WR, WCR and Metro Railway/KolkataDokument3 SeitenCR, Er, Ecr, Ecor, NR, NCR, Ner, NFR, NWR, SR, SCR, Ser, Secr, SWR, WR, WCR and Metro Railway/Kolkatapmali2Noch keine Bewertungen

- Circular 984Dokument48 SeitenCircular 984Aries MatibagNoch keine Bewertungen

- Assignment 1Dokument10 SeitenAssignment 1Zawwar Ahmad100% (1)

- Ganga Raju - Myneta - Info - ls2014 - CandidateDokument18 SeitenGanga Raju - Myneta - Info - ls2014 - Candidategraceenggint8799Noch keine Bewertungen

- Effect of Corporate Governance Mechanism On The Quality Financial ReportingDokument5 SeitenEffect of Corporate Governance Mechanism On The Quality Financial ReportingLazulfa Ari AmaliaNoch keine Bewertungen

- Corporate Law AssignmentDokument15 SeitenCorporate Law Assignmentsandeep Gurjar100% (1)

- 526 TableDokument11 Seiten526 TableAllysson Mae LicayanNoch keine Bewertungen

- Amendment in Itb and GCC: Amend - ITBGCC 1Dokument2 SeitenAmendment in Itb and GCC: Amend - ITBGCC 1Mayank SharmaNoch keine Bewertungen

- Evershine Modular KitchenDokument14 SeitenEvershine Modular Kitchenwonders_24108631Noch keine Bewertungen

- Aviation IndustryDokument15 SeitenAviation Industryvinaykakar894440% (5)

- Cap. BudgetDokument3 SeitenCap. BudgetChaucer19Noch keine Bewertungen

- FI Posting To Leading Ledger Only (Without Hitting Non - Leading Ledger) PDFDokument12 SeitenFI Posting To Leading Ledger Only (Without Hitting Non - Leading Ledger) PDFAnanthakumar ANoch keine Bewertungen

- Assignment-3 Corporate Governance of Bharthi AirtelDokument9 SeitenAssignment-3 Corporate Governance of Bharthi Airteljeny babuNoch keine Bewertungen