Beruflich Dokumente

Kultur Dokumente

Sovereign Debt Crisis

Hochgeladen von

puretrustCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Sovereign Debt Crisis

Hochgeladen von

puretrustCopyright:

Verfügbare Formate

Copyright Martin Armstrong All Rights Reserved January 30th, 2012

The Sovereign Debt Crisis WHEN?

he real question that we face for all the markets is WHEN will the Sovereign Debt Crisis go into meltdown? We are in the 13th year from the Major Directional Change of 1999 that marked the birth of the Euro, low in gold and crude oil, and the bubble in shares that peaked in many countries in 2000. Just as the United States has been obsessed with the Great Depression as government always is ready to stimulate and many see this as pending hyperinflation with the end of the world, Germany suffers from the opposite delusion. There, the fear is inflation and thus when the US tries to inflate its way out of every crisis, Germany seeks to impose austerity and create economic stagnation and decline. Chancellor Angela Merkel managed to win in Europe when 25 out of 27 EU states agreed to a Germaninspired pact for stricter budget discipline as the member states stand among the ashes of austerity with the walls crumbing around them. The two members who refused to go along with Germany were Britain and the Czech Republic. What will now dominate Europe is a quasi-automatic sanctioning mechanism that will be imposed upon any member state that now breaches the European Union budget deficit limits. The idea is to enshrine a balanced budget system that cannot possibly work. The European Central Bank has long argued for such measures to be imposed within the euro zone. While this is seen as a first step towards a fiscal union by many, that actual type of unification is not realistic given the economic stress that lies ahead. It is also seen as a major step in restoring confidence in the whole euro zone from a perspective of debt holders. The bankers will be cheering and their analysts will pump out endearing platitudes of long-term success. But, this again sacrifices the liberty and living standards of the people to support the holders of government debt. This austerity program has been quite insane for the problem of cutting public spending and raising taxes to service mountains of debt will ensure high unemployment and nothing but rising social unrest. This is a lethal

combination, but it also tends to support the view that the real crisis may not hit until the next peak in the Economic Confidence Model due in 2015.75 going into 2017. Merkel told a news conference the agreements on the fiscal pact and a permanent rescue fund for the euro zone were a "small but fine step on the path to restoring confidence." This illustrates that the primary concern is maintaining confidence among bond holders not actually addressing the whole structural problem of the Euro or the post-WWII Marxist philosophy of borrowing perpetually for socialism when the bulk of the national debts are accumulative interest expenditures. The whole idea of governments caring for the poor is all bullshit. It is now about complying with the bankers who sell their debt. Governments are trapped. They see borrowing year after year as the only system they know. Thus, we should expect that the Sovereign Debt Crisis simply erupts on a stage of fiscal mismanagement. These political leaders agreed that a 500-billion-euro European Stability Mechanism will enter into force in July, a year earlier than planned. But this merely demonstrates that the debt crisis will not be addressed and they are hoping to merely restore the confidence of bond holders so it will be business as usual borrow perpetually with no intent of paying off anything while hammering citizens for more taxes. Pressure has been applied from the United States, China, and the IMF (inter alia) to increase the size of the European Stability Mechanism, but Merkel has refused to consider the issue before March. Nevertheless, this austerity policy of severely restricting deficit spending is purely a German viewpoint, which is opposite that of the United States. The problems created by austerity are generally social unrest and the threat of war. The danger of monetization is the depreciation of cash savings. Restoring market confidence is merely a short-term affect for the markets are showing that people are still afraid to invest as cash remains at record highs and corporate profits in the US are also at record highs. Therefore, the burning question remains, do we see a collapse right now or do we have to wait until the ECM turns again 2015.75? So far, the timing appears to be on schedule for 2015.75 as the next financial big crisis. The USA is not ready to collapse. That appears to be the last leg to fall. What we are more likely to see first is the crisis start to brew in Japan. The nuclear disaster has led to a rising undercurrent of dissatisfaction with government. The food supply has been tainted and radiation has been detected in Tokyo. This is contributing to the final stages necessary for the final low in Japan on the horizon. 26 years from the 1989 high also brings us to 2015. No matter which way we look at this, the next peak in the ECM looks like 2007 was just a practice run.

Das könnte Ihnen auch gefallen

- The Corona Crash: How the Pandemic Will Change CapitalismVon EverandThe Corona Crash: How the Pandemic Will Change CapitalismNoch keine Bewertungen

- Euro ZoneDokument4 SeitenEuro ZoneDurgesh KesarkarNoch keine Bewertungen

- Fear Returns: World EconomyDokument6 SeitenFear Returns: World EconomymuradgwaduriNoch keine Bewertungen

- The Centrality of The g20 To Australian Foreign PolicyDokument15 SeitenThe Centrality of The g20 To Australian Foreign PolicyLatika M BourkeNoch keine Bewertungen

- According To Napier 10 2022Dokument11 SeitenAccording To Napier 10 2022Gustavo TapiaNoch keine Bewertungen

- IMF's Bold Recipe For Recovery: TagsDokument5 SeitenIMF's Bold Recipe For Recovery: TagsKrishna SumanthNoch keine Bewertungen

- Europe's Sovereign Dept CrisisDokument5 SeitenEurope's Sovereign Dept CrisisCiocoiu Vlad AndreiNoch keine Bewertungen

- George Soros On Soverign CrisesDokument8 SeitenGeorge Soros On Soverign Crisesdoshi.dhruvalNoch keine Bewertungen

- Lessons From The Global Financial Crisis: What Has Happened?Dokument11 SeitenLessons From The Global Financial Crisis: What Has Happened?palashndcNoch keine Bewertungen

- The Eurozone in Crisis:: Professor Assaf RazinDokument59 SeitenThe Eurozone in Crisis:: Professor Assaf RazinUmesh YadavNoch keine Bewertungen

- John Mauldin Weekly 10 SeptemberDokument11 SeitenJohn Mauldin Weekly 10 Septemberrichardck61Noch keine Bewertungen

- Spex Issue 24Dokument11 SeitenSpex Issue 24SMU Political-Economics Exchange (SPEX)Noch keine Bewertungen

- Financial Institutions Stare Into The Abyss: World EconomyDokument6 SeitenFinancial Institutions Stare Into The Abyss: World EconomyfrankhordenNoch keine Bewertungen

- Op-Ed JPF Century Weekly 110110Dokument3 SeitenOp-Ed JPF Century Weekly 110110BruegelNoch keine Bewertungen

- BIS LeverageRootToTheCrisisDokument5 SeitenBIS LeverageRootToTheCrisisHector Perez SaizNoch keine Bewertungen

- English Project Răducu Elena Nicole CSIE Grupa 1024Dokument9 SeitenEnglish Project Răducu Elena Nicole CSIE Grupa 1024ile 06Noch keine Bewertungen

- Global Financial Crisis and Sri LankaDokument5 SeitenGlobal Financial Crisis and Sri LankaRuwan_SuNoch keine Bewertungen

- Final PDokument2 SeitenFinal PAshwin ChoudharyNoch keine Bewertungen

- What Needs To Be DoneDokument9 SeitenWhat Needs To Be DonebowssenNoch keine Bewertungen

- Euro Debt Crises: Written by Shoaib YaqoobDokument4 SeitenEuro Debt Crises: Written by Shoaib Yaqoobhamid2k30Noch keine Bewertungen

- IS LM Model For Great Depression and EurocrisisDokument8 SeitenIS LM Model For Great Depression and EurocrisisHariprasad Sakthivel100% (4)

- From Financial Crisis To Stagnation The Destruction of Shared Prosperity and The Role of EconomicsDokument10 SeitenFrom Financial Crisis To Stagnation The Destruction of Shared Prosperity and The Role of EconomicsmrwonkishNoch keine Bewertungen

- Whither The Great Recessio - Reading The Tea Leaves - 30 Aug 2009Dokument2 SeitenWhither The Great Recessio - Reading The Tea Leaves - 30 Aug 2009api-26869162Noch keine Bewertungen

- Inflation and Rising Demands On Governments Are Changing Economic PolicyDokument4 SeitenInflation and Rising Demands On Governments Are Changing Economic PolicyNinaNoch keine Bewertungen

- The Austerity Delusion (Krugman)Dokument11 SeitenThe Austerity Delusion (Krugman)phdpolitics1Noch keine Bewertungen

- October Market Brief 2012Dokument3 SeitenOctober Market Brief 2012Christopher Michael QuigleyNoch keine Bewertungen

- Bus Tim May 2709 Glob Fix PublDokument3 SeitenBus Tim May 2709 Glob Fix Publchorpharn4269Noch keine Bewertungen

- Guide To The Eurozone CrisisDokument9 SeitenGuide To The Eurozone CrisisLakshmikanth RaoNoch keine Bewertungen

- Wien Byron - July 2010 Market Commentary - Smartest ManDokument4 SeitenWien Byron - July 2010 Market Commentary - Smartest ManGlenn BuschNoch keine Bewertungen

- The Economist - Finacial CrisisDokument4 SeitenThe Economist - Finacial CrisisEnzo PitonNoch keine Bewertungen

- Debt CrisisDokument8 SeitenDebt CrisisUshma PandeyNoch keine Bewertungen

- BCG Back To MesopotamiaDokument15 SeitenBCG Back To MesopotamiaZerohedgeNoch keine Bewertungen

- European Meltdown: Still Ahead or Better Outcome PossibleDokument18 SeitenEuropean Meltdown: Still Ahead or Better Outcome PossiblepriyakshreyaNoch keine Bewertungen

- We Are All Europeans NowDokument3 SeitenWe Are All Europeans NowAlexander MirtchevNoch keine Bewertungen

- Greece and The Euro CrisisDokument8 SeitenGreece and The Euro CrisisRhonda BushNoch keine Bewertungen

- Ten Major Differences Between The Great Depression and Today's Great RecessionDokument16 SeitenTen Major Differences Between The Great Depression and Today's Great RecessionwdokkenNoch keine Bewertungen

- Bob Chapman The European Debt Crisis The Creditors Are America's Too Big To Fail Wall Street Banksters 26 10 2011Dokument4 SeitenBob Chapman The European Debt Crisis The Creditors Are America's Too Big To Fail Wall Street Banksters 26 10 2011sankaratNoch keine Bewertungen

- W. Bello: Turning Villains Into Victims Finance Capital and GreeceDokument35 SeitenW. Bello: Turning Villains Into Victims Finance Capital and GreeceGeorge PayneNoch keine Bewertungen

- Will The Euro Survive 2012 ZDDokument3 SeitenWill The Euro Survive 2012 ZDBruegelNoch keine Bewertungen

- Guttmann Plihon ConsumerDokument21 SeitenGuttmann Plihon Consumerluiz-paulo-fontes-rezende-514Noch keine Bewertungen

- 1 DissertationsDokument11 Seiten1 DissertationsKumar DeepanshuNoch keine Bewertungen

- The Global Economy - December 19, 2012Dokument3 SeitenThe Global Economy - December 19, 2012Swedbank AB (publ)Noch keine Bewertungen

- EC6201 International EconomicsDokument4 SeitenEC6201 International EconomicsutahgurlNoch keine Bewertungen

- The Europea Debt: Why We Should Care?Dokument4 SeitenThe Europea Debt: Why We Should Care?Qraen UchenNoch keine Bewertungen

- MONEY AND BANKING (School Work)Dokument9 SeitenMONEY AND BANKING (School Work)Lan Mr-aNoch keine Bewertungen

- Steering Out of The Crisis: Robert WadeDokument8 SeitenSteering Out of The Crisis: Robert WadegootliNoch keine Bewertungen

- What Is The European DebtDokument32 SeitenWhat Is The European DebtVaibhav JainNoch keine Bewertungen

- General Theory of Austerity by Simon Wren-LewisDokument9 SeitenGeneral Theory of Austerity by Simon Wren-LewisPerfere johoNoch keine Bewertungen

- Global Economic RecoveryDokument13 SeitenGlobal Economic Recoveryd4debojit100% (2)

- America vs. Europe - Which Is The Bigger Threat To The World EconomyDokument8 SeitenAmerica vs. Europe - Which Is The Bigger Threat To The World EconomyBrendan ChuaNoch keine Bewertungen

- Atwel - Global Macro 6/2011Dokument15 SeitenAtwel - Global Macro 6/2011Jan KaskaNoch keine Bewertungen

- Economic and Market: A U.S. Recession?Dokument16 SeitenEconomic and Market: A U.S. Recession?dpbasicNoch keine Bewertungen

- Crisis SummariesDokument23 SeitenCrisis Summariesa24dkNoch keine Bewertungen

- Final ExamDokument4 SeitenFinal ExamLeticia ScheinkmanNoch keine Bewertungen

- AusterityDokument11 SeitenAusterityscriberoneNoch keine Bewertungen

- The World Economy After The Pandemic, Will Inflation Return?Dokument3 SeitenThe World Economy After The Pandemic, Will Inflation Return?Rishabh Kumar PG22Noch keine Bewertungen

- Return of The CrisisDokument15 SeitenReturn of The CrisischarurastogiNoch keine Bewertungen

- Microsoft India The Best Employer: Randstad: What Are The Differences Between Closed Economy and Open Economy ?Dokument5 SeitenMicrosoft India The Best Employer: Randstad: What Are The Differences Between Closed Economy and Open Economy ?Subramanya BhatNoch keine Bewertungen

- Crises Managed 30-11-11Dokument24 SeitenCrises Managed 30-11-11Lubomir ChristoffNoch keine Bewertungen

- The Spectre of Eurozone DeflationDokument2 SeitenThe Spectre of Eurozone DeflationsignalhucksterNoch keine Bewertungen

- Urban Survival Stein Miller Rev 9-17-12 BDokument1 SeiteUrban Survival Stein Miller Rev 9-17-12 BpuretrustNoch keine Bewertungen

- Doctor Warns Obama Taking Over Psychiatr - PDFDokument4 SeitenDoctor Warns Obama Taking Over Psychiatr - PDFpuretrustNoch keine Bewertungen

- Analysis of The Yield CurveDokument4 SeitenAnalysis of The Yield CurvepuretrustNoch keine Bewertungen

- NSF ProposalDokument22 SeitenNSF Proposalpuretrust100% (2)

- Dark Rituals Dark PowersDokument10 SeitenDark Rituals Dark Powerskaliyuga123100% (1)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Personal Dynamic MediaDokument14 SeitenPersonal Dynamic MediapuretrustNoch keine Bewertungen

- Prospect TheoryDokument3 SeitenProspect TheorypuretrustNoch keine Bewertungen

- Rothbard - Intellectuals Strategy)Dokument25 SeitenRothbard - Intellectuals Strategy)Hbeltrao100% (1)

- Tutorial ArabicDokument120 SeitenTutorial ArabicWaseemah100% (10)

- Prospect TheoryDokument3 SeitenProspect TheorypuretrustNoch keine Bewertungen

- Prospect TheoryDokument3 SeitenProspect TheorypuretrustNoch keine Bewertungen

- Anatomy of A Debt CrisisDokument46 SeitenAnatomy of A Debt CrisispuretrustNoch keine Bewertungen

- Japan - The Total Collapse of The Monetary SystemDokument4 SeitenJapan - The Total Collapse of The Monetary SystempuretrustNoch keine Bewertungen

- Dark Rituals Dark PowersDokument10 SeitenDark Rituals Dark Powerskaliyuga123100% (1)

- The Clara - 102 U.S. 200Dokument3 SeitenThe Clara - 102 U.S. 200puretrustNoch keine Bewertungen

- Schumann ResonancesDokument11 SeitenSchumann ResonancespuretrustNoch keine Bewertungen

- Coming Commodity BoomDokument8 SeitenComing Commodity BoompuretrustNoch keine Bewertungen

- The Age of MaterialismDokument13 SeitenThe Age of MaterialismpuretrustNoch keine Bewertungen

- S C e N A RDokument8 SeitenS C e N A RpuretrustNoch keine Bewertungen

- Application For Order Dissolvingthe Internal Revenue ServiceDokument21 SeitenApplication For Order Dissolvingthe Internal Revenue ServicepuretrustNoch keine Bewertungen

- De Novo ReviewDokument3 SeitenDe Novo ReviewpuretrustNoch keine Bewertungen

- The Constitution of The United StatesDokument21 SeitenThe Constitution of The United StatespuretrustNoch keine Bewertungen

- Cracking The Code of The IRSDokument212 SeitenCracking The Code of The IRSAllison Albright100% (5)

- The Federal Zone: Cracking The Code of Internal Revenue: Eleventh EditionDokument24 SeitenThe Federal Zone: Cracking The Code of Internal Revenue: Eleventh EditionpuretrustNoch keine Bewertungen

- United States v. LopezDokument64 SeitenUnited States v. LopezpuretrustNoch keine Bewertungen

- Cracking The Code of The IRSDokument212 SeitenCracking The Code of The IRSAllison Albright100% (5)

- IntroDokument6 SeitenIntropuretrustNoch keine Bewertungen

- Places Purchased by The Consent of The Legislature of One of The Fifty State(s), in Which The Same Shall Be, For The Erection of FortsDokument8 SeitenPlaces Purchased by The Consent of The Legislature of One of The Fifty State(s), in Which The Same Shall Be, For The Erection of FortspuretrustNoch keine Bewertungen

- UGC NET General PaperDokument126 SeitenUGC NET General PaperVishal RajputNoch keine Bewertungen

- Grade 6 Summary Final GradesDokument7 SeitenGrade 6 Summary Final GradesJb MejiaNoch keine Bewertungen

- Bernaldez Vs FranciaDokument6 SeitenBernaldez Vs Franciaaljohn pantaleonNoch keine Bewertungen

- Oglesby v. Sanders - Document No. 3Dokument1 SeiteOglesby v. Sanders - Document No. 3Justia.comNoch keine Bewertungen

- An Africa ThunderstormDokument2 SeitenAn Africa Thunderstormanitha100% (1)

- Corruption in KenyaDokument3 SeitenCorruption in KenyaAugustine MuindiNoch keine Bewertungen

- Uas 2023 SmaDokument3 SeitenUas 2023 SmaAndreasNoch keine Bewertungen

- Stewart Blackmore (Labour) ManifestoDokument6 SeitenStewart Blackmore (Labour) ManifestoIWCPOnlineNoch keine Bewertungen

- Bel Amis by Laws & ConstitutionDokument8 SeitenBel Amis by Laws & Constitutionᜋᜊ ᜁᜈNoch keine Bewertungen

- Lincoln DBQ - ApushDokument4 SeitenLincoln DBQ - Apushapi-321197078Noch keine Bewertungen

- Delegated Governance and The British State (Oxford) PDFDokument383 SeitenDelegated Governance and The British State (Oxford) PDFMihaelaZavoianuNoch keine Bewertungen

- Proof of Address You Are Required To Submit Atleast 1 of The Documents Listed BelowDokument5 SeitenProof of Address You Are Required To Submit Atleast 1 of The Documents Listed BelowAjit JenaNoch keine Bewertungen

- WarriorsDokument57 SeitenWarriorsGerardo E. Lopez Morales100% (3)

- CPWD Circular 270619 1Dokument1 SeiteCPWD Circular 270619 1JaslinrajsrNoch keine Bewertungen

- Ahmed RazaDokument1 SeiteAhmed Razashafa_abdullahNoch keine Bewertungen

- QEP Theme 2 - Cooperative Federalism - HandoutsDokument3 SeitenQEP Theme 2 - Cooperative Federalism - HandoutsZerosubNoch keine Bewertungen

- Towards Bureaucractic Reform - BingDokument32 SeitenTowards Bureaucractic Reform - Bingmrchinaeyes7878Noch keine Bewertungen

- Dev 1150 Slides - September - 2020Dokument48 SeitenDev 1150 Slides - September - 2020Hendrix NailNoch keine Bewertungen

- HR 1995 - Congratulating Civil Engg Board Exam Topnotchers From SUCsDokument2 SeitenHR 1995 - Congratulating Civil Engg Board Exam Topnotchers From SUCsKabataan Party-ListNoch keine Bewertungen

- OSCSCDokument4 SeitenOSCSCBufun MishraNoch keine Bewertungen

- 250 Labor Export Policy of Developing Countries The Case of The Philippines and IndonesiaDokument4 Seiten250 Labor Export Policy of Developing Countries The Case of The Philippines and Indonesiapanday25Noch keine Bewertungen

- Counter-Affidavit Torres vs. GalangDokument3 SeitenCounter-Affidavit Torres vs. GalangArvy Agustin100% (1)

- (Richard Bellamy, Madeleine Kennedy-Macfoy, Editor (B-Ok - Xyz)Dokument179 Seiten(Richard Bellamy, Madeleine Kennedy-Macfoy, Editor (B-Ok - Xyz)Nikk EncarnacionNoch keine Bewertungen

- Jurisprudence PossessionDokument64 SeitenJurisprudence PossessionGuevarra AngeloNoch keine Bewertungen

- 2003 - TIROL - Corporation LawDokument2 Seiten2003 - TIROL - Corporation LawCourtney TirolNoch keine Bewertungen

- Draft Articles On Jurisdictional Immunities of States PDFDokument51 SeitenDraft Articles On Jurisdictional Immunities of States PDFMohamed ZainNoch keine Bewertungen

- PP vs. Eusebio LopezDokument2 SeitenPP vs. Eusebio LopezVinz G. VizNoch keine Bewertungen

- Recommendations For Reform of The European Parliament's Rules On Transparency, Integrity, Accountability and Anti-CorruptionDokument20 SeitenRecommendations For Reform of The European Parliament's Rules On Transparency, Integrity, Accountability and Anti-Corruptionporunsaharalibre.orgNoch keine Bewertungen

- Ilbco's Food Safety Standards Act (3rd Edition 2009) Published by Rajan NijhawanDokument113 SeitenIlbco's Food Safety Standards Act (3rd Edition 2009) Published by Rajan NijhawanGourav Kumar SinhaNoch keine Bewertungen

- The Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpVon EverandThe Russia Hoax: The Illicit Scheme to Clear Hillary Clinton and Frame Donald TrumpBewertung: 4.5 von 5 Sternen4.5/5 (11)

- Thomas Jefferson: Author of AmericaVon EverandThomas Jefferson: Author of AmericaBewertung: 4 von 5 Sternen4/5 (107)

- The Shadow War: Inside Russia's and China's Secret Operations to Defeat AmericaVon EverandThe Shadow War: Inside Russia's and China's Secret Operations to Defeat AmericaBewertung: 4.5 von 5 Sternen4.5/5 (12)

- Modern Warriors: Real Stories from Real HeroesVon EverandModern Warriors: Real Stories from Real HeroesBewertung: 3.5 von 5 Sternen3.5/5 (3)

- The Courage to Be Free: Florida's Blueprint for America's RevivalVon EverandThe Courage to Be Free: Florida's Blueprint for America's RevivalNoch keine Bewertungen

- The Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteVon EverandThe Smear: How Shady Political Operatives and Fake News Control What You See, What You Think, and How You VoteBewertung: 4.5 von 5 Sternen4.5/5 (16)

- The Great Gasbag: An A–Z Study Guide to Surviving Trump WorldVon EverandThe Great Gasbag: An A–Z Study Guide to Surviving Trump WorldBewertung: 3.5 von 5 Sternen3.5/5 (9)

- Nine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesVon EverandNine Black Robes: Inside the Supreme Court's Drive to the Right and Its Historic ConsequencesNoch keine Bewertungen

- Game Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeVon EverandGame Change: Obama and the Clintons, McCain and Palin, and the Race of a LifetimeBewertung: 4 von 5 Sternen4/5 (572)

- Stonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonVon EverandStonewalled: My Fight for Truth Against the Forces of Obstruction, Intimidation, and Harassment in Obama's WashingtonBewertung: 4.5 von 5 Sternen4.5/5 (21)

- The Red and the Blue: The 1990s and the Birth of Political TribalismVon EverandThe Red and the Blue: The 1990s and the Birth of Political TribalismBewertung: 4 von 5 Sternen4/5 (29)

- The Quiet Man: The Indispensable Presidency of George H.W. BushVon EverandThe Quiet Man: The Indispensable Presidency of George H.W. BushBewertung: 4 von 5 Sternen4/5 (1)

- Commander In Chief: FDR's Battle with Churchill, 1943Von EverandCommander In Chief: FDR's Battle with Churchill, 1943Bewertung: 4 von 5 Sternen4/5 (16)

- Reading the Constitution: Why I Chose Pragmatism, not TextualismVon EverandReading the Constitution: Why I Chose Pragmatism, not TextualismNoch keine Bewertungen

- Confidence Men: Wall Street, Washington, and the Education of a PresidentVon EverandConfidence Men: Wall Street, Washington, and the Education of a PresidentBewertung: 3.5 von 5 Sternen3.5/5 (52)

- We've Got Issues: How You Can Stand Strong for America's Soul and SanityVon EverandWe've Got Issues: How You Can Stand Strong for America's Soul and SanityNoch keine Bewertungen

- Power Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicVon EverandPower Grab: The Liberal Scheme to Undermine Trump, the GOP, and Our RepublicNoch keine Bewertungen

- The Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaVon EverandThe Deep State: How an Army of Bureaucrats Protected Barack Obama and Is Working to Destroy the Trump AgendaBewertung: 4.5 von 5 Sternen4.5/5 (4)

- Socialism 101: From the Bolsheviks and Karl Marx to Universal Healthcare and the Democratic Socialists, Everything You Need to Know about SocialismVon EverandSocialism 101: From the Bolsheviks and Karl Marx to Universal Healthcare and the Democratic Socialists, Everything You Need to Know about SocialismBewertung: 4.5 von 5 Sternen4.5/5 (42)

- Camelot's Court: Inside the Kennedy White HouseVon EverandCamelot's Court: Inside the Kennedy White HouseBewertung: 4 von 5 Sternen4/5 (17)

- An Ordinary Man: The Surprising Life and Historic Presidency of Gerald R. FordVon EverandAn Ordinary Man: The Surprising Life and Historic Presidency of Gerald R. FordBewertung: 4 von 5 Sternen4/5 (5)

- The Last Republicans: Inside the Extraordinary Relationship Between George H.W. Bush and George W. BushVon EverandThe Last Republicans: Inside the Extraordinary Relationship Between George H.W. Bush and George W. BushBewertung: 4 von 5 Sternen4/5 (6)

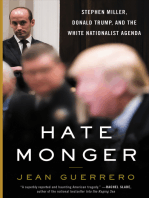

- Hatemonger: Stephen Miller, Donald Trump, and the White Nationalist AgendaVon EverandHatemonger: Stephen Miller, Donald Trump, and the White Nationalist AgendaBewertung: 4 von 5 Sternen4/5 (5)

- Crimes and Cover-ups in American Politics: 1776-1963Von EverandCrimes and Cover-ups in American Politics: 1776-1963Bewertung: 4.5 von 5 Sternen4.5/5 (26)

- The Magnificent Medills: The McCormick-Patterson Dynasty: America's Royal Family of Journalism During a Century of Turbulent SplendorVon EverandThe Magnificent Medills: The McCormick-Patterson Dynasty: America's Royal Family of Journalism During a Century of Turbulent SplendorNoch keine Bewertungen

- The Next Civil War: Dispatches from the American FutureVon EverandThe Next Civil War: Dispatches from the American FutureBewertung: 3.5 von 5 Sternen3.5/5 (47)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingVon EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingBewertung: 4.5 von 5 Sternen4.5/5 (97)