Beruflich Dokumente

Kultur Dokumente

171021

Hochgeladen von

sslee0328_129887293Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

171021

Hochgeladen von

sslee0328_129887293Copyright:

Verfügbare Formate

Course # 171021 Analysis of the Corporate Annual Report

based on the electronic .pdf file(s): Analysis of the Corporate Annual Report by: Dr. Jae K. Shim, Ph.D., 2009, 56 pages

5 CPE Credit Hours Accounting & Auditing

A P E X C P E . C O M . . . . . 713.234.0892 . . . . . support@apexcpe.com

This exam sheet is made available for your convenience in answering questions while offline. Please note that you will still need to enter your answers on the online exam sheet for grading. Instructions are provided at the end of this document.

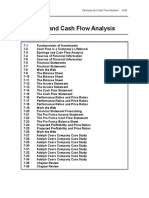

Chapter 1 - Annual Report : Its Components

1. The basic financial statements include a Balance sheet, income statement, statement of changes in retained earnings. Statement of financial position, income statement, and statement of changes in retained earnings. Balance sheet, statement of financial position, income statement, and statement of changes in retained earnings. Balance sheet, income statement, statement of cash flows, and statement of retained earnings. 2. The primary purpose of the balance sheet is to reflect The fair market value of the firms assets. The liquidation value of the firms assets. The firms net asset value. The equation: assets = liabilities + equity. 3. A statement of cash flows is to be presented in general purpose external financial statements by which of the following? Publicly held business enterprises only. Privately held business enterprises only. All business enterprises. All business enterprises and not-for-profit organizations. 4. A statement of cash flows is intended to help users of financial statements Evaluate a firms liquidity and solvency. Evaluate a firms assets and liabilities. Determine a firms operating performance. Determine whether insiders have sold or purchased the firms stock. 5. Which one of the following financial statements includes all of the following items: net income, depreciation, operating activities, and financial activities? Balance sheet. Income statement.

Statement of cash flows. Statement of shareholders equity. 6. A segment is reportable if any one of the following conditions exists except: Revenue is 10% or more of total corporate revenue Operating profit is 10% or more of total corporate operating profit Identifiable assets are 10% or more of total corporate assets Foreign operations provide 3%or more of total corporate sales 7. Footnote disclosures usually do not include: Accounting methods Statement of changes in stockholders equity Inventory pricing Pension fund 8. The Section 404 of the Sarbanes-Oxley Act requires ___ additional reports on the effectiveness of internal control over financial reporting: 2 3 1 4 9. The primary purpose of the income statement is to reflect The fair value of the firms assets at some moment in time. Operating performance for a specified time period. The status of the firms assets in case of forced liquidation of the firm. The firms potential for growth in stock values in the stock market. 10. Another name for the balance sheet is the: Statement of cash flows Statement of earnings Statement of financial position Retained earnings statement 11. Which of the following types of accounts are not found on the balance sheet? Revenues Assets Liabilities

Owners' equity 12. Which of the following would be classified as a current liability? Accounts payable Land Capital stock Accounts receivable 13. Cash outflows from investing activities include: Repurchasing of stock Payments to buy fixed assets Issuing dividend payments Payments on accounts payable arising from the initial purchase of goods

Chapter 2 - How the Financial Statements Tie Together

14. Which of the following is a primary use of cash? Borrowing Investment by owners Operating expenses Sale of equipment 15. Which of the following is an example of liquidity ratios? Times interest earned Quick ratio Return on equity P/E ratio 16. Factors that an investor considers in evaluating a firms stock include all except: Financial health Industry factors Number of future investors Future outlook of the company 17. Which of the following is an example of leverage ratios? Times interest earned

Quick ratio Payout ratio Return on equity 18. If the debt ratio is 0.5 what is the debt-equity ratio? 0.5 1 1.5 2 19. Given the following data: Sales = 2000; Cost of good sold = 1500; Average receivables = 100, calculate the average collection period: 24.33 18.25 137 1.33 20. Gross profit margin is Gross profits divided by net sales Net sales divided by gross profit Sales multiplied by gross profit Average assets multiplied by gross profits 21. Market value ratios do not include: Opportunity values Earnings per share Price-earnings ratio (multiple) Book value per share 22. What ratio is used to measure a firm's liquidity? Debt ratio Asset turnover Current ratio Return on equity 23. What ratio is used to measure a firm's leverage? Debt ratio Current ratio

Asset turnover Return on equity 24. What ratio is used to measure a firm's efficiency at using its assets? Current ratio Total asset turnover Return on sales Return on equity 25. What ratio is used to measure the profit earned on each dollar invested in a firm? Current ratio Asset turnover Return on sales Return on total asset

Chapter 3 - Classified Financial Statements

Chapter 4 - Statement of Cash Flows

Chapter 5 - Other Sections of the Annual Report

Chapter 6 - How to Read a Quarterly Report

Chapter 7 - The Sarbanes-Oxley Act

Chapter 8 - Analysis of Financial Statements

Chapter 9 - What and Why of Financial Statement Analysis

Chapter 10 - Working with Financial Ratios

Chapter 11 - Solvency (Leverage and Debt Service)

Chapter 12 - An Overall Evaluation : Summary of Financial Ratios

Chapter 13 - The Power of Cash Flow Ratios

Chapter 14 - Conclusion

Chapter 15 - Glossary

Instructions for Submitting Answers Online: Sign In at www.ApexCPE.com Click the "My CPE" tab at the top of the page. Click "My CPE Courses". Find the current CPE year and click "Go to My Courses". Find this course and click the "Go to Course" link. Step 2 on the Course Syllabus page is "Take the Final Exam". Click the "Begin Final Exam" link. Enter your answers on the online exam sheet. Click the "Grade Exam" button at the bottom of the page. Your exam will be graded automatically. If your score exceeds 70%, a "Create Certificate" button will display. Otherwise, you may continue to retake the exam until you pass. A short evaluation page will display. Please provide your feedback for the course.

Once the evaluation is complete, click the "Submit Evaluation & Create Certificate" button at the top of the page. You may print your Certificate of Completion by selecting File Print from your browser. Certificates remain online for at least five years from the certificate date.

If you have any questions, please call us at 713.234.0892 or send an email to support@apexcpe.com

COPYRIGHT 2009 Apex CPE - ALL RIGHTS RESERVED

713.234.0892

Das könnte Ihnen auch gefallen

- The Portable MBA in Finance and AccountingVon EverandThe Portable MBA in Finance and AccountingBewertung: 4 von 5 Sternen4/5 (19)

- Understanding Business Accounting For DummiesVon EverandUnderstanding Business Accounting For DummiesBewertung: 3.5 von 5 Sternen3.5/5 (8)

- International Financial Statement Analysis WorkbookVon EverandInternational Financial Statement Analysis WorkbookNoch keine Bewertungen

- Assignment On SCMDokument5 SeitenAssignment On SCMcattiger123Noch keine Bewertungen

- Applied Corporate Finance. What is a Company worth?Von EverandApplied Corporate Finance. What is a Company worth?Bewertung: 3 von 5 Sternen3/5 (2)

- Financial Statements: Join PRO or PRO Plus and Get Lifetime Access To Our Premium MaterialsDokument1 SeiteFinancial Statements: Join PRO or PRO Plus and Get Lifetime Access To Our Premium MaterialsJazzmin Rae BarbaNoch keine Bewertungen

- Fin621 Final Term Solved MCQS: JournalizingDokument23 SeitenFin621 Final Term Solved MCQS: JournalizingIshtiaq JatoiNoch keine Bewertungen

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersVon EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersBewertung: 5 von 5 Sternen5/5 (5)

- The Business Owner's Guide to Reading and Understanding Financial Statements: How to Budget, Forecast, and Monitor Cash Flow for Better Decision MakingVon EverandThe Business Owner's Guide to Reading and Understanding Financial Statements: How to Budget, Forecast, and Monitor Cash Flow for Better Decision MakingBewertung: 4 von 5 Sternen4/5 (4)

- FIN621 Solved MCQs Finalterm Mega FileDokument23 SeitenFIN621 Solved MCQs Finalterm Mega FileKashif Rana50% (4)

- Fs AnalysisDokument34 SeitenFs Analysisbawangb21Noch keine Bewertungen

- Financial Accounting - Want to Become Financial Accountant in 30 Days?Von EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Bewertung: 5 von 5 Sternen5/5 (1)

- FINA2004 Unit 5Dokument11 SeitenFINA2004 Unit 5Taedia HibbertNoch keine Bewertungen

- What is Financial Accounting and BookkeepingVon EverandWhat is Financial Accounting and BookkeepingBewertung: 4 von 5 Sternen4/5 (10)

- GeloDokument4 SeitenGeloJhay Thompson BernabeNoch keine Bewertungen

- Introduction To Accounting & Finance FinalDokument25 SeitenIntroduction To Accounting & Finance FinalManeesh Chitturu100% (1)

- Advanced Financial Accounting Chapter 6 - Cash Flow StatementsDokument16 SeitenAdvanced Financial Accounting Chapter 6 - Cash Flow StatementsSyed Sohaib AliNoch keine Bewertungen

- Financial Statement Analysis Lecture v2Dokument8 SeitenFinancial Statement Analysis Lecture v2Yaj CruzadaNoch keine Bewertungen

- Internship Report - 03 June 22Dokument12 SeitenInternship Report - 03 June 22Alina KujurNoch keine Bewertungen

- What Are Financial RatiosDokument3 SeitenWhat Are Financial RatiosChandria FordNoch keine Bewertungen

- Finman ReviewerDokument17 SeitenFinman ReviewerSheila Mae Guerta LaceronaNoch keine Bewertungen

- Statement of Cash Flows: Preparation, Presentation, and UseVon EverandStatement of Cash Flows: Preparation, Presentation, and UseNoch keine Bewertungen

- Financial Accounting and Analysis (B)Dokument16 SeitenFinancial Accounting and Analysis (B)sushainkapoor photoNoch keine Bewertungen

- International Financial Statement AnalysisVon EverandInternational Financial Statement AnalysisBewertung: 1 von 5 Sternen1/5 (1)

- Financial Services Firms: Governance, Regulations, Valuations, Mergers, and AcquisitionsVon EverandFinancial Services Firms: Governance, Regulations, Valuations, Mergers, and AcquisitionsNoch keine Bewertungen

- From Business Activities To Financial Statements: Four Key Components of Effective Financial Statement AnalysisDokument30 SeitenFrom Business Activities To Financial Statements: Four Key Components of Effective Financial Statement Analysis10061979Noch keine Bewertungen

- Chapter No. 8: Financial Statements AnalysisDokument23 SeitenChapter No. 8: Financial Statements AnalysisBalakrishna ChakaliNoch keine Bewertungen

- The Comprehensive Guide on How to Read a Financial Report: Wringing Vital Signs Out of the NumbersVon EverandThe Comprehensive Guide on How to Read a Financial Report: Wringing Vital Signs Out of the NumbersBewertung: 2 von 5 Sternen2/5 (1)

- What Are Financial Ratios?: Corporate Finance InstituteDokument9 SeitenWhat Are Financial Ratios?: Corporate Finance InstituteJNoch keine Bewertungen

- Financial Management Source #7Dokument49 SeitenFinancial Management Source #7EDPSENPAINoch keine Bewertungen

- Analyzing Common Stocks PPT at BEC DOMSDokument47 SeitenAnalyzing Common Stocks PPT at BEC DOMSBabasab Patil (Karrisatte)Noch keine Bewertungen

- Evaluation of Financial StatusDokument2 SeitenEvaluation of Financial StatuseightNoch keine Bewertungen

- Midterm Departmental Examination Multiple Choice. Identify The Choice That Completes The Statement or Answers The QuestionDokument5 SeitenMidterm Departmental Examination Multiple Choice. Identify The Choice That Completes The Statement or Answers The QuestionRandy ManzanoNoch keine Bewertungen

- Quiz SummaryDokument13 SeitenQuiz SummarydancinhomerNoch keine Bewertungen

- Work # 1 Financial Analysis - World of Games 2015 (2500 Words) April 28, 2016Dokument13 SeitenWork # 1 Financial Analysis - World of Games 2015 (2500 Words) April 28, 2016Assignment HelperNoch keine Bewertungen

- Module 1 Interpretations of Financial StatementsDokument21 SeitenModule 1 Interpretations of Financial StatementsPushpaNoch keine Bewertungen

- Fin621 Hira Khan QuizzDokument16 SeitenFin621 Hira Khan QuizzMadiha KhanNoch keine Bewertungen

- Current Assets Current LiabilitiesDokument7 SeitenCurrent Assets Current LiabilitiesShubham GuptaNoch keine Bewertungen

- Finance For Non-Finance PeopleDokument18 SeitenFinance For Non-Finance PeopleSyed Muhammad AsimNoch keine Bewertungen

- Essentials of Financial Statement Analysis: Revsine/Collins/Johnson/Mittelstaedt: Chapter 5Dokument16 SeitenEssentials of Financial Statement Analysis: Revsine/Collins/Johnson/Mittelstaedt: Chapter 51220helen2000Noch keine Bewertungen

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"Von Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"Noch keine Bewertungen

- Chapter 8Dokument6 SeitenChapter 8Nor AzuraNoch keine Bewertungen

- Earnings and Cash Flow Analysis: SlidesDokument6 SeitenEarnings and Cash Flow Analysis: Slidestahera aqeelNoch keine Bewertungen

- Financial Analysis and Long-Term Planning: May Anne Aves BS Accountancy IIIDokument3 SeitenFinancial Analysis and Long-Term Planning: May Anne Aves BS Accountancy IIIMeyannaNoch keine Bewertungen

- Equity Research Interview Questions and AnswersDokument22 SeitenEquity Research Interview Questions and AnswersHarsh JainNoch keine Bewertungen

- Lesson 2A - Financial RatiosDokument4 SeitenLesson 2A - Financial RatiosButchoy ButchukoyNoch keine Bewertungen

- Financial Management - Chapter 8Dokument23 SeitenFinancial Management - Chapter 8rksp99999Noch keine Bewertungen

- Asignación 2 FSRADokument5 SeitenAsignación 2 FSRAElia SantanaNoch keine Bewertungen

- Chapter 7 - Cash Flow AnalysisDokument18 SeitenChapter 7 - Cash Flow AnalysisulfaNoch keine Bewertungen

- Ratio AnalysisDokument6 SeitenRatio AnalysisMilcah QuisedoNoch keine Bewertungen

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)Von EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)Noch keine Bewertungen

- Principles of Finance Chapter07 BlackDokument115 SeitenPrinciples of Finance Chapter07 BlackLim Mei Suok100% (1)

- Pegasus W200Dokument56 SeitenPegasus W200Aleixandre GomezNoch keine Bewertungen

- Tazkira Mujaddid AlfesaniDokument53 SeitenTazkira Mujaddid AlfesanisayedNoch keine Bewertungen

- Naskah IschialgiaDokument9 SeitenNaskah IschialgiaPuspo Wardoyo100% (1)

- Eapp Las Q3 Week 1Dokument8 SeitenEapp Las Q3 Week 1Maricel VallejosNoch keine Bewertungen

- Social PsychologyDokument6 SeitenSocial Psychologyshakti1432ss100% (3)

- Syllabus Spring 2021Dokument17 SeitenSyllabus Spring 2021Eden ParkNoch keine Bewertungen

- CE GATE'2017 Paper 02 Key Solution PDFDokument29 SeitenCE GATE'2017 Paper 02 Key Solution PDFgolaNoch keine Bewertungen

- Areopagitica - John MiltonDokument1 SeiteAreopagitica - John MiltonwehanNoch keine Bewertungen

- Sales Manager Job DescriptionDokument8 SeitenSales Manager Job Descriptionsalesmanagement264Noch keine Bewertungen

- Form A HypothesisDokument2 SeitenForm A Hypothesismrshong5bNoch keine Bewertungen

- The Java Collections Framework: InterfacesDokument22 SeitenThe Java Collections Framework: InterfacesSourav DasNoch keine Bewertungen

- Grade Three U3l2Dokument84 SeitenGrade Three U3l2Mohamed ElsisyNoch keine Bewertungen

- EY Global Hospitality Insights 2016Dokument24 SeitenEY Global Hospitality Insights 2016Anonymous BkmsKXzwyKNoch keine Bewertungen

- 01.performing Hexadecimal ConversionsDokument11 Seiten01.performing Hexadecimal ConversionsasegunloluNoch keine Bewertungen

- @PAKET A - TPM BAHASA INGGRIS KuDokument37 Seiten@PAKET A - TPM BAHASA INGGRIS KuRamona DessiatriNoch keine Bewertungen

- Hard Rock Miner - S Handbook - Jack de La Vergne - Edition 3 - 2003Dokument330 SeitenHard Rock Miner - S Handbook - Jack de La Vergne - Edition 3 - 2003Adriel senciaNoch keine Bewertungen

- Decoding The Ancient Kemetic CalendarDokument9 SeitenDecoding The Ancient Kemetic CalendarOrockjo75% (4)

- Part DDokument6 SeitenPart DKaranja KinyanjuiNoch keine Bewertungen

- Theology NotesDokument3 SeitenTheology NotesNia De GuzmanNoch keine Bewertungen

- Rule 108 Republic Vs TipayDokument1 SeiteRule 108 Republic Vs TipayShimi Fortuna100% (1)

- Form Filling & Submission QueriesDokument3 SeitenForm Filling & Submission QueriesMindbanNoch keine Bewertungen

- Playing Djembe PDFDokument63 SeitenPlaying Djembe PDFpbanerjeeNoch keine Bewertungen

- Revised Poea Rules and Regulations Governing RecruitmentDokument8 SeitenRevised Poea Rules and Regulations Governing RecruitmenthansNoch keine Bewertungen

- Amazon PrimeDokument27 SeitenAmazon PrimeMohamedNoch keine Bewertungen

- Class 11 Biology Notes Chapter 2 Studyguide360Dokument10 SeitenClass 11 Biology Notes Chapter 2 Studyguide360ANoch keine Bewertungen

- Unit 25 Sound Recording Lab LacDokument16 SeitenUnit 25 Sound Recording Lab Lacapi-471521676Noch keine Bewertungen

- ShindaiwaDgw311DmUsersManual204090 776270414Dokument37 SeitenShindaiwaDgw311DmUsersManual204090 776270414JGT TNoch keine Bewertungen

- Sol2e Printables Unit 5ADokument2 SeitenSol2e Printables Unit 5AGeorgio SentialiNoch keine Bewertungen

- The Next Generation: DSD Rotary Screw CompressorsDokument2 SeitenThe Next Generation: DSD Rotary Screw CompressorsВасилий ЗотовNoch keine Bewertungen

- 04 TP FinancialDokument4 Seiten04 TP Financialbless erika lendroNoch keine Bewertungen