Beruflich Dokumente

Kultur Dokumente

Troubleshooter: Leap in Pet Premiums: Laura Whateley - The Times

Hochgeladen von

api-173451071Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Troubleshooter: Leap in Pet Premiums: Laura Whateley - The Times

Hochgeladen von

api-173451071Copyright:

Verfügbare Formate

Troubleshooter: leap in pet premiums

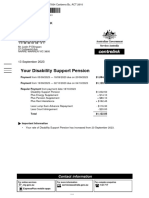

Laura Whateley The Times Published at 12:01AM, January 26 2013 I have a Scottish terrier called Harry. He has been insured with Sainsburys since November 2008, when I paid 54.60-a-month premiums until November 2010, when they went up to 81.50. Then, in November 2011, the premium went up to 142.62. Harry had been healthy and I hadnt claimed in the preceding year. I was appalled at a rise of 75 per cent. However, I kept paying, as Harry was 13 and, although healthy, I had never known a Scottie to reach the age of 14. I thought I might need the insurance. I checked my bank statement on Christmas Eve and was astonished that the amount Sainsburys had taken out of my bank account was 226.37 in November and December. I hadnt received any renewal documents. I rang up Sainsburys, cancelled the insurance, and asked for my premiums back. Sainsburys said no because my policy renewed automatically and I had not cancelled within 14 days. Jann Grant, via e-mail It is unclear why Jann did not receive anything alerting her to this crazy premium increase. A spokesman for Sainsburys explains: We issued renewal documents as usual. Were sorry that these appear not to have reached Ms Grant. We automatically renew cover each year unless the customer cancels the policy. This is designed to ensure the animal is always protected. Sainsburys has now taken the opportunity to review Ms Grants individual circumstances again and would like to recognise her loyalty by agreeing to refund November and Decembers premiums, and has also offered 30 of Sainsburys vouchers with best wishes. This is good news, but lets dwell for a moment on that premium rise, of 60 per cent in the past year. To get some perspective on this I had a word with a friend who is a small-animal vet. I ask what he could do for 3,000 a year the amount that Jann would be paying Sainsburys just to insure against unexpectedly high vet bills. He says exploratory surgery to remove a lump from a dog, and keep it in hospital for a few days to recover. Twice over. One of the most expensive procedures would be to repair a fracture, which cost in the region of 1,500 to 2,000. Bearing in mind that Janns Scottie is 13, you are unlikely to make the decision to go ahead with such expensive, gruelling treatment anyway. And thats not the least of it: claimants on the Sainsburys policy also have to pay an excess of 15 per cent. Given that Harry has no pre-existing conditions, and Jann has only ever claimed twice, once for a 68.84 bill in 2009 and another for 701.25 for dental treatment in September 2010, shed be better off keeping the premiums under her mattress than pumping them into insurance that is far more expensive than the costs it is supposed to protect against. Sainsburys says that the 60 per cent rise, on top of a previous 75 per cent rise overall, her policy has jumped by more than 300 per cent in four years was down to vets getting pricier. We calculate premiums based on factors including age, breed and claims history. Unfortunately, vet fees are continuing to rise due to advances in treatment, which means our pets have never received better veterinary care, but it does cost more. Yes, expensive treatments such as chemotherapy are increasingly fashionable in a country mad about Lolcat videos and pets, but I struggle to believe that advances in science have pushed up the costs of seeing a vet by 60 per cent in the past few months alone.

Das könnte Ihnen auch gefallen

- Ab Whyyouneedins Fillable 10 MattseamanDokument2 SeitenAb Whyyouneedins Fillable 10 Mattseamanapi-290923903Noch keine Bewertungen

- Universal Credit What You'Ll Get - GOV - UkDokument1 SeiteUniversal Credit What You'Ll Get - GOV - UkkarenfergieNoch keine Bewertungen

- Top 100 Pet Blogs and Websites To Observe in 2021kuegvDokument9 SeitenTop 100 Pet Blogs and Websites To Observe in 2021kuegvicoincryptos1102Noch keine Bewertungen

- Your Quote - Pet Insurance - TescoDokument12 SeitenYour Quote - Pet Insurance - TescoRBXdinosaurNoch keine Bewertungen

- GeneralPolicyWording-V9 3Dokument21 SeitenGeneralPolicyWording-V9 3Phoebe BurrisNoch keine Bewertungen

- Pet Insurance BY 121823605030Dokument15 SeitenPet Insurance BY 121823605030Sri HarshaNoch keine Bewertungen

- Topic: Pet Insurance Why Pet Insurance Is Not Worth ItDokument6 SeitenTopic: Pet Insurance Why Pet Insurance Is Not Worth ItOdumogu ChristianNoch keine Bewertungen

- SM Accounting Newsletter Spring 2011Dokument4 SeitenSM Accounting Newsletter Spring 2011smaccountingNoch keine Bewertungen

- Important Information - J310118916Dokument2 SeitenImportant Information - J310118916Justin EllingsenNoch keine Bewertungen

- Motoring Troubles: Winter 2014Dokument4 SeitenMotoring Troubles: Winter 2014api-273967536Noch keine Bewertungen

- IPS AIO - DSI - MWPA - 100Rs Per Day - 15LCIDokument2 SeitenIPS AIO - DSI - MWPA - 100Rs Per Day - 15LCIvikas pallaNoch keine Bewertungen

- Kezia Dugdale Writes To SNP MPsDokument97 SeitenKezia Dugdale Writes To SNP MPsScottish Labour PartyNoch keine Bewertungen

- The Hidden Value in Your Life Insurance: Funds for Your RetirementVon EverandThe Hidden Value in Your Life Insurance: Funds for Your RetirementNoch keine Bewertungen

- Your Policy ExplainedDokument29 SeitenYour Policy ExplaineddeonptNoch keine Bewertungen

- Pet Insurance ProjectDokument51 SeitenPet Insurance ProjectMohit Zaveri100% (5)

- Weight WatchersDokument1 SeiteWeight WatchersDigital MediaNoch keine Bewertungen

- HWP T Cs - Nov2020 v3Dokument5 SeitenHWP T Cs - Nov2020 v3api-194777754Noch keine Bewertungen

- Important Information About Your Insurance: GPO Box 1901 Melbourne VIC 3001 Australia T 1300 300 273 F 1300 366 273Dokument8 SeitenImportant Information About Your Insurance: GPO Box 1901 Melbourne VIC 3001 Australia T 1300 300 273 F 1300 366 273Antoine Nabil ZakiNoch keine Bewertungen

- RSPCA Vet Fee Claim Form SecuredDokument2 SeitenRSPCA Vet Fee Claim Form SecuredMihaela LetNoch keine Bewertungen

- Final BudgetDokument13 SeitenFinal Budgetapi-354625480Noch keine Bewertungen

- Puppycontract FoxxDokument3 SeitenPuppycontract FoxxblinkypoetNoch keine Bewertungen

- Dog and Cat Insurance Home and Lifestyle Product Information DocumentDokument2 SeitenDog and Cat Insurance Home and Lifestyle Product Information DocumentTomNoch keine Bewertungen

- Bring Your Life To Full Bloom: The Way You Want, Worry-FreeDokument14 SeitenBring Your Life To Full Bloom: The Way You Want, Worry-FreeMohammad Aizat AzlanNoch keine Bewertungen

- What Your Doctor Wants You to Know to Crush Medical Debt: A Health System Insider's 3 Steps to Protect Yourself from America's #1 Cause of BankruptcyVon EverandWhat Your Doctor Wants You to Know to Crush Medical Debt: A Health System Insider's 3 Steps to Protect Yourself from America's #1 Cause of BankruptcyNoch keine Bewertungen

- Highborn Adult ContractDokument3 SeitenHighborn Adult Contractapi-323018844Noch keine Bewertungen

- Recovery Hospital Cash FactsheetDokument4 SeitenRecovery Hospital Cash FactsheetMuhammad ArifinNoch keine Bewertungen

- CANINEHealthy Pets Plus BrochureDokument2 SeitenCANINEHealthy Pets Plus Brochurewhiskey13Noch keine Bewertungen

- Project of Management of Financial Services: General Insurance (Pet Insurance)Dokument18 SeitenProject of Management of Financial Services: General Insurance (Pet Insurance)shitijmalhotraNoch keine Bewertungen

- Pawsitively Affordable: A Guide to Free and Low-Cost Pet CareVon EverandPawsitively Affordable: A Guide to Free and Low-Cost Pet CareNoch keine Bewertungen

- Closing ScriptDokument7 SeitenClosing ScriptAdnan JavedNoch keine Bewertungen

- Health InsuranceDokument1 SeiteHealth Insuranceapi-473034142Noch keine Bewertungen

- PacketDokument21 SeitenPacketKelly MarshNoch keine Bewertungen

- MN - 2015 09 01Dokument32 SeitenMN - 2015 09 01mooraboolNoch keine Bewertungen

- Great Dane Limited ContractDokument9 SeitenGreat Dane Limited Contractapi-391051712Noch keine Bewertungen

- KILL BILLS!: The 9 Insider Tricks You Need to Win the War on Household BillsVon EverandKILL BILLS!: The 9 Insider Tricks You Need to Win the War on Household BillsNoch keine Bewertungen

- Increasing Pet Insurance AwarenessDokument1 SeiteIncreasing Pet Insurance AwarenesspetsofhealthNoch keine Bewertungen

- The Coming Baby Boomer Crisis: How to Protect YourselfVon EverandThe Coming Baby Boomer Crisis: How to Protect YourselfNoch keine Bewertungen

- Sitter-Support Client Agreement 2Dokument4 SeitenSitter-Support Client Agreement 2api-173462628Noch keine Bewertungen

- HPB HSA Advisory On VapingDokument2 SeitenHPB HSA Advisory On VapingjamaniNoch keine Bewertungen

- Comprehensive Female Protection: Personal Accident Plan For WomenDokument24 SeitenComprehensive Female Protection: Personal Accident Plan For WomenPORTME. MYNoch keine Bewertungen

- Pet Health Insurance:A Veterinarian's PerspectiveVon EverandPet Health Insurance:A Veterinarian's PerspectiveBewertung: 5 von 5 Sternen5/5 (1)

- Pet Health Scheme Application FormDokument2 SeitenPet Health Scheme Application Formapi-344912314Noch keine Bewertungen

- Pet Care ReimbursementDokument3 SeitenPet Care ReimbursementAnkit SheoranNoch keine Bewertungen

- Prestigious Pets Lawsuit: Texas Attorney Tom Fleischer Cease & Desist LetterDokument4 SeitenPrestigious Pets Lawsuit: Texas Attorney Tom Fleischer Cease & Desist LetterDefiantly.netNoch keine Bewertungen

- What You Need To Know About Changes To BenefitsDokument10 SeitenWhat You Need To Know About Changes To BenefitsserengroupNoch keine Bewertungen

- OE Powerpoint PresentationDokument35 SeitenOE Powerpoint PresentationAnonymous ibpKT07GNoch keine Bewertungen

- 33 QuestionsDokument11 Seiten33 QuestionsItsJust HamnaNoch keine Bewertungen

- "Angry, Upset, Embarrassed" - Scam Victims On Losing Life Savings and Battling With Mental FalloutDokument4 Seiten"Angry, Upset, Embarrassed" - Scam Victims On Losing Life Savings and Battling With Mental FalloutDance-Off 15Noch keine Bewertungen

- FWD Maid Policy ContractDokument24 SeitenFWD Maid Policy ContractgNoch keine Bewertungen

- Your Neighbourhood Issue 6Dokument4 SeitenYour Neighbourhood Issue 6YoungPeopleAheadNoch keine Bewertungen

- PayAssure InfomationDokument2 SeitenPayAssure InfomationMun Kit100% (1)

- FijiTimes - June 8 2012 PDFDokument48 SeitenFijiTimes - June 8 2012 PDFfijitimescanadaNoch keine Bewertungen

- "The Group With The Scoop": TH e Rules of Fi Nancial Security Are Diff Erent Now You Are The First!!Dokument4 Seiten"The Group With The Scoop": TH e Rules of Fi Nancial Security Are Diff Erent Now You Are The First!!Tim MileyNoch keine Bewertungen

- Pet Insurance ProductDokument2 SeitenPet Insurance ProductJD BeanNoch keine Bewertungen

- Prairie FestDokument1 SeitePrairie FestLaura Kay ProsserNoch keine Bewertungen

- High Price of Winter: Free!Dokument8 SeitenHigh Price of Winter: Free!StaywellNoch keine Bewertungen

- Pet Insurance ProjectDokument51 SeitenPet Insurance Projecttamil maran.uNoch keine Bewertungen

- Spurs Likely To Pay AVB Less Than 3mDokument2 SeitenSpurs Likely To Pay AVB Less Than 3mapi-173451071Noch keine Bewertungen

- Spurs Should Go For The Older, Wiser HoddleDokument4 SeitenSpurs Should Go For The Older, Wiser Hoddleapi-173451071Noch keine Bewertungen

- Tim Sherwood Hopes To Have Last Word in Emmanuel Adebayor StoryDokument5 SeitenTim Sherwood Hopes To Have Last Word in Emmanuel Adebayor Storyapi-173451071Noch keine Bewertungen

- Bez: My Manifesto? The Best Bits Will Be Because of Acid': Michael Odell, The TimesDokument5 SeitenBez: My Manifesto? The Best Bits Will Be Because of Acid': Michael Odell, The Timesapi-173451071Noch keine Bewertungen

- Madness in The MethodDokument3 SeitenMadness in The Methodapi-173451071Noch keine Bewertungen

- Things Never Get Much Better Than All Right' in Leeds: Rory Smith, The TimesDokument5 SeitenThings Never Get Much Better Than All Right' in Leeds: Rory Smith, The Timesapi-173451071Noch keine Bewertungen

- André Villas-Boas: Facial Hair Today, Gone TomorrowDokument8 SeitenAndré Villas-Boas: Facial Hair Today, Gone Tomorrowapi-173451071Noch keine Bewertungen

- It's Strictly Business As Far As Levy Is ConcernedDokument2 SeitenIt's Strictly Business As Far As Levy Is Concernedapi-173451071Noch keine Bewertungen

- Exiled Emmanuel Adebayor Ready To Earn His Spurs After André Villas-Boas ExitDokument2 SeitenExiled Emmanuel Adebayor Ready To Earn His Spurs After André Villas-Boas Exitapi-173451071Noch keine Bewertungen

- Spurs Going BackwardsDokument3 SeitenSpurs Going Backwardsapi-173451071Noch keine Bewertungen

- London Visit Inspired René Magritte To Don Iconic Bowler HatDokument2 SeitenLondon Visit Inspired René Magritte To Don Iconic Bowler Hatapi-173451071Noch keine Bewertungen

- Being Put On Pedestal Will Test Gareth Bale As He Explores New HorizonDokument5 SeitenBeing Put On Pedestal Will Test Gareth Bale As He Explores New Horizonapi-173451071Noch keine Bewertungen

- Soundcheque: Helping Aspiring Music-Makers Find SuccessDokument2 SeitenSoundcheque: Helping Aspiring Music-Makers Find Successapi-173451071Noch keine Bewertungen

- Real Madrid's Valuation of Gareth Bale Is MadnessDokument2 SeitenReal Madrid's Valuation of Gareth Bale Is Madnessapi-173451071Noch keine Bewertungen

- Gareth Bale Could Have Played Last Game For Tottenham'Dokument2 SeitenGareth Bale Could Have Played Last Game For Tottenham'api-173451071Noch keine Bewertungen

- Suarez Is Top Spurs TargetDokument2 SeitenSuarez Is Top Spurs Targetapi-173451071Noch keine Bewertungen

- André Villas-Boas Criticises Carlo Ancelotti Over Public Gareth Bale BidDokument2 SeitenAndré Villas-Boas Criticises Carlo Ancelotti Over Public Gareth Bale Bidapi-173451071Noch keine Bewertungen

- Daniel Levy's Defiance Leaves Spurs A Work in Progress: Rory Smith, The TimesDokument4 SeitenDaniel Levy's Defiance Leaves Spurs A Work in Progress: Rory Smith, The Timesapi-173451071Noch keine Bewertungen

- Caitlin Moran On TV: Whenever Pop Is Ambitious, It's Thanks To BowieDokument4 SeitenCaitlin Moran On TV: Whenever Pop Is Ambitious, It's Thanks To Bowieapi-173451071Noch keine Bewertungen

- Bale: The Real DealDokument4 SeitenBale: The Real Dealapi-173451071Noch keine Bewertungen

- Tom Huddlestone Plans Show of Strength Over His Next MoveDokument4 SeitenTom Huddlestone Plans Show of Strength Over His Next Moveapi-173451071Noch keine Bewertungen

- Moussa Dembélé Claims Tottenham Will Step Up To Fill Void Left by Gareth BaleDokument3 SeitenMoussa Dembélé Claims Tottenham Will Step Up To Fill Void Left by Gareth Baleapi-173451071Noch keine Bewertungen

- Win or Lose, André Villa-Boas Has Been A Hit: Villas-Boas Has Steered Spurs To The Brink of A Top-Four FinishDokument2 SeitenWin or Lose, André Villa-Boas Has Been A Hit: Villas-Boas Has Steered Spurs To The Brink of A Top-Four Finishapi-173451071Noch keine Bewertungen

- Iain Banks 1954-2013Dokument4 SeitenIain Banks 1954-2013api-173451071Noch keine Bewertungen

- Real Will Go To World Record 85m For BaleDokument2 SeitenReal Will Go To World Record 85m For Baleapi-173451071Noch keine Bewertungen

- The Daily Rich List: The Richest Premier League Owners: Roman Abramovich and Girlfriend Dasha ZhukovaDokument12 SeitenThe Daily Rich List: The Richest Premier League Owners: Roman Abramovich and Girlfriend Dasha Zhukovaapi-173451071Noch keine Bewertungen

- David Bowie Breaks Album Silence With A Cryptic List of 42 WordsDokument4 SeitenDavid Bowie Breaks Album Silence With A Cryptic List of 42 Wordsapi-173451071Noch keine Bewertungen

- UntitledDokument7 SeitenUntitledapi-173451071Noch keine Bewertungen

- Why Britain Is Hooked On Happy Pills: James Davies Photographed by Mark Harrison. Still Life: Romas FoordDokument9 SeitenWhy Britain Is Hooked On Happy Pills: James Davies Photographed by Mark Harrison. Still Life: Romas Foordapi-173451071Noch keine Bewertungen

- Morrissey Saved From Death' But Told To Stop TouringDokument2 SeitenMorrissey Saved From Death' But Told To Stop Touringapi-173451071Noch keine Bewertungen

- 8 Most Common College DiseasesDokument13 Seiten8 Most Common College DiseasesgizleNoch keine Bewertungen

- Sains t2 PDFDokument6 SeitenSains t2 PDFSJK CHUNG HUA 4 1/2 四哩半中公Noch keine Bewertungen

- CN 9-12Dokument6 SeitenCN 9-12The Real UploaderNoch keine Bewertungen

- Manual de Endodoncia Basica V6Dokument6 SeitenManual de Endodoncia Basica V6evripidis tziokasNoch keine Bewertungen

- The PhiladelphiaDokument6 SeitenThe PhiladelphiaRyan CaddiganNoch keine Bewertungen

- Practice Prelim 3-KeyDokument3 SeitenPractice Prelim 3-KeyLauren PriscoNoch keine Bewertungen

- Gibberish WordsDokument4 SeitenGibberish WordsDaniel PopaNoch keine Bewertungen

- Chapter 41, Pages 527-537: Transport of Oxygen and Carbon Dioxide in Blood and Tissue FluidsDokument46 SeitenChapter 41, Pages 527-537: Transport of Oxygen and Carbon Dioxide in Blood and Tissue FluidsAlia HaiderNoch keine Bewertungen

- Flying Star WikiDokument14 SeitenFlying Star WikiOwlbear100% (1)

- Mark Scheme (Results) Summer 2021Dokument25 SeitenMark Scheme (Results) Summer 2021Gaia PhyllisNoch keine Bewertungen

- NCP Decrease Cardiac OutputDokument2 SeitenNCP Decrease Cardiac OutputAnonymous 2hJKVrNoch keine Bewertungen

- Lung ModelDokument6 SeitenLung ModelGülşah Öztürk KadıhasanoğluNoch keine Bewertungen

- Hi-Yield Notes in Im & PediaDokument20 SeitenHi-Yield Notes in Im & PediaJohn Christopher LucesNoch keine Bewertungen

- Formation of Faeces and DefecationDokument11 SeitenFormation of Faeces and Defecationbiologi88Noch keine Bewertungen

- Role of Homeopathy Medicine in Veterinary PracticeDokument30 SeitenRole of Homeopathy Medicine in Veterinary PracticeDr.Jibachha Sah,Vet.physician,author, & motivatorNoch keine Bewertungen

- 101 DalmatiansDokument2 Seiten101 Dalmatiansmacarong_uongsuatuoiNoch keine Bewertungen

- Background of The StudyDokument4 SeitenBackground of The StudyFerreze AnnNoch keine Bewertungen

- Haccp: (Hazard Analysis Critical Control Point)Dokument79 SeitenHaccp: (Hazard Analysis Critical Control Point)Sinta Wulandari100% (1)

- Chapter 1 MCNDokument14 SeitenChapter 1 MCNLawrence NemirNoch keine Bewertungen

- Case Analysis - FractureDokument7 SeitenCase Analysis - FractureMichelle TeodoroNoch keine Bewertungen

- Overgranulation: A. Muhammad Reva A.MDokument21 SeitenOvergranulation: A. Muhammad Reva A.Mgalih widodoNoch keine Bewertungen

- Animales en La Cultura YorubaDokument9 SeitenAnimales en La Cultura Yorubaaganju999Noch keine Bewertungen

- Brewer A A Treating Complete Dednture PatientsDokument16 SeitenBrewer A A Treating Complete Dednture PatientsGreen SleevesNoch keine Bewertungen

- Baylissascaris LarvisDokument136 SeitenBaylissascaris LarvisAlejoDubertiNoch keine Bewertungen

- Moxa PaperDokument20 SeitenMoxa PaperG.Noch keine Bewertungen

- Of Mice and Men TestDokument6 SeitenOf Mice and Men TestLadyRogueNoch keine Bewertungen

- What Bugs Hawaii: RoachesDokument1 SeiteWhat Bugs Hawaii: RoachesHonolulu Star-AdvertiserNoch keine Bewertungen

- Organs of Hearing and Tactile ResponsesDokument4 SeitenOrgans of Hearing and Tactile ResponsesNarasimha MurthyNoch keine Bewertungen

- Villanueva General Ordinance of 2009Dokument148 SeitenVillanueva General Ordinance of 2009Rogelio E. SabalbaroNoch keine Bewertungen

- Kozier's Peri Operative NSG ChecklistDokument15 SeitenKozier's Peri Operative NSG ChecklistMichaelNoch keine Bewertungen