Beruflich Dokumente

Kultur Dokumente

The Securities & Exchange Board of India Act, 1992 1) What Are The Object and Powers of SEBI Act, 1992?

Hochgeladen von

Sagar GadaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Securities & Exchange Board of India Act, 1992 1) What Are The Object and Powers of SEBI Act, 1992?

Hochgeladen von

Sagar GadaCopyright:

Verfügbare Formate

For Private Circulation only Chapter-07 The Securities & Exchange Board of India Act, 1992 1) What are

the object and powers of SEBI Act, 1992? Or Explain the role of SEBI for ensuring transparency in the securities market.

A] The objects of the SEBI Act are as follows: a) Protection of the interests of investors in securities. b) Promoting orderly and healthy growth of the securities market. c) Regulation of the securities market and other incidental matters. d) Promoting fair dealings by the issuer of securities and ensuring a market place where they can raise funds at a relatively low cost. e) Regulating and developing a code of conduct and fair practices by intermediaries like brokers, merchant bankers etc., with a view to making them more competitive and professional. f) Monitoring the activities of Stock Exchanges, Mutual fund and Merchant Bankers etc.

B] Powers of SEBI a. Regulating the business in stock exchange and any other securities markets. b. Registering and regulating the working of stock brokers, sub-brokers, share transfer agents, bankers to an issue, trustees of trust deeds, registrars to an issue, merchant bankers, underwriters, portfolio managers etc. c. Registering and regulating the working of the venture capital funds and collective investment schemes and mutual funds. d. Registering and regulating the function of depositories, participants, custodians of securities, foreign institutional investors, credit rating agencies and other intermediaries. e. Prohibiting fraudulent and unfair trade practices relating to securities markets. f. Prohibiting insider trading in securities. g. Regulating substantial acquisition of shares and take-over of companies.

h. Promoting investors education and training of intermediaries of securities markets. i. Perform powers under the provisions of the Securities Contracts (Regulation) Act, 1956, as may be delegated by the Central Government. j. Levying fees or other charges for carrying out the purpose of this section.

k. Calling for information and record from any bank or authority or board or corporation established by Central or State Government in respect of any transaction in securities which is under investigation or inquiry by the SEBI. l. Calling for information for inspection, Audit of stock exchanges, mutual funds ant other persons associated with the securities market, intermediaries and self regulatory organization in the securities market. m. Power to make inspection of any book or register or other documents of listed companies, public companies, which intends to get it securities listed on any recognized stock exchange. n. Powers of Civil Court as are vested in a civil court under the Code of Civil Procedure, 1908, while trying a suit in respect of following matter: i) The discovery and production of books account and other documents as specified by SEBI. ii) Summoning and enforcing the attendance of persons and examining them on oath. iii) Inspection of any books, registers, documents and records of company. iv) Issuing commission for the examination of witness or documents. o. Power to order for an inquiry or investigation in respect matter related to suspend the trading of any security in a recognized stock exchange, restrain person from accessing the securities market and prohibit any person associated with the securities market to buy or sell or deal in securities. p. Power to issue directors for inquiry in the interest of investors, or orderly development of securities market. 2) Securities Market Awareness Campaign (SMAC) SEBI launched a comprehensive education campaign aimed at creating awareness among investors about securities market. The following are the approach by SMAC: a) Workshop: Under this, the workshops are conducted to reach out the common investors, by the experts by delivering lectures and providing message on the

functioning of the securities market, fundamentals of investments and risk management. b) Advertisement: The SEBI prepared simple Dos and Donts for investors relating to various aspects of the securities market. The messages are spread across the investor base by way of advertisements in newspapers, especially in the regional newspapers. c) Educative Material: SEBI has prepared a standardized reading material and presentation materials for the workshops. Also SEBI has prepared reference guides on topics concerning investors. The materials are available in 10 major regional languages. d) Website Dedicated to Investor Education: SEBI has dedicated investor website (http://invstor.sebi.gov.in). It has also setup a simple and effective internet based response to investors. It ensure internet based registration of complaints and take immediate action on the grievances of investors. e) Radio: SEBI also provide information and investor guidance through radio frequently. f) Television: SEBI also provide cautionary message through major television channels.

Das könnte Ihnen auch gefallen

- Mastering the Art of Stock Brokering: Your Comprehensive Guide to Success in Financial MarketsVon EverandMastering the Art of Stock Brokering: Your Comprehensive Guide to Success in Financial MarketsNoch keine Bewertungen

- SEBI AssignmentDokument9 SeitenSEBI AssignmentDeepak KumarNoch keine Bewertungen

- SEBIDokument8 SeitenSEBISakshi rayNoch keine Bewertungen

- Security Analysis Project FinalDokument37 SeitenSecurity Analysis Project FinalDharodVarunNoch keine Bewertungen

- Topic 1 C Securities Exchanges.Dokument16 SeitenTopic 1 C Securities Exchanges.Tushar BhatiNoch keine Bewertungen

- Unit 8Dokument16 SeitenUnit 8tusharsharma72062Noch keine Bewertungen

- Role of SebiDokument81 SeitenRole of Sebimanwanimuki12Noch keine Bewertungen

- Introduction:-: Providing Liability To SecuritiesDokument10 SeitenIntroduction:-: Providing Liability To SecuritiespappunaagraajNoch keine Bewertungen

- Venu FMSDokument37 SeitenVenu FMSVenu GopalNoch keine Bewertungen

- Sebi Main ProjectDokument36 SeitenSebi Main ProjectMinal DalviNoch keine Bewertungen

- Internal Backlog Company Law Role of Sebi in Stock ExchangeDokument9 SeitenInternal Backlog Company Law Role of Sebi in Stock ExchangeApoorv SrivastavaNoch keine Bewertungen

- Purpose and Role of SEBIDokument4 SeitenPurpose and Role of SEBIMuskaan SinghNoch keine Bewertungen

- Mfsi Unit 4 FinalDokument15 SeitenMfsi Unit 4 Finalsauravnagpal309Noch keine Bewertungen

- Secondary Market/Stock Market Exchange (Se)Dokument36 SeitenSecondary Market/Stock Market Exchange (Se)nagniranjanNoch keine Bewertungen

- Corporate Law Project NewDokument10 SeitenCorporate Law Project NewAyushi VermaNoch keine Bewertungen

- Powers of SEBIDokument3 SeitenPowers of SEBIKhushbu ShrivastavNoch keine Bewertungen

- SEBI ActDokument2 SeitenSEBI ActPankaj2c100% (1)

- SEBIDokument24 SeitenSEBIYashviNoch keine Bewertungen

- Mission of SEBIDokument7 SeitenMission of SEBIananth100% (1)

- NSDL NotesDokument14 SeitenNSDL NotesAnmol RahangdaleNoch keine Bewertungen

- Functions of SebiDokument20 SeitenFunctions of SebiDeenanath SahuNoch keine Bewertungen

- The Securities and Exchange Board of India: ObjectivesDokument5 SeitenThe Securities and Exchange Board of India: ObjectivesAvinash HariramaniNoch keine Bewertungen

- Introduction To Stock MarketDokument13 SeitenIntroduction To Stock MarketasifanisNoch keine Bewertungen

- Sebi Capital Market InvestorsDokument34 SeitenSebi Capital Market Investors9887287779Noch keine Bewertungen

- Roles Functions Of: & SebiDokument61 SeitenRoles Functions Of: & SebiashviniNoch keine Bewertungen

- SEBI - Structure, Objectives, FunctionDokument12 SeitenSEBI - Structure, Objectives, FunctionShubham VermaNoch keine Bewertungen

- Functions of Stock ExchangeDokument7 SeitenFunctions of Stock ExchangeGhulam MurtazaNoch keine Bewertungen

- Securiti Es and Exchange Board of of India: Presented by Preetham Naveen Shreesha Nakul Prasad Murugesh Kumar DDokument19 SeitenSecuriti Es and Exchange Board of of India: Presented by Preetham Naveen Shreesha Nakul Prasad Murugesh Kumar DMurugesh KumarNoch keine Bewertungen

- SebiDokument18 SeitenSebiSandeep Galipelli50% (2)

- 2 MBL KA Jun16 78838Dokument14 Seiten2 MBL KA Jun16 78838Shrikant BudholiaNoch keine Bewertungen

- Market Regulator - SEBIDokument29 SeitenMarket Regulator - SEBISachin GaudNoch keine Bewertungen

- Law Final GauriDokument10 SeitenLaw Final GauriPoonam KhondNoch keine Bewertungen

- C Law Unit II - Securities Exchange Board of India (SEBI ACT)Dokument5 SeitenC Law Unit II - Securities Exchange Board of India (SEBI ACT)Mr. funNoch keine Bewertungen

- Long Answer - SebiDokument10 SeitenLong Answer - SebiAryanNoch keine Bewertungen

- About BSEC: 1. Administration & Finance (A&F) DepartmentDokument7 SeitenAbout BSEC: 1. Administration & Finance (A&F) DepartmentOmar Faruk SujonNoch keine Bewertungen

- Assignment: Course Title: Investment Banking Course Code: BI-405Dokument13 SeitenAssignment: Course Title: Investment Banking Course Code: BI-405Farabee FerdousNoch keine Bewertungen

- Capital Market Reforms and FfoDokument10 SeitenCapital Market Reforms and FfoVishruti Shah JobanputraNoch keine Bewertungen

- SEBI - Introduction: The Basic Objectives of The Board Were Identified AsDokument5 SeitenSEBI - Introduction: The Basic Objectives of The Board Were Identified AsSenthilKumar SubramanianNoch keine Bewertungen

- Equities in IndiaDokument3 SeitenEquities in Indiansrivastav1Noch keine Bewertungen

- SEBIDokument3 SeitenSEBIShradha GujarNoch keine Bewertungen

- SEBIDokument4 SeitenSEBINMRaycNoch keine Bewertungen

- 3 Market & SebiDokument7 Seiten3 Market & SebiSaloni AgrawalNoch keine Bewertungen

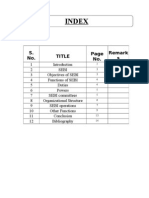

- Index: S. No. Title No. Remark SDokument17 SeitenIndex: S. No. Title No. Remark SSiddhi PatwaNoch keine Bewertungen

- Management Revised SyllabusDokument19 SeitenManagement Revised SyllabuskanikaNoch keine Bewertungen

- Capital MarketsDokument75 SeitenCapital MarketsnyawirahNoch keine Bewertungen

- Capital Market - Part-3 - Stock Exchange in IndiaDokument5 SeitenCapital Market - Part-3 - Stock Exchange in Indiaankurchauhan9304Noch keine Bewertungen

- Role of SebiDokument3 SeitenRole of SebiAnkush PoojaryNoch keine Bewertungen

- Establishment and Incorporation of BoardDokument5 SeitenEstablishment and Incorporation of BoardJanki PatelNoch keine Bewertungen

- Security MarketDokument30 SeitenSecurity Marketashish_k_srivastavaNoch keine Bewertungen

- Protection of The Interest of The InvestorDokument15 SeitenProtection of The Interest of The InvestorAnkitha ReddyNoch keine Bewertungen

- Online TradingDokument50 SeitenOnline TradingKeleti SanthoshNoch keine Bewertungen

- Investor Protection Measures by SebiDokument3 SeitenInvestor Protection Measures by SebiMitu Rana100% (1)

- BIRLA Sun LifeDokument18 SeitenBIRLA Sun LifeAbhishek KoriNoch keine Bewertungen

- SEBI As A Capital Market RegulatorDokument22 SeitenSEBI As A Capital Market RegulatorKamta Prasad SahuNoch keine Bewertungen

- Stock Market Mastery : Investing for Long-Term SuccessVon EverandStock Market Mastery : Investing for Long-Term SuccessNoch keine Bewertungen

- Commercial Dispute Resolution in China: An Annual Review and Preview 2021Von EverandCommercial Dispute Resolution in China: An Annual Review and Preview 2021Noch keine Bewertungen

- International Trade Finance: A NOVICE'S GUIDE TO GLOBAL COMMERCEVon EverandInternational Trade Finance: A NOVICE'S GUIDE TO GLOBAL COMMERCENoch keine Bewertungen

- Sebi Act 1992Dokument3 SeitenSebi Act 1992Sagar GadaNoch keine Bewertungen

- Crisil Sixth SemDokument47 SeitenCrisil Sixth SemSagar GadaNoch keine Bewertungen

- Sebi Act 1992Dokument3 SeitenSebi Act 1992Sagar GadaNoch keine Bewertungen

- Sebi Act 1992Dokument3 SeitenSebi Act 1992Sagar GadaNoch keine Bewertungen

- Sebi Act 1992Dokument3 SeitenSebi Act 1992Sagar GadaNoch keine Bewertungen

- Sebi Act 1992Dokument3 SeitenSebi Act 1992Sagar GadaNoch keine Bewertungen

- Money Market FundDokument3 SeitenMoney Market Fundspark_123Noch keine Bewertungen

- Equity Portfolio ManagementDokument31 SeitenEquity Portfolio ManagementSagar GadaNoch keine Bewertungen

- Overview Bank Smit BagadiaDokument43 SeitenOverview Bank Smit BagadiaSagar GadaNoch keine Bewertungen

- Money Market InstrumentsDokument22 SeitenMoney Market Instrumentspradeeprajendran1988Noch keine Bewertungen

- Exim Bank NFTP PresentationDokument30 SeitenExim Bank NFTP PresentationSagar GadaNoch keine Bewertungen