Beruflich Dokumente

Kultur Dokumente

TVS Motor, 4th February, 2013

Hochgeladen von

Angel BrokingCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

TVS Motor, 4th February, 2013

Hochgeladen von

Angel BrokingCopyright:

Verfügbare Formate

3QFY2013 Result Update | Automobile

February 1, 2013

TVS Motor Company

Performance Highlights

Quarterly highlights (Standalone)

Y/E March (` cr) Net Sales EBITDA Adj. EBITDA margin (%) Adj. PAT 3QFY13 1,799 107 5.9 52 3QFY12 1,775 129 7.2 57 % chg (yoy) 1.3 (16.8) (130)bp (7.2) 2QFY13 1,691 101 6.0 45 % chg (qoq) 6.4 5.7 (4)bp 16.1

ACCUMULATE

CMP Target Price

Investment Period

Stock Info Sector Market Cap (` cr) Net Debt (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code Automobile 2,024 638 1.3 56/32 317,508 1.0 19,781 5,999 TVSM.BO TVSL@IN

`43 `47

12 Months

Source: Company, Angel Research

For 3QFY2013, TVS Motor Company (TVSL) reported lower-than-expected results on the bottom-line front primarily owing to EBITDA margin pressures. The EBITDA margin remained stable on a sequential basis at 5.9%, lower than our expectations of 6.5%, led by higher promotional expenditure related to the launch of Phoenix and the festival season. Going ahead, the recent launch of Phoenix, coupled with the impending launches of two scooters, one motorcycle and a diesel three-wheeler in FY2014 is expected to boost volumes and enable the company recover some lost ground in FY2014. Additionally, reduction in interest cost due to retiring of interest bearing debt will also boost profitability going ahead. Due to attractive valuations, we maintain our Accumulate rating on the stock. Lower-than-expected bottom-line performance: For 3QFY2013, TVSL registered a modest growth of 1.3% yoy (6.4% qoq) in its top-line to `1,799cr due to a 2.1% yoy (up 6.7% qoq) decline in volumes led by the slowdown in the two-wheeler industry and increasing competition. On the operating front, the EBITDA margin came in at 5.9%, witnessing a decline of 130bp yoy (flat qoq) primarily due to higher promotional expenditure related to the launch of Phoenix and also on account of the festival season. The raw-material cost as a percentage of sales however, remained stable on a yoy as well as qoq basis. Consequently, the net profit posted a decline of 7.2% yoy (up 16.1% qoq on higher volumes) to `52cr as against our expectations of `59cr. On the positive side, interest expense declined 15.1% yoy (22.4% qoq) as the company reduced its interest bearing debt by `180cr in 9MFY2013. Outlook and valuation: We expect the companys by new launches) and register a growth of 8% in of 8.5% in FY2013. At `43, TVSL is trading 8.1x FY2014E earnings. We therefore maintain stock with a target price of `47. total volumes to recover (driven FY2014 after posting a decline at an attractive valuation of our Accumulate rating on the

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 57.4 24.0 2.3 16.3

Abs. (%) Sensex TVS Motor

3m 6.6 10.2

1yr 14.3 (18.9)

3yr 20.9 15.2

Key financials (Standalone)

Y/E March (` cr) Net Sales % chg Net Profit % chg EBITDA (%) EPS (`) P/E (x) P/BV (x) RoE (%) RoCE (%) EV/Sales (x) EV/EBITDA (x)

Source: Company, Angel Research

FY2011 6,288 41.9 199 65.7 6.2 4.2 10.2 2.0 21.3 15.2 0.3 5.1

FY2012 7,126 13.3 249 25.3 6.6 5.2 8.1 1.7 22.9 18.5 0.3 3.8

FY2013E 7,019 (1.5) 202 (18.6) 6.0 4.3 10.0 1.6 16.4 14.5 0.2 3.8

FY2014E 7,827 11.5 251 23.8 6.3 5.3 8.1 1.4 18.0 16.9 0.2 2.9

Yaresh Kothari

022-3935 7800 Ext: 6844 yareshb.kothari@angelbroking.com

Please refer to important disclosures at the end of this report

TVS Motor Company | 3QFY2013 Result Update

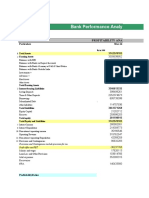

Exhibit 1: Quarterly financial performance (Standalone)

Y/E March (` cr) Net Sales Consumption of RM (% of Sales) Staff Costs (% of Sales) Purchase of goods (% of Sales) Other Expenses (% of Sales) Total Expenditure Operating Profit OPM (%) Interest Depreciation Other Income PBT (excl. Extr. Items) Extr. Income/(Expense) PBT (incl. Extr. Items) (% of Sales) Provision for Taxation (% of PBT) Reported PAT Adj PAT Adj. PATM Equity capital (cr) Reported EPS (`)

Source: Company, Angel Research

3QFY13 1,799 1,256 69.8 104 5.8 40 2.2 292 16.3 1,692 107 5.9 12 33 5 67 67 3.7 15 21.7 52 52 2.9 47.5 1.1

3QFY12 1,775 1,243 70.0 90 5.1 35 2.0 278 15.6 1,647 129 7.2 14 30 (10) 76 76 4.3 19 25.2 57 57 3.2 47.5 1.2

% chg (yoy) 1.3 1.0 15.2 12.2 5.3 2.8 (16.8) (15.1) 11.0 (147.7) (11.3) (11.3) (23.5) (7.2) (7.2)

2QFY13 1,691 1,185 70.1 108 6.4 37 2.2 259 15.3 1,589 101 6.0 15 32 4 58 58 3.4 13 22.3 45 45 2.7 47.5

% chg (qoq) 6.4 5.9 (3.2) 6.3 13.0 6.5 5.7 (22.4) 2.5 11 15.2 15.2 12.1 (2.7) 16.1 16.1

9MFY13 5,310 3,745 70.5 314 5.9 110 2.1 825 15.5 4,994 316 5.9 42 96 14 191 191 3.6 43 22.2 149 149 2.8 47.5

9MFY12 5,513 3,965 71.9 274 5.0 107 1.9 782 14.2 5,129 384 7.0 44 86 0 255 255 4.6 62 24.5 193 193 3.5 47.5 4.1

% chg (yoy) (3.7) (5.5) 14.6 2.2 5.5 (2.6) (17.8) (3.0) 11.6 3,618.9 (25.0) (25.0) (31.9) (22.7) (22.7)

(7.2)

1.0

16.1

3.1

(22.8)

Exhibit 2: 3QFY2013 Actual vs Angel estimates

Y/E March (` cr) Net Sales EBITDA EBITDA margin (%) Adj. PAT

Source: Company, Angel Research

Actual 1,799 107 5.9 52

Estimates 1,826 119 6.5 59

Variation (%) (1.5) (10.4) (59)bp (11.0)

February 1, 2013

TVS Motor Company | 3QFY2013 Result Update

Exhibit 3: Quarterly volume performance

(unit) Total volumes Domestic Exports Motorcycles Domestic Exports Total motorcycles Scooters Domestic Exports Total scooters Mopeds Domestic Exports Total mopeds Three-wheelers Domestic Exports Total three-wheelers 4,707 8,895 13,602 3,760 5,181 8,941 25.2 71.7 52.1 4,539 7,674 12,213 3.7 15.9 11.4 7,806 13,486 21,292 6,235 15,749 21,984 25.2 (14.4) (3.1) 193,677 985 194,662 186,472 2,796 189,268 3.9 (64.8) 2.8 183,335 448 183,783 5.6 119.9 5.9 386,582 1,076 387,658 383,531 4,939 388,470 0.8 (78.2) (0.2) 107,666 4,141 111,807 128,052 8,498 136,550 (15.9) (51.3) (18.1) 117,220 1,881 119,101 (8.2) 120.1 (6.1) 222,586 9,347 231,933 257,620 17,365 274,985 (13.6) (46.2) (15.7) 153,413 44,873 198,286 142,516 52,406 194,922 7.6 (14.4) 1.7 124,935 45,891 170,826 22.8 (2.2) 16.1 267,348 96,824 364,172 330,670 123,125 453,795 (19.1) (21.4) (19.7) 3QFY13 518,357 459,463 58,894 3QFY12 529,681 460,800 68,881 % chg (yoy) (2.1) (0.3) (14.5) 2QFY13 485,923 430,029 55,894 % chg (qoq) 6.7 6.8 5.4 9MFY13 1,005,055 884,322 120,733 9MFY12 1,139,234 978,056 161,178 % chg (yoy) (11.8) (9.6) (25.1)

Source: Company, Angel Research

Modest top-line growth of 1.3% yoy as volumes declined 2.1% yoy: For 3QFY2013, TVSLs top-line registered a modest growth of 1.3% yoy to `1,799cr mainly due to a 2.1% yoy decline in volumes during the quarter. Nonetheless, net average realization increased 4.2% yoy (flat qoq) during the quarter. The weak volume performance can be attributed to a general slowdown in the two-wheeler industry and also increasing competition from Honda Motorcycle and Scooters India Ltd (HMSI). As a result, scooter volume registered a sharp decline of 18.1% yoy and motorcycle sales posted a sluggish growth of 1.7% yoy. Three-wheeler sales on the other hand staged a recovery, posting a 52.1% yoy (11.4% qoq) growth. On a sequential basis though, the top-line grew by 6.4% driven by a volume growth of 6.7% led by the festival demand.

Exhibit 4: Total volumes down 2.1% yoy

(units) 700,000 600,000 500,000 400,000 300,000 200,000 100,000 0

(19.6) 24.0 15.3 15.1 1.1 1.7 (2.1) 524,171 519,514 535,008 39.9

Exhibit 5: Strong growth in net average realization

(%) 50.0 40.0 30.0 20.0 10.0 0.0 (10.0) (20.0) (30.0) (`) 35,000 34,000 33,000 32,000 31,000 30,000 29,000 28,000

30,781 30,968 30,352 (2.0) 8.9 7.6

Total volume

604,226

yoy growth (RHS)

Net average realization

8.1 6.7 32,300 7.1 32,960 31,911

yoy growth (RHS)

34,502 8.1 34,196 34,344

(%) 10.0 8.0

4.2

529,681 528,099 519,132

485,923

518,357

6.0 4.0 2.0 0.0 (2.0) (4.0)

5.9

(3.0)

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

4QFY12

1QFY13

2QFY13

3QFY13

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

4QFY12

1QFY13

2QFY13

Source: Company, Angel Research

Source: Company, Angel Research

February 1, 2013

3QFY13

TVS Motor Company | 3QFY2013 Result Update

Exhibit 6: Muted growth in the top-line

(` cr) 2,500 2,000 1,500 1,000 500 0 51.1 1,991 34.5 1,746 1,647 1,635 25.3 23.2 7.8 (0.5) 4.2 (15.1) 1.3 1,775 1,627 1,820 1,691 1,799 Net sales (LHS) Net sales growth (RHS) (%) 60.0 50.0 40.0 30.0 20.0 10.0 0.0 (10.0) (20.0)

Exhibit 7: Domestic market share trend

(%) 25.0 20.0 15.0 10.0 5.0 0.0 3.7 3.5 2.3 2.6 2.8 3.2 2.9 3.3 3.1 15.1 6.9 14.7 6.8 14.3 6.3 15.2 6.9 13.5 5.6 13.6 5.9 12.8 5.4 13.1 5.3 21.9 Scooters Three Wheelers 21.3 20.5 22.9 19.4 15.4 15.3 16.0 14.2 Motor Cycles Total Two Wheelers

12.6 5.8

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

4QFY12

1QFY13

2QFY13

3QFY13

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

4QFY12

1QFY13

2QFY13

Source: Company, Angel Research

Source: Company, SIAM, Angel Research

EBITDA margin at 5.9% as against our expectations of 6.5%: On the operating front, the EBITDA margin remained stable on a sequential basis at 5.9%, lower than our expectations of 6.5%, led by higher promotional expenditure related to the launch of Phoenix and also on account of the festival season. However, the raw-material cost as a percentage of sales remained stable on a yoy as well as qoq basis. The Management expects operating margins to improve going ahead, led by improved volumes, better-product-mix and benign raw material prices. However, we believe that margin expansion would be limited given the weak domestic demand scenario and increasing competition which would necessitate higher promotional expenditure. Further new launches would also require higher advertising expenditure.

Exhibit 8: EBITDA margin remains under pressure

(%) 90.0 80.0 70.0 60.0 50.0 40.0 30.0 20.0 10.0 0.0 6.1 5.9 6.7 7.0 7.2 6.1 5.9 6.0 5.9 EBITDA margin 74.7 74.6 76.9 75.9 73.2 Raw material cost/sales 74.2 74.6 73.6 72.8

Exhibit 9: Lower-than-expected bottom-line

(` cr) 90 80 70 60 50 40 30 20 10 0

56 44 59 77 57 57 51 45 52

Net profit (LHS) 3.9 3.4 2.7 3.4 3.2

Net profit margin (RHS) 3.5 2.8 2.7 2.9

(%) 4.5 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0.0

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

4QFY12

1QFY13

2QFY13

3QFY13

3QFY11

4QFY11

1QFY12

2QFY12

3QFY12

4QFY12

1QFY13

2QFY13

Source: Company, Angel Research

Source: Company, Angel Research

Net profit lower than our expectations: TVSL reported a 7.2% yoy decline in its net profit to `52cr; which was lower than our estimates of `59cr, mainly due to lower-than-expected operating performance. However on the positive side, interest expense declined 15.1% yoy (22.4% qoq) as the company reduced its interest bearing debt by `180cr in 9MFY2013.

February 1, 2013

3QFY13

3QFY13

TVS Motor Company | 3QFY2013 Result Update

Investment arguments

Success of new launches key to volume growth: We expect TVSL to register a decline of 8.5% yoy in its total volumes in FY2013 due to the slowdown in two-wheeler demand and rising competitive intensity in the sector. Nonetheless, TVSL plans to launch two scooters, one motorcycle and a diesel three-wheeler in FY2014, and we believe the success of these new launches is key for the company to register volume growth going ahead. We expect the new launches coupled with the recent launch of Phoenix to enable TVSL to ramp up its monthly run rate and post annual volumes of 2.17mn units (8% growth) in FY2014E. Limited room for margin expansion: Although the Management expects operating margins to improve going ahead, led by improved volumes, better product mix, and benign raw material pricing environment; we believe that scope for margin expansion would be limited. We believe that rising competition coupled with new launches would necessitate higher advertisement and promotional expenditure which would keep margins under pressure. We expect the companys margin to improve by ~30bp in FY2014.

Outlook and valuation

We lower our FY2013 volume estimates to factor in the continued slowdown in the domestic and export two-wheeler markets. We now expect TVSLs volumes to decline by 8.5% yoy in FY2013. Further, we also lower our operating margin estimates for FY2013 to factor in the lower-than-expected performance during the quarter. We expect the operating environment to remain challenging for TVSL in 4QFY2014 as well, mainly due to rising competition in the sector amidst moderation in demand.

Exhibit 10: Change in estimates

Y/E March Net Sales (` cr) OPM (%) EPS (`)

Source: Company, Angel Research

Earlier Estimates 7,350 6.2 4.6 8,300 6.5 5.8

Revised Estimates 7,019 6.0 4.3 7,827 6.3 5.3

% chg (4.5) (20)bp (6.4) (5.7) (20)bp (9.2)

FY2013E FY2014E FY2013E FY2014E FY2013E FY2014E

Nevertheless, the recent launch of Phoenix, coupled with the impending launch of two scooters, one motorcycle and a diesel three-wheeler in FY2014 is expected to boost volumes and enable the company recover some lost ground in FY2014. Additionally, reduction is interest cost due to retiring of interest bearing debt will also boost profitability going ahead. At the current market price of `43, TVSL is trading at an attractive valuation of 8.1x FY2014E earnings. We therefore maintain our Accumulate rating on the stock with a target price of `47.

February 1, 2013

TVS Motor Company | 3QFY2013 Result Update

Exhibit 11: Key assumptions

Y/E March Total volume (units) Motorcycles Scooters Mopeds Three-Wheelers Change yoy (%) Motorcycles Scooters Mopeds Three-Wheelers Domestic (units) Exports (units)

Source: Company, Angel Research

FY09 1,321,534 634,918 246,153 435,589 4,874 3.8 6.2 (6.9) 5.9 3,707.8 1,128,136 193,398

FY10 1,536,895 640,965 309,501 571,563 14,866 16.3 1.0 25.7 31.2 205.0 1,371,481 165,414

FY11 2,032,404 836,821 452,006 703,717 39,860 32.2 30.6 46.0 23.1 168.1 1,797,993 234,411

FY12 2,196,138 841,362 529,095 785,942 39,739 8.1 0.5 17.1 11.7 (0.3) 1,909,672 286,466

FY13E 2,009,849 753,019 444,440 766,293 46,097 (8.5) (10.5) (16.0) (2.5) 16.0 1,788,766 221,083

FY14E 2,170,440 798,200 511,106 812,271 48,863 8.0 6.0 15.0 6.0 6.0 1,899,135 271,305

Exhibit 12: Angel vs consensus forecast

Angel estimates FY13E FY14E 7,019 7,827 4.3 5.3 Consensus FY13E FY14E 7,338 8,270 4.3 5.4 Variation (%) FY13E FY14E (4.3) (5.4) (1.6) (1.4)

Total op. income (` cr) EPS (`)

Source: Bloomberg, Angel Research

Exhibit 13: One-year forward P/E band

(`) 100 90 80 70 60 50 40 30 20 10 0

Share Price (`) 6x 9x 12x 15x

Exhibit 14: One-year forward P/E chart

(x) 20.0 18.0 16.0 14.0 12.0 10.0 8.0 6.0 4.0 2.0 0.0 One-yr forward P/E Three-yr average P/E

Jul-09

Jul-10

Jul-11

Jan-10

Jan-11

Jan-12

Jul-12

Apr-10

Apr-11

Oct-09

Oct-10

Oct-11

Apr-12

Mar-04

Mar-05

Mar-06

Apr-03

Feb-07

Feb-08

Feb-09

Source: Company, Angel Research

Feb-10

Source: Company, Angel Research

Exhibit 15: One-year forward EV/EBITDA band

(` cr) 6,000 5,000 4,000 3,000 2,000 1,000 0 EV (` cr) 4x 6x 8x 10x

Exhibit 16: Two-wheeler stocks performance vs Sensex

TVSL HMCL BJAUT Sensex

700 600 500 400 300 200 100 0

Dec-09

Jan-09

Oct-12 Jul-12

Jan-11

Jan-12

Jan-13

Mar-08

Aug-08

Oct-10

Apr-11

Mar-04

Mar-05

Mar-06

Feb-07

Feb-08

Feb-09

Source: Company, Angel Research

Feb-10

Source: Company, Angel Research

February 1, 2013

May-10

Jan-11

Jan-12

Apr-03

Jan-13

Sep-11

Feb-12

Jan-13

Jul-09

Jan-13

TVS Motor Company | 3QFY2013 Result Update

Exhibit 17: Automobile - Recommendation summary

Company Ashok Leyland Bajaj Auto Hero MotoCorp Maruti Suzuki Mahindra & Mahindra Tata Motors TVS Motor Reco. Buy Neutral Accumulate Neutral Accumulate Buy Accumulate CMP Tgt. price (`) (`) 25 2,053 1,813 1,609 886 285 43 28 1,923 998 337 47 Upside (%) 15.5 6.1 12.6 18.2 11.5 P/E (x) FY13E 16.6 19.1 17.1 25.0 16.3 8.0 10.0 FY14E 11.1 16.2 15.1 16.8 14.3 6.7 8.1 EV/EBITDA (x) FY13E 6.6 13.4 8.7 12.2 9.4 4.1 3.8 FY14E 5.4 10.9 7.2 8.1 7.7 3.6 2.9 RoE (%) FY13E 9.3 45.8 44.3 11.6 24.2 30.2 16.4 FY14E 13.3 42.8 40.9 15.3 23.2 27.6 18.0 FY12-14E EPS CAGR (%) 2.7 8.9 5.3 37.5 15.3 12.3 0.4

Source: Company, Angel Research

Company background

TVS Motor (TVSL), a flagship company of the TVS Group, is the third largest 2W manufacturer in India. The company is present across the motorcycles, scooters and mopeds segments, having a market share of ~8%, ~22% and 100%, respectively. The company successfully ventured into the 3W segment in FY2009 and garnered a ~5% market share as of March 31, 2012. The company has three manufacturing facilities in India, located at Hosur (Tamil Nadu), Mysore (Karnataka) and Solan (Himachal Pradesh) with 2W and 3W capacity of 2.75mn and 75,000 units, respectively. TVSL is also the second largest exporter of two-wheelers in the country.

February 1, 2013

TVS Motor Company | 3QFY2013 Result Update

Profit and loss statement (Standalone)

Y/E March (` cr) Total operating income % chg Total expenditure Net raw material costs Other mfg costs Employee expenses Other EBITDA % chg (% of total op. income) Depreciation & amortization EBIT % chg (% of total op. income) Interest and other charges Other income Recurring PBT % chg Extraordinary income/(exp.) PBT Tax (% of PBT) PAT (reported) ADJ. PAT % chg (% of total op. income) Basic EPS (`) Adj. EPS (`) % chg FY2009 FY2010 FY2011 FY2012 FY2013E FY2014E 3,739 14.2 3,552 2,783 111 205 453 187 94.9 5.0 103 84 6,824.8 2.3 65 12 31 (12.1) 2 30 0 0.1 31 29 872.9 0.8 0.7 0.6 872.9 4,430 18.5 4,243 3,137 133 248 724 187 0.4 4.2 103 85 1.3 1.9 75 67 76 144.9 (32) 108 (12) (11.0) 88 120 306.6 2.7 1.9 2.5 306.6 6,288 41.9 5,896 4,614 171 327 784 392 109.2 6.2 107 285 235.5 4.5 72 36 248 225.7 (4) 252 54 21.2 195 199 65.7 3.2 4.1 4.2 65.6 7,126 13.3 6,657 5,261 202 370 823 469 19.7 6.6 118 352 23.5 4.9 57 22 316 27.6 316 67 21.3 249 249 25.3 3.5 5.2 5.2 25.3 7,019 (1.5) 6,598 5,152 218 393 835 421 (10.3) 6.0 128 293 (16.7) 4.2 54 22 261 (17.5) 261 59 22.5 202 202 (18.6) 2.9 4.3 4.3 (18.6) 7,827 11.5 7,337 5,737 239 446 916 489 16.2 6.3 136 354 20.6 4.5 51 23 325 24.6 325 75 23.0 251 251 23.8 3.2 5.3 5.3 23.8

February 1, 2013

TVS Motor Company | 3QFY2013 Result Update

Balance sheet statement (Standalone)

Y/E March (` cr) SOURCES OF FUNDS Equity share capital Reserves & surplus Shareholders Funds Total loans Deferred tax liability Other long term liabilities Long term provisions Total Liabilities APPLICATION OF FUNDS Gross block Less: Acc. depreciation Net Block Capital work-in-progress Goodwill Investments Long term loans and advances Other noncurrent assets Current assets Cash Loans & advances Other Current liabilities Net current assets Misc. exp. not written off Total Assets 1,865 869 996 40 478 894 42 350 502 619 275 75 1,864 1,909 953 956 27 739 965 101 354 511 734 231 30 1,983 1,972 1,035 938 57 661 96 1,106 6 301 799 1,086 19 1,771 2,154 1,129 1,026 53 931 53 1,078 13 247 819 1,110 (31) 2,031 2,285 1,257 1,028 57 931 53 1,101 56 246 799 1,154 (53) 2,016 2,421 1,392 1,029 61 931 53 1,360 190 274 896 1,268 92 2,165 24 786 810 906 148 1,864 24 842 865 1,003 115 1,983 48 952 999 633 96 43 1,771 48 1,122 1,169 715 98 49 2,031 48 1,257 1,305 565 98 49 2,016 48 1,436 1,484 535 98 49 2,165 FY2009 FY2010 FY2011 FY2012 FY2013E FY2014E

February 1, 2013

TVS Motor Company | 3QFY2013 Result Update

Cash flow statement (Standalone)

Y/E March (` cr) Profit before tax Depreciation Change in working capital Others Other income Direct taxes paid Cash Flow from Operations (Inc.)/Dec. in fixed assets (Inc.)/Dec. in investments Other income Cash Flow from Investing Issue of equity Inc./(Dec.) in loans Dividend paid (Incl. Tax) Others Cash Flow from Financing Inc./(Dec.) in cash Opening Cash balances Net cash credit adjustment Closing Cash balances FY2009 FY2010 FY2011 31 103 (29) 66 (12) (0) 160 (88) (139) 12 (215) 240 19 (226) 33 (22) 4 (60) 42 76 103 103 112 (67) 12 339 (30) (262) 67 (225) 97 33 (102) 28 142 42 83 101 248 107 (67) 35 (36) (54) 234 (93) 78 36 20 24 (295) 60 (218) (428) (174) 101 (79) 6 FY2012 FY2013E FY2014E 316 118 63 33 (22) (67) 441 (177) (270) 22 (425) (72) 72 (150) (150) (135) 6 (142) 13 261 128 70 (22) (59) 378 (135) 22 (113) (150) 72 (222) 43 13 56 325 136 (11) (23) (75) 352 (140) 23 (117) (30) 72 (102) 133 56 190

February 1, 2013

10

TVS Motor Company | 3QFY2013 Result Update

Key ratios

Y/E March Valuation Ratio (x) P/E (on FDEPS) P/CEPS P/BV Dividend yield (%) EV/Sales EV/EBITDA EV / Total Assets Per Share Data (`) EPS (Basic) EPS (fully diluted) Cash EPS DPS Book Value DuPont Analysis EBIT margin Tax retention ratio Asset turnover (x) ROIC (Post-tax) Cost of Debt (Post Tax) Leverage (x) Operating ROE Returns (%) ROCE (Pre-tax) Angel ROIC (Pre-tax) ROE Turnover ratios (x) Asset Turnover (Gross Block) Inventory / Sales (days) Receivables (days) Payables (days) WC cycle (ex-cash) (days) Solvency ratios (x) Net debt to equity Net debt to EBITDA Interest Coverage (EBIT / Int.) 0.5 2.1 1.3 0.2 0.9 1.1 (0.0) (0.1) 3.9 (0.2) (0.5) 6.2 (0.3) (1.0) 5.5 (0.4) (1.2) 7.0 2.0 36 13 53 21 2.3 26 17 51 15 3.2 24 14 49 4 3.5 28 13 53 (1) 3.2 29 13 56 (4) 3.3 29 13 53 (5) 4.8 0.9 3.6 4.4 0.9 14.3 15.2 16.1 21.3 18.5 17.4 22.9 14.5 15.0 16.4 16.9 17.9 18.0 2.3 1.0 2.2 4.9 8.2 0.4 3.5 1.9 1.1 2.4 5.2 8.8 0.3 4.0 4.5 0.8 3.4 12.3 7.0 0.1 12.7 4.9 0.8 3.8 14.6 6.7 (0.1) 13.7 4.2 0.8 3.5 11.4 6.5 (0.3) 10.1 4.5 0.8 4.0 13.8 7.1 (0.4) 11.4 0.7 0.6 2.8 0.4 17.1 1.9 2.5 4.7 0.6 18.2 4.1 4.2 6.4 1.1 21.0 5.2 5.2 7.7 1.3 24.6 4.3 4.3 7.0 1.3 27.5 5.3 5.3 8.1 1.3 31.2 68.6 15.1 2.5 0.8 0.7 20.3 1.3 16.9 9.1 2.3 1.4 0.5 18.2 1.1 10.2 6.6 2.0 2.6 0.3 5.1 1.1 8.1 5.5 1.7 3.1 0.3 3.8 0.9 10.0 6.1 1.6 3.1 0.2 3.8 0.8 8.1 5.2 1.4 3.1 0.2 2.9 0.7 FY2009 FY2010 FY2011 FY2012 FY2013E FY2014E

February 1, 2013

11

TVS Motor Company | 3QFY2013 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

TVS Motor Company No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

February 1, 2013

12

Das könnte Ihnen auch gefallen

- Indzara Personal Finance Manager 2010 v2Dokument8 SeitenIndzara Personal Finance Manager 2010 v2AlexandruDanielNoch keine Bewertungen

- Sample Chart of Accounts: Account Name Code Financial Statement Group NormallyDokument2 SeitenSample Chart of Accounts: Account Name Code Financial Statement Group NormallyQamar ShahzadNoch keine Bewertungen

- Discretionary Trust FormDokument12 SeitenDiscretionary Trust FormAnthony Seaton50% (2)

- Technical & Derivative Analysis Weekly-14092013Dokument6 SeitenTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- BCom Finance Fundamentals of Investment PDFDokument80 SeitenBCom Finance Fundamentals of Investment PDFsree220Noch keine Bewertungen

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioVon EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNoch keine Bewertungen

- AppleDokument40 SeitenApplesuryavamshirakesh10% (1)

- Director of Consulting Sample Resume From Freedom ResumesDokument2 SeitenDirector of Consulting Sample Resume From Freedom ResumesFreedom Resumes100% (1)

- SAP Fixed AssetsDokument45 SeitenSAP Fixed Assetsrohitmandhania80% (5)

- Hero Moto Corp, 1Q FY 2014Dokument14 SeitenHero Moto Corp, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Ashok Leyland: Performance HighlightsDokument13 SeitenAshok Leyland: Performance HighlightsAngel BrokingNoch keine Bewertungen

- TVS Motor 4Q FY 2013Dokument13 SeitenTVS Motor 4Q FY 2013Angel BrokingNoch keine Bewertungen

- MM 1qfy2013 RuDokument13 SeitenMM 1qfy2013 RuAngel BrokingNoch keine Bewertungen

- Bajaj Auto 4Q FY 2013Dokument14 SeitenBajaj Auto 4Q FY 2013Angel BrokingNoch keine Bewertungen

- Mahindra N Mahindra, 1Q FY 2014Dokument14 SeitenMahindra N Mahindra, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Apollo Tyres: Performance HighlightsDokument15 SeitenApollo Tyres: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Msil 4Q Fy 2013Dokument15 SeitenMsil 4Q Fy 2013Angel BrokingNoch keine Bewertungen

- Bajaj Auto Result UpdatedDokument11 SeitenBajaj Auto Result UpdatedAngel BrokingNoch keine Bewertungen

- Glaxosmithkline Pharma: Performance HighlightsDokument11 SeitenGlaxosmithkline Pharma: Performance HighlightsAngel BrokingNoch keine Bewertungen

- GSPL 4Q Fy 2013Dokument10 SeitenGSPL 4Q Fy 2013Angel BrokingNoch keine Bewertungen

- Maruti Suzuki, 28th January, 2013Dokument13 SeitenMaruti Suzuki, 28th January, 2013Angel BrokingNoch keine Bewertungen

- Ceat, 11th January, 2013Dokument12 SeitenCeat, 11th January, 2013Angel Broking100% (2)

- TVS Motor Company: Performance HighlightsDokument12 SeitenTVS Motor Company: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Bajaj Auto: Performance HighlightsDokument12 SeitenBajaj Auto: Performance HighlightsAngel BrokingNoch keine Bewertungen

- HMCL 4Q Fy 2013Dokument13 SeitenHMCL 4Q Fy 2013Angel BrokingNoch keine Bewertungen

- Crompton Greaves: Performance HighlightsDokument12 SeitenCrompton Greaves: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Maruti Suzuki, 1Q FY 2014Dokument16 SeitenMaruti Suzuki, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Apollo Tyre 4Q FY 2013Dokument14 SeitenApollo Tyre 4Q FY 2013Angel BrokingNoch keine Bewertungen

- Maruti Suzuki: Performance HighlightsDokument13 SeitenMaruti Suzuki: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Oriental Bank, 1Q FY 2014Dokument11 SeitenOriental Bank, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- IDBI Bank Result UpdatedDokument13 SeitenIDBI Bank Result UpdatedAngel BrokingNoch keine Bewertungen

- Axis Bank, 1Q FY 2014Dokument14 SeitenAxis Bank, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Bosch 3qcy2012ruDokument12 SeitenBosch 3qcy2012ruAngel BrokingNoch keine Bewertungen

- Syndicate Bank, 1Q FY 2014Dokument11 SeitenSyndicate Bank, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Union Bank of India Result UpdatedDokument11 SeitenUnion Bank of India Result UpdatedAngel BrokingNoch keine Bewertungen

- Axis Bank: Performance HighlightsDokument13 SeitenAxis Bank: Performance HighlightsAngel BrokingNoch keine Bewertungen

- ICICI Bank Result UpdatedDokument15 SeitenICICI Bank Result UpdatedAngel BrokingNoch keine Bewertungen

- Apol Lo Tyres Result UpdatedDokument13 SeitenApol Lo Tyres Result UpdatedAngel BrokingNoch keine Bewertungen

- Crompton GreavesDokument12 SeitenCrompton GreavesAngel BrokingNoch keine Bewertungen

- Amara Raja 4Q FY 2013Dokument11 SeitenAmara Raja 4Q FY 2013Angel BrokingNoch keine Bewertungen

- Indian Overseas BankDokument11 SeitenIndian Overseas BankAngel BrokingNoch keine Bewertungen

- Dena Bank, 1Q FY 2014Dokument11 SeitenDena Bank, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Union Bank of India: Performance HighlightsDokument11 SeitenUnion Bank of India: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Corporation Bank 4Q FY 2013Dokument11 SeitenCorporation Bank 4Q FY 2013Angel BrokingNoch keine Bewertungen

- Maruti Suzuki: Performance HighlightsDokument13 SeitenMaruti Suzuki: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Indraprasth Gas Result UpdatedDokument10 SeitenIndraprasth Gas Result UpdatedAngel BrokingNoch keine Bewertungen

- Maruti Suzuki: Performance HighlightsDokument12 SeitenMaruti Suzuki: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Jammu and Kashmir Bank: Performance HighlightsDokument11 SeitenJammu and Kashmir Bank: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Hero Motocorp: Performance HighlightsDokument14 SeitenHero Motocorp: Performance HighlightsAngel BrokingNoch keine Bewertungen

- ICICI Bank Result UpdatedDokument15 SeitenICICI Bank Result UpdatedAngel BrokingNoch keine Bewertungen

- Motherson Sumi Systems Result UpdatedDokument14 SeitenMotherson Sumi Systems Result UpdatedAngel BrokingNoch keine Bewertungen

- Canara Bank Result UpdatedDokument11 SeitenCanara Bank Result UpdatedAngel BrokingNoch keine Bewertungen

- ITC Result UpdatedDokument15 SeitenITC Result UpdatedAngel BrokingNoch keine Bewertungen

- Canara Bank, 1Q FY 2014Dokument11 SeitenCanara Bank, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- Punjab National Bank Result UpdatedDokument12 SeitenPunjab National Bank Result UpdatedAngel BrokingNoch keine Bewertungen

- SBI, 19th February, 2013Dokument14 SeitenSBI, 19th February, 2013Angel BrokingNoch keine Bewertungen

- Performance Highlights: 2QFY2013 Result Update - Auto AncillaryDokument11 SeitenPerformance Highlights: 2QFY2013 Result Update - Auto AncillaryAngel BrokingNoch keine Bewertungen

- Syndicate Bank 4Q FY 2013Dokument11 SeitenSyndicate Bank 4Q FY 2013Angel BrokingNoch keine Bewertungen

- Bank of Baroda, 7th February, 2013Dokument12 SeitenBank of Baroda, 7th February, 2013Angel BrokingNoch keine Bewertungen

- Apol Lo Tyres Angel 160511Dokument13 SeitenApol Lo Tyres Angel 160511sohamdasNoch keine Bewertungen

- Axis Bank: Performance HighlightsDokument13 SeitenAxis Bank: Performance HighlightsRahul JagdaleNoch keine Bewertungen

- KEC International 4Q FY 2013Dokument11 SeitenKEC International 4Q FY 2013Angel BrokingNoch keine Bewertungen

- Allahabad Bank, 1Q FY 2014Dokument11 SeitenAllahabad Bank, 1Q FY 2014Angel BrokingNoch keine Bewertungen

- JP Associates: Performance HighlightsDokument12 SeitenJP Associates: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Canara Bank Result UpdatedDokument11 SeitenCanara Bank Result UpdatedAngel BrokingNoch keine Bewertungen

- ACC Q4CY11 Result Update Fortune 09022012Dokument5 SeitenACC Q4CY11 Result Update Fortune 09022012anknkulsNoch keine Bewertungen

- Aventis Pharma Result UpdatedDokument10 SeitenAventis Pharma Result UpdatedAngel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report November 12Dokument2 SeitenMetal and Energy Tech Report November 12Angel BrokingNoch keine Bewertungen

- WPIInflation August2013Dokument5 SeitenWPIInflation August2013Angel BrokingNoch keine Bewertungen

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDokument4 SeitenRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNoch keine Bewertungen

- Special Technical Report On NCDEX Oct SoyabeanDokument2 SeitenSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNoch keine Bewertungen

- Oilseeds and Edible Oil UpdateDokument9 SeitenOilseeds and Edible Oil UpdateAngel BrokingNoch keine Bewertungen

- Commodities Weekly Outlook 16-09-13 To 20-09-13Dokument6 SeitenCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 14 2013Dokument2 SeitenDaily Agri Tech Report September 14 2013Angel BrokingNoch keine Bewertungen

- International Commodities Evening Update September 16 2013Dokument3 SeitenInternational Commodities Evening Update September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Report September 16 2013Dokument9 SeitenDaily Agri Report September 16 2013Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 16 2013Dokument2 SeitenDaily Agri Tech Report September 16 2013Angel BrokingNoch keine Bewertungen

- MetalSectorUpdate September2013Dokument10 SeitenMetalSectorUpdate September2013Angel BrokingNoch keine Bewertungen

- Daily Metals and Energy Report September 16 2013Dokument6 SeitenDaily Metals and Energy Report September 16 2013Angel BrokingNoch keine Bewertungen

- Currency Daily Report September 16 2013Dokument4 SeitenCurrency Daily Report September 16 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 8th JanDokument3 SeitenDerivatives Report 8th JanAngel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Dokument4 SeitenDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNoch keine Bewertungen

- Commodities Weekly Tracker 16th Sept 2013Dokument23 SeitenCommodities Weekly Tracker 16th Sept 2013Angel BrokingNoch keine Bewertungen

- Technical Report 13.09.2013Dokument4 SeitenTechnical Report 13.09.2013Angel BrokingNoch keine Bewertungen

- Sugar Update Sepetmber 2013Dokument7 SeitenSugar Update Sepetmber 2013Angel BrokingNoch keine Bewertungen

- Derivatives Report 16 Sept 2013Dokument3 SeitenDerivatives Report 16 Sept 2013Angel BrokingNoch keine Bewertungen

- IIP CPIDataReleaseDokument5 SeitenIIP CPIDataReleaseAngel BrokingNoch keine Bewertungen

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDokument1 SeitePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNoch keine Bewertungen

- TechMahindra CompanyUpdateDokument4 SeitenTechMahindra CompanyUpdateAngel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument13 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Market Outlook 13-09-2013Dokument12 SeitenMarket Outlook 13-09-2013Angel BrokingNoch keine Bewertungen

- MarketStrategy September2013Dokument4 SeitenMarketStrategy September2013Angel BrokingNoch keine Bewertungen

- Metal and Energy Tech Report Sept 13Dokument2 SeitenMetal and Energy Tech Report Sept 13Angel BrokingNoch keine Bewertungen

- Daily Agri Tech Report September 06 2013Dokument2 SeitenDaily Agri Tech Report September 06 2013Angel BrokingNoch keine Bewertungen

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDokument6 SeitenTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNoch keine Bewertungen

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDokument4 SeitenJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNoch keine Bewertungen

- Esso Standard Eastern vs. CommissionerDokument2 SeitenEsso Standard Eastern vs. CommissionerlexxNoch keine Bewertungen

- Eight Days A Week PDFDokument439 SeitenEight Days A Week PDFRita D'HaeneNoch keine Bewertungen

- Banking DicDokument1.222 SeitenBanking DicRehab Habiba Almuhajira100% (1)

- Income From Other SourceDokument20 SeitenIncome From Other SourceRewant MehraNoch keine Bewertungen

- Arisaig Diaries November 2015Dokument8 SeitenArisaig Diaries November 2015HimanshuNoch keine Bewertungen

- Shreya Jain - PGFC1935 - Performance AnalysisDokument13 SeitenShreya Jain - PGFC1935 - Performance AnalysisSurbhî GuptaNoch keine Bewertungen

- Chapter 8Dokument20 SeitenChapter 8anil.gelra5140Noch keine Bewertungen

- Application For Deceased ClaimDokument38 SeitenApplication For Deceased Claimmohammed258Noch keine Bewertungen

- A Project Report On "Exhibit & Presentation Linking" An Event Study ATDokument41 SeitenA Project Report On "Exhibit & Presentation Linking" An Event Study ATNaresh ReddyNoch keine Bewertungen

- Coffee Shop Business PlanDokument11 SeitenCoffee Shop Business PlanRamana Reddy0% (1)

- Group 5 FabmDokument33 SeitenGroup 5 FabmHanissandra Franz V. DalanNoch keine Bewertungen

- Deepak ComputationDokument3 SeitenDeepak ComputationRavi YadavNoch keine Bewertungen

- United Way Annual Report 2009Dokument28 SeitenUnited Way Annual Report 2009traci_wickettNoch keine Bewertungen

- Partnerships NotesDokument6 SeitenPartnerships NoteskdescallarNoch keine Bewertungen

- Actbas1 - Lesson 1 2tay1112Dokument48 SeitenActbas1 - Lesson 1 2tay1112Janelle GollabaNoch keine Bewertungen

- Homework CVP & BEDokument11 SeitenHomework CVP & BEYamato De Jesus NakazawaNoch keine Bewertungen

- E-Business Model Design, Classification and MeasurementsDokument20 SeitenE-Business Model Design, Classification and MeasurementsLuz MarinaNoch keine Bewertungen

- Dhaka Bank ( - ) MTO - 29.09.2017Dokument6 SeitenDhaka Bank ( - ) MTO - 29.09.2017sahadatNoch keine Bewertungen

- JMP Securities Reaffirms Outperform On NAVB and $3PT - May 16Dokument8 SeitenJMP Securities Reaffirms Outperform On NAVB and $3PT - May 16MayTepperNoch keine Bewertungen

- Techna-X Berhad: Incorporated in MalaysiaDokument17 SeitenTechna-X Berhad: Incorporated in MalaysiaChoon Wei WongNoch keine Bewertungen

- EngagementDokument47 SeitenEngagementJean CabigaoNoch keine Bewertungen

- Cir Vs Campos RuedaDokument4 SeitenCir Vs Campos RuedaAljay LabugaNoch keine Bewertungen