Beruflich Dokumente

Kultur Dokumente

Accounting Applications

Hochgeladen von

aumit0099Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Accounting Applications

Hochgeladen von

aumit0099Copyright:

Verfügbare Formate

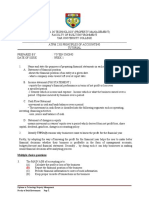

THIS IS A NEW SPECIFICATION

ADVANCED GCE

ACCOUNTING

Accounting Applications RESOURCE BOOKLET To be given to candidates at the start of the examination

*OCE/V04104*

F012/RB

SPECIMEN 2009

Duration: 2 hours

INSTRUCTIONS TO CANDIDATES

The information required to answer questions 14 is contained within this Resource Booklet. Do not hand this Resource Booklet in at the end of the examination. It is not needed by the Examiner.

INFORMATION FOR CANDIDATES

SP

OCR 2009 [500/2302/0] SP (SLM) V04104/1 OCR is an exempt Charity

EC

This document consists of 8 pages. Any blank pages are indicated.

IM

EN

Turn over

2 Answer both questions.

Almond and Barley are partners in a music shop. The partnership agreement states that Almond as manager, receives a salary of 10,000 per annum. Interest is charged at 10% on the balance of drawings at the end of the year, and interest on capital is paid to each partner at the rate of 8% per annum. The remainder of the profit being shared equally. The net profit before appropriation for the year ended 31 December 2006 was 36,940. The following information is also available: 20,000 15,000 18,000 12,500 600 Cr 300 Dr

Drawings

Almond Barley Almond Barley Almond Barley

Capital Accounts

Current Accounts

(i)

Cherry would bring 12,000 in cash and a vehicle valued at 5,000 into the partnership as capital. Partners will share profits two fifths Almond, two fifths Barley and one fifth Cherry. On 31 December 2006, goodwill was valued at 20,000. Goodwill will not remain in the books of the new partnership. On 31 December 2006, fixed assets are to be re-valued at 100,000, from their original cost of 85,000.

(ii) (iii)

(iv)

REQUIRED

SP

(b) (i)

(a) The Appropriation Account for Almond and Barley for the year ended 31 December 2006. [7] The Current Accounts for Almond and Barley as at 31 December 2006. The Capital Accounts for Almond, Barley and Cherry as at 1 January 2007. [8] [10]

(ii)

(c) Explain why partnerships generally write off goodwill through the capital account rather than record it on the balance sheet. [4] Total Marks [29]

OCR 2009

EC

IM

F012RB Spec09

On 1 January 2007, Almond and Barley agreed to admit Cherry as a partner. The following was agreed between the three partners:

EN

1 January 2006 1 January 2006 1 January 2006 1 January 2006

3 2 Peter Green commenced business several years ago selling jewellery. He prepared the following receipts and payments details for the year ended 31 December 2006: 3,000 83,000 3,000 8,000 29,000 4,200 4,000 2,000 12,000 15,000 18,000

Balance b/d Receipts from debtors Capital Loan: M Mint

Trade creditors Motor expenses Rent Rates General expenses Wages Drawings

Additional information: (i)

The receipts and payments details have been prepared from the business bank account through which all receipts and payments have passed. The loan from M Mint was received on 1 September 2006 and interest is payable at 12% per annum. The loan is for a four year period. Discounts received from suppliers for the year ended 31 December 2006 were 1,500.

(ii)

(iii)

In addition to the items mentioned above, the assets and liabilities of Peter Green were as follows: 31 December 2005 8,000 6,000 3,500 500 1,000 4,300 31 December 2006 6,800 5,500 8,200 900 1,500 5,700

SP

REQUIRED

Delivery van at net book value Stock at cost Trade debtors Motor expenses owing Rent prepaid Trade creditors

(a)* The Trading and Profit and Loss Account for Peter Green for the year ended 31 December 2006 and the Balance Sheet as at that date. [29] (b) Peter is considering the possibility of forming a partnership with his local business rival Danny Violet. State three advantages and three disadvantages of forming such a partnership. [6] Total Marks [35]

EC

IM

F012RB Spec09

EN

OCR 2009

Turn over

4 3 The following summary information relates to two businesses Stone and Rye. Both businesses traded in the same market sector for the year ended 31 December 2006. Trading and Profit and Loss Accounts for the year ended 31 December 2006 Stone 600,000 300,000 300,000 150,000 150,000 Rye 600,000 240,000 360,000 120,000 240,000

EC

Stone Rye

Balance Sheets as at 31 December 2006 Stone Fixed Assets Current Assets Stock 30,000 Debtors 40,000 110,000 Cash at bank 180,000 Current Liabilities Creditors 50,000 Bank overdraft

370,000

EN

Rye 50,000 150,000 200,000 140,000 60,000

Sales Cost of sales Gross Profit Expenses Net Profit

500,000

IM

130,000 500,000 375,000 150,000 525,000 25,000 500,000 20,000 46,000

F012RB Spec09

500,000 335,000 240,000 575,000 75,000 500,000

Financed by: Opening capital Net profit Drawings Closing capital

OCR 2009

SP

Additional information

Stock as at 1 January 2006

5 REQUIRED (a) Calculate the following ratios for Stone and Rye: (i) (ii) (iii) (iv) (v) (vi) gross profit as a percentage of sales; net profit as a percentage of sales; return on capital employed (based on closing capital); current ratio; liquid (acid test) ratio; stock turnover. [2] [2] [2] [2] [2] [4]

(b) Using the ratios calculated in (a) evaluate: the liquidity of both businesses; the profitability of both businesses.

EN

[8]

(c) Advise the managements of both Stone and Rye on the actions they should now take to improve liquidity and profitability. [8]

IM SP EC

OCR 2009 F012RB Spec09

Total Marks [30]

Turn over

6 4 Amber Ltd is preparing its Cash Budget for the three months ending 31 March 2007. The following forecasts are available. Sales 480,000 500,000 520,000 490,000 Purchases 300,000 320,000 380,000 310,000 Wages 48,000 48,000 52,000 56,000 General Expenses 90,000 90,000 90,000 90,000

December 2006 January 2007 February 2007 March 2007

The following information is also available. (i) (ii) (iii) All purchases are on a credit basis and are paid for one month after purchases are made. 40% of sales are on a cash basis. The remainder are paid one month after sales are made. General expenses include depreciation of 2,000 per month. General expenses are paid one month in arrears. 75% of wages are paid in the month they are earned, and 25% are paid during the following month. The company intends to purchase new equipment at a cost of 30,000 in December 2006, with 10% payable on 15 January 2007 and the balance on 15 March 2007. Old equipment originally costing 10,000 is to be disposed of for 1,000, to be received during February 2007. The budgeted bank balance on 1 January 2007 is 48,000.

(iv)

(v)

(vi)

REQUIRED

(a) The Cash Budget for Amber Ltd for the three months ending 31 March 2007. (b)* Discuss three benefits to a company of budgeting.

EC

IM

F012RB Spec09

EN

[15] [11]

SP

OCR 2009

Total marks [26]

7 BLANK PAGE

OCR 2009

SP

F012RB Spec09

EC

IM

EN

Copyright Information OCR is committed to seeking permission to reproduce all third-party content that it uses in its assessment materials. OCR has attempted to identify and contact all copyright holders whose work is used in this paper. To avoid the issue of disclosure of answer-related information to candidates, all copyright acknowledgements are reproduced in the OCR Copyright Acknowledgements Booklet. This is produced for each series of examinations, is given to all schools that receive assessment material and is freely available to download from our public website (www.ocr.org.uk) after the live examination series. If OCR has unwittingly failed to correctly acknowledge or clear any third-party content in this assessment material, OCR will be happy to correct its mistake at the earliest possible opportunity. For queries or further information please contact the Copyright Team, First Floor, 9 Hills Road, Cambridge CB2 1PB. OCR is part of the Cambridge Assessment Group; Cambridge Assessment is the brand name of University of Cambridge Local Examinations Syndicate (UCLES), which is itself a department of the University of Cambridge. OCR 2009 F012RB Spec09

SP

EC

IM

EN

Das könnte Ihnen auch gefallen

- 2010 LCCI Level 3 Series 2 Question Paper (Code 3012)Dokument8 Seiten2010 LCCI Level 3 Series 2 Question Paper (Code 3012)mappymappymappyNoch keine Bewertungen

- 2010 LCCI Bookkeeping and Accounts Series 3Dokument8 Seiten2010 LCCI Bookkeeping and Accounts Series 3Fung Hui Ying75% (4)

- 7110 s09 QP 2Dokument20 Seiten7110 s09 QP 2mstudy123456100% (1)

- Model Answers Series 2 2010Dokument17 SeitenModel Answers Series 2 2010Jack Tsang100% (1)

- Accounting/Series 3 2007 (Code3001)Dokument18 SeitenAccounting/Series 3 2007 (Code3001)Hein Linn KyawNoch keine Bewertungen

- 20jan2009 PDFDokument16 Seiten20jan2009 PDFAnonymous 08s0UFNoch keine Bewertungen

- Accounting/Series 4 2007 (Code3001)Dokument17 SeitenAccounting/Series 4 2007 (Code3001)Hein Linn Kyaw100% (2)

- Book-Keeping & Accounts/Series-2-2005 (Code2006)Dokument14 SeitenBook-Keeping & Accounts/Series-2-2005 (Code2006)Hein Linn Kyaw100% (2)

- Accounting PrinciplesDokument8 SeitenAccounting Principlesaumit0099Noch keine Bewertungen

- 9706 w09 QP 42Dokument8 Seiten9706 w09 QP 42Shanavaz AsokachalilNoch keine Bewertungen

- Source Booklet Jan 09 6001Dokument12 SeitenSource Booklet Jan 09 6001MashiatUddinNoch keine Bewertungen

- Accounting A2 Jan 2005Dokument11 SeitenAccounting A2 Jan 2005Orbind B. ShaikatNoch keine Bewertungen

- Lcci Level3 Solution Past Paper Series 3-10Dokument14 SeitenLcci Level3 Solution Past Paper Series 3-10tracyduckk67% (3)

- 2009-Financial Reporting Main EQP and CommentariesDokument46 Seiten2009-Financial Reporting Main EQP and CommentariesBryan SingNoch keine Bewertungen

- 2007 LCCI Level 2 Series 3 (HK) Model AnswersDokument12 Seiten2007 LCCI Level 2 Series 3 (HK) Model AnswersChoi Kin Yi Carmen67% (3)

- Commercial Studies: University of Cambridge International Examinations General Certificate of Education Ordinary LevelDokument8 SeitenCommercial Studies: University of Cambridge International Examinations General Certificate of Education Ordinary Levelmstudy123456Noch keine Bewertungen

- 7110 June 2006Dokument12 Seiten7110 June 2006Kristen NallanNoch keine Bewertungen

- Secimen: Advanced Gce AccountingDokument8 SeitenSecimen: Advanced Gce Accountingaumit0099Noch keine Bewertungen

- Commercial Studies: PAPER 2 ArithmeticDokument8 SeitenCommercial Studies: PAPER 2 Arithmeticmstudy123456Noch keine Bewertungen

- Code 2007 Accounting Level 2 2010 Series 4Dokument15 SeitenCode 2007 Accounting Level 2 2010 Series 4apple_syih100% (1)

- Financial Accounting: Formation 2 Examination - April 2008Dokument11 SeitenFinancial Accounting: Formation 2 Examination - April 2008Luke ShawNoch keine Bewertungen

- 6002 (1) - AccountingDokument16 Seiten6002 (1) - AccountingDaphne RenNoch keine Bewertungen

- 9706 w10 QP 41Dokument8 Seiten9706 w10 QP 41Diksha KoossoolNoch keine Bewertungen

- Book Keeping and Accounts Past Paper Series 2 2011Dokument6 SeitenBook Keeping and Accounts Past Paper Series 2 2011Aggelos Ispirli0% (1)

- Edexcel Unit 2 Jun 2014 QPDokument14 SeitenEdexcel Unit 2 Jun 2014 QPcyberdeadmanNoch keine Bewertungen

- Financial Accounting December 2009 Exam PaperDokument10 SeitenFinancial Accounting December 2009 Exam Paperkarlr9Noch keine Bewertungen

- Accounting/Series 2 2007 (Code3001)Dokument16 SeitenAccounting/Series 2 2007 (Code3001)Hein Linn Kyaw100% (3)

- 9706 Y16 SP 2Dokument18 Seiten9706 Y16 SP 2Wi Mae RiNoch keine Bewertungen

- Higher Level Paper 2 2010Dokument8 SeitenHigher Level Paper 2 2010Mark MoloneyNoch keine Bewertungen

- 9706 s16 QP 32 PDFDokument12 Seiten9706 s16 QP 32 PDFFarrukhsgNoch keine Bewertungen

- Cambridge International Examinations Cambridge International Advanced Subsidiary and Advanced LevelDokument18 SeitenCambridge International Examinations Cambridge International Advanced Subsidiary and Advanced LevelsagarnitishpirtheeNoch keine Bewertungen

- Insert Source Booklet Jan 09 6001Dokument12 SeitenInsert Source Booklet Jan 09 6001Yue Ying0% (1)

- Managing finances efficientlyDokument6 SeitenManaging finances efficientlyNaeem IlyasNoch keine Bewertungen

- AccountingDokument4 SeitenAccountingNaiya JoshiNoch keine Bewertungen

- AC1025 2008-Principles of Accounting Main EQP and Commentaries AC1025 2008-Principles of Accounting Main EQP and CommentariesDokument59 SeitenAC1025 2008-Principles of Accounting Main EQP and Commentaries AC1025 2008-Principles of Accounting Main EQP and Commentaries전민건Noch keine Bewertungen

- 6002 Source Booklet January 2011Dokument12 Seiten6002 Source Booklet January 2011Sausan AliNoch keine Bewertungen

- Solution Past Paper Higher-Series4-08hkDokument16 SeitenSolution Past Paper Higher-Series4-08hkJoyce LimNoch keine Bewertungen

- Accounting-2009 Resit ExamDokument18 SeitenAccounting-2009 Resit ExammasterURNoch keine Bewertungen

- Book Keeping & Accounts/Series-2-2007 (Code2006)Dokument12 SeitenBook Keeping & Accounts/Series-2-2007 (Code2006)Hein Linn Kyaw100% (2)

- Series 4 2013Dokument7 SeitenSeries 4 2013Apollo YapNoch keine Bewertungen

- University of Cambridge International Examinations General Certificate of Education Ordinary LevelDokument8 SeitenUniversity of Cambridge International Examinations General Certificate of Education Ordinary Levelmstudy123456Noch keine Bewertungen

- Certificate in Advanced Business Calculations: Series 2 Examination 2008Dokument5 SeitenCertificate in Advanced Business Calculations: Series 2 Examination 2008Apollo YapNoch keine Bewertungen

- Pra Uas Financial AccountingDokument2 SeitenPra Uas Financial AccountingYani UlyNoch keine Bewertungen

- Book Keeping & Accounts/Series-3-2007 (Code2006)Dokument11 SeitenBook Keeping & Accounts/Series-3-2007 (Code2006)Hein Linn Kyaw100% (3)

- Financial Accounting and Reporting: Blank PageDokument28 SeitenFinancial Accounting and Reporting: Blank PageMehtab NaqviNoch keine Bewertungen

- Question Paper Unit f014 01 RB Management Accounting Resource BookletDokument8 SeitenQuestion Paper Unit f014 01 RB Management Accounting Resource Bookletjt7qdbvqhvNoch keine Bewertungen

- Preparing Taxation Computations: (UK Stream)Dokument11 SeitenPreparing Taxation Computations: (UK Stream)Phoenix ZhangNoch keine Bewertungen

- Property Boom and Banking Bust: The Role of Commercial Lending in the Bankruptcy of BanksVon EverandProperty Boom and Banking Bust: The Role of Commercial Lending in the Bankruptcy of BanksNoch keine Bewertungen

- Clay Refractory Products World Summary: Market Sector Values & Financials by CountryVon EverandClay Refractory Products World Summary: Market Sector Values & Financials by CountryNoch keine Bewertungen

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionVon EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNoch keine Bewertungen

- Operating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16Von EverandOperating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16Noch keine Bewertungen

- Sound Recording Studio Revenues World Summary: Market Values & Financials by CountryVon EverandSound Recording Studio Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Finance for IT Decision Makers: A practical handbookVon EverandFinance for IT Decision Makers: A practical handbookNoch keine Bewertungen

- Water Well Drilling Contractors World Summary: Market Values & Financials by CountryVon EverandWater Well Drilling Contractors World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosVon EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNoch keine Bewertungen

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosVon EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNoch keine Bewertungen

- Cement World Summary: Market Values & Financials by CountryVon EverandCement World Summary: Market Values & Financials by CountryBewertung: 5 von 5 Sternen5/5 (1)

- Iron & Steel Scrap Wholesale, Processors & Dealers Revenues World Summary: Market Values & Financials by CountryVon EverandIron & Steel Scrap Wholesale, Processors & Dealers Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- The EnvironmentDokument2 SeitenThe Environmentaumit0099Noch keine Bewertungen

- Ws EcondefDokument10 SeitenWs Econdefaumit0099Noch keine Bewertungen

- Trade UnionDokument10 SeitenTrade Unionaumit0099Noch keine Bewertungen

- Secimen: Advanced Gce AccountingDokument8 SeitenSecimen: Advanced Gce Accountingaumit0099Noch keine Bewertungen

- Unit f014 Management Accounting Mark Scheme SpecimenDokument10 SeitenUnit f014 Management Accounting Mark Scheme Specimenzahid_mahmood3811Noch keine Bewertungen

- Using Fiscal Policy To Manage The EconomyDokument1 SeiteUsing Fiscal Policy To Manage The Economyaumit0099Noch keine Bewertungen

- Articles - Harvard Business Review - Mckinsey Awards For Best HBR ArticlesDokument7 SeitenArticles - Harvard Business Review - Mckinsey Awards For Best HBR ArticlesSandeepSingh67% (3)

- Ocr 7728 Sam Gce Unit f012 MsDokument8 SeitenOcr 7728 Sam Gce Unit f012 MsmilanvijithaNoch keine Bewertungen

- Economic GrowthDokument1 SeiteEconomic Growthaumit0099Noch keine Bewertungen

- Company AccountsDokument12 SeitenCompany Accountsaumit0099Noch keine Bewertungen

- Accounting PrinciplesDokument8 SeitenAccounting Principlesaumit0099Noch keine Bewertungen

- C - M GC: Ase Study C OmputersDokument3 SeitenC - M GC: Ase Study C Omputersaumit0099Noch keine Bewertungen

- Management AccountingDokument16 SeitenManagement Accountingaumit0099Noch keine Bewertungen

- Accounting PrinciplesDokument12 SeitenAccounting Principlesaumit0099Noch keine Bewertungen

- ResourceDokument8 SeitenResourceaumit0099Noch keine Bewertungen

- Erratum Notice: Igcse Economics Syllabus 0455 O Level Economics Syllabus 2281 4. Curriculum ContentDokument1 SeiteErratum Notice: Igcse Economics Syllabus 0455 O Level Economics Syllabus 2281 4. Curriculum Contentaumit0099Noch keine Bewertungen

- Accounting PrinciplesDokument8 SeitenAccounting Principlesaumit0099Noch keine Bewertungen

- Syallbus BusDokument25 SeitenSyallbus Busaumit0099Noch keine Bewertungen

- Case StudyDokument3 SeitenCase Studyaumit0099Noch keine Bewertungen

- Cadbury ReoprtDokument4 SeitenCadbury Reoprtaumit0099Noch keine Bewertungen

- NotesDokument32 SeitenNotesaumit0099Noch keine Bewertungen

- Higher Algebra - Hall & KnightDokument593 SeitenHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Cadbury ReoprtDokument4 SeitenCadbury Reoprtaumit0099Noch keine Bewertungen

- BUSS4 2011 TWELVE firms analysisDokument3 SeitenBUSS4 2011 TWELVE firms analysisaumit0099Noch keine Bewertungen

- International MarketingDokument15 SeitenInternational Marketingaumit0099Noch keine Bewertungen

- Edexcel Unit 3Dokument7 SeitenEdexcel Unit 3aumit0099Noch keine Bewertungen

- Case StudyDokument3 SeitenCase Studyaumit0099Noch keine Bewertungen

- Ratios BenchmarkDokument2 SeitenRatios Benchmarkaumit009950% (2)

- SporeDokument1 SeiteSporeaumit0099Noch keine Bewertungen

- Capital BudgetingDokument4 SeitenCapital BudgetingSatish Kumar SonwaniNoch keine Bewertungen

- Block L - Salary-Based Budgeting Worksheet 8 - Sheet1Dokument2 SeitenBlock L - Salary-Based Budgeting Worksheet 8 - Sheet1api-49586045967% (3)

- Case 9-47 PDFDokument5 SeitenCase 9-47 PDFMicha Maalouly33% (3)

- Investment DecisionsDokument17 SeitenInvestment Decisionssajith santyNoch keine Bewertungen

- Activity 3 in StatDokument13 SeitenActivity 3 in StatIanna ManieboNoch keine Bewertungen

- Financial Proposal for Training Manual DevelopmentDokument6 SeitenFinancial Proposal for Training Manual DevelopmentNandakumar100% (2)

- England S Debt To India Lajpat Rai 1917Dokument384 SeitenEngland S Debt To India Lajpat Rai 1917smallverysmall100% (2)

- Republic Act No. 526 - An Act Creating The City of CabanatuanDokument27 SeitenRepublic Act No. 526 - An Act Creating The City of CabanatuanNived Lrac Pdll SgnNoch keine Bewertungen

- Finance Manager Reporting Planning in Los Angeles, CA ResumeDokument2 SeitenFinance Manager Reporting Planning in Los Angeles, CA ResumeRCTBLPONoch keine Bewertungen

- VP Facilities Construction in United States Resume Roy OlsenDokument2 SeitenVP Facilities Construction in United States Resume Roy OlsenRoy OlsenNoch keine Bewertungen

- For Students Capital BudgetingDokument3 SeitenFor Students Capital Budgetingwew123Noch keine Bewertungen

- p3 Guide For MunicipalitiesDokument74 Seitenp3 Guide For MunicipalitiesaliomairNoch keine Bewertungen

- Multiple Choice Questions: Diploma in Technology Property Management Faculty of Built EnvironmentDokument2 SeitenMultiple Choice Questions: Diploma in Technology Property Management Faculty of Built EnvironmentKarCheeNoch keine Bewertungen

- A) Labour Cost - Computation and Control: by Sudha AgarwalDokument61 SeitenA) Labour Cost - Computation and Control: by Sudha AgarwalAkhil VashishthaNoch keine Bewertungen

- The Basics of Capital Budgeting Evaluating Cash Flows: Answers TO Selected End-Of-Chapter QuestionsDokument17 SeitenThe Basics of Capital Budgeting Evaluating Cash Flows: Answers TO Selected End-Of-Chapter QuestionsIka NurjanahNoch keine Bewertungen

- A Study of Financial Policies and Procedures of Suvastu Development LTD - (A Study On Gulshan Branch)Dokument23 SeitenA Study of Financial Policies and Procedures of Suvastu Development LTD - (A Study On Gulshan Branch)Didar RikhonNoch keine Bewertungen

- Stores Management GuideDokument20 SeitenStores Management Guidearulraj1971Noch keine Bewertungen

- Fixed Asset PolicyDokument20 SeitenFixed Asset PolicyMandar Jayesh Patel100% (4)

- Public Sector Conceptual FrameworkDokument29 SeitenPublic Sector Conceptual FrameworkAmunigun MaryamNoch keine Bewertungen

- Attachment Intermediate-Paper-3 Lyst5500 PDFDokument367 SeitenAttachment Intermediate-Paper-3 Lyst5500 PDFAbizer KachwalaNoch keine Bewertungen

- Ready ReckonerDokument72 SeitenReady ReckonerSRINIVAS SEESALANoch keine Bewertungen

- Job DescriptionDokument2 SeitenJob Descriptionapi-115666031Noch keine Bewertungen

- Economics CptbookDokument424 SeitenEconomics CptbookAnshumanSatapathyNoch keine Bewertungen

- Let Reviewer (Economics)Dokument4 SeitenLet Reviewer (Economics)Jessa Beloy100% (2)

- BOA Syllabus MASDokument3 SeitenBOA Syllabus MASElizabeth YgotNoch keine Bewertungen

- Demo MP Current English ExamPediaDokument28 SeitenDemo MP Current English ExamPediaanchalsingh8430Noch keine Bewertungen

- Capital Budgeting Multiple Choice Questions and AnswersDokument2 SeitenCapital Budgeting Multiple Choice Questions and AnswersArvind Tripathi0% (6)

- Important Indian Economy QuestionsDokument7 SeitenImportant Indian Economy QuestionsRachit MunjalNoch keine Bewertungen

- General Oil and GasDokument10 SeitenGeneral Oil and GasRizqullah RamadhanNoch keine Bewertungen